Professional Documents

Culture Documents

Project Appraisal and Financing

Project Appraisal and Financing

Uploaded by

Kapil DharmaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Appraisal and Financing

Project Appraisal and Financing

Uploaded by

Kapil DharmaniCopyright:

Available Formats

Project financing

Project financing

Raising of funds to finance an economically

separable legal entity

Sources of funds - lenders, equity investors/

sponsors, subsidies and aids

Project cash flows service debt and provide

returns to equity investors

Government and other agencies providing

subsidies and aids look forward to the projects

economic, social and environmental benefits

Government subsidies and assistance

Capital subsidy

Tax break / Tax holiday

Exemption or reduction of import duty

Export credit financing direct loan, loan guarantee and

insurance

Grant of land free of cost or at a nominal price

Assurance of availability of raw materials, power etc.

Assurance of output off-take for a guaranteed price and

duration

Infrastructural support at no or nominal cost

Arranging finance at concessional rates

Accelerated depreciation for tax benefits

Basic elements of project financing

Project entity

Lenders

Debt

repayment

Debt

funds

Equity

investors

Returns to

investors

Equity

funds

Suppliers Purchasers

Output

Purchase

contracts

Supply

contracts

Raw

materials

Project financing vs. direct financing

In direct financing

project assets and liabilities are integrated into the

sponsors balance sheet

lenders look to the firms entire asset portfolio to

generate the cash flow to service their debt

loans are often unsecured

In project financing

project assets, liabilities and cash flows are

segregated from the sponsoring entity

project assets are pledged to secure loans

lenders have no recourse or limited recourse to cash

flows from the sponsors other assets not part of the

project

Special Purpose Vehicle (SPV)

A separate legal entity

It has a finite life since a projects life is finite

Project cash flows are distributed to lenders and

equity investors

Equity investors make reinvestment decisions

unlike in direct financing where corporate

managers may retain cash flows from profitable

projects and/or reinvest in other projects of their

own choice at the expense of lenders and

shareholders interests

Advantages of project financing

More efficient in terms of allocation of

financial risks and returns

Project ownership and better management

control and monitoring

Performance-linked compensation

Reduction of the underinvestment problem

Reduction of information asymmetry and

signaling cost

Reduction of agency cost

Advantages of project financing

Enhancement of shareholder value

Highly leveraged capital structure

Lower overall cost of funds

Ability of the project sponsor to negotiate

with equity investors to invest free cash

flows in other seemingly profitable projects

so that the dividend requirement can be

waived

Reduction of dispute resolution and legal

or regulatory costs

Disadvantages of project financing

Complex structure of financing

requires negotiations by all parties

generally involves more cost and time

Lenders have no or limited recourse to the

sponsors other assets

Project-related information has to be

shared with lenders and investors for

arranging finance that may reduce the

sponsors competitive advantage

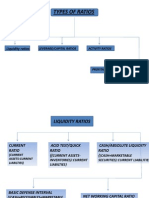

Project appraisal

Project feasibility

Technical

Commercial

Economic

Financial

Managerial

Risk assessment

Completion

Technological

Supply of raw

materials

Economic

Financial

Currency

Political

Force majeure

Technical feasibility

Product, process, technology, technical

specifications

Detailed engineering work, capacity and

possibility of expansion

Details of cost projections and escalation

factors

Project time schedule and milestones

Land acquisition, infrastructure development,

approvals from government departments etc.

Technical feasibility

Supply of raw materials, power, water etc.

Details of plant, machinery, equipment etc.

Transport and communication facilities

Housing, education, healthcare, recreation

etc., if applicable

Pollution control, effluent / waste disposal

Requirement and availability of manpower

Consultation with external specialists

Commercial feasibility

Projection of demand for projects output

Market survey for projects output

Demand forecasts of industry associations

Evaluation of the project firms advertising,

sales promotion, warehousing, distribution

and other marketing aspects

Incorporation of forecast information into

project time, cost and other parameters

Economic feasibility

Break-Even Analysis

Net Present Value

Internal Rate of Return

Break-Even Analysis

Break-even volume is given by

Unit contribution Break-even volume = Total

fixed costs

Margin of safety = Installed capacity Break-

even volume

Economic feasibility

Net Present Value (NPV)

NPV is given by the present value of all future

cash flows minus the initial investment

( )

I

r

CF

NPV

n

t

t

t

+

=

=1

1

Where CF = After tax operating cash flows or

PAT + Non-cash expenses + Interest

r = Weighted Average Cost of Capital

I = Initial investment

n = Useful life of project

Economic feasibility

Weighted Average Cost of Capital (WACC)

= u(1-T)r

d

+ (1- u)r

e

Where

u = Debt as a fraction of investment

T = Tax rate

r

d

= Cost of debt

r

e

= Cost of equity

Economic feasibility

Cost of debt, r

d

, can be obtained by solving the

following equation:

( )

=

+

=

L

t

t

d

t

r

C

NP

1

1

Where

NP = Net proceeds, i.e. gross proceeds minus

floatation expenses such as underwriting fees,

legal fees etc.

C = Interest + principal payment

L = Length of the loan period

Economic feasibility

Cost of equity, r

e

, can be obtained by using

the Capital Asset Pricing Model (CAPM):

r

e

= r

f

+ |(r

m

- r

f

)

Where

r

f

= Risk-free rate of return

r

m

= Return on market portfolio

| = Riskiness of asset

r

m

-r

f

is called the market risk premium

Economic feasibility

Example

Investment = 100, Debt : Equity = 60:40

Useful life = 2 years, C

1

= C

2

= 34.48

CF

1

= 48, CF

2

= 74, Tax rate = 0.30

r

f

= 0.08, r

m

= 0.2, | = 1

Cost of debt:

( )

% 10 1 . 0

1

48 . 34

) 1 (

48 . 34

60

2

or r

r

r

d

d

d

=

+

+

+

=

Cost of equity: r

e

= 0.08 + 1(0.2 0.08) = 0.2 or 20%

Economic feasibility

WACC = 0.6(1-0.3)0.1+0.40.2 = 0.122

or 12.2%

( )

( )

0 56 . 1 100 56 . 101

100

122 . 0 1

74

122 . 0 1

48

% 2 . 12 @

2

> = =

+

+

+

= NPV

Theref ore

Since NPV > 0, the project is economically viable

Economic feasibility

Internal Rate of Return (IRR)

IRR is the rate of return that makes NPV zero.

IRR can be obtained by solving the following

equation:

( )

0

1

1

=

+

=

I

IRR

CF

n

t

t

t

Considering the previous example, IRR = 13.3%

Since IRR > WACC, the project is viable

Economic feasibility

NPV and IRR may lead to contradictory

decisions depending on the size and cash

flows of projects

Considering the previous example, if CF

1

= 113.5 and CF

2

= 0 for an alternative way

of operation, NPV = 1.16 and IRR = 13.5%

For size differential, NPV is a better rule

since it adds more wealth

For cash flow differential also, NPV makes

more realistic reinvestment assumptions

Economic feasibility

Social rate of discount and Economic Rate

of Return (ERR)

ERR is the rate of return when the present

value (PV) of all social benefits equals the

PV of all social costs

Discrepancies between social valuations

and market valuations occur due to

Price distortions

Administered/regulated pricing

Economic feasibility

Taxes and duties

Foreign exchange regulations

Monopolistic status of the company, etc.

Social valuations should reflect opportunity

costs of resources, i.e., the valuations of

foregone economic outputs

Taxes and duties are passed on to the

government. Since they do not consume

resources, they cost nothing to the society.

Hence their inclusions give rise to price

aberrations

Economic feasibility

Consider the previous example

Year

0 1 2

Capital cost

Land 8 - -

Plant & M/C 80 10 -

Duties/Taxes 6 4 -

Others 6 6 -

Total 100 20 -

Operating cost - 82 126

Total cost 100 102 126

Revenue - 150 200

Cash flow -100 48 74

Economic feasibility

Considering social valuations

Agricultural land. The present value (PV) of

the agricultural outputs during the projects

useful life is, say, 5

Plant & M/C are imported. Say about 20% of

their costs is accounted for by import duties,

which must be deducted

Duties/Taxes should be removed

The following table shows social costs, social

benefits and resultant cash flows

Economic feasibility

Year

0 1 2

Capital cost

Land 5 - -

Plant & M/C 64 8 -

Duties/Taxes - - -

Others 6 6 -

Total 75 14 -

Operating cost - 82 126

Total cost 75 96 126

Revenue - 150 200

Cash flow -75 54 74

Economic feasibility

Considering a social rate of discount, 12%

NPV@12% = 54/1.12 + 74/(1.12)

2

75 = 32.2

Economic Rate of Return (ERR) = 40.5%

Since NPV > 0 and ERR > Social rate of

discount, the project is socially desirable

If it is an import substitution project and

the imported output would have cost more

to the society, the project would be more

socially desirable

Economic feasibility

Suppose now that the project company is

a monopolist, charging 15% more than the

economic worth of the output

Then social benefits in year 1 and year 2

should be 150/1.15 and 200/1.15 or 130

and 174, respectively

Also cash flows in year 1 and year 2 would

become 34 and 48, respectively

Economic feasibility

Therefore, NPV@12%

= 34/1.12 + 48/(1.12)

2

75 = - 6.4

Economic Rate of Return (ERR) = 5.8%

Since NPV < 0 and ERR < Social rate of

discount, the project is not socially viable

Hence, a project which is otherwise viable

may not be desirable from the social point

of view

Financial feasibility

Inherent value of project assets

Marketability of assets in case the project fails

Borrowing capacity/Maximum loan amount

PV/o where PV represents the present value

(PV) of future cash flows and o is the target

cash flow coverage ratio

Debt-Equity ratio

Norms stipulated by financial institutions

Different for different categories, areas and

sectors

Financial feasibility

Promoters contribution

Higher contribution means higher stake and

involvement, and lower debt-equity ratio

Lower risk to lenders

Norms may be different for different areas, type of

company (private or public limited)

Security margin

Loan is sanctioned against tangible assets

Financing of intangible assets is promoters sole

responsibility

Security margin - % of tangible assets financed with

promoters contribution

Financial feasibility

Debt Service Coverage Ratio (DSCR)

(Operating cash flows Tax) / (Interest +

principal payments)

(PAT + Non-cash expenses + Interest) /

(Interest + principal payments)

DSCR ~ 1.5 2 is considered healthy

If DSCR is too high, loan repayment can be

effected quickly forcing financial institutions to

charge higher rates of interest

Assumptions should be realistic to keep DSCR

within acceptable limits

Financial feasibility

Loan repayment schedule

Moratorium of, say, 2 years

Period and instalments depend on cash flow

projections and DSCR

Syndication

Group of financial institutions extending loan

Conversion of debt

Convertible debenture

Conversion period and cap on equity holding

Financial feasibility

Some examples

Project cost 100; Debt-equity ratio 3:1

For a private limited company with no capital

subsidy, promoters contribution (equity)= 25

and debt = 75. Promoters contribution = 25%

If capital subsidy is 10, promoters equity is 15

Equity

Promoters contribution 15

Capital subsidy 10

Total 25

Debt 75

Project cost 100

Financial feasibility

Promoters contribution drops to 15%

If debt-equity ratio falls or capital subsidy is

reduced, promoters contribution increases

which may necessitate public issues

Public issue = 60%, promoters equity = 40%

Equity

promoters contribution 10

Public issue 15

Total equity 25

Debt 75

Project cost 100

Financial feasibility

Promoters contribution drops to 10%

Minimum promoters contribution = 15%

Equity

Promoters contribution 10

Public issue 15

Total equity 25

Debt

Unsecured loan

arranged by promoter 5

Term loan 70

Total debt 75

Project cost 100

Financial feasibility

Promoters contribution = promoters equity +

unsecured loan arranged by promoter = 10 +

5 = 15; promoters contribution = 15%

Debt-equity ratio = 70:30 = 2.33:1 < 3:1

Public issue = 40%, promoters equity = 60%

Equity

Promoters contribution 10

FIs contribution 5

Public issue 10

Total equity 25

Debt 75

Project cost 100

Managerial feasibility

Experience and track record in previous

similar projects

Seriousness and financial soundness

Technical background and competence

Capabilities of key management personnel

Review of staff assigned to the project

Site visits and joint study with the project

teams of financial institutions and experts

Financial institutions nominees on Board

Risk assessment

Completion risk

Inaccurate cash flow projections

Technical infeasibility / Environmental issues

Technological risk

New / unproven technology

Technological obsolescence

Raw material supply risk

Price and availability of raw materials during

the loan repayment period

Risk assessment

Economic risk

Demand may not pick up as expected

Price realization may not match expectation

Operating cost may shoot up due to inflation

Volatility in foreign exchange rates may have

adverse impacts on operations

Servicing debt and providing returns to equity

investors may be difficult after meeting costs

Can be hedged by entering into forwards and

futures contracts with suppliers and buyers

Risk assessment

Financial risk

Floating rate of interest

Interest rate cap contract

Interest rate swap agreement

Bank Project

Swap

counterp

arty

Loan Pay 8%

Pay LIBOR + 1% Receive LIBOR

Risk assessment

Currency risk

If revenue realization and debt servicing are

denominated in different currencies, varying

exchange rates may affect cash flows

Remedies (i) revenue, cost and debt are in

the same currency, (ii) hedging with currency

forwards or futures, and (iii) currency swap

Bank Project

Swap

counterp

arty

Loan in Rs Pay 10% ($)

Pay 8% (Rs) Receive 8% (Rs)

Risk assessment

Political risk

New policies, taxes, legal restrictions

Change of government

Force majeure

Acts of God

Earthquake, fire, flood, cyclone, strike etc.

Some of the above may get insurance cover

In case of force majeure, lenders require

sponsors to pledge insurance payments

Public-Private Partnership (PPP)

Private participation in infrastructure

projects is sought for

financing and efficiency

Issues ownership, management and

operations, financing, responsibility,

sharing of risks and rewards

Private ownership

Govt. control on safety,

quality, fees charged etc.

Government ownership

Private leasing, management

and operations

Public-Private Partnership (PPP)

Build-Operate-Transfer (BOT)

Private party builds and operates the facility

for a fixed term (concession period) after

which ownership is transferred to the govt.

Period should be such that capital invested is

recovered and adequate return on capital is

received

Govt. may have to pay the private party an

amount equal to the remaining value of the

facility upon transfer of ownership

Public-Private Partnership (PPP)

Build-Transfer-Operate (BTO)

Ownership is transferred to the govt. as soon as the

project is completed

The facility is leased by the private party from the

govt. for a fixed period

After that the govt. can run the facility itself or again

lease it to a private party

Buy-Build-Operate (BBO)

A loss-making govt.-owned unit or a unit in urgent

need of repair or expansion may be bought (with

ownership) by a private party, developed and run as a

profit-making public-use facility

Public-Private Partnership (PPP)

Lease-Develop-Operate (LDO)

The private party leases a govt. facility/land,

develops and operates for a fixed period

There is a revenue sharing arrangement

between the private party and the govt.

This is a useful model when the govt. would

not sell the facility or the private party cannot

arrange adequate finance to buy the facility

This is also a useful model when the facility is

currently losing money

Advantages of PPP

Private financing arrangement. Scope for

raising funds through multi-lateral lending

agencies

Efficient project execution, management

and operations

Expertise and experience of private party

Adoption of state-of-the-art technology

Sharing of risks and rewards between the

govt. and the private party

Advantages of PPP

Govt. assistance in acquisition of land,

getting permits and approvals, financing,

assured supply of raw materials, tax/duty

concessions, infrastructural support etc.

Commercial development of the property

(mall, shopping complex, multiplex etc.)

Allowing private investments will indicate

govt.s willingness to attract more private

and foreign investments

Disadvantages of PPP

Govt. regulations on fees to be charged.

Returns may not be commensurate with

those of alternative projects

Uncertainty in demand for/usage of the

facility and hence uncertainty in toll/fee

collection and revenue streams

Possible competition from comparable

govt. projects

Disadvantages of PPP

Political problem If the govt. introduces

new policies or the govt. is changed, the

project may be scrapped or may have to

be reworked exposing the private party to

a considerable financial risk

Govt. control on various matters reduces

efficiency. For example, resorting to govt.

process of tendering might not be in true

interest of the private party

You might also like

- Financial Management 2E: Rajiv Srivastava - Dr. Anil Misra Solutions To Numerical ProblemsDocument5 pagesFinancial Management 2E: Rajiv Srivastava - Dr. Anil Misra Solutions To Numerical ProblemsParesh ShahNo ratings yet

- Bme Term PaperdocDocument6 pagesBme Term PaperdocVamshi Krishna MallelaNo ratings yet

- Noida Toll BridgeDocument12 pagesNoida Toll BridgeqleapNo ratings yet

- Project Appraisal and Financing (Bba643a) - 1543381569183 PDFDocument16 pagesProject Appraisal and Financing (Bba643a) - 1543381569183 PDFlekha1997No ratings yet

- Project Appraisal and FinanceDocument14 pagesProject Appraisal and FinanceVicky NsNo ratings yet

- Case Study - Bharat Infrastructure LimitedDocument12 pagesCase Study - Bharat Infrastructure LimitedTanviAgrawalNo ratings yet

- FMCG Comparative PerformanceDocument50 pagesFMCG Comparative Performanceavinash singhNo ratings yet

- Capital Budgeting and Investment DecisionsDocument3 pagesCapital Budgeting and Investment DecisionsCharmae Agan CaroroNo ratings yet

- Model PAPER-Analysis of Financial Statement - MBA-BBADocument5 pagesModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- A Study On Financial Modeling and ValuationDocument31 pagesA Study On Financial Modeling and ValuationGURPREETNo ratings yet

- Project Appraisal and Financing Course OutlineDocument3 pagesProject Appraisal and Financing Course OutlineSaksham GoyalNo ratings yet

- Mba18b - Sales and Distribution ManagementDocument2 pagesMba18b - Sales and Distribution ManagementAkram KhanNo ratings yet

- Summer Project ReportDocument37 pagesSummer Project ReportSant Singh SethiNo ratings yet

- Indian Broking Industry AnalysisDocument41 pagesIndian Broking Industry AnalysisacarksNo ratings yet

- A Study of Firozabad Bangle IndustryDocument5 pagesA Study of Firozabad Bangle IndustrySmriti TripathiNo ratings yet

- Advanced Cost AccountingDocument2 pagesAdvanced Cost Accountingpooja sainiNo ratings yet

- Financial Management PDFDocument11 pagesFinancial Management PDFஒப்பிலியப்பன்No ratings yet

- Limitations of Capital BudgetingDocument2 pagesLimitations of Capital BudgetingLJBernardoNo ratings yet

- A Project Report On S: Submitted in Partial Fulfillment For The Degree of Bachelor of Business AdministrationDocument5 pagesA Project Report On S: Submitted in Partial Fulfillment For The Degree of Bachelor of Business AdministrationGauravsNo ratings yet

- Project ReportDocument3 pagesProject Reportrajwindersangwan1No ratings yet

- Balance of Payment: Trend of Bop For The Last 10 YearsDocument9 pagesBalance of Payment: Trend of Bop For The Last 10 YearsAkshaya VenugopalNo ratings yet

- Nestle P and LDocument2 pagesNestle P and Lashmit gumberNo ratings yet

- The Comprehensive Analysis of Mcdowells No1Document46 pagesThe Comprehensive Analysis of Mcdowells No1Pradipta Mukherjee100% (1)

- SWOT AnalysisDocument6 pagesSWOT Analysisbhavesh1712No ratings yet

- Capital Budgeting SHARIBDocument103 pagesCapital Budgeting SHARIBfarzijii4No ratings yet

- Resource Planning in A Development BankDocument16 pagesResource Planning in A Development BankLaveena BachaniNo ratings yet

- Atlas Group of CompaniesDocument31 pagesAtlas Group of CompaniesmuhammadtaimoorkhanNo ratings yet

- NPVDocument55 pagesNPVRavi Singh100% (1)

- Capital BudgetingDocument12 pagesCapital BudgetingKhadar50% (4)

- List of Project TopicsDocument42 pagesList of Project TopicsVinoth Kumar100% (10)

- Lecture 1-FINANCIAL MODELINGDocument15 pagesLecture 1-FINANCIAL MODELINGAbhi akhadeNo ratings yet

- BBA CAT-1 Question Paper - B2BDocument2 pagesBBA CAT-1 Question Paper - B2BGowthamanNo ratings yet

- Jain Irrigation Systems Strategy Report (HBS Case Study)Document17 pagesJain Irrigation Systems Strategy Report (HBS Case Study)Vineet Singh100% (3)

- WRFWRF Topic 2 - Financial Planning - Lecture Notes (2021 Adj)Document19 pagesWRFWRF Topic 2 - Financial Planning - Lecture Notes (2021 Adj)Govardan SureshNo ratings yet

- A PPT On ELSSDocument21 pagesA PPT On ELSSVinay BhargavaNo ratings yet

- Week 1FMDocument52 pagesWeek 1FMchitkarashelly100% (1)

- Basic Financial DecisionsDocument2 pagesBasic Financial DecisionsDeepika VijayakumarNo ratings yet

- This Study Resource Was: Surf Excel Marketing Mix (4Ps) StrategyDocument9 pagesThis Study Resource Was: Surf Excel Marketing Mix (4Ps) StrategyIshu GunasekaraNo ratings yet

- HindustanDocument73 pagesHindustanGuman Singh0% (1)

- Corporate Bridge Consultancy - SIP ReportDocument12 pagesCorporate Bridge Consultancy - SIP Reportharishmittal20No ratings yet

- Marginal and Profit Planning - Unit IV CH 4Document22 pagesMarginal and Profit Planning - Unit IV CH 4devika125790% (1)

- 1.0 Introduction To Topic: 1.1 Who Is Customer?Document33 pages1.0 Introduction To Topic: 1.1 Who Is Customer?goswamiphotostatNo ratings yet

- Financial Modeling Program April 11 1Document22 pagesFinancial Modeling Program April 11 1Rohit AgarwalNo ratings yet

- 06 Financial Estimates and ProjectionsDocument19 pages06 Financial Estimates and ProjectionsSri RanjaniNo ratings yet

- 39 Ratio Analysis All Formula by MeDocument9 pages39 Ratio Analysis All Formula by Meangelohero6643No ratings yet

- Accounting Techniques For Decision MakingDocument24 pagesAccounting Techniques For Decision MakingRima PrajapatiNo ratings yet

- Market AnlysisDocument8 pagesMarket AnlysisprakashNo ratings yet

- ProcessDocument61 pagesProcesskodiraRakshithNo ratings yet

- Equity ValuationDocument42 pagesEquity ValuationSrinivas NuluNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- 2.1 New Model For Indian Road PPPDocument17 pages2.1 New Model For Indian Road PPPRohitNo ratings yet

- Sole-Ace ReportDocument68 pagesSole-Ace ReportMuskan ValbaniNo ratings yet

- Letter of TransmittalDocument3 pagesLetter of TransmittalRocky RoyNo ratings yet

- Working Capital Two Mark QuestionsDocument4 pagesWorking Capital Two Mark QuestionsHimaja SridharNo ratings yet

- Chemical Industry PDFDocument20 pagesChemical Industry PDFJose PriceNo ratings yet

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceFrom EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNo ratings yet

- Presentation Economic and Financial Analysis INTERACT ENPIDocument23 pagesPresentation Economic and Financial Analysis INTERACT ENPIshah md musleminNo ratings yet

- 1.040 Project Management: Mit OpencoursewareDocument32 pages1.040 Project Management: Mit OpencoursewareEngrFaheemNo ratings yet

- Project Management UNIT-3Document43 pagesProject Management UNIT-3Nitish KumarNo ratings yet

- Chapter 1 Introduction To Engineering EconomyDocument55 pagesChapter 1 Introduction To Engineering EconomyNadia IsmailNo ratings yet