Professional Documents

Culture Documents

Limited Revision To As 21, Consolidated Financial Statements

Limited Revision To As 21, Consolidated Financial Statements

Uploaded by

Vivek ReddyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Limited Revision To As 21, Consolidated Financial Statements

Limited Revision To As 21, Consolidated Financial Statements

Uploaded by

Vivek ReddyCopyright:

Available Formats

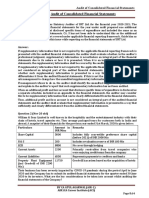

Limited Revision to Accounting Standard (AS) 21 (issued 2001)

The following is the text of the limited revision to AS 21, Consolidated Financial Statements, issued by the Institute of Chartered Accountants of India.

In view of the proposed Accounting Standard (AS) 30, Financial Instruments: Recognition and Measurement, AS 21 (issued 2001) is modified as under (modifications are shown as double-underline/strike-through):

1.

The name of the Standard is modified as below:

Consolidated Financial Statements and Accounting for Investments in Subsidiaries in Separate Financial Statements

2. The Applicability paragraph of the Standard is amended as follows:

Accounting Standard (AS) 21 (issued 2001), Consolidated Financial Statements and Accounting for Investments in Subsidiaries in Separate Financial Statements, issued by the Council of the Institute of Chartered Accountants of India, comes came into effect in respect of accounting periods commencing on or after 1-4-2001. This limited revision to the Standard comes into effect in respect of accounting periods commencing on or after the date on which Accounting Standard (AS) 30, Financial Instruments: Recognition and Measurement, comes into effect. In respect of separate financial statements of an enterprise, this limited revision comes into effect from the same date. In respect of consolidated financial statements, this Accounting Standard is mandatory1 where the enterprise prepares and presents consolidated financial statements. In other words, the accounting standard does not mandate an enterprise to present consolidated financial statements but, if the enterprise presents consolidated financial statements, for a period commencing on or after the date on which this Standard first came into effect, i.e., 1-4-2001, for complying with the requirements of any statute or otherwise, it should prepare and present consolidated financial statements in accordance with this Standard.An enterprise that presents

This implies that, while discharging their attest function, it will be the duty of the members of the Institute to examine whether this Accounting Standard is complied with in the presentation of financial statements covered by their audit. In the event of any deviation from this Accounting Standard, it will be their duty to make adequate disclosures in their audit reports so that the users of financial statements may be aware of such deviations.

Page247

consolidated financial statements should prepare and present these statements in accordance with this Standard.2 The following is the text of the Accounting Standard.

3.

The Objective paragraph of the Standard is amended as follows:

The objective of this Statement is to lay down principles and procedures for preparation and presentation of consolidated financial statements and for accounting for investments in subsidiaries in separate financial statements. Consolidated financial statements are presented by a parent (also known as holding enterprise) to provide financial information about the economic activities of its group. These statements are intended to present financial information about a parent and its subsidiary(ies) as a single economic entity to show the economic resources controlled by the group, the obligations of the group and results the group achieves with its resources.

4.

The Scope paragraphs of the Standard are amended as follows:

Scope

1. This Statement should be applied in the preparation and presentation of consolidated financial statements for a group of enterprises under the control of a parent. 2. This Statement should also be applied in accounting for investments in subsidiaries in the separate financial statements of a parent. 3. In the preparation of consolidated financial statements, other Accounting Standards also apply in the same manner as they apply to the separate financial statements. 4. This Statement does not deal with: (a) methods of accounting for amalgamations and their effects on consolidation, including goodwill arising on amalgamation (see AS 14, Accounting for Amalgamations);

It is clarified that AS 21 is mandatory if an enterprise presents consolidated financial statements. In other words, the accounting standard does not mandate an enterprise to present consolidated financial statements but, if the enterprise presents consolidated financial statements for complying with the requirements of any statute or otherwise, it should prepare and present consolidated financial statements in accordance with AS 21 (see The Chartered Accountant, July 2001, page 95).

Page248

(b)

accounting for investments in associates (at present governed by see AS 1323, Accounting for Investments in Associates3); and accounting for investments interests in joint ventures (at present governed by see AS 1327, Accounting for InvestmentsFinancial Reporting of Interests in Joint Ventures4).

(c)

5. 11.

Paragraph 11 is amended as follows: A subsidiary should be excluded from consolidation when: (a) control is intended to be temporary because the subsidiary is acquired and held exclusively with a view to its subsequent disposal in the near future5; or it operates under severe long-term restrictions which significantly impair its ability to transfer funds to the parent.

(b)

In consolidated financial statements, investments in such subsidiaries should be accounted for in accordance with Accounting Standard (AS) 1330, Accounting for InvestmentsFinancial Instruments: Recognition and Measurement. The reasons for not consolidating a subsidiary should be disclosed in the consolidated financial statements.

6. After paragraph 11, new paragraph 11A is added. follows:

New paragraph 11A is as

11A. A subsidiary is not excluded from consolidation simply because the parent is a venture capital organisation or a similar entity.

7.

Paragraphs 23 and 24 are amended as follows:

23. An investment in an enterprise should be accounted for in accordance with Accounting Standard (AS) 1330, Accounting for InvestmentsFinancial Instruments: Recognition and

3

Accounting Standard (AS) 23, Accounting for Investments in Associates in Consolidated Financial Statements, which came into effect in respect of accounting periods commencing on or after 1-4-2002, specifies the requirements relating to accounting for investments in associates in Consolidated Financial Statements.

4

Accounting Standard (AS) 27, Financial Reporting of Interests in Joint Ventures, which came into effect in respect of accounting periods commencing on or after 1-4- 2002, specifies the requirements relating to accounting for investments in joint ventures.

5

See also Accounting Standards Interpretations (ASIs) 8 and 25.

Page249

Measurement, from the date that the enterprise ceases to be a subsidiary, and provided that it does not become an associate as defined in AS 23 or a jointly controlled entity as described in AS 276. 24. The carrying amount of the investment at the date that it the enterprise ceases to be a subsidiary is regarded as the cost on initial measurement of a financial asset in accordance with AS 30thereafter. 8. Paragraph 28, appearing under the heading Accounting for Investments in Subsidiaries in a Parents Separate Financial Statements is amended. New paragraph 28A is added. Amended paragraph 28 and new paragraph 28A are as follows:

Accounting for Investments in Subsidiaries in a Parents Separate Financial Statements

28. In a parents separate financial statements, investments in subsidiaries, except investments in subsidiaries covered under paragraph 11 of this Statement, should be accounted for either: in accordance with Accounting Standard (AS) 13, Accounting for Investments (a) at cost, or (b) in accordance with AS 30, Financial Instruments: Recognition and Measurement. The same accounting should be applied for each category of investments. Investments in subsidiaries covered under paragraph 11 of this Statement should be accounted for in accordance with Accounting Standard (AS) 30, Financial Instruments: Recognition and Measurement. 28A. To determine whether an investment in a subsidiary accounted for at cost in accordance with paragraph 28 is impaired, an enterprise applies AS 28, Impairment of Assets. AS 28 which explains how an enterprise reviews the carrying amount of its assets, how it determines the recoverable amount of an asset, and when it recognises, or reverses the recognition of, an impairment loss is also applicable to impairment of an investment in a subsidiary.

Accounting Standard (AS) 23, 'Accounting for Investments in Associates in Consolidated Financial Statements', which came into effect in respect of accounting periods commencing on or after 1.4.2002, defines the term associate and specifies the requirements relating to accounting for investments in associates in Consolidated Financial Statements.

Page250

You might also like

- Accounting Standards ProjectDocument6 pagesAccounting Standards ProjectPuneet ChawlaNo ratings yet

- Accounting Standard 21Document10 pagesAccounting Standard 21Rahul kumar sinhaNo ratings yet

- Accounting For Investments in Associates in Consolidated Financial StatementsDocument5 pagesAccounting For Investments in Associates in Consolidated Financial Statementssks0865No ratings yet

- Separate Financial Statements: Exposure DraftDocument9 pagesSeparate Financial Statements: Exposure DraftratiNo ratings yet

- Accounting Standard 21Document12 pagesAccounting Standard 21Chirag MalhotraNo ratings yet

- Separate Financial Statements: International Accounting Standard 27Document10 pagesSeparate Financial Statements: International Accounting Standard 27babylovelylovelyNo ratings yet

- IAS 27 Consolidatedand Separate Financial StatementsDocument8 pagesIAS 27 Consolidatedand Separate Financial Statementsthanhha1985No ratings yet

- Consolidated Financial Statements: Accounting Standard (AS) 21Document12 pagesConsolidated Financial Statements: Accounting Standard (AS) 21Vikas TirmaleNo ratings yet

- Expo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsDocument26 pagesExpo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsratiNo ratings yet

- 27-Separate Financial Statements PDFDocument10 pages27-Separate Financial Statements PDFChelsea Anne VidalloNo ratings yet

- Separate Financial StatementsDocument14 pagesSeparate Financial StatementsGracienne Granados CursoNo ratings yet

- Ias 27 PDFDocument14 pagesIas 27 PDFRandy PaderesNo ratings yet

- IAS 28 - Associates and Joint Ventures PDFDocument16 pagesIAS 28 - Associates and Joint Ventures PDFJanelle SentinaNo ratings yet

- Financial Statement Analysis and Ratio AnalysisDocument29 pagesFinancial Statement Analysis and Ratio AnalysisNayana GoswamiNo ratings yet

- Ifrs VS PsakDocument58 pagesIfrs VS PsakAnisyaCahyaningrumNo ratings yet

- Fa 534Document11 pagesFa 534Sonia MakwanaNo ratings yet

- Ias 27Document2 pagesIas 27Foititika.netNo ratings yet

- Final Acs Notes (Autosaved)Document50 pagesFinal Acs Notes (Autosaved)Puru ChhabraNo ratings yet

- Comparison of IFRS and Indian Accounting StandardsDocument25 pagesComparison of IFRS and Indian Accounting StandardsAnu AnandNo ratings yet

- Illustration 2 - CFS - Ind As Auditor's Report - Listed - Unqualified - 201904Document14 pagesIllustration 2 - CFS - Ind As Auditor's Report - Listed - Unqualified - 201904Vrinda AgrawalNo ratings yet

- Provision For Consolidation of Financial StatementDocument7 pagesProvision For Consolidation of Financial StatementAshokNo ratings yet

- ' Consolidated Financial Statements"Document17 pages' Consolidated Financial Statements"MeenakshiMohanDangeNo ratings yet

- Consolidated and Separate Financial Statements: International Accounting Standard 27Document41 pagesConsolidated and Separate Financial Statements: International Accounting Standard 27davidwijaya1986No ratings yet

- 67409bos54195 cp8Document30 pages67409bos54195 cp8IntrovertNo ratings yet

- Advanced Accounting - APPLICABILITY OF ACCOUNTING STANDARDSDocument4 pagesAdvanced Accounting - APPLICABILITY OF ACCOUNTING STANDARDSGedie RocamoraNo ratings yet

- Ias 27Document44 pagesIas 27Mariana Mirela0% (1)

- Statements Guidance Notes Issued by IcaiDocument9 pagesStatements Guidance Notes Issued by IcaiSatish MehtaNo ratings yet

- Auditing FinalsDocument29 pagesAuditing FinalsZymelle Princess FernandezNo ratings yet

- Audit of CFSDocument30 pagesAudit of CFSDhivyaNo ratings yet

- Lecture 15 - Procedures and Reports On SPEDocument6 pagesLecture 15 - Procedures and Reports On SPERachel LeachonNo ratings yet

- Accounting Kewal Garg: List of Accounting Standards (AS 1 32) of ICAI: Download PDFDocument2 pagesAccounting Kewal Garg: List of Accounting Standards (AS 1 32) of ICAI: Download PDFDedhia Vatsal hiteshNo ratings yet

- IAS 34: Interim Financial ReportingDocument8 pagesIAS 34: Interim Financial ReportingcolleenyuNo ratings yet

- As 23Document4 pagesAs 23api-3705645No ratings yet

- Comparison of IfrsDocument33 pagesComparison of Ifrsvikrams_106No ratings yet

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- Financial StatementDocument7 pagesFinancial StatementEunice SorianoNo ratings yet

- Abebayehu Hailu.1pdfDocument18 pagesAbebayehu Hailu.1pdfletagemechu29No ratings yet

- Consolidation of Financial Statments Final ProjectDocument35 pagesConsolidation of Financial Statments Final ProjectK-Ayurveda WelexNo ratings yet

- Ifrs Indian GAPP Cost V/s Fair Value: Components of Financial StatementsDocument8 pagesIfrs Indian GAPP Cost V/s Fair Value: Components of Financial Statementsnagendra2007No ratings yet

- Presentation On Revised Schedule ViDocument65 pagesPresentation On Revised Schedule ViSangram PandaNo ratings yet

- Notes Fa2Document12 pagesNotes Fa2Ankita BawaneNo ratings yet

- Audit of CFSDocument30 pagesAudit of CFSkaran kapadiaNo ratings yet

- Accounting Standard 21Document13 pagesAccounting Standard 21api-3828505100% (1)

- Preparation and Presentation of Financial Statements of IAS 1Document7 pagesPreparation and Presentation of Financial Statements of IAS 1Md AladinNo ratings yet

- Isa 805Document13 pagesIsa 805baabasaamNo ratings yet

- As21 of Tata Motors by ShyamDocument13 pagesAs21 of Tata Motors by Shyamzaqz100% (2)

- 69253asb55316 As25Document32 pages69253asb55316 As25Shivam SinghNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- 08 Handout 1 (CFAS)Document12 pages08 Handout 1 (CFAS)laurencedechosa907No ratings yet

- Accounting InformationDocument9 pagesAccounting InformationAtaulNo ratings yet

- Indian Accounting Standards (Abbreviated As Ind-AS) in India Accounting StandardsDocument6 pagesIndian Accounting Standards (Abbreviated As Ind-AS) in India Accounting Standardsmba departmentNo ratings yet

- PWC IFRS 18 SummaryDocument6 pagesPWC IFRS 18 SummaryMohammad IslamNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Audit and Accounting Guide: Entities With Oil and Gas Producing Activities, 2018From EverandAudit and Accounting Guide: Entities With Oil and Gas Producing Activities, 2018No ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Central Excise Act Notes For Self PreparationDocument29 pagesCentral Excise Act Notes For Self PreparationVivek ReddyNo ratings yet

- Reaching Strategic EdgeDocument14 pagesReaching Strategic EdgeVivek ReddyNo ratings yet

- TDS On Printing & StationeryDocument11 pagesTDS On Printing & StationeryVivek Reddy100% (1)

- Data Storage, Retrieval and DBMSDocument31 pagesData Storage, Retrieval and DBMSVivek Reddy100% (1)

- Section 37 CaselawsDocument17 pagesSection 37 CaselawsVivek ReddyNo ratings yet

- Profit and Loss Account PDFDocument10 pagesProfit and Loss Account PDFVivek ReddyNo ratings yet

- Sec 17 of Indian Registration ActDocument5 pagesSec 17 of Indian Registration ActVivek ReddyNo ratings yet

- CAclubindia News - Managerial Remuneration (In A Simple Way) PDFDocument3 pagesCAclubindia News - Managerial Remuneration (In A Simple Way) PDFVivek ReddyNo ratings yet