Professional Documents

Culture Documents

And From Everything You Gain, Khums Is For Allah and His Prophets . (8:41)

And From Everything You Gain, Khums Is For Allah and His Prophets . (8:41)

Uploaded by

MikPiscesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

And From Everything You Gain, Khums Is For Allah and His Prophets . (8:41)

And From Everything You Gain, Khums Is For Allah and His Prophets . (8:41)

Uploaded by

MikPiscesCopyright:

Available Formats

And from everything you gain, Khums is for Allah and His Prophets.

[8:41]

THINGS KHUMS HAS TO BE PAID ON

Net Savings

Lawful Wealth Mixed With Unlawful Wealth

Buried Treasure

Minerals

Precious Stones Obtained From Sea By Diving

War Booty

Land Purchased

KHUMS ON NET SAVINGS

INCOME

NEW ITEMS

ALLOWABLE EXPENSES

NET SAVINGS

NET SAVINGS

Food Drink Accommodation Medical expenses Payment of Sadaqah Gifts Paying debts Wages of servants

x 20%

KHUMS

Transportation Furniture Marriage expenses Haj Ziyarat Donations Legal penalties Insurance premiums

The amount deducted from your salary for mandatory provident fund or for mandatory pension plan, income tax, etc

KHUMS ON LAWFUL MIXED WITH UNLAWFUL WEALTH

WAJIB TO PAY KHUMS FROM A WEALTH WHICH IS MIXED WITH SOME ILLEGITIMATE WEALTH

Owner is unable to distinguish the amount or the items which have come to his possession by lawful and legitimate means from those which he has acquired by unlawful means

Anything that has been acquired by the means not permitted in the Shariah, e.g. usury, gambling or liquor business

If a person cannot distinguish the amount, the item and the owner of the wealth acquired by unlawful means from the legitimate wealth, then the only way to make his existing properties lawful is to pay Khums from the entire wealth

If a person knows the amount or the item possessed by unlawful means but does not know the owner or owners, then he must give that amount or item to the needy as charity (Sadaqah) on behalf of the unknown owner

HOWEVER, BEFORE GIVING THAT AMOUNT OR ITEM AS SADAQAH, IT IS EHTIYATE WAJIB TO ASK THE PERMISSION OF THE MUJTAHID.

DISTRIBUTION OF KHUMS KHUMS

SEHME IMAM

SEHME SADAAT

This part is given to the Imam of the time

This part is given needy persons from the family of the Holy Prophet (S)

IN THE GHAIBAT OF THE IMAM (A) THIS PART OF THE KHUMS IS GIVEN TO A MUJTAHID. WITH HIS PERMISSION WE USE THIS MONEY FOR OTHER PURPOSES, LIKE BUILDING MOSQUES, MADRESSAS, ETC.

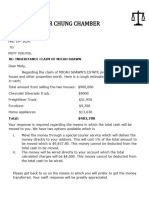

EXAMPLE OF HOW TO CALCULATE KHUMS

Mohsin earns 2 500 every month. His khums is due mid April. He has the following monthly expenses: Travelling costs to and from work 100 Household Expenses 300 Mortgage 800 Insurance [Car &Home] 200 He has a saving account which has 5 000 Question: How much khums will he pay if he has never paid khums before? Salary he gets in hand after ALL Government deductions: Total expenses for the month: Savings: Savings after deducting all expenses: Total Khums due on: Khums to be paid 6 100 @ 20% Sehme Sadaat Sehme Imam 2 500 1 400 5 000 1 100 6 100 1 220 610 610

EXAMPLE OF HOW TO CALCULATE KHUMS

Question: Suppose he has been paying khums every month and khums has already been paid on 4 000 of his savings. Will he have to pay on that again this year? If not, how much will he pay instead? Solution: He will not pay on the 4000 he has already paid khums on. His khums for this year will be: Salary he gets in hand after ALL Government deductions: Total expenses for the month: Savings: Savings after deducting all expenses: Total Khums due on: Khums to be paid 2 100 @ 20% Sehme Sadaat Sehme Imam 2 500 1 400 1 000 1 100 2 100 420 210 210

You might also like

- ACC 4020 - SU - W3 - A2 - Moore - DDocument6 pagesACC 4020 - SU - W3 - A2 - Moore - DRosalia Anabell Lacuesta100% (1)

- 5Document11 pages5mariyha PalangganaNo ratings yet

- Personal Finance and Wealth Planning - A Case Study Based in The UKDocument18 pagesPersonal Finance and Wealth Planning - A Case Study Based in The UKMohd Shahbaz HusainNo ratings yet

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Statement PDFDocument7 pagesStatement PDFSamir GhimireNo ratings yet

- Monopoly Accounting PDFDocument10 pagesMonopoly Accounting PDFMike NicolasNo ratings yet

- Ielts, ToEFL, Sat, GRE, GMAT Vocabulary in BengaliDocument67 pagesIelts, ToEFL, Sat, GRE, GMAT Vocabulary in Bengalivaga_bond2356667100% (1)

- Desperately Seeking ParadiseDocument34 pagesDesperately Seeking ParadiseEvangelos PavlouNo ratings yet

- Afghanistan ProjectDocument88 pagesAfghanistan Projectsreerag100% (1)

- Bigger Pocket Notes: Total Monthly Income $2000/month Total Monthly Cashflow $390/monthDocument1 pageBigger Pocket Notes: Total Monthly Income $2000/month Total Monthly Cashflow $390/monthRichard Marcus SeigelNo ratings yet

- MR Christopher OtabilDocument4 pagesMR Christopher OtabilPrince Akonor AsareNo ratings yet

- AYB320 0122 TrustsTutorialDocument20 pagesAYB320 0122 TrustsTutorialLinh ĐanNo ratings yet

- Payments - Universal CreditDocument3 pagesPayments - Universal Creditwh1tecloudsNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial Planningsabarais100% (3)

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- Budget-Planner 2Document4 pagesBudget-Planner 2Kla SioNo ratings yet

- Letter To Moty .03Document2 pagesLetter To Moty .03rmarcgypsyNo ratings yet

- Donors TaxDocument6 pagesDonors TaxMachi KomacineNo ratings yet

- Clubbing & Setoff (Autosaved)Document32 pagesClubbing & Setoff (Autosaved)madaanprazwal123No ratings yet

- Project Paper CalculationDocument9 pagesProject Paper CalculationZurika WarniNo ratings yet

- TAXATION 2 Chapter 7 Donors Tax PDFDocument6 pagesTAXATION 2 Chapter 7 Donors Tax PDFKim Cristian MaañoNo ratings yet

- Zakat Computation and Had KifayahDocument34 pagesZakat Computation and Had KifayahBatrisyiaNo ratings yet

- ACCA TX Lecture Notes Deductions and Tax CreditsDocument13 pagesACCA TX Lecture Notes Deductions and Tax Creditsfabriciosoares54No ratings yet

- Chapter 5 DDR A231Document14 pagesChapter 5 DDR A231Patricia TangNo ratings yet

- Household Expenses Calculator V1.2Document5 pagesHousehold Expenses Calculator V1.2MUHAMMAD NOMANNo ratings yet

- Fin 533Document11 pagesFin 533FATIMAH MOHAMAD ISANo ratings yet

- TrustsDocument9 pagesTrustskayzmm99No ratings yet

- Islamic Accounting: BWFS3073 Group ADocument15 pagesIslamic Accounting: BWFS3073 Group AAbdiKarem JamalNo ratings yet

- Transfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atDocument8 pagesTransfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atKristina Casandra FernandezNo ratings yet

- Unit 1, BudgetDocument7 pagesUnit 1, Budget4cmassasinNo ratings yet

- 0 Taxes: Gift A D EstateDocument1 page0 Taxes: Gift A D EstateZeyad El-sayedNo ratings yet

- 1522760242Document5 pages1522760242precious mountainsNo ratings yet

- Income Tax Planning (Class Notes - Chapter 9) 2023Document13 pagesIncome Tax Planning (Class Notes - Chapter 9) 2023Nazarene MoralesNo ratings yet

- Payments - Universal CreditDocument1 pagePayments - Universal Creditchloedee30No ratings yet

- Quizzes SolutionDocument10 pagesQuizzes SolutionHerzeila BernardoNo ratings yet

- Donor's Tax Under TRAIN - RLDDocument2 pagesDonor's Tax Under TRAIN - RLDTajimi CastañoNo ratings yet

- Household Expenses Calculator V1.2Document12 pagesHousehold Expenses Calculator V1.2piyushbamsNo ratings yet

- Co-Ownership, Estate and TrustDocument6 pagesCo-Ownership, Estate and TrustRyan Christian Balanquit100% (2)

- TH THDocument12 pagesTH THmariyha PalangganaNo ratings yet

- December 2018Document8 pagesDecember 2018LelouchNo ratings yet

- Working Out Your Wages 1 2Document10 pagesWorking Out Your Wages 1 213593678No ratings yet

- Mathematics Grade 10 Weeks 1 - 4Document43 pagesMathematics Grade 10 Weeks 1 - 4Meng WanNo ratings yet

- Grade 10 Mathematics - 2021 - Term 2Document197 pagesGrade 10 Mathematics - 2021 - Term 2Naomi RodriguesNo ratings yet

- Computation of Taxable Income and Tax LiabilityDocument9 pagesComputation of Taxable Income and Tax LiabilityaNo ratings yet

- Chapter On ZakatDocument19 pagesChapter On Zakatimranhaq23No ratings yet

- Income From Other SourcesDocument8 pagesIncome From Other SourcesSonali MuskanNo ratings yet

- Abellano - STM - Midterm - ExamDocument3 pagesAbellano - STM - Midterm - ExamNelia AbellanoNo ratings yet

- Living AccommodationDocument6 pagesLiving AccommodationSumiya YousefNo ratings yet

- SCC Comunicados Pi Batch0100151116c5897dc2c75000Document4 pagesSCC Comunicados Pi Batch0100151116c5897dc2c75000Thomas StanyardNo ratings yet

- Unit 1 Topic 4Document18 pagesUnit 1 Topic 4eshamahmood29No ratings yet

- 2.1 ATX Employment Income 180623Document67 pages2.1 ATX Employment Income 180623janelivia20No ratings yet

- Chapter 2 - Donor's Tax (Notes)Document8 pagesChapter 2 - Donor's Tax (Notes)Angela Denisse FranciscoNo ratings yet

- Consumer Arithmetic PART 2Document5 pagesConsumer Arithmetic PART 2damijaemccallaNo ratings yet

- Math108x Document w07GroupAssignmentDocument23 pagesMath108x Document w07GroupAssignmentirvinchavez659No ratings yet

- 2019-09-27 - Bank Account Fee Information DocumentDocument2 pages2019-09-27 - Bank Account Fee Information DocumentMarisac MihaiNo ratings yet

- We've Completed Your Payment Request: NEST, Nene Hall, Lynch Wood Business Park, Peterborough, PE2 6FY T: 0300 020 0090Document2 pagesWe've Completed Your Payment Request: NEST, Nene Hall, Lynch Wood Business Park, Peterborough, PE2 6FY T: 0300 020 0090Saymon Pita ReinaNo ratings yet

- Tutorial 10-2021-PIT2 ProblemsDocument8 pagesTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18No ratings yet

- The Laws of Zakat - Session 1Document15 pagesThe Laws of Zakat - Session 1sayeed sayeedNo ratings yet

- Donor TaxDocument20 pagesDonor TaxJhon baal S. SetNo ratings yet

- Presentation of TaxationDocument10 pagesPresentation of TaxationMaaz SiddiquiNo ratings yet

- Change Your Money Cycle: Your Spending Habits Determine Your Wealth: Financial Freedom, #103From EverandChange Your Money Cycle: Your Spending Habits Determine Your Wealth: Financial Freedom, #103No ratings yet

- Useful ExplanationsDocument13 pagesUseful Explanationsapi-3738883No ratings yet

- ZakaatDocument8 pagesZakaatapi-3738883100% (2)

- Tuhaf Al UqulDocument840 pagesTuhaf Al Uqulapi-3738883No ratings yet

- The Right PathDocument6 pagesThe Right Pathapi-3738883100% (2)

- Journey Towards PerfectionDocument7 pagesJourney Towards Perfectionapi-3738883No ratings yet

- TayammumDocument1 pageTayammumapi-3738883100% (1)

- Allahu AkbarDocument6 pagesAllahu Akbarapi-3738883No ratings yet

- SalaateqasrDocument7 pagesSalaateqasrapi-3738883100% (1)

- TaqleedDocument3 pagesTaqleedapi-3738883No ratings yet

- SifatesubutiyaDocument8 pagesSifatesubutiyaapi-3738883No ratings yet

- SifatesalbiyyahDocument8 pagesSifatesalbiyyahapi-3738883No ratings yet

- SalaatemayyitburialDocument10 pagesSalaatemayyitburialapi-3738883No ratings yet

- SalaatejamaatDocument6 pagesSalaatejamaatapi-3738883No ratings yet

- NajasaatDocument3 pagesNajasaatapi-3738883100% (1)

- ShakiyatDocument14 pagesShakiyatapi-3738883No ratings yet

- SalaateayaatDocument4 pagesSalaateayaatapi-3738883No ratings yet

- SalaateidainDocument2 pagesSalaateidainapi-3738883No ratings yet

- QiblahDocument4 pagesQiblahapi-3738883No ratings yet

- MutahhiraatDocument12 pagesMutahhiraatapi-3738883No ratings yet

- NafilaDocument5 pagesNafilaapi-3738883No ratings yet

- NadhrahdqasamDocument1 pageNadhrahdqasamapi-3738883No ratings yet

- HalalharaamfoodsDocument7 pagesHalalharaamfoodsapi-3738883No ratings yet

- HaidhistihadhanifasDocument9 pagesHaidhistihadhanifasapi-3738883No ratings yet

- EhkamemayyitDocument10 pagesEhkamemayyitapi-3738883No ratings yet

- GhuslDocument5 pagesGhuslapi-3738883100% (4)

- GhuslhunootDocument11 pagesGhuslhunootapi-3738883No ratings yet

- Furoo e DeenDocument11 pagesFuroo e Deenapi-3738883No ratings yet

- The Impact of Moorish Rule in Spain - Aman RaiDocument15 pagesThe Impact of Moorish Rule in Spain - Aman RaiAman RaiNo ratings yet

- EnneagramDocument32 pagesEnneagramatom33100% (4)

- Understanding The Illuminati Mindset: Why The USA Is Scheduled For DestructionDocument16 pagesUnderstanding The Illuminati Mindset: Why The USA Is Scheduled For DestructionJeremy James100% (7)

- Hewlett eDocument77 pagesHewlett ePaula CantuNo ratings yet

- Karamaate Sahaba (Roman Urdu) PDFDocument355 pagesKaramaate Sahaba (Roman Urdu) PDFMustafawi PublishingNo ratings yet

- Highway To Success Part 1 Article 1Document18 pagesHighway To Success Part 1 Article 1Basheer JumaNo ratings yet

- Azad Feb07Document5 pagesAzad Feb07Yusuf MurabbiNo ratings yet

- Is The Prophet Hadhir and NadhirDocument10 pagesIs The Prophet Hadhir and Nadhirzaki77No ratings yet

- STer KADocument39 pagesSTer KAAlmasita AginshaNo ratings yet

- Tafseer Ibn Kathir in Urdu 14Document71 pagesTafseer Ibn Kathir in Urdu 14Muhammad UzairNo ratings yet

- SENARAI ULAMA INDUK SRI PETALING - Sheet3Document3 pagesSENARAI ULAMA INDUK SRI PETALING - Sheet3Norull AhmadNo ratings yet

- 1976 April 30 Bible Fairy TalesDocument3 pages1976 April 30 Bible Fairy TalesVvadaHottaNo ratings yet

- Institutes of Sir SyedDocument8 pagesInstitutes of Sir SyedYoucef KhanNo ratings yet

- Jurnal Al-Ma'iyyah (Putus Sekolah)Document16 pagesJurnal Al-Ma'iyyah (Putus Sekolah)Nurul ChafidhohNo ratings yet

- ProspectusDocument67 pagesProspectusSheikh NasirNo ratings yet

- Musa Al-SadrDocument23 pagesMusa Al-Sadrapi-268945877No ratings yet

- GGDN - Adab Makan Dan Makanan - Senyum Ramadhan Mkes 1Document10 pagesGGDN - Adab Makan Dan Makanan - Senyum Ramadhan Mkes 1ririsNo ratings yet

- A Boy With Nine Names - : Another Doomed Prophecy of Mirza Ghulam A QadianiDocument6 pagesA Boy With Nine Names - : Another Doomed Prophecy of Mirza Ghulam A Qadianifunny and amazing videosNo ratings yet

- Sri Lankan Personal Laws Between Justice and FreedomDocument21 pagesSri Lankan Personal Laws Between Justice and FreedomThavam RatnaNo ratings yet

- Absensi KotabumiDocument8 pagesAbsensi KotabumiSaras Oka AuliaNo ratings yet

- Kementerian Agama Republik IndonesiaDocument2 pagesKementerian Agama Republik IndonesiaAlza zamzamiNo ratings yet

- Annual Statistical Report33Document10 pagesAnnual Statistical Report33anon_455666085No ratings yet

- (I) Liaquat Ali Khan - Khwaja Nazimuddin (Ii) Malik Ghulam Muhammad (Iii) Iskander MirzaDocument1 page(I) Liaquat Ali Khan - Khwaja Nazimuddin (Ii) Malik Ghulam Muhammad (Iii) Iskander Mirzamahnoor ahmadNo ratings yet

- Hadith As Source of GuidanceDocument19 pagesHadith As Source of GuidanceSadia AleemNo ratings yet

- StudentRegisters-AA-M - 455 Sep 06 2012 at 03 30 AM 1346891459Document56 pagesStudentRegisters-AA-M - 455 Sep 06 2012 at 03 30 AM 1346891459Nasser AmmarNo ratings yet

- GuruNanak SakhisDocument36 pagesGuruNanak SakhisJoojhaar Singh100% (1)

- Semi Tic Alphabet SoupDocument2 pagesSemi Tic Alphabet SoupVladan GolubovicNo ratings yet