Professional Documents

Culture Documents

Financial Statement Analysis: Du Pont Chart

Financial Statement Analysis: Du Pont Chart

Uploaded by

Vikram GuhaCopyright:

Available Formats

You might also like

- AstrazenecaDocument10 pagesAstrazenecasambit mishraNo ratings yet

- Finance Balance Sheet IND SRF LTD Year 202203 202103 202003 201903 201803Document39 pagesFinance Balance Sheet IND SRF LTD Year 202203 202103 202003 201903 201803Agneesh DuttaNo ratings yet

- Balancesheet As On 3/31/2017 3/31/2018 3/31/2019Document6 pagesBalancesheet As On 3/31/2017 3/31/2018 3/31/2019Shubham RankaNo ratings yet

- Sushrut Yadav PGFB2156 CVDocument43 pagesSushrut Yadav PGFB2156 CVAgneesh DuttaNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Finals Output-AgadDocument16 pagesFinals Output-AgadClarito, Trisha Kareen F.No ratings yet

- Krispy Kriem Doughnuts: Prepared By: Sanae DRISSI Sofia SBITI Alae Eddine ALAMI Sara HafyaneDocument18 pagesKrispy Kriem Doughnuts: Prepared By: Sanae DRISSI Sofia SBITI Alae Eddine ALAMI Sara Hafyaneh_anisNo ratings yet

- Future RetailDocument15 pagesFuture RetailVaibhav SaithNo ratings yet

- Balance Sheet of Ambuja CementDocument4 pagesBalance Sheet of Ambuja CementMansharamani ChintanNo ratings yet

- Company/Ratios/Key Financial Ratios/4904/Bank of PunjabDocument170 pagesCompany/Ratios/Key Financial Ratios/4904/Bank of Punjabdhaaranir6844No ratings yet

- Glenmark BalanceSheet CashflowDocument3 pagesGlenmark BalanceSheet CashflowRaina RajNo ratings yet

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianNo ratings yet

- Renuka Sugars P and L AccntDocument13 pagesRenuka Sugars P and L AccntDivya NadarajanNo ratings yet

- Fin STMTDocument8 pagesFin STMTGuru_McLarenNo ratings yet

- Key Financial RatiosDocument16 pagesKey Financial Ratioskriss2coolNo ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Analysis of Working CapitalDocument7 pagesAnalysis of Working CapitalAzfar KawosaNo ratings yet

- Standalone Financial StatementsDocument42 pagesStandalone Financial StatementsSaurabh NeveNo ratings yet

- Income Statement: Particulars Mar-11 Mar-10Document17 pagesIncome Statement: Particulars Mar-11 Mar-10Ashish Kumar JhaNo ratings yet

- Ratio Anaylsis With Excel (Hypothetical)Document7 pagesRatio Anaylsis With Excel (Hypothetical)awhan sarangiNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Trent LTD Ratio Analysis Excel Shivam JhaDocument6 pagesTrent LTD Ratio Analysis Excel Shivam JhaVandit BatlaNo ratings yet

- Ratio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Document6 pagesRatio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Thomas RajanNo ratings yet

- Benchmarking Model For Dabut India LTD.: Use This Report ToDocument60 pagesBenchmarking Model For Dabut India LTD.: Use This Report Toeshug_1No ratings yet

- Statement of Standalone and Consolidated Audited Results For The Year Ended 31St March 2012Document6 pagesStatement of Standalone and Consolidated Audited Results For The Year Ended 31St March 2012atalbiharitripathyNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of Fundssumit_pNo ratings yet

- Enginee Rs India: Previous YearsDocument9 pagesEnginee Rs India: Previous YearsArun KanadeNo ratings yet

- Balance Sheet: Sources of FundsDocument3 pagesBalance Sheet: Sources of FundsJay MogradiaNo ratings yet

- Consolidated Balance Sheet of Zodiac Clothing Company - in Rs. Cr.Document8 pagesConsolidated Balance Sheet of Zodiac Clothing Company - in Rs. Cr.Shashank PatelNo ratings yet

- Comparative Balance SheetDocument8 pagesComparative Balance Sheet1028No ratings yet

- Dion Global Solutions Limited: SourceDocument15 pagesDion Global Solutions Limited: SourceAnish DalmiaNo ratings yet

- JSW EnergyDocument15 pagesJSW EnergyShashank PullelaNo ratings yet

- CompanyDocument19 pagesCompanyMark GrayNo ratings yet

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- Project Management AccountingDocument10 pagesProject Management AccountingDiwaker LohaniNo ratings yet

- Profit and Loss and Balance Sheet of Idbi BankDocument11 pagesProfit and Loss and Balance Sheet of Idbi BankHarjeet KaurNo ratings yet

- Particular: Total LiabilitiesDocument2 pagesParticular: Total LiabilitiesKshitij MaheshwaryNo ratings yet

- Balance Sheet: Sources of FundsDocument7 pagesBalance Sheet: Sources of FundsAvanti GampaNo ratings yet

- M Book 1Document2 pagesM Book 1marianmadhurNo ratings yet

- Powegrid Financial ModelDocument14 pagesPowegrid Financial ModelPALASH SHAHNo ratings yet

- Statement of Profit and Loss For The Year End 7.746%Document9 pagesStatement of Profit and Loss For The Year End 7.746%Akanksha MalhotraNo ratings yet

- Horniman HorticultureDocument16 pagesHorniman HorticultureLakshmi ThiagarajanNo ratings yet

- Particulars 2013-Mar 2012-Mar 2011-Mar 2010-Mar Income:: Reported Net Profit 9,794.32 8,065.10 4,696.10 3,779.92Document5 pagesParticulars 2013-Mar 2012-Mar 2011-Mar 2010-Mar Income:: Reported Net Profit 9,794.32 8,065.10 4,696.10 3,779.92pmchotaliaNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- Metrobank 2012 AnalysisDocument11 pagesMetrobank 2012 AnalysisJoyce Ann Sosa100% (1)

- Mahindra and MahindraDocument11 pagesMahindra and MahindraLaksh SinghalNo ratings yet

- Equities and Liabilities: Shareholder'S FundsDocument9 pagesEquities and Liabilities: Shareholder'S FundsKrishna MehtaNo ratings yet

- Eicher Motors: Year Dec 10 Dec 11 Dec 12 Dec 13 Dec 14 Sources of FundsDocument19 pagesEicher Motors: Year Dec 10 Dec 11 Dec 12 Dec 13 Dec 14 Sources of FundsSathish KumarrNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- Cemex Holdings Philippines, IncDocument17 pagesCemex Holdings Philippines, IncBabie Angela Dubria Roxas100% (1)

- Balance Sheet ACC Sources of FundsDocument13 pagesBalance Sheet ACC Sources of FundsAshish SinghNo ratings yet

- Balance Sheet: Lending To Financial InstitutionsDocument10 pagesBalance Sheet: Lending To Financial InstitutionsAlonewith BrokenheartNo ratings yet

- Amit Icici Bank LimitedDocument25 pagesAmit Icici Bank LimitedAmit JainNo ratings yet

- Years 2000 2001 2002Document6 pagesYears 2000 2001 2002shafiqmbaNo ratings yet

- Britannia Industries LTDDocument4 pagesBritannia Industries LTDMEENU MARY MATHEWS RCBSNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

Financial Statement Analysis: Du Pont Chart

Financial Statement Analysis: Du Pont Chart

Uploaded by

Vikram GuhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis: Du Pont Chart

Financial Statement Analysis: Du Pont Chart

Uploaded by

Vikram GuhaCopyright:

Available Formats

Financial Statement Analysis: Du

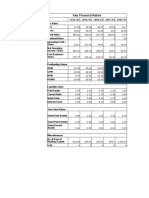

Pidilite

2009

2006

5,114.45

4,276.93

1,952.78

1,581.00

Other Expenses

PBIT

106.10

731.42

321.58

50.20

Interest

37.47

PBT

Tax

52.62

678.8

140.89

12.73

PAT

537.91

12.73

Sales

Raw Material

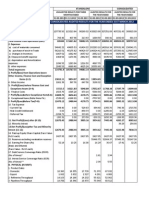

Net Worth

Loan

Total Liabilities

F.A.

Inventory

Receivables

Cash

Other CA

Less: C.L.

Total Assets

Current assets

Cost of debt

0.00

2009

531.81

1,277.97

2006

-196.51

921.91

1809.78

725.40

241.49

295.44

551.59

866.32

993.81

1,706.15

329.24

642.03

11.78

21.8

574.89

1809.78

725.40

3274.44

4.12

1004.85

4.06

862.72

2009

Return On Net Worth

127.64

Impact of leverage

3.86

-1.01

Return on Investment

40.41

Asset Turnover Ratio

2.83

2.69

Fixed Asset TO

21.18

6.61

Current Asset TO

1.56

Current Ratio

1.92

1.75

Inventory TO

9.27

Debtors TO

5.90

Collection Days

62

tement Analysis: Du pont chart

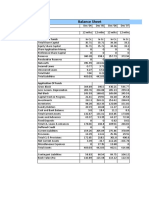

2006

Return On Net Worth

-6.48

Leverage or financial risk

2.40

-4.69

Return on Investment

6.92

Profit Margin

14.30

2.57

Current Asset TO

1.94

Raw Material to Sales

83.62

80.96

Inventory TO

5.93

Converstion cost to sales

2.07

16.47

Debtors TO

3.04

Interest to Sales

1.03

1.92

Collection Days

120

You might also like

- AstrazenecaDocument10 pagesAstrazenecasambit mishraNo ratings yet

- Finance Balance Sheet IND SRF LTD Year 202203 202103 202003 201903 201803Document39 pagesFinance Balance Sheet IND SRF LTD Year 202203 202103 202003 201903 201803Agneesh DuttaNo ratings yet

- Balancesheet As On 3/31/2017 3/31/2018 3/31/2019Document6 pagesBalancesheet As On 3/31/2017 3/31/2018 3/31/2019Shubham RankaNo ratings yet

- Sushrut Yadav PGFB2156 CVDocument43 pagesSushrut Yadav PGFB2156 CVAgneesh DuttaNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Finals Output-AgadDocument16 pagesFinals Output-AgadClarito, Trisha Kareen F.No ratings yet

- Krispy Kriem Doughnuts: Prepared By: Sanae DRISSI Sofia SBITI Alae Eddine ALAMI Sara HafyaneDocument18 pagesKrispy Kriem Doughnuts: Prepared By: Sanae DRISSI Sofia SBITI Alae Eddine ALAMI Sara Hafyaneh_anisNo ratings yet

- Future RetailDocument15 pagesFuture RetailVaibhav SaithNo ratings yet

- Balance Sheet of Ambuja CementDocument4 pagesBalance Sheet of Ambuja CementMansharamani ChintanNo ratings yet

- Company/Ratios/Key Financial Ratios/4904/Bank of PunjabDocument170 pagesCompany/Ratios/Key Financial Ratios/4904/Bank of Punjabdhaaranir6844No ratings yet

- Glenmark BalanceSheet CashflowDocument3 pagesGlenmark BalanceSheet CashflowRaina RajNo ratings yet

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianNo ratings yet

- Renuka Sugars P and L AccntDocument13 pagesRenuka Sugars P and L AccntDivya NadarajanNo ratings yet

- Fin STMTDocument8 pagesFin STMTGuru_McLarenNo ratings yet

- Key Financial RatiosDocument16 pagesKey Financial Ratioskriss2coolNo ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Analysis of Working CapitalDocument7 pagesAnalysis of Working CapitalAzfar KawosaNo ratings yet

- Standalone Financial StatementsDocument42 pagesStandalone Financial StatementsSaurabh NeveNo ratings yet

- Income Statement: Particulars Mar-11 Mar-10Document17 pagesIncome Statement: Particulars Mar-11 Mar-10Ashish Kumar JhaNo ratings yet

- Ratio Anaylsis With Excel (Hypothetical)Document7 pagesRatio Anaylsis With Excel (Hypothetical)awhan sarangiNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Trent LTD Ratio Analysis Excel Shivam JhaDocument6 pagesTrent LTD Ratio Analysis Excel Shivam JhaVandit BatlaNo ratings yet

- Ratio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Document6 pagesRatio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Thomas RajanNo ratings yet

- Benchmarking Model For Dabut India LTD.: Use This Report ToDocument60 pagesBenchmarking Model For Dabut India LTD.: Use This Report Toeshug_1No ratings yet

- Statement of Standalone and Consolidated Audited Results For The Year Ended 31St March 2012Document6 pagesStatement of Standalone and Consolidated Audited Results For The Year Ended 31St March 2012atalbiharitripathyNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of Fundssumit_pNo ratings yet

- Enginee Rs India: Previous YearsDocument9 pagesEnginee Rs India: Previous YearsArun KanadeNo ratings yet

- Balance Sheet: Sources of FundsDocument3 pagesBalance Sheet: Sources of FundsJay MogradiaNo ratings yet

- Consolidated Balance Sheet of Zodiac Clothing Company - in Rs. Cr.Document8 pagesConsolidated Balance Sheet of Zodiac Clothing Company - in Rs. Cr.Shashank PatelNo ratings yet

- Comparative Balance SheetDocument8 pagesComparative Balance Sheet1028No ratings yet

- Dion Global Solutions Limited: SourceDocument15 pagesDion Global Solutions Limited: SourceAnish DalmiaNo ratings yet

- JSW EnergyDocument15 pagesJSW EnergyShashank PullelaNo ratings yet

- CompanyDocument19 pagesCompanyMark GrayNo ratings yet

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- Project Management AccountingDocument10 pagesProject Management AccountingDiwaker LohaniNo ratings yet

- Profit and Loss and Balance Sheet of Idbi BankDocument11 pagesProfit and Loss and Balance Sheet of Idbi BankHarjeet KaurNo ratings yet

- Particular: Total LiabilitiesDocument2 pagesParticular: Total LiabilitiesKshitij MaheshwaryNo ratings yet

- Balance Sheet: Sources of FundsDocument7 pagesBalance Sheet: Sources of FundsAvanti GampaNo ratings yet

- M Book 1Document2 pagesM Book 1marianmadhurNo ratings yet

- Powegrid Financial ModelDocument14 pagesPowegrid Financial ModelPALASH SHAHNo ratings yet

- Statement of Profit and Loss For The Year End 7.746%Document9 pagesStatement of Profit and Loss For The Year End 7.746%Akanksha MalhotraNo ratings yet

- Horniman HorticultureDocument16 pagesHorniman HorticultureLakshmi ThiagarajanNo ratings yet

- Particulars 2013-Mar 2012-Mar 2011-Mar 2010-Mar Income:: Reported Net Profit 9,794.32 8,065.10 4,696.10 3,779.92Document5 pagesParticulars 2013-Mar 2012-Mar 2011-Mar 2010-Mar Income:: Reported Net Profit 9,794.32 8,065.10 4,696.10 3,779.92pmchotaliaNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- Metrobank 2012 AnalysisDocument11 pagesMetrobank 2012 AnalysisJoyce Ann Sosa100% (1)

- Mahindra and MahindraDocument11 pagesMahindra and MahindraLaksh SinghalNo ratings yet

- Equities and Liabilities: Shareholder'S FundsDocument9 pagesEquities and Liabilities: Shareholder'S FundsKrishna MehtaNo ratings yet

- Eicher Motors: Year Dec 10 Dec 11 Dec 12 Dec 13 Dec 14 Sources of FundsDocument19 pagesEicher Motors: Year Dec 10 Dec 11 Dec 12 Dec 13 Dec 14 Sources of FundsSathish KumarrNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- Cemex Holdings Philippines, IncDocument17 pagesCemex Holdings Philippines, IncBabie Angela Dubria Roxas100% (1)

- Balance Sheet ACC Sources of FundsDocument13 pagesBalance Sheet ACC Sources of FundsAshish SinghNo ratings yet

- Balance Sheet: Lending To Financial InstitutionsDocument10 pagesBalance Sheet: Lending To Financial InstitutionsAlonewith BrokenheartNo ratings yet

- Amit Icici Bank LimitedDocument25 pagesAmit Icici Bank LimitedAmit JainNo ratings yet

- Years 2000 2001 2002Document6 pagesYears 2000 2001 2002shafiqmbaNo ratings yet

- Britannia Industries LTDDocument4 pagesBritannia Industries LTDMEENU MARY MATHEWS RCBSNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet