Professional Documents

Culture Documents

Case

Case

Uploaded by

Sricharan RayuduOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case

Case

Uploaded by

Sricharan RayuduCopyright:

Available Formats

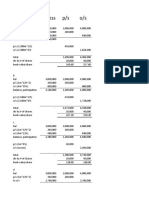

SITUATION The management of Indian Commercial Bank was contemplating to buy a new IBM computer which could be used

to replace the posting, monthly statement, payroll and interest departments now operating in the Bank. The installation of Computer would result in drastic reduction in payroll in these departments. The computer would cost Rs. 27,00,000. Besides, the Bank will have to incur additional cost of Rs. 1,50,000 for installation, Rs. 75,000 for power lines and electrical work and Rs. 75,000 for transportation. The computer is expected to have a 5-year useful life with a salvage value of Rs. 2,27,000. Depreciation is to be by the straight-line method. The equipment that would be replaced by the computer has been fully depreciated and the management feels that it could be sold in the present favorable market for Rs. 1,50,000 net. The Bank executives estimate that the computer should save Rs. 9,75,000 a year before depreciation and taxes, but they realize this will be subject to the amount of business which the Bank handles. A meeting of the Banks executives was convened to make estimates emerged from the deliberations.

Savings from Computer (Rs.) Probability %age

12,00,000 14,00,000 11,00,000 09,00,000 07,00,000

10 40 30 15 05

The Bank had only common stock standing. The liability side of the Banks Balance Sheet was as follows : Per Cent Demand Deposits 60 Time Deposits 30 Capital Stocks and Reserves Surplus 10 The Bank followed the usual pattern of charging for checking accounts; however, even so it found that there is an additional expense to the Bank of 1 %. The savings accounts earned on an average a 4 % return. The Banks earnings per share last year was 3 /-, with a payout of 50 %. The growth of earnings per share and dividend has been 7 % per year for the last five years. The present market price of the stock is Rs. 45 and not been subject to much fluctuation. Required : Should the Bank purchase this machine ?

You might also like

- M一级百题段风险管理Alex金程教育Document56 pagesM一级百题段风险管理Alex金程教育JIAWEINo ratings yet

- Capital Budgeting Sums-Doc For PDF (Encrypted)Document7 pagesCapital Budgeting Sums-Doc For PDF (Encrypted)Prasad GharatNo ratings yet

- Capital Budgeting TechniquesDocument2 pagesCapital Budgeting TechniquesmananipratikNo ratings yet

- 2015.08.16 S2 2015 AssignmentDocument4 pages2015.08.16 S2 2015 AssignmentSameer SharmaNo ratings yet

- John LTD Starts Selling Mobile Phones in 20x2 Details of PDFDocument1 pageJohn LTD Starts Selling Mobile Phones in 20x2 Details of PDFMiroslav GegoskiNo ratings yet

- Parab (2013) Financial Management JBIMS 20130408Document19 pagesParab (2013) Financial Management JBIMS 20130408Vishal BaviskarNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- CF Pre Final 2022Document3 pagesCF Pre Final 2022riddhi sanghviNo ratings yet

- Master of Business AdministrationDocument2 pagesMaster of Business AdministrationAnnieannaNo ratings yet

- IMT-59 Financial Management M2Document6 pagesIMT-59 Financial Management M2solvedcareNo ratings yet

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitNo ratings yet

- Master of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsDocument4 pagesMaster of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsjyothishwethaNo ratings yet

- MBA 2nd-4th Sem Internal TestDocument3 pagesMBA 2nd-4th Sem Internal TestNritya khoundNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsVasim ShaikhNo ratings yet

- How To Calculate BankDocument5 pagesHow To Calculate BankPankaj SharmaNo ratings yet

- Corporate Financing Decisions, Spring 2016Document4 pagesCorporate Financing Decisions, Spring 2016Ashok BistaNo ratings yet

- End-Term 2022 QuestionsDocument4 pagesEnd-Term 2022 Questionsarvind.mba23093No ratings yet

- Common Bases On Which The Exchange Ratio Is Determined AreDocument10 pagesCommon Bases On Which The Exchange Ratio Is Determined Aredivadivs100% (1)

- Capital BudgetingDocument108 pagesCapital BudgetingSakib Farooquie100% (1)

- Gujarat Technological University: InstructionsDocument3 pagesGujarat Technological University: InstructionssanketchauhanNo ratings yet

- Banking Concepts: Cash Reserve Ratio (CRR)Document18 pagesBanking Concepts: Cash Reserve Ratio (CRR)AjDonNo ratings yet

- Monthly Digest April 2019 Eng - PDF 51Document30 pagesMonthly Digest April 2019 Eng - PDF 51Sanjeev ChughNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- Additional Questions for practiceDocument7 pagesAdditional Questions for practicesuman.roy23-25No ratings yet

- Coc Ques pt1Document4 pagesCoc Ques pt1dhall.tushar2004No ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- SFM 5 PDFDocument4 pagesSFM 5 PDFketulNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- Capital StructureDocument2 pagesCapital StructureSahil RupaniNo ratings yet

- Capital StructureDocument2 pagesCapital StructureSahil RupaniNo ratings yet

- Capital StructureDocument2 pagesCapital StructureSahil RupaniNo ratings yet

- Capital Budgeting Techniques-For StudentsDocument4 pagesCapital Budgeting Techniques-For StudentsIshika HimatsinghkaNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementellaNo ratings yet

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Institute of Professional Education and Research (Technical Campus) Financial Management Practice BookDocument3 pagesInstitute of Professional Education and Research (Technical Campus) Financial Management Practice Bookmohini senNo ratings yet

- Strategic Corporate Finance AssignmentDocument6 pagesStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- Leverages Only QuestionsDocument3 pagesLeverages Only QuestionsÐíñkár PáhâríýâNo ratings yet

- Time Value of Money SumsDocument13 pagesTime Value of Money SumsrahulNo ratings yet

- Receivables ManagementDocument2 pagesReceivables Managementsamegroup4No ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Cost of CapitalDocument10 pagesCost of CapitalmansurresyNo ratings yet

- RTP CA Final Old Course Paper 2 Management Accounting and FinDocument38 pagesRTP CA Final Old Course Paper 2 Management Accounting and FinSajid AliNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- SFM CaseDocument12 pagesSFM Casedht6885100% (2)

- 05 s601 SFM PDFDocument4 pages05 s601 SFM PDFMuhammad Zahid FaridNo ratings yet

- LeonsDocument34 pagesLeonsFeilix BennyNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar50% (2)

- Banking Today Nov 15Document22 pagesBanking Today Nov 15Apurva JhaNo ratings yet

- Section A QUESTION 1 (Compulsory Question - 40 Marks)Document5 pagesSection A QUESTION 1 (Compulsory Question - 40 Marks)Jay Napstar NkomoNo ratings yet

- Assignment: Banking & InsuranceDocument9 pagesAssignment: Banking & InsuranceAshu GumberNo ratings yet

- MOP-Capital Theory Assignment-020310Document4 pagesMOP-Capital Theory Assignment-020310charnu1988No ratings yet

- Final Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Document3 pagesFinal Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Taimoor ShahidNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- +status Note On Npa/ Stressed Borrower (Rs.5 Crores N Above) Branch-Chennai Zone - Chennai NBG-South M/s Hallmark Living Space Private LimitedDocument2 pages+status Note On Npa/ Stressed Borrower (Rs.5 Crores N Above) Branch-Chennai Zone - Chennai NBG-South M/s Hallmark Living Space Private LimitedAbhijit TripathiNo ratings yet

- Stock Valuation and Investment Decisions Chapter 8 - CfaDocument55 pagesStock Valuation and Investment Decisions Chapter 8 - Cfashare757575% (4)

- IAS 16-Property, Plant and Equipment (PPE) : Nguyễn Đình Hoàng UyênDocument47 pagesIAS 16-Property, Plant and Equipment (PPE) : Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisjoeNo ratings yet

- Consolidated Balance Sheet: As at 31st March, 2016Document15 pagesConsolidated Balance Sheet: As at 31st March, 2016Saswata ChoudhuryNo ratings yet

- Learning: Misamis University Wilnirose C. MalinaoDocument4 pagesLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNo ratings yet

- 2021 Actual Accounts.Document18 pages2021 Actual Accounts.Elijah Amanoghene OSIANORNo ratings yet

- Capital Expenditure - Wikipedia, The Free EncyclopediaDocument2 pagesCapital Expenditure - Wikipedia, The Free EncyclopediaVijay KumarNo ratings yet

- ACCTG 029 - MOD 4 INTERCO INVTY (Review Prob)Document4 pagesACCTG 029 - MOD 4 INTERCO INVTY (Review Prob)Alliah Nicole RamosNo ratings yet

- Partnerships Liquidation PDFDocument33 pagesPartnerships Liquidation PDFSekar Nurthilawah ManellaNo ratings yet

- Chapter 10 - NON-CURRENT ASSETS AND DEPRECIATIONDocument15 pagesChapter 10 - NON-CURRENT ASSETS AND DEPRECIATIONĐặng Thái SơnNo ratings yet

- TCDN (Bank Test c16)Document54 pagesTCDN (Bank Test c16)Nguyễn Thanh TrúcNo ratings yet

- Delta Spinners 2009Document40 pagesDelta Spinners 2009bari.sarkarNo ratings yet

- ACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditDocument8 pagesACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditJeffrey Jazz BugashNo ratings yet

- (Reyes) Portal of Installment LiquidationDocument16 pages(Reyes) Portal of Installment LiquidationChe NelynNo ratings yet

- Process Costing-FifoDocument8 pagesProcess Costing-FifoMang OlehNo ratings yet

- Trading Strategies Involving OptionsDocument21 pagesTrading Strategies Involving OptionsSoumya ShobhanaNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Tata Steel Limited: History and Over ViewDocument3 pagesTata Steel Limited: History and Over Viewchadaram prasanthNo ratings yet

- Socresources Inc - Sec Form 17q 3rdq 2022 - 21nov2022 - PseDocument29 pagesSocresources Inc - Sec Form 17q 3rdq 2022 - 21nov2022 - PseRj ArevadoNo ratings yet

- NSSCAS Accounting Syllabus Final Nov 2020Document48 pagesNSSCAS Accounting Syllabus Final Nov 2020jemimanzinu6No ratings yet

- 8-Multiple Choice Questions On Accounting Equation PDFDocument9 pages8-Multiple Choice Questions On Accounting Equation PDFHammadkhan Dj89No ratings yet

- Chapter 6 ADVACC 2Document21 pagesChapter 6 ADVACC 2Angelic100% (1)

- A90 Report 1Document22 pagesA90 Report 1Jewel Mae MercadoNo ratings yet

- Capital BudgetingmbaeserveDocument30 pagesCapital BudgetingmbaeserveDavneet ChopraNo ratings yet

- Voluntary Assessment Payment ProgramDocument2 pagesVoluntary Assessment Payment ProgramNepean Philippines IncNo ratings yet

- INTACCDocument6 pagesINTACCAeliey AceNo ratings yet