Professional Documents

Culture Documents

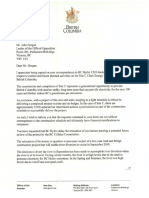

Duncan's Letter To Flaherty

Duncan's Letter To Flaherty

Uploaded by

The Globe and Mail0 ratings0% found this document useful (0 votes)

2K views2 pagesJune 10 letter on the pension system from Ontario Finance Minister Dwight Duncan to federal Finance Minister Jim Flaherty.

Original Title

Duncan's letter to Flaherty

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJune 10 letter on the pension system from Ontario Finance Minister Dwight Duncan to federal Finance Minister Jim Flaherty.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2K views2 pagesDuncan's Letter To Flaherty

Duncan's Letter To Flaherty

Uploaded by

The Globe and MailJune 10 letter on the pension system from Ontario Finance Minister Dwight Duncan to federal Finance Minister Jim Flaherty.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

Minky ot Fete ite doe Fnancot igi

(fie ofthe sae urea au minete

1 Pt Fat outing Suh Tage, ae Fst ss

JUN 2010

‘The Honourable James M. Flaherty

Minister of Finance

Department of Finance Canada

140 O'Connor Street,

Ottawa, ON

K1A0G5

Dear Minister Flaherty,

{In the lead-up to the upcoming Finance Ministers’ meeting in Prince Edward Island, |

wanted to take the opportunity to communicate with you about Ontario's position on.

strengthening Canada's retirement income system. | have appreciated the opportunity

to work together constructively on this important issue, and trust we will continue to

have the opportunity to do so in PEI and in the months beyond,

have become increasingly concerned, especially since the global economic downturn,

that many Canadians are not saving adequately for retirement. Recent research, policy

work, and public consultations have confirmed that although our retirement income

system has many strengths, a significant minority of Canadians in the future are likely to

experience a material decrease in their standard of living upon retirement unless

‘changes are made.

Ontario supports a pan-Canadian approach to the reform that will provide tomorrow's

seniors with better, lower-cost tools to maintain their standard of livingin retirement.

Reforms should build upon the strengths and institutions of the existing retirement

income system, which has significantly reduced poverty among seniors and currently

allows most Canadians to maintain a similar standard of living before and after

retirement.

‘Ontario supports a multi-pronged approach to reform that would strengthen both the

second and third pillars of the system.

First, | believe we can make regulatory changes to hamess Canada's world leading

private-sector expertise, including financial institutions and others, to provide more

cfficient, lower-cost retirement options. Current tax and pension rules say that defined-

contribution pension plans can only be offered where there is an employment

Joona

relationship. This limits the retirement savings options available to the self-employed

land those wno work for small businesses. By changing these laws, we can expand the

range of people who can set up pension plans, and the range of people who can

access them. We could allow large, mult-employer defined contribution pension plans

with low administrative costs to provide portable coverage to more Canadians.

‘Second, | believe we should seriously consider building on the strengths of the CPP

through’a phased-in, moderate increase to retirement and survivor benefits. CPP’s

‘uaranteed benefits are secure, inflation-indexed, and portable. The average CPP

benefit is about $8,000 per year and the maximum is about $1 1,000 per year — lower

than the public employment-related pensions of most other similar countries. Any

improvements would have to be pre-funded, itergenerationally equitable, and

affordable for working people and employers.

Ontario, ke many other jurisdictions, is also modemizing the logisatve framework for

existing defined benefit pension plans and looking at ways to foster innovation in the

future. We would welcome opportunities to work together to strengthen ths important

component of the retirement income system and improve the regulation ofthese plans

across jurisdictions.

Sincerely,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Legacy of Thoughts by Bernard C. ShermanDocument47 pagesA Legacy of Thoughts by Bernard C. ShermanThe Globe and Mail100% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Maiwand Yar Letter To FamilyDocument9 pagesMaiwand Yar Letter To FamilyThe Globe and Mail100% (1)

- Rosyln Goldner Report-Mackin FOIDocument79 pagesRosyln Goldner Report-Mackin FOIBob MackinNo ratings yet

- James B. Comey StatementDocument7 pagesJames B. Comey StatementYahoo News100% (6)

- NDP-Green AgreementDocument10 pagesNDP-Green AgreementThe Globe and Mail100% (1)

- MR Horgan Site c20170606Document2 pagesMR Horgan Site c20170606The Vancouver SunNo ratings yet

- Presentation On The Cyber Security Action PlanDocument34 pagesPresentation On The Cyber Security Action PlanThe Globe and Mail100% (2)

- WorkSafeBC Report On The Vancouver School BoardDocument32 pagesWorkSafeBC Report On The Vancouver School BoardThe Globe and Mail100% (1)

- U.K. Prime Minister Theresa May's Letter To European Council President Donald TuskDocument6 pagesU.K. Prime Minister Theresa May's Letter To European Council President Donald TuskValentina Zarya100% (1)

- Broken Promises: Alex's Story (Report)Document71 pagesBroken Promises: Alex's Story (Report)The Vancouver SunNo ratings yet

- Galloway Lawyer LetterDocument2 pagesGalloway Lawyer LetterThe Globe and MailNo ratings yet

- The Scalia FileDocument261 pagesThe Scalia FileThe Globe and MailNo ratings yet

- Nigel Wright RCMP DocumentsDocument13 pagesNigel Wright RCMP DocumentsThe Globe and Mail100% (1)

- The Enron Clause - PPA BriefingDocument28 pagesThe Enron Clause - PPA BriefingThe Globe and MailNo ratings yet

- Airbnb Vancouver Economic Impact ReportDocument12 pagesAirbnb Vancouver Economic Impact ReportCKNW980No ratings yet

- Last Resort: One Family's Tragic Struggle To Find Help For Their SonDocument66 pagesLast Resort: One Family's Tragic Struggle To Find Help For Their SonCKNW980No ratings yet

- Annual Report: Office of The Police Complaint CommissionerDocument74 pagesAnnual Report: Office of The Police Complaint CommissionerCKNW980No ratings yet

- VSB Trustees Allege DefamationDocument4 pagesVSB Trustees Allege DefamationThe Globe and MailNo ratings yet

- Short-Term Rentals PresentationDocument47 pagesShort-Term Rentals PresentationThe Globe and MailNo ratings yet

- UVic Sex Assault ReportDocument101 pagesUVic Sex Assault ReportThe Globe and MailNo ratings yet

- Re: Water Is SacredDocument1 pageRe: Water Is SacredThe Globe and MailNo ratings yet

- Décision Du Juge RussellDocument1,601 pagesDécision Du Juge RussellRadio-CanadaNo ratings yet

- CDPC Marijuana SubmissionDocument9 pagesCDPC Marijuana SubmissionThe Globe and MailNo ratings yet

- CLT Recommendations To Government Nov26FinalDocument36 pagesCLT Recommendations To Government Nov26FinalVancouver_ObserverNo ratings yet