Professional Documents

Culture Documents

MBA 643 - Notes

MBA 643 - Notes

Uploaded by

SandeepCopyright:

Available Formats

You might also like

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- FINA1221 Formula SheetDocument2 pagesFINA1221 Formula SheetTjia Hwei ChewNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Formula Sheet-Coporate FinanceDocument3 pagesFormula Sheet-Coporate FinanceWH JeepNo ratings yet

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Strategic Program Management - PGMP PDFDocument2 pagesStrategic Program Management - PGMP PDFSandeepNo ratings yet

- PG MPNotesDocument16 pagesPG MPNotesSandeep100% (1)

- NatureviewDocument32 pagesNatureviewSandeep100% (4)

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Prices Index in Change % Prices Stock in Change %Document2 pagesPrices Index in Change % Prices Stock in Change %Maidhily GovindNo ratings yet

- Công thức IM tự luận- cho finalDocument6 pagesCông thức IM tự luận- cho finalTuấn NguyễnNo ratings yet

- Important FormulasDocument5 pagesImportant FormulasKhalil AkramNo ratings yet

- Fin All Formula - Docx 1Document9 pagesFin All Formula - Docx 1Marcus HollowayNo ratings yet

- Session 9-02-07-2020 Portfolio Return and Risk: Arithmetic Versus Geometric AveragesDocument7 pagesSession 9-02-07-2020 Portfolio Return and Risk: Arithmetic Versus Geometric AveragesVineetha Chowdary Gude100% (1)

- Foundations of Finance MidtermDocument2 pagesFoundations of Finance MidtermVamsee JastiNo ratings yet

- Portfolio Management: Statical Analysis For Single SecurityDocument5 pagesPortfolio Management: Statical Analysis For Single SecurityJenneey D RajaniNo ratings yet

- Formula Sheet-2nd QuizDocument6 pagesFormula Sheet-2nd QuizEge MelihNo ratings yet

- FINALS Investment Cheat SheetDocument9 pagesFINALS Investment Cheat SheetNicholas YinNo ratings yet

- Formulas and ConceptsDocument7 pagesFormulas and Conceptscolen.anneNo ratings yet

- Formula SheetDocument3 pagesFormula SheetjainswapnilNo ratings yet

- Formula For Financial Market TheoryDocument6 pagesFormula For Financial Market TheoryHansNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- CORPORATE FINANCE - Chap 11Document4 pagesCORPORATE FINANCE - Chap 11Nguyễn T. Anh Minh100% (1)

- FormulasDocument7 pagesFormulaskasimgenelNo ratings yet

- Risk and Return Formula SheetDocument7 pagesRisk and Return Formula SheetMaha Bianca Charisma CastroNo ratings yet

- Fin 302 Formulas Chapter 10 and 11Document3 pagesFin 302 Formulas Chapter 10 and 11Shahinul KabirNo ratings yet

- Financial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementDocument7 pagesFinancial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementAakash TiwariNo ratings yet

- Sample L1formulasheetdecember2024Document8 pagesSample L1formulasheetdecember2024fakemail9552369978No ratings yet

- EMBA Chapter5Document38 pagesEMBA Chapter5Mehrab RehmanNo ratings yet

- FM Formula Sheet 02Document2 pagesFM Formula Sheet 02Aninda DuttaNo ratings yet

- Presentation 04 - Risk and Return 2012.11.15Document54 pagesPresentation 04 - Risk and Return 2012.11.15SantaAgataNo ratings yet

- Executive Summary of Finance 430Document31 pagesExecutive Summary of Finance 430Ein LuckyNo ratings yet

- 2018 Level I Formula Sheet 1 PDFDocument27 pages2018 Level I Formula Sheet 1 PDFShamima YesminNo ratings yet

- FNCE Cheat Sheet Midterm 1Document1 pageFNCE Cheat Sheet Midterm 1carmenng1990No ratings yet

- R M R M R M R M: Time Value of MoneyDocument8 pagesR M R M R M R M: Time Value of MoneyHenry JiangNo ratings yet

- 2017 Level I Formula SheetDocument28 pages2017 Level I Formula SheetVishal GoriNo ratings yet

- Sample Formula Sheet for CIMA Certification: = R - (R - β * (R - RDocument2 pagesSample Formula Sheet for CIMA Certification: = R - (R - β * (R - RLouis SmithNo ratings yet

- Formula For Financial Market Theory AMENDEDDocument7 pagesFormula For Financial Market Theory AMENDEDHansNo ratings yet

- Chapter 4 Risk and ReturnDocument40 pagesChapter 4 Risk and ReturnmedrekNo ratings yet

- Formulas: FV PV × (1 + R)Document3 pagesFormulas: FV PV × (1 + R)pram006No ratings yet

- Formula SheetDocument3 pagesFormula SheetAshley ShaddockNo ratings yet

- CapmDocument26 pagesCapmapi-3814557100% (1)

- CFA Level I Formula SheetDocument27 pagesCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- CH 02Document48 pagesCH 02Harsh DhawanNo ratings yet

- MGT201 Assignment SolutionDocument3 pagesMGT201 Assignment SolutionMuhammad Najeebullah Khan33% (3)

- Multi-Factor Asset Pricing: and More On The HomeworkDocument25 pagesMulti-Factor Asset Pricing: and More On The HomeworkMadihaBhattiNo ratings yet

- Formula SheetDocument3 pagesFormula SheetEdithNo ratings yet

- Finance 3000 Midterm2 Formula Sheet: October 28, 2015Document2 pagesFinance 3000 Midterm2 Formula Sheet: October 28, 2015Jack JacintoNo ratings yet

- The Return & Risk: Books: L J GitmanDocument23 pagesThe Return & Risk: Books: L J GitmanNilima Islam Mim 201-11-6426No ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- Security Analysis & Portfolio Management: Dr. Hemant ManujDocument13 pagesSecurity Analysis & Portfolio Management: Dr. Hemant ManujHasan NabeelNo ratings yet

- Port MNGT tRiskandReturn4Document105 pagesPort MNGT tRiskandReturn4guhandossNo ratings yet

- Volatility Modelling: Next ChapterDocument33 pagesVolatility Modelling: Next ChapterMujeeb Ul Rahman MrkhosoNo ratings yet

- Final Formula SheetDocument2 pagesFinal Formula SheetShahzia MudbhatkalNo ratings yet

- CAPMDocument45 pagesCAPMkokmunwai717No ratings yet

- Risk, Return, and Security Market LineDocument15 pagesRisk, Return, and Security Market LineMSA-ACCA100% (2)

- Decomposition of Risk-Adjusted Performance: R (B (P) ) RF + B (P) (R (B) - RF) 2% + 0.67 (9%-2%) 6.7%Document1 pageDecomposition of Risk-Adjusted Performance: R (B (P) ) RF + B (P) (R (B) - RF) 2% + 0.67 (9%-2%) 6.7%tamizharasidNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Baby NamesDocument3 pagesBaby NamesSandeepNo ratings yet

- Merck Case AnalysisDocument39 pagesMerck Case AnalysisSandeep100% (1)

- MBA 603 - Briefing Memo - Economics of Low Cost AirlineDocument6 pagesMBA 603 - Briefing Memo - Economics of Low Cost AirlineSandeepNo ratings yet

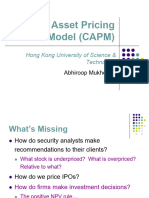

MBA 643 - Notes

MBA 643 - Notes

Uploaded by

SandeepOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA 643 - Notes

MBA 643 - Notes

Uploaded by

SandeepCopyright:

Available Formats

TVM EAR (1+r)n-1 Annuity - PVIFA = ( 1 (1/(1+r)n)/r FVIFA = ((1+r)t -1)/r Growing Annuity - PVo = (C1/ r g) - ((C1 ( 1 + g )t/(

/( 1 + r )t)/r g) Bond Valuation Fisher 1+R = (1+r) (1+h) R- Nominal, r= real, h = inflation, EAR = (1+(APR/m))m -1 Stocks Valuation Po = Div1/r, Po = Div1/(r-g), Est. Growth Rate g = retention ratio x return on ret earnings, r = Div1/P0 + g = dividend yield + growth in earnings (or growth of dividends or capital gains yield)Just before dividend is paid Pt = Pt + Div-t CAPM Expected Return on Single Security P R Variance = R N M N Expected Return on Portfolio R p = W i Ri or R p = P j R pj Variance [ R pR Pj [ R pj R p ]2 P = 2 ]

N j 1 j j

Variance for 2 stock portfolio = 2 = W 2 2 +W 2 2 + 2 W A W B A,B Co-variance A,B = P j [ R Aj - R A ][ RBj - R B ] Corr. of Return A,B = A A B B A B j=1 CAPM Assumptions - Riskless Borrowing and Lending, Homogenous Expectations, Security Market Line, The Capital Asset Pricing Model

i=1

j=1

j 1

j 1

A,B

Riskless Borrowing and Lending Separation Principle, CML, Opportunity set, R port

Wrf xRrf Wriskyport x R riskyport

2 m

& 2port = W2risky port x 2risky port

Homogenous Expectations - TOTAL RISK OF A STOCK = SYSTEMATIC + UNSYSTEMATIC RISK i = i,m /

SML Beta Vs Return, Beta = 0 should earn risk free rate, Beta =1 for all risky asset market portfolio, relation is linear and is CAPM CAPM - R i R f i x[ R m Rrf ] Return on portfolio E(P) = Wa * E (a) + Wb * E(b) Beta of portfolio = Wa * Beta(a) + Wb * Beta(b) BETA is measure of systematic risk. Capital Budgeting NPV, Payback Period, Discounted Payback Period, IRR Discount rate which makes NPV = 0. , Mutually Exclusive projects The scale problem IRR Ignores the scales Vs NPV, Use incremental IRR Sum the cash flows and calculate NPV of increments. Incremental IRR > Required Rate of Return The timing problem Two projects NPV profiles may intersect each other. PICK project with higher NPV along the curves

You might also like

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- FINA1221 Formula SheetDocument2 pagesFINA1221 Formula SheetTjia Hwei ChewNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Formula Sheet-Coporate FinanceDocument3 pagesFormula Sheet-Coporate FinanceWH JeepNo ratings yet

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Strategic Program Management - PGMP PDFDocument2 pagesStrategic Program Management - PGMP PDFSandeepNo ratings yet

- PG MPNotesDocument16 pagesPG MPNotesSandeep100% (1)

- NatureviewDocument32 pagesNatureviewSandeep100% (4)

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Prices Index in Change % Prices Stock in Change %Document2 pagesPrices Index in Change % Prices Stock in Change %Maidhily GovindNo ratings yet

- Công thức IM tự luận- cho finalDocument6 pagesCông thức IM tự luận- cho finalTuấn NguyễnNo ratings yet

- Important FormulasDocument5 pagesImportant FormulasKhalil AkramNo ratings yet

- Fin All Formula - Docx 1Document9 pagesFin All Formula - Docx 1Marcus HollowayNo ratings yet

- Session 9-02-07-2020 Portfolio Return and Risk: Arithmetic Versus Geometric AveragesDocument7 pagesSession 9-02-07-2020 Portfolio Return and Risk: Arithmetic Versus Geometric AveragesVineetha Chowdary Gude100% (1)

- Foundations of Finance MidtermDocument2 pagesFoundations of Finance MidtermVamsee JastiNo ratings yet

- Portfolio Management: Statical Analysis For Single SecurityDocument5 pagesPortfolio Management: Statical Analysis For Single SecurityJenneey D RajaniNo ratings yet

- Formula Sheet-2nd QuizDocument6 pagesFormula Sheet-2nd QuizEge MelihNo ratings yet

- FINALS Investment Cheat SheetDocument9 pagesFINALS Investment Cheat SheetNicholas YinNo ratings yet

- Formulas and ConceptsDocument7 pagesFormulas and Conceptscolen.anneNo ratings yet

- Formula SheetDocument3 pagesFormula SheetjainswapnilNo ratings yet

- Formula For Financial Market TheoryDocument6 pagesFormula For Financial Market TheoryHansNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- CORPORATE FINANCE - Chap 11Document4 pagesCORPORATE FINANCE - Chap 11Nguyễn T. Anh Minh100% (1)

- FormulasDocument7 pagesFormulaskasimgenelNo ratings yet

- Risk and Return Formula SheetDocument7 pagesRisk and Return Formula SheetMaha Bianca Charisma CastroNo ratings yet

- Fin 302 Formulas Chapter 10 and 11Document3 pagesFin 302 Formulas Chapter 10 and 11Shahinul KabirNo ratings yet

- Financial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementDocument7 pagesFinancial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementAakash TiwariNo ratings yet

- Sample L1formulasheetdecember2024Document8 pagesSample L1formulasheetdecember2024fakemail9552369978No ratings yet

- EMBA Chapter5Document38 pagesEMBA Chapter5Mehrab RehmanNo ratings yet

- FM Formula Sheet 02Document2 pagesFM Formula Sheet 02Aninda DuttaNo ratings yet

- Presentation 04 - Risk and Return 2012.11.15Document54 pagesPresentation 04 - Risk and Return 2012.11.15SantaAgataNo ratings yet

- Executive Summary of Finance 430Document31 pagesExecutive Summary of Finance 430Ein LuckyNo ratings yet

- 2018 Level I Formula Sheet 1 PDFDocument27 pages2018 Level I Formula Sheet 1 PDFShamima YesminNo ratings yet

- FNCE Cheat Sheet Midterm 1Document1 pageFNCE Cheat Sheet Midterm 1carmenng1990No ratings yet

- R M R M R M R M: Time Value of MoneyDocument8 pagesR M R M R M R M: Time Value of MoneyHenry JiangNo ratings yet

- 2017 Level I Formula SheetDocument28 pages2017 Level I Formula SheetVishal GoriNo ratings yet

- Sample Formula Sheet for CIMA Certification: = R - (R - β * (R - RDocument2 pagesSample Formula Sheet for CIMA Certification: = R - (R - β * (R - RLouis SmithNo ratings yet

- Formula For Financial Market Theory AMENDEDDocument7 pagesFormula For Financial Market Theory AMENDEDHansNo ratings yet

- Chapter 4 Risk and ReturnDocument40 pagesChapter 4 Risk and ReturnmedrekNo ratings yet

- Formulas: FV PV × (1 + R)Document3 pagesFormulas: FV PV × (1 + R)pram006No ratings yet

- Formula SheetDocument3 pagesFormula SheetAshley ShaddockNo ratings yet

- CapmDocument26 pagesCapmapi-3814557100% (1)

- CFA Level I Formula SheetDocument27 pagesCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- CH 02Document48 pagesCH 02Harsh DhawanNo ratings yet

- MGT201 Assignment SolutionDocument3 pagesMGT201 Assignment SolutionMuhammad Najeebullah Khan33% (3)

- Multi-Factor Asset Pricing: and More On The HomeworkDocument25 pagesMulti-Factor Asset Pricing: and More On The HomeworkMadihaBhattiNo ratings yet

- Formula SheetDocument3 pagesFormula SheetEdithNo ratings yet

- Finance 3000 Midterm2 Formula Sheet: October 28, 2015Document2 pagesFinance 3000 Midterm2 Formula Sheet: October 28, 2015Jack JacintoNo ratings yet

- The Return & Risk: Books: L J GitmanDocument23 pagesThe Return & Risk: Books: L J GitmanNilima Islam Mim 201-11-6426No ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- Security Analysis & Portfolio Management: Dr. Hemant ManujDocument13 pagesSecurity Analysis & Portfolio Management: Dr. Hemant ManujHasan NabeelNo ratings yet

- Port MNGT tRiskandReturn4Document105 pagesPort MNGT tRiskandReturn4guhandossNo ratings yet

- Volatility Modelling: Next ChapterDocument33 pagesVolatility Modelling: Next ChapterMujeeb Ul Rahman MrkhosoNo ratings yet

- Final Formula SheetDocument2 pagesFinal Formula SheetShahzia MudbhatkalNo ratings yet

- CAPMDocument45 pagesCAPMkokmunwai717No ratings yet

- Risk, Return, and Security Market LineDocument15 pagesRisk, Return, and Security Market LineMSA-ACCA100% (2)

- Decomposition of Risk-Adjusted Performance: R (B (P) ) RF + B (P) (R (B) - RF) 2% + 0.67 (9%-2%) 6.7%Document1 pageDecomposition of Risk-Adjusted Performance: R (B (P) ) RF + B (P) (R (B) - RF) 2% + 0.67 (9%-2%) 6.7%tamizharasidNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Baby NamesDocument3 pagesBaby NamesSandeepNo ratings yet

- Merck Case AnalysisDocument39 pagesMerck Case AnalysisSandeep100% (1)

- MBA 603 - Briefing Memo - Economics of Low Cost AirlineDocument6 pagesMBA 603 - Briefing Memo - Economics of Low Cost AirlineSandeepNo ratings yet