Professional Documents

Culture Documents

Care LoanRating

Care LoanRating

Uploaded by

AndwarkCopyright:

Available Formats

You might also like

- Education Loan CertificateDocument2 pagesEducation Loan CertificateMadhumitha L82% (11)

- Phil RatingsDocument8 pagesPhil RatingsTrisha Timpog100% (1)

- Chapter 1 - A Framework For Financial Accounting: Click On LinksDocument14 pagesChapter 1 - A Framework For Financial Accounting: Click On LinksABDULLAH ALSHEHRINo ratings yet

- Almario Bsa2d At6 Fin2Document6 pagesAlmario Bsa2d At6 Fin2Tracy Camille100% (1)

- Customer Satisfaction Towards Life InsuranceDocument70 pagesCustomer Satisfaction Towards Life Insurancekkccommerceproject100% (1)

- Banking DictionaryDocument188 pagesBanking DictionaryRanjan Shetty100% (1)

- 2203001_FMIS Assignment 8Document4 pages2203001_FMIS Assignment 82203037No ratings yet

- Credit RatingsDocument15 pagesCredit RatingsLalit GuptaNo ratings yet

- CRISIL Rating ScaleDocument5 pagesCRISIL Rating ScalecharlyNo ratings yet

- CRR ScaleDocument1 pageCRR ScaleRijesh RaghunathanNo ratings yet

- Credit Rating Scales, ShivamDocument8 pagesCredit Rating Scales, Shivamshivamagarwal292No ratings yet

- Rating Methodology: Crisil Care IcraDocument5 pagesRating Methodology: Crisil Care IcraRohit SharmaNo ratings yet

- RatingsScale 2008 PDFDocument13 pagesRatingsScale 2008 PDFPradeep272No ratings yet

- Credit Rating: Fees Structure FEE Structure Initial Rating FeesDocument6 pagesCredit Rating: Fees Structure FEE Structure Initial Rating FeesWindowFashionNo ratings yet

- Credit Rating AgenciesDocument40 pagesCredit Rating AgenciesSmriti DurehaNo ratings yet

- Rating SymbolsDocument4 pagesRating SymbolsAmrit GCNo ratings yet

- Overview of Smera'S Rating ProcessDocument3 pagesOverview of Smera'S Rating ProcessAshwin Kailasam NellaiappanNo ratings yet

- CRISL Rating of Banks and FI SDocument2 pagesCRISL Rating of Banks and FI SFaisal Tanvir KhanNo ratings yet

- Definition, Types and Scales of Credit RatingDocument8 pagesDefinition, Types and Scales of Credit Ratingjannatul ferthousNo ratings yet

- June 15 2011 Standardisation of Rating SymbolsDocument8 pagesJune 15 2011 Standardisation of Rating SymbolsRajalakshmi13No ratings yet

- Standardisation Rating Symbols Definitions CRISILDocument10 pagesStandardisation Rating Symbols Definitions CRISILsunil_k_agrawal5487No ratings yet

- Credit Rating: Submitted By: Group 5 TH Roll No. 6144, 6145, 6136,6141,6104Document26 pagesCredit Rating: Submitted By: Group 5 TH Roll No. 6144, 6145, 6136,6141,6104sukhjeetkaur35No ratings yet

- Index SR - No. Content Page No. 1 2 P.M.SDocument42 pagesIndex SR - No. Content Page No. 1 2 P.M.SURVIL DESAINo ratings yet

- Crisil RatingDocument20 pagesCrisil RatingChintan AcharyaNo ratings yet

- Risk Spectrum For BanksDocument5 pagesRisk Spectrum For BanksLý Minh TânNo ratings yet

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaNo ratings yet

- Monetery Policy and BankingDocument8 pagesMonetery Policy and Banking17FB049 Mokter HasanNo ratings yet

- (Highest Safety) : Crisil AaaDocument1 page(Highest Safety) : Crisil AaamgajenNo ratings yet

- Credit Rating GROUP 11Document11 pagesCredit Rating GROUP 11Siddharth Shah0% (1)

- Credit RatingDocument4 pagesCredit Ratingshrutygupta06No ratings yet

- Credit Rating ScaleDocument4 pagesCredit Rating ScaleKamal AntarNo ratings yet

- Credit RatingDocument2 pagesCredit RatingNaushad AnsariNo ratings yet

- Valuka Feeds Crab ReportDocument2 pagesValuka Feeds Crab ReportPrince AsifNo ratings yet

- JCR-VIS Credit Rating Company Limited: Medium To Long-Term AAADocument4 pagesJCR-VIS Credit Rating Company Limited: Medium To Long-Term AAAFarhana RafiqNo ratings yet

- Standard & Poor's Business and Financial Terms July 2014Document25 pagesStandard & Poor's Business and Financial Terms July 2014Andy LeungNo ratings yet

- Credit RatingDocument50 pagesCredit Ratingmaruf_tanmimNo ratings yet

- Credit RatingDocument48 pagesCredit RatingChinmayee ChoudhuryNo ratings yet

- Pacra PreDocument24 pagesPacra PreAli HusanenNo ratings yet

- Credit RatingsDocument3 pagesCredit RatingsElvis JoseNo ratings yet

- Pacra Methodology LT ST Fy20Document3 pagesPacra Methodology LT ST Fy20Osman Hassan ButtNo ratings yet

- Credit Rating Agencies in IndiaDocument26 pagesCredit Rating Agencies in IndiaNeHa VaRun75% (4)

- RatingDocument4 pagesRatinganumnasikNo ratings yet

- Rating DefinitionsDocument3 pagesRating DefinitionsMuhammad Eid SaberNo ratings yet

- Credit Rating: Prof - Bijoy GuptaDocument21 pagesCredit Rating: Prof - Bijoy GuptaManash GopeNo ratings yet

- CreditratingDocument20 pagesCreditratingNeethu NairNo ratings yet

- Plagiarism Report 1Document2 pagesPlagiarism Report 1Siddharth AgarwalNo ratings yet

- Risk Management and ALMDocument93 pagesRisk Management and ALMThe Cultural CommitteeNo ratings yet

- Credit RatingDocument8 pagesCredit Ratingpatelchhotupatel8No ratings yet

- Credit Rating Credit RatingDocument37 pagesCredit Rating Credit Ratingrakesh288No ratings yet

- Module 5 - Credit Rating and Securitization of Debts2Document15 pagesModule 5 - Credit Rating and Securitization of Debts2welcome2jungleNo ratings yet

- Symbols Symbolsand Definitions For BondDocument1 pageSymbols Symbolsand Definitions For BondhizelaryaNo ratings yet

- Presented By: Rajesh Sandhya Santhosh Abhishek DamyantiDocument11 pagesPresented By: Rajesh Sandhya Santhosh Abhishek DamyantiDamyanti ShawNo ratings yet

- PACRADocument35 pagesPACRAFahad RazaNo ratings yet

- Internal Rating GuidelinesDocument11 pagesInternal Rating GuidelinesLokndra ChaudharyNo ratings yet

- 6-Notes On Credit Rating ServicesDocument21 pages6-Notes On Credit Rating ServicesKirti GiyamalaniNo ratings yet

- Credit Rating Agencies Credit Rating AgenciesDocument31 pagesCredit Rating Agencies Credit Rating AgenciesSuhana HariNo ratings yet

- Final 23 May Issuer Ratings Scale and DefinitionsDocument1 pageFinal 23 May Issuer Ratings Scale and DefinitionsMotiram Paudel BimalNo ratings yet

- Credit Rating Analysis: Presented By: ArunDocument13 pagesCredit Rating Analysis: Presented By: Arunarunmech_04No ratings yet

- Credit RiskDocument57 pagesCredit RiskmefulltimepassNo ratings yet

- Presented By-Name - Avinaw Kumar Enrolment No-20Bspdd01C033: Summitted To-Dr. Deepti Kiran Icfai University DehradunDocument11 pagesPresented By-Name - Avinaw Kumar Enrolment No-20Bspdd01C033: Summitted To-Dr. Deepti Kiran Icfai University DehradunAvinaw KumarNo ratings yet

- 4 Debt ManagementDocument122 pages4 Debt ManagementAquesha TirmiziNo ratings yet

- Credit RatingDocument2 pagesCredit RatingSumesh MirashiNo ratings yet

- Ufi M 5Document25 pagesUfi M 5sresthapatel28No ratings yet

- CFA Level 1 FundamentalsDocument5 pagesCFA Level 1 Fundamentalskazimeister1No ratings yet

- FR M1 - Module Quiz 1 (Part 1) - KnowledgEquityDocument11 pagesFR M1 - Module Quiz 1 (Part 1) - KnowledgEquityThế Dân NguyễnNo ratings yet

- India Non Judicial: Hundred RupeesDocument22 pagesIndia Non Judicial: Hundred RupeesParthasarathy SarathyNo ratings yet

- Post Test KB Akuntansi UndoneDocument6 pagesPost Test KB Akuntansi UndoneKiras SetyaNo ratings yet

- Chapter 3 FinmarDocument21 pagesChapter 3 FinmarJohn SecretNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive IncomeVeronica BaileyNo ratings yet

- Bank ReconnnnDocument5 pagesBank ReconnnnRamm Raven Castillo100% (1)

- Accounting 206Document3 pagesAccounting 206Evan MiñozaNo ratings yet

- Adobe Scan 12-Apr-2024Document1 pageAdobe Scan 12-Apr-2024furquan10010No ratings yet

- Statement 2022 9Document5 pagesStatement 2022 9wconceptouNo ratings yet

- Rumah Sakit Dr. Oen Kandang Sapi Solo: Surakarta 57128 Jl. Brigjend Katamso No.55Document2 pagesRumah Sakit Dr. Oen Kandang Sapi Solo: Surakarta 57128 Jl. Brigjend Katamso No.55yulius agus lingga pratomoNo ratings yet

- CRM of HSBCDocument112 pagesCRM of HSBCBabui OrccoNo ratings yet

- Gauhati University Exam Form Payment Receipt - 023959Document2 pagesGauhati University Exam Form Payment Receipt - 023959M Computer & TravelsNo ratings yet

- ExerciseDocument2 pagesExercisesantaNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- LEDGER & Trial BalanceDocument3 pagesLEDGER & Trial BalanceShaba Ponu JacobNo ratings yet

- Chola MS Insurance Annual Report 2019 20Document139 pagesChola MS Insurance Annual Report 2019 20happy39No ratings yet

- AP Navigate Gui12Document4 pagesAP Navigate Gui12Guhanadh PadarthyNo ratings yet

- Inv 0128 22Document1 pageInv 0128 22BILAL FAROOQUINo ratings yet

- Ifrs 1 First Time Adoption of Ifrss: BackgroundDocument3 pagesIfrs 1 First Time Adoption of Ifrss: Backgroundmusic niNo ratings yet

- RocketpreepayDocument5 pagesRocketpreepayMizanur RahmanNo ratings yet

- Savings and Loan CrisisDocument15 pagesSavings and Loan CrisisSiuMing ChanNo ratings yet

- Ibs Ipoh Main, Jsis 1 31/07/22Document6 pagesIbs Ipoh Main, Jsis 1 31/07/22azman ab wahabNo ratings yet

- Actng 1 2Document16 pagesActng 1 2Aries Christian S PadillaNo ratings yet

Care LoanRating

Care LoanRating

Uploaded by

AndwarkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Care LoanRating

Care LoanRating

Uploaded by

AndwarkCopyright:

Available Formats

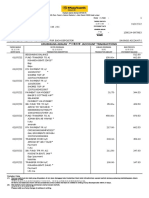

Credit Rating of Debt instruments A.

Long /Medium -term instruments (NCD/FD/CD/SO/CPS/RPS/L)

Symbols CARE AAA

Rating Definition Instruments with this rating are considered to be of the best credit quality, offering highest safety for timely servicing of debt obligations. Such instruments carry minimal credit risk. Instruments with this rating are considered to offer high safety for timely servicing of debt obligations. Such instruments carry very low credit risk. Instruments with this rating are considered to offer adequate safety for timely servicing of debt obligations. Such instruments carry low credit risk. Instruments with this rating are considered to offer moderate safety for timely servicing of debt obligations. Such instruments carry moderate credit risk. Instruments with this rating are considered to offer inadequate safety for timely servicing of debt obligations. Such instruments carry high credit risk. Instruments with this rating are considered to offer low safety for timely servicing of debt obligations and carry very high credit risk. Such Instruments are susceptible to default. Instruments with this rating are considered to be having very high likelihood of default in the payment of interest and principal. Instruments with this rating are of the lowest category. They are either in default or are likely to be in default soon.

CARE AA

CARE A

CARE BBB

CARE BB

CARE B

CARE C CARE D

NCD FD CD SO CPS RPS

Non Convertible Debenture Fixed Deposit Certificate of Deposit Structured Obligations Convertible Preference Shares Redeemable Preference Shares

As instrument characteristics or debt management capability could cover a wide range of possible attributes whereas rating is expressed only in limited number of symbols, CARE

assigns '+' or '-' signs to be shown after the assigned rating (wherever necessary) to indicate the relative position within the band covered by the rating symbol.

B. Short term instruments Symbols

PR1

PR2

PR3

PR4

Rating Definition Instruments with this rating would have strong capacity for timely payment of short-term debt obligations and carry lowest credit risk. Within this category, instruments with relatively better credit characteristics are assigned PR1+ rating. Instruments with this rating would have adequate capacity for timely payment of short-term debt obligations and carry higher credit risk as compared to instruments rated higher. Instruments with this rating would have moderate capacity for timely repayment of short term debt obligations at the time of rating and carry higher credit risk as compared to instruments rated higher. Instruments with this rating would have inadequate capacity for timely payment of short-term debt obligations and carry very high credit risk. Such Instruments are susceptible to default. The instrument is in default or is likely to be in default on maturity.

PR5

As instrument characteristics or debt management capability could cover a wide range of possible attributes whereas rating is expressed only in limited number of symbols, CARE assigns '+' or '-' signs to be shown after the assigned rating (wherever necessary) to indicate the relative position within the band covered by the rating symbol. Suffix (L) will be used for loans.

You might also like

- Education Loan CertificateDocument2 pagesEducation Loan CertificateMadhumitha L82% (11)

- Phil RatingsDocument8 pagesPhil RatingsTrisha Timpog100% (1)

- Chapter 1 - A Framework For Financial Accounting: Click On LinksDocument14 pagesChapter 1 - A Framework For Financial Accounting: Click On LinksABDULLAH ALSHEHRINo ratings yet

- Almario Bsa2d At6 Fin2Document6 pagesAlmario Bsa2d At6 Fin2Tracy Camille100% (1)

- Customer Satisfaction Towards Life InsuranceDocument70 pagesCustomer Satisfaction Towards Life Insurancekkccommerceproject100% (1)

- Banking DictionaryDocument188 pagesBanking DictionaryRanjan Shetty100% (1)

- 2203001_FMIS Assignment 8Document4 pages2203001_FMIS Assignment 82203037No ratings yet

- Credit RatingsDocument15 pagesCredit RatingsLalit GuptaNo ratings yet

- CRISIL Rating ScaleDocument5 pagesCRISIL Rating ScalecharlyNo ratings yet

- CRR ScaleDocument1 pageCRR ScaleRijesh RaghunathanNo ratings yet

- Credit Rating Scales, ShivamDocument8 pagesCredit Rating Scales, Shivamshivamagarwal292No ratings yet

- Rating Methodology: Crisil Care IcraDocument5 pagesRating Methodology: Crisil Care IcraRohit SharmaNo ratings yet

- RatingsScale 2008 PDFDocument13 pagesRatingsScale 2008 PDFPradeep272No ratings yet

- Credit Rating: Fees Structure FEE Structure Initial Rating FeesDocument6 pagesCredit Rating: Fees Structure FEE Structure Initial Rating FeesWindowFashionNo ratings yet

- Credit Rating AgenciesDocument40 pagesCredit Rating AgenciesSmriti DurehaNo ratings yet

- Rating SymbolsDocument4 pagesRating SymbolsAmrit GCNo ratings yet

- Overview of Smera'S Rating ProcessDocument3 pagesOverview of Smera'S Rating ProcessAshwin Kailasam NellaiappanNo ratings yet

- CRISL Rating of Banks and FI SDocument2 pagesCRISL Rating of Banks and FI SFaisal Tanvir KhanNo ratings yet

- Definition, Types and Scales of Credit RatingDocument8 pagesDefinition, Types and Scales of Credit Ratingjannatul ferthousNo ratings yet

- June 15 2011 Standardisation of Rating SymbolsDocument8 pagesJune 15 2011 Standardisation of Rating SymbolsRajalakshmi13No ratings yet

- Standardisation Rating Symbols Definitions CRISILDocument10 pagesStandardisation Rating Symbols Definitions CRISILsunil_k_agrawal5487No ratings yet

- Credit Rating: Submitted By: Group 5 TH Roll No. 6144, 6145, 6136,6141,6104Document26 pagesCredit Rating: Submitted By: Group 5 TH Roll No. 6144, 6145, 6136,6141,6104sukhjeetkaur35No ratings yet

- Index SR - No. Content Page No. 1 2 P.M.SDocument42 pagesIndex SR - No. Content Page No. 1 2 P.M.SURVIL DESAINo ratings yet

- Crisil RatingDocument20 pagesCrisil RatingChintan AcharyaNo ratings yet

- Risk Spectrum For BanksDocument5 pagesRisk Spectrum For BanksLý Minh TânNo ratings yet

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaNo ratings yet

- Monetery Policy and BankingDocument8 pagesMonetery Policy and Banking17FB049 Mokter HasanNo ratings yet

- (Highest Safety) : Crisil AaaDocument1 page(Highest Safety) : Crisil AaamgajenNo ratings yet

- Credit Rating GROUP 11Document11 pagesCredit Rating GROUP 11Siddharth Shah0% (1)

- Credit RatingDocument4 pagesCredit Ratingshrutygupta06No ratings yet

- Credit Rating ScaleDocument4 pagesCredit Rating ScaleKamal AntarNo ratings yet

- Credit RatingDocument2 pagesCredit RatingNaushad AnsariNo ratings yet

- Valuka Feeds Crab ReportDocument2 pagesValuka Feeds Crab ReportPrince AsifNo ratings yet

- JCR-VIS Credit Rating Company Limited: Medium To Long-Term AAADocument4 pagesJCR-VIS Credit Rating Company Limited: Medium To Long-Term AAAFarhana RafiqNo ratings yet

- Standard & Poor's Business and Financial Terms July 2014Document25 pagesStandard & Poor's Business and Financial Terms July 2014Andy LeungNo ratings yet

- Credit RatingDocument50 pagesCredit Ratingmaruf_tanmimNo ratings yet

- Credit RatingDocument48 pagesCredit RatingChinmayee ChoudhuryNo ratings yet

- Pacra PreDocument24 pagesPacra PreAli HusanenNo ratings yet

- Credit RatingsDocument3 pagesCredit RatingsElvis JoseNo ratings yet

- Pacra Methodology LT ST Fy20Document3 pagesPacra Methodology LT ST Fy20Osman Hassan ButtNo ratings yet

- Credit Rating Agencies in IndiaDocument26 pagesCredit Rating Agencies in IndiaNeHa VaRun75% (4)

- RatingDocument4 pagesRatinganumnasikNo ratings yet

- Rating DefinitionsDocument3 pagesRating DefinitionsMuhammad Eid SaberNo ratings yet

- Credit Rating: Prof - Bijoy GuptaDocument21 pagesCredit Rating: Prof - Bijoy GuptaManash GopeNo ratings yet

- CreditratingDocument20 pagesCreditratingNeethu NairNo ratings yet

- Plagiarism Report 1Document2 pagesPlagiarism Report 1Siddharth AgarwalNo ratings yet

- Risk Management and ALMDocument93 pagesRisk Management and ALMThe Cultural CommitteeNo ratings yet

- Credit RatingDocument8 pagesCredit Ratingpatelchhotupatel8No ratings yet

- Credit Rating Credit RatingDocument37 pagesCredit Rating Credit Ratingrakesh288No ratings yet

- Module 5 - Credit Rating and Securitization of Debts2Document15 pagesModule 5 - Credit Rating and Securitization of Debts2welcome2jungleNo ratings yet

- Symbols Symbolsand Definitions For BondDocument1 pageSymbols Symbolsand Definitions For BondhizelaryaNo ratings yet

- Presented By: Rajesh Sandhya Santhosh Abhishek DamyantiDocument11 pagesPresented By: Rajesh Sandhya Santhosh Abhishek DamyantiDamyanti ShawNo ratings yet

- PACRADocument35 pagesPACRAFahad RazaNo ratings yet

- Internal Rating GuidelinesDocument11 pagesInternal Rating GuidelinesLokndra ChaudharyNo ratings yet

- 6-Notes On Credit Rating ServicesDocument21 pages6-Notes On Credit Rating ServicesKirti GiyamalaniNo ratings yet

- Credit Rating Agencies Credit Rating AgenciesDocument31 pagesCredit Rating Agencies Credit Rating AgenciesSuhana HariNo ratings yet

- Final 23 May Issuer Ratings Scale and DefinitionsDocument1 pageFinal 23 May Issuer Ratings Scale and DefinitionsMotiram Paudel BimalNo ratings yet

- Credit Rating Analysis: Presented By: ArunDocument13 pagesCredit Rating Analysis: Presented By: Arunarunmech_04No ratings yet

- Credit RiskDocument57 pagesCredit RiskmefulltimepassNo ratings yet

- Presented By-Name - Avinaw Kumar Enrolment No-20Bspdd01C033: Summitted To-Dr. Deepti Kiran Icfai University DehradunDocument11 pagesPresented By-Name - Avinaw Kumar Enrolment No-20Bspdd01C033: Summitted To-Dr. Deepti Kiran Icfai University DehradunAvinaw KumarNo ratings yet

- 4 Debt ManagementDocument122 pages4 Debt ManagementAquesha TirmiziNo ratings yet

- Credit RatingDocument2 pagesCredit RatingSumesh MirashiNo ratings yet

- Ufi M 5Document25 pagesUfi M 5sresthapatel28No ratings yet

- CFA Level 1 FundamentalsDocument5 pagesCFA Level 1 Fundamentalskazimeister1No ratings yet

- FR M1 - Module Quiz 1 (Part 1) - KnowledgEquityDocument11 pagesFR M1 - Module Quiz 1 (Part 1) - KnowledgEquityThế Dân NguyễnNo ratings yet

- India Non Judicial: Hundred RupeesDocument22 pagesIndia Non Judicial: Hundred RupeesParthasarathy SarathyNo ratings yet

- Post Test KB Akuntansi UndoneDocument6 pagesPost Test KB Akuntansi UndoneKiras SetyaNo ratings yet

- Chapter 3 FinmarDocument21 pagesChapter 3 FinmarJohn SecretNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive IncomeVeronica BaileyNo ratings yet

- Bank ReconnnnDocument5 pagesBank ReconnnnRamm Raven Castillo100% (1)

- Accounting 206Document3 pagesAccounting 206Evan MiñozaNo ratings yet

- Adobe Scan 12-Apr-2024Document1 pageAdobe Scan 12-Apr-2024furquan10010No ratings yet

- Statement 2022 9Document5 pagesStatement 2022 9wconceptouNo ratings yet

- Rumah Sakit Dr. Oen Kandang Sapi Solo: Surakarta 57128 Jl. Brigjend Katamso No.55Document2 pagesRumah Sakit Dr. Oen Kandang Sapi Solo: Surakarta 57128 Jl. Brigjend Katamso No.55yulius agus lingga pratomoNo ratings yet

- CRM of HSBCDocument112 pagesCRM of HSBCBabui OrccoNo ratings yet

- Gauhati University Exam Form Payment Receipt - 023959Document2 pagesGauhati University Exam Form Payment Receipt - 023959M Computer & TravelsNo ratings yet

- ExerciseDocument2 pagesExercisesantaNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- LEDGER & Trial BalanceDocument3 pagesLEDGER & Trial BalanceShaba Ponu JacobNo ratings yet

- Chola MS Insurance Annual Report 2019 20Document139 pagesChola MS Insurance Annual Report 2019 20happy39No ratings yet

- AP Navigate Gui12Document4 pagesAP Navigate Gui12Guhanadh PadarthyNo ratings yet

- Inv 0128 22Document1 pageInv 0128 22BILAL FAROOQUINo ratings yet

- Ifrs 1 First Time Adoption of Ifrss: BackgroundDocument3 pagesIfrs 1 First Time Adoption of Ifrss: Backgroundmusic niNo ratings yet

- RocketpreepayDocument5 pagesRocketpreepayMizanur RahmanNo ratings yet

- Savings and Loan CrisisDocument15 pagesSavings and Loan CrisisSiuMing ChanNo ratings yet

- Ibs Ipoh Main, Jsis 1 31/07/22Document6 pagesIbs Ipoh Main, Jsis 1 31/07/22azman ab wahabNo ratings yet

- Actng 1 2Document16 pagesActng 1 2Aries Christian S PadillaNo ratings yet