Professional Documents

Culture Documents

Market Update 18 July 10

Market Update 18 July 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

You might also like

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995No ratings yet

- BSBMGT517 Assessor Marking Guide v2.0Document28 pagesBSBMGT517 Assessor Marking Guide v2.0Manreet KaurNo ratings yet

- (SwiftStandards) Category 6 - Treasury Markets Precious Metals (MT600 - MT699)Document103 pages(SwiftStandards) Category 6 - Treasury Markets Precious Metals (MT600 - MT699)anuragNo ratings yet

- OB ProjectDocument38 pagesOB ProjectAli KumaylNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- SP500 Update 2 Jan 11Document9 pagesSP500 Update 2 Jan 11AndysTechnicalsNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Market Update 29 Aug 10Document13 pagesMarket Update 29 Aug 10AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 16 Jan 10Document8 pagesS&P 500 Update 16 Jan 10AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Morning View 5mar2010Document7 pagesMorning View 5mar2010AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- Morning View 20jan2010Document8 pagesMorning View 20jan2010AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Morning View 3feb2010 - S&P GoldDocument6 pagesMorning View 3feb2010 - S&P GoldAndysTechnicalsNo ratings yet

- Hacker 3 RCDocument290 pagesHacker 3 RCjennyphuong0802No ratings yet

- SP500 Update 24apr11Document7 pagesSP500 Update 24apr11AndysTechnicalsNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Market Commentary 1may11Document12 pagesMarket Commentary 1may11AndysTechnicalsNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Gold Update 2 Nov 09Document4 pagesGold Update 2 Nov 09AndysTechnicalsNo ratings yet

- S&P 500 Update 19 Mar 10Document8 pagesS&P 500 Update 19 Mar 10AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- ( ) RC BasicDocument27 pages( ) RC Basiclahjinia0313No ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Test 10 PDFDocument9 pagesTest 10 PDFquyenNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- UGE1177 U2 LS04 PlanesDocument14 pagesUGE1177 U2 LS04 PlanesVVM. S.4646No ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Nov 09Document6 pagesS&P 500 Update 4 Nov 09AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Solar ControlDocument5 pagesSolar ControlTaehyun KangNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Company BackgroundDocument4 pagesCompany BackgroundCabdulahi CumarNo ratings yet

- Purchasing, Receipt & Inspection of MaterialDocument11 pagesPurchasing, Receipt & Inspection of MaterialDr. Rakshit SolankiNo ratings yet

- Tsla q4 and Fy 2021 UpdateDocument37 pagesTsla q4 and Fy 2021 UpdateFred Lamert100% (2)

- Mock Exam C - Afternoon Session (With Solutions)Document65 pagesMock Exam C - Afternoon Session (With Solutions)kelim34310No ratings yet

- MSC Dissertation Finance TopicsDocument6 pagesMSC Dissertation Finance TopicsWhereCanIBuyResumePaperAkron100% (1)

- THPT - 2020 - 401Document4 pagesTHPT - 2020 - 401Anh MaiNo ratings yet

- Module 5Document5 pagesModule 5Noel S. De Juan Jr.No ratings yet

- Automation and RoboticsDocument8 pagesAutomation and RoboticsRavierMNo ratings yet

- BEL Project Engineer Trainee Officer NotificationDocument5 pagesBEL Project Engineer Trainee Officer NotificationrithinNo ratings yet

- Atok Big Wedge Company vs. GisonDocument8 pagesAtok Big Wedge Company vs. GisonJoshua OuanoNo ratings yet

- Project Management Essential NotesDocument36 pagesProject Management Essential NotesMarco GaspariNo ratings yet

- 100% Off & Free Udemy Coupons June 2024Document2 pages100% Off & Free Udemy Coupons June 2024Rashedul IslamNo ratings yet

- Resume TWDocument1 pageResume TWapi-271182842No ratings yet

- Test Bank For Economics of Strategy 7th Edition by DranoveDocument14 pagesTest Bank For Economics of Strategy 7th Edition by Dranovewinry100% (1)

- Nicolo Di Jerlando ResumeDocument3 pagesNicolo Di Jerlando Resumeapi-376266725No ratings yet

- Malnad Start Up Eco SystemDocument8 pagesMalnad Start Up Eco SystemArya EdifyNo ratings yet

- Entrepreneurship Trends and IssuesDocument55 pagesEntrepreneurship Trends and IssuesKatelyn RellitaNo ratings yet

- Study - Id128160 - Digital Economy Compass 2022Document246 pagesStudy - Id128160 - Digital Economy Compass 2022Georgiana OanaNo ratings yet

- CV Jenny HillemannDocument1 pageCV Jenny HillemannzahidNo ratings yet

- BOP Credit Card Sales Training Tool Kit (7 Files Merged)Document115 pagesBOP Credit Card Sales Training Tool Kit (7 Files Merged)Shivam KumarNo ratings yet

- Chapter - 3 - The Business Mission ShortDocument22 pagesChapter - 3 - The Business Mission ShortNetsi Yami100% (1)

- 2017 Spencer OMard Morris Techeira Frederick Peters CAPE Entrepreneurship Practice Unit 2Document197 pages2017 Spencer OMard Morris Techeira Frederick Peters CAPE Entrepreneurship Practice Unit 2Jody-Ann MearsNo ratings yet

- 03 - Litreature ReviewDocument6 pages03 - Litreature ReviewJerisha blessyNo ratings yet

- Track & Trace Express - DHL - GlobalDocument2 pagesTrack & Trace Express - DHL - GlobalDragimage JenianNo ratings yet

- Santhosh Kumar - ProfileDocument6 pagesSanthosh Kumar - ProfileSupraja SuppuNo ratings yet

- Major Vs Minor NonconformityDocument2 pagesMajor Vs Minor NonconformitySouha Alhallak AlhallakNo ratings yet

Market Update 18 July 10

Market Update 18 July 10

Uploaded by

AndysTechnicalsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Update 18 July 10

Market Update 18 July 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

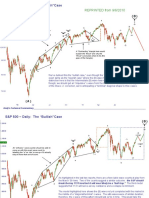

S&P 500 Sep e-Minis ~ (120 min.

“y” This wave count highlighted last week would certainly be the count that achieves that bigger

right shoulder. This model EASILY takes the S&P back to 1150 because a (B)-Wave here

must retrace 60-80% of the (A) Wave. Unfortunately, because of the structure of the waves

down, the precise wave count is impossible to know with any certainty.

b

(B)

“c”

“x” REPRINTED from 7/11/2010

c

a

“a”

a

b

a

b

c

“w” “b”

c

“y”

( A )?

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (120 min.)

“y” The predictions of this model have been pretty good so far, so we’ll just keep with it. The “a”

wave definitely has the “look” of an impulse, which suggests it was just the initial wave

higher. If that’s correct, then this “b” wave should find support before (or into) the 1032-1040

zone. The early July lows should hold under this model. The “b” wave should last a few

b weeks before we see the “c” wave.

(B)

“c”

“x”

c

a “a”

a

a b

b

c “b”

“w”

c

“y”

( A )?

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.)

The market easily sliced through the 1044 resistance point highlighted last

weekend, which allowed the market to “pivot” to the next level of resistance.

Highlighted here are the support and resistance points of the S&P futures.

1054 becomes first level of support for bulls with 1040 becoming more solid

support. First resistance at 1080 is nearby for the bears, a break of which

should send the market to 1103 if not 1130.

1130

1103

1080

1054

1040

REPRINTED from 7/11/2010

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Sep e-Minis ~ (240 min.)

After breaking our first level resistance at 1080, the market found serious trouble into

the second resistance level of 1103, reversing at a high of 1099.25. First and second

levels of support remain unchanged for this week. A break below 1054 should cause

the futures to swing down to 1040 which should be a good support as the 61.8%

retracement and a classical chart pivot. 1089 and 1100 are first and second level

resistance points for this week, breaks of which should send the market even higher.

1100

1089

1054

1040

Andy’s Technical Commentary__________________________________________________________________________________________________

-X-

S&P 500 Daily (Z)

“y”

1205

(Y) (B)

“y” “w” “c”?

c Sept-Oct?

“x” “x”

“w” a

g “a”?

e

b

c

(X)

a “b”?

“w”

1034

f “y”

“x”

(W) d (A)

b

(C)

869

(X)

The medium term wave count might look something like this one. An intermediate (B) here

MUST last until at least September. Perhaps we see generalized “liquidation” through the end

of the year that carries over into 2011. This sort of setup would look VERY similar to the way

2007 ended when the market peaked in October.

667

-W-

Andy’s Technical Commentary__________________________________________________________________________________________________

-X-

S&P 500 Daily ~ A “Triple” Finally Concluded? (Z)

(Y) “y”?

“y”

c “w”

“w” a “x”

g

e

b

c

a (X)

1034

f

d

“x”

(W)

b

REPRINTED from 5/2/2010

869

(X)

This would have to be the model that finished the entire advance from the 667 lows. Because

of how treacherous it has been attempting to call “the top,” I won’t do so now. However, given

the time of the year (“Sell in May and Go Away”) and the fact that this market has rallied so

unrelentingly, it would seem to be ripe for at least a robust correction.

667

-W-

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Weekly - Alternative

This would be alternative count. It’s taken from the conclusions that Glenn Neely

has reached. Essentially it calls for more time before the Primary - B - wave

< B >? finally concludes. He would probably be the first to admit, though, that the “a”

wave high might not be bettered during the (Y) wave. I still have some doubts

about this model: I don’t like how big the “e” wave is within (W) and I don’t like

741 as the conclusion of the pattern lower. However, Neely makes a lot more

< B >? money than me and he’s been doing it a lot longer, so who am I to argue?

-B-

(Y)

“a” “c”

(W)

“e”

REPRINTED from 5/2/2010

“b”

“a” “c” (X)

“d”

In practical terms, this count and the one on the

741 previous page are actually not very different.

-A-

“b”

Andy’s Technical Commentary__________________________________________________________________________________________________

“d”

Dollar Index (180 min) e

88.71

Left

Shoulder

Right

Shoulder

b

Head

-2-?

-1-?

-4-?

-3-?

-5-

There’s actually a decent smaller scale H&S which was activated on the Dollar c

Index at 85.00. This pattern targets 81.50. Highlighted here is the wave model “e”

that could certainly take the DXY to 81.50s. (B)

Andy’s Technical Commentary__________________________________________________________________________________________________

“d”

Dollar Index (180 min) e

88.71

Left

Shoulder

Right

Shoulder

b

Head

d

a

c f

e

g

“e”

(B)

The move down from 88.71 does not yet have a “completed” look and it’s now developing in an “odd” way. It makes me

believe we’re seeing one of those “bow tie” shaped seven-legged corrections that Neely has dubbed “diametrics.” The H&S

target here was 81.50 and that level still seems within reach. Longer term the picture remains bullish the DXY, but it looks

like we have several more trading days before completing the wave lower.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995No ratings yet

- BSBMGT517 Assessor Marking Guide v2.0Document28 pagesBSBMGT517 Assessor Marking Guide v2.0Manreet KaurNo ratings yet

- (SwiftStandards) Category 6 - Treasury Markets Precious Metals (MT600 - MT699)Document103 pages(SwiftStandards) Category 6 - Treasury Markets Precious Metals (MT600 - MT699)anuragNo ratings yet

- OB ProjectDocument38 pagesOB ProjectAli KumaylNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- SP500 Update 2 Jan 11Document9 pagesSP500 Update 2 Jan 11AndysTechnicalsNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Market Update 29 Aug 10Document13 pagesMarket Update 29 Aug 10AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 16 Jan 10Document8 pagesS&P 500 Update 16 Jan 10AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Morning View 5mar2010Document7 pagesMorning View 5mar2010AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- Morning View 20jan2010Document8 pagesMorning View 20jan2010AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Morning View 3feb2010 - S&P GoldDocument6 pagesMorning View 3feb2010 - S&P GoldAndysTechnicalsNo ratings yet

- Hacker 3 RCDocument290 pagesHacker 3 RCjennyphuong0802No ratings yet

- SP500 Update 24apr11Document7 pagesSP500 Update 24apr11AndysTechnicalsNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Market Commentary 1may11Document12 pagesMarket Commentary 1may11AndysTechnicalsNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Gold Update 2 Nov 09Document4 pagesGold Update 2 Nov 09AndysTechnicalsNo ratings yet

- S&P 500 Update 19 Mar 10Document8 pagesS&P 500 Update 19 Mar 10AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- ( ) RC BasicDocument27 pages( ) RC Basiclahjinia0313No ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Test 10 PDFDocument9 pagesTest 10 PDFquyenNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- UGE1177 U2 LS04 PlanesDocument14 pagesUGE1177 U2 LS04 PlanesVVM. S.4646No ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Nov 09Document6 pagesS&P 500 Update 4 Nov 09AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Solar ControlDocument5 pagesSolar ControlTaehyun KangNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Company BackgroundDocument4 pagesCompany BackgroundCabdulahi CumarNo ratings yet

- Purchasing, Receipt & Inspection of MaterialDocument11 pagesPurchasing, Receipt & Inspection of MaterialDr. Rakshit SolankiNo ratings yet

- Tsla q4 and Fy 2021 UpdateDocument37 pagesTsla q4 and Fy 2021 UpdateFred Lamert100% (2)

- Mock Exam C - Afternoon Session (With Solutions)Document65 pagesMock Exam C - Afternoon Session (With Solutions)kelim34310No ratings yet

- MSC Dissertation Finance TopicsDocument6 pagesMSC Dissertation Finance TopicsWhereCanIBuyResumePaperAkron100% (1)

- THPT - 2020 - 401Document4 pagesTHPT - 2020 - 401Anh MaiNo ratings yet

- Module 5Document5 pagesModule 5Noel S. De Juan Jr.No ratings yet

- Automation and RoboticsDocument8 pagesAutomation and RoboticsRavierMNo ratings yet

- BEL Project Engineer Trainee Officer NotificationDocument5 pagesBEL Project Engineer Trainee Officer NotificationrithinNo ratings yet

- Atok Big Wedge Company vs. GisonDocument8 pagesAtok Big Wedge Company vs. GisonJoshua OuanoNo ratings yet

- Project Management Essential NotesDocument36 pagesProject Management Essential NotesMarco GaspariNo ratings yet

- 100% Off & Free Udemy Coupons June 2024Document2 pages100% Off & Free Udemy Coupons June 2024Rashedul IslamNo ratings yet

- Resume TWDocument1 pageResume TWapi-271182842No ratings yet

- Test Bank For Economics of Strategy 7th Edition by DranoveDocument14 pagesTest Bank For Economics of Strategy 7th Edition by Dranovewinry100% (1)

- Nicolo Di Jerlando ResumeDocument3 pagesNicolo Di Jerlando Resumeapi-376266725No ratings yet

- Malnad Start Up Eco SystemDocument8 pagesMalnad Start Up Eco SystemArya EdifyNo ratings yet

- Entrepreneurship Trends and IssuesDocument55 pagesEntrepreneurship Trends and IssuesKatelyn RellitaNo ratings yet

- Study - Id128160 - Digital Economy Compass 2022Document246 pagesStudy - Id128160 - Digital Economy Compass 2022Georgiana OanaNo ratings yet

- CV Jenny HillemannDocument1 pageCV Jenny HillemannzahidNo ratings yet

- BOP Credit Card Sales Training Tool Kit (7 Files Merged)Document115 pagesBOP Credit Card Sales Training Tool Kit (7 Files Merged)Shivam KumarNo ratings yet

- Chapter - 3 - The Business Mission ShortDocument22 pagesChapter - 3 - The Business Mission ShortNetsi Yami100% (1)

- 2017 Spencer OMard Morris Techeira Frederick Peters CAPE Entrepreneurship Practice Unit 2Document197 pages2017 Spencer OMard Morris Techeira Frederick Peters CAPE Entrepreneurship Practice Unit 2Jody-Ann MearsNo ratings yet

- 03 - Litreature ReviewDocument6 pages03 - Litreature ReviewJerisha blessyNo ratings yet

- Track & Trace Express - DHL - GlobalDocument2 pagesTrack & Trace Express - DHL - GlobalDragimage JenianNo ratings yet

- Santhosh Kumar - ProfileDocument6 pagesSanthosh Kumar - ProfileSupraja SuppuNo ratings yet

- Major Vs Minor NonconformityDocument2 pagesMajor Vs Minor NonconformitySouha Alhallak AlhallakNo ratings yet