Professional Documents

Culture Documents

SR No Particulars Amt (Rs in Lacs)

SR No Particulars Amt (Rs in Lacs)

Uploaded by

Payal PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SR No Particulars Amt (Rs in Lacs)

SR No Particulars Amt (Rs in Lacs)

Uploaded by

Payal PatelCopyright:

Available Formats

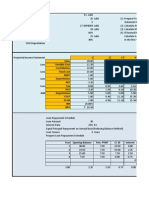

100000 Sr No 1 2 3 4 5 6 7 Particulars Equipment Cost Miscellaneous cost Furniture Initial Marketing Exp Preliminary & Pre Operative Exp

Contingency Working Capital Margin Cost of Project Means of Finance Promoter's equity Private investor Total Amt (Rs in Lacs) 77 1 9 5.000 11.175 4 2 109

45% 55%

49.2 60.1 109.3

1 Equipment costs 1 No of Seats Voice Call Back Office Total Seats Cost per seat Voice Call Back office Sub Total (A) 2 Desktop Cost No of Desktop Cost per desktop Sub Total (B) 3 Cost of Software Cost of Operating System per PC Cost of MS Office Per PC Total cost of Operating System Total Cost of MS Office Sub Total Total Equipment Costs 2 Miscellaneous Cost Document Mgmt System Fax Machine Lazer Printers Photo Copier Canteen Equipment Fire Fighting Equipment Speaker System Total Misc Cost 3 Furniture Area (Sq ft) Rate Per Sq. ft. Total

12 12 24 2 2.5 54 40 35000 14 8500 13500 3.40 5 9 77

1500 600 9

4 P&P Company formation (Form Filing, Company Incorporation, Partnership) Legal Expenses Consultancy Fees Establishment Expenses/Set Up Cost 1. Manpower Training & Certification expenses 2. Office Rent 3. Electircity 4. Internet Connectivity 5. Administration Total 5 Initial Marketing Exp 6 Contingency Contingency Equipment Furniture Miscellaneous Total

3 1 3

1 1 1 1 1 11 5

5% 4 0.4500 0.0500 4

$ $ $ $ $ $

No of Months Call Centre 1 10 1 1 Back Office 1 12 1 1

12 45 450 85 5 45 540 85 6 Year 1 12 341 Rs. Rs. Rs. Rs. Rs. Rs. Year 2 12 358 Year 3 12 376

1 Installed Capacity (Call Centre) No of Seats Rate Per Seat Per Hour in Rs.

Weeks per annum / period Days per Week No of Shifts per day No of Hours per sift Hours per Day Hours per period Utilisation factor 2 Installed Capacity (Back Office) A No of Seats (Captive) B No of Seats (Third Party) Total Rate Per Seat Per Hour in Rs.

52 6 3 8 24 89856 60%

52 6 3 8 24 89856 70%

52 6 3 8 24 89856 80%

8 4 12 394

8 4 12 413

8 4 12 434

Weeks per annum / period Days per Week No of Shifts per day No of Hours per sift Hours per Day Hours per period Utilisation factor

52 6 3 8 24 89856 60%

52 6 3 8 24 89856 70%

52 6 3 8 24 89856 80%

Revenue- Call Centre in (Rs) Lacs Revenue- Back Office in (Rs) Lacs Total

184 212 396

225 260 485

270 312 583

Expenditure Office Rent Area Rate

Sq ft Per Month Per sq. mtr

2500 31.5

Sub Total Add: Taxes Maintenance Total Office Rent Rent Salary Model Director-Call Centre Salary Pm Salary PA Director-Back Office Salary Pm Salary PA Agents for Call Centre Salary Pm Salary PA Supervisors for Call centre Salary Pm Salary PA Agents for Back office Salary Pm Salary PA Supervisors for Call centre Salary Pm Salary PA Administration Administration-Head Salary Pm Salary PA Assistants No of Persons Salary Pm Salary PA Total-Administration Marketing Marketing-Head Salary Pm Salary PA Assistants No of Persons Salary Pm Salary PA Total-Marketing Accounts/Finance Accounts/Finance-Head Increase

10% 10%

9.45 1 1 11 Year 1 Year 2 11 Year 1 Year 2 13 Year 3 Year 3 15

15%

10%

30000 4

33000 4

36300 4

10%

30000 4 40 15000 72 5 12000 7 40 15000 72 5 12000 7

33000 4 40 16500 79 5 13200 8 40 16500 79 5 13200 8

36300 4 40 18150 87 5 14520 9 40 18150 87 5 14520 9

10% 10%

10% 10%

10% 10%

10% 10%

10%

1 12000 1 2 10000 2 4

1 13200 2 2 11000 3 4

1 14520 2 2 12100 3 5

10%

1 10000 1 2 8000 2 3

1 11000 1 2 8800 2 3

1 12100 1 2 9680 2 4

Salary Pm Salary PA Assistants No of Persons Salary Pm Salary PA Total-Accounts/Finance

10%

10000 1 2 8000 2 3

11000 1 2 8800 2 3

12100 1 2 9680 2 4

Information Technology IT-Head Salary Pm Salary PA Assistants No of Persons Salary Pm Salary PA Total-IT Salary Add Perks Total Salary

10%

1 10000 1 2 8000 2 3 179 45 224

1 11000 1 2 8800 2 3 197 49 246

1 12100 1 2 9680 2 4 216 54 270

25%

Training & Recruitment Costs Training & Recruitment Costs Repirs & Maintenance Repirs & Maintenance Increase Administration Administration Marketing Marketing Utility Cost Electricity Expenses Air Conditioner Capacity Consumption Unit Rate Total Hrs Per Day Days Per Week Total Weeks Cost of AC Consumption for Computers Consumption per Computer Add: Misc Equipment No of Computers Cost of Computer System

% of salary 8% % of Gross Block 3% 10% % of Revenue 3% % of Revenue 5% 20 24 29 12 15 17 13 15 16

Basis MT Unit/MT/Per Hr Per Unit

Year 1 15 1 5 24 6 52 6

Year 2 15 1 6 24 6 52 7

Watts/Per Hr

200 10% 40 3 40 4

General Lighting Consumption Sq. Ft Cost of General Lighting

watt/Sq.ft

1 2500 1 2500 1

Total Electricity Cost Other Miscellaneous Expenses Other Miscellaneous Expenses Mkting Exp Written off Mkting Exp Written off Preliminary Exp Written off Preliminary Exp Written off Working Capital Requirement Current Assets Debtors-Call Centre Debtors-Back Office Total CA Current Liability Creditors Net Current Assets Margin Money Eligible Bank Finance Interest on BB for Working Capital Internet Connectivity Charges Internet Connectivity Charges Depreciation Schedule Equipment Cost Opening Balance Addition Deduction Closing Balance Depreciation Furniture Opening Balance Addition Deduction Closing Balance Depreciation Miscellaneous Opening Balance Months 1.5 1.5 Year 1 % of Revenue 3.0% Years 5 Years 5

10

12

12

15

Year 2 23 27 50 28 33 61

1.5

42 8 2 6 1

46 14 4 11 1

25%

12%

30 Year 1

30 Year 2

16.21%

80.64 0 0 80.64 13.1

80.64 0 0 80.64 13.1

6.33%

9.45 0 0 9.45 0.60

9.45 0 0 9.45 0.60

1.05

1.05

Addition Deduction Closing Balance Depreciation

4.75%

0 0 1.05 0.05

0 0 1.05 0.05

Total Depreciation

13.72

13.72

Year 4 12 395

Year 5 12 415

425 229.1328

52 6 3 8 24 89856 90%

52 6 3 8 24 89856 100%

8 4 12 456

8 4 12 479

52 6 3 8 24 89856 90%

52 6 3 8 24 89856 100%

319 369 688

373 430 803

Year 4 17 Year 4

Year 5 20 Year 5

39930 5

43923 5

39930 5 40 19965 96 5 15972 10 40 19965 96 5 15972 10

43923 5 40 21961.5 105 5 17569 11 40 21961.5 105 5 17569 11

1 15972 2 2 13310 3 5

1 17569 2 2 14641 4 6

1 13310 2 2 10648 3 4

1 14641 2 2 11713 3 5

13310 2 2 10648 3 4

14641 2 2 11713 3 5

1 13310 2 2 10648 3 4 238 59 297

1 14641 2 2 11713 3 5 262 65 327

18

20

21

24

34

40 MT Sq FT 3 500

Year 3 15 2 6 24 6 52 10

Year 4 15 2 7 24 6 52 13

Year 5 15 2 7 24 6 52 16

40 4

40 4

40 5

2500 1

2500 1

2500 1

15

18

22

17

21

24

Year 3 34 39 73

Year 4 40 46 86

Year 5 47 54 100

52 21 5 16 2

57 29 7 21 3

64 37 9 27 3

30 Year 3

30 Year 4

30 Year 5

80.64 0 0 80.64 13.1

80.64 0 0 80.64 13.1

80.64 0 0 80.64 13.1

9.45 0 0 9.45 0.60

9.45 0 0 9.45 0.60

9.45 0 0 9.45 0.60

1.05

1.05

1.05

0 0 1.05 0.05

0 0 1.05 0.05

0 0 1.05 0.05

13.72

13.72

13.72

Profit & Loss Account Particular No of Seats Call Centre Back office Total Revenue Call Centre Back office Total Expenditure Office Rent Salary Training & Recruitment Cost Utility Costs Repairs & Maintenance Administrative Costs Marketing Internet Connectivity Charges Other Miscellaneous Exp Marketing Exp Written off Preliminary Exp written off Total Expenditure PBDIT Interest on Working Capital Depreciation Profit from Operations 30% Tax PAT OPM (%) PAT/Sales (%) Year 1 Year 2 Year 3 Year 4 Year 5

12 12 24

12 12 24

12 12 24

12 12 24

12 12 24

184 212 396

225 260 485

270 312 583

319 369 688

373 430 803

11 224 13 10 2 12 20 30 12 1 2 337 59 1 13.72 45 13 31 15% 8%

13 246 15 12 2 15 24 30 15 1 2 375 111 1 13.72 96 29 67 23% 14%

15 270 16 15 3 17 29 30 17 1 2 417 166 2 13.72 150 45 105 28% 18%

17 297 18 18 3 21 34 30 21 1 2 463 225 3 13.72 209 63 146 33% 21%

20 327 20 22 3 24 40 30 24 1 2 513 289 3 13.72 272 82 191 36% 24%

Cash flow

Sources of Funds PAT Depreciation Increase in equity Prel. & Pre-op. exps. W/off Increase in creditors Increase in Working capital loan

Year 1

Year 2

Year 3

Year 4

Year 5

31 14 109 3 42 6

67 14 0 3 5 5

105 14 0 3 5 5

146 14 0 3 6 6

191 14 0 3 6 6

Total inflow Application of funds Increase in Fixed assets Increase in P&P Increase in Marketing Increase in Debtors Total outflow Op. cash balance Add.: surplus/deficit Closing cash balance

205

93

132

175

220

91 0 11 0 5 0 50 11.14495 157 0 48 48 11.14 48 82 130

0 0 0 12.13561 12.14 130 120 251

0 0 0 13.19748 13.20 251 161 412

0 0 0 14.33519 14.34 412 206 618

Balance Sheet

Liabilities Share capital Reserves & surplus Working capital loan Creditors Total Liabilities Assets Fixed Assets Less: Depreciation Net Block Debtors Cash balance Prel. & Pre-op. expenses not w/off. Initial Marketing exp not written off Total Assets Difference

Year 1

Year 2

Year 3

Year 4

Year 5

109 31 6 42 188

109 98 11 46 265

109 203 16 52 380

109 349 21 57 538

109 540 27 64 741

91 14 77 50 48 9 4 188 0.000

91 27 64 61 130 7 3 265 0.000

91 41 50 73 251 4 2 380 0.000

91 55 36 86 412 2 1 538 0.000

91 69 23 100 618 0 0 741 0.000

Investment by Private investor Conversion Price at PE of No of Shares on Conversion Equity Before Conversion Total Equity after Conversion at end of Year 4 PAT at the end of Year 4 Fully diluted EPS at end of Year 4 5

60.09 57 1.82 10.92627 12.74213 146.27 11.48 104 -44.13

IRR of the project Particular Outflow Investments Total Outflow Year 1 Year 2 Year 3 Year 4 Year 5

109 109

0 0

0 0

0 0

0 0

Inflow PAT Depreciation Preliminary expt written off Total Inflow Net Cash Flow IRR 31 14 3 14 -95 79% 67 14 3 50 50 105 14 3 88 88 146 14 3 129 129 191 14 3 174 174

Particular Outflow Investments Total Outflow

Year 1

Year 2

Year 3

Year 4

Year 5

60 60

0 0

0 0

0 0

0 0

Inflow Capital Gain 524

Total Inflow Net Cash Flow IRR

0 -60 72%

0 0

0 0

0 0

524 524

Year 5 PE EPS Market Price per share No of Shares Capital Gain 5 17 87 6 524

NPV Investment Inflows Rate NPV

Year 1 -109 14 10% 188.49

Year 2 0 50

Year 3 0 88

Year 4 0 129

Year 5 0 174

Scenario Analysis Base Rate PAT PAT/Sales OPM/Sales IRR NPV 1.05 31 8% 15% 79% 188.49

Change in selling price Scenario I PAT PAT/Sales OPM/Sales IRR NPV

5% 20 5% 11% 22% 19.69 Scenario II 31 8% 15% 79% 188.49

PE EPS

5 13.39 66.93673 1.82 121.5479

You might also like

- Chapter 2 Solutions - Matching Supply With DemandDocument13 pagesChapter 2 Solutions - Matching Supply With Demanddonutshop100% (1)

- Case Winston & HolmesDocument6 pagesCase Winston & HolmesAmitNo ratings yet

- Urban WatersDocument15 pagesUrban WatersRahul Tiwari100% (2)

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- Vegetron ExcelDocument21 pagesVegetron Excelanirudh03467% (3)

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Worksheet PDFDocument4 pagesWorksheet PDFNaomi Baker82% (22)

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- ACC Q4CY11 Result Update Fortune 09022012Document5 pagesACC Q4CY11 Result Update Fortune 09022012anknkulsNo ratings yet

- Financial PlanDocument6 pagesFinancial PlanRishika ShuklaNo ratings yet

- Asset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)Document12 pagesAsset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)kjmarts08No ratings yet

- Farmful StudiesDocument84 pagesFarmful StudiesHardik J AminNo ratings yet

- Eco Frame LTDDocument7 pagesEco Frame LTDewinzeNo ratings yet

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasNo ratings yet

- Oper FrameworkDocument32 pagesOper Frameworkapi-313047789No ratings yet

- Zipcar FishboneDocument24 pagesZipcar FishboneKrishna Srikumar0% (3)

- Bharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0Document4 pagesBharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0sakiv1No ratings yet

- Kajaria Ceramics: Upgrade in Price TargetDocument4 pagesKajaria Ceramics: Upgrade in Price TargetSudipta BoseNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingPrashant Dhage100% (2)

- Project Investment Particulars No Per Unit CostDocument28 pagesProject Investment Particulars No Per Unit CostMirza JunaidNo ratings yet

- Raheja Developers - Installment Payment PlanDocument6 pagesRaheja Developers - Installment Payment PlanNishit GargNo ratings yet

- Other Supporting Docs NeededDocument33 pagesOther Supporting Docs NeededMark Ivan JagodillaNo ratings yet

- Financial Feasibility of Business PlanDocument14 pagesFinancial Feasibility of Business PlanmuhammadnainNo ratings yet

- 1 MW WorkingDocument4 pages1 MW WorkingMohan ManiNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- Entrepreneur ProjectDocument276 pagesEntrepreneur ProjectUsmanNo ratings yet

- Competition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) TurnoverDocument13 pagesCompetition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) Turnoverchintan61@gmail.comNo ratings yet

- Acc Hidza SyazzliaDocument33 pagesAcc Hidza SyazzliaFirdaus AhmadNo ratings yet

- Financial PlanDocument15 pagesFinancial PlanIshaan YadavNo ratings yet

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Document6 pages"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855No ratings yet

- Revenue Table.55555Document11 pagesRevenue Table.55555tilahunthmNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Financial Study LunaDocument9 pagesFinancial Study LunaNia LunaNo ratings yet

- Technics Oil & Gas: 3QFY12 Results ReviewDocument4 pagesTechnics Oil & Gas: 3QFY12 Results ReviewtansillyNo ratings yet

- Conference Call TranscriptDocument20 pagesConference Call TranscriptHimanshu BhambhaniNo ratings yet

- NSDC Project ReportDocument53 pagesNSDC Project ReportAbirMukherjee67% (3)

- 2008 BudgetDocument65 pages2008 BudgetPreston LewisNo ratings yet

- My Value InvestingDocument54 pagesMy Value InvestingJitendra SutarNo ratings yet

- Financial Analysis of BioconDocument12 pagesFinancial Analysis of BioconNipun KothariNo ratings yet

- Value SpreadsheetDocument58 pagesValue SpreadsheetJitendra SutarNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Yogurberry Business Franchise Financials HyderabadDocument5 pagesYogurberry Business Franchise Financials HyderabadBharath ReddyNo ratings yet

- Vegetron Limited Key Assumptions: Depreciation Rates Current Assets RequirementDocument29 pagesVegetron Limited Key Assumptions: Depreciation Rates Current Assets RequirementLeo JohnNo ratings yet

- FMT - Quiz 2 SyllabusDocument41 pagesFMT - Quiz 2 SyllabusAvirup ChatterjeeNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahav100% (1)

- Tat Hong Research 26 AprDocument4 pagesTat Hong Research 26 AprmervynteoNo ratings yet

- Total Cost of ProjectDocument44 pagesTotal Cost of ProjectBharat SharmaNo ratings yet

- Financial For Feasibility StudyDocument15 pagesFinancial For Feasibility StudyAbigail GeronimoNo ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Drafting Service Revenues World Summary: Market Values & Financials by CountryFrom EverandDrafting Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet