Professional Documents

Culture Documents

Ch8 Two Security

Ch8 Two Security

Uploaded by

Ronil ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch8 Two Security

Ch8 Two Security

Uploaded by

Ronil ShahCopyright:

Available Formats

Chapter 8 2 Sec

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

A

B

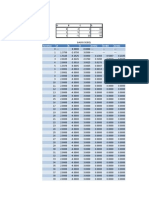

Chapter 8 Two Security Portfolio

Asset Allocation Analysis: Risk and Return

Expected

Standard

Return

Deviation

Security 1

0.08

0.12

Security 2

0.13

0.2

T-Bill

0.05

0

Weight

Security 1

1

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

Weight

Security 2

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Minimum Variance Portfolio

Weight 1

Weight 2

Return

Risk

CAL(MV)

Optimal Risky Portfolio

Weight 1

Weight 2

Ex Ret

St Dev.

CAL(OR)

Reward to

Variability

Corr.

Coeff s,b Covariance

0.3

0.0072

Expected

Standard Reward to

Return

Deviation Variability

0.08000

0.12000 0.25000

0.08500

0.11559 0.30281

0.09000

0.11454 0.34922

0.09500

0.11696 0.38474

0.10000

0.12264 0.40771

0.10500

0.13115 0.41937

0.11000

0.14199 0.42258

0.11500

0.15466 0.42027

0.12000

0.16876 0.41479

0.12500

0.18396 0.40771

0.13000

0.20000 0.40000

Short Sales No Short

Allowed

Sales

0.82000

0.82000

0.18000

0.18000

0.08900

0.08900

0.11447

0.11447

Short Sales No Short

Allowed

Sales

0.40000

0.40000

0.60000

0.60000

0.11000

0.11000

0.14199

0.14199

0.42258

0.42258

Optimal Portfolio with a Risk Free Asset

Short Sales No Short

Allowed

Sales

Desired rate of return:

0.12

Weight OP

Weight RF

Ex Ret

St Dev

1.16667

-0.16667

0.12000

0.16565

Optimal Portfolio w/o a Risk Free Asset

Desired rate of return:

0.12

Weight 1

Weight 2

Ex. Return

St Dev

0.20000

0.80000

0.12000

0.16876

1.16667

-0.16667

0.12000

0.16565

Chapter 8 2 Sec Sol

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

A

B

C

Chapter 8 Two Security Portfolio

Asset Allocation Analysis: Risk and Return

Expected

Standard

Corr.

Return

Deviation

Coeff 1,2 Covariance

Security 1

0.09

0.18

0.3

0.01512

Security 2

0.17

0.28

T-Bill

0.035

0

Weight

Weight

Security 1 Security 2

1

0

0.9

0.1

0.8

0.2

0.7

0.3

0.6

0.4

0.5

0.5

0.4

0.6

0.3

0.7

0.2

0.8

0.1

0.9

0

1

Expected Standard Reward to

Return

Deviation Variability

0.09000

0.18000 0.30556

0.09800

0.17248 0.36526

0.10600

0.16944 0.41902

0.11400

0.17112 0.46166

0.12200

0.17739 0.49046

0.13000

0.18778 0.50592

0.13800

0.20166 0.51077

0.14600

0.21836 0.50833

0.15400

0.23730 0.50148

0.16200

0.25797 0.49230

0.17000

0.28000 0.48214

Minimum Variance Portfolio

Short Sales No Short

Allowed

Sales

Weight 1

0.78550

0.78550

Weight 2

0.21450

0.21450

Return

0.10716

0.10716

Risk

0.16939

0.16939

CAL(MV)

Optimal Risky Portfolio Short Sales No Short

Allowed

Sales

Weight 1

0.39063

0.39063

Weight 2

0.60937

0.60937

Ex Ret

0.13875

0.13875

St Dev.

0.20311

0.20311

CAL(OR)

Reward to

Variability

0.51080

0.51080

Optimal Portfolio with a Risk Free Asset

Short Sales No Short

Allowed

Sales

Desired rate of return:

0.12

Weight OP

Weight RF

Ex Ret

St Dev

0.81928

0.18072

0.12000

0.16641

Optimal Portfolio w/o a Risk Free Asset

Desired rate of return:

0.12

Weight 1

Weight 2

Ex. Return

St Dev

0.62500

0.37500

0.12000

0.17541

0.81928

0.18072

0.12000

0.16641

You might also like

- Essentials of Investments 10th Edition Bodie Solutions ManualDocument16 pagesEssentials of Investments 10th Edition Bodie Solutions Manualmichaelstokes21121999xsb100% (25)

- R06 Time-Series Analysis - AnswersDocument56 pagesR06 Time-Series Analysis - AnswersShashwat Desai100% (1)

- Reading 1 Estimating Market Risk Measures - An Introduction and Overview - AnswersDocument22 pagesReading 1 Estimating Market Risk Measures - An Introduction and Overview - AnswersDivyansh ChandakNo ratings yet

- Ch06 Tool KitDocument36 pagesCh06 Tool KitRoy HemenwayNo ratings yet

- BKM9e EOC Ch27Document4 pagesBKM9e EOC Ch27Cardoso PenhaNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Standard Deviation on Individual Security = σ = √σ: Risk Return Problems Problem 1Document3 pagesStandard Deviation on Individual Security = σ = √σ: Risk Return Problems Problem 1jakia yasminNo ratings yet

- FIN 300 TEST 2 2021 Special - Solutions (2) .Docx..FinalDocument5 pagesFIN 300 TEST 2 2021 Special - Solutions (2) .Docx..FinalTekego TlakaleNo ratings yet

- Chapter 13: Empirical Evidence On Security Returns: Problem SetsDocument9 pagesChapter 13: Empirical Evidence On Security Returns: Problem SetsMehrab Jami Aumit 1812818630No ratings yet

- Sapm - Solution, Assignment 2Document5 pagesSapm - Solution, Assignment 2nikhilchatNo ratings yet

- Chapter 11 P7 P10 1617252729Document7 pagesChapter 11 P7 P10 1617252729Dawson Dela CruzNo ratings yet

- Iteration A B C Err (A) Err (B) Err (C)Document5 pagesIteration A B C Err (A) Err (B) Err (C)Nate RiveraNo ratings yet

- Chapter 5Document23 pagesChapter 5Kenya HunterNo ratings yet

- Demo Qs Topic 5 Part 1Document6 pagesDemo Qs Topic 5 Part 1Triet NguyenNo ratings yet

- Shear – v Rd,cDocument2 pagesShear – v Rd,cmoyale2023No ratings yet

- Risk and Return The Capital Asset Pricing Model (Capm)Document47 pagesRisk and Return The Capital Asset Pricing Model (Capm)Bussines LearnNo ratings yet

- Reading 47 Measuring and Monitoring Volatility - AnswersDocument41 pagesReading 47 Measuring and Monitoring Volatility - Answersapurv 11 jainNo ratings yet

- Chapter 7Document3 pagesChapter 7YINN YEE TANNo ratings yet

- Solutions To Chapter 7Document12 pagesSolutions To Chapter 7Naa'irah RehmanNo ratings yet

- Quiz 2 Practice IADocument3 pagesQuiz 2 Practice IABrendan RongNo ratings yet

- Investment Assign 2 - QuestionsDocument7 pagesInvestment Assign 2 - QuestionsYuhan KENo ratings yet

- Chapt 7Document19 pagesChapt 7studious07No ratings yet

- Secuirty C Security A Security B: All Three Security Portfolio (ABC) 4.21%Document5 pagesSecuirty C Security A Security B: All Three Security Portfolio (ABC) 4.21%Parth PoddarNo ratings yet

- Chapter 5 Solutions - FinmanDocument8 pagesChapter 5 Solutions - Finmanhannah villanuevaNo ratings yet

- Cailin Chen Question 9: (10 Points)Document5 pagesCailin Chen Question 9: (10 Points)Manuel BoahenNo ratings yet

- Practice Question - Chaptr 4Document8 pagesPractice Question - Chaptr 4Pro TenNo ratings yet

- Ch4sol PDFDocument7 pagesCh4sol PDFAmine IzamNo ratings yet

- The Basics of Risk: Problem 1Document7 pagesThe Basics of Risk: Problem 1Sandeep MishraNo ratings yet

- Systematic Risk and The Equity Risk Premium: ER W ER W ERDocument12 pagesSystematic Risk and The Equity Risk Premium: ER W ER W ERLeanne TehNo ratings yet

- Chapter 13: Empirical Evidence On Security Returns: Stock A B C D E F G H IDocument2 pagesChapter 13: Empirical Evidence On Security Returns: Stock A B C D E F G H IAlfahari AnggoroNo ratings yet

- Basic Statistics For Erratic and Kriged Block Grades Tests For Spatial Dependence Between Ordered GradesDocument1 pageBasic Statistics For Erratic and Kriged Block Grades Tests For Spatial Dependence Between Ordered GradesJulio Carrion ContrerasNo ratings yet

- Solutions To Selected Problems: Appendix HDocument5 pagesSolutions To Selected Problems: Appendix HKhalid AlhammouriNo ratings yet

- Solutions To Selected Problems: Appendix HDocument5 pagesSolutions To Selected Problems: Appendix HKhalid AlhammouriNo ratings yet

- Descriptive Statistics With Minitab Summer A, 2007: Example 1Document3 pagesDescriptive Statistics With Minitab Summer A, 2007: Example 1radislamyNo ratings yet

- Credit RiskDocument27 pagesCredit RiskMiguel CMNo ratings yet

- AngleDocument13 pagesAnglejvanandhNo ratings yet

- Answers To Practice Questions: Introduction To Risk, Return, and The Opportunity Cost of CapitalDocument9 pagesAnswers To Practice Questions: Introduction To Risk, Return, and The Opportunity Cost of CapitalShireen QaiserNo ratings yet

- Sensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsDocument5 pagesSensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsMatthew HaleNo ratings yet

- MGS3100: Exercises - ForecastingDocument8 pagesMGS3100: Exercises - ForecastingJabir ArifNo ratings yet

- Panel 1: Risk Parameters of The Investable Universe (Annualized)Document1 pagePanel 1: Risk Parameters of The Investable Universe (Annualized)JosuaNo ratings yet

- Asg6 SolutionsDocument6 pagesAsg6 SolutionsxolilazndolloxNo ratings yet

- Electronics Engineering LAB - 02: Nust Colege of Electrical and Mechanical EngineeeringDocument9 pagesElectronics Engineering LAB - 02: Nust Colege of Electrical and Mechanical EngineeeringDei mosNo ratings yet

- Linear Statistical ModelsDocument16 pagesLinear Statistical ModelssdeeproyNo ratings yet

- Elisa Auto Curve FitDocument6 pagesElisa Auto Curve FitRismauli Simanjuntak100% (1)

- General Linear Model Do MinitabDocument48 pagesGeneral Linear Model Do MinitabJose MadymeNo ratings yet

- Total 5 Marks: Question 1 BDocument8 pagesTotal 5 Marks: Question 1 Bshaneice_lewisNo ratings yet

- Ch1sol-Đã G PDocument31 pagesCh1sol-Đã G PLinh LinhNo ratings yet

- Investments Global Edition 10th Edition Bodie Solutions Manual DownloadDocument15 pagesInvestments Global Edition 10th Edition Bodie Solutions Manual DownloadJoshua Brown100% (19)

- Dsa 284557 PDFDocument6 pagesDsa 284557 PDFrrebollarNo ratings yet

- T Distribution: Critical T ValuesDocument1 pageT Distribution: Critical T ValuesCarrie PerezNo ratings yet

- Essentials of Investments 10th Edition Bodie Solutions ManualDocument29 pagesEssentials of Investments 10th Edition Bodie Solutions ManualrispalavieteNo ratings yet

- Assignment No 2 - Calculation Fo VARDocument7 pagesAssignment No 2 - Calculation Fo VARMuhammad ImranNo ratings yet

- Essentials of Investments 10Th Edition Bodie Solutions Manual Full Chapter PDFDocument36 pagesEssentials of Investments 10Th Edition Bodie Solutions Manual Full Chapter PDFellis.marr199100% (11)

- Essentials of Investments 10th Edition Bodie Solutions Manual 1Document16 pagesEssentials of Investments 10th Edition Bodie Solutions Manual 1donald100% (45)

- Essentials of Investments 10th Edition Bodie Solutions Manual 1Document36 pagesEssentials of Investments 10th Edition Bodie Solutions Manual 1stevenknappkorcfzgiwa100% (32)

- Gridding Report - : Data SourceDocument3 pagesGridding Report - : Data SourceAndi_Eqha_Insomn_895No ratings yet

- Chapt 9 Exam FinaDocument7 pagesChapt 9 Exam FinaNirmal PatelNo ratings yet

- Certificate of DepositsDocument9 pagesCertificate of DepositsRonil ShahNo ratings yet

- Exchange Traded FundsDocument11 pagesExchange Traded FundsRonil ShahNo ratings yet

- FL CourseDocument47 pagesFL CourseRonil ShahNo ratings yet

- UrvilDocument1 pageUrvilRonil ShahNo ratings yet

- Ranbaxy Annual ReportDocument25 pagesRanbaxy Annual ReportRonil ShahNo ratings yet

- Azim PremjiDocument1 pageAzim PremjiRonil ShahNo ratings yet

- HRDocument21 pagesHRRonil ShahNo ratings yet