Professional Documents

Culture Documents

Data Scan: Japan Q2 GDP

Data Scan: Japan Q2 GDP

Uploaded by

api-162199694Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Data Scan: Japan Q2 GDP

Data Scan: Japan Q2 GDP

Uploaded by

api-162199694Copyright:

Available Formats

Data Scan

August 13, 2012

Japan Q2 GDP

More pronounced slowdown from Q3

Last: 5.5%saar Expected: 2.3%saar Actual: 1.4%saar Assessment: Synchronized global slowdown weighing on Japan. Still much worse to come.

Asias major trading economies were weaker than expected in Q2 with IP and exports falling well short of the mark. Japan, not surprisingly, is the latest casualty of that dynamic. The economy grew by 1.4%saar in Q2 (the consensus looked for a 2.3%saar outturn) following an upward revision to Q1 growth which printed firmly at 5.5%saar. Plagued by persistent deflation, which perversely inflates the real GDP arithmetic, the nominal GDP figures are illustrative of weakness. Nominal GDP contracted by 0.6%saar in the quarter. With the tail-end of reconstruction demand still providing a hefty support to growth, all is not well in the land of the setting sun. Given what we call the triple-threat slowdown occurring coincidentally in China, Europe and the US, we believe this current down-cycle in the economy will only become more pronounced as reconstruction demand wanes from Q3. Ultimately, Japan will recess, most probably from Q4. For the BoJ, endless and inescapable easing is the only option.

The beginning of a more profound slowdown. Japanese IP and GDP with our forecasts for Q3.

Source: Asia Sentry Advisory Pty Ltd and Bloomberg

Monday August 13, 2012.

P a g e |1

Asia Sentry Advisory Pty Ltd Suite 9, Level 40, Northpoint Tower 100 Miller Street, North Sydney, NSW, 2060, Australia. Ph: +61 2 9931 7820 Fx: +61 2 9931 6888 M: +61 401 548 820 www.asiasentry.com gbmaguire@bloomberg.net glenn@asiasentry.com

Asia Sentry Advisory Pty Ltd is a boutique economic consultancy established to meet the growing demands of clients seeking greater exposure to the most dynamic economic region in the post-crisis global economy, Asia. Asia Sentry Advisory marries keen judgment with a rigorous model-based approach and a deeply intuitive understanding of Asia that can only come from on-the-ground experience to deliver market out-performing analysis and forecasts.

How closely are you watching?

Follow us on Twitter, @AsiaSentry Watch us on YouTube. Asia Sentry Advisory See us analyze in real-time on LiveStream, Asia Sentry Advisory

You might also like

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDocument2 pagesAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694No ratings yet

- Third Point Q3 2012 Investor Letter TPOIDocument11 pagesThird Point Q3 2012 Investor Letter TPOIVALUEWALK LLCNo ratings yet

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDocument2 pagesAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694No ratings yet

- A Troika of Disappointment: Asia Sentry DispatchDocument4 pagesA Troika of Disappointment: Asia Sentry Dispatchapi-162199694No ratings yet

- Slower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012Document3 pagesSlower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012api-162199694No ratings yet

- I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012Document3 pagesI'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012api-162199694No ratings yet

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNo ratings yet

- RCSI Weekly Bull/Bear Recap: Nov. 18-22, 2013Document7 pagesRCSI Weekly Bull/Bear Recap: Nov. 18-22, 2013RCS_CFANo ratings yet

- RCSI Presentation - China's Threats: Deflation & Slowing GrowthDocument10 pagesRCSI Presentation - China's Threats: Deflation & Slowing GrowthRCS_CFANo ratings yet

- CIO CMO - Approving Fiscal BoostersDocument10 pagesCIO CMO - Approving Fiscal BoostersRCS_CFANo ratings yet

- HIM2018Q4NPDocument6 pagesHIM2018Q4NPPuru SaxenaNo ratings yet

- CIO CMO - The Pressure's On Emerging Market Central BanksDocument9 pagesCIO CMO - The Pressure's On Emerging Market Central BanksRCS_CFANo ratings yet

- CIO Weekly Letter - Mexico The Global PiñataDocument4 pagesCIO Weekly Letter - Mexico The Global PiñataRCS_CFANo ratings yet

- Quarterly Review and Outlook: Growth Recession Continues Fiscal Policy in NeutralDocument6 pagesQuarterly Review and Outlook: Growth Recession Continues Fiscal Policy in NeutralHonza MynarNo ratings yet

- Global Forecast: UpdateDocument6 pagesGlobal Forecast: Updatebkginting6300No ratings yet

- Economic Insights 25 02 13Document16 pagesEconomic Insights 25 02 13vikashpunglia@rediffmail.comNo ratings yet

- Gic WeeklyDocument12 pagesGic WeeklycampiyyyyoNo ratings yet

- Quarterly Market Review: Second Quarter 2016Document15 pagesQuarterly Market Review: Second Quarter 2016Anonymous Ht0MIJNo ratings yet

- Rbi Bulletin October 2013Document140 pagesRbi Bulletin October 2013vijaythealmightyNo ratings yet

- IMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011Document12 pagesIMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011babstar999No ratings yet

- Reserve Bank of India Bulletin August 2011 Volume LXV Number 8Document356 pagesReserve Bank of India Bulletin August 2011 Volume LXV Number 8pt797jNo ratings yet

- Ulman Financial Client Letter - 2022 2nd QuarterDocument14 pagesUlman Financial Client Letter - 2022 2nd QuarterClay Ulman, CFP®No ratings yet

- State of Oregon Economic Indicators: May 12 IndexDocument2 pagesState of Oregon Economic Indicators: May 12 IndexStatesman JournalNo ratings yet

- Reserve Bank of India November Bulletin 2009Document444 pagesReserve Bank of India November Bulletin 2009tonypauljohnNo ratings yet

- The GIC Weekly Update November 2015Document12 pagesThe GIC Weekly Update November 2015John MathiasNo ratings yet

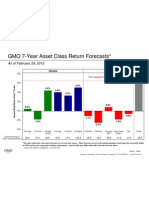

- 7YrForecasts 813Document1 page7YrForecasts 813CanadianValueNo ratings yet

- Foreign Fund Management China 11Document89 pagesForeign Fund Management China 11Ning JiaNo ratings yet

- Van Hoisington Letter, Q3 2011Document5 pagesVan Hoisington Letter, Q3 2011Elliott WaveNo ratings yet

- The GIC WeeklyDocument12 pagesThe GIC WeeklyedgarmerchanNo ratings yet

- Assignment Experential LearningDocument1 pageAssignment Experential LearningJohn SamuelNo ratings yet

- Grantham Quarterly Dec 2011Document4 pagesGrantham Quarterly Dec 2011careyescapitalNo ratings yet

- GMO 7 Year Asset Class Forecast Apr 14Document1 pageGMO 7 Year Asset Class Forecast Apr 14CanadianValueNo ratings yet

- Lacy Hunt - Hoisington - Quartely Review Q1 2015Document5 pagesLacy Hunt - Hoisington - Quartely Review Q1 2015TREND_7425No ratings yet

- Global Markets Chart Book: High-Grade Bond Yields Plunge To Record LowsDocument12 pagesGlobal Markets Chart Book: High-Grade Bond Yields Plunge To Record LowslosdiabloNo ratings yet

- 16.02 RWC GIAA PresentationDocument35 pages16.02 RWC GIAA PresentationGIAANo ratings yet

- Stocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?Document5 pagesStocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?saif_shakeelNo ratings yet

- Global Market Outlook - August 2013 - GWMDocument14 pagesGlobal Market Outlook - August 2013 - GWMFauzi DjauhariNo ratings yet

- GMO 7-Year Forecast - Feb '12Document1 pageGMO 7-Year Forecast - Feb '12Douglas RattrayNo ratings yet

- The End of An Era: Uarterly EtterDocument10 pagesThe End of An Era: Uarterly EtterthickskinNo ratings yet

- Ebbs & Flows: EM Maiden Funds Outflow in 15 WeeksDocument9 pagesEbbs & Flows: EM Maiden Funds Outflow in 15 WeeksNgọcThủy100% (1)

- GMO Capital Q3 2013 Letter To InvestorsDocument15 pagesGMO Capital Q3 2013 Letter To InvestorsWall Street WanderlustNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- (US-Africa Summit To Focus On Security, Economics) - (VOA - Voice of America English News)Document1 page(US-Africa Summit To Focus On Security, Economics) - (VOA - Voice of America English News)unokepasavaNo ratings yet

- GMO Quarterly Letter-My Sister's Pension Assets 0412 GMO-GranthamDocument11 pagesGMO Quarterly Letter-My Sister's Pension Assets 0412 GMO-GranthamMarko AleksicNo ratings yet

- Governor Waller's SpeechDocument11 pagesGovernor Waller's SpeechTim MooreNo ratings yet

- Mizuho EconomicOutlook 17.5.29Document3 pagesMizuho EconomicOutlook 17.5.29abraNo ratings yet

- MSFL - Inflation Aug'11Document4 pagesMSFL - Inflation Aug'11Himanshu KuriyalNo ratings yet

- Asia Equity Insights-HSBCDocument10 pagesAsia Equity Insights-HSBCtinylittleworldNo ratings yet

- G10 Annual OutlookDocument27 pagesG10 Annual OutlookansarialiNo ratings yet

- Baseeds 15-30Document4 pagesBaseeds 15-30api-276766667No ratings yet

- Economic Growth Must Be Re-DirectedDocument2 pagesEconomic Growth Must Be Re-DirectedEd SawyerNo ratings yet

- Economic CollapseDocument2 pagesEconomic CollapseBernardokpeNo ratings yet

- The January Effect - Fact or FictionDocument3 pagesThe January Effect - Fact or FictionProshareNo ratings yet

- Data Scan: China July CPI and PPIDocument2 pagesData Scan: China July CPI and PPIapi-162199694No ratings yet

- Data Scan: China July Trade FiguresDocument2 pagesData Scan: China July Trade Figuresapi-162199694No ratings yet

- I Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For TodayDocument4 pagesI Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For Todayapi-162199694No ratings yet

- Winners and Losers of The Financial CrisisDocument1 pageWinners and Losers of The Financial Crisisregalia_79No ratings yet

- Asian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012Document3 pagesAsian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012api-162199694No ratings yet

- Data Scan: Japan June Machinery OrdersDocument2 pagesData Scan: Japan June Machinery Ordersapi-162199694No ratings yet

- The Folly of A Payrolls Relief Rally: Asia Sentry DispatchDocument4 pagesThe Folly of A Payrolls Relief Rally: Asia Sentry Dispatchapi-162199694No ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Economic Letter Economic Letter: China's Slowdown May Be Worse Than Official Data SuggestDocument4 pagesEconomic Letter Economic Letter: China's Slowdown May Be Worse Than Official Data Suggestapi-162199694No ratings yet

- Thoughts On RBA Rate CutDocument1 pageThoughts On RBA Rate Cutapi-162199694No ratings yet

- September Interest Rate Decision: Deleted: DeletedDocument2 pagesSeptember Interest Rate Decision: Deleted: Deletedapi-162199694No ratings yet

- No Asia Inflection Over AugustDocument3 pagesNo Asia Inflection Over Augustapi-162199694No ratings yet

- Data Scan: China July Expenditure DataDocument3 pagesData Scan: China July Expenditure Dataapi-162199694No ratings yet

- Data Scan: China July Trade FiguresDocument2 pagesData Scan: China July Trade Figuresapi-162199694No ratings yet

- China's New, Prudent Policy RegimeDocument6 pagesChina's New, Prudent Policy Regimeapi-162199694No ratings yet

- Data Scan: Japan June Machinery OrdersDocument2 pagesData Scan: Japan June Machinery Ordersapi-162199694No ratings yet

- Data Scan: China July CPI and PPIDocument2 pagesData Scan: China July CPI and PPIapi-162199694No ratings yet

- Content But Not Complacent.: Policy PerspectiveDocument5 pagesContent But Not Complacent.: Policy Perspectiveapi-162199694No ratings yet

- A Troika of Disappointment: Asia Sentry DispatchDocument4 pagesA Troika of Disappointment: Asia Sentry Dispatchapi-162199694No ratings yet

- The Folly of A Payrolls Relief Rally: Asia Sentry DispatchDocument4 pagesThe Folly of A Payrolls Relief Rally: Asia Sentry Dispatchapi-162199694No ratings yet

- Taiwanese July Trade Figures Confirm Asia Is Still Weakening, Not StabilizingDocument1 pageTaiwanese July Trade Figures Confirm Asia Is Still Weakening, Not Stabilizingapi-162199694No ratings yet

- Pan-Asia Coincident Weakening in Exports and Imports ContinuesDocument3 pagesPan-Asia Coincident Weakening in Exports and Imports Continuesapi-162199694No ratings yet

- Not The Gold, But A Silver Medal PerformanceDocument4 pagesNot The Gold, But A Silver Medal Performanceapi-162199694No ratings yet

- I Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For TodayDocument4 pagesI Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For Todayapi-162199694No ratings yet

- Some August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012Document5 pagesSome August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012api-162199694No ratings yet

- Slower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012Document3 pagesSlower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012api-162199694No ratings yet

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDocument1 pageAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694No ratings yet

- Global Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012Document3 pagesGlobal Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012api-162199694No ratings yet

- Asian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012Document3 pagesAsian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012api-162199694No ratings yet

- How Long Can Talk Trump Data?: Glenn Maguire's Asia Sentry Dispatch July 30, 2012Document3 pagesHow Long Can Talk Trump Data?: Glenn Maguire's Asia Sentry Dispatch July 30, 2012api-162199694No ratings yet

- I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012Document3 pagesI'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012api-162199694No ratings yet