Professional Documents

Culture Documents

Test Two - FIN541 Date: 1 Dec 2012 Answer All Questions

Test Two - FIN541 Date: 1 Dec 2012 Answer All Questions

Uploaded by

olubokOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Two - FIN541 Date: 1 Dec 2012 Answer All Questions

Test Two - FIN541 Date: 1 Dec 2012 Answer All Questions

Uploaded by

olubokCopyright:

Available Formats

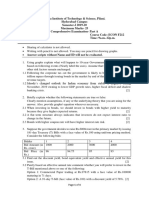

Test Two FIN541 Answer All Questions Question 1

Date: 1 Dec 2012

a) Currently, in March 2012, stock market analyst forecasts that Bursa Malaysia will continue uptrend momentum until June then the market will be back to normal. Given the current data on FKLI: June FKLI Sep FKLI 1500 1575

In June 2012, June FKLI and Sep FKLI are traded at 1510 and 1570 respectively. Outline the strategy undertaken by the spreader and calculate the profit or loss from the strategy. (8 marks) b) Explain any 4 (four) benefits of FKLI. (12 marks)

Question 2

a)

Give three (3) reasons why KLIBOR futures are traded on three-month maturity. (3 marks)

b) c)

Explain the relationship between interest rates and the KLIBOR index. (3 marks) Your company needs to borrow RM100 million by Dec 2012. Today, Sept 2012, physical 3-month KLIBOR is trading at 3.50% per annum, while FKB3 are at 96.15, 96.12 and 96.10 for Oct, Nov and Dec 2012 respectively. Your company has made arrangement to borrow at 2.75% of KLIBOR. In anticipation of rising interest rates, establish your hedging strategy by showing its benefits as measured by EIR, if as expected, both prices convergence at 4.25% per annum on the third Wednesday of Dec 2012. (14 marks)

(Total: 40 marks)

You might also like

- Global Macro Trading: Profiting in a New World EconomyFrom EverandGlobal Macro Trading: Profiting in a New World EconomyRating: 4 out of 5 stars4/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- BF - 307: Derivative Securities January 19, 2012 Homework Assignment 1 Suman Banerjee InstructionsDocument3 pagesBF - 307: Derivative Securities January 19, 2012 Homework Assignment 1 Suman Banerjee Instructionssamurai_87No ratings yet

- Ca-Final SFM Question Paper Nov 13Document11 pagesCa-Final SFM Question Paper Nov 13Pravinn_MahajanNo ratings yet

- P4 Becke Mock 2015Document13 pagesP4 Becke Mock 2015Kelly Tan Xue LingNo ratings yet

- P2 Financial Management June 2012Document9 pagesP2 Financial Management June 2012Subramaniam KrishnamoorthiNo ratings yet

- BWFF 2023Document21 pagesBWFF 2023Skuan TanNo ratings yet

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- MODAUD1 UNIT 6 - Audit of InvestmentsDocument7 pagesMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNo ratings yet

- Ifrs 2 SBPDocument3 pagesIfrs 2 SBPNATIONAL SAVINGSNo ratings yet

- TEST Paper 1Document7 pagesTEST Paper 1Abhu ArNo ratings yet

- Strategic Management Leadership-June 2023Document7 pagesStrategic Management Leadership-June 2023Md. Mostafizur RahmanNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- 6 July 2015 2Document1 page6 July 2015 2Ady HasbullahNo ratings yet

- Seminar Qns Set 1 Riskand Return April 2018Document2 pagesSeminar Qns Set 1 Riskand Return April 2018Tonie NascentNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- CA FINAL SFM - NOV 2012 Question PAPERDocument8 pagesCA FINAL SFM - NOV 2012 Question PAPERPravinn_MahajanNo ratings yet

- Market Outlook 22 ND February 2012Document4 pagesMarket Outlook 22 ND February 2012Angel BrokingNo ratings yet

- Acc217 Quation and AnswersDocument27 pagesAcc217 Quation and AnswersLeroyNo ratings yet

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Pile cp6Document57 pagesPile cp6casarokarNo ratings yet

- Market Outlook 8th JanDocument13 pagesMarket Outlook 8th JanAngel BrokingNo ratings yet

- K.J. Somaiya Institute of Management Studies & Research Course: PGDM - RM End Term Exam Sub: Macro Economics and PolicyDocument1 pageK.J. Somaiya Institute of Management Studies & Research Course: PGDM - RM End Term Exam Sub: Macro Economics and PolicyAyush GoyalNo ratings yet

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 27th February 2012Document5 pagesMarket Outlook 27th February 2012Angel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Final-Term Exam (Take-Home) Fall - 2020 Department of Business AdministrationDocument4 pagesFinal-Term Exam (Take-Home) Fall - 2020 Department of Business Administrationsyed aliNo ratings yet

- Section 1 Explain The Following in 1 Line (5 X1 5) : Financial ManagementDocument4 pagesSection 1 Explain The Following in 1 Line (5 X1 5) : Financial ManagementSamar AsilNo ratings yet

- Basic Accounting (Acc30205) Assignment: Financial Ratio AnaylsisDocument14 pagesBasic Accounting (Acc30205) Assignment: Financial Ratio Anaylsisapi-284695904No ratings yet

- Corporate FinanceDocument7 pagesCorporate Financeseyon sithamparanathanNo ratings yet

- Financial Markets and Institutions 26mLkeG0NODocument2 pagesFinancial Markets and Institutions 26mLkeG0NOKhushi SangoiNo ratings yet

- Audit Prob InvestmentDocument5 pagesAudit Prob InvestmentANGIE BERNAL100% (1)

- Actuarial Society of India Examinations: 24 November 2005Document4 pagesActuarial Society of India Examinations: 24 November 2005YogeshAgrawalNo ratings yet

- Gaf 520 Dist Assign 1Document9 pagesGaf 520 Dist Assign 1Tawanda ZimbiziNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Fin630 Apr 2008Document5 pagesFin630 Apr 2008cikincikincikinNo ratings yet

- Wa 8Document1 pageWa 8Muhammad nasirNo ratings yet

- Market Outlook 14th October 2011Document6 pagesMarket Outlook 14th October 2011Angel BrokingNo ratings yet

- Multinational Business Finance Assignment 2Document6 pagesMultinational Business Finance Assignment 2Ajay PawarNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document6 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)tayyabashehzadNo ratings yet

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Business Finance Decisions: T I C A PDocument4 pagesBusiness Finance Decisions: T I C A PImran AhmadNo ratings yet

- Answer ALL of The Following Questions. Marks Will Be Awarded For Logical Argumentation and Appropriate Presentation of The AnswersDocument7 pagesAnswer ALL of The Following Questions. Marks Will Be Awarded For Logical Argumentation and Appropriate Presentation of The AnswersVong Yu Kwan EdwinNo ratings yet

- ACCT 352 Fall 2022 Midterm BlankDocument12 pagesACCT 352 Fall 2022 Midterm Blankannika.schmunkNo ratings yet

- 565-2 Business Studies Paper 2 QuestionsDocument4 pages565-2 Business Studies Paper 2 Questionsrnyaboke90No ratings yet

- Best Stocks of 2012Document7 pagesBest Stocks of 2012Indrajit BanerjeeNo ratings yet

- 5555Document9 pages5555arsalanssgNo ratings yet

- 2012 2013 UAS Akuntansi Keuangan LanjutanDocument12 pages2012 2013 UAS Akuntansi Keuangan LanjutanarifahsanulNo ratings yet

- Derivatives Market ImpedimentsDocument20 pagesDerivatives Market ImpedimentsHasanul BannaNo ratings yet

- CF MTQPDocument2 pagesCF MTQPNeha H GNo ratings yet

- PA1 Mock ExamDocument18 pagesPA1 Mock Examyciamyr67% (3)

- AFC 2012 Sem 1Document8 pagesAFC 2012 Sem 1Ollie WattsNo ratings yet

- Model Test Paper For CAIIB BFMDocument13 pagesModel Test Paper For CAIIB BFMAnkit Sahu100% (1)

- 7 Af 301 Fa - QPDocument5 pages7 Af 301 Fa - QPMuhammad BilalNo ratings yet

- Audit of Shareholders EquityDocument6 pagesAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- End Term Question Paper FOFADocument4 pagesEnd Term Question Paper FOFAadityaagr2910No ratings yet

- EIB Working Papers 2019/11 - Macro-based asset allocation: An empirical analysisFrom EverandEIB Working Papers 2019/11 - Macro-based asset allocation: An empirical analysisNo ratings yet