Professional Documents

Culture Documents

SEF Compliance Amid Regulatory Turbulence

SEF Compliance Amid Regulatory Turbulence

Uploaded by

tabbforumCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SEF Compliance Amid Regulatory Turbulence

SEF Compliance Amid Regulatory Turbulence

Uploaded by

tabbforumCopyright:

Available Formats

INSIGHTS FOR YOUR INDUSTRY: FINANCIAL SERVICES

JANUARY 2014 - WHITE PAPER #8

SEF Compliance Amid Regulatory Turbulence

The new world of SEF execution will cause market participants to reassess swap trading operations, workows and IT infrastructures.

Introduction:

upon participants in swaps transactions. A key mandate is the requirement that most swaps be subject to trading systems known as swap execution facilities (SEFs), which will facilitate transactions by accepting bids and offers from market participants. DoddFrank has also mandated central clearing for many types of swaps (see gure 1.) Overall, most swaps market participants will have to comply with a new and demanding regulatory environment. The reforms underway for swaps trading are creating multiple challenges for nancial services rms as they race to meet the demands of regulators, internal business groups and competitors. In the U.S., the Dodd-Frank Act imposes transparency, record-keeping and audit trails, and swaps data regulatory reporting

For rms to remain competitive, they will need to rapidly expand their technology infrastructure to facilitate compliance in todays fastchanging regulatory landscape.

FIGURE 1: CLEARING ON THE RISE CLEARING ON THE RISE

Regulators are pushing swapsmarket market participants toward clearing clearing Regulators are pushing swaps participants toward

21% 57%

2008 43% 79%

21 percent of the $340 Trillion market for Interest Rate Swaps was cleared

2013

57 percent of the $340 Trillion market for Interest Rate Swaps was cleared Source: CFTC

Source: CFTC

SEF Compliance Amid Regulatory Turbulence SEFs DEFINED

OpenLink - Insights

Are a regulated platform for swap trading that provides pre-trade information (bids and offers) and an execution mechanism for swap transactions among eligible participants. The regulated trading of certain swaps is a result of requirements in the United States by the Dodd-Frank Wall Street Reform and Consumer Protection Act.

The new world of executed swaps is compelling rms to quickly nd ways to costeffectively manage their SEF interactions as well as bilateral, exchange-traded and cleared transactions. Firms will have to revisit their relationships and workows with counterparties and other market players. They will also have to review their trading, risk management and compliance platforms, possibly revamping operations, workows and IT infrastructures.

orders and guidances that form the backbone for a new market structure.

Getting to this new world of execution requires a maze-like process of rulemaking with many key rules still pending.

The new rules for clearing and execution are advancing, if not in unison. The clearing of interest rate and credit index swaps for swap dealers, hedge funds and other nancial institutions was up and running during the rst month of the launch of nearly 20 pioneering SEFs. However, some SEFs that were among the rst movers had trouble meeting the October 2 deadline to begin operations In order for rms to remain competitive, they because of regulatory confusion. The CFTC will need to rapidly expand their technology had to give them another month to become infrastructure to facilitate compliance in operational. todays fast-changing regulatory landscape. Treasurers serve as nancial risk managers that seek to protect athe company's value from theregulatory nancial Despite confounding risks it faces from its business activities. Because these risks can arise from many sources, the role whirlwind, industry players are complying. requires an understanding of many areas of business and the ability to communicate with a variety Swaps Market Participants Push Gary Gensler, the outgoing chairman of of nancial professionals. Once an offshoot of the accounting department, corporate treasury the CFTC, reported that 80 percent of new Ahead management has evolved into its own company department and professional body. interest rate swaps were being cleared under In the wake of new regulations stemming the new rules and regulations. As of Oct. from Dodd-Frank, swaps dealers and their 25, 2013, $190 trillion of the approximately clients are diving into the new environment $340 trillion market-facing interest rate swaps of SEF-executed OTC transactions that have market, or 57 percent, was cleared, compared been established and approved under the to 21 percent of the market in 2008, according CREDIT OPERATIONAL CURRENCY INTEREST RATE U.S. Commodity Futures LIQUIDITY Trading Commission RISK RISK CFTC. In RISK RISK RISK to the addition, swaps data TREASURER (CFTC). The new environment for executed repositories are lling up as data on $400 swaps is likely to spur many discussions for a trillion in market-facing swaps is being fed variety of rms. Buy-side rms, for instance, into repositories, according to CFTC reports. such as large asset managers are considering At the same time, new regimes for valuations, how many SEF connections they need or margining and collateral management are whether they should work with a bank or taking hold. President Obama nominated other rm that will cost-effectively aggregate Timothy Massad, overseer of the Troubled SEF links. The newly minted SEFs are Asset Relief Program, to replace Gensler who struggling to dene the instruments they will stepped down in January 2014. As Massad have to accommodate, including cleared and awaits Senate approval, the CFTC appointed non-cleared instruments, OTC and bilateral Commissioner Mark P. Wetjen to be the acting transactions, all of which will require new chairman of the agency. workows, operations and IT support. Although their goals may be temporarily Yet to get to this seemingly straightforward deferred, regulators are pushing to achieve a new world of execution requires a maze-like new transparency in the pre-trade and postprocess of rulemaking with many key reforms trade processes that parallels the strides they still pending. At last count in October 2013, have made in centralized clearing services. the CFTC with feedback from the industry has been rening and ushering in 62 nal rules,

January 2014 - White Paper #8

Page 2

SEF Compliance Amid Regulatory Turbulence

OpenLink - Insights trade (MAT) rules. Final decisions are slated for early 2014 as SEFs themselves have been putting forth proposals about the types of swaps they would prefer to transact. The CFTC has set the criteria for the proposals, asking how many ready and willing buyers and sellers there are for a particular swap, the frequency and size of those transactions, the trading volumes expected, the anticipated number and types of market participants, the bid/ask spread and what the expectations are for the number of resting rm or indicative bids/offers.

An Inauspicious Start

Yet it was hardly a smooth transition. The CFTC has been having a contentious transition to SEF-executed swap transactions. To its credit, the CFTC has been persistent in proposing and rening rules and deadlines, and has been unrelenting in keeping the industry on course with OTC reforms. One of the regulators key actions has been to steadily process and allow a wide range of market participants to temporarily register as SEFs. The applicants have ranged from the IntercontinentalExchange (ICE), which launched ICE Swap Trade to interdealer broker ICAP, which brought forward ICAP SEF. In addition, market data terminal, news and systems vendor Bloomberg was the rst to get approval for a multi-asset SEF. But complications continued.

The CFTC has been having a contentious transition to SEFexecuted swap transactions.

The CFTC is rening its made available to trade rules to govern the kind of instruments to be processed via SEFs.

In mid-January 2014, the CFTC certied the MAT determinations proposed by the Javelin SEF, a subsidiary of Javelin Capital Markets, which cover interest rate swaps. The approval means that mandatory trading of swaps via SEFs or exchanges (DCMs) will start on Feb. 16, 2014, and will conform to Javelins MAT Several key market participants such as rules, unless participants are exempt or the options platform providers needed a transaction is a block trade, according to the deadline extension because of the CFTCs CFTC. much publicized Footnote 88 surprise to The Javelin MAT rules govern U.S. dollar and the approved SEF rules. In short, the CFTC Euro-denominated interest rate swaps with requires many-to-many trading platforms the following maturities: 2 year, 3 year, 5 year, that act much like SEFs to register as SEFs 7 year, 10 year, 12 year, 15 year, 20 year and and to meet the new compliance rules. Yet 30 year. The Javelin MAT determinations also the eleventh hour discovery of the footnote certify certain forward or IMM interest rate forced platform providers to scramble to swaps. get clients onboard and to revamp their infrastructures, ultimately causing the CFTC The CFTC is considering other MAT proposals to move the initial early October deadline to such as those from MarketAxess covering early November. credit default swaps, trueEX for interest rates and Tradeweb and Bloomberg on credit and Making matters worse, the 16-day federal rates instruments. government shutdown that stretched from mid-September to mid-October 2013 While the nal MAT rules will compel DCMs hampered the CFTCs efforts and at the same and SEFs to execute the mandated swaps, the time spurred it into action. The shutdown rule has an inherent, if far off, expiration date. caused the regulator to issue guidances and A swap that has been deemed available to other actions on the eve of the shutdown that trade will remain subject to the trade execution created more confusion than clarity. Ultimately, requirement until all SEFs and DCMs that the industry had to wait until the end of the had listed or offered that swap for trading, shutdown to resolve several questions and including the SEF or DCM that submitted the concerns. Firms hoping to launch themselves available-to-trade determination, no longer as SEFs had to wait until the shutdown was list or offer the swap for trading, the CFTC over before they could proceed. says in its most recent fact sheet on the issue.

What Swaps Will Be Made Available SEFs have too much sway over the process to Trade? and want swaps dealers, futures commission

Some critics of the process are concerned that

Regardless of the shutdown, the CFTC has merchants (FCMs), central counterparty been actively rening its made available to clearinghouses (CCPs), and buy-side rms to January 2014 - White Paper #8 Page 3

SEF Compliance Amid Regulatory Turbulence

OpenLink - Insights

Swaps market participants will not be able to avoid new costs and stresses.

have a greater role in the process. The CFTC Infrastructures Under Stress will determine the nal content of the MAT Swaps market participants will not be able to rules after a 90-day review process for each avoid new costs and stresses. proposal and after gathering comments from industry participants. The rigors of mandated execution for swaps cut across the traditional front-to-back ofce barriers and require market participants The Agency Model to reassess their current IT infrastructures While the MAT designation is being debated, and operations for the interest rate, credit, the CFTC has embraced an agency-style, currency, equity and commodity asset classes. aggregator model for SEF connectivity that is intended to insure that SEFs, many of whom Firms will have to rethink trade capture, are major dealers, maintain a level playing valuation, compliance and limits monitoring, conrmations and afrmations, transaction eld for swaps market participants. enrichment, regulatory reporting, position By allowing the aggregation of SEF and risk reporting, collateral management, connectivity, the regulator is of hoping to Major Areas Risk for Multinational accounting,Corporations and cash management. The prevent a closed, dealer-to-dealer market execution and clearing reforms will also The enterprise risk systems and operations of non-nancial MNCs will have to as some of the rst SEFs were seen challenges as impact take on many exposure across key trading areas. settlement, accounting, treasury imposing restrictions on market participants management and regulatory reporting reminiscent of market conditions before the processes. Great Recession.

FIGURE 2: WHAT ARE THE COSTS OF SEF EXECUTION?

AGENCY COSTS

EXTENSIVE RECORDKEEPING FOR SEF EXECUTION

MULTIPLE CONNECTIONS TO SEFS

IT INFRASTRUCTURE OVERHAULS

COSTS OF SEF EXECUTION

LEGAL AGREEMENTS NEW WORKFLOWS

The regulator is also adding an element of disintermediation as the decision will allow banks to provide aggregated SEF links to many pools of liquidity, which could create new competition for established dealers. The support for aggregation will also allow market participants such as buy-side rms to sidestep the need and costs (see gure 2) of SEF membership.

The goal for many rms will be nding the right mix of operations, workows and IT to manage a far more complex swaps execution environment that could include bilateral, cleared and non-cleared, exchange-traded and OTC instruments. Processing this variety of swaps will be greatly hampered by fragmented IT systems, operations and workows. Autonomous applications for trading and risk management Page 4

January 2014 - White Paper #8

SEF Compliance Amid Regulatory Turbulence that are either not integrated or poorly connected could prevent rms from streamlining operations and achieving an enterprise-wide view of exposure potential. Disparate systems can complicate and delay matters for traders and risk managers. Staff workows can also be disjointed especially when tasks are completed without a single, consistent set of information. In addition, data transfers among autonomous systems are error prone, causing delays via corrections, reconciliations or in worst case scenarios, broken and failed transactions. Firms that want to know their swap trading positions in real time will nd this situation difcult.

OpenLink - Insights Market participants will also have to reconcile the thorny issue of connectivity to SEFs, which is costly and will incur demands for gathering execution details and pre-execution compliance. While the CFTC has sanctioned the creation of SEF connectivity aggregators, it is unclear at this stage whether banks (or other market players) are willing and eager to take on this responsibility. It is also unknown what kind of demand exists for such a service. Whether rms aggregate SEF links via a third-party or on their own, they will have to gather data in an attempt to achieve price transparency among the SEF providers and compile clearing details. They will also have to uncover credit availability and order

Disparate trading systems can complicate and delay matters for traders and risk managers.

FIGURE 3: WHAT ARE THE BENEFITS OF SEF EXECUTION?

SELL-SIDE BUY-SIDE

GREATER TRANSPARENCY INTO SWAP TRANSACTIONS

AUDIT TRAILS TO BOLSTER CLIENT SUPPORT

MORE ACCOUNTABILITY FOR SWAPS CLIENTS

STREAMLINED OPERATIONS VIA AUTOMATION

BENEFITS OF SEF EXECUTION

A MORE LEVEL PLAYING FIELD FOR INDUSTRY PLAYERS BETTER PRICING AND LIQUIDITY

Other workow issues are challenging rms such as the streamlining of the capture of executed trades, gathering ll details, making allocations, establishing clearing statuses and certainty of clearing, and swap data repository (SDR) reporting. There will also be new operational and compliance demands for market participants such as the conrmation of executions and overall compliance with internal policies. In addition, SEF membership will require market participants to take on new, burdensome record-keeping and auditing responsibilities to meet regulators needs.

status, compile SDR reporting details, and monitor CFTC position limits. With an eye to the ongoing struggle to achieve operational efciency in swaps execution, rms will also have to constantly review, streamline and rene their SDR reporting and record-keeping processes (see gure 3).

January 2014 - White Paper #8

Page 5

SEF Compliance Amid Regulatory Turbulence

OpenLink - Insights

Conclusion: A Unied Core for SEF A holistic workow can ultimately serve as the foundation for optimal operational efciency. Execution

From a unied core, rms will be able to manage multiple SEF connections, execution and ll details, and clearing statuses while aiming to streamline the capture of executed trades. A unied approach also helps rms face complex price aggregation across SEFs that will enable strategic price comparisons of the execution venues. It will also help rms conduct a pre-trade analysis of the most costMost rms fail to maximize their use of cash and effective clearing venues (FCMs and CCPs), collateral because of an incomplete view of taking into consideration initial margin, fees securities and because cash is often harbored and related costs. in discrete sections of the organization. Given The analysis should also include actionable the new regulations and the related new prices retrieved via central limit order book collateral demands, rms will need a way to (CLOB) and request for quote (RFQ) execution efciently monitor incoming and outgoing methodologies, and will help rms as they collateral, and to value collateral using market formulate CLOB and/or RFQ strategies. standard models and data sources. A unied and integrated approach is also effective Its likely that rms will need to apply new IT for optimal management of post-execution support, operations and workow processes operations such selective netting, portfolio to encompass the full lifecycle of SEFbased execution, including SEF connectivity compression, and post-clearing allocations. and swaps transaction management. A comprehensive, unied approach will help ease the major burdens that market participants face in complying with regulators, satisfying internal trading needs and staying ahead of the competition. In the new world of swaps trading, market participants will need tools and workows to help them adjust to the new regime of SEF execution, which has been made more challenging and expensive because of the shifting regulatory requirements. A centralized core would help rms adjust to these demands.

LEARN MORE:

OpenLink is committed to staying at the forefront of regulatory reform, working closely with clients, regulatory agencies, clearing houses, clearing members, service providers and trade data repositories to keep pace with the rapidly evolving derivatives landscape. OpenLink continues to provide leading technology solutions for the energy and nancial services markets with its suite of regulatory compliance software. For more information, please visit our Regulatory Compliance page at www.openlink.com For further information, please contact OpenLinks Subject Matter Expert, Phil Wang.

CONTACT US:

OpenLink - Marketing and Communications Phone: +1 516 833 4509 1502 RXR Plaza 15th Floor West Tower Uniondale, NY 11556 United States www.openlink.com

Copyright 2013 OpenLink. All Rights Reserved.

December 2013 - White Paper #8

Page 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CAIIB ABM Sample Questions by Murugan PDFDocument82 pagesCAIIB ABM Sample Questions by Murugan PDFchatsak100% (7)

- V17-045 Institutionalizing CryptoDocument23 pagesV17-045 Institutionalizing CryptotabbforumNo ratings yet

- V16-009 The Evolving Middle OfficeDocument6 pagesV16-009 The Evolving Middle OfficetabbforumNo ratings yet

- China's Toys IndustriesDocument22 pagesChina's Toys IndustriesPathar MayurNo ratings yet

- Demo Research Proposal On Load Shedding in BangladeshDocument6 pagesDemo Research Proposal On Load Shedding in BangladeshPeashNo ratings yet

- in Contemporary World SubjectDocument33 pagesin Contemporary World SubjectRandom Videos67% (3)

- Street Contxt Benchmark Report Q4 2018Document15 pagesStreet Contxt Benchmark Report Q4 2018tabbforumNo ratings yet

- V17-059 Bond Market AutomationDocument12 pagesV17-059 Bond Market AutomationtabbforumNo ratings yet

- Making The Connection: The Electronic Shift in Legacy Bond Market WorkflowDocument13 pagesMaking The Connection: The Electronic Shift in Legacy Bond Market WorkflowtabbforumNo ratings yet

- Greenwich Associates Bond Etf Study 2018Document8 pagesGreenwich Associates Bond Etf Study 2018tabbforumNo ratings yet

- AP Cut Through The Hype Nov 2018Document10 pagesAP Cut Through The Hype Nov 2018tabbforum100% (1)

- Numerix White Paper: The 5 Top-of-Mind Issues Dominating The LIBOR TransitionDocument5 pagesNumerix White Paper: The 5 Top-of-Mind Issues Dominating The LIBOR TransitiontabbforumNo ratings yet

- Market Data RevenuesDocument16 pagesMarket Data RevenuestabbforumNo ratings yet

- Fee Pilot Comment - PragmaDocument4 pagesFee Pilot Comment - PragmatabbforumNo ratings yet

- DataBoiler FeePilot610 CommentsDocument10 pagesDataBoiler FeePilot610 CommentstabbforumNo ratings yet

- Insights - MF Risk Contribution Part 3Document16 pagesInsights - MF Risk Contribution Part 3tabbforumNo ratings yet

- Tick Size Pilot: Year in ReviewDocument13 pagesTick Size Pilot: Year in ReviewtabbforumNo ratings yet

- V16-021 Futures Algos - A Class of Their Own FinalDocument5 pagesV16-021 Futures Algos - A Class of Their Own Finaltabbforum100% (1)

- Total Cost of Trading 120418Document28 pagesTotal Cost of Trading 120418tabbforumNo ratings yet

- Ampersand White Paper - Risk Contribution of StocksDocument16 pagesAmpersand White Paper - Risk Contribution of StockstabbforumNo ratings yet

- LiquidMetrixWhitepaper TradeTechDocument19 pagesLiquidMetrixWhitepaper TradeTechtabbforumNo ratings yet

- Liquidnet MiFID II Research - UnbundlingDocument16 pagesLiquidnet MiFID II Research - UnbundlingtabbforumNo ratings yet

- RE/MAX Rouge River Realty LTDDocument2 pagesRE/MAX Rouge River Realty LTDJennifer PearceNo ratings yet

- Nomura Initiaties GoldDocument105 pagesNomura Initiaties Goldsovereign01No ratings yet

- Buacc5934 Financial AccountingDocument12 pagesBuacc5934 Financial AccountingamnaNo ratings yet

- Headland Capital Partners Invests Rs 40 Crore in Microqual Techno FinalDocument2 pagesHeadland Capital Partners Invests Rs 40 Crore in Microqual Techno FinalmicroqualNo ratings yet

- Where Is There Consensus Among American Economic Historians? The Results of A Survey On Forty PropositionsDocument17 pagesWhere Is There Consensus Among American Economic Historians? The Results of A Survey On Forty PropositionsArmando MartinsNo ratings yet

- 2nd Special Bureau Dar CAMPS Report REVISED 22st7 009 Last Revised 8amDocument10 pages2nd Special Bureau Dar CAMPS Report REVISED 22st7 009 Last Revised 8amDepartment of Political Affairs, African Union CommissionNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNo ratings yet

- FV Measurements IFRS 13 For Real Estate Industry (PWC 2011)Document11 pagesFV Measurements IFRS 13 For Real Estate Industry (PWC 2011)So LokNo ratings yet

- BEP History Sec508 WebDocument36 pagesBEP History Sec508 WebElliot CarterNo ratings yet

- Birth Defects of GATT and WTODocument2 pagesBirth Defects of GATT and WTORachit MunjalNo ratings yet

- The Struggling Spanish Economy: Guide Words Possible Source Main IdeaDocument4 pagesThe Struggling Spanish Economy: Guide Words Possible Source Main IdeaMayeNo ratings yet

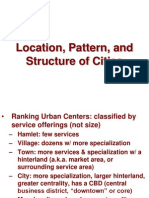

- Structure of Cities 2Document35 pagesStructure of Cities 2SHOAIBNo ratings yet

- Proposed Otago Regional Policy Statement 2021 Summary of Decisions Requested Report Part ADocument805 pagesProposed Otago Regional Policy Statement 2021 Summary of Decisions Requested Report Part AClint AnthonyNo ratings yet

- Bijela Lista-Januar 2016Document15 pagesBijela Lista-Januar 2016MarkysMNENo ratings yet

- Pickup Data 7th July 2020 DelhiveryDocument9 pagesPickup Data 7th July 2020 Delhiveryaryandubey7771No ratings yet

- Key Check 8 Harvest ManagementDocument17 pagesKey Check 8 Harvest Managementjames reid100% (1)

- Timor LesteDocument135 pagesTimor LesteNick Mclean100% (1)

- Books InformationDocument71 pagesBooks Informationfrontechasl100% (1)

- Manifest SlipDocument2 pagesManifest Slipgajender yadavNo ratings yet

- Mumbai Data Ceo PDFDocument1,463 pagesMumbai Data Ceo PDFSaurabh Jain0% (1)

- We Can Extend Our Growth Accounting Equation To Include Three FactorsDocument1 pageWe Can Extend Our Growth Accounting Equation To Include Three Factorstrilocksp SinghNo ratings yet

- HR Assignment (Anshul Jain-TIPS)Document3 pagesHR Assignment (Anshul Jain-TIPS)Sakshi JainNo ratings yet

- FALL 2012-13: by Assoc. Prof. Sami FethiDocument84 pagesFALL 2012-13: by Assoc. Prof. Sami FethiTabish BhatNo ratings yet

- Power ProjectDocument9 pagesPower ProjectDhwani_panickerNo ratings yet

- Currency Exchange Rate and International Trade and Capital FlowsDocument39 pagesCurrency Exchange Rate and International Trade and Capital FlowsudNo ratings yet

- 2014.11.05 Pershikov ViktorDocument50 pages2014.11.05 Pershikov ViktorAndile NkabindeNo ratings yet