Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

53 viewsDescription: Tags: hb2-27

Description: Tags: hb2-27

Uploaded by

anon-203234Loan status determines eligibility for student financial aid funds. Students with loans in deferment, forbearance, grace periods, or repayment are eligible. Those who have paid loans in full, received loan discharges, or had loans canceled are also eligible. Students with defaulted loans or active bankruptcy claims on defaulted loans are ineligible unless certain conditions are met, such as making satisfactory repayment arrangements.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Mou Draft STD-1Document8 pagesMou Draft STD-1Ravikiran Kardile100% (3)

- Secured Transactions Law OutlineDocument59 pagesSecured Transactions Law OutlineAbigail ChapmanNo ratings yet

- Digest of Justinian, Volume 1 (D.1-15)Document530 pagesDigest of Justinian, Volume 1 (D.1-15)Ion Dumitrescu100% (2)

- Clearance GuideDocument2 pagesClearance Guideanon-529662100% (3)

- Chapter 4 OBLICON PDFDocument5 pagesChapter 4 OBLICON PDFsampdnimNo ratings yet

- Two Women Scenes For Teens: A Collection of Six Duets For Teen WomenDocument10 pagesTwo Women Scenes For Teens: A Collection of Six Duets For Teen WomenAnonymous KtLPe7BmNo ratings yet

- Conservatory - Pet Rules and Regulations (Amended 31-Mar-2014)Document2 pagesConservatory - Pet Rules and Regulations (Amended 31-Mar-2014)api-283790301No ratings yet

- Appendix C 2002-2003 Loan Status Codes and Eligibility Charts Code Status Eligibility For Title IvDocument11 pagesAppendix C 2002-2003 Loan Status Codes and Eligibility Charts Code Status Eligibility For Title Ivanon-285199No ratings yet

- Description: Tags: PK200701AttachmentADocument1 pageDescription: Tags: PK200701AttachmentAanon-543937No ratings yet

- Description: Tags: PK200701AttachmentADocument1 pageDescription: Tags: PK200701AttachmentAanon-987023No ratings yet

- Joint and Solidary ObligationsDocument13 pagesJoint and Solidary ObligationsJUPITER BARUELONo ratings yet

- Description: Tags: GEN0620AttachBDocument1 pageDescription: Tags: GEN0620AttachBanon-527377No ratings yet

- General ForbearanceDocument4 pagesGeneral ForbearanceRizope32No ratings yet

- Differences Between Chapters 7, 11, 12, & 13Document3 pagesDifferences Between Chapters 7, 11, 12, & 13prubiouk100% (1)

- Oblicon Prefinal Notes PDFDocument17 pagesOblicon Prefinal Notes PDFArwella Gregorio100% (1)

- Description: Tags: 0203SLGCh5DefaultDocument5 pagesDescription: Tags: 0203SLGCh5Defaultanon-368406No ratings yet

- OBLICON Chapter 4Document45 pagesOBLICON Chapter 4micah badilloNo ratings yet

- Description: Tags: lrdrh-2-57Document1 pageDescription: Tags: lrdrh-2-57anon-165959No ratings yet

- Debt RestructuringDocument4 pagesDebt RestructuringPushTheStart GamingNo ratings yet

- CHAPTER 11 Debenture & ChargeDocument35 pagesCHAPTER 11 Debenture & Charge2024736179No ratings yet

- Bankruptcy BasicsDocument28 pagesBankruptcy BasicsSamNo ratings yet

- Denial Letter 1Document1 pageDenial Letter 1mohammadNo ratings yet

- Description: Tags: 0102Vol5IntroDocument4 pagesDescription: Tags: 0102Vol5Introanon-912405No ratings yet

- NotesDocument88 pagesNotesBananaNo ratings yet

- Oblicon Midterm 1Document8 pagesOblicon Midterm 1lunaughh549No ratings yet

- Extinguishment of ObligationsDocument18 pagesExtinguishment of ObligationsMimiNo ratings yet

- TOPIC 4 MR Debentures - 230314 - 081422Document14 pagesTOPIC 4 MR Debentures - 230314 - 081422shivani dholeNo ratings yet

- Description: Tags: DlmpnnolabelDocument9 pagesDescription: Tags: Dlmpnnolabelanon-380563No ratings yet

- Banker S Right of Set Off - Explained - BankExamsTodayDocument4 pagesBanker S Right of Set Off - Explained - BankExamsTodayHimanshu Panchpal100% (3)

- Description: Tags: 0304CODVol5Sec4ComboEditsvApr03Document28 pagesDescription: Tags: 0304CODVol5Sec4ComboEditsvApr03anon-804563No ratings yet

- Trusts Law: Da & KR Defences (Term 2 Week 5) DefencesDocument2 pagesTrusts Law: Da & KR Defences (Term 2 Week 5) DefencesstraNo ratings yet

- SPECCOMDocument9 pagesSPECCOMMiller Paulo2 BilagNo ratings yet

- Description: Tags: StudentGuide0708 ForbearanceDocument1 pageDescription: Tags: StudentGuide0708 Forbearanceanon-600258No ratings yet

- Description: Tags: DLMPNDocument9 pagesDescription: Tags: DLMPNanon-217455No ratings yet

- Session 6 LAW201Document9 pagesSession 6 LAW201Jonalyn DureroNo ratings yet

- Dev't Bank of The Philippines V Arcilla Jr.Document1 pageDev't Bank of The Philippines V Arcilla Jr.brendamanganaanNo ratings yet

- Article 1198Document4 pagesArticle 1198Crystal Gayle De CastroNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActAggi Rayne Sali BucoyNo ratings yet

- CASE 02 - Carodan Vs China BankDocument3 pagesCASE 02 - Carodan Vs China Bankbernadeth ranolaNo ratings yet

- This Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtDocument1 pageThis Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtCresenciano MalabuyocNo ratings yet

- This Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtDocument1 pageThis Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtCresenciano MalabuyocNo ratings yet

- Article 1284Document1 pageArticle 1284Mitz Arzadon100% (1)

- Truth in LendingDocument2 pagesTruth in LendingFrancis Felices100% (1)

- Dotesb/23: Enrollment Consent Form-D Vivid ConsultantDocument1 pageDotesb/23: Enrollment Consent Form-D Vivid ConsultantGauri GanganiNo ratings yet

- Table B-10: Loan Status Codes: GA Data Provider InstructionsDocument4 pagesTable B-10: Loan Status Codes: GA Data Provider Instructionsanon-863389No ratings yet

- Notes For L2Document9 pagesNotes For L2yuyin.gohyyNo ratings yet

- Contracts OutlineDocument57 pagesContracts Outlinetomwinters100% (1)

- Law On Obligation and Contracts (OBLICON)Document5 pagesLaw On Obligation and Contracts (OBLICON)Dummy GoogleNo ratings yet

- LAW (Article 1250 - 1270)Document5 pagesLAW (Article 1250 - 1270)Samantha SuyatNo ratings yet

- Obligations and Contracts / Prepared By: Atty. Yasmeen L. Junaid, CPADocument4 pagesObligations and Contracts / Prepared By: Atty. Yasmeen L. Junaid, CPAJoy Park100% (1)

- Kinds of Obligations PT 1Document9 pagesKinds of Obligations PT 1Bianca JampilNo ratings yet

- Extingquishment of Obligations PDFDocument9 pagesExtingquishment of Obligations PDFReylNo ratings yet

- RFBT OBLICON - Depa ReviewerDocument1 pageRFBT OBLICON - Depa ReviewerLovely JaneNo ratings yet

- Dation of Payment (Dacion en Pago)Document4 pagesDation of Payment (Dacion en Pago)Liza FloresNo ratings yet

- 5 - Obligations - Lobo (Extinguishment - Payment)Document17 pages5 - Obligations - Lobo (Extinguishment - Payment)Angelo LoboNo ratings yet

- S&P Debt Rating DefinitionsDocument6 pagesS&P Debt Rating DefinitionsilyakostNo ratings yet

- Acc DebenturesDocument12 pagesAcc DebenturesDRISYANo ratings yet

- Good Faith Estimate (GFE) : PurposeDocument3 pagesGood Faith Estimate (GFE) : PurposeEdwin RajNo ratings yet

- Credit and CollectionDocument3 pagesCredit and CollectionArnold BelangoyNo ratings yet

- 2019 Pre Bar Lecture in Banking and SPCL (070919) - Mjrsi PDFDocument22 pages2019 Pre Bar Lecture in Banking and SPCL (070919) - Mjrsi PDFLeslie Javier BurgosNo ratings yet

- Master Promissory Note Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramJohn sopertt50% (2)

- Modes of Extinguishment of ObligationDocument6 pagesModes of Extinguishment of ObligationJames Ibrahim Alih100% (2)

- Graduate Fellowship Deferment RequestDocument4 pagesGraduate Fellowship Deferment RequestrhNo ratings yet

- How to Win the Property War in Your Bankruptcy: Winning at Law, #4From EverandHow to Win the Property War in Your Bankruptcy: Winning at Law, #4No ratings yet

- Condition and Warranties-3Document21 pagesCondition and Warranties-3Patel LavkeshNo ratings yet

- Agreement With KSEBDocument3 pagesAgreement With KSEBhafizrahimmitNo ratings yet

- PCIB Vs FrancoDocument2 pagesPCIB Vs FrancoKIMMY100% (1)

- N-08-02 Consolidated Plywood V IFC LeasingDocument2 pagesN-08-02 Consolidated Plywood V IFC LeasingMalcolm Cruz100% (1)

- GABELO V CA Case DigestDocument1 pageGABELO V CA Case DigestMidzmar Kulani50% (2)

- Uniform Civil CodeDocument18 pagesUniform Civil Codeaditya_agarwal16100% (1)

- ALFORQUE - Quisumbing vs. Gov. GarciaDocument2 pagesALFORQUE - Quisumbing vs. Gov. Garciajimmie alforqueNo ratings yet

- Reviewer Family Code Articles 1-40Document7 pagesReviewer Family Code Articles 1-40Cristhian Rey BotorNo ratings yet

- Procedure For B & D RegistrationDocument6 pagesProcedure For B & D RegistrationA K MittalNo ratings yet

- Auditing - Auditor's LiabilityDocument13 pagesAuditing - Auditor's LiabilityThao NguyenNo ratings yet

- Action in Rem and Action in PersonamDocument3 pagesAction in Rem and Action in PersonamAnonymous H1TW3YY51KNo ratings yet

- March 20, 2013 PMDocument227 pagesMarch 20, 2013 PMOSDocs2012No ratings yet

- TRH - Articles of IncorporationDocument3 pagesTRH - Articles of IncorporationDaniel WatsonNo ratings yet

- Bernabe vs. AlejoDocument10 pagesBernabe vs. AlejoQueenie SabladaNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 1981, Docket 96-9717Document11 pagesUnited States Court of Appeals, Second Circuit.: No. 1981, Docket 96-9717Scribd Government DocsNo ratings yet

- Checkpoint LTD V Strathclyde Pension Fund (Case Digest)Document12 pagesCheckpoint LTD V Strathclyde Pension Fund (Case Digest)pieremicheleNo ratings yet

- Intrinsic and Extrinsic Aids in ConstructionDocument16 pagesIntrinsic and Extrinsic Aids in ConstructionRaffyLaguesma100% (1)

- New SMDC Ra-BisDocument4 pagesNew SMDC Ra-BisRam PinedaNo ratings yet

- Partnership Law SyllabusDocument3 pagesPartnership Law SyllabusMaya AustriaNo ratings yet

- LB-202 Content Family Law January, 2018Document5 pagesLB-202 Content Family Law January, 2018Harsh Vardhan Singh HvsNo ratings yet

- 1funa v. Executive Secretary-CASE-DIGESTDocument3 pages1funa v. Executive Secretary-CASE-DIGESTDorz B. Suralta100% (1)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Philippine Home Assurance VsDocument2 pagesPhilippine Home Assurance VsEdward Kenneth KungNo ratings yet

- G.R. No. L-50008Document4 pagesG.R. No. L-50008Rene ValentosNo ratings yet

- Alvarado vs. Gaviola Jr.Document8 pagesAlvarado vs. Gaviola Jr.Dexter CircaNo ratings yet

- Jsa Jis B 7516 2005Document10 pagesJsa Jis B 7516 2005Parsa RezaieNo ratings yet

Description: Tags: hb2-27

Description: Tags: hb2-27

Uploaded by

anon-2032340 ratings0% found this document useful (0 votes)

53 views1 pageLoan status determines eligibility for student financial aid funds. Students with loans in deferment, forbearance, grace periods, or repayment are eligible. Those who have paid loans in full, received loan discharges, or had loans canceled are also eligible. Students with defaulted loans or active bankruptcy claims on defaulted loans are ineligible unless certain conditions are met, such as making satisfactory repayment arrangements.

Original Description:

Original Title

description: tags: hb2-27

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLoan status determines eligibility for student financial aid funds. Students with loans in deferment, forbearance, grace periods, or repayment are eligible. Those who have paid loans in full, received loan discharges, or had loans canceled are also eligible. Students with defaulted loans or active bankruptcy claims on defaulted loans are ineligible unless certain conditions are met, such as making satisfactory repayment arrangements.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

53 views1 pageDescription: Tags: hb2-27

Description: Tags: hb2-27

Uploaded by

anon-203234Loan status determines eligibility for student financial aid funds. Students with loans in deferment, forbearance, grace periods, or repayment are eligible. Those who have paid loans in full, received loan discharges, or had loans canceled are also eligible. Students with defaulted loans or active bankruptcy claims on defaulted loans are ineligible unless certain conditions are met, such as making satisfactory repayment arrangements.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

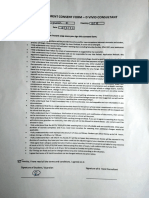

Effect of Loan Status on Student Aid Eligibility

Loan Status NSLDS Code Eligible for SFA Funds*

In school, DA-Deferred Yes

grace period, FB-Forbearance

ID-In school or grace

period

RP-In repayment

Paid DP-Default, then paid in full Yes

PC-Paid in full through For consolidation, it does not matter

consolidation what type of consolidation loan the

PF-Paid in full borrower received, nor whether loan

was in default before consolidation.

Lost guarantee UI-Uninsured, Unreinsured Yes

It does not matter if the loan was in

default.

Canceled or BC-No default, bankruptcy Yes

discharged discharge For a borrower who had a

CA-Canceled disability cancellation to receive

DF-Default, false certification new loans, the borrower must

discharge have a doctor’s certification that

DG-Default, false certification his or her condition has

(ability to benefit) discharge improved and sign a statement

DI-Disability indicating that he or she is

DJ-Default, discharged by judicial aware that the new loan cannot

ruling be canceled on the basis of any

DK-Default, bankruptcy discharge present impairment unless the

DN-Default, closed school condition deteriorates.

discharge

DS-Default, disability cancellation

EA-False certification (ability to

benefit) discharge

EC-Closed school discharge

EF-Loan discharged for fraudulent

disbursement

EJ-Court ordered write-off

OD-Default, bankruptcy discharge

No default, BK-No prior default, active Yes

bankruptcy bankruptcy claim Loan was not in default and has not

filing been discharged.

Default DL-Defaulted, in litigation No

DT-Defaulted, collection

terminated

DU-Defaulted, unresolved

Default, DB-Defaulted, active bankruptcy No, unless debtor can show that

bankruptcy claim loan is dischargeable.

filing DO-Defaulted, active bankruptcy

claim

Default, DC-Defaulted, compromised Yes

compromise Compromise is recognized as

payment in full.

Default, DW-Defaulted, write-off No, unless debtor reaffirms loan and

written-off makes satisfactory repayment

arrangements or repays loan in full.

Default, DX-Defaulted, satisfactory Yes, if borrower continues to comply

satisfactory arrangements, and six with repayment plan or is granted

repayment consecutive payments forbearance.

arrangement

*Federal Perkins Loan regulations allow the financial aid administrator to deny eligibility for additional loans

if he or she has evidence that the applicant is unwilling to repay the loan.

Student Eligibility 2 - 27

You might also like

- Mou Draft STD-1Document8 pagesMou Draft STD-1Ravikiran Kardile100% (3)

- Secured Transactions Law OutlineDocument59 pagesSecured Transactions Law OutlineAbigail ChapmanNo ratings yet

- Digest of Justinian, Volume 1 (D.1-15)Document530 pagesDigest of Justinian, Volume 1 (D.1-15)Ion Dumitrescu100% (2)

- Clearance GuideDocument2 pagesClearance Guideanon-529662100% (3)

- Chapter 4 OBLICON PDFDocument5 pagesChapter 4 OBLICON PDFsampdnimNo ratings yet

- Two Women Scenes For Teens: A Collection of Six Duets For Teen WomenDocument10 pagesTwo Women Scenes For Teens: A Collection of Six Duets For Teen WomenAnonymous KtLPe7BmNo ratings yet

- Conservatory - Pet Rules and Regulations (Amended 31-Mar-2014)Document2 pagesConservatory - Pet Rules and Regulations (Amended 31-Mar-2014)api-283790301No ratings yet

- Appendix C 2002-2003 Loan Status Codes and Eligibility Charts Code Status Eligibility For Title IvDocument11 pagesAppendix C 2002-2003 Loan Status Codes and Eligibility Charts Code Status Eligibility For Title Ivanon-285199No ratings yet

- Description: Tags: PK200701AttachmentADocument1 pageDescription: Tags: PK200701AttachmentAanon-543937No ratings yet

- Description: Tags: PK200701AttachmentADocument1 pageDescription: Tags: PK200701AttachmentAanon-987023No ratings yet

- Joint and Solidary ObligationsDocument13 pagesJoint and Solidary ObligationsJUPITER BARUELONo ratings yet

- Description: Tags: GEN0620AttachBDocument1 pageDescription: Tags: GEN0620AttachBanon-527377No ratings yet

- General ForbearanceDocument4 pagesGeneral ForbearanceRizope32No ratings yet

- Differences Between Chapters 7, 11, 12, & 13Document3 pagesDifferences Between Chapters 7, 11, 12, & 13prubiouk100% (1)

- Oblicon Prefinal Notes PDFDocument17 pagesOblicon Prefinal Notes PDFArwella Gregorio100% (1)

- Description: Tags: 0203SLGCh5DefaultDocument5 pagesDescription: Tags: 0203SLGCh5Defaultanon-368406No ratings yet

- OBLICON Chapter 4Document45 pagesOBLICON Chapter 4micah badilloNo ratings yet

- Description: Tags: lrdrh-2-57Document1 pageDescription: Tags: lrdrh-2-57anon-165959No ratings yet

- Debt RestructuringDocument4 pagesDebt RestructuringPushTheStart GamingNo ratings yet

- CHAPTER 11 Debenture & ChargeDocument35 pagesCHAPTER 11 Debenture & Charge2024736179No ratings yet

- Bankruptcy BasicsDocument28 pagesBankruptcy BasicsSamNo ratings yet

- Denial Letter 1Document1 pageDenial Letter 1mohammadNo ratings yet

- Description: Tags: 0102Vol5IntroDocument4 pagesDescription: Tags: 0102Vol5Introanon-912405No ratings yet

- NotesDocument88 pagesNotesBananaNo ratings yet

- Oblicon Midterm 1Document8 pagesOblicon Midterm 1lunaughh549No ratings yet

- Extinguishment of ObligationsDocument18 pagesExtinguishment of ObligationsMimiNo ratings yet

- TOPIC 4 MR Debentures - 230314 - 081422Document14 pagesTOPIC 4 MR Debentures - 230314 - 081422shivani dholeNo ratings yet

- Description: Tags: DlmpnnolabelDocument9 pagesDescription: Tags: Dlmpnnolabelanon-380563No ratings yet

- Banker S Right of Set Off - Explained - BankExamsTodayDocument4 pagesBanker S Right of Set Off - Explained - BankExamsTodayHimanshu Panchpal100% (3)

- Description: Tags: 0304CODVol5Sec4ComboEditsvApr03Document28 pagesDescription: Tags: 0304CODVol5Sec4ComboEditsvApr03anon-804563No ratings yet

- Trusts Law: Da & KR Defences (Term 2 Week 5) DefencesDocument2 pagesTrusts Law: Da & KR Defences (Term 2 Week 5) DefencesstraNo ratings yet

- SPECCOMDocument9 pagesSPECCOMMiller Paulo2 BilagNo ratings yet

- Description: Tags: StudentGuide0708 ForbearanceDocument1 pageDescription: Tags: StudentGuide0708 Forbearanceanon-600258No ratings yet

- Description: Tags: DLMPNDocument9 pagesDescription: Tags: DLMPNanon-217455No ratings yet

- Session 6 LAW201Document9 pagesSession 6 LAW201Jonalyn DureroNo ratings yet

- Dev't Bank of The Philippines V Arcilla Jr.Document1 pageDev't Bank of The Philippines V Arcilla Jr.brendamanganaanNo ratings yet

- Article 1198Document4 pagesArticle 1198Crystal Gayle De CastroNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActAggi Rayne Sali BucoyNo ratings yet

- CASE 02 - Carodan Vs China BankDocument3 pagesCASE 02 - Carodan Vs China Bankbernadeth ranolaNo ratings yet

- This Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtDocument1 pageThis Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtCresenciano MalabuyocNo ratings yet

- This Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtDocument1 pageThis Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtCresenciano MalabuyocNo ratings yet

- Article 1284Document1 pageArticle 1284Mitz Arzadon100% (1)

- Truth in LendingDocument2 pagesTruth in LendingFrancis Felices100% (1)

- Dotesb/23: Enrollment Consent Form-D Vivid ConsultantDocument1 pageDotesb/23: Enrollment Consent Form-D Vivid ConsultantGauri GanganiNo ratings yet

- Table B-10: Loan Status Codes: GA Data Provider InstructionsDocument4 pagesTable B-10: Loan Status Codes: GA Data Provider Instructionsanon-863389No ratings yet

- Notes For L2Document9 pagesNotes For L2yuyin.gohyyNo ratings yet

- Contracts OutlineDocument57 pagesContracts Outlinetomwinters100% (1)

- Law On Obligation and Contracts (OBLICON)Document5 pagesLaw On Obligation and Contracts (OBLICON)Dummy GoogleNo ratings yet

- LAW (Article 1250 - 1270)Document5 pagesLAW (Article 1250 - 1270)Samantha SuyatNo ratings yet

- Obligations and Contracts / Prepared By: Atty. Yasmeen L. Junaid, CPADocument4 pagesObligations and Contracts / Prepared By: Atty. Yasmeen L. Junaid, CPAJoy Park100% (1)

- Kinds of Obligations PT 1Document9 pagesKinds of Obligations PT 1Bianca JampilNo ratings yet

- Extingquishment of Obligations PDFDocument9 pagesExtingquishment of Obligations PDFReylNo ratings yet

- RFBT OBLICON - Depa ReviewerDocument1 pageRFBT OBLICON - Depa ReviewerLovely JaneNo ratings yet

- Dation of Payment (Dacion en Pago)Document4 pagesDation of Payment (Dacion en Pago)Liza FloresNo ratings yet

- 5 - Obligations - Lobo (Extinguishment - Payment)Document17 pages5 - Obligations - Lobo (Extinguishment - Payment)Angelo LoboNo ratings yet

- S&P Debt Rating DefinitionsDocument6 pagesS&P Debt Rating DefinitionsilyakostNo ratings yet

- Acc DebenturesDocument12 pagesAcc DebenturesDRISYANo ratings yet

- Good Faith Estimate (GFE) : PurposeDocument3 pagesGood Faith Estimate (GFE) : PurposeEdwin RajNo ratings yet

- Credit and CollectionDocument3 pagesCredit and CollectionArnold BelangoyNo ratings yet

- 2019 Pre Bar Lecture in Banking and SPCL (070919) - Mjrsi PDFDocument22 pages2019 Pre Bar Lecture in Banking and SPCL (070919) - Mjrsi PDFLeslie Javier BurgosNo ratings yet

- Master Promissory Note Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramJohn sopertt50% (2)

- Modes of Extinguishment of ObligationDocument6 pagesModes of Extinguishment of ObligationJames Ibrahim Alih100% (2)

- Graduate Fellowship Deferment RequestDocument4 pagesGraduate Fellowship Deferment RequestrhNo ratings yet

- How to Win the Property War in Your Bankruptcy: Winning at Law, #4From EverandHow to Win the Property War in Your Bankruptcy: Winning at Law, #4No ratings yet

- Condition and Warranties-3Document21 pagesCondition and Warranties-3Patel LavkeshNo ratings yet

- Agreement With KSEBDocument3 pagesAgreement With KSEBhafizrahimmitNo ratings yet

- PCIB Vs FrancoDocument2 pagesPCIB Vs FrancoKIMMY100% (1)

- N-08-02 Consolidated Plywood V IFC LeasingDocument2 pagesN-08-02 Consolidated Plywood V IFC LeasingMalcolm Cruz100% (1)

- GABELO V CA Case DigestDocument1 pageGABELO V CA Case DigestMidzmar Kulani50% (2)

- Uniform Civil CodeDocument18 pagesUniform Civil Codeaditya_agarwal16100% (1)

- ALFORQUE - Quisumbing vs. Gov. GarciaDocument2 pagesALFORQUE - Quisumbing vs. Gov. Garciajimmie alforqueNo ratings yet

- Reviewer Family Code Articles 1-40Document7 pagesReviewer Family Code Articles 1-40Cristhian Rey BotorNo ratings yet

- Procedure For B & D RegistrationDocument6 pagesProcedure For B & D RegistrationA K MittalNo ratings yet

- Auditing - Auditor's LiabilityDocument13 pagesAuditing - Auditor's LiabilityThao NguyenNo ratings yet

- Action in Rem and Action in PersonamDocument3 pagesAction in Rem and Action in PersonamAnonymous H1TW3YY51KNo ratings yet

- March 20, 2013 PMDocument227 pagesMarch 20, 2013 PMOSDocs2012No ratings yet

- TRH - Articles of IncorporationDocument3 pagesTRH - Articles of IncorporationDaniel WatsonNo ratings yet

- Bernabe vs. AlejoDocument10 pagesBernabe vs. AlejoQueenie SabladaNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 1981, Docket 96-9717Document11 pagesUnited States Court of Appeals, Second Circuit.: No. 1981, Docket 96-9717Scribd Government DocsNo ratings yet

- Checkpoint LTD V Strathclyde Pension Fund (Case Digest)Document12 pagesCheckpoint LTD V Strathclyde Pension Fund (Case Digest)pieremicheleNo ratings yet

- Intrinsic and Extrinsic Aids in ConstructionDocument16 pagesIntrinsic and Extrinsic Aids in ConstructionRaffyLaguesma100% (1)

- New SMDC Ra-BisDocument4 pagesNew SMDC Ra-BisRam PinedaNo ratings yet

- Partnership Law SyllabusDocument3 pagesPartnership Law SyllabusMaya AustriaNo ratings yet

- LB-202 Content Family Law January, 2018Document5 pagesLB-202 Content Family Law January, 2018Harsh Vardhan Singh HvsNo ratings yet

- 1funa v. Executive Secretary-CASE-DIGESTDocument3 pages1funa v. Executive Secretary-CASE-DIGESTDorz B. Suralta100% (1)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Philippine Home Assurance VsDocument2 pagesPhilippine Home Assurance VsEdward Kenneth KungNo ratings yet

- G.R. No. L-50008Document4 pagesG.R. No. L-50008Rene ValentosNo ratings yet

- Alvarado vs. Gaviola Jr.Document8 pagesAlvarado vs. Gaviola Jr.Dexter CircaNo ratings yet

- Jsa Jis B 7516 2005Document10 pagesJsa Jis B 7516 2005Parsa RezaieNo ratings yet