Professional Documents

Culture Documents

NYC Stats 4Q12

NYC Stats 4Q12

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

You might also like

- Ecommerce Pitchbook Nomura Case StudyDocument23 pagesEcommerce Pitchbook Nomura Case StudyNeha Butala100% (1)

- Shop Agreement Cantt OfficeDocument4 pagesShop Agreement Cantt Officemuied0% (1)

- Financial Analysis - Savico Shopping CentreDocument11 pagesFinancial Analysis - Savico Shopping CentreHoang Pham50% (2)

- Running Head: Financial Statement Analysis of Samsung 1Document19 pagesRunning Head: Financial Statement Analysis of Samsung 1Sangita GautamNo ratings yet

- Absolute Sale of Unregistered LandDocument2 pagesAbsolute Sale of Unregistered Landapbacani100% (2)

- NYC Stats 3Q12Document5 pagesNYC Stats 3Q12Anonymous Feglbx5No ratings yet

- 1CO2200A1008Document1 page1CO2200A1008jotham_sederstr7655No ratings yet

- Nyc PDFDocument5 pagesNyc PDFAnonymous Feglbx5No ratings yet

- 1CO2200A1023Document1 page1CO2200A1023Jotham SederstromNo ratings yet

- City of Houston Public Neighborhood PresentationDocument50 pagesCity of Houston Public Neighborhood PresentationOrganizeTexasNo ratings yet

- Manhattan Stats Q3 2013Document5 pagesManhattan Stats Q3 2013Anonymous Feglbx5No ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Mphasis: Performance HighlightsDocument13 pagesMphasis: Performance HighlightsAngel BrokingNo ratings yet

- TCS Analysts Q3 12Document31 pagesTCS Analysts Q3 12FirstpostNo ratings yet

- Media Release RIL Q4 FY202324 Financial and Operational Performance - 0Document50 pagesMedia Release RIL Q4 FY202324 Financial and Operational Performance - 0akshay kausaleNo ratings yet

- Dena Bank (DENBAN) : Core Performance Drives ProfitabilityDocument7 pagesDena Bank (DENBAN) : Core Performance Drives ProfitabilitySachin GuptaNo ratings yet

- OND'13 Performance SlidesDocument4 pagesOND'13 Performance SlidesAbhishek DadaryaNo ratings yet

- Marketinsightshcmc q3 2014 enDocument27 pagesMarketinsightshcmc q3 2014 enTran Duc DungNo ratings yet

- Tech Mahindra, 7th February, 2013Document12 pagesTech Mahindra, 7th February, 2013Angel BrokingNo ratings yet

- Trends in India Service Export FinalDocument29 pagesTrends in India Service Export FinalAnanya VermaNo ratings yet

- DRT 3167Document1 pageDRT 3167mpelletterie_9876204No ratings yet

- Media Release RIL Q3 FY2023 24 Financial and Operational PerformanceDocument39 pagesMedia Release RIL Q3 FY2023 24 Financial and Operational PerformanceAmit KumarNo ratings yet

- 1CO1900A0716Document1 page1CO1900A0716jotham_sederstr7655No ratings yet

- PNB Analyst Presentation March16Document29 pagesPNB Analyst Presentation March16tamirisaarNo ratings yet

- Digi Q412 Earning ReportDocument29 pagesDigi Q412 Earning ReportharimaucapitalNo ratings yet

- Office Market Snapshot: Northern VirginiaDocument2 pagesOffice Market Snapshot: Northern VirginiaAnonymous Feglbx5No ratings yet

- Broward County Retail MarketView Q1 2016Document3 pagesBroward County Retail MarketView Q1 2016William HarrisNo ratings yet

- M&A Trend Report: Q1-Q3 2013: JapanDocument3 pagesM&A Trend Report: Q1-Q3 2013: JapanKPNo ratings yet

- Brantford 2011 Financial ReportsDocument168 pagesBrantford 2011 Financial ReportsHugo RodriguesNo ratings yet

- Vodafone Vs AirtelDocument13 pagesVodafone Vs AirtelMuhammad Irfan ZafarNo ratings yet

- RIL Media Release Q2 FY21 30102020Document19 pagesRIL Media Release Q2 FY21 30102020Krishan ParwaniNo ratings yet

- RIL Media Release Q2 FY21 30102020Document43 pagesRIL Media Release Q2 FY21 30102020aditya111No ratings yet

- Fin Feasibiltiy Zubair Reg 54492Document9 pagesFin Feasibiltiy Zubair Reg 54492kzubairNo ratings yet

- Telecom Egypt Full Year 2014 EarningDocument10 pagesTelecom Egypt Full Year 2014 EarningMohamed YahiaNo ratings yet

- (c5) Lewis Workman Steve - PRC Fuel Tax ReformDocument12 pages(c5) Lewis Workman Steve - PRC Fuel Tax ReformAsian Development Bank ConferencesNo ratings yet

- Preliminary Revenue Tables 12-6-16Document2 pagesPreliminary Revenue Tables 12-6-16Taylor M. FreyerNo ratings yet

- Enabling Customer Relationships: ExceptionalDocument35 pagesEnabling Customer Relationships: ExceptionaljatindbNo ratings yet

- Metro InpiredDocument16 pagesMetro InpiredOkky Pratama MartadirejaNo ratings yet

- Tech Mahindra Result UpdatedDocument12 pagesTech Mahindra Result UpdatedAngel BrokingNo ratings yet

- Prelims 11 PresDocument39 pagesPrelims 11 PresCrayzee BandittNo ratings yet

- 4Q13 Presentation of ResultsDocument24 pages4Q13 Presentation of ResultsMillsRINo ratings yet

- Globe: Analyst Briefing MaterialsDocument11 pagesGlobe: Analyst Briefing MaterialsBusinessWorldNo ratings yet

- RIL SegmentsDocument47 pagesRIL Segmentsdeepsinghrawat06No ratings yet

- NMDC Result UpdatedDocument7 pagesNMDC Result UpdatedAngel BrokingNo ratings yet

- 1Q15 Presentation of ResultsDocument20 pages1Q15 Presentation of ResultsMillsRINo ratings yet

- CepurosDocument1 pageCepurosPrakhar RaghuvanshNo ratings yet

- Hyundai Motor - Ir Presentation 2012 - 1Q - EngDocument20 pagesHyundai Motor - Ir Presentation 2012 - 1Q - EngSam_Ha_No ratings yet

- 2008 BudgetDocument65 pages2008 BudgetPreston LewisNo ratings yet

- Demand Forecasting InfosysDocument6 pagesDemand Forecasting InfosysHarvinder SinghNo ratings yet

- TV3 AnalysisDocument3 pagesTV3 AnalysishotransangNo ratings yet

- Finance Presentation-V3 Af16 - 0Document12 pagesFinance Presentation-V3 Af16 - 0KEHKASHAN NIZAMNo ratings yet

- 17 - 1 - 2013 - 13 - 10 - 12 - FileName - HCLT-Q2-2013-OND'12-IR ReleaseDocument26 pages17 - 1 - 2013 - 13 - 10 - 12 - FileName - HCLT-Q2-2013-OND'12-IR ReleasepajijayNo ratings yet

- Analysis of Sumsung Annual ReportDocument11 pagesAnalysis of Sumsung Annual ReportEr YogendraNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Hindalco Industries LTDDocument7 pagesHindalco Industries LTDVarun RanganathanNo ratings yet

- Unity Infraprojects (UNIINF) : Stretched Working Capital To Restrict GrowthDocument8 pagesUnity Infraprojects (UNIINF) : Stretched Working Capital To Restrict GrowthShyam RathiNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- ICICI Q1-2017 PerformanceDocument77 pagesICICI Q1-2017 PerformancedarshanmaldeNo ratings yet

- Samsung C&T 1Q2012 Earnings ReleaseDocument13 pagesSamsung C&T 1Q2012 Earnings ReleaseSam_Ha_No ratings yet

- Tech Mahindra 4Q FY13Document12 pagesTech Mahindra 4Q FY13Angel BrokingNo ratings yet

- Digital Transformation Payday: Navigate the Hype, Lower the Risks, Increase Return on InvestmentsFrom EverandDigital Transformation Payday: Navigate the Hype, Lower the Risks, Increase Return on InvestmentsNo ratings yet

- Capturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021From EverandCapturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

- The Recto and Maceda LawDocument3 pagesThe Recto and Maceda Lawjovani emaNo ratings yet

- Urban DesignDocument25 pagesUrban Designneeraj sharmaNo ratings yet

- Weygan ResearchDocument7 pagesWeygan ResearchKaila WeyganNo ratings yet

- Lateral Ebcs 8Document3 pagesLateral Ebcs 8Engineeri TadiyosNo ratings yet

- Epe Mini Stadium Full Structural DrawingsDocument29 pagesEpe Mini Stadium Full Structural DrawingsRahman AdedokunNo ratings yet

- Submitted By:-Jahnvi Gulati B.Arch (Ar) 4 Year, 8 SemDocument22 pagesSubmitted By:-Jahnvi Gulati B.Arch (Ar) 4 Year, 8 SemJahnvi Gulati100% (3)

- QRT2 Let064Document1 pageQRT2 Let064mark carloNo ratings yet

- Activites StatusDocument13 pagesActivites StatusAbenezer TesfayeNo ratings yet

- 2 RHPC Marna 1000mmDocument2 pages2 RHPC Marna 1000mmrkmeenaNo ratings yet

- Table Of: Scale: Not To Scale ARDocument1 pageTable Of: Scale: Not To Scale ARKeannu Delera0% (1)

- Deed of Sale Lot TemplateDocument2 pagesDeed of Sale Lot TemplateKenny SerranoNo ratings yet

- Edgar Katipunan ABP Sheet1Document1 pageEdgar Katipunan ABP Sheet1erichfaith23estilleroNo ratings yet

- Dawn Rapoport and Chandra Parker Doucette Take On David J. Stern in A Class ActionDocument2 pagesDawn Rapoport and Chandra Parker Doucette Take On David J. Stern in A Class ActionForeclosure FraudNo ratings yet

- Rent Agreement 2020 EditedDocument3 pagesRent Agreement 2020 EditedNovice VlogsNo ratings yet

- MERLIN Page 1Document1 pageMERLIN Page 1Partha GangopadhyayNo ratings yet

- Bond Beam - Bond Beam Block vs. Lintel Block - NitterhouseDocument15 pagesBond Beam - Bond Beam Block vs. Lintel Block - NitterhouseRonald SiraitNo ratings yet

- BRRRR HowtoMake100000PerYearwithFixerUpperRentalPropertiesDocument11 pagesBRRRR HowtoMake100000PerYearwithFixerUpperRentalPropertiesAdianice CorreaNo ratings yet

- BOQ Struktur VICTOR HOUSEDocument5 pagesBOQ Struktur VICTOR HOUSEOxi ArimbawaNo ratings yet

- RDO No. 39 - South Quezon CityDocument318 pagesRDO No. 39 - South Quezon CityBeng Kalaw62% (13)

- Property Law Model AnswersDocument12 pagesProperty Law Model AnswersAlexNo ratings yet

- Ncs Boq FormatDocument6 pagesNcs Boq FormatJasper ryan GonzalesNo ratings yet

- #22. BSP Vs Libo-OnDocument2 pages#22. BSP Vs Libo-OneizNo ratings yet

- Thesis On Real Estate InvestmentDocument8 pagesThesis On Real Estate Investmentafkojxato100% (2)

- Certification (No Balance)Document3 pagesCertification (No Balance)Darwin Solanoy100% (1)

- Assignment BALLB 5th SemDocument2 pagesAssignment BALLB 5th SemMukesh RajNo ratings yet

- Notes Land Titles and DeedsDocument5 pagesNotes Land Titles and DeedsMaria Fiona Duran MerquitaNo ratings yet

- DownloadDocument1 pageDownloadraym jerald felixNo ratings yet

- The Registration Act 1908: A Critical AnalysisDocument10 pagesThe Registration Act 1908: A Critical AnalysisNisha YadavNo ratings yet

NYC Stats 4Q12

NYC Stats 4Q12

Uploaded by

Anonymous Feglbx5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NYC Stats 4Q12

NYC Stats 4Q12

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

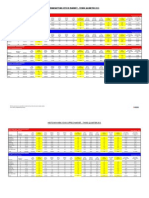

MANHATTAN OFFICE MARKET - FOURTH QUARTER 2012

MANHATTAN OFFICE MARKET

Class A Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Inventory

Total

Available

Space

Midtown

320

180,995,042

19,772,025

Midtown South

27

14,382,706

684,987

5.3%

627,077

Downtown

46

47,141,922

3,856,125

-6.4%

3,118,041

393

242,519,670

24,313,137

4.2%

19,366,836

Y-o-Y

% Change

Submarket

Totals

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

6.5%

15,621,718

4,150,307

8.6%

2.3%

10.9%

57,910

4.4%

0.4%

4.8%

738,084

6.6%

1.6%

8.2%

4,946,301

8.0%

2.0%

10.0%

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

0.7%

$75.07

$58.19

0.2%

$68.26

$39.07

-0.6%

$45.91

$31.77

$72.54

1.9%

10,226,359

-31.6%

599,105

(391,149)

$63.59

10.7%

665,892

-13.1%

53,772

59,612

$45.16

1.8%

2,779,338

-38.7%

709,325

401,779

0.4%

$70.15

$54.02

$67.95

2.8%

13,671,589

-32.5%

1,362,202

70,242

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

MANHATTAN OFFICE MARKET

Class B Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Inventory

Total

Available

Space

Midtown

328

44,581,134

4,442,620

14.7%

4,113,722

328,898

9.2%

0.7%

10.0%

1.3%

$48.11

$44.01

$48.00

8.5%

2,868,652

-9.5%

(565,040)

(726,184)

Midtown South

186

29,468,182

2,141,315

35.3%

1,737,823

403,492

5.9%

1.4%

7.3%

2.0%

$52.57

$48.93

$52.03

14.3%

2,229,274

-3.2%

(66,346)

(171,989)

Downtown

57

27,758,202

2,959,127

5.6%

2,530,529

428,598

9.1%

1.5%

10.7%

0.7%

$34.96

$33.61

$34.84

-0.9%

1,515,238

0.2%

15,863

(37,098)

571

101,807,518

9,543,062

15.6%

8,382,074

1,160,988

8.2%

1.1%

9.4%

1.3%

$45.06

$41.88

$44.82

8.2%

6,613,164

-5.3%

(615,523)

(935,271)

Total

Available

Space

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

145,810

Submarket

Totals

MANHATTAN OFFICE MARKET

Class C Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Inventory

Midtown

151

15,959,466

722,229

-12.7%

657,734

64,495

4.1%

0.4%

4.5%

-0.7%

$37.87

$35.41

$37.79

7.8%

901,914

-1.9%

153,412

Midtown South

217

21,384,607

1,774,776

-9.3%

1,710,543

64,233

8.0%

0.3%

8.3%

-1.0%

$43.98

$37.92

$43.88

5.3%

1,179,936

-13.6%

54,999

54,943

Downtown

74

10,352,397

688,230

-47.8%

659,546

28,684

6.4%

0.3%

6.6%

-5.3%

$31.72

$32.87

$31.74

-11.7%

858,116

47.4%

457,210

445,438

442

47,696,470

3,185,235

-22.4%

3,027,823

157,412

6.3%

0.3%

6.7%

-1.9%

$39.98

$35.97

$39.88

3.6%

2,939,966

2.5%

665,621

646,191

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

(971,523)

Submarket

Totals

MANHATTAN OFFICE MARKET

Overall Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Inventory

Total

Available

Space

Midtown

799

241,535,642

24,936,874

7.2%

20,393,174

4,543,700

8.4%

1.9%

10.3%

0.7%

$68.77

$57.54

$67.36

3.0%

13,996,925

-26.5%

187,477

Midtown South

430

65,235,495

4,601,078

9.8%

4,075,443

525,635

6.2%

0.8%

7.1%

0.6%

$50.02

$46.46

$49.69

8.3%

4,075,102

-8.1%

42,425

(57,434)

Downtown

177

85,252,521

7,503,482

-8.9%

6,308,116

1,195,366

7.4%

1.4%

8.8%

-0.7%

$40.06

$32.86

$39.58

-0.8%

5,152,692

-22.2%

1,182,398

810,119

1406

392,023,658

37,041,434

3.8%

30,776,733

6,264,701

7.9%

1.6%

9.4%

0.4%

$60.40

$51.90

$59.54

4.0%

23,224,719

-22.8%

1,412,300

(218,838)

Submarket

Totals

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

MIDTOWN NEW YORK OFFICE MARKET- FOURTH QUARTER 2012

MIDTOWN NEW YORK OFFICE MARKET

Class A Statistical Summary

Submarket

Number of

Buildings

Murray Hill

10

Grand Central

68

Fourth Quarter 2012

Total

Available

Space

Y-o-Y

% Change

6,899,203

301,685

-38.1%

297,485

36,427,439

4,571,836

7.5%

3,825,093

Inventory

Direct

Available

Space

Sublease

Available

Space

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

0.1%

4.4%

-2.7%

$52.74

$47.00

$52.63

2.0%

12.6%

0.8%

$59.65

$44.81

$58.63

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

4,200

4.3%

746,743

10.5%

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

3.8%

456,390

-71.0%

252,081

253,525

4.1%

1,941,484

-45.1%

(82,035)

(371,544)

Year-to-Date

Total Absorption

Rate

United Nations

1,859,450

36,389

15.0%

36,389

2.0%

0.0%

2.0%

0.5%

$54.94

N/A

$54.94

41.6%

11,970

-75.8%

(27,529)

(27,529)

East Side

37

17,741,052

1,603,238

-4.2%

1,319,100

284,138

7.4%

1.6%

9.0%

-0.2%

$63.41

$60.40

$63.11

2.7%

1,185,425

1.1%

119,717

26,597

Park Avenue

30

21,652,799

2,098,810

2.7%

1,519,959

578,851

7.0%

2.7%

9.7%

0.3%

$83.15

$69.52

$80.32

-3.5%

1,076,989

-2.4%

257,914

4,400

Madison/ Fifth

74

21,597,596

3,492,322

10.0%

2,760,690

731,632

12.8%

3.4%

16.2%

1.5%

$101.46

$61.42

$97.63

0.0%

1,576,070

-17.8%

152,123

(202,799)

6 Ave/ Rock Cntr

41

38,003,977

4,071,665

17.9%

2,949,984

1,121,681

7.8%

3.0%

10.7%

1.6%

$80.04

$57.51

$73.49

1.3%

1,687,037

-24.8%

(579,986)

(443,870)

Westside

28

20,435,166

2,214,826

31.4%

1,691,267

523,559

8.3%

2.6%

10.8%

2.4%

$66.83

$54.76

$64.60

3.1%

1,230,024

-47.3%

58,340

Penn Station

6,576,415

353,028

27.4%

313,301

39,727

4.8%

0.6%

5.4%

1.2%

$57.63

$48.45

$56.69

2.3%

347,248

7.1%

(44,110)

(75,837)

Times Square South

12

7,323,711

1,020,948

-28.2%

901,172

119,776

12.3%

1.6%

13.9%

-5.5%

$76.32

$62.38

$75.44

6.1%

626,873

-8.1%

442,338

408,087

Lincoln Center

2,478,234

7,278

-87.3%

7,278

0.3%

0.0%

0.3%

-2.0%

$45.00

N/A

$45.00

-8.9%

86,849

1001.7%

50,252

50,252

320

180,995,042

19,772,025

6.5%

15,621,718

4,150,307

8.6%

2.3%

10.9%

0.7%

$75.07

$58.19

$72.54

1.9%

10,226,359

-31.6%

599,105

(391,149)

Totals

MIDTOWN NEW YORK OFFICE MARKET

Class B Statistical Summary

(12,431)

Fourth Quarter 2012

Number of

Buildings

Inventory

Total

Available

Space

Y-o-Y

% Change

Submarket

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Murray Hill

51

6,396,473

305,785

-15.4%

277,183

28,602

4.3%

Grand Central

64

7,270,513

757,900

22.3%

715,634

42,266

9.8%

Y-o-Y

% Change

0.4%

4.8%

-0.9%

$42.50

$40.04

$42.27

0.0%

542,287

32.6%

159,449

154,838

0.6%

10.4%

2.0%

$50.93

$38.09

$50.45

7.5%

513,175

-27.5%

(193,528)

(200,258)

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

United Nations

810,198

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

East Side

22

1,110,473

29,512

-50.8%

29,512

2.7%

0.0%

2.7%

-2.7%

$53.94

N/A

$53.94

1.2%

42,214

-37.9%

25,314

25,314

Park Avenue

N/A

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

Madison/ Fifth

47

3,073,031

214,645

40.4%

210,851

3,794

6.9%

0.1%

7.0%

2.0%

$66.40

N/A

$66.40

5.9%

71,128

-52.8%

(79,488)

(80,708)

6 Ave/ Rock Cntr

25

1,781,381

217,312

3.4%

210,812

6,500

11.8%

0.4%

12.2%

-0.1%

$52.37

N/A

$52.37

-2.8%

123,838

-24.7%

12,550

9,837

Westside

22

3,028,533

51,310

-65.1%

51,310

1.7%

0.0%

1.7%

-3.0%

$50.43

N/A

$50.43

4.4%

120,018

-45.1%

55,094

55,094

Penn Station

19

5,788,473

1,058,420

3.4%

1,042,023

16,397

18.0%

0.3%

18.3%

0.6%

$49.45

$55.00

$49.55

31.9%

312,034

4.1%

(278,462)

(267,742)

Times Square South

62

14,311,550

1,623,958

45.1%

1,392,619

231,339

9.7%

1.6%

11.3%

3.5%

$45.41

$44.49

$45.38

6.4%

1,132,797

-1.0%

(253,716)

(410,306)

Lincoln Center

1,010,509

183,778

2.2%

183,778

18.2%

0.0%

18.2%

0.4%

$41.15

N/A

$41.15

-6.0%

11,161

51.9%

(12,253)

(12,253)

328

44,581,134

4,442,620

14.7%

4,113,722

328,898

9.2%

0.7%

10.0%

1.3%

$48.11

$44.01

$48.00

8.5%

2,868,652

-9.5%

(565,040)

(726,184)

Totals

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

0.0%

N/A

MIDTOWN NEW YORK OFFICE MARKET- FOURTH QUARTER 2012

MIDTOWN NEW YORK OFFICE MARKET

Class C Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Direct

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Direct

Available

Space

Y-o-Y

% Pt. Change

Inventory

Total

Available

Space

Y-o-Y

% Change

Submarket

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

Murray Hill

22

1,070,823

65,810

27.4%

59,210

6,600

5.5%

0.6%

6.1%

1.3%

$38.62

$36.00

$38.36

13.4%

37,606

-51.2%

(13,985)

(13,985)

Grand Central

272,576

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

United Nations

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

East Side

43,000

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

Park Avenue

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

Madison/ Fifth

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

6 Ave/ Rock Cntr

368,885

23,727

42.7%

23,727

6.4%

0.0%

6.4%

-1.5%

$37.96

N/A

$37.96

8.5%

71,419

516.1%

11,289

11,289

Westside

21

2,322,389

153,072

57.0%

121,261

31,811

5.2%

1.4%

6.6%

2.4%

$37.07

N/A

$37.07

13.2%

144,470

-8.6%

Penn Station

20

2,226,447

17,621

-43.4%

8,321

9,300

0.4%

0.4%

0.8%

-0.6%

$42.57

N/A

$42.57

49.9%

47,786

-60.3%

22,515

13,215

Times Square South

73

9,600,346

461,999

-26.8%

445,215

16,784

4.6%

0.2%

4.8%

-1.8%

$37.90

$35.10

$37.82

5.4%

600,633

9.6%

144,066

177,575

Lincoln Center

55,000

N/A

0.0%

0.0%

0.0%

0.0%

N/A

N/A

N/A

N/A

N/A

151

15,959,466

722,229

-12.7%

657,734

64,495

4.1%

0.4%

4.5%

-0.7%

$37.87

$35.41

$37.79

7.8%

901,914

-1.9%

153,412

145,810

Totals

MIDTOWN NEW YORK OFFICE MARKET

Overall Statistical Summary

Y-o-Y

% Change

14,366,499

673,280

-25.2%

633,878

43,970,528

5,329,736

9.4%

4,540,727

2,669,648

36,389

15.0%

36,389

18,894,525

1,632,750

-5.8%

1,348,612

21,652,799

2,098,810

2.7%

1,519,959

121

24,670,627

3,706,967

11.4%

73

40,154,243

4,312,704

17.2%

Westside

71

25,786,088

2,419,208

Penn Station

45

14,591,335

1,429,069

Times Square South

147

31,235,607

Lincoln Center

15

3,543,743

799

241,535,642

Inventory

Murray Hill

83

Grand Central

137

United Nations

16

East Side

61

Park Avenue

30

Madison/ Fifth

6 Ave/ Rock Cntr

Totals

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

0.3%

4.7%

-1.6%

$46.55

$40.12

$46.15

-0.4%

1,036,283

-49.7%

397,545

394,378

1.8%

12.1%

1.0%

$58.60

$44.36

$57.68

4.8%

2,454,659

-42.2%

(275,563)

(571,802)

1.4%

0.0%

1.4%

0.3%

$54.94

N/A

$54.94

41.6%

11,970

-75.8%

(27,529)

(27,529)

7.1%

1.5%

8.6%

-0.4%

$63.19

$60.40

$62.92

2.9%

1,227,639

-1.4%

145,031

51,911

578,851

7.0%

2.7%

9.7%

0.3%

$83.15

$69.52

$80.32

-3.5%

1,076,989

-2.4%

257,914

4,400

2,971,541

735,426

12.0%

3.0%

15.0%

1.6%

$99.72

$61.42

$96.22

0.1%

1,647,198

-20.4%

72,635

(283,507)

3,184,523

1,128,181

7.9%

2.8%

10.7%

1.5%

$78.11

$57.51

$72.41

1.9%

1,882,294

-22.2%

(556,147)

(422,744)

25.3%

1,863,838

555,370

7.2%

2.2%

9.4%

1.8%

$64.60

$54.76

$62.91

5.1%

1,494,512

-44.8%

102,961

379

7.3%

1,363,645

65,424

9.3%

0.4%

9.8%

0.7%

$51.58

$50.50

$51.53

22.3%

707,068

-5.0%

(300,057)

(330,364)

3,106,905

-2.0%

2,739,006

367,899

8.8%

1.2%

9.9%

-0.2%

$54.43

$53.41

$54.39

0.4%

2,360,303

-0.6%

332,688

175,356

191,056

-19.5%

191,056

5.4%

0.0%

5.4%

-1.3%

$41.30

N/A

$41.30

-8.5%

98,010

543.4%

37,999

37,999

24,936,874

7.2%

20,393,174

4,543,700

8.4%

1.9%

10.3%

0.7%

$68.77

$57.54

$67.36

3.0%

13,996,925

-26.5%

187,477

(971,523)

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

(42,284)

Fourth Quarter 2012

Total

Available

Space

Number of

Buildings

Submarket

(10,473)

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

39,402

4.4%

789,009

10.3%

0

284,138

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

MIDTOWN SOUTH NEW YORK OFFICE MARKET - FOURTH QUARTER 2012

MIDTOWN SOUTH NEW YORK OFFICE MARKET

Class A Statistical Summary

Number of

Buildings

Submarket

SoHo

Inventory

Total

Available

Space

0

Fourth Quarter 2012

Y-o-Y

% Change

N/A

Direct

Available

Space

0

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

N/A

Direct

Wtd. Avg.

Rental Rate

$0.00

Sublease

Wtd. Avg.

Rental Rate

$0.00

Total

Wtd. Avg.

Rental Rate

$0.00

Y-o-Y

% Change

N/A

Year-to-Date

Leasing

Activity

0

Y-o-Y

% Change

N/A

Year-to-Date

Direct Absorption

Rate

0

Year-to-Date

Total Absorption

Rate

0.0%

0.0%

0.0%

Greenwich/NoHo

120,000

N/A

0.0%

0.0%

0.0%

N/A

$0.00

$0.00

$0.00

N/A

N/A

Madison/Union Square

17

9,372,050

424,571

106.0%

366,661

57,910

3.9%

0.6%

4.5%

2.2%

$48.00

$39.07

$43.49

-4.8%

370,195

8.2%

(134,478)

(128,638)

Hudson Sq./W. Village

2,102,656

260,416

-41.4%

260,416

12.4%

0.0%

12.4%

-5.5%

$72.91

$0.00

$72.91

16.0%

232,412

-43.3%

188,250

188,250

Chelsea

2,788,000

N/A

0.0%

0.0%

0.0%

0.0%

$0.00

$0.00

$0.00

N/A

63,285

334.9%

Totals

27

14,382,706

684,987

5.3%

627,077

57,910

4.4%

0.4%

4.8%

0.2%

$68.26

$39.07

$63.59

10.7%

665,892

-13.1%

53,772

59,612

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Direct

Wtd. Avg.

Rental Rate

Year-to-Date

Direct Absorption

Rate

MIDTOWN SOUTH NEW YORK OFFICE MARKET

Class B Statistical Summary

Total

Available

Space

Fourth Quarter 2012

Year-to-Date

Total Absorption

Rate

Number of

Buildings

Inventory

SoHo

11

1,113,748

6,394

-19.1%

4,782

1,612

0.4%

0.1%

0.6%

-0.1%

$43.18

$0.00

$43.18

-6.7%

31,244

-47.3%

15,441

13,829

Greenwich/NoHo

18

3,121,328

172,903

418.7%

160,483

12,420

5.1%

0.4%

5.5%

4.4%

$60.56

$0.00

$60.56

30.9%

59,307

-64.4%

(120,322)

(132,742)

Madison/Union Square

125

16,210,488

1,344,891

13.1%

1,147,154

197,737

7.1%

1.2%

8.3%

1.3%

$49.77

$46.54

$49.39

5.4%

1,391,841

2.0%

35,103

(30,679)

Hudson Sq./W. Village

11

3,348,220

214,062

114.4%

120,166

93,896

3.6%

2.8%

6.4%

3.4%

$56.18

$55.99

$56.10

37.6%

306,827

-19.8%

29,724

32,785

Chelsea

21

5,674,398

403,065

59.8%

305,238

97,827

5.4%

1.7%

7.1%

2.6%

$57.61

$39.15

$55.27

32.2%

440,055

32.9%

(26,292)

(55,182)

Totals

186

29,468,182

2,141,315

35.3%

1,737,823

403,492

5.9%

1.4%

7.3%

2.0%

$52.57

$48.93

$52.03

14.3%

2,229,274

-3.2%

(66,346)

(171,989)

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

266,301

Submarket

MIDTOWN SOUTH NEW YORK OFFICE MARKET

Class C Statistical Summary

Fourth Quarter 2012

Y-o-Y

% Change

Number of

Buildings

Inventory

Total

Available

Space

SoHo

36

2,972,906

121,016

Greenwich/NoHo

18

1,429,050

203,155

Madison/Union Square

79

5,609,860

138,437

-24.8%

Hudson Sq./W. Village

23

4,803,110

920,488

Chelsea

61

6,569,681

391,680

Totals

217

21,384,607

1,774,776

Submarket

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

71.1%

99,855

-22.0%

203,155

118,577

21,161

3.4%

0.7%

14.2%

0.0%

19,860

2.1%

0.4%

2.5%

-0.9%

910,488

-23.6%

378,468

10,000

19.0%

0.2%

13,212

5.8%

0.2%

-9.3%

1,710,543

64,233

8.0%

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

4.1%

1.6%

$47.27

$50.03

$47.45

-0.7%

35.9%

8,607

(4,135)

14.2%

-4.0%

$39.83

$0.00

$39.83

10.6%

72,257

-1.9%

26,602

54,912

-0.8%

$38.26

$0.00

$38.26

15.2%

247,320

-45.4%

77,099

59,739

19.2%

-0.2%

$45.17

$32.00

$45.03

1.9%

319,758

2.5%

(20,865)

(7,975)

6.0%

-2.0%

$44.48

$37.41

$44.21

2.2%

274,300

-17.3%

(36,444)

(47,598)

0.3%

8.3%

-1.0%

$43.98

$37.92

$43.88

5.8%

1,179,936

-13.6%

54,999

54,943

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Direct

Wtd. Avg.

Rental Rate

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Direct Absorption

Rate

MIDTOWN SOUTH NEW YORK OFFICE MARKET

Overall Statistical Summary

Year-to-Date

Total Absorption

Rate

Fourth Quarter 2012

Number of

Buildings

Inventory

Total

Available

Space

SoHo

47

4,086,654

127,410

62.1%

104,637

22,773

2.6%

0.6%

3.1%

1.1%

$47.04

$50.03

$47.22

-0.9%

297,545

16.6%

24,048

9,694

Greenwich/Noho

37

4,670,378

376,058

28.0%

363,638

12,420

7.8%

0.3%

8.1%

1.6%

$48.62

$0.00

$48.62

31.6%

131,564

-45.2%

(93,720)

(77,830)

Madison/Union Square

221

31,192,398

1,907,899

20.8%

1,632,392

275,507

5.2%

0.9%

6.1%

1.1%

$48.53

$44.26

$47.93

6.1%

2,009,356

-6.9%

(22,276)

(99,578)

Hudson Sq./W. Village

41

10,253,986

1,394,966

-5.3%

1,291,070

103,896

12.6%

1.0%

13.6%

-0.2%

$51.58

$53.68

$51.74

4.3%

858,997

-22.2%

197,109

213,060

Submarket

Year-to-Date

Total Absorption

Rate

Chelsea

84

15,032,079

794,745

3.9%

683,706

111,039

4.5%

0.7%

5.3%

0.1%

$50.95

$38.77

$49.93

19.3%

777,640

14.8%

(62,736)

(102,780)

Totals

430

65,235,495

4,601,078

9.8%

4,075,443

525,635

6.2%

0.8%

7.1%

0.6%

$50.02

$46.46

$49.69

8.3%

4,075,102

-8.1%

42,425

(57,434)

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

DOWNTOWN NEW YORK OFFICE MARKET - FOURTH QUARTER 2012

DOWNTOWN NEW YORK OFFICE MARKET

Class A Statistical Summary

Submarket

City Hall

World Trade/World

Financial

Number of

Buildings

Inventory

Fourth Quarter 2012

Total

Available

Space

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

6,298,488

99,236

78.0%

9,489

89,747

0.2%

1.4%

1.6%

0.7%

$42.00

$41.75

$41.89

-5.7%

72,462

5.4%

22,060

1,863

11,902,802

387,075

16.6%

292,491

94,584

2.5%

0.8%

3.3%

0.5%

$53.30

$32.71

$50.45

-9.3%

868,293

-65.1%

13,061

(21,329)

Financial West

663,315

53,857

-48.5%

43,723

10,134

6.6%

1.5%

8.1%

-7.6%

$36.06

$32.00

$35.67

0.4%

42,352

-44.9%

(3,702)

18,523

Financial East

21

23,074,388

2,948,118

-11.3%

2,524,730

423,388

10.9%

1.8%

12.8%

-1.6%

$45.91

$28.98

$45.30

2.3%

1,617,852

2.1%

649,556

430,227

Insurance

5,202,929

367,839

21.2%

247,608

120,231

4.8%

2.3%

7.1%

1.2%

$39.10

$38.75

$39.07

5.8%

178,379

-43.6%

28,350

(27,505)

Totals

46

47,141,922

3,856,125

-6.4%

3,118,041

738,084

6.6%

1.6%

8.2%

-0.6%

$45.91

$31.77

$45.16

1.8%

2,779,338

-38.7%

709,325

401,779

DOWNTOWN NEW YORK OFFICE MARKET

Class B Statistical Summary

Submarket

City Hall

World Trade/World

Financial

Fourth Quarter 2012

Number of

Buildings

Total

Available

Space

Y-o-Y

% Change

Inventory

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

3,192,893

118,931

-19.4%

3,618,654

234,474

-37.5%

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

118,931

3.7%

0.0%

3.7%

-0.9%

119,895

114,579

3.3%

3.2%

6.5%

-3.9%

$38.17

$0.00

$38.17

4.6%

132,775

$43.05

$25.39

$39.30

6.6%

205,793

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

35.2%

21,072

23,348

-36.4%

179,993

85,464

Financial West

3,962,787

741,305

16.7%

735,124

6,181

18.6%

0.2%

18.7%

2.7%

$32.52

$28.00

$32.48

-4.2%

224,136

-15.6%

(34,562)

(40,743)

Financial East

26

11,271,101

1,415,863

11.5%

1,126,928

288,935

10.0%

2.6%

12.6%

1.3%

$35.67

$35.00

$35.56

2.0%

802,667

38.9%

(53,173)

(50,300)

Insurance

10

5,712,767

448,554

19.7%

429,651

18,903

7.5%

0.3%

7.9%

1.8%

$34.05

$0.00

$34.05

-5.1%

149,867

-39.2%

(97,467)

(54,867)

Totals

57

27,758,202

2,959,127

5.6%

2,530,529

428,598

9.1%

1.5%

10.7%

0.7%

$34.96

$33.61

$34.84

-0.9%

1,515,238

0.2%

15,863

(37,098)

DOWNTOWN NEW YORK OFFICE MARKET

Class C Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Total

Available

Space

Y-o-Y

% Change

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Direct

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Direct

Available

Space

Y-o-Y

% Pt. Change

Inventory

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

36

4,694,823

117,452

-79.4%

98,555

18,897

2.1%

0.4%

2.5%

-9.2%

$36.31

$35.01

$36.26

-13.1%

461,810

51.8%

396,302

377,750

49,500

N/A

0.0%

0.0%

0.0%

0.0%

$0.00

$0.00

$0.00

N/A

N/A

1,360,707

105,570

-28.4%

99,615

5,955

7.3%

0.4%

7.8%

-3.1%

$34.64

$38.50

$34.75

-1.5%

159,973

65.6%

31,493

35,598

Financial East

1,265,966

300,942

10.4%

297,110

3,832

23.5%

0.3%

23.8%

2.7%

$28.72

$26.00

$28.69

5.2%

70,692

55.1%

(24,867)

(26,699)

Insurance

24

2,981,401

164,266

-49.8%

164,266

5.5%

0.0%

5.5%

-3.9%

$32.60

$0.00

$32.60

-2.5%

165,641

22.2%

54,282

58,789

Totals

74

10,352,397

688,230

-47.8%

659,546

28,684

6.4%

0.3%

6.6%

-5.3%

$31.72

$32.87

$31.74

-11.7%

858,116

47.4%

457,210

445,438

Submarket

City Hall

World Trade/World

Financial

Financial West

DOWNTOWN NEW YORK OFFICE MARKET

Overall Statistical Summary

Fourth Quarter 2012

Number of

Buildings

Total

Available

Space

Y-o-Y

% Change

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Direct

Available

Space

Y-o-Y

% Pt. Change

Inventory

51

14,186,204

335,619

-56.6%

226,975

108,644

1.6%

0.8%

2.4%

-3.0%

$37.53

$39.43

$37.62

-7.6%

12

15,570,956

621,549

-12.1%

412,386

209,163

2.6%

1.3%

4.0%

-0.6%

$50.32

$29.73

$47.00

6.1%

Financial West

15

5,986,809

900,732

1.5%

878,462

22,270

14.7%

0.4%

15.0%

0.2%

$32.93

$31.65

$32.91

-4.0%

Financial East

56

35,611,455

4,664,923

-4.2%

3,948,768

716,155

11.1%

2.0%

13.1%

-0.6%

$41.68

$33.08

$41.04

-0.2%

Submarket

City Hall

World Trade/World

Financial

Insurance

Totals

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

667,047

41.6%

439,434

402,961

1,074,086

-61.8%

193,054

64,135

426,461

-2.9%

(6,771)

13,378

2,491,211

12.8%

571,516

353,228

43

13,897,097

980,659

-2.4%

841,525

139,134

6.1%

1.0%

7.1%

0.3%

$35.32

$38.75

$35.41

0.3%

493,887

-29.3%

(14,835)

(23,583)

177

85,252,521

7,503,482

-8.9%

6,308,116

1,195,366

7.4%

1.4%

8.8%

-0.7%

$40.06

$32.86

$39.58

-0.8%

5,152,692

-22.2%

1,182,398

810,119

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

You might also like

- Ecommerce Pitchbook Nomura Case StudyDocument23 pagesEcommerce Pitchbook Nomura Case StudyNeha Butala100% (1)

- Shop Agreement Cantt OfficeDocument4 pagesShop Agreement Cantt Officemuied0% (1)

- Financial Analysis - Savico Shopping CentreDocument11 pagesFinancial Analysis - Savico Shopping CentreHoang Pham50% (2)

- Running Head: Financial Statement Analysis of Samsung 1Document19 pagesRunning Head: Financial Statement Analysis of Samsung 1Sangita GautamNo ratings yet

- Absolute Sale of Unregistered LandDocument2 pagesAbsolute Sale of Unregistered Landapbacani100% (2)

- NYC Stats 3Q12Document5 pagesNYC Stats 3Q12Anonymous Feglbx5No ratings yet

- 1CO2200A1008Document1 page1CO2200A1008jotham_sederstr7655No ratings yet

- Nyc PDFDocument5 pagesNyc PDFAnonymous Feglbx5No ratings yet

- 1CO2200A1023Document1 page1CO2200A1023Jotham SederstromNo ratings yet

- City of Houston Public Neighborhood PresentationDocument50 pagesCity of Houston Public Neighborhood PresentationOrganizeTexasNo ratings yet

- Manhattan Stats Q3 2013Document5 pagesManhattan Stats Q3 2013Anonymous Feglbx5No ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Mphasis: Performance HighlightsDocument13 pagesMphasis: Performance HighlightsAngel BrokingNo ratings yet

- TCS Analysts Q3 12Document31 pagesTCS Analysts Q3 12FirstpostNo ratings yet

- Media Release RIL Q4 FY202324 Financial and Operational Performance - 0Document50 pagesMedia Release RIL Q4 FY202324 Financial and Operational Performance - 0akshay kausaleNo ratings yet

- Dena Bank (DENBAN) : Core Performance Drives ProfitabilityDocument7 pagesDena Bank (DENBAN) : Core Performance Drives ProfitabilitySachin GuptaNo ratings yet

- OND'13 Performance SlidesDocument4 pagesOND'13 Performance SlidesAbhishek DadaryaNo ratings yet

- Marketinsightshcmc q3 2014 enDocument27 pagesMarketinsightshcmc q3 2014 enTran Duc DungNo ratings yet

- Tech Mahindra, 7th February, 2013Document12 pagesTech Mahindra, 7th February, 2013Angel BrokingNo ratings yet

- Trends in India Service Export FinalDocument29 pagesTrends in India Service Export FinalAnanya VermaNo ratings yet

- DRT 3167Document1 pageDRT 3167mpelletterie_9876204No ratings yet

- Media Release RIL Q3 FY2023 24 Financial and Operational PerformanceDocument39 pagesMedia Release RIL Q3 FY2023 24 Financial and Operational PerformanceAmit KumarNo ratings yet

- 1CO1900A0716Document1 page1CO1900A0716jotham_sederstr7655No ratings yet

- PNB Analyst Presentation March16Document29 pagesPNB Analyst Presentation March16tamirisaarNo ratings yet

- Digi Q412 Earning ReportDocument29 pagesDigi Q412 Earning ReportharimaucapitalNo ratings yet

- Office Market Snapshot: Northern VirginiaDocument2 pagesOffice Market Snapshot: Northern VirginiaAnonymous Feglbx5No ratings yet

- Broward County Retail MarketView Q1 2016Document3 pagesBroward County Retail MarketView Q1 2016William HarrisNo ratings yet

- M&A Trend Report: Q1-Q3 2013: JapanDocument3 pagesM&A Trend Report: Q1-Q3 2013: JapanKPNo ratings yet

- Brantford 2011 Financial ReportsDocument168 pagesBrantford 2011 Financial ReportsHugo RodriguesNo ratings yet

- Vodafone Vs AirtelDocument13 pagesVodafone Vs AirtelMuhammad Irfan ZafarNo ratings yet

- RIL Media Release Q2 FY21 30102020Document19 pagesRIL Media Release Q2 FY21 30102020Krishan ParwaniNo ratings yet

- RIL Media Release Q2 FY21 30102020Document43 pagesRIL Media Release Q2 FY21 30102020aditya111No ratings yet

- Fin Feasibiltiy Zubair Reg 54492Document9 pagesFin Feasibiltiy Zubair Reg 54492kzubairNo ratings yet

- Telecom Egypt Full Year 2014 EarningDocument10 pagesTelecom Egypt Full Year 2014 EarningMohamed YahiaNo ratings yet

- (c5) Lewis Workman Steve - PRC Fuel Tax ReformDocument12 pages(c5) Lewis Workman Steve - PRC Fuel Tax ReformAsian Development Bank ConferencesNo ratings yet

- Preliminary Revenue Tables 12-6-16Document2 pagesPreliminary Revenue Tables 12-6-16Taylor M. FreyerNo ratings yet

- Enabling Customer Relationships: ExceptionalDocument35 pagesEnabling Customer Relationships: ExceptionaljatindbNo ratings yet

- Metro InpiredDocument16 pagesMetro InpiredOkky Pratama MartadirejaNo ratings yet

- Tech Mahindra Result UpdatedDocument12 pagesTech Mahindra Result UpdatedAngel BrokingNo ratings yet

- Prelims 11 PresDocument39 pagesPrelims 11 PresCrayzee BandittNo ratings yet

- 4Q13 Presentation of ResultsDocument24 pages4Q13 Presentation of ResultsMillsRINo ratings yet

- Globe: Analyst Briefing MaterialsDocument11 pagesGlobe: Analyst Briefing MaterialsBusinessWorldNo ratings yet

- RIL SegmentsDocument47 pagesRIL Segmentsdeepsinghrawat06No ratings yet

- NMDC Result UpdatedDocument7 pagesNMDC Result UpdatedAngel BrokingNo ratings yet

- 1Q15 Presentation of ResultsDocument20 pages1Q15 Presentation of ResultsMillsRINo ratings yet

- CepurosDocument1 pageCepurosPrakhar RaghuvanshNo ratings yet

- Hyundai Motor - Ir Presentation 2012 - 1Q - EngDocument20 pagesHyundai Motor - Ir Presentation 2012 - 1Q - EngSam_Ha_No ratings yet

- 2008 BudgetDocument65 pages2008 BudgetPreston LewisNo ratings yet

- Demand Forecasting InfosysDocument6 pagesDemand Forecasting InfosysHarvinder SinghNo ratings yet

- TV3 AnalysisDocument3 pagesTV3 AnalysishotransangNo ratings yet

- Finance Presentation-V3 Af16 - 0Document12 pagesFinance Presentation-V3 Af16 - 0KEHKASHAN NIZAMNo ratings yet

- 17 - 1 - 2013 - 13 - 10 - 12 - FileName - HCLT-Q2-2013-OND'12-IR ReleaseDocument26 pages17 - 1 - 2013 - 13 - 10 - 12 - FileName - HCLT-Q2-2013-OND'12-IR ReleasepajijayNo ratings yet

- Analysis of Sumsung Annual ReportDocument11 pagesAnalysis of Sumsung Annual ReportEr YogendraNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Hindalco Industries LTDDocument7 pagesHindalco Industries LTDVarun RanganathanNo ratings yet

- Unity Infraprojects (UNIINF) : Stretched Working Capital To Restrict GrowthDocument8 pagesUnity Infraprojects (UNIINF) : Stretched Working Capital To Restrict GrowthShyam RathiNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- ICICI Q1-2017 PerformanceDocument77 pagesICICI Q1-2017 PerformancedarshanmaldeNo ratings yet

- Samsung C&T 1Q2012 Earnings ReleaseDocument13 pagesSamsung C&T 1Q2012 Earnings ReleaseSam_Ha_No ratings yet

- Tech Mahindra 4Q FY13Document12 pagesTech Mahindra 4Q FY13Angel BrokingNo ratings yet

- Digital Transformation Payday: Navigate the Hype, Lower the Risks, Increase Return on InvestmentsFrom EverandDigital Transformation Payday: Navigate the Hype, Lower the Risks, Increase Return on InvestmentsNo ratings yet

- Capturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021From EverandCapturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

- The Recto and Maceda LawDocument3 pagesThe Recto and Maceda Lawjovani emaNo ratings yet

- Urban DesignDocument25 pagesUrban Designneeraj sharmaNo ratings yet

- Weygan ResearchDocument7 pagesWeygan ResearchKaila WeyganNo ratings yet

- Lateral Ebcs 8Document3 pagesLateral Ebcs 8Engineeri TadiyosNo ratings yet

- Epe Mini Stadium Full Structural DrawingsDocument29 pagesEpe Mini Stadium Full Structural DrawingsRahman AdedokunNo ratings yet

- Submitted By:-Jahnvi Gulati B.Arch (Ar) 4 Year, 8 SemDocument22 pagesSubmitted By:-Jahnvi Gulati B.Arch (Ar) 4 Year, 8 SemJahnvi Gulati100% (3)

- QRT2 Let064Document1 pageQRT2 Let064mark carloNo ratings yet

- Activites StatusDocument13 pagesActivites StatusAbenezer TesfayeNo ratings yet

- 2 RHPC Marna 1000mmDocument2 pages2 RHPC Marna 1000mmrkmeenaNo ratings yet

- Table Of: Scale: Not To Scale ARDocument1 pageTable Of: Scale: Not To Scale ARKeannu Delera0% (1)

- Deed of Sale Lot TemplateDocument2 pagesDeed of Sale Lot TemplateKenny SerranoNo ratings yet

- Edgar Katipunan ABP Sheet1Document1 pageEdgar Katipunan ABP Sheet1erichfaith23estilleroNo ratings yet

- Dawn Rapoport and Chandra Parker Doucette Take On David J. Stern in A Class ActionDocument2 pagesDawn Rapoport and Chandra Parker Doucette Take On David J. Stern in A Class ActionForeclosure FraudNo ratings yet

- Rent Agreement 2020 EditedDocument3 pagesRent Agreement 2020 EditedNovice VlogsNo ratings yet

- MERLIN Page 1Document1 pageMERLIN Page 1Partha GangopadhyayNo ratings yet

- Bond Beam - Bond Beam Block vs. Lintel Block - NitterhouseDocument15 pagesBond Beam - Bond Beam Block vs. Lintel Block - NitterhouseRonald SiraitNo ratings yet

- BRRRR HowtoMake100000PerYearwithFixerUpperRentalPropertiesDocument11 pagesBRRRR HowtoMake100000PerYearwithFixerUpperRentalPropertiesAdianice CorreaNo ratings yet

- BOQ Struktur VICTOR HOUSEDocument5 pagesBOQ Struktur VICTOR HOUSEOxi ArimbawaNo ratings yet

- RDO No. 39 - South Quezon CityDocument318 pagesRDO No. 39 - South Quezon CityBeng Kalaw62% (13)

- Property Law Model AnswersDocument12 pagesProperty Law Model AnswersAlexNo ratings yet

- Ncs Boq FormatDocument6 pagesNcs Boq FormatJasper ryan GonzalesNo ratings yet

- #22. BSP Vs Libo-OnDocument2 pages#22. BSP Vs Libo-OneizNo ratings yet

- Thesis On Real Estate InvestmentDocument8 pagesThesis On Real Estate Investmentafkojxato100% (2)

- Certification (No Balance)Document3 pagesCertification (No Balance)Darwin Solanoy100% (1)

- Assignment BALLB 5th SemDocument2 pagesAssignment BALLB 5th SemMukesh RajNo ratings yet

- Notes Land Titles and DeedsDocument5 pagesNotes Land Titles and DeedsMaria Fiona Duran MerquitaNo ratings yet

- DownloadDocument1 pageDownloadraym jerald felixNo ratings yet

- The Registration Act 1908: A Critical AnalysisDocument10 pagesThe Registration Act 1908: A Critical AnalysisNisha YadavNo ratings yet