Professional Documents

Culture Documents

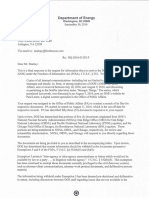

Richard Griffin Financial Disclosure

Richard Griffin Financial Disclosure

Uploaded by

Lachlan MarkayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Richard Griffin Financial Disclosure

Richard Griffin Financial Disclosure

Uploaded by

Lachlan MarkayCopyright:

Available Formats

:If :!

7S(R~v,

03/ZQUUJ

" (; F 1l ~a.rr 2(,3-1 [.S~ Oj1.in~ (~H ,·t~rnm'·nt.f: hi rs ~lJ ...

ofHj:'rtnUfklt!t,\!,:_Ift!rJ.1J~i·I' l'~~_(:-I

Executive

Report i n g St at.u s

Branch

Personnel

PUBLIC FINANCIAL DISCLOSURE REPORT

r,Jrrn

uj\tn N~)~..tI09 ~-nno l

t~?prn'l:tl,i~

,p~~~e9f:'prO'qtm(~OI,l~>:indi~i';\(Y, tle(timJ.i

11H:~lnd·H'I~r.

lCh~,:>.Apl'r"p(lal"

B~',-;"f:SJ ·--------t-:,-,;:\-S-'[-:N7\-'m-,1-(;-'

Calc;ahlt

i COli

r:0\'(!r~(.i b:... ,{('~iHrl '

Nei...rEntrant.

r-i0millfte,

(,If 15(1--

I eIlnil:illion HLer

Lllulid;u"

I..C:J

0I

_'-

Tcrnunauon

Dare (ifAppU-, f-;dJ1",la"':m1i1~J}:l\c~H.':~ri

Reporting Individual's

---

......

------.._------.l..-I..~I'"I-;,-r-~-t

~~".""' ..JJ :

b.~

F-cc

or Late Filing

(h)t!SM) 1110re

-N-' .1-"-"-t"-"-'-l(-I-~.J!J-'·l~-.f-"~ !-~:.-I-l-ii-l j-a-:

__

rhl~rep~)n ;lnd ~:it[~~·~t~~~~ ~,~~l~

'\11\' Iqdlv;l.l"al

\\tw h require ..l to

th.ln:';O

me

~~~t~~~S,(.:~ll~1 :.;~~!~~t~~nrl~~H~:!(~

d~l~!.j

Name

Griffin TiU,,' oj Position

Richard

th"n ,Mhlavs aner {!ie 1,lq dav of the fHrn}; (lxt'f<J1SJOll Pl!! ilUi. ·;tl:JU i,-(~~iJtd~l_"l to a $200 fee.

Po:oition for Which

FlIillg Locarjon of Preserrt Off'ic.e

Board Member, National Labor Relations 130afC

l ncumb en ts: T1H~ rep..'nin~ period is !ht~ [H"t'cl·-dlng c~h.~ndiiIT y{:';:t; t_'\:LCpt Pan II (or S(il\:(hll" C and I':m I (,fS.:h,,,1t1'" I)

\vlw:n: yuu- mU:->l4.l-;,.njnchak' th.;! fiHng

Reponing

Periods

tOt: 07"~"'J:;-dl :t~;~dd r(>~-~,l r.

vcar ur: to t'm! fiatv vuu 1'1' ..'. P;U[ ll ~(!lI::,lCll<.'D is iii'! J.ppl!(;lbk.

fi

]1u~jta'm;\~ Hehlwl,nll

r!'deral G~-1v,,*rru):"~nl ll.H"n~ '~h~ p~!::Lt'uitlf"', llt'oot,~tHlnl,fi ,".i{/f ,~~imrt' .4lifH\"i a,~

hI'

'l'e rmlnartou

penod b;;lj.in~ at.t he ~.l1d0; {he perl(')\! covered by YOUt pn ......,IW1 ... {taru!!. i:41u1 en, ..s l :11rile care oJ tenllm,tH',Jl. P,ut :J of Sdw(,juls: DbJult dP~H~~;!bli;~. Numilu:<os, Candidates New Entrants for President and and

period

Filers; 'Ilu- B'pnniill:

Vice I"resldent~

lctRU1·1·ttn{:ht~!.1&lI.-t'mI:'Ili!' r h.·;'\'t' l'llai1<!oathl]t;h!np ~Ul~_l ,)tta(hcu all 'Sehcc.u!.'.!s an: u·i.1~~, :(o()m:)k-';.l~ Ii.tid correct .~ rw h{'·,I.ofm~knrn·.'h,:dMI,·_ nt ()lh"r ft""l~w (lhlesu.d II} <lgem;YJ

illr iucomc (IlLOCf.: CI is the preceding

calendar

Schedule

A,-Ttw n;'pllrlinr,

~('~;Jrup to the dan- ,,1' filing, Value assets as of ;"'lUY I._~atl..~ tJ',f.HY:i-t! that h lvilhin .ViJ'~l ,\) Jays Qf \.he date 01 [;lin)!,.

YC-.1rand

thv I:'U.ffl'nt tdli.;'ndi.i,[

Agency J::tbi~sOlfi.:ial'sOJ'iI:i"n

On_un: bi.l-!<>~; ~rrmfltUlll.mur!l';iJ,Jrt \\'1\.:!

<1tl·~·

contained

J\:.~ilf:J.t.hm5

1.!1I~HS

r ~1'l!lJ~I;k!hJ\ Ih"n'_,;ri:s

;;-1'••

inli:ilWrlh~HKI!

',,-miw ..!!b ue tl., '

~pph(,!hl;;

>, itwj

{mh::<:l

:(!

Schedule C, P a r t I nj.. JHh·~·I'-·l1w h reporting period j, t he pn-'n'dm,~ r.ih-nd.u V\:,'.f d111.1 the current calendar vear 1Ip to :lDV d.HpvOU chnn:~-;':' i.;HI P1 \\'3l1un ~~ dri'~"" of ihe <hie [;l1n14. -

or

h;~'\ r,_!\'~'!J',"'-:t

A~~~l~~~!~(~:_~~~:'; ~~~~;·"~~~:'~~:':'~~ rA the d:Ht' l:hng.

alT~ln~~p.irlt:nlS)~ oj uie precedinj;

t-------~-- __ __-~~~~~----------------------------------------------{ __ -- ~

--.}

Sc hud u lc D The "'ponmg period is t w o c.ik-nrl.rr '~'l_J"lr_c; .11";(j

y',odJ

o.

,

"rflllJlg.

ihc ..:urrem calendar

up {()the d:;w

U.S.Officeof Government thics E Reporting Individual's Name Griffin, Richard F.

OGE1"onn (Rev.09/2010) 278 5 C.F.R. Part 2634

SCHEDULE A

Valuation of Assets at close of reporting period

BLOCKB

Page Number

2 of 6

Assets and Income

BLOCK A For you, your spouse, and dependent children, report each asset held for investment or the production of income which had a fair market value exceeding $1,000 at the close of the re~orting period, or which generated more than 200 in income during the reporting period, together with such income. For yourself, also report the source and actual amount of earned income exceeding $200 (other than from the U.S.Government). Foryourspouse, report the source but not the amount of earned income of more than $1,000 (except report the actual amount of any honoraria over $200 of your spouse). NoneD

Income: type and amount. If "None (or less than $201)" is checked, no other entry is needed in Block C for that item.

BLOCK C

>

Type

0 0 0 0 0 0 0

Amount ~

M

Ii tJ

0 0

18

0 0 0

q

M

I

Lrl

W

,....;

w

I

......

o· 0" 0" 0 0 Lrl 0 q ......

0

N W

I

0 0 0

0 0 0

0 0 0

q0

0 0

W

I

0 0 0

1<

~~

II

.

0 o. '~

,....;

fr.}

www

x

0" ...... M 0 0 0 ,....; M M q00 0 0 ,....; 0 0 o. ,....; 0 q 0" Lrl 00 00 w00 0w 0 0 0 0 .... 0 0 q qq Lrl 0" 0 N 0 Q) ,....; ir: Lrl Lrl N Lrl ...... >

I I

Lrl W

I

w

I

0 0 0

0 0q6 q Lrl Lrl

w

Lrl N W

M

IJ

0"

0 0 0

.W

r----------------Examples KempstoneEquityFund

CentralAirlinesCommon

f-----------f------------ ',_

DoeJones&Smith, Hometown, State IRA: eartland 500 IndexFund H

:-1-1<,_ .....,..

f-

r-- !- rr

I-

_1=1 x

f-- h f--

- ... -

!- 1-- 1-- 1-- ,_

--

- ._ ,- I-

i~It .s It :1 I~ IJ

....

Q) til

'0

1J I.§

til

8

fr.}'.

,....;

o. 0" Lrl u:. q Lrl W N

www

I I I

0 0

0 0

0 0

0 0 0

0 0 0 0

W

I

0 0 0q

M

I

0 0 0

0 0 0

1<

Lrl

,....;

.... 0.

Ie

~ ~ Ci

x

~ 8

Q)

~ ~ 0

Q)

,....;

N M N vi' Zwwwww

q

x

,....;

,....;

Lrl

0 0

q

Lrl ,....;

Lrl w 0" w 0" Q) 0 0 0 .... q .... ,....; Lrl ,....; >w w

,....;

0 0

0 0

0 0 q

M

0 0 0

0 O.

Lrl W

I

0

0 0 0

0 0

0 0 q

Other Income (Specify Type & Actual Amount)

Date (Mo., Day, Yr.) Only if Honoraria

8

,_

Income S130,OOO

J ___ I-- ,_

- =Ii>

-1<

~ r-- -

f-- ,_ ,,_

- r-I-

r-- r-

- -- ._ '- .- _:_I_I_ f-....

..,...

r" [~[ ,.... ,.... r-fox

r--

1---,_ 1---Law Partnership

1---

r--r

fo-

--

,....,.. .......

r-

--.-

--r--1-----

r---

International Union of Operating Engineers (IUOE) AFL-CIO Employees Federal Credit Union Savings account Wachovia Bank (joint account with spouse) Savings Account IUOE HQ Pension Plan-Defined Benefit Plan Value Not Readily Ascertainable

Salary, General Counsel

$376,778

X X

Eligible 55 for at monthly

retirement

Ix

$9,395 6

benefits f o per month

IUOE Employees Severance Pay Plan

* This category applies only if the asset/income is solely that of the filer's spouse or dependent children. If the asset/income is either that of the filer or jointly held

by the filer with the spouse or dependent children, mark the other higher categories of value, as appropriate.

OGE Form 278 (Rev. 09/2010) 5 C.F .R. Part 2634 U.S. Office of Government Ethics

Reporting Individual's Griffin , Richard F.

Name

SCHEDULE

Valuationof Assets at close of reporting period

BLOCKB

(Use only if needed)

A continued

Page Number 3 of

Assets and Income

Income: type and amount. If "None (or less than $201)" is checked, no other entry is needed in Block C for that item.

BLOCKC

BLOCK A

Type

..... ---0 o. .....

Amount ~ .....

0

"" .::

-s

til

Vl Vl

o.

......

If)

0 0

~ , H "" -3 ......

q; <lJ

o.

~

1

""

......

.~ ~.

0 0 0 0 0 0 0

0

...... ......

,,, , ...... ...... ...... "" "" "" ""

0 0 0 0 0 0 0 0

cS 000 If) 0 o. N If) .....

0 0 0

0 0 0

0 0 0

of<

0 0 0

0 0 00 0 0 o. 0 q If)

0 0 0

0 0 0

"d

.:: ~ ..,

0

0

••.•

i~

o· 0 0 0 0 o. If) If) ...... If)

""

<l)

q0 0 0 "d ...... 0 0 0 If) ...... <lJ o· 0 0 0

H

,, "" "" ...... ......

0

If)

If)

, ""

0 0

...... 0 0

0

0 0 0

S

Vl

.:: <lJ

1;::

"d

~~

0. <lJ u X

""

"" "" ""

>

o. o.

o.

If)

""

H q;

""

......

If) V7

N

V7

>

>:Q

~ ~

.~ ~.~

Vl

t\l

"P

<lJ

"" q

.S ~ o. N til ...... , c.J "" '" ...... t\l -3 , 0 q; ...... '-' 's. .:: 0 o. 0

Vl

N til

"d

Vl

"d

q;

-e

>, 0

,.q '-' 0 Vl 0 Vl

0 0

"l

IG

.:: :~~ a

<lJ

'-'

'-' Vl

til .E u z

......

H

<l)

<l)

""

N

""

......

V7

~..~.. a~

0 0 0 0 0

q

If)

f>'i..

, ""

0

.--<

If) V7

......

.'1.•. ,

o· 0 0q 0 .....

0 0 0

0 0 0

of<

0

0

""

0 0

If)

......

,0 "" 0

0 0

0 0 0

q

If)

......

......

o.

......

, "" ......

0 0

0 0 0

0 0 o.

If)

(Specify Type & Actual Amount)

Other Income

Date

(Mo., Day, Yr.)

Only if Honoraria

=,

••

V7

0 H H 0 "" 0 "" 0 0 <l) o. ~ ...... > ...... 0 V7

""

Central Pension Fund of IUOE - Defined Benefit Plan - Value Not Readily Ascertainable

Eligible at 65 for monthly retirement benefits of $3,774 per month

The Maret School Spouse Employer

Salary

Maret School 403(B) DC Plan S TIAA CREF Equity Index Fund Maret School 403(B) DC Plan TIAA CREF Bond Market Fund Maret School 403(B) TDA Plan TIAA CREF Equity Index Fund Maret School 403(8) TDA Plan TIAA CREF Bond Market Fund Maret School 403(B) TDA Plan TIAA CREF Money Market Fund

X X X X X

X X X X X

Income Not Readily Ascertainable Income Not Readily Ascertainable Income Not Readily Ascertainable Income Not Readily Ascertainable Income Not Readily Ascertainable

This category applies only if the asset/income is solely that of the filer's spouse or dependent children. If the asset/income by the filer with the spouse or dependent children, mark the other higher categories of value, as appropriate.

is either

that of the filer or jointly

held

OGE Form278 (Rev. 09/2010) 5 C.F.R Part 2634 US. Office of Government Ethics

Do not complete Schedule B if you are a new entrant, nominee, or Vice Presidential or Presidential Candidate

Griffin r Richard

Reporting Individual's Name F.

SCHEDULE B

Do not report a transaction involving property used solely as your personal residence, or a transaction solely between you, your spouse, or dependent child. Check the "Certificate of divestiture" block to indicate sales made pursuant to a certificate of divestiture from OGE. None

Page Number

4

of

Part I: Transactions

Report any purchase, sale, or exchange by you, your spouse, or dependent children during the reporting period of any real property, stocks, bonds, commodity futures, and other securities when the amount of the transaction exceeded $1,000. Include transactions that resulted in a loss. Example!CentralAirlinesCommon

1 2 3 4 5

D

Date

(Mo., Day, Yr.)

Q)

Transaction Type (x)

.10. 1·0 .-<0 ....-'10 ,...,0 00 00 00 o ,0 ,v) v;.. .. 00 ,..., V) lI),_; .-I,i-i

Identification of Assets x Nominee - Not Applicable

(Ii

o

2/1/99

'

gq

rn

"",.. """" "",.. "'''''

x

,0 0 .-<0 ,-;0 .-<0 0 00 00 00 00 '0 00 00 0'" "'0 V).-< '-<N Nt/')

Amount of Transaction (x) , , 1·0

co

~-v.t

""""

OJ .., OJ .... o' 6 "'::; 0 0 00 oq 00 '$.i.q ~o o , !!:o, OJ._ !!:~ t::!!: ~~

ts'

oq

O~

~it3

'-<0 .-<0 '-<0 00 00 00 00 00 ,0 00 00 00 00 00 0,V) '-;vi VlN trlO N'fl

4-<

S·~

u'O

""""

0",

*This category applies only if the underlying asset is solely that of the filer's spouse or dependent children. If the underlying asset is either held by the filer or jointly held by the filer with the spouse or dependent children, use the other higher categories of value, as appropriate.

Part II: Gifts, Reimbursements,

and Travel Expenses

the U.S. Government; given to your agency in connection with official travel; received from relatives; received by your spouse or dependent child totally independent of their relationship to you; or provided as personal hospitality at the donor's residence. Also, for purposes of aggregating gifts to determine the total value from one source, exclude items worth $134 or less. See instructions for other exclusions. None Brief Description

For you, your spouse and dependent children, report the source, a brief descripttion, and the value of: (1) gifts (such as tangible items, transportation, lodging, food, or entertainment) received from one source totaling more than $335 and (2) travel-related cash reimbursements received from one source totaling more than $335. For conflicts analysis, it is helpful to indicate a basis for receipt, such as personal friend, agency approval under 5 U.S.C. § 4111 or other statutory authority, etc. For travel-related gifts and reimbursements, include travel itinerary, dates, and the nature of expenses provided. Exclude anything given to you by Source

(Name and Address) NY

0

Value

$500

;~:t'IAssn. ofRockCollectors,NY, Examples ____________ ank jones, SanFrancisco,CA

1 2 3 4 5

----------------------------_-----Airline ticket, hotel room & meals incident to national conference 6/15/99 (personal activity unrelated to duty) Leatherbriefcase(personalfriend)

---$350

Nominee - Not Applicable

SF 278 (Rev. 0312000) 5 C.F.R.Part 2634 US Office of Government Ethics .. Reporting Individual's Griffin, Richard Name

F.

SCHEDULE C

a mortgage on your personal residence unless it is rented out; loans secured by automobiles, household furniture or appliances; and liabilities owed to certain relatives listed in instructions. See instructions for revolving charge accounts. Type of Liability ~o.!!IP~ o..!!..!:e.!:!:!J .E.!:.0perty,Delaw:!!!. ___ Promissory note • None~

Page Number

5 of 6

Part I: Liabilities

Report liabilities over $10,000 owed to anyone creditor at any time during the reporting period by you, your spouse, or dependent children. Check the highest amount owed during the reporting period. Exclude Creditors Examples

1 (Name and Address)

Category of Amount or Value (x)

Date Incurred

Interest Rate 1--8% 10%

Term if applicable

rT:~i~C~~w~~on'D£_ __ hnjones, 123 jSt., Washington, DC

1-1999

1991

---- e_ on demand

25 yrs.

t~

""""

00 riIf"l ri If"l

~{h

vi' 0

riO 00 00

qo"

x

0 riO 00

'"1--

--

""""

..'.<0 00 00 00 00 00 '0 00 00" 00 Olf"l If"l0 ri riN NV"l If"l

~o

,0 riO

oq

o.

-- -- ~-x

Wfb

""""

:> ri' 0""

~o ",0

0 0 0

~ 0

"""" """" """" o~ -- I-- :--

riO 00 00 00 00 00 ...-'I" v)'

,

'0 riO 00 0.0 00 0.0 .V"l V"lN .-;0 00 00 00 00 00 0 0 0 0 0

q o . Lri'o ... ~o NV"l

*This category applies only if the liability is solely that of the filer's spouse or dependent with the spouse or dependent children, mark the other higher categories, as appropriate.

children.

If the liability

is that of the filer or a joint liability

of the filer

Part II: Agreements

or Arrangements

of absence; and (4) future employment. See instructions regarding ing of negotiations for any of these arrangements or benefits. the reportNoneD Date

7/85

Report your agreements or arrangements for: (1) continuing participation in an employee benefit plan (e.g. pension, 401k, deferred compensation); (2) continuation of payment by a former employer (including severance payments); (3) leaves Status and Terms of any Agreement Example

1 2

or Arrangement share

Parties Doe jones & Smith, Hometown, State International Union of Operating Engineers IUOE Headquarters Pension and Benficiaries Plan Central Pension Fund of the IUOE and Pa[lcipating Employers

Pursuant to pre-existing severance plan, willreceive lump sum payment of one week of pay for every year of service up to a maximum of 30 weeks upon separation from employment (date indicated is initial partcipation date) Pursuant to defined benefit pension plan, willbe entitled to annual benefit upon retirement (date indicated is initial participation date) Pursuant to defined benefit pension plan, willbe entitled to annual benefit upon retirement (date indicated is initial participation date)

Pursuant to partnership agreement, will receive lump sum payment of capital account & partnership calculated on service performed through 1/00.

12/08 9/83 4/05

3 4

Prior Editions Cannot Be Used.

OGE/Adobe

Acrobat version 1.0,2 (1lI01/2004)

SF 278 (Rev. 03/2000) 5 C.F.R. Part 2634 U.S. Office of Government Reporting Individual's

Ethics Name

Griffin, Richard

F.

SCHEDULED

Page Number

6 of 6

Report any positions held during the applicable reporting period, whether compensated or not. Positions include but are not limited to those of an officer, director, trustee, general partner, proprietor, representative, employee, or consultant of any corporation, firm, partnership, or other business enterprise or any non-profit

Organization Examples 1 ~~t'l (Name and Address) Assn. of Rock Collectors, NY, NY -------------------oe Jones & Smith, Hometown, State

Part I: Positions Held Outside U.S. Government

organization or educational institution. Excl ude positions with religious, social, fraternal, or political entities and those solely of an honorary nature. None

Type of Organization Position :.::.sident ________ Partner Held

-------------Non-profit education Law firm

I From

!_3~_

7/85

(Mo., Yr.)

---Present 1100

To (Mo.,Yr.)

International Union of Operating Engineers Washington, DC AFL-CIO Lawyers Coordinating Committee

Labor Union Union lawyers association

General Counsel Member, Board of Directors

09/1983 09/1994

present present

Part II: Compensation

in Excess of $5,000 Paid by One Source

Report sources of more than $5,000 compensation received by you or your business affiliation for services provided directly by you during anyone year of the reporting period. This includes the names of clients and customers of any corporation, firm, partnership, or other business enterprise, or any other

Source Examples : ~e 1 (Name and Address) Legal services --Jones & Smith, Hometown, State __________________ tro University (client of Doe Jones & Smith), Money town, State

non-profit organization when you directly provided the services generating a fee or payment of more than $5,000. You need not report the U.S. Government as a source.

Brief Description of Duties

Do not complete this part if you are an Incumbent, Termination Filer, or Vice Presidential or Presidential Candidate. None

------------------------------Legal services in connection with university construction

International Union of Operating Engineers

Salary for General Counsel position

Prior Editions

Cannot

Be Used.

OGE/Adobe

Acrobat version 1.0.1 (3/29/01)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- ComplaintDocument24 pagesComplaintAnonymous eQuHs8N100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Democracy Alliance State Funds, Fall 2015Document21 pagesDemocracy Alliance State Funds, Fall 2015Lachlan MarkayNo ratings yet

- David Brock Speech at Democracy Matters 17Document15 pagesDavid Brock Speech at Democracy Matters 17Lachlan Markay100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Eddie Deck Emails To Ryan JacksonDocument2 pagesEddie Deck Emails To Ryan JacksonLachlan MarkayNo ratings yet

- Democracy Alliance Portfolio, Fall 2015Document10 pagesDemocracy Alliance Portfolio, Fall 2015Lachlan MarkayNo ratings yet

- Foundation For Moral Law DonorsDocument9 pagesFoundation For Moral Law DonorsLachlan MarkayNo ratings yet

- Old Town Digital Agency IncorporationDocument1 pageOld Town Digital Agency IncorporationLachlan MarkayNo ratings yet

- Judicial Watch 2017 Form 990Document35 pagesJudicial Watch 2017 Form 990Lachlan MarkayNo ratings yet

- Prosperity Alliance Tax Exemption ApplicationDocument10 pagesProsperity Alliance Tax Exemption ApplicationLachlan MarkayNo ratings yet

- Turning Point USA - FY 2016 990Document36 pagesTurning Point USA - FY 2016 990Lachlan MarkayNo ratings yet

- Trump Legal Expense Fund DisclosuresDocument6 pagesTrump Legal Expense Fund DisclosuresLachlan MarkayNo ratings yet

- Matt Rosendale - Path To VictoryDocument3 pagesMatt Rosendale - Path To VictoryLachlan MarkayNo ratings yet

- Cres Fy2016 990Document38 pagesCres Fy2016 990Lachlan MarkayNo ratings yet

- Project Veritas Tax Exemption ApplicationDocument22 pagesProject Veritas Tax Exemption ApplicationLachlan MarkayNo ratings yet

- Arif Court OrderDocument12 pagesArif Court OrderLachlan MarkayNo ratings yet

- Energy Department Discusses Stranger ThingsDocument163 pagesEnergy Department Discusses Stranger ThingsLachlan Markay100% (1)

- Kilowatt Financial, LLC, Incorporation Documents - TexasDocument2 pagesKilowatt Financial, LLC, Incorporation Documents - TexasLachlan MarkayNo ratings yet

- Pentagon Backs Iron Dome FundingDocument2 pagesPentagon Backs Iron Dome FundingLachlan MarkayNo ratings yet

- Lawsuit Against Ormat TechnologiesDocument81 pagesLawsuit Against Ormat TechnologiesLachlan MarkayNo ratings yet