Professional Documents

Culture Documents

OTS TSF Return Form v02 PDF

OTS TSF Return Form v02 PDF

Uploaded by

amirhdlCopyright:

Available Formats

You might also like

- Vehicle Registration FormDocument2 pagesVehicle Registration FormLachlanNo ratings yet

- Form A1Document2 pagesForm A1api-370689094% (16)

- Filing Instructions: Please Follow These Instructions CarefullyDocument4 pagesFiling Instructions: Please Follow These Instructions CarefullyMafer ChavezNo ratings yet

- File 1Document3 pagesFile 1Girijadevi Kalpakkam RamamurthiNo ratings yet

- Sub: Formal Order For Supply of Tyre, Tube & Flap: ECL/PUR/41413013/E/LV Tyre/033 Opened On 18.06.2014Document4 pagesSub: Formal Order For Supply of Tyre, Tube & Flap: ECL/PUR/41413013/E/LV Tyre/033 Opened On 18.06.2014Ataa AssaadNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Certificate of Estimated Property Tax Millage RateDocument2 pagesCertificate of Estimated Property Tax Millage RateRobin OdaNo ratings yet

- Automated Refund of An Electronic Ticket)Document4 pagesAutomated Refund of An Electronic Ticket)AHMED ALRADAEENo ratings yet

- New Vehicle Purchase Agreement: For: Greg TedfordDocument7 pagesNew Vehicle Purchase Agreement: For: Greg TedfordGreg TedfordNo ratings yet

- Income Tax Chart 2016-17Document1 pageIncome Tax Chart 2016-17Basavaraju K R100% (1)

- 9706 w10 QP 41Document8 pages9706 w10 QP 41Diksha KoossoolNo ratings yet

- Carriers Account Application GTT 072621Document17 pagesCarriers Account Application GTT 072621messiNo ratings yet

- ONETT For Sale of Real Property Classified As Ordinary AssetDocument1 pageONETT For Sale of Real Property Classified As Ordinary Assetd-fbuser-49417072No ratings yet

- CSD Guidelines - 4 WheelerDocument2 pagesCSD Guidelines - 4 WheelerkapsicumadNo ratings yet

- Scrap Tire Shredding InformationDocument10 pagesScrap Tire Shredding InformationOscar VmartínezNo ratings yet

- Return Review Letter 2019 11 14 09 07 35 944Document3 pagesReturn Review Letter 2019 11 14 09 07 35 944Waqar Alam KhanNo ratings yet

- GST Guide For Motor Traders - FinalDocument33 pagesGST Guide For Motor Traders - FinalSamuel YeongNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Dealer VIN: Order Type Ramp Code Batch ID Price LevelDocument12 pagesDealer VIN: Order Type Ramp Code Batch ID Price LevelFRISCONo ratings yet

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Document6 pages"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855No ratings yet

- New Vehicle Registration ProceedureDocument3 pagesNew Vehicle Registration ProceedureParfact ENo ratings yet

- Mobile Services: Your Account SummaryDocument41 pagesMobile Services: Your Account SummaryPranav JhaNo ratings yet

- National Aluminium Company Limited: (Purchase Dept)Document19 pagesNational Aluminium Company Limited: (Purchase Dept)Hytech Pvt. Ltd.No ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Tire Exces TaxDocument14 pagesTire Exces Taxw uNo ratings yet

- US Internal Revenue Service: n1027Document1 pageUS Internal Revenue Service: n1027IRSNo ratings yet

- 21 Tax Compliance Charts - Tax Print AY.16-17Document32 pages21 Tax Compliance Charts - Tax Print AY.16-17ImranMamajiwalaNo ratings yet

- Master Input Sheet: InputsDocument37 pagesMaster Input Sheet: Inputsminhthuc203No ratings yet

- Guidelines For Purchase of Four Wheelers From CSD Entitlement For Four Wheelers:-Eligibility Category CC PeriodicityDocument2 pagesGuidelines For Purchase of Four Wheelers From CSD Entitlement For Four Wheelers:-Eligibility Category CC PeriodicityhemanthNo ratings yet

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- Quotation Plus Trading Far East 2024Document1 pageQuotation Plus Trading Far East 2024mywahyuadit10No ratings yet

- 5paisa Capital Limited: Contract Note No. 0004658086Document2 pages5paisa Capital Limited: Contract Note No. 0004658086Bs20mscph013No ratings yet

- 2.75 Op ManualDocument76 pages2.75 Op ManualSedat TopcuNo ratings yet

- Finance Committee Mtg. (2/23/2015)Document7 pagesFinance Committee Mtg. (2/23/2015)Robin OdaNo ratings yet

- IA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxDocument2 pagesIA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxbolinagNo ratings yet

- F o R o Ffi C IDocument4 pagesF o R o Ffi C Iapi-26168972No ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- RajasthanDocument5 pagesRajasthanrahul srivastavaNo ratings yet

- February 23 CommitteeDocument14 pagesFebruary 23 CommitteeRobin OdaNo ratings yet

- Baba Markting Form Vat 240 2010-2011Document5 pagesBaba Markting Form Vat 240 2010-2011arunupadhyaNo ratings yet

- Quotatian RUSH 1.5 G ATDocument1 pageQuotatian RUSH 1.5 G ATmywahyuadit10No ratings yet

- MTR 6 PT Excel FormatDocument5 pagesMTR 6 PT Excel FormatJOYSON NOEL DSOUZANo ratings yet

- 2 Gcno Numeric 8 The Unique Number Given For Every Trip (Trip Sheet Number)Document3 pages2 Gcno Numeric 8 The Unique Number Given For Every Trip (Trip Sheet Number)IndrajitNo ratings yet

- Applij: Cover Page 0Document20 pagesApplij: Cover Page 0api-209261981No ratings yet

- Reconciling 2b Invoices For PaymentDocument3 pagesReconciling 2b Invoices For Paymentapi-279228567No ratings yet

- Application For Exemption of Customs DutyDocument10 pagesApplication For Exemption of Customs DutyFahad BataviaNo ratings yet

- Chennai Port Trust: Stores Department Tender FormDocument8 pagesChennai Port Trust: Stores Department Tender FormnlotasNo ratings yet

- 2021 Preventive Maintenance Service RFQ and TORDocument7 pages2021 Preventive Maintenance Service RFQ and TORrobotmatinoNo ratings yet

- Brief Presentation: V.I.P. Very Important PassengersDocument8 pagesBrief Presentation: V.I.P. Very Important PassengerssrtempNo ratings yet

- Annual Statistical Supplement: 2011 EditionDocument44 pagesAnnual Statistical Supplement: 2011 EditionRamiroRNo ratings yet

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- Periodic Stock StatementDocument2 pagesPeriodic Stock StatementAs IfNo ratings yet

- Fill Able Form 4507Document2 pagesFill Able Form 4507totololo78No ratings yet

- International Fuel Tax Agreement (Ifta) Tax Return: Reset PrintDocument4 pagesInternational Fuel Tax Agreement (Ifta) Tax Return: Reset Printmarypriya_1984No ratings yet

- 35 Unit1128.invDocument4 pages35 Unit1128.invLaxmikant JoshiNo ratings yet

- ACTDocument3 pagesACTNgô Lan TườngNo ratings yet

- 130 U 3Document2 pages130 U 3Juan Escobar JuncalNo ratings yet

- Shock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandShock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Interior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandInterior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

OTS TSF Return Form v02 PDF

OTS TSF Return Form v02 PDF

Uploaded by

amirhdlOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OTS TSF Return Form v02 PDF

OTS TSF Return Form v02 PDF

Uploaded by

amirhdlCopyright:

Available Formats

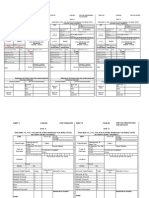

ONTARIO TIRE STEWARDSHIP (OTS) TIRE STEWARDSHIP FEE RETURN

Registrant Name (Legal Name) Registration Number

TSF v02

Reporting Period (Calendar month in which tire sales occurred)

Due Date The TSF Return and related payment are due at the end of the month following the Reporting Period. Interest is payable on all overdue amounts. A Return must be submitted for every month, even if there were no TSF applicable supply in the Reporting Period.

SUPPLY OF TIRES & TSFs IN REPORTING PERIOD Tire Types* # Tires TSF Rate *(Definitions are available at Supplied Per Tire www.ontarioTS.ca)

Passenger & Light Truck Tires Medium Truck Tires Agricultural Drive and Logger Skidder Tires Small and Large Industrial tires Small OTR Tires Medium OTR Tires Large OTR Tires Giant OTR Tires X X X X X X X X

$ TSF Due

$ 5.84 = $14.65 = $15.29 = $12.51 = $22.24 = $97.30 = $104.25= $250.20=

, , , , , , , , , , , , ,

, , , , , , , , ,

. . . . . . . . . . . . .

TOTAL TSF DUE HST @ 13% Penalties (Pen.) Interest (Int.) TOTAL REMITTANCE PAYABLE (TSFs + HST + Pen. + Int.)

WHERE TO REMIT:

, , , ,

A cheque or money order for the total amount should be made payable to Ontario Tire Stewardship, attached to this TSF Return, and forwarded to the following address: Ontario Tire Stewardship , Attention: TSF Processing Unit 405 The West Mall, Suite 500, Toronto, Ontario, M9C 5K7 Note: Nil Returns can be faxed to 1-866-884-7372 (8-ONT-TIRES-2) CERTIFICATION: I certify that the amounts indicated above are the amounts of the Tire Stewardship Fees that I am required to remit for the reporting period indicated. OTS is entitled to examine my records relating to supply of new tires and remittance of the Tire Stewardship Fees.

Authorized signature: _________________________________________ Date:

_________ / ____________ / _________

Day Month Year

HST # 874044803

You might also like

- Vehicle Registration FormDocument2 pagesVehicle Registration FormLachlanNo ratings yet

- Form A1Document2 pagesForm A1api-370689094% (16)

- Filing Instructions: Please Follow These Instructions CarefullyDocument4 pagesFiling Instructions: Please Follow These Instructions CarefullyMafer ChavezNo ratings yet

- File 1Document3 pagesFile 1Girijadevi Kalpakkam RamamurthiNo ratings yet

- Sub: Formal Order For Supply of Tyre, Tube & Flap: ECL/PUR/41413013/E/LV Tyre/033 Opened On 18.06.2014Document4 pagesSub: Formal Order For Supply of Tyre, Tube & Flap: ECL/PUR/41413013/E/LV Tyre/033 Opened On 18.06.2014Ataa AssaadNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Certificate of Estimated Property Tax Millage RateDocument2 pagesCertificate of Estimated Property Tax Millage RateRobin OdaNo ratings yet

- Automated Refund of An Electronic Ticket)Document4 pagesAutomated Refund of An Electronic Ticket)AHMED ALRADAEENo ratings yet

- New Vehicle Purchase Agreement: For: Greg TedfordDocument7 pagesNew Vehicle Purchase Agreement: For: Greg TedfordGreg TedfordNo ratings yet

- Income Tax Chart 2016-17Document1 pageIncome Tax Chart 2016-17Basavaraju K R100% (1)

- 9706 w10 QP 41Document8 pages9706 w10 QP 41Diksha KoossoolNo ratings yet

- Carriers Account Application GTT 072621Document17 pagesCarriers Account Application GTT 072621messiNo ratings yet

- ONETT For Sale of Real Property Classified As Ordinary AssetDocument1 pageONETT For Sale of Real Property Classified As Ordinary Assetd-fbuser-49417072No ratings yet

- CSD Guidelines - 4 WheelerDocument2 pagesCSD Guidelines - 4 WheelerkapsicumadNo ratings yet

- Scrap Tire Shredding InformationDocument10 pagesScrap Tire Shredding InformationOscar VmartínezNo ratings yet

- Return Review Letter 2019 11 14 09 07 35 944Document3 pagesReturn Review Letter 2019 11 14 09 07 35 944Waqar Alam KhanNo ratings yet

- GST Guide For Motor Traders - FinalDocument33 pagesGST Guide For Motor Traders - FinalSamuel YeongNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Dealer VIN: Order Type Ramp Code Batch ID Price LevelDocument12 pagesDealer VIN: Order Type Ramp Code Batch ID Price LevelFRISCONo ratings yet

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Document6 pages"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855No ratings yet

- New Vehicle Registration ProceedureDocument3 pagesNew Vehicle Registration ProceedureParfact ENo ratings yet

- Mobile Services: Your Account SummaryDocument41 pagesMobile Services: Your Account SummaryPranav JhaNo ratings yet

- National Aluminium Company Limited: (Purchase Dept)Document19 pagesNational Aluminium Company Limited: (Purchase Dept)Hytech Pvt. Ltd.No ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Tire Exces TaxDocument14 pagesTire Exces Taxw uNo ratings yet

- US Internal Revenue Service: n1027Document1 pageUS Internal Revenue Service: n1027IRSNo ratings yet

- 21 Tax Compliance Charts - Tax Print AY.16-17Document32 pages21 Tax Compliance Charts - Tax Print AY.16-17ImranMamajiwalaNo ratings yet

- Master Input Sheet: InputsDocument37 pagesMaster Input Sheet: Inputsminhthuc203No ratings yet

- Guidelines For Purchase of Four Wheelers From CSD Entitlement For Four Wheelers:-Eligibility Category CC PeriodicityDocument2 pagesGuidelines For Purchase of Four Wheelers From CSD Entitlement For Four Wheelers:-Eligibility Category CC PeriodicityhemanthNo ratings yet

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- Quotation Plus Trading Far East 2024Document1 pageQuotation Plus Trading Far East 2024mywahyuadit10No ratings yet

- 5paisa Capital Limited: Contract Note No. 0004658086Document2 pages5paisa Capital Limited: Contract Note No. 0004658086Bs20mscph013No ratings yet

- 2.75 Op ManualDocument76 pages2.75 Op ManualSedat TopcuNo ratings yet

- Finance Committee Mtg. (2/23/2015)Document7 pagesFinance Committee Mtg. (2/23/2015)Robin OdaNo ratings yet

- IA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxDocument2 pagesIA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxbolinagNo ratings yet

- F o R o Ffi C IDocument4 pagesF o R o Ffi C Iapi-26168972No ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- RajasthanDocument5 pagesRajasthanrahul srivastavaNo ratings yet

- February 23 CommitteeDocument14 pagesFebruary 23 CommitteeRobin OdaNo ratings yet

- Baba Markting Form Vat 240 2010-2011Document5 pagesBaba Markting Form Vat 240 2010-2011arunupadhyaNo ratings yet

- Quotatian RUSH 1.5 G ATDocument1 pageQuotatian RUSH 1.5 G ATmywahyuadit10No ratings yet

- MTR 6 PT Excel FormatDocument5 pagesMTR 6 PT Excel FormatJOYSON NOEL DSOUZANo ratings yet

- 2 Gcno Numeric 8 The Unique Number Given For Every Trip (Trip Sheet Number)Document3 pages2 Gcno Numeric 8 The Unique Number Given For Every Trip (Trip Sheet Number)IndrajitNo ratings yet

- Applij: Cover Page 0Document20 pagesApplij: Cover Page 0api-209261981No ratings yet

- Reconciling 2b Invoices For PaymentDocument3 pagesReconciling 2b Invoices For Paymentapi-279228567No ratings yet

- Application For Exemption of Customs DutyDocument10 pagesApplication For Exemption of Customs DutyFahad BataviaNo ratings yet

- Chennai Port Trust: Stores Department Tender FormDocument8 pagesChennai Port Trust: Stores Department Tender FormnlotasNo ratings yet

- 2021 Preventive Maintenance Service RFQ and TORDocument7 pages2021 Preventive Maintenance Service RFQ and TORrobotmatinoNo ratings yet

- Brief Presentation: V.I.P. Very Important PassengersDocument8 pagesBrief Presentation: V.I.P. Very Important PassengerssrtempNo ratings yet

- Annual Statistical Supplement: 2011 EditionDocument44 pagesAnnual Statistical Supplement: 2011 EditionRamiroRNo ratings yet

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- Periodic Stock StatementDocument2 pagesPeriodic Stock StatementAs IfNo ratings yet

- Fill Able Form 4507Document2 pagesFill Able Form 4507totololo78No ratings yet

- International Fuel Tax Agreement (Ifta) Tax Return: Reset PrintDocument4 pagesInternational Fuel Tax Agreement (Ifta) Tax Return: Reset Printmarypriya_1984No ratings yet

- 35 Unit1128.invDocument4 pages35 Unit1128.invLaxmikant JoshiNo ratings yet

- ACTDocument3 pagesACTNgô Lan TườngNo ratings yet

- 130 U 3Document2 pages130 U 3Juan Escobar JuncalNo ratings yet

- Shock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandShock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Interior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandInterior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet