Professional Documents

Culture Documents

Description: Tags: 2000-Low-Income

Description: Tags: 2000-Low-Income

Uploaded by

anon-985837Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Description: Tags: 2000-Low-Income

Description: Tags: 2000-Low-Income

Uploaded by

anon-985837Copyright:

Available Formats

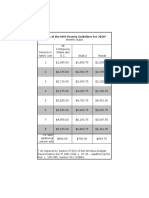

Federal TRIO Programs

2000 Annual Low Income Levels

(Effective February 2000 until further notice)

Size of Family 48 Contiguous States, Alaska Hawaii

Unit D.C., and Outlying

Jurisdictions

1 $12,525 $15,645 $14,385

2 $16,875 $21,090 $19,395

3 $21,225 $26,535 $24,405

4 $25,575 $31,980 $29,415

5 $29,925 $37,425 $34,425

6 $34,275 $42,870 $39,435

7 $38,625 $48,315 $44,445

8 $42,975 $53,760 $49,455

For family units with more than 8 members, add the following amount for each additional

family member: $4,350 for the 48 Contiguous States, the District of Columbia and

outlying jurisdictions; $5,445 for Alaska; and $5,010 for Hawaii.

The term "low-income individual" means an individual whose family's taxable income

for the preceding year did not exceed 150% of the poverty level amount.

The figures shown under family income represent amounts equal to 150% of the family

income levels established by the Census Bureau for determining poverty status. The

poverty guidelines were published by the U.S. Department of Health and Human Services

in the Federal Register, Vol. 65, No. 31, February 15, 2000, pp. 7555-7557.

You might also like

- HHS Expenditures On RefugeesDocument3 pagesHHS Expenditures On RefugeesGlennKesslerWPNo ratings yet

- Unemployment Benefits Letter 4.7.2020 .1Document7 pagesUnemployment Benefits Letter 4.7.2020 .1Scott SuttonNo ratings yet

- Income RequirementsDocument1 pageIncome RequirementsKamran KasaeiNo ratings yet

- Federal Poverty GuidelinesDocument1 pageFederal Poverty GuidelinespatriciapaganNo ratings yet

- 2017 HHS Poverty Guidelines For Affidavit of SupportDocument1 page2017 HHS Poverty Guidelines For Affidavit of SupportLiz MNo ratings yet

- Poverty Guidelines PDFDocument2 pagesPoverty Guidelines PDFLedoNo ratings yet

- 2018 Poverty GuidelinesDocument1 page2018 Poverty GuidelinesRICK STANTONNo ratings yet

- Fy24 Snap Cola MemoDocument5 pagesFy24 Snap Cola MemoRaleigh FordNo ratings yet

- In Come by Zip Demographics SampleDocument20 pagesIn Come by Zip Demographics SampleJena benNo ratings yet

- AmericanOpportunityAccountsAct PDFDocument2 pagesAmericanOpportunityAccountsAct PDFSenator Cory BookerNo ratings yet

- 17-18 Sliding Fee Scale - WebsiteDocument1 page17-18 Sliding Fee Scale - Websiteapi-243097359No ratings yet

- BNC FormDocument1 pageBNC Formsharesansar99No ratings yet

- Tefap Household Eligibility Form Fy24Document1 pageTefap Household Eligibility Form Fy24api-212571155No ratings yet

- Alternate Pick Up Form 2022+Document1 pageAlternate Pick Up Form 2022+TaisNo ratings yet

- Inequities Exposed: Black Woman and The Wage GapDocument20 pagesInequities Exposed: Black Woman and The Wage GapnimraNo ratings yet

- Family BudgetDocument7 pagesFamily BudgetDy Ju Arug ALNo ratings yet

- FHCE Fed Poverty LevelDocument2 pagesFHCE Fed Poverty Levelabc xyzNo ratings yet

- 2015 Federal Poverty GuidelinesDocument1 page2015 Federal Poverty GuidelinesJulian RodriguezNo ratings yet

- California State Controller'S Office Paycheck Calculator - 2021 Tax RatesDocument1 pageCalifornia State Controller'S Office Paycheck Calculator - 2021 Tax RatesSamantha JahansouzshahiNo ratings yet

- California Public Expenditures 2008-2009Document5 pagesCalifornia Public Expenditures 2008-2009docdumpsterNo ratings yet

- Economic Impact of Tribal GamingDocument2 pagesEconomic Impact of Tribal GamingKJZZ PhoenixNo ratings yet

- FY23-Income-Eligibility-Standards For SNAPDocument2 pagesFY23-Income-Eligibility-Standards For SNAPVerna EguiresNo ratings yet

- Sample BudgetDocument3 pagesSample Budgetwbfuller16641No ratings yet

- ARP National FactsheetDocument4 pagesARP National FactsheetNo CappinNo ratings yet

- Income Guidelines 2015Document1 pageIncome Guidelines 2015Brett ScottNo ratings yet

- 2010 11HEAP ApplicationDocument4 pages2010 11HEAP ApplicationEnder751No ratings yet

- 2023 Federal Poverty GuidelinesDocument1 page2023 Federal Poverty GuidelinesCourtNo ratings yet

- Affidavit of SupportDocument2 pagesAffidavit of SupportLuciano AndréNo ratings yet

- SalariesDocument6 pagesSalariesAnonymous sZf498gF5kNo ratings yet

- I 912pDocument1 pageI 912pphilip shternNo ratings yet

- A 0-100% Poverty B 101-125% Poverty C 126-150% Poverty D 151-175% Poverty E 176-200% PovertyDocument1 pageA 0-100% Poverty B 101-125% Poverty C 126-150% Poverty D 151-175% Poverty E 176-200% PovertyUw ImgNo ratings yet

- Illinois' Bill BacklogDocument3 pagesIllinois' Bill BacklogChadMerdaNo ratings yet

- Presentation - DC Minimum Income - REMI Conference 10.12.18Document28 pagesPresentation - DC Minimum Income - REMI Conference 10.12.18Anonymous 9jKoP8LNo ratings yet

- MC 3189Document5 pagesMC 3189chris.vitelaNo ratings yet

- FS8 StatisticsENGDocument4 pagesFS8 StatisticsENGkosnanatNo ratings yet

- Career BudgetDocument1 pageCareer Budgetapi-435326846No ratings yet

- Will Get Free Meals.: Written DuringDocument6 pagesWill Get Free Meals.: Written Duringanon-579447No ratings yet

- Activity 3 - PA 504Document5 pagesActivity 3 - PA 504Johann RamosNo ratings yet

- Iowa Budget Cuts in SSB Approved by Senate Appropriations Committee 10-25-2018Document4 pagesIowa Budget Cuts in SSB Approved by Senate Appropriations Committee 10-25-2018IOWANEWS1No ratings yet

- Examining Child Expenditure MethodologiesDocument11 pagesExamining Child Expenditure MethodologiesTony CurtisNo ratings yet

- A Message From The Secretary of The TreasuryDocument26 pagesA Message From The Secretary of The TreasurylosangelesNo ratings yet

- Houshang StubDocument1 pageHoushang StubCandy CookiesNo ratings yet

- TestBank Chapter-1Document62 pagesTestBank Chapter-1Mallory CooperNo ratings yet

- Fair PharmaCare BCDocument2 pagesFair PharmaCare BCkmdietriNo ratings yet

- Racial Equity Impact Assessment: BILL 24-0236Document17 pagesRacial Equity Impact Assessment: BILL 24-0236Martin AustermuhleNo ratings yet

- Agriculture Law: RS21202Document5 pagesAgriculture Law: RS21202AgricultureCaseLawNo ratings yet

- Do The Rich Get RicherDocument3 pagesDo The Rich Get RicherJohnny gweenNo ratings yet

- State Infrastructure BanksDocument5 pagesState Infrastructure Banksaja henNo ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- Impacts of The American Rescue Plan Act: Brian Schmidt, Sr. Regional EconomistDocument9 pagesImpacts of The American Rescue Plan Act: Brian Schmidt, Sr. Regional EconomistGodwin AmekuediNo ratings yet

- ACCESS Application Check List April 2023 enDocument2 pagesACCESS Application Check List April 2023 enStarrx714No ratings yet

- A Hand Up:: How State Earned Income Tax Credits Help Working Families Escape Poverty in 2011Document26 pagesA Hand Up:: How State Earned Income Tax Credits Help Working Families Escape Poverty in 2011Jamie SandersonNo ratings yet

- Paystub RobinsonDocument1 pagePaystub Robinsonviany leproNo ratings yet

- Taller Practica ContableDocument24 pagesTaller Practica ContableLuiz Cortez ArangoNo ratings yet

- Obama Tax Plan: Impact On IdahoDocument2 pagesObama Tax Plan: Impact On IdahoThe Heritage FoundationNo ratings yet

- 2021 22 PFS Fee Waiver GuidelinesDocument3 pages2021 22 PFS Fee Waiver GuidelinesOkNo ratings yet

- 2019-2020 Compensation Analysis Published ReportDocument1 page2019-2020 Compensation Analysis Published ReportMark SchnyderNo ratings yet

- How to Pick Yourself Up By Your Bootstraps and Start All Over Again!From EverandHow to Pick Yourself Up By Your Bootstraps and Start All Over Again!No ratings yet