Professional Documents

Culture Documents

Option Reference Guide-Important

Option Reference Guide-Important

Uploaded by

lsunusCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Use Cases For Example ATM SystemDocument54 pagesUse Cases For Example ATM SystemGayatri SharmaNo ratings yet

- Descartes Meditation 3Document6 pagesDescartes Meditation 3lsunusNo ratings yet

- ราคาอ้างอิงของยา เดือนมกราคม-มีนาคม 2561Document143 pagesราคาอ้างอิงของยา เดือนมกราคม-มีนาคม 2561Tommy PanyaratNo ratings yet

- Electrolytic Silver Refining ProcessDocument8 pagesElectrolytic Silver Refining ProcessPamo Caytano100% (1)

- Introduc) On Why Study Algorithms?: Design and Analysis of Algorithms IDocument7 pagesIntroduc) On Why Study Algorithms?: Design and Analysis of Algorithms IlsunusNo ratings yet

- Descartes Meditation 3Document5 pagesDescartes Meditation 3lsunusNo ratings yet

- Tentative NumPy TutorialDocument30 pagesTentative NumPy TutoriallsunusNo ratings yet

- Intro To Data StructuresDocument28 pagesIntro To Data StructureslsunusNo ratings yet

- Prakash Kadam & Etc. Etc. Vs Ramprasad Vishwanath GuptaDocument18 pagesPrakash Kadam & Etc. Etc. Vs Ramprasad Vishwanath GuptaAshish DavessarNo ratings yet

- How To Use The Bob Beck ProtocolDocument10 pagesHow To Use The Bob Beck ProtocolzuzumwiNo ratings yet

- Cilindros Hidraulicos HydrowaDocument44 pagesCilindros Hidraulicos HydrowaconradoralNo ratings yet

- UntitledDocument292 pagesUntitledD17CQAT01-N LE THANH TUANNo ratings yet

- BODIES BODIES BodiesDocument92 pagesBODIES BODIES BodiesNatalia Romero MedinaNo ratings yet

- Solute Inputs in The Salar de Atacama (N. Chile) : V. Carmona, J.J. Pueyo, C. Taberner, G. Chong, M. ThirlwallDocument4 pagesSolute Inputs in The Salar de Atacama (N. Chile) : V. Carmona, J.J. Pueyo, C. Taberner, G. Chong, M. ThirlwallJosue FerretNo ratings yet

- Fevo 10 828503 1Document10 pagesFevo 10 828503 1keilazache2780No ratings yet

- Asme B31.3Document2 pagesAsme B31.3Juan ortega castellarNo ratings yet

- (1872) Regulations For The Uniform and Dress of The Army of The United StatesDocument40 pages(1872) Regulations For The Uniform and Dress of The Army of The United StatesHerbert Hillary Booker 2nd100% (5)

- Astronomy - 12 - 15 - 18 - 5 - 6 KeyDocument11 pagesAstronomy - 12 - 15 - 18 - 5 - 6 Keykalidindi_kc_krishnaNo ratings yet

- Acct Lesson 9Document9 pagesAcct Lesson 9Gracielle EspirituNo ratings yet

- Kariru - Contemporary Trends and Issues in The HospitalityDocument17 pagesKariru - Contemporary Trends and Issues in The Hospitalitygorgo.incNo ratings yet

- Bed 2nd Sem ResultDocument1 pageBed 2nd Sem ResultAnusree PranavamNo ratings yet

- Bonds Payable Sample ProblemsDocument2 pagesBonds Payable Sample ProblemsErin LumogdangNo ratings yet

- Amazon Intern Job DescriptionsDocument15 pagesAmazon Intern Job Descriptionschirag_dceNo ratings yet

- Nazario Austria Vs NLRC 310 SCRA 293 (1999)Document3 pagesNazario Austria Vs NLRC 310 SCRA 293 (1999)hehe kurimaoNo ratings yet

- DSC Polyma E 1013Document24 pagesDSC Polyma E 1013sanipoulouNo ratings yet

- Dominos Swot & 4 PsDocument10 pagesDominos Swot & 4 PsPrithvi BarodiaNo ratings yet

- SRS Template ExampleDocument16 pagesSRS Template ExampleabcNo ratings yet

- Transformer T1Document1 pageTransformer T1Vikash TiwariNo ratings yet

- R105Document1 pageR105Francisco Javier López BarrancoNo ratings yet

- Bermundo Task 3 Iii-20Document2 pagesBermundo Task 3 Iii-20Jakeson Ranit BermundoNo ratings yet

- Doing Business in Lao PDR: Tax & LegalDocument4 pagesDoing Business in Lao PDR: Tax & LegalParth Hemant PurandareNo ratings yet

- Motorcycle Parts Inventory Management System: AbstractDocument8 pagesMotorcycle Parts Inventory Management System: AbstractFayyaz Gulammuhammad100% (1)

- TSL3223 Eby Asyrul Bin Majid Task1Document5 pagesTSL3223 Eby Asyrul Bin Majid Task1Eby AsyrulNo ratings yet

- GEN005 - Quiz 2 ANSWER KEYDocument4 pagesGEN005 - Quiz 2 ANSWER KEYELLE WOODS0% (1)

- Washing MachineDocument6 pagesWashing MachineianNo ratings yet

Option Reference Guide-Important

Option Reference Guide-Important

Uploaded by

lsunusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

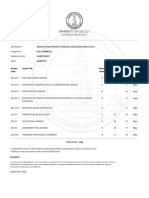

Option Reference Guide-Important

Option Reference Guide-Important

Uploaded by

lsunusCopyright:

Available Formats

Option Long Call / Bought Call Buy ITM/ATM call

Market View Bullish

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 4.00 Jan 3 Buy 1 XYZ Mar 3.80 call at .30 ND: Call premium paid (.30) XYZ 10.00 Oct 1 Buy XYZ at 10.00 Sell 1 XYZ Oct 10.50 call at .85 ND: Stock price - call prem rec 10.00 - .85 = (9.15) XYZ 25.00 Oct 5 Buy XYZ at 25.00 Buy May 24.50 put at 1.25 ND:Stock price + put prem paid 25.00 + 1.25 = (26.25) XYZ 13.00 Feb 10

Buy 1 XYZ Apr 14.25 call at .75c Sell 1 XYZ Apr 15.50 call at .25 ND: call prem paid call prem rec

Maximum Risk Limited to call premium paid .30c

Maximum Profit Unlimited until expiry

Breakeven Strike + call premium paid 3.80 + .30 = 4.10

Time Decay Volatility Disadvantage to bought call Volatility: Increasing

u Net Debit Neutral to Bullish u Net Debit Moderately Bullish u Net Debit Moderately Bullish

Extent of move up uncertain

Covered Call / Buy Write Buy stock Sell OTM call (sell monthly) Synthetic Call Buy stock Buy ATM/ slightly OTM put Bull Call Spread Buy ITM, slightly OTM call, sell a further OTM call same month Bull Put Spread Buy OTM put sell further OTM put same month Collar Buy stock, buy ATM/ OTM put, sell OTM call

Unlimited **

(stock may fall to 0)

Stock price paid call prem rec 10.00 - .85 = 9.15 Limited Stock price paid + put prem paid - strike 25.00 + 1.25 - 24.50 = .75 Limited to net debit .50

Limited Call prem rec + strike stock price paid .85 + 10.50 - 10.00 = 1.35 Unlimited

Price paid for stock call prem rec 10.00-.85=9.15

Advantage to sold call value Volatility: na

Strike + put prem paid + stock price - put strike 24.50 + 1.25 + 25.00 24.50 = 26.25 Lower strike + net debit 14.25 + .50 = 14.75

Disadvantage to bought put Volatility: na Advantage when in profit Disadvantage in loss Volatility: na

uu Net Debit

Limited Diff in strikes - net debit (15.50 -14.25) - .50 = .75

.75 - .25 = (.50) XYZ 5.00 Oct 7 Sell 1 XYZ Nov 4.50 put at .40 Buy 1 XYZ Nov 4.00 put at .15 NC: Put prem rec put prem paid .40 - .25 = .25 XYZ 19.45 May 29 Buy XYZ at 19.45 Buy Jan 20.00 put at .65 Sell Jan 25.00 call at .50 ND: Stock price paid + put prem paid call prem rec 9.45 + .65 - .50 = (19.60) XYZ 11.50 Jan 6 Sell 1 XYZ Jan 10.50 put at .50 NC: Put premium received = .50 Limited Diff in strikes - net credit (4.50 - 4.00) - .25 = .50 .25 = .25 Limited Stock price paid + put prem paid - put strike - call prem rec 19.45+.65 - 20.00 -.50 =.40 (trade risk) Unlimited **

(Stock may fall to zero)

Moderately Bullish uu Net Credit Moderately Bullish uu Net Debit

Limited Net credit .25

Higher strike - net credit 4.50 - .25 = 4.25

Advantage when in profit Disadvantage in loss Volatility: na Advantage when in profit Disadvantage in loss Volatility: na

Limited Call strike - put strike trade risk 25.00 - 20.00 -.40 = 4.60

Stock price paid - call prem rec + put prem paid 19.45 -.50 + .65 = 19.60

Short Put / Sold Put -Naked Sell OTM put

Neutral to Bullish uu Net Credit

Strike Put prem rec 10.50 - .50 = 10.00

Limited to put prem received .50

Strike put prem received 10.50 - .50 = 10.00

Advantage to sold put Volatility: na

Option Calendar Call Buy LT NTM call Sell ST call same strike (sell monthly)

Market View Neutral to Bullish

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 10.00 May 5 Buy Jan 10.00 call at 2.00 Sell May 10.00 call at .40 Init. ND: Call prem paid call prem rec 2.00 - .40 = (1.60) Sell calls monthly for more income XYZ 25.00 Jan 20 Buy Dec 24.00 call at 3.00 Sell Feb 26.50 call at .25 Init.ND: Call prem paid call prem rec 3.00 - .25 = (2.75) Calls sold monthly XYZ 48.00 May 15 Sell Aug 50 call at 4.20 Buy Aug 55 call at 2.40 Buy Aug 60 call at .80 NC: Call prem rec call prem paid 4.20 - 2.40 - .80 = 1.00 XYZ 13.82 May 25 Sell Oct 12.50 call at 2.45 Buy 2 Oct 15.00 calls at 1.25 ND: Call prems paid Call prems rec 2.50 - 2.45 = (.05)

Maximum Risk Limited to net debit paid 1.60 This reduces each month as calls are sold

Maximum Profit Limited Bought call value when sold call expires, when stock at strike - net debit

Breakeven Down & Up: depends on value of bought call when sold call expires

Time Decay Volatility Disadvantage to bought call Advantage to sold call Volatility:na

uu Net Debit Bullish uu Net Debit Bullish uuu Net Credit or Debit Very Bullish

Fast and substantial move upward in price

Diagonal Call Buy deep ITM LT call Sell higher strike ST call (sell monthly) Bear Call Ladder Sell x lower strike calls Buy x higher strike calls, buy x even higher strike calls-same expiry Call Ratio Backspread Sell lower strike ATM calls, Buy OTM calls same expiry ratio 2:1 or 3:2 Covered Short Straddle

Very Risky NR

Limited to net debit paid this reduces each month as calls are sold

Limited Bought call value when sold call expires, when stock at higher strike - net debit Unlimited

Down & Up: depends on value of bought call when sold call expires

Disadvantage to bought call Advantage to sold call Volatility: na Advantage when position in profit Disadvantage when in loss Volatility: High Disadvantage extended time erodes time value Volatility: High

Limited Middle strike - lower strike +nd (or nc) (interim risk) 55.00 - 50.00 - 1.00 = 4.00

Down: Lower strike - nd or (+nc) 50.00 + 1.00 = 51.00 Up: Higher strike + max risk 60.00 - 4.00 = 64.00 Down: Lower strike + net credit NA because net debit in this case Up:Higher strike + (diff in strikes)no. long calls no. short calls+ nd or(- nc)

15.00+(2.501)+.05=17.55

uuu Net Credit or Debit

Limited Diff in strikes + net debit paid or - net credit rec 2.50 + .05 = 2.55

Unlimited

Bullish uuu Net Debit

Buy stock Sell OTM put, sell call with same strike and month Covered Short Strangle

Risky

Expect steady rise

Bullish uuu Net Debit

Buy stock Sell OTM put, sell OTM call same month

Expect steady rise

XYZ 14.10 Feb 26 Sell Mar 15.00 put at 1.30 Sell Mar 15.00 call at .45 ND:Stock price paid - option premiums rec 14.10 -1.30 -.45 = (12.35) XYZ 14.10 June 20 Sell July 13.75 put at .60 Sell July 15.00 call at.45 ND:Stock price - option premiums 14.10 - .60 - .45 = (13 .05)

Unlimited Very Risky Stock price paid + put strike -put prem rec - call prem rec 14.10 + 15.00 -1.30 -.45 = 27.35 (risk is double nd) Unlimited - Risky Stock price + put strike put prem rec - call prem rec 14.10 + 13.75 - .60 -.45 = 26.80 (double nd)

Limited Prems received + strike stock price paid .45 + 1.30 + 15.00 -14.10 = 2.65 Limited Call and put prems rec + call strike - stock price paid .60+.45+15.00-14.10=1.95

Strike - half premiums rec + half diff between stock price paid and strike 15.00 - .875 + .45 = 14.57 waiting on answer here Varied depending on stock price, premiums received and strikes emailing

Advantage will erode value of options sold Volatility: na

Advantage will erode value of options sold Volatility: na

Option Calendar Put Buy LT NTM put, sell ST put same strike (sell monthly) Diagonal Put Buy LT OTM put, sell a further OTM higher strike put (sell monthly) Strap Buy ATM put 3 months expiry Buy 2 ATM calls same month same strike Long Combo Sell LT OTM put Buy LT OTM call same expiry Ratio Put Spread Buy 1 ATM put, Sell 2 OTM puts same expiry ratio 2:1

Market View Neutral to Bullish

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 32.50 Oct 6 Buy Jun 32.50 put at 4.50 Sell Nov 32.50 put at 1.50 Int. ND: Put prem paid put prem rec 4.50 - 1.50 = (3.00) Puts sold monthly XYZ 13.00 May 11 Buy Jan 12.50 put at 2.00 Sell June 13.75 put at 1.10 Init NC: Put prem paid put prem rec Puts sold monthly 2.00 - 1.10 = .90 XYZ 12.68 April 15 Buy July 12.50 put at .85 Buy 2 July 12.50 puts at 1.20 ND: Put premiums (3.25) XYZ 11.75 Dec 2 Sell May 10.00 put at .55 Buy May 13.30 call at .78 ND: Call prem paid put prem rec .78 - .55 = (.23) XYZ AT 27.65 May 25 Sell 2 June 25.00 puts at .42 Buy a 27.50 put at 1.33 ND: Put prem paid put prems rec 1.33 - .42 - .42 = (.49)

Maximum Risk Limited Put strike - max value of bought put at first exp +nd

Maximum Profit Limited Bought put value at strike at first expiry - nd

Breakeven Down: Depends on value of bough put when sold put expires Up: Depends on value of bought put when sold put expires Down: Depends on value of bough put when sold put expires Up: Depends on value of bought put when sold put expires Down: Strike - net debit 12.50 - 3.25 = 9.25 Up: Strike + net debit 2 12.50 + (3.252) = 14.125

Time Decay Volatility Advantage to sold put Disadvantage to bought put Volatility: na Disadvantage to bought put Advantage to sold put Volatility: na Disadvantage especially as option approaches expiry Volatility: High Disadvantage but minimal Volatility: na

uuu

Expect steady rise

Net Debit

Bullish uuu Net Credit Neutral to Bullish

Large move either way preferably upward

Limited Higher strike -max bought put value at first exp - nc

Limited Depends on value of bought put at sold put expiry

uuuu Net Debit

Limited to net debit .85 + 1.20 + 1.20 = 3.25

Unlimited

Bullish uuuu Net Debit or Credit Neutral to Bullish

Increasing volatility but market rangebound

Unlimited ** Lower strike + net debit 10.00 + .23 = 10.23

Unlimited

ND: Higher strike + ND 13.30 + .23 = 13.53 NC: Lower strike - NC

uuuu Net Debit

Unlimited ** Higher strike - (diff in strikes x sold contracts) + net debit 27.50 - (2.5x2)+.49 =22.99

Limited (No. bought puts x diff in strikes) -nd or + nc (1x2.50) - .49 = 2.01

Down: Higher strike -(diff in strikes x no. sold puts) (no. sold puts bought puts) nc or + nd 27.50 - (2.5x2) (2-1)+.49 = 22.99 Up: Higher strike - (net debit x no. sold puts) 27.50 - (.49 x 1) = 27.01

Advantage Volatility: Low

Option Long Put / Bought Put Buy an ITM ATM put

Market View Bearish

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 3.20 Sept 15 Buy 3.25 Nov put at .15 ND: Put premium (.15) XYZ 7.95 Aug 2 Short sell stock at 7.95 Buy Oct 8.00 call at .50 NC: Shorted stock price-call prem paid 7.95 - .50 = 7.45 XYZ 10.00 Aug 12 Sell Sept 11.00 call at .50 Buy Sept 12.00 call at .25 NC: Call prem rec call prem paid .50 - .25 = .25 XYZ 13.00 June 15 Sell Nov 10.00 put at .175 Buy Nov 12.50 put at .90 ND: Put prem paid put prem rec .90 - .175 = (.725) XYZ 12.05 Feb 26 Sell short stock 12.05 Sell Mar 11.00 put for .50 NC: Stock price + put prem rec 12.05 + .50 = 12.55 XYX 5.00 Nov 2 Sell 5.80 Nov call at .30 NC: Sold call premium (.30) XYZ 15.10 May 8 Buy 2 Aug 15.00 puts at .80 Buy 15.00 call at 1.20 ND: Premiums bought (2.80)

Maximum Risk Limited to premium paid .15

Maximum Profit Unlimited

Breakeven Strike price-put premium 3.25 - .15 = 3.10

Time Decay Volatility Disadvantage to bought put Volatility: na

u Net Debit Bearish

Market fall extent unknown

Synthetic Put Short sell stock Buy ATM or slightly OTM call Bear Call Spread Sell ST OTM call Buy further OTM call same month Bear Put Spread Buy OTM put Sell further OTM put same month Covered Put / Married Put Short sell stock Sell OTM put Short Call / Sold Call (Naked) Sell OTM call near month Strip Buy 2 ATM puts Buy ATM call same strike and expiry

uu Net Credit

Limited Call prem paid + call strike shorted stock price .50 + 8.00 - 7.95 = .55 Limited Diff in strikes - net credit 1.00 - .25 = .75

Unlimited ** Shorted stock price - call prem paid 7.95 - .50 = 7 45 Limited to net credit .25

Shorted stock price call prem paid 7.95 -. 50 = 7.45

Disadvantage to call Volatility: na

Neutral to Bearish

Market fall extent unknown

Lower strike+net credit 11.00 - .25 = 10.75

uu Net Credit

Advantage when profitable Disadvantage when in loss Volatility: na Advantage when profitable Disadvantage when in loss Volatility: na Advantage Volatility:na

Bearish

Market fall extent unknown

uu Net Debit

Limited to net debit .725

Limited Diff in strikes - net debit 2.50 - .725 = 1.77

Higher strike - net debit 12.50 - .725 = 11.77

Neutral to Bearish

Expect steady fall

Unlimited

uuu Net Credit

Limited (Shorted stock pricestrike) + put prem 12.05 - 11.00 + .50 = 1.55 Limited to net credit rec .30

Shorted stock price + put prem received 12.05 + .50 = 12.55

Bearish

Sure market will not rise

Unlimited

Strike price + call prem received 5.80 + .30 = 6.10

Advantage Volatility:na

uuu Net Credit

Neutral to Bearish

Preferable large move to downside

Limited to net debit 2.80

Unlimited

Down: Strike - (nd 2) 15.00 - (2.80 2) = 13.60 Up: Strike + nd 15.00 + 2.80 = 17.80

Disadvantage Volatility: High

uuu Net Debit

Bull Put Ladder Sell OTM put Buy further OTM put (ls) Buy even further OTM put (els) same expiry Ratio Call Spread Sell 2 ITM calls Buy further ITM call (ls) same expiry ratio of 2:1 or 3:2 Put Ratio Backspread Sell an OTM put Buy 2 further OTM puts (ls) Same expiry Ratio 2:1 or 3:2

Bearish uuu Net Debit or Credit Neutral to Bearish uuu Net Debit or Credit Extremely Bearish uuu Net Debit Credit or Nil Cost Bearish uuuu Net Credit or Debit

XYX 13.00 Nov 5 Sell Feb 12.50 put at 1.15 Buy Feb 11.25 put at.60 Buy Feb 10.00 put at .30 NC: Put prem recput prems paid 1.15 - .60 - .30 = .25 XYZ 5.53 Oct 29 Sell 2 Nov 5.50 calls at .30 Buy Nov 5.00 call at .63 ND: Call prem paid - call prem rec .63 - .30 - .30 = (.03) XYX 55.96 July 5 Sell Dec 60.00 put at 8.40 Buy 2 Dec 50.00 puts at 4.30 ND: Put prems paidput prem rec 4.30 + 4.30 8.40 = .20

Limited Higher strike midd strike nc or (+ nd) 12.50 11.25 - .25 = 1.00 (interim risk is nd) not app here as nc Unlimited

Unlimited ** Lower strike max risk 10.00 1.00 = 9.00

Limited Diff in strikes net debit or (+ nc) .50 - .03 = .47 chreckin the +nc opp too Unlimited ** Lower strike max risk 50.00 10.20 = 39.80 NC: Lower strike max risk

Limited Diff in strikes + nd 10.00 + .20 = 10.20 NC: No. sold puts x diff in strikes - nc

Short Combo Buy OTM put Sell OTM call same expiry

XYX 20.10 Jan 3 Buy Mar 18.00 put at .70 Sell Mar 22.00 call at .80 NC: Call prem rec put prem paid .80 - .70 = .10

Unlimited

Unlimited ** Lower strike + nc or (-nd) 18.00 + .10 = 17.90

Down: Lower strike max risk 10.00 1.00 = 9.00 Up: Higher strike nc or (+nd) 12.50 - .25 = 12.25 Down: Lower strike + nd or (-nc) 5.00 + .03 = 5.03 Up: Higher strike + max reward 5.50 + .47 = 5.97 Down: Lower strike max risk 50.00 10.20 = 39.80 Up: na and here NC: Down: Lower strike max risk Up: Higher strike (nc 2) Higher strike + nc or (-nd) 22.00 + .10 = 22.10

Disadvantage when in loss, highest at middle strike Volatility:High Advantage as more sold than bought options Volatility: Low Disadvantage Volatility:High

Advantage but minimal Volatility:na

Option Straddle Buy ATM put, Buy ATM call same expiry, same strike Strangle Buy OTM put, Buy OTM call same expiry Short Put Butterfly Sell OTM put, Buy 2 ATM puts Sell ITM put same expiry Short Iron Butterfly Sell OTM put, buy ATM put, buy ATM call, sell further OTM call same expiry

Market View Neutral

Large move expected in either direction

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 15.10 July 16 Buy Oct 15.00 put at .70 Buy Oct 15.00 call at .95 ND: Premiums bought .70 + .95 = (1.65) XYZ 15.10 July 16 Buy 14.00 Oct put at .35 Buy 16.00 Oct call at .60 ND: Premiums bought .35 + .60 = (.95) XYZ 25.00 May 16 Sell Aug 22.50 put at 1.28 Buy 2 Aug 25.00 puts at 2.41 Sell Aug 27.50 put at 3.92 NC: Prems sold - prem bought 1.28 + 3.92 - 2.41 - 2.41 = .38 XYZ 10.20 June 17 Sell Sept 9.00 put for .30 Buy Aug 10.00 put for .80 Buy Aug 10.00 call for 1.00 Sell Aug 11.00 call at .90 Prems bought - prems sold .80 + 1.00 - .30 - .90 = (.60) XYZ 27.50 May 10 Sell May 25.00 put at 1.25 Buy May 20.00 put at .25 Sell May 30.00 call at 1.30 Buy May 35.00 call at .35 NC: Prems sold - prems bought 1.25 + 1.30 - .25 - .35 = 1.95 XYZ 25.00 April 10 Buy May 20.00 put at .30 Sell May 25.00 put at 1.50 Sell May 25.00 call at 2.00 Buy May 30.00 call at .50 NC: Prems sold - prems bought 1.50 + 2.00 - .30. -50 = 2.70

Maximum Risk Limited to net debit 1.65

Maximum Profit Unlimited

Breakeven Down: Strike - net debit 15.00 - 1.65 = 13.35 Up: Strike + net debit 15.00 + 1.65 = 16.65

Time Decay Volatility Disadvantage Volatility: High

uu Net Debit

Neutral

Large move expected in either direction uu

Limited to net debit .95

Unlimited

Down: Lower strike - nd 14.00 - .95 = 13.05 Up: Higher strike + nd 16.00 + .95 = 16.95

Disadvantage Volatility: High

Net Debit

Neutral uu Net Credit

Substantial move up or down

Limited Diff in adjacent strikes net credit 2.50 - .38 = 2.12

Limited to net credit .38

Down: Lower strike + nc 22.50 + .38 = 22.88 Up: Higher strike - nc 27.50 -.38 = 27.12

Disadvantage Volatility: High

Neutral uu

Substantial move up or down

Limited to net debit .60

Limited Diff in adjacent strikes-net debit 1.00 - .60 = .40

Down: Middle strike - nd 10.00 - .60 = 9.40 Up: Middle strike + nd 10.00 + .60 = 10.60

Disadvantage Volatility: High

Net Debit

Long Iron Condor Sell OTM put Buy further OTM put (ls) Sell OTM call Sell further OTM call (hs) same expiry Long Iron Butterfly Buy OTM put, sell ATM put, sell ATM call, buy OTM call same expiry

Neutral uu Net Credit

Limited Diff in adjacent strikes - nc 5.00 - 1.95 = 3.05

Limited to net credit 1.95

Down: Lower middle strike - net credit 25.00 - 1.95 = 23.05 Up: Upper middle strike + net credit 30.00 + 1.95 = 31.95 Down: Middle strike-nc 25.00 - 2.70 = 22.30 Up: Middle strike + nc 25.00 + 2.70 = 27.70

Expect minimal price movement

Advantage when profitable Disadvantage when in loss Volatility: Low Advantage when profitable Disadvantage when in loss Volatility: Low

Neutral

Limited Diff in adjacent strikes-nc 5.00 - 2.70 = 2.30

Limited to net credit 2.70

Expect minimal price movement

uu Net Credit

Option Long Call Butterfly Buy ITM call Sell 2 ATM calls Buy OTM call same expiry Long Call Condor Buy ITM call Sell further ITM call (ls) Sell OTM call Buy further OTM call (hs) Same expiry Long Put Condor Sell OTM put Buy further OTM put (ls) Sell ITM put Buy further ITM put (hs) same expiry Short Call Condor Buy ITM call Sell further ITM call (ls) Buy OTM call Sell further OTM call (hs) same expiry Short Iron Condor Buy OTM put Sell further OTM put (ls) Buy OTM call Sell further OTM call (hs) same expiry

Market View Neutral

Expect minimal price movement

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 25.00 May 17 Buy June 22.50 call at 3.06 Sell 2 June 25.00 calls at 1.53 Buy June 27.50 call at .65 ND: Prems bought - prems sold 3.06 + .65 - 1.53 - 1.53 = (.65) XYZ 13.00 April 18 Sell May 12.50 call at 1.20 Buy May 11.25 call at 2.13 Sell May 13.75 call at .58 Buy May 15.00 call at .24 ND: Prems bought - prems sold 2.13 + .24 - 1.20 - .58 = (.59) XYZ 13.00 April 18 Sell May 12.50 put at .45 Buy May 11.25 put at .12 Sell May 13.75 put at 1.07 Buy May 15.00 put at 1.98 ND: Prems bought - prems sold .12 + 1.98 - .45 - 1.07 = (.58) XYZ 13.00 April 18 Buy July 12.50 call at 1.76 Sell July 11.25 call at 2.54 Buy July 13.75 call at 1.17 Sell July 15.00 call at .75 ND: Prems sold - prems bought 2.54 + .75 - 1.76 - 1.17 = .36 XYZ 13.00 April 18 Buy July 12.50 put at .93 Sell July 11.25 put at .47 Buy July 13.75 call at 1.17 Sell July 15.00 call at .75 ND: prems bought - prems sold .93 + 1.17 - .47 - .75 = (.88)

Maximum Risk Limited to net debit .65

Maximum Profit Limited Diff in adjacent strikes - nd 2.50 - .65 = 1.85

Breakeven Down: Lower strike + nd 22.50 +. 65 = 23.15 Up: Higher strike - nd 27.50 - .65 = 26.85

Time Decay Volatility Advantage when profitable Disadvantage when in loss Volatility: Low Advantage when profitable Disadvantage when in loss Volatility: Low

uu Net Debit

Neutral uuu Net Debit

Limited to net debit .59

Limited Diff in adjacent strikes - nd 1.25 - .59 = .66

Down: Lower strike + nd 11.25 + .59 = 11.84 Up: Higher strike - nd 15.00 -.59 = 14.41

Expect minimal price movement

Neutral uuu Net Debit

Limited to net debit .58

Limited Diff in adjacent strikes - nd 1.25 - .58 = .67

Down: Lower strike + nd 11.25 + .58 = 11.83 Up: Higher strike - nd 15.00 - .58 - 14.42

Expect minimal price movement

Advantage when profitable Disadvantage when in loss Volatility: Low

Neutral uuu

Substantial move up or down

Limited Diff in adjacent strikes - nc 1.25 - .36 =.89

Limited to net credit .36

Down: Lower strike + nc 11.25 + .36 = 11.61 Up: Higher strike - nc 15.00 - .36 = 14.64

Disadvantage Volatility: High

Net Credit

Neutral uuu

Substantial move up or down

Limited To net debit .88

Limited Diff in adjacent strikes - nd 1.25 - .88 = .37

Down: Lower middle strike - nd 12.50 - .88 = 11.62 Up: Higher middle strike + nd 13.75 + .88 = 14.63

Disadvantage Volatility: High

Net Debit

Option Short Put Condor Buy OTM put Sell further OTM put Buy ITM put Sell futher ITM put Same expiry Short Straddle Sell ATM put, sell ATM call same strike same expiry

Market View Neutral

Payoff

At Initiation Debit/Credit

Creating Initial Strategy Debit/Credit XYZ 13.00 April 18 Buy July 12.50 put at .93 Sell July 11.25 put at .47 Buy July 13.75 put at 1.58 Sell July 15.00 put at 2.40 ND: Prems sold - prems bought .47 + 2.40 - .93 - 1.58 = .36 XYZ 8.15 Sept 17 Sell June 8.00 put at .50 Sell June 800 call at .70 NC: Premiums sold .50 + .70 = 1.20

Maximum Risk Limited Diff in adjacent strikes - nc 1.25 - .36 =

Maximum Profit Limited to net credit .36

Breakeven Down: Lower strike + nc 11.25 + .36 = 11.61 Up: Higher strike - nc 15.00 - .36 = 14.64

Time Decay Volatility Disadvantage Volatility: High

uuu

Substantial move up or down

Net Credit

Neutral uuu

Expect minimal price movement

Unlimited

Limited to net credit 1.20

Down: Strike - net credit 8.00 - 1.20 = 6.80 Up: Strike + net credit 8.00 + 1.20 = 9.20

Advantage Volatility: Low

Net Credit XYZ at 25.15 Oct 16 Sell Nov 23.50 put at .25 Sell Nov 26.50 call at .45 NC: Premiums sold .25 + .45 = .70 Unlimited Limited to net credit .70 Down: Lower strike - nc 23.50 - .70 = 22.80 Up: Higher Strike + nc 26.50 + .70 = 27.20 Advantage Volatility: Low

Short Strangle Sell OTM put sell OTM calls same expiry

Neutral uuu

Expect minimal price movement

Net Credit XYZ at 6.52 June 13 Buy June 6.25 call at .60 Sell June 6.87 call at .20 Sell June 7.50 call .10 ND: Call prem paid call prems rec .60 - .20 - .10 = .30 XYZ at 26.00 July 13 Sell Aug 25.00 put at .90 Sell Aug 22.50 put at .25 Buy Aug 27.50 put at 2.30 ND: Put prem paid put prems paid 2.30 - .25 - .90 = 1.15 Interim risk 1.15 Unlimited Limited Middle strike lower strike net debit 6.87 - 6.25 - .30 = .32 Down: Lower strike + nd 6.25 + .30 = Up: Higher strike + midd strike lower strike nd 7.50 + 6.87 6.25 - .30 = 7.82 Down: Lower strike max reward 22.50 1.35 = 21.15 Up: Higher strike + nd 27.50 + 1.15 = 28.65 Disadvantage at lower strike advantage at highest strike Volatility: Low Advantage when profitable especially round middle strike Volatility: Low

Bull Call Ladder Buy ITM / ATM call Sell OTM call Sell further OTM call (hs) same month

Neutral uuu Net Debit

usually

Bear Put Ladder Sell OTM put Sell further OTM put (ls) Buy ITM put same expiry

Neutral uuu Net Debit

usually

Unlimited ** Lower strike (higher strike midd strike) + nd 22.50 (27.50 25.00) + 1.15 = 21.15

Limited Higher strike midd strike net debit 27.50 25.00 1.15=1.35

Guts Buy ITM call buy ITM put same month

Neutral uuuu

Substantial move up or down

XYZ 16.05 Feb 17 Buy May 15.50 call at 2.00 Buy may 17.50 put 1.80 ND: Premiums bought 2.00 + 1.80 = (3.80)

Limited Net debit - diff in strikes 3.80 - 2.00 = 1.80 (max risk)

Unlimited

Net Debit XYZ 17.46 Aug 4 Sell Oct 15.00 put at .50 Buy Oct 15.00 call at 3.00 Buy Oct 20.00 put at 3.10 Sell Oct 20.00 call at .60 ND: Prems bought - prems sold 3.00 + 3.10 - .50 - .60 = (5.00) XYZ 20.29 July 15 Sell Aug 18.00 call at 2.64 Sell June 22.00 put at 2.24 NC: Premiums sold 2.64 + 2.24 = 4.88 Limited Net debit - diff between strikes 5.00 - 5.00 = 0.00 Profits made as you leg in or out of trade Unlimited Limited Diff between strikes - net debit 5.00 - 5.00 = 0.00 Profits made as you leg in or out of trade Limited Net credit - diff in strikes 4.88 - 4.00 = .88

Down: Lower strike - max risk 15.50 - 1.80 = 13.70 Up: Higher strike + max risk 17.50 + 1.80 = 19.30 na

Disadvantage Volatility: High

Long Box Sell OTM put buy same strike ITM call buy ITM put, sell same strike OTM call same month Short Guts Sell ITM call sell ITM put same expiry

Neutral uuuu

Substantial move up or down

Advantage Volatility: High

Net Debit

Neutral

Expect minimal price movement

uuuu Net Credit

Down: Lower strike nc + diff in strikes 18.00 - 4.88 + 4.00= 26.88 Up: Higher strike + nc diff in strikes 22.00 + 4.88 - 4.00 = 2.88

Advantage Volatility: Low

Abbreviations: ATM Diff Exp Init ITM LT Max NC or nc ND or nd NTM OTM Prem Prems Rec ST (hs) (ls) (els) midd app At the money Difference Expiry Initial In the money Long term Maximum Net credit Net debit Near the money Out of the money Premium Premiums Received Short term Higher strike Lower strike Even lower strike Middle Applicable

**

Risk is so large that it is classified as unlimited even though it is limited

ITM / OTM / ATM In the Money / Out of the Money / At the Money

Calls OTM ATM ITM Puts OTM ATM ITM Out of the money At the money In the money Strike lower than Stock Price Strike equal to Stock Price Strike higher than Stock Price Only time value in premium Only time value in premium Intrinsic value and time value Out of the money At the money In the money Strike higher than Stock Price Strike equal to Stock Price Strike lower than Stock Price Only time value in premium Only time value in premium Intrinsic value and time value

Call Option

ITM

Put Option

ITM

Call Option

OTM

Put Option

OTM

Strike Below Share Price Strike Above Share Price Strike Above Share Price Strike Below Share Price

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Use Cases For Example ATM SystemDocument54 pagesUse Cases For Example ATM SystemGayatri SharmaNo ratings yet

- Descartes Meditation 3Document6 pagesDescartes Meditation 3lsunusNo ratings yet

- ราคาอ้างอิงของยา เดือนมกราคม-มีนาคม 2561Document143 pagesราคาอ้างอิงของยา เดือนมกราคม-มีนาคม 2561Tommy PanyaratNo ratings yet

- Electrolytic Silver Refining ProcessDocument8 pagesElectrolytic Silver Refining ProcessPamo Caytano100% (1)

- Introduc) On Why Study Algorithms?: Design and Analysis of Algorithms IDocument7 pagesIntroduc) On Why Study Algorithms?: Design and Analysis of Algorithms IlsunusNo ratings yet

- Descartes Meditation 3Document5 pagesDescartes Meditation 3lsunusNo ratings yet

- Tentative NumPy TutorialDocument30 pagesTentative NumPy TutoriallsunusNo ratings yet

- Intro To Data StructuresDocument28 pagesIntro To Data StructureslsunusNo ratings yet

- Prakash Kadam & Etc. Etc. Vs Ramprasad Vishwanath GuptaDocument18 pagesPrakash Kadam & Etc. Etc. Vs Ramprasad Vishwanath GuptaAshish DavessarNo ratings yet

- How To Use The Bob Beck ProtocolDocument10 pagesHow To Use The Bob Beck ProtocolzuzumwiNo ratings yet

- Cilindros Hidraulicos HydrowaDocument44 pagesCilindros Hidraulicos HydrowaconradoralNo ratings yet

- UntitledDocument292 pagesUntitledD17CQAT01-N LE THANH TUANNo ratings yet

- BODIES BODIES BodiesDocument92 pagesBODIES BODIES BodiesNatalia Romero MedinaNo ratings yet

- Solute Inputs in The Salar de Atacama (N. Chile) : V. Carmona, J.J. Pueyo, C. Taberner, G. Chong, M. ThirlwallDocument4 pagesSolute Inputs in The Salar de Atacama (N. Chile) : V. Carmona, J.J. Pueyo, C. Taberner, G. Chong, M. ThirlwallJosue FerretNo ratings yet

- Fevo 10 828503 1Document10 pagesFevo 10 828503 1keilazache2780No ratings yet

- Asme B31.3Document2 pagesAsme B31.3Juan ortega castellarNo ratings yet

- (1872) Regulations For The Uniform and Dress of The Army of The United StatesDocument40 pages(1872) Regulations For The Uniform and Dress of The Army of The United StatesHerbert Hillary Booker 2nd100% (5)

- Astronomy - 12 - 15 - 18 - 5 - 6 KeyDocument11 pagesAstronomy - 12 - 15 - 18 - 5 - 6 Keykalidindi_kc_krishnaNo ratings yet

- Acct Lesson 9Document9 pagesAcct Lesson 9Gracielle EspirituNo ratings yet

- Kariru - Contemporary Trends and Issues in The HospitalityDocument17 pagesKariru - Contemporary Trends and Issues in The Hospitalitygorgo.incNo ratings yet

- Bed 2nd Sem ResultDocument1 pageBed 2nd Sem ResultAnusree PranavamNo ratings yet

- Bonds Payable Sample ProblemsDocument2 pagesBonds Payable Sample ProblemsErin LumogdangNo ratings yet

- Amazon Intern Job DescriptionsDocument15 pagesAmazon Intern Job Descriptionschirag_dceNo ratings yet

- Nazario Austria Vs NLRC 310 SCRA 293 (1999)Document3 pagesNazario Austria Vs NLRC 310 SCRA 293 (1999)hehe kurimaoNo ratings yet

- DSC Polyma E 1013Document24 pagesDSC Polyma E 1013sanipoulouNo ratings yet

- Dominos Swot & 4 PsDocument10 pagesDominos Swot & 4 PsPrithvi BarodiaNo ratings yet

- SRS Template ExampleDocument16 pagesSRS Template ExampleabcNo ratings yet

- Transformer T1Document1 pageTransformer T1Vikash TiwariNo ratings yet

- R105Document1 pageR105Francisco Javier López BarrancoNo ratings yet

- Bermundo Task 3 Iii-20Document2 pagesBermundo Task 3 Iii-20Jakeson Ranit BermundoNo ratings yet

- Doing Business in Lao PDR: Tax & LegalDocument4 pagesDoing Business in Lao PDR: Tax & LegalParth Hemant PurandareNo ratings yet

- Motorcycle Parts Inventory Management System: AbstractDocument8 pagesMotorcycle Parts Inventory Management System: AbstractFayyaz Gulammuhammad100% (1)

- TSL3223 Eby Asyrul Bin Majid Task1Document5 pagesTSL3223 Eby Asyrul Bin Majid Task1Eby AsyrulNo ratings yet

- GEN005 - Quiz 2 ANSWER KEYDocument4 pagesGEN005 - Quiz 2 ANSWER KEYELLE WOODS0% (1)

- Washing MachineDocument6 pagesWashing MachineianNo ratings yet