Professional Documents

Culture Documents

FY 2013 State Budgets

Uploaded by

jspectorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FY 2013 State Budgets

Uploaded by

jspectorCopyright:

Available Formats

JULY 3, 2012

US PUBLIC FINANCE

SPECIAL COMMENT

Trend of On Time State Budgets Continues as Revenues Improve

Every state adopted a budget on time for fiscal 2013. The adoption of timely budgets in the last two cycles (most state fiscal years begin July 1) reflects moderate improvement in state fiscal conditions, and the fact that states have largely avoided the political showdowns that marked the peak of the recession. The trend of on-time budget passage underscores the willingness of state officials to make difficult fiscal decisions. While the economic recovery remains tepid and fiscal challenges remain, revenues are growing and budget gaps are markedly lower. According to the Center for Budget and Policy Priorities (CBPP), state budget gaps totaled $191 billion in fiscal 2010 and $130 billion in fiscal 2011. A separate study by the National Association of State Budget Officers estimated total budget gaps of $110 billion for fiscal 2012. This special comment discusses the current budgetary environment for all states, the trend in measures used to balance state budgets and the institutional mechanisms in place for states to address late budgets, particularly with respect to debt service payments. Our findings reflect:

Table of Contents:

LATE BUDGETS REFLECT POLITICAL DISCORD AND/OR SUPERMAJORITY VOTING REQUIREMENTS NO GOVERNMENT SHUTDOWNS FOR FISCAL 2013 ESTABLISHED PROCEDURES ENSURE TIMELY DEBT SERVICE PAYMENTS IN LATE BUDGET SITUATIONS ECONOMIC AND REVENUE GROWTH HELP STATES TO OVERCOME THE POLITICAL STALEMATE THAT MARKED MUCH OF THE DOWNTURN MOODYS RELATED RESEARCH

2 3 3

4 6

Analyst Contacts:

NEW YORK +1.212.553.1653

Kimberly Lyons +1.212.553.4673 Assistant Vice President Analyst kimberly.lyons@moodys.com Nicholas Samuels +1.212.553.7121 Vice President Senior Analyst nicholas.samuels@moodys.com Emily Raimes +1.212.553.7203 Vice President Senior Analyst emily.raimes@moodys.com Timothy Blake +1.212.553.0849 Managing Director Public Finance timothy.blake@moodys.com Robert A. Kurtter +1.212.553.4453 Managing Director Public Finance robert.kurtter@moodys.com

Every state enacted a budget on time for fiscal 2013. By comparison, four states enacted their budgets late in fiscal 2009, five in fiscal 2010, three in fiscal 2011 and one last yearMinnesota; Improving revenues have helped states overcome much of the political intractability that led to late budgets during the downturn. Through the spring, more than half the states report that fiscal 2012 revenues exceeded budgeted forecasts and most others were on target.

U.S. PUBLIC FINANCE

Late Budgets Reflect Political Discord and/or Supermajority Voting Requirements

The strength of financial governance and the efficiency of state budget procedures is an important credit consideration. Late budgets primarily reflect political disagreements, and in extreme cases lead to government shutdowns. In some states the requirement that a legislative supermajority approve the budget can exacerbate existing political disagreement. However, even when budget enactment is delayed, most states resolve their issues in a relatively short period, with no long-term impact on their fiscal health or credit. Eight states have experienced at least one late budget in the last five years, and four of those eight states have experienced more than one late budget in the same time period (Exhibit 1). The states that tend to be late typically have established practices in place to ensure that disbursements for debt service and other expenses continue, even in the absence of full year spending plans. These practices are established by state constitution, statute, or by policy. Most states begin their fiscal year on July 1 (four states have different fiscal years: Alabama and Michigan begin October 1; New York on April 1; and Texas on September 1). For fiscal 2013, the legislatures in Massachusetts and South Carolina passed budgets late in the legislative session, but before the beginning of the new fiscal year. In both states, budget laws grant the governor a period to review the measures, 10 days for Massachusetts and five for South Carolina. Because the spending measures were passed so late, neither governor signed the budget by July 1. We do not consider these budgets late, however, since the full-year spending measures were passed and in both cases, the states enacted interim spending measures that cover operations and debt service.

EXHIBIT 1

Improving Trend for Budget Adoption

States that missed the start of the fiscal year

State G.O. Debt Rating FY2012 FY2011 FY2010 FY2009

California Connecticut Illinois Minnesota New York North Carolina Ohio Pennsylvania

Source: Moodys Investor Service

A1/Stable Aa3/Stable A2/Stable Aa1/Negative Aa2/Stable Aaa/Stable Aa1/Stable Aa1/Negative X

X X X X X X X X

X X X

JULY 3, 2012

SPECIAL COMMENT: TREND OF ON TIME STATE BUDGETS CONTINUES AS REVENUES IMPROVE

U.S. PUBLIC FINANCE

No Government Shutdowns for Fiscal 2013

Underscoring how the resolution of significant budget shortfalls can heighten ideological differences and lead to political stalemate, the Minnesota government shutdown for 20 days at the start of fiscal 2012, the longest state shutdown in recent history (Exhibit 2). During the 2011 legislative session, Governor Mark Dayton's original executive budget recommendation included new taxes forecasted to generate approximately $3 billion of recurring revenues. Disagreement over the proposed new taxes for the fiscal 2012-2013 biennium resulted in a budget impasse, with the state legislature staunchly against any additional taxes. The state failed to enact a new biennium budget in time for fiscal 2012, prompting an immediate shutdown of government operations pursuant to statute, which prohibited the state from spending without a legislatively approved budget. Debt service was not affected: mechanisms were put in place to ensure that all of the states bonds continued to be paid on time.

EXHIBIT 2

Only a handful of State Shutdowns Last Ten Years

State G.O. Debt Rating Length of Shutdown Year of Shutdown

Michigan Michigan Pennsylvania New Jersey Minnesota Minnesota

Source: Moodys Investor Service

Aa2/Stable Aa2/Stable Aa1/Negative Aa3/Stable Aa1/Negative Aa1/Negative

2 hours 4 hours 1 day 7 days 8 days 20 days

2007 2009 2007 2006 2005 2011

Established Procedures Ensure Timely Debt Service Payments in Late Budget Situations

While many states have mechanisms to ensure timely debt service and maintenance of operations in the event of late budget adoption, some states have no established contingency plans for late budgets. In states that have no formal statutory or constitutional contingency plans but have a history of late budget adoption, procedures have historically been put in place to address government payments and manage cash flow during periods of budget delays. Some states have contingency plans that allow them to operate under an executive order, a continuing resolution, or an emergency spending bill. These measures ensure that the state can continue government operations, including the payment of debt service obligations. For bonds that require legislative appropriation, such as lease-backed debt, most states set debt service payment dates well beyond the start of the a states fiscal year to avoid possible delays in the event of a late budget adoption. Even with contingency plans or established mechanisms, late budget adoption at the state level can disrupt the flow of state payments to vendors and employees, as well as school districts, cities, public universities and other political subdivisions such as transit systems that rely in part of state funds. A delayed state budget could also result in late debt service payments but states have historically made special accommodations to allow debt service payments to be made on time.

JULY 3, 2012

SPECIAL COMMENT: TREND OF ON TIME STATE BUDGETS CONTINUES AS REVENUES IMPROVE

U.S. PUBLIC FINANCE

Economic and Revenue Growth Help States to Overcome the Political Stalemate that Marked Much of the Downturn

The prevalence of timely budgets reflects the improvement in state revenue trends. While the tradeoffs are still difficult, the magnitude of necessary budget cuts is smaller than in the depths of the recession and attaining budget consensus has been easier and faster. Based on our analysis, through the spring, revenues in more than half the states exceeded forecasts and most others were in line with estimates (Exhibit 3). Revenues in some states, however, continue to miss budgeted targets and others have revised their forecasts downward, opening gaps that states will need to close. New data from the CBPP show that the shortfalls closed in fiscal 2013 budgets totaled $54 billion, still large but about half the size of the gaps they closed going into fiscal 2012. Two states with historically late budgets, New York and California, have both reversed trend in recent years, passing timely budgets for fiscal 2012 and now 2013. New York passed its budget on time for fiscal year 2013 with seemingly little of the infighting of the past. Californias governor signed a budget just days before the end of the fiscal year, assisted in part by a constitutional amendment approved by voters last year that eliminates the legislatures pay for each day it is late passing a budget. Californias budget relies on a temporary tax increase which must be approved by voters in November. If the ballot measure fails, spending cuts to K-12 education will be triggered. Continuing the recent trend of anti-tax governance environments, some states enacted tax reductions for Fiscal 2013. The state of Kansas passed sweeping tax reductions in its 2012 legislative session. The states personal income tax rates will be consolidated at 3% and 4.9%, replacing the current top rates of 6.45% and 6.25% and the low rate of 3.5%. In addition, the states sales tax rate will decline to 5.7% from 6.3% in fiscal 2013 as previously planned. Georgia also enacted tax reductions, most notably a two year sales tax holiday and eliminated the state property tax fee associated with car registrations. In North Dakota, which continues to have the highest economic growth of all states, a measure to repeal property taxes within the state was placed on the June ballot. Proponents of the measure cited the states trend of revenue over-performance as a driver for property tax relief, but voters ultimately voted against the measure.

JULY 3, 2012

SPECIAL COMMENT: TREND OF ON TIME STATE BUDGETS CONTINUES AS REVENUES IMPROVE

U.S. PUBLIC FINANCE

EXHIBIT 3

Year to Date Revenue Performance versus Forecast

State G.O. Rating

FY 2012 Rev YOY (%)

Rev vs Estimates

Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming *** Average Revs YOY Data Summary Revs Vs Estimates:

Aa1/Stable Aaa/Stable Aa3/Stable* Aa1/Stable A1/Stable Aa1/Stable* Aa3/Stable Aaa/Stable Aa1/Stable Aaa/Stable Aa2/Stable Aa1/Stable* A2/Stable Aaa/Stable* Aaa/Stable* Aa1/Negative* Aa2/Negative* Aa2/Stable Aa2/Negative* Aaa/Negative Aa1/Stable Aa2/Stable Aa1/Negative Aa2/Stable Aaa/Stable Aa1/Stable NGO** Aa2/Stable Aa1/Stable Aa3/Stable Aaa/Negative Aa2/Stable Aaa/Stable Aa1/Stable* Aa1/Stable Aa2/Stable Aa1/Stable Aa1/Negative Baa1/Negative Aa2/Negative Aaa/Stable NGO** Aaa/Stable Aaa/Stable Aaa/Stable Aaa/Stable Aaa/Negative Aa1/Negative Aa1/Stable Aa2/Stable NGO**

2.6% 29% 5.3% 2.9% -10% 7.8% 4.7% -5.5% 3.1% 5.1% 12% 6.3% 11.3% 9.0% 6.2% 8.4% 3.7% 1.2% 2.5% 6.7% 2.0% 1.7% 4.1% 4.3% 3.4% 8.2% 5.6% 4.8% -1.8% 3.7% 2.4% -3.3% 1.2% 62% 7.8% 9.2% 0.8% 2.5% 0.9% 3.8% 5.5% 7.4% 3.4% 12% 2.7% 0.9% 5.9% 1.3% 1.0% 2.0% 8.4% 5.6% 29 7 15

Exceeding Exceeding Exceeding In Line With Lagging Exceeding Lagging Lagging Exceeding Exceeding In Line With Exceeding In Line With In Line With Exceeding In Line With In Line With Lagging Exceeding Exceeding Exceeding Exceeding Exceeding Exceeding In Line With Exceeding Exceeding Exceeding Lagging Lagging Exceeding Exceeding In Line With Exceeding Exceeding Exceeding In Line With Lagging In Line With Exceeding Exceeding In Line With Exceeding Exceeding Exceeding In Line With In Line With In Line With In Line With Exceeding Exceeding Exceeding Lagging In Line

* Issuer Rating ** No General Obligation Debt *** Moody's does not currently maintain a public rating on debt supported by the state

JULY 3, 2012

SPECIAL COMMENT: TREND OF ON TIME STATE BUDGETS CONTINUES AS REVENUES IMPROVE

U.S. PUBLIC FINANCE

Moodys Related Research

Special Comment:

Rating Changes for the 50 States from 1973, July 2012 (143616) Outlook for U.S. State Governments Remains Negative in 2012, February 2012 (139230)

Outlook:

To access any of these reports, click on the entry above. Note that these references are current as of the date of publication of this report and that more recent reports may be available. All research may not be available to all clients.

JULY 3, 2012

SPECIAL COMMENT: TREND OF ON TIME STATE BUDGETS CONTINUES AS REVENUES IMPROVE

U.S. PUBLIC FINANCE

Report Number: 143551

Author Kimberly Lyons

Senior Production Associate Diana Brimson

2012 Moodys Investors Service, Inc. and/or its licensors and affiliates (collectively, MOODYS). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. (MIS) AND ITS AFFILIATES ARE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODYS (MOODYS PUBLICATIONS) MAY INCLUDE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MOODYS DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODYS OPINIONS INCLUDED IN MOODYS PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. CREDIT RATINGS AND MOODYS PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODYS PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODYS PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODYS ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODYS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODYS PRIOR WRITTEN CONSENT. All information contained herein is obtained by MOODYS from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided AS IS without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODYS is not an auditor and cannot in every instance independently verify or validate information received in the rating process. Under no circumstances shall MOODYS have any liability to any person or entity for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligent or otherwise) or other circumstance or contingency within or outside the control of MOODYS or any of its directors, officers, employees or agents in connection with the procurement, collection, compilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if MOODYS is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The ratings, financial reporting analysis, projections, and other observations, if any, constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hold any securities. Each user of the information contained herein must make its own study and evaluation of each security it may consider purchasing, holding or selling. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODYS IN ANY FORM OR MANNER WHATSOEVER. MIS, a wholly-owned credit rating agency subsidiary of Moodys Corporation (MCO), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MISs ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading Shareholder Relations Corporate Governance Director and Shareholder Affiliation Policy. Any publication into Australia of this document is by MOODYS affiliate, Moodys Investors Service Pty Limited ABN 61 003 399 657, which holds Australian Financial Services License no. 336969. This document is intended to be provided only to wholesale clients within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODYS that you are, or are accessing the document as a representative of, a wholesale client and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to retail clients within the meaning of section 761G of the Corporations Act 2001. Notwithstanding the foregoing, credit ratings assigned on and after October 1, 2010 by Moodys Japan K.K. (MJKK) are MJKKs current opinions of the relative future credit risk of entities, credit commitments, or debt or debt-like securities. In such a case, MIS in the foregoing statements shall be deemed to be replaced with MJKK. MJKK is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly owned by Moodys Overseas Holdings Inc., a wholly-owned subsidiary of MCO. This credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors. It would be dangerous for retail investors to make any investment decision based on this credit rating. If in doubt you should contact your financial or other professional adviser.

JULY 3, 2012

SPECIAL COMMENT: TREND OF ON TIME STATE BUDGETS CONTINUES AS REVENUES IMPROVE

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorNo ratings yet

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorNo ratings yet

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsNo ratings yet

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorNo ratings yet

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorNo ratings yet

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorNo ratings yet

- State Health CoverageDocument26 pagesState Health CoveragejspectorNo ratings yet

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorNo ratings yet

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinNo ratings yet

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanNo ratings yet

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorNo ratings yet

- Class of 2022Document1 pageClass of 2022jspectorNo ratings yet

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinNo ratings yet

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorNo ratings yet

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorNo ratings yet

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorNo ratings yet

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyNo ratings yet

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorNo ratings yet

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorNo ratings yet

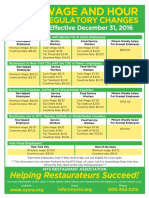

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorNo ratings yet

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonNo ratings yet

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorNo ratings yet

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanNo ratings yet

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorNo ratings yet

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorNo ratings yet

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorNo ratings yet

- Voting Report CardDocument1 pageVoting Report CardjspectorNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Strategic Management Report On Wateen Telecom LTDDocument54 pagesStrategic Management Report On Wateen Telecom LTDfarhanfarhat67% (3)

- BacklogDocument8 pagesBacklogamitdesai92No ratings yet

- Betterteam Recruitment Plan Template 20201201Document2 pagesBetterteam Recruitment Plan Template 20201201Joyce SuaNo ratings yet

- Hannes Meyer's biographical essay explores the architect's workDocument52 pagesHannes Meyer's biographical essay explores the architect's worknisivocciaNo ratings yet

- 2020 Management Paper by Talvir SInghDocument202 pages2020 Management Paper by Talvir SInghSheetala HegdeNo ratings yet

- Registro Cosmetico EuropaDocument19 pagesRegistro Cosmetico EuropaMax J. B. SouzaNo ratings yet

- FETTY CAKE LTDDocument3 pagesFETTY CAKE LTDNGONIDZASHE G MUBAYIWANo ratings yet

- Aloha ConnectDocument2 pagesAloha ConnectJorgeNo ratings yet

- 1575 Tania SultanaDocument34 pages1575 Tania SultanaTania SultanaNo ratings yet

- Sales QuotationDocument1 pageSales QuotationTekbahadur SinghNo ratings yet

- Multiple Choice Problems Chapter 8Document12 pagesMultiple Choice Problems Chapter 8Dieter LudwigNo ratings yet

- School of Architecture, Building & Design: Highpark Suites, Kelana JayaDocument42 pagesSchool of Architecture, Building & Design: Highpark Suites, Kelana JayaZue Rai Fah100% (1)

- Theory Okhtein Assignment Nadine Mohamed Group 1Document8 pagesTheory Okhtein Assignment Nadine Mohamed Group 1ATLA ForeverNo ratings yet

- The New Context For Specialty CoffeeDocument8 pagesThe New Context For Specialty CoffeeSpecialtyCoffee100% (2)

- Job Specification and Job Description of Nestle Bangladesh - PREPARED FOR ASSIGNMENT ON JOB DESCRIPTION AND JOB Tamanna Parveen Eva (TPE Senior Lecturer - Course Hero PDFDocument12 pagesJob Specification and Job Description of Nestle Bangladesh - PREPARED FOR ASSIGNMENT ON JOB DESCRIPTION AND JOB Tamanna Parveen Eva (TPE Senior Lecturer - Course Hero PDFHumayun JavedNo ratings yet

- Asian Journal of Management Cases: Zainab Riaz, Lahore University of Management Sciences, PakistanDocument1 pageAsian Journal of Management Cases: Zainab Riaz, Lahore University of Management Sciences, PakistanbhagavathamhNo ratings yet

- Kevin O'LearyDocument4 pagesKevin O'LearyRichard WoottonNo ratings yet

- Calculating conversion values and bond prices of convertible bondsDocument2 pagesCalculating conversion values and bond prices of convertible bondsDebarnob SarkarNo ratings yet

- Minimum Wages in MaharashtraDocument6 pagesMinimum Wages in MaharashtrasalapeNo ratings yet

- Monetary Policy Statement October 2020Document2 pagesMonetary Policy Statement October 2020African Centre for Media ExcellenceNo ratings yet

- Wallfort - 29 April 2022Document24 pagesWallfort - 29 April 2022Utsav LapsiwalaNo ratings yet

- The Most Important Cities of AustraliaDocument3 pagesThe Most Important Cities of AustraliaLudovica BonessiNo ratings yet

- Woodsmith - Vol 41, No 246, 2019Document72 pagesWoodsmith - Vol 41, No 246, 2019reivnax100% (1)

- Student RequirementsDocument7 pagesStudent RequirementsYANNA CABANGONNo ratings yet

- Municipality of San Clemente - Citizens CharterDocument155 pagesMunicipality of San Clemente - Citizens CharterFree FlixnetNo ratings yet

- Will The Internet Destroy The News MediaDocument20 pagesWill The Internet Destroy The News MediaJoshua GansNo ratings yet

- Contemporary Logistics in China - Interconnective Channels and Collaborative Sharing-SprDocument216 pagesContemporary Logistics in China - Interconnective Channels and Collaborative Sharing-SprTrainer Ayoub Al AjroudiNo ratings yet

- Handbook For The NEBOShDocument83 pagesHandbook For The NEBOShAndi RahamantoNo ratings yet

- Quizzes Compilation TaxationDocument11 pagesQuizzes Compilation TaxationHads LunaNo ratings yet

- BASICS OF INSURANCE - Question & AnswersDocument14 pagesBASICS OF INSURANCE - Question & Answersjeganrajraj100% (2)