Professional Documents

Culture Documents

Indian Glass Industry - An Overview

Uploaded by

Pankaj DutiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Glass Industry - An Overview

Uploaded by

Pankaj DutiaCopyright:

Available Formats

Special Report

Indian Glass Industry An Overview

PANKAJ DUTIA

pankaj@chemicalweekly.com

INTRODUCTION master craftsmen and entrepreneurs manu- Saint-Gobain Glass India Ltd. (Sri-

Glass is the most eco-friendly packag- facturing a vast variety of glass items by perumbudur, Tamil Nadu); and Gujarat

ing media. Principal raw materials used in the traditional process. Side by side with Guardian Ltd. (Ankleshwar, Gujarat). These

the manufacture of glass are silica sand, this, we have the most modern plants pro- three companies meet Western standards.

soda ash, calcite, dolomite, etc. All raw ducing glass containers, float-glass etc. by

materials are available indigenously. Each use of latest technology. Gujarat Guardian produces 550-tpd

bit of broken glass can be re-cycled to (tons per day); Asahi Indias two plants pro-

manufacture new glass with much lower From mouth blown and hand working duce 500-tpd and 750-tpd; and Saint-

consumption of energy. Most of the raw processes, the industry has taken to auto- Gobains two plants produce 550-tpd and

materials are mined in rural and backward mation in a big way, although traditional 700-tpd. One other domestic company,

areas of the country providing employment manufacturing processes have not been Triveni Glass Ltd. (Iradatganj, Allahabad),

to families below the poverty line. abandoned. Mouth blown and handcrafted also produces 200-tpd of float-glass.

glassware have a dominant role in decora-

The industry now offers a wide range of tive and table glassware, which are ex- Gujarat Guardian was the first float-

products from toughened, unbreakable, lami- ported in large quantities. glass company to be set up in India in 1993.

nated safety glass, solar control glass to It was a joint venture between Guardian

insulating glass, which can be used in inte- The majority of raw materials required Industries International Corp. of the United

riors as well as exteriors of buildings, say by the industry are available locally, pro- States and Indias Modi Group.

industry sources. Besides buildings, the viding excellent scope for growth and de-

industry has expanded its base to other velopment. Asahi India Glass started operations in

areas including jewellery, crystal show December 1994. It started off as a joint

pieces and ornaments. Types of glass produced venture between the Tatas and Asahi (Ja-

Both float and sheet-glass are pro- pan), but with the exit of the Asahi in 2003,

Historical perspective duced in India, with market shares of 89% it was taken over by Asahi India Safety, an

Glass industry in India remained in the and 11%, respectively. However, the automotive glass manufacturing company.

form of a cottage industry till the beginning greater proportion of sheet and lower- The merged entity is known as Asahi India

of 20th century. The first glass plant was quality float capacity will be gradually Glass Ltd. The company started a new float

set up in August 1908 by Lokmanaya phased out and replaced with high-qua- plant with a 750-tpd capacity on Jan. 1 in

Balgangadhar Tilak at Talegaon (Maha- lity float-glass. Despite the closure of Uttaranchal.

rashtra) near Pune. The plant was financed certain sheet-glass manufacturing units,

by collecting one paisa per family per month total flat glass production has increased Triveni Glass started operations in

from the masses and was named as Paisa due to establishment of new float lines. March 1996. Its a mini float plant, based

Fund Glass Works. This plant continues to There has been an increase in demand on Chinese technology.

be in production. for float-glass as a result of increased

investment from the construction and Saint-Gobain started operations in 2000

The industry in India has made a steady automotive sectors. Float-glass manufac- and is currently Indias largest float-glass

progress since then, particularly after India turers are gearing up to meet this de- producer. It is a 100% subsidiary of the

attained independence. It is also a classic mand and are planning to increase their Saint-Gobain Group.

example of co-existence of smaller and the installed capacities.

largest size plants. Many a delicate, deco- Recent growth trends

rative and utilitarian glass products are Major players The per capita consumption of glass,

manufactured by the labour intensive The major producers of float-glass in which was 0.41-kg in 1999, reached 0.76-

mouth blown process. Firozabad, the glass India are three foreign joint ventures: Asahi kg in 2006, a figure that is still low com-

city of India, continues to be a place of India Glass Ltd. (Taloja, Maharashtra); pared to other countries.

Chemical Weekly September 18, 2007 197

197

Special Report

The enthusiasm shown by architects manufacture of glass and glass products. Total imports of glass and glassware

toward glass usage has contributed to the Total income of 30 companies studied in- during 2004-05 was valued at Rs. 8,916-mn

growth of the glass industry, particularly in creased at a rate of 5.8% per annum in the (US$207-mn), which increased to Rs.

segments like IT/ITes [Information techno- last three years (for which the data is avail- 12,508-mn (US$288-mn) in 2005-06. Dur-

logy/ Information technology enabled ser- able), while sales increased by only 2.5% ing 2005-06, imports of glass fibres (includ-

vices], the hospitality sector, malls and per annum. ing glass wool) constituted 29% of total

commercial development. imports, followed by ground/polished glass

As against this, total expenses in- in sheets (16%), table & kitchenware glass

The flat-glass industry grew by about creased by 4.9 per cent per annum, with (13%), glass envelops (including bulbs &

80% between the year 2000 and 2006 or at raw material expenses rising by 9 per cent tubes) (8%), glass beads & imitation

a compound annual growth rate of 10.1%. per annum and power & fuel expenses at jewellery articles (7%).

3.7 per cent per annum. Raw material ex-

Glass containers penses constituted 28 per cent of total ex- Exports of glass

Glass container production has more penses in 2005-06. Profit after tax on total Increased levels of glass and glass-

than doubled from approximately 800,000- income has been in the range of 3.4-5.6% ware exports have been recorded in recent

tons in 1997-98 to some 1.7-mt in 2004-05. cumulatively in last three years. years. Exports have grown from US$35-mn

This is despite the stiff competition faced in 1993-94 to US$240-mn in 2005-06.

from alternative packaging materials. Imports of glass

There has been massive surge of Products that achieved strong export

Glass processing sector imports of glass, especially from China, growth in 2005-06 were safety glass, glass

In India, most of the glass usage is in which has impacted the local glass beads/jewelry articles, glass used in con-

the raw form, but processing has grown tableware industry. Manufacturers al- struction, containers, table/kitchenware

rapidly in the recent past. While glass pro- lege that large quantities of opal and and mirrors. Export shortfalls were recorded

cessing for automotive purposes has been crystal ware being dumped in the mar- for ground/polished glass, glass envelops

there in India for some time now (although ket. This has resulted in underuti- (bulbs & tubes) and glass fibres.

the rate of growth has increased signifi- lisation of installed capacity and ad-

cantly), the architectural processing seg- versely affected profitability of local The Indian market

ment is the one that is growing faster. manufacturers. The two main consuming sectors of

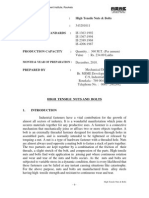

Processing started in India 12 years ago, Table 1

and today there are 49 tempering lines. Financial aggregates of Indian glass industry

Architectural tempering started in 1994; [Rs. Crore]

double-glazing in 1996; and architectural

lamination in 2000. Hardware for glass 2003-04 2004-05 2005-06

started being manufactured in 1998. Total income 2,773 3,022 3,105

Sales 2,743 2,969 2,879

Other than the foreign manufacturers, Total expenses 2,652 2,846 2,918

27 domestic companies process glass with Raw material expenses 684 794 813

more than 40 tempering lines, 15 double- Power, fuel & water charge 488 518 525

glazing lines and six lamination lines, ac- PAT net of P&E 97 169 100

cording to All India Glass Processors Panel, Total forex earnings 332 401 302

affiliated to the All India Flat Glass Manu- Total forex spending 255 371 636

facturers Association (AIFGMA).

Profitability [%]

There are 5,000 glass retailers are in PAT net of P&E / Total income net of P&E 3.5 5.6 3.4

the country. PAT net of P&E / Avg. capital employed 4.4 8.1 4.3

PAT net of P&E / Avg. total assets 2.7 4.7 2.5

Industry performance No. of companies 30 30 27

Table 1 below provides the financial Source: CMIE

aggregates of 30 companies engaged in the

198 Chemical Weekly September 18, 2007

198

Special Report

Table 2

Imports of glass & glassware products

[Rs. Million]

2004-05 2005-06

Type of glass Value Share [%] Value Share [%]

Cast & rolled glass in sheets/profiles 28.61 0.32 63.21 0.51

Drawn/blown glass in sheets 84.53 0.95 247.17 1.98

Ground/polished glass in sheets 1,264.92 14.19 2,036.39 16.28

Worked glass 11.93 0.13 11.27 0.09

Safety glass-tampered/laminated 401.28 4.50 375.57 3.00

Multiple walled insulating units of glass 8.09 0.09 18.25 0.15

Glass mirrors 220.14 2.47 381.86 3.05

Glass used for packing/preservation (containers) 239.06 2.68 686.13 5.49

Glass envelops including bulbs & tubes 1,447.87 16.24 948.05 7.58

Glass inners used in vacuum flasks/other vessels 3.58 0.04 17.08 0.14

Table/kitchenware glass 1,106.41 12.41 1,560.13 12.47

Optical elements/signaling glassware 95.59 1.07 128.23 1.03

Watch/clock/ophthalmic glass 655.28 7.35 672.81 5.38

Glass used in construction 185.85 2.08 223.29 1.79

Laboratory & pharmaceutical glassware 156.03 1.75 344.50 2.75

Glass beads & jewelry articles 621.49 6.97 869.61 6.95

Glass fibres, including glass wool 2,124.38 23.83 3,555.85 28.43

Other glass articles 260.62 2.92 368.58 2.95

Total 8,915.66 100.00 12,507.98 100.00

flat glass in India are the construction place in the automotive industry, which vest to support its plan to reach a mar-

and automotive industries. 83% of the is predicted to grow following cut in ex- ket share of 36% of the Indian glass and

glass produced is used in the construc- cise duty on vehicles and the easy avail- glass product market in the coming

tion industry, 15% in the automotive in- ability of flexible automobile loans. years.

dustry and 2% in miscellaneous indus-

tries, such as furniture and photo frames. Traditionally dominated by local play- This firm isnt alone in investing. Ko-

ers, the industry has seen a slew of glo- rean glass maker, DM Wall System Co

Both automobiles and construction bal players setting up new units in India. Ltd., is planning to establish another unit

have been experiencing hyper growth In the past 15 years, the industry saw in Chennai. Europes leading glass pro-

during the past two to three years. While investments totaling Rs. 2,100-crore cessor, Gloverbel (Belgium) will set up

production of four-wheelers registered [US$4.7-mn] in raw-glass manufacturing its first glass processing plant in Taloja

18.6% growth in 2006, the construction and architectural-glass processing, pri- near Mumbai.

sector is estimated to be growing at marily in the horizontal tempering pro-

around 12% per annum. cess. The number of architectural tem- Though there is a great demand for

pering lines in the country has grown from glass, which is growing at around 12%, ana-

Almost 80-mn square feet of land in three in 1998 to more than 49 by the end lysts say supply will far exceed demand at

India is earmarked for shopping malls. of 2006. least till 2009.

Nowadays, taking into consideration cli-

mate, safety, sound attenuation, energy There are several proposals for new With US$478-mn in investments in the

conservation and aesthetics, builders are investments in the industry, including in next five years in the processing segment,

opting for more glass in their construc- the processed glass industry. Saint- the glass industry is likely to witness a

tion. The glass revolution is also taking Gobain has said it would continue to in- three-fold increase by 2009, say players in

Chemical Weekly September 18, 2007 199

199

Special Report

Table 3

Exports of glass & glassware products

[Rs. Million]

2004-05 2005-06

Type of glass Value Share [%] Value Share [%]

Cast & rolled glass in sheets/profiles 34.91 0.38 16.40 0.16

Drawn/blown glass in sheets 157.41 1.71 190.48 1.85

Ground/polished glass in sheets 734.54 8.00 371.34 3.60

Worked glass 6.73 0.07 3.23 0.03

Safety glass-tampered/laminated 36.75 0.40 84.13 0.82

Multiple walled insulating units of glass 14.46 0.16 2.99 0.03

Glass mirrors 159.68 1.74 258.21 2.51

Glass used for packing/preservation (containers) 1,986.86 21.64 2,662.68 25.85

Glass envelops including bulbs & tubes 1,066.83 11.62 852.30 8.27

Glass inners used in vacuum flasks/other vessels 239.98 2.61 259.95 2.52

Table/kitchenware glass 271.22 2.95 279.64 2.71

Optical elements/signaling glassware 23.01 0.25 19.23 0.19

Watch/clock/ophthalmic glass 41.84 0.46 86.38 0.84

Glass used in construction 340.04 3.70 684.45 6.64

Laboratory & pharmaceutical glassware 257.08 2.80 327.73 3.18

Glass beads & jewelry articles 1,395.28 15.19 2,235.19 21.70

Glass fibers including glass wool 1,932.68 21.05 1,330.12 12.91

Other glass articles 483.29 5.26 637.09 6.18

Total 9,182.59 100.00 10,301.54 100.00

the industry. In the next five years, the in- investment. This is because the company latory framework building codes for safety,

dustry will offer a US$1-bn market for ar- now uses Indian engineers, while it had to energy codes etc. need to keep pace with

chitectural glassware. Growing quality con- enlist the services of expatriate engineers industry growth and new glass usages.

sciousness has led to a rapid growth in the earlier. In the automotive segment, as safety

float-glass segment, in a market which was consciousness goes up, the Indian Govern- Looking ahead

predominantly a sheet-glass market till six ment and the courts are expected to take The industry is expected to grow at a

years back. Float-glass currently has 70% strict views on auto safety standards, just as rate of 10% per year in the next five years,

market share and is driving the growth in they have already done in the case of auto given that the Indian economy has been

the sector. As per industry estimates, the emission standards. This could lead to sig- growing at an average rate of about 8.5% in

sector has been growing at 8% for the last nificant replacement opportunities for glass the last four years.

couple of years and is expected to grow at markets in the heavy and light commercial

10-15% in the coming years. vehicle segments. A glazy road ahead can be Over the long term, glass demand is an-

seen for the glass industry. ticipated to grow at around 3.8% per year,

The exports market is also looking up. significantly above global economic growth

India could soon emerge as a major export Challenges for the industry rates. Demand for value-added products is

base for glass makers supplying to the auto- Two main problems hounding the indus- growing at a faster rate than demand for basic

mobile industry. For example, Saint Gobains try are overcapacity, in spite of rising de- glass, boosting sales of building products

plant at Sriperambadur (Chennai) has become mand, and lack of codes and standards. and automotive glazing. Architects are us-

the third lowest cost manufacturer among ing more glass and value-added glass. As

the French multinationals 29 plants across The glass industry is also weighed legislation and regulations concerning safety,

the world, after Poland and Spain. The engi- down by the spiraling cost of manufactur- sound attenuation and energy conservation

neering cost for its expansion was pegged at ing. Energy costs are increasing, as are raw fall into place, India will be a significant com-

half of what it had cost at the time of original material and infrastructure costs. The regu- petitor in the global glass market.

200 Chemical Weekly September 18, 2007

200

You might also like

- Glass IndustryDocument11 pagesGlass Industrysmita6nayakNo ratings yet

- Dal Mill ProjectDocument59 pagesDal Mill ProjectShashiSinghNo ratings yet

- Risk Culture Assessment QuestionnaireDocument3 pagesRisk Culture Assessment QuestionnairemohamedNo ratings yet

- Asahi India Glass Project by DEEPAK SINGH AaaDocument57 pagesAsahi India Glass Project by DEEPAK SINGH AaaDeepak SinghNo ratings yet

- Toughened GlassDocument14 pagesToughened GlassRachit Agarwal100% (1)

- Bhorukha AluminiumDocument76 pagesBhorukha Aluminiumtanujaigoor100% (3)

- Ms Word McqsDocument12 pagesMs Word McqsUraiBa AnsaRi0% (1)

- Project Report On Galvanised Nut & BoltDocument6 pagesProject Report On Galvanised Nut & BoltEIRI Board of Consultants and PublishersNo ratings yet

- Project Report On Aluminium ExtrusionDocument8 pagesProject Report On Aluminium ExtrusionEIRI Board of Consultants and PublishersNo ratings yet

- Entp. Project On Investment CastingDocument34 pagesEntp. Project On Investment Castingapi-19762123100% (1)

- DKS Industries Billet Project ReportDocument24 pagesDKS Industries Billet Project ReportMathura Packing100% (2)

- Steel Industry in IndiaDocument8 pagesSteel Industry in IndiaakashNo ratings yet

- Project Profile-Pet PreformsDocument4 pagesProject Profile-Pet Preformsbravehear030100% (2)

- OHS Policies and Guidelines (TESDA CSS NC2 COC1)Document1 pageOHS Policies and Guidelines (TESDA CSS NC2 COC1)Anonymous fvY2BzPQVx100% (2)

- Project Report On Float GlassDocument8 pagesProject Report On Float GlassEIRI Board of Consultants and PublishersNo ratings yet

- Belgaum Foundry ClusterDocument19 pagesBelgaum Foundry ClusterVinay Vasant Mangale0% (1)

- Plastic Jerry CanDocument26 pagesPlastic Jerry CanSivaratnam NavatharanNo ratings yet

- Project Report Tissue PaperDocument5 pagesProject Report Tissue PaperShadow PrinceNo ratings yet

- Summer Training Report at Hindusthan National GlassDocument33 pagesSummer Training Report at Hindusthan National GlassAshish ChughNo ratings yet

- Project Report On Glass Bottles For LiquorDocument7 pagesProject Report On Glass Bottles For LiquorEIRI Board of Consultants and Publishers0% (1)

- Manufacturing Quality Castings for 30 YearsDocument44 pagesManufacturing Quality Castings for 30 YearsDivya Ramraj60% (5)

- Project of Wall PuttyDocument4 pagesProject of Wall PuttyVineet MishraNo ratings yet

- Color Coated Sheets ResearchDocument8 pagesColor Coated Sheets ResearchGirish SahareNo ratings yet

- Mba Finance ProjectDocument78 pagesMba Finance ProjectRajin Pc100% (2)

- Steel Rebar Industry ProfileDocument34 pagesSteel Rebar Industry ProfileOvidiu TomaNo ratings yet

- DLL Theorems On RectangleDocument5 pagesDLL Theorems On RectanglePatrick Guerra100% (1)

- Project Report On Copper ProductsDocument6 pagesProject Report On Copper ProductsEIRI Board of Consultants and Publishers100% (1)

- Detailed Project Report for LLDPE Water Storage Tank Manufacturing UnitDocument38 pagesDetailed Project Report for LLDPE Water Storage Tank Manufacturing Unitneeraj1274No ratings yet

- Dpr-Meghana Roofing Industries-From Page5Document20 pagesDpr-Meghana Roofing Industries-From Page5technopreneurvizagNo ratings yet

- Business Study On Plastic Industry New FormatDocument52 pagesBusiness Study On Plastic Industry New Formatimdeepak1No ratings yet

- Study of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainDocument65 pagesStudy of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainSourav SenNo ratings yet

- Project Report On Discontinuous Puf Panels Using Cyclopentane As A Blowing AgentDocument6 pagesProject Report On Discontinuous Puf Panels Using Cyclopentane As A Blowing AgentEIRI Board of Consultants and PublishersNo ratings yet

- Final Dinesh ProjectDocument16 pagesFinal Dinesh ProjectAravindhan LNo ratings yet

- Project Relative Advantages and Disadvantages of UPVC, Aluminum and Wooden Doors/WindowsDocument16 pagesProject Relative Advantages and Disadvantages of UPVC, Aluminum and Wooden Doors/Windowskhan03355No ratings yet

- Glass Industry Analysis ReportDocument14 pagesGlass Industry Analysis ReportSATWAT PARIJA100% (2)

- CeramicGlazedTiles ProjectDocument18 pagesCeramicGlazedTiles ProjectSiddharth AryaNo ratings yet

- Laminated Object Manufacturing Process ExplainedDocument6 pagesLaminated Object Manufacturing Process Explainedpapajohn1383No ratings yet

- Project Report of PVC PipesDocument7 pagesProject Report of PVC PipesRajesh KumarNo ratings yet

- Mahajan Mini Flour Mill, UdhampurDocument24 pagesMahajan Mini Flour Mill, UdhampurMj PayalNo ratings yet

- Marble Industry SWOT Analysis - ImsciencesDocument16 pagesMarble Industry SWOT Analysis - ImsciencesR.Qayyum100% (2)

- New-Ethiopia 5000t Lost Foam Casting PlantDocument42 pagesNew-Ethiopia 5000t Lost Foam Casting Plantkeyo100% (1)

- Aluminum Utensils Project ProfileDocument9 pagesAluminum Utensils Project Profilearun1417No ratings yet

- uPVC WINDOWS FROM uPVC PROFILESDocument2 pagesuPVC WINDOWS FROM uPVC PROFILESN RaoNo ratings yet

- Report Project CompleteDocument41 pagesReport Project CompletesitijarahmadzinNo ratings yet

- Industrial Training Report Steel LTD or Tube/pipe MillDocument70 pagesIndustrial Training Report Steel LTD or Tube/pipe MillInderjeet Singh83% (6)

- Disposal Syringe MFG Plant IndiaDocument8 pagesDisposal Syringe MFG Plant IndiaSK Reddy KotlaNo ratings yet

- Project Profile On Paper Cups-10lDocument14 pagesProject Profile On Paper Cups-10lRamakrishnan RajappanNo ratings yet

- 815 KamdhenuDocument31 pages815 KamdhenuAnkit Agrawal100% (1)

- Project ReportDocument61 pagesProject Reportjeetto75% (4)

- New Era in SteelmakingDocument6 pagesNew Era in SteelmakingjtpmlNo ratings yet

- Indian Plywood OutlookDocument6 pagesIndian Plywood OutlookArumugam RamalingamNo ratings yet

- Industrial Project Report On Granite (Marble) Polishing Batti (Bar)Document3 pagesIndustrial Project Report On Granite (Marble) Polishing Batti (Bar)eiribooks0% (1)

- Faucet Production ProcessDocument4 pagesFaucet Production ProcessSunil100% (2)

- Project Report On Exercise Notebook Industry Like ClassmateDocument7 pagesProject Report On Exercise Notebook Industry Like ClassmateEIRI Board of Consultants and Publishers100% (1)

- Siddharth's ProjectDocument46 pagesSiddharth's ProjectSamuel DavisNo ratings yet

- Glass IndustryDocument43 pagesGlass IndustryYunus Ahmed67% (3)

- Project Report - Rubber IndustryDocument17 pagesProject Report - Rubber Industryprahladjoshi67% (3)

- Project Profile On Fly Ash Bricks Srs EnterprisesDocument17 pagesProject Profile On Fly Ash Bricks Srs EnterprisesRAHUL SHARMANo ratings yet

- High Tensile Nuts BoltsDocument10 pagesHigh Tensile Nuts BoltssagarhalappaNo ratings yet

- Logistics in India's Glass Manufacturing IndustryDocument14 pagesLogistics in India's Glass Manufacturing IndustryVishwas JNo ratings yet

- Evolution of Glass Inds-Mukul SomanDocument22 pagesEvolution of Glass Inds-Mukul SomanraghuNo ratings yet

- Indian Glass Industry Set For Brisk Action': Focus On Indian Sub-ContinentDocument6 pagesIndian Glass Industry Set For Brisk Action': Focus On Indian Sub-ContinentArchit GargNo ratings yet

- Glass Sheets (Automatic Plant)Document18 pagesGlass Sheets (Automatic Plant)arthiaugustyNo ratings yet

- Consumer Awareness About Sai Ram CeramicsDocument13 pagesConsumer Awareness About Sai Ram Ceramicsnirmala periasamyNo ratings yet

- 2010 Final Exam (Answers)Document10 pages2010 Final Exam (Answers)T FNo ratings yet

- ClassDocument40 pagesClassapi-449920999No ratings yet

- Laptop Chip Level CourseDocument2 pagesLaptop Chip Level CourselghmshariNo ratings yet

- Fuzzy Logic Tutorial: What Is, Application & ExampleDocument7 pagesFuzzy Logic Tutorial: What Is, Application & ExampleDe' LufiasNo ratings yet

- Basic Engineering & Site DataDocument13 pagesBasic Engineering & Site DataBalasubramanianNo ratings yet

- Hemera Creality CR10s Pro Upgrade Guide (Edition 1)Document24 pagesHemera Creality CR10s Pro Upgrade Guide (Edition 1)gumushNo ratings yet

- Disaster Readiness Exam SpecificationsDocument2 pagesDisaster Readiness Exam SpecificationsRICHARD CORTEZNo ratings yet

- Summary of C: How To Program Sixth Edition by Deitel: Introduction To Computers, The Internet and The WebDocument15 pagesSummary of C: How To Program Sixth Edition by Deitel: Introduction To Computers, The Internet and The WebFrieda NgaharjoNo ratings yet

- Mouse Molecular Genetics Student Activity 2Document7 pagesMouse Molecular Genetics Student Activity 2Jonathan ZhouNo ratings yet

- Pulungmasle High School: Boy Scouts of The Philippines - Pulungmasle High School Chapter Work Plan For S.Y 2018-2019Document3 pagesPulungmasle High School: Boy Scouts of The Philippines - Pulungmasle High School Chapter Work Plan For S.Y 2018-2019Rd DavidNo ratings yet

- Adolescent InterviewDocument9 pagesAdolescent Interviewapi-532448305No ratings yet

- Latka March2020 DigitalDocument68 pagesLatka March2020 DigitalDan100% (2)

- 8th Grade GT Science SyllabusDocument2 pages8th Grade GT Science Syllabusapi-420198655No ratings yet

- MY LIFE VISION, MISSION AND CORE VALUES BMEC 2W 2122Document4 pagesMY LIFE VISION, MISSION AND CORE VALUES BMEC 2W 2122Nikolai Avery NorthNo ratings yet

- Frequently Asked Questions (Faq) FOR New Unifi Mobile Prepaid #BebasDocument1 pageFrequently Asked Questions (Faq) FOR New Unifi Mobile Prepaid #BebasNgHanSeongNo ratings yet

- Valve Type Trim Type CF XTDocument1 pageValve Type Trim Type CF XTAye KyweNo ratings yet

- Critical Regionalism in ArchitectureDocument75 pagesCritical Regionalism in ArchitecturebranishNo ratings yet

- Nb7040 - Rules For Pipe Connections and Spools: Acc. Building Specification. Rev. 2, November 2016Document4 pagesNb7040 - Rules For Pipe Connections and Spools: Acc. Building Specification. Rev. 2, November 201624142414No ratings yet

- Career Development Plan: Career Navigation at UBC WebsiteDocument10 pagesCareer Development Plan: Career Navigation at UBC WebsiteKty Margaritta MartinezNo ratings yet

- PronunciationDocument5 pagesPronunciationHưng NguyễnNo ratings yet

- Grade 7 holiday assignment anagrams numbers analogiesDocument4 pagesGrade 7 holiday assignment anagrams numbers analogies360MaRko oo.No ratings yet

- UN 9252-06 Part 1-UD-AU-000-EB-00020 PDFDocument7 pagesUN 9252-06 Part 1-UD-AU-000-EB-00020 PDFManjeet SainiNo ratings yet

- Calibration Procedure Crowcon Xgard Gas Detectors - 5720273 - 01Document16 pagesCalibration Procedure Crowcon Xgard Gas Detectors - 5720273 - 01Daniel Rolando Gutierrez FuentesNo ratings yet

- Floor Boxes and Power Supplies OverviewDocument32 pagesFloor Boxes and Power Supplies OverviewAbdoNo ratings yet

- Spiros Styliaras: Devops EngineerDocument2 pagesSpiros Styliaras: Devops EngineerΣπύρος ΣτυλιαράςNo ratings yet

- Mass Transfer in Industrial ApplicationsDocument1 pageMass Transfer in Industrial ApplicationsMPD19I001 VITHISHA MNo ratings yet