Professional Documents

Culture Documents

Classification of Cost

Classification of Cost

Uploaded by

Rizve AhmedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classification of Cost

Classification of Cost

Uploaded by

Rizve AhmedCopyright:

Available Formats

1.1.

CLASSIFICATION OF COST

Cost classification is the process of grouping costs according to their common features. Costs are to be classified in such a manner that they are identified with cost center or cost unit. ON THE BASIS OF BEHAVIOUR OF COST Behavior means change in cost due to change in output. On the basis of behavior cost is classified into the following categories: a) Fixed cost b) Variable cost c) Semi-variable cost ON THE BASIS OF ELEMENTS OF COST a) Direct material b) Direct labor or direct wages c) Direct expenses or chargeable expenses d) Indirect cost e) Indirect material f) Indirect labor g) Indirect expenses

1.2. ON THE BASIS OF BEHAVIOUR OF COST

Fixed cost It is that portion of the total cost which remains constant irrespective of the output upto capacity limit. It is called as a period cost as it is concerned with period. It depends upon the passage of time. It is also referred to as non-variable cost or stand by cost, capacity cost or period cost. It tends to be unaffected by variations in output. These costs provide conditions for production rather than costs of production. They are created by contractual obligations and managerial decisions. Rent of premises, taxes and insurance, staff salaries constitute fixed cost. Variable cost This cost varies according to the output. In other words, it is a cost which changes according to the changes in output. It tends to vary in direct proportion to output. If the output is decreased, variable cost also will decrease. It is concerned with output or product. Therefore, it is called as a product cost. If the output is doubled, variable cost will also be doubled. For example, direct material, direct labor, direct expenses and variable overheads. It is shown in the diagram below.

Semi-variable cost This is also referred to as semi-fixed or partly variable cost. It remains constant up to a certain level and registers change afterwards. These costs vary in some degree with volume but not in direct or same proportion. Such costs are fixed only in relation to specified constant conditions. For example, repairs and maintenance of machinery, telephone charges, supervision professional tax, etc.

You might also like

- Acca Paper 1.2Document25 pagesAcca Paper 1.2anon-280248No ratings yet

- Cost Classification or Cost Flow in An OrgaizationDocument8 pagesCost Classification or Cost Flow in An OrgaizationvaloruroNo ratings yet

- Accounting For Factory OverheadDocument21 pagesAccounting For Factory OverheadMirante DalapaNo ratings yet

- Classification of Costs - TutorialDocument1 pageClassification of Costs - TutorialAnimesh MayankNo ratings yet

- Business Environment - Classification of CostDocument12 pagesBusiness Environment - Classification of Costanurabi796No ratings yet

- Classification of CostsDocument10 pagesClassification of CostsChristine Marie RamirezNo ratings yet

- Cost Accounting PPT FinalDocument47 pagesCost Accounting PPT FinalAkanksha GuptaNo ratings yet

- Cost Classification and Segregation: Various Classifications/Concepts of CostsDocument6 pagesCost Classification and Segregation: Various Classifications/Concepts of CostsGilner PomarNo ratings yet

- Classification of CostDocument33 pagesClassification of CostGeet SharmaNo ratings yet

- Classification of Cost PPT-2Document51 pagesClassification of Cost PPT-2Ashi AhmedNo ratings yet

- CHAPTER 2 - Cost Concept and Cost Behavior AnalysisDocument8 pagesCHAPTER 2 - Cost Concept and Cost Behavior AnalysisMaria Elliane Querubin RosalesNo ratings yet

- Cost I Exit SummaryDocument92 pagesCost I Exit Summarykeyruebrahim44No ratings yet

- Elements of Cost and Cost Sheet - FYBBA-IBDocument25 pagesElements of Cost and Cost Sheet - FYBBA-IBSakuraNo ratings yet

- Chapter 2Document17 pagesChapter 2Ngọc Minh Đỗ ChâuNo ratings yet

- DSFDFJM LLKDocument27 pagesDSFDFJM LLKDeepak R GoradNo ratings yet

- Session Objectives:: Different Basis For Classification ofDocument12 pagesSession Objectives:: Different Basis For Classification ofOmkar Reddy PunuruNo ratings yet

- Jyoti CA AsignmtDocument17 pagesJyoti CA AsignmtjyotirbkgmailcomNo ratings yet

- Costing: Prepared By: Dr. B. K. MawandiyaDocument26 pagesCosting: Prepared By: Dr. B. K. MawandiyaNamanNo ratings yet

- CH 14 Cost BehaviorDocument11 pagesCH 14 Cost BehaviorMark ScottNo ratings yet

- Lecture Notes 1Document8 pagesLecture Notes 1Bhavya ShettyNo ratings yet

- Chapter 2Document18 pagesChapter 2Hk100% (1)

- CostDocument33 pagesCostversmajardoNo ratings yet

- Chapter 2Document10 pagesChapter 2Aklil TeganewNo ratings yet

- Fixed Cost: Expenses Variable CostsDocument6 pagesFixed Cost: Expenses Variable CostsAjay TiwariNo ratings yet

- Pre-Study Session 4Document10 pagesPre-Study Session 4Narendralaxman ReddyNo ratings yet

- Cost Volume Profit AnalysisDocument32 pagesCost Volume Profit AnalysisADILLA ADZHARUDDIN100% (1)

- Cost Concepts and ClassificationDocument54 pagesCost Concepts and ClassificationShubham KumarNo ratings yet

- Cost Account 01Document6 pagesCost Account 01mika piusNo ratings yet

- Marginal CostingDocument17 pagesMarginal CostingGovind PrajapatiNo ratings yet

- Cost Behavior - Analysis and Use-1Document83 pagesCost Behavior - Analysis and Use-1Sabbir ZisNo ratings yet

- Cost Ch. IIDocument83 pagesCost Ch. IIMagarsaa AmaanNo ratings yet

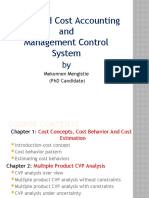

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunNo ratings yet

- Marginal CostingDocument16 pagesMarginal CostingShainaNo ratings yet

- Unit 1 Section 5Document4 pagesUnit 1 Section 5Babamu Kalmoni JaatoNo ratings yet

- Full Cost AccountingDocument27 pagesFull Cost AccountingMarjorie OndevillaNo ratings yet

- Classification of Cost. (ODA, ODAIT, ODFB&ODEF)Document4 pagesClassification of Cost. (ODA, ODAIT, ODFB&ODEF)rofoba6609No ratings yet

- Classification of CostDocument9 pagesClassification of CostJefry JosephNo ratings yet

- Cost Management and ReportingDocument60 pagesCost Management and Reportingmonkey beanNo ratings yet

- Cost Concepts: Cost: Lecture Notes On Module-2Document18 pagesCost Concepts: Cost: Lecture Notes On Module-2ramanarao susarlaNo ratings yet

- BBA211 Vol2 CostTerminologiesDocument13 pagesBBA211 Vol2 CostTerminologiesAnisha SarahNo ratings yet

- Group 5: Break-Even Analysis Is A Method of Studying The Relationship Among SalesDocument6 pagesGroup 5: Break-Even Analysis Is A Method of Studying The Relationship Among SalesvidaNo ratings yet

- Cost ConceptsDocument5 pagesCost Conceptssyed HassanNo ratings yet

- Cost ClassificationDocument30 pagesCost ClassificationnehaNo ratings yet

- Notes Chapter IDocument6 pagesNotes Chapter Iadiebeduya53No ratings yet

- New MicrosoftDocument16 pagesNew MicrosoftarpanavsNo ratings yet

- MAC 1 Chapter 2 Costs Concepts and ClassificationDocument54 pagesMAC 1 Chapter 2 Costs Concepts and ClassificationABMAYALADANO ,ErvinNo ratings yet

- CHAPTER I Lecture NoteDocument12 pagesCHAPTER I Lecture NotegereNo ratings yet

- Module 8: Introduction To Cost Accounting Lecture 1: Introduction To Cost Accounting Objectives in This Lecture You Will Learn The FollowingDocument5 pagesModule 8: Introduction To Cost Accounting Lecture 1: Introduction To Cost Accounting Objectives in This Lecture You Will Learn The FollowingJayesh ChopadeNo ratings yet

- Breakeven Analysis Notes For JkuatDocument20 pagesBreakeven Analysis Notes For Jkuatmoza salimNo ratings yet

- CHAPTER I Lecture NoteDocument20 pagesCHAPTER I Lecture NotegereNo ratings yet

- Cost ClassificationDocument9 pagesCost ClassificationPuneet TandonNo ratings yet

- Distinguish Between Marginal Costing and Absorption CostingDocument10 pagesDistinguish Between Marginal Costing and Absorption Costingmohamed Suhuraab50% (2)

- Module 1 - Review of Part 1Document6 pagesModule 1 - Review of Part 1Francis Ryan PorquezNo ratings yet

- Classification of Cost PDFDocument49 pagesClassification of Cost PDFPresident DyosaNo ratings yet

- CHAPTER I Lecture NoteDocument17 pagesCHAPTER I Lecture NoteKalkidan NigussieNo ratings yet

- Financial Vs Management AccountingDocument16 pagesFinancial Vs Management AccountingNishant SinghNo ratings yet

- Marginal Costing - DefinitionDocument15 pagesMarginal Costing - DefinitionShivani JainNo ratings yet

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- Cost & Management Accounting - Lec 2Document30 pagesCost & Management Accounting - Lec 2Agnes JosephNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet