Professional Documents

Culture Documents

Deductions Not Allowable Under Section 58

Deductions Not Allowable Under Section 58

Uploaded by

rainza_22Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deductions Not Allowable Under Section 58

Deductions Not Allowable Under Section 58

Uploaded by

rainza_22Copyright:

Available Formats

Deductions not allowable (section 58)

No deduction shall be made in computing the Income from other sources of an assessee in respect of the following items of expenses: 1. In the case of an assessee: a> any personal expenses of the assessee. b> any interest chargeable to tax under the Act which is payable outside India on which tax has not been paid or deducted at source. c>Any payable taxable in India as salaries, if it is payable outside India unless tax has been paid thereon or deducted at source. 2. In addition to these disallowances, section 58(2) specifically provides that the disallowances of payments to relatives and associate concerns and disallowances of payment or aggregate of payments exceeding rs.20000 made to a person during a day otherwise than by account payee cheque or draft covered by section 40A will be applicable to the computation of income under the head income from other sources as well. 3. Income tax and wealth tax paid. 4. No deductions in respect of any expenditure or allowance in connection with income of any or nature. By way of earnings by lottries, cross word puzzles, races including horse races, card games and other games of any sort of form gambling or betting. The prohibition will not, however apply in respect of the income of an assessee, being the owner of the race horses, from the activity and owning such horses. In respect of the activity of owning and maintaining race horses, expenses incurred shall be allowed even in the absence of any stake money earned. Such loss shall be allowed to be carried forward in accordance with the provision of the section 74A.

You might also like

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- View Certi If CateDocument1 pageView Certi If CateMahfuzur Rahman0% (3)

- 095 Marubeni V CIR (1989) LacsonDocument2 pages095 Marubeni V CIR (1989) LacsonKyle SubidoNo ratings yet

- CH 07Document16 pagesCH 07cushin2009100% (1)

- Deductions From Income From Other SourcesDocument7 pagesDeductions From Income From Other SourcesPADMANABHAN POTTINo ratings yet

- Section 58Document1 pageSection 58velugulasuresh2No ratings yet

- Income From Other Sources.: Vaibhav N BanjanDocument21 pagesIncome From Other Sources.: Vaibhav N BanjanPiyush MittalNo ratings yet

- Unit 1 - Income From Other SourcesDocument15 pagesUnit 1 - Income From Other SourcesSHUBH RATHNo ratings yet

- 74798bos60498 cp3 U5Document51 pages74798bos60498 cp3 U5Raj ThakurNo ratings yet

- Income From Other - SourcesDocument6 pagesIncome From Other - SourcesMohammad Yusuf NabeelNo ratings yet

- INCOME TAX - 6 Other SourcesDocument5 pagesINCOME TAX - 6 Other SourcesAbhaya kumarNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- Unit - 5: Income From Other Sources: After Studying This Chapter, You Would Be Able ToDocument45 pagesUnit - 5: Income From Other Sources: After Studying This Chapter, You Would Be Able ToShantanuNo ratings yet

- Income From Other SourcesDocument5 pagesIncome From Other SourcesGovarthanan NarasimhanNo ratings yet

- Sub Taxation I Semester 4th Day Teacher Pampa Jana Topic Income From Other Sources.Document6 pagesSub Taxation I Semester 4th Day Teacher Pampa Jana Topic Income From Other Sources.harshadaphandge165No ratings yet

- Income Under The HeadDocument13 pagesIncome Under The HeadParul Bhardwaj VaidyaNo ratings yet

- 4th Sem Taxation 1 - Income From Other Source by Pa - 231201 - 225812Document6 pages4th Sem Taxation 1 - Income From Other Source by Pa - 231201 - 225812chandelkomal707No ratings yet

- Unit 2 IFOS TheoryDocument36 pagesUnit 2 IFOS TheoryShri VidhyaNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other SourcessristiNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other Sourcesshankarinadar100% (1)

- Taxation LawDocument13 pagesTaxation LawShreejana RaiNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcessanjul2008No ratings yet

- Deductions Under S.57 & S.58 Deductions - S. 57: Ii inDocument2 pagesDeductions Under S.57 & S.58 Deductions - S. 57: Ii insnehachandan91No ratings yet

- (Section 70) - Set Off of Loss Under (Intra-Head AdDocument2 pages(Section 70) - Set Off of Loss Under (Intra-Head Adsukantabera215No ratings yet

- ITLPDocument1 pageITLPHakuna DasNo ratings yet

- Income From Other SourcesDocument20 pagesIncome From Other SourcesAlokNo ratings yet

- Income From Other Source Dec 2023Document31 pagesIncome From Other Source Dec 2023garglakshita6No ratings yet

- Income From Other Sources - NotesDocument4 pagesIncome From Other Sources - NotesAniket AgrawalNo ratings yet

- TAx A-3Document2 pagesTAx A-3Gowsik RameshNo ratings yet

- 107 - Taxation LawDocument11 pages107 - Taxation LawSurendrasingh ZalaNo ratings yet

- Income From Other SourcesDocument19 pagesIncome From Other SourcesRam RamNo ratings yet

- Income From Other SourcesDocument17 pagesIncome From Other Sourcesrakhee dewanNo ratings yet

- Income From Other SourcesDocument24 pagesIncome From Other Sourcesnikhilk222No ratings yet

- Tax Law AssignDocument10 pagesTax Law AssignZeeshan AliNo ratings yet

- Income Tax: You Earn It & The Government Takes A Part (A Big Part) of ItDocument35 pagesIncome Tax: You Earn It & The Government Takes A Part (A Big Part) of ItGuru PrasadNo ratings yet

- Income Form Other Sources-9Document10 pagesIncome Form Other Sources-9s4sahith50% (2)

- Some Issues On Practice of TDS Law Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Seminar by NIRCHarish KalidasNo ratings yet

- 49.income From Other SourcesDocument11 pages49.income From Other Sourcespratapnirbhay0551No ratings yet

- Tax LSPU Final Examination March 2016 AnswersDocument10 pagesTax LSPU Final Examination March 2016 AnswersKring de VeraNo ratings yet

- Basic Concepts of Income Tax Act: "Income Tax Is Levied On The Total Income of The Previous Year of Every Person."Document3 pagesBasic Concepts of Income Tax Act: "Income Tax Is Levied On The Total Income of The Previous Year of Every Person."babita_27No ratings yet

- Seminar On TDSDocument29 pagesSeminar On TDSCA Virendra ChhajerNo ratings yet

- Wa0004.Document64 pagesWa0004.dhruv MehtaNo ratings yet

- Chargeability and Section 56 PDFDocument6 pagesChargeability and Section 56 PDFArpit GoyalNo ratings yet

- Taxs Law ExamDocument15 pagesTaxs Law ExamSaif AliNo ratings yet

- Income From Other Sources (IFOS) : Taxation - Group 4Document19 pagesIncome From Other Sources (IFOS) : Taxation - Group 4Dalmia Finance 2018-20No ratings yet

- Some Issues On Practice of TDS Law Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Seminar by NIRCShashank Deva SunnyNo ratings yet

- q4xRQ-4 Resources 5848 DT CMA Final Part 2 2020-21 Lyst2690Document183 pagesq4xRQ-4 Resources 5848 DT CMA Final Part 2 2020-21 Lyst2690Gaurav GaurNo ratings yet

- Income From Other SourceDocument12 pagesIncome From Other SourceKeerthanaNo ratings yet

- Some Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCJinoy P MathewNo ratings yet

- Section 194Document10 pagesSection 194Hitesh NarwaniNo ratings yet

- Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesDr. P. Sree Sudha, Associate Professor, Dsnluammu arellaNo ratings yet

- Incomes Specifically Chargeable SDocument2 pagesIncomes Specifically Chargeable Ssnehachandan91No ratings yet

- Income From Other Sources: Click To Add TextDocument14 pagesIncome From Other Sources: Click To Add TextAlezNo ratings yet

- Law of Taxation NotesDocument49 pagesLaw of Taxation NotesBhoomika SinghNo ratings yet

- Income From Other SourcesDocument29 pagesIncome From Other SourcesSatish BhadaniNo ratings yet

- Gain On Disposal of A Capital Asset in A Tax Year Is Chargeable Under The Head Capital Gains On Accrual BasisDocument19 pagesGain On Disposal of A Capital Asset in A Tax Year Is Chargeable Under The Head Capital Gains On Accrual BasisAmarKumarNo ratings yet

- Assignment - Explain Income From Other SourcesDocument9 pagesAssignment - Explain Income From Other SourcesPraveen SNo ratings yet

- Income From Other Sources: Name Freya P Mistry Class Sybcom Sem 4 Roll No 153Document12 pagesIncome From Other Sources: Name Freya P Mistry Class Sybcom Sem 4 Roll No 153varunNo ratings yet

- Some Incomes Are Falling Under The Head Income From Other SourcesDocument5 pagesSome Incomes Are Falling Under The Head Income From Other SourcesDushyanth NairNo ratings yet

- Income From Other Sources - Ay0910Document41 pagesIncome From Other Sources - Ay0910ravibavaria5913No ratings yet

- TAXATION LAW II (Notes For Exams)Document59 pagesTAXATION LAW II (Notes For Exams)MrinalBhatnagarNo ratings yet

- Tax Deductable AtsourceDocument22 pagesTax Deductable AtsourceMohd. Shadab khanNo ratings yet

- Income From Other SourcesDocument9 pagesIncome From Other Sourcesrakshitha9reddy-1No ratings yet

- Application For Property Tax Relief For Military PersonnelDocument1 pageApplication For Property Tax Relief For Military PersonnelSyed Mohammed AizazNo ratings yet

- 09 Foreign Tax Credit Foreign LossesDocument7 pages09 Foreign Tax Credit Foreign LossesTayyaba YounasNo ratings yet

- First Income Tax Quiz LetranDocument15 pagesFirst Income Tax Quiz LetranAnselmo Rodiel IVNo ratings yet

- 0006 Abdul Qadir MemonDocument114 pages0006 Abdul Qadir Memonflower4u2008No ratings yet

- REQUERIMIENTODocument110 pagesREQUERIMIENTOJulian Leonardo Mahecha SuescunNo ratings yet

- Calculation Sheet F.Y. 2022 - 23 NewDocument1 pageCalculation Sheet F.Y. 2022 - 23 Newmandalsomithmandal1986No ratings yet

- Guidelines and Procedures For Applying Tax Treaty Relief AvailmentDocument1 pageGuidelines and Procedures For Applying Tax Treaty Relief Availmentlaica valderasNo ratings yet

- BRB23 TaxDocument203 pagesBRB23 TaxIsabella Siggaoat100% (1)

- Computation 22-23Document2 pagesComputation 22-23Ruloans VaishaliNo ratings yet

- physicalCustomerInvoice-9170519792-4036-b3c8c084 92fa 4b8f A606 58c6d645a5f65piwPugLHo-4470244159Document1 pagephysicalCustomerInvoice-9170519792-4036-b3c8c084 92fa 4b8f A606 58c6d645a5f65piwPugLHo-4470244159Radhika RamachandranNo ratings yet

- Tax Hacks The Tax Survival Tournament With Answers 1 PDFDocument23 pagesTax Hacks The Tax Survival Tournament With Answers 1 PDFjane dillanNo ratings yet

- Fall2 QuizDocument4 pagesFall2 Quizpro mansaNo ratings yet

- Salary Slip (31431735 December, 2017)Document1 pageSalary Slip (31431735 December, 2017)sabahat cheemaNo ratings yet

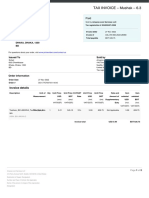

- TAX INVOICE - Mushak - 6.3: Sohail 63/2 Chawkbazar DHAKA, DHAKA, 1200 BDDocument2 pagesTAX INVOICE - Mushak - 6.3: Sohail 63/2 Chawkbazar DHAKA, DHAKA, 1200 BDAnowarul HaqueNo ratings yet

- Baf-Economics-Ii-Semester-Iii-And-Iv-Syllabus-To-Be-Implememnted-2017 2018 - 2Document71 pagesBaf-Economics-Ii-Semester-Iii-And-Iv-Syllabus-To-Be-Implememnted-2017 2018 - 2api-292680897No ratings yet

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- T2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationDocument9 pagesT2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationBryan WilleyNo ratings yet

- Instructions ItrDocument988 pagesInstructions ItrBalasubramanian NatarajanNo ratings yet

- Budget Highlights - Crowe Nepal (78-79)Document72 pagesBudget Highlights - Crowe Nepal (78-79)binuNo ratings yet

- Tax EvasionDocument6 pagesTax Evasionmoon walkerNo ratings yet

- Payslip2 PDFDocument1 pagePayslip2 PDFSumanthNo ratings yet

- 3229 To 3233 Dollar Industries LimitedDocument2 pages3229 To 3233 Dollar Industries LimitedmanjujeejooNo ratings yet

- Income Taxation of Trusts and EstatesDocument4 pagesIncome Taxation of Trusts and EstatesMilky CoffeeNo ratings yet

- Tutorial 1Document7 pagesTutorial 1Shan JeefNo ratings yet

- PATELDocument1 pagePATELRJ MechNo ratings yet

- Tax Management-Module 1 Problems On Residential Status and Incidence On TaxDocument2 pagesTax Management-Module 1 Problems On Residential Status and Incidence On TaxdiviprabhuNo ratings yet