Professional Documents

Culture Documents

Balance Sheet Is "Stock" (As Of) Other Statements Are "Flow" (Through Time) When Analyzing, Keep "Unusual Events" in Mind"

Balance Sheet Is "Stock" (As Of) Other Statements Are "Flow" (Through Time) When Analyzing, Keep "Unusual Events" in Mind"

Uploaded by

kegnataOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet Is "Stock" (As Of) Other Statements Are "Flow" (Through Time) When Analyzing, Keep "Unusual Events" in Mind"

Balance Sheet Is "Stock" (As Of) Other Statements Are "Flow" (Through Time) When Analyzing, Keep "Unusual Events" in Mind"

Uploaded by

kegnataCopyright:

Available Formats

2-1

NOTES Balance Sheet is Stock (as of)

Other Statements are Flow (through time)

When analyzing, keep unusual events in mind

2-2

What effect did the expansion have on net operating working capital (NOWC)?

NonNonNOW = interest interest C bearing CA bearing CL NOWC98 = ($7,282 + $632,160 + $1,287,360) - ($524,160 + $489,600) = $913,042. NOWC97 = $793,800.

2-3

What effect did the expansion have on capital used in operations? Operating capital = NOWC + Net fixed assets. Operating = $913,042 + $939,790 capital98 = $1,852,832. Operating = $1,138,600. capital97

2-4

Did the expansion create additional net operating profit after taxes (NOPAT)?

NOPAT = EBIT(1 - Tax rate)

NOPAT98 = -$690,560(1 - 0.4) = -$690,560(0.6) = -$414,336.

NOPAT97= $125,460.

2-5

What is your initial assessment of the expansions effect on operations?

Sales NOPAT NOWC

1998 1997 $5,834,400 $3,432,000 ($414,336) $125,460 $913,042 $793,800

Operating capital$1,852,832 $1,138,600

2-6

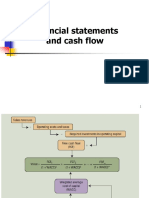

What effect did the companys expansion have on its net cash flow and operating cash flow?

NCF98 = NI + DEP =$519,936 + $116,960 NCF97 = -$402,976. $87,960 + $18,900 = $106,860. OCF = NOPAT + DEP 98 = -$414,336 + $116,960 = -$297,376. OCF97 = $125,460 + $18,900 = $144,360.

2-7

What was the free cash flow (FCF) for 1998? FCF = NOPAT - Net capital investment = -$414,336 - ($1,852,832 $1,138,600) = -$414,336 - $714,232 = -$1,128,568. How do you suppose investors reacted?

2-8

What is the companys EVA? Assume the firms after-tax cost of capital (COC) was 11% in 1997 and 13% in 1998.

EVA98 = NOPAT- (COC)(Capital) = -$414,336 (0.13)($1,852,832) = -$414,336 - $240,868 = -$655,204. EVA97 = $125,460 - (0.11)($1,138,600) = $125,460 - $125,246 = $214.

2-9

Would you conclude that the expansion increased or decreased MVA? Market value Equity capital MVA = of equity supplied . During the last year stock price has decreased 73%, so market value of equity has declined. Consequently, MVA has declined.

2 - 10

Does the company pay its suppliers on time?

Probably not. A/P increased 260% over the past year, while sales increased by only 70%. If this continues, suppliers may cut off trade credit.

2 - 11

Does it appear that the sales price exceeds the cost per unit sold?

No, the negative NOPAT shows that the company is spending more on its operations than it is taking in.

2 - 12

What effect would each of these actions have on the cash account?

1. The company offers 60-day credit terms. The improved terms are matched by its competitors, so sales remain constant. A/R would Cash would

2 - 13

2. Sales double as a result of the change in credit terms. Short-run: Inventory and fixed assets to meet increased sales. A/R , Cash . Company may have to seek additional financing. Long-run: Collections increase and the companys cash position would improve.

2 - 14

How was the expansion financed?

The expansion was financed primarily with external capital.

The company issued long-term debt which reduced its financial strength and flexibility.

2 - 15

Would external capital have been required if they had broken even in 1998 (Net income = 0)?

Yes, the company would still have to finance its increase in assets.

2 - 16

What happens if fixed assets are depreciated over 7 years (as opposed to the current 10 years)?

No effect on physical assets. Fixed assets on balance sheet would decline. Net income would decline. Tax payments would decline. Cash position would improve.

2 - 17

Other policies that affect financial statements

Inventory valuation methods. Capitalization of R&D expenses. Policies for funding the companys retirement plan.

2 - 18

Does the companys positive stock price ($2.25), in the face of large losses, suggest that investors are irrational?

Common stock has limited liability. Therefore, it can never have a negative value. If it is expected to produce future cash flows, it will have a positive value.

2 - 19

Why did the stock price fall after the dividend was cut?

Management was signaling that the firms operations were in trouble. The dividend cut lowered investors expectations for future cash flows, which caused the stock price to decline.

2 - 20

What were some other sources of financing used in 1998?

Selling financial assets: Short term investments decreased by $48,600. Bank loans: Notes payable increased by $520,000. Credit from suppliers: A/P increased by $378,560. Employees: Accruals increased by $353,600.

2 - 21

What is the effect of the $346,624 tax credit received in 1998.

This suggests the company paid at least $346,624 in taxes during the past 2 years. If the payments over the past 2 years were less than $346,624 the firm would have had to carry forward the amount of its loss that was not carried back. If the firm did not receive a full refund its cash position would be even worse.

2 - 22

Got questions?

Get answers!!

Email: Voicemail: (404) 651-2691 chodges@gsu.edu Electronic Bulletin Board:

http://www-cba.gsu.edu/ ~wwwfin/finconf/finba862/finba862.html

You might also like

- Running Head: A Financial Forecast For New World Chemicals IncDocument9 pagesRunning Head: A Financial Forecast For New World Chemicals IncTimNo ratings yet

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- Advanced Corporate Finance PPT About The Agency Problems and Dividends Policy Around The World. by Waqas HmaidiDocument36 pagesAdvanced Corporate Finance PPT About The Agency Problems and Dividends Policy Around The World. by Waqas HmaidiWaqas D. HamidiNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument40 pagesFinancial Statements, Cash Flow, and TaxesKamran Ali AnsariNo ratings yet

- CH 02Document30 pagesCH 02AhsanNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument30 pagesFinancial Statements, Cash Flow, and TaxesSumitMadnaniNo ratings yet

- ch02 Financial Statement, Cash Flows and TaxesDocument30 pagesch02 Financial Statement, Cash Flows and TaxesAffan AhmedNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument29 pagesFinancial Statements, Cash Flow, and TaxesHooriaKhanNo ratings yet

- Chapter 02Document19 pagesChapter 02armanchowdhury651No ratings yet

- Financial Planning and Forecasting: Pro Forma Financial StatementsDocument8 pagesFinancial Planning and Forecasting: Pro Forma Financial StatementsLevi Lazareno EugenioNo ratings yet

- NOPAT NOPAT2011 - NOPAT20010 (Note ' MeansDocument5 pagesNOPAT NOPAT2011 - NOPAT20010 (Note ' MeansBryan LluismaNo ratings yet

- Cash Flows - Part II: Analysing The Cash Flow Statement: DirectorDocument5 pagesCash Flows - Part II: Analysing The Cash Flow Statement: DirectorRaniNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument42 pagesInvesting and Financing Decisions and The Balance SheetNahla Ali HassanNo ratings yet

- Investment Analysis and Portfolio Management 2012Document61 pagesInvestment Analysis and Portfolio Management 2012Nelson Ivan Acosta100% (1)

- Chap 002Document24 pagesChap 002samina aliNo ratings yet

- Chapter 2 Buiness FinanxceDocument38 pagesChapter 2 Buiness FinanxceShajeer HamNo ratings yet

- Chapter 03Document29 pagesChapter 03andi.w.rahardjoNo ratings yet

- FinMan - Case #1Document3 pagesFinMan - Case #1Shaula Tan SombilonNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument36 pagesFinancial Statements, Cash Flow, and TaxesHussainNo ratings yet

- Dividend Assessment: The Cash - Trust NexusDocument13 pagesDividend Assessment: The Cash - Trust NexusAnshik BansalNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument43 pagesFinancial Statements, Cash Flow, and TaxesshimulNo ratings yet

- Working Capital ManagementDocument39 pagesWorking Capital ManagementMay-Ann EneroNo ratings yet

- Chapter 2Document35 pagesChapter 2Aimes AliNo ratings yet

- Ceres Gardening Company Submission TemplateDocument8 pagesCeres Gardening Company Submission TemplateDeepika ChandrashekarNo ratings yet

- Financial AccountingDocument9 pagesFinancial AccountingRiya DhanukaNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- 04 FM 9Document8 pages04 FM 9Lam Wai KitNo ratings yet

- Topic 5 - Financial PlanningDocument41 pagesTopic 5 - Financial Planninghachimaai0511No ratings yet

- Financial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinDocument24 pagesFinancial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinMd Musa PatoaryNo ratings yet

- ' Chapter 2 Lecture Notes STUDENTS SEPT 2023Document19 pages' Chapter 2 Lecture Notes STUDENTS SEPT 2023evelyngoveaNo ratings yet

- Clase 1 Casos en Finanzas UDDDocument35 pagesClase 1 Casos en Finanzas UDDJuan Gallegos M.No ratings yet

- Analytical Issues in Financial AccountingDocument33 pagesAnalytical Issues in Financial AccountingSwathi AshokNo ratings yet

- Solution For The Analysis and Use of Financial Statements White G Ch03Document50 pagesSolution For The Analysis and Use of Financial Statements White G Ch03Tamim Rahman0% (1)

- Tugas FM FuzzyTronicDocument7 pagesTugas FM FuzzyTronicAnggit Tut PinilihNo ratings yet

- Solution For The Analysis and Use of Financial Statements White G ch03Document48 pagesSolution For The Analysis and Use of Financial Statements White G ch03twinkle goyalNo ratings yet

- Corporate Finances Problems Solutions Ch.18Document9 pagesCorporate Finances Problems Solutions Ch.18Egzona FidaNo ratings yet

- Accounting For Financial ManagementDocument42 pagesAccounting For Financial ManagementTIDURLANo ratings yet

- 032431986X 104971Document5 pages032431986X 104971Nitin JainNo ratings yet

- Shahnai - 2279 - 4080 - 1 - Chap 2 Financial Planning & ForecastingDocument48 pagesShahnai - 2279 - 4080 - 1 - Chap 2 Financial Planning & ForecastingShahzad C7No ratings yet

- Working Capital ManagementDocument41 pagesWorking Capital ManagementsadfiziaNo ratings yet

- CH 3 - Financial Statements, Cash FlowDocument48 pagesCH 3 - Financial Statements, Cash Flowssierras1No ratings yet

- Submitted To: Hashem M Khaiyyum (KHM) Lecturer Department of Finance and Accounting School of Business North South UniversityDocument5 pagesSubmitted To: Hashem M Khaiyyum (KHM) Lecturer Department of Finance and Accounting School of Business North South UniversitySamin ChowdhuryNo ratings yet

- Question # 1. "The Success and Failure of A Corporation Depends On The Relationship Between ItsDocument5 pagesQuestion # 1. "The Success and Failure of A Corporation Depends On The Relationship Between ItsQavi ShaikhNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakpurnamaNo ratings yet

- Tugas Studi Kasus AKM1 Kelompok 4Document4 pagesTugas Studi Kasus AKM1 Kelompok 4Marchelino GirothNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument105 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinVKrishna Kilaru100% (2)

- UNSW Business School School of Accounting ACCT1501 Accounting and Financial Management 1A Term 1 2020Document4 pagesUNSW Business School School of Accounting ACCT1501 Accounting and Financial Management 1A Term 1 2020hvk;h ;No ratings yet

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- Chap002 RWJ PrintedDocument38 pagesChap002 RWJ Printedmohamed ashorNo ratings yet

- CH #3Document7 pagesCH #3Waleed Ayaz UtmanzaiNo ratings yet

- Dev Financial Analysis-2Document8 pagesDev Financial Analysis-2Adam BelmekkiNo ratings yet

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersamsa100% (1)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Factors For Successful Development of Farmer Cooperatives in Northwest ChinaDocument16 pagesFactors For Successful Development of Farmer Cooperatives in Northwest ChinakegnataNo ratings yet

- 9 M S of Management PDFDocument76 pages9 M S of Management PDFkegnata60% (5)

- PP20-Bond Portfolio Management (V1)Document21 pagesPP20-Bond Portfolio Management (V1)kegnataNo ratings yet

- Public FinanceDocument1 pagePublic FinancekegnataNo ratings yet

- The Capital Asset Pricing Model (Chapter 8)Document47 pagesThe Capital Asset Pricing Model (Chapter 8)kegnataNo ratings yet

- MicrofinanceDocument60 pagesMicrofinancekristokunsNo ratings yet

- The More Import Tables SAPDocument9 pagesThe More Import Tables SAPvicearellanoNo ratings yet

- Prudential Bank v. Don A. Alviar, Et AlDocument14 pagesPrudential Bank v. Don A. Alviar, Et AlMarielNo ratings yet

- Dear Neighbor Letter (Re PBA)Document2 pagesDear Neighbor Letter (Re PBA)AmityvilleFirstPartyNo ratings yet

- How To Survive Financially As A Single Mom - Clever Girl FinanceDocument27 pagesHow To Survive Financially As A Single Mom - Clever Girl FinanceBarely LegalNo ratings yet

- 4 2 Technical Analysis Fibonacci PDFDocument11 pages4 2 Technical Analysis Fibonacci PDFDis JovscNo ratings yet

- Invoice 43904700Document1 pageInvoice 43904700Sandra IvanovićNo ratings yet

- Monetory and FiscalDocument2 pagesMonetory and FiscalMosNo ratings yet

- Contrasting Lean Accounting With Traditional Standard CostingDocument1 pageContrasting Lean Accounting With Traditional Standard CostingAxl BenaventeNo ratings yet

- PJJ Discussion 3 BsiDocument3 pagesPJJ Discussion 3 BsiMultimediaNo ratings yet

- Management of Transaction ExposureDocument10 pagesManagement of Transaction ExposuredediismeNo ratings yet

- Internship Report at Janata BankDocument34 pagesInternship Report at Janata BankFaysalAminTamim0% (1)

- 0452 s12 Ms 12Document7 pages0452 s12 Ms 12Faisal RaoNo ratings yet

- Aligning Carbon Pricing With National Priorities of Pakistan. Saadullah AyazDocument16 pagesAligning Carbon Pricing With National Priorities of Pakistan. Saadullah AyazSaadullah AyazNo ratings yet

- BBBBBDocument8 pagesBBBBBAlvira FajriNo ratings yet

- Deed of Consent - PlatformDocument43 pagesDeed of Consent - PlatformYonca YalçınNo ratings yet

- State Bank of Hyderabad Annual Report PDF - 2018 2019 EduVarkDocument10 pagesState Bank of Hyderabad Annual Report PDF - 2018 2019 EduVarknagarajanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDr V SaptagiriNo ratings yet

- Ifrs 15Document99 pagesIfrs 15Eddie MutizwaNo ratings yet

- Sanjay Case Study 2017 QsDocument3 pagesSanjay Case Study 2017 QsIBBF FitnessNo ratings yet

- Affidavit of 2 Disinterested People SssDocument3 pagesAffidavit of 2 Disinterested People SssEMMA DE VERANo ratings yet

- Gtu Mba 4549221 Summer 2023Document2 pagesGtu Mba 4549221 Summer 2023suvagiyaamisha16No ratings yet

- The Binomial Option Pricing Model (BOPM) : ©david Dubofsky and 17-1 Thomas W. Miller, JRDocument29 pagesThe Binomial Option Pricing Model (BOPM) : ©david Dubofsky and 17-1 Thomas W. Miller, JRrohanjha007No ratings yet

- TicketDocument4 pagesTicketMohamed EbrahimNo ratings yet

- 800 Super - Media Release On Award of NEA Contract - South West IPCDocument2 pages800 Super - Media Release On Award of NEA Contract - South West IPCtheredcornerNo ratings yet

- Certified Expert in ESG and Impact Investing 2022Document4 pagesCertified Expert in ESG and Impact Investing 2022Amit PNo ratings yet

- Commercial InvoiceDocument2 pagesCommercial InvoiceRogério FariasNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignment1954032027cucNo ratings yet

- Multiple Choice Questions On Financial Accounting V2Document6 pagesMultiple Choice Questions On Financial Accounting V2Kate FernandezNo ratings yet

- P35 Late Payment Charge in Islamic Bank Ezani1Document6 pagesP35 Late Payment Charge in Islamic Bank Ezani1Ana FienaNo ratings yet