Professional Documents

Culture Documents

Consolidated Balance Sheet of Holding Company Vs Subsidiary Company

Consolidated Balance Sheet of Holding Company Vs Subsidiary Company

Uploaded by

salehin1969Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Balance Sheet of Holding Company Vs Subsidiary Company

Consolidated Balance Sheet of Holding Company Vs Subsidiary Company

Uploaded by

salehin1969Copyright:

Available Formats

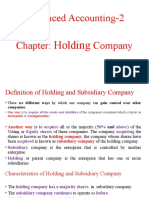

Consolidated balance sheet of Holding Company Vs Subsidiary Company's Balance Sheet Subsidiary company's balance sheet's assets and

liabilities will become the part of consolidated balance sheet of holding company. 1. All the liabilities of subsidiary company will be added in the consolidated balance sheet of subsidiary company. But Share capital of subsidiary company in holding company will not shown in the consolidated balance sheet in the books of holding company. Because, this share capital automatically adjust with the amount of the investment of holding company in to subsidiary company . 2. Add all the assets of subsidiary company with the assets of holding company. But Investment of holding company in Subsidiary company will not shown in consolidated balance sheet because, investment in subsidiary company will automatically adjust with the amount of share capital of subsidiary company in holding company. 3. Add minority interest in liability side. First of all we should know what minority interest is. Minority interest is the shareholder but there is not holding companys shareholder. So, when holding company shows consolidated balance sheet, it is the duty of accountant to show minority interest in the liability side of consolidated balance sheet. We can calculate minority interest with following formula Total share capital of Subsidiary company = XXXXX Less Investment of Holding company in to subsidiary company = - XXXX Add proportionate share of the subsidiary companys profit and Reserves or increase in the value of assets + XXXX Less proportionate share of the subsidiary companys loss and decrease In the value of total assets of company - XXXXX Value of Minority Interest XXXXX 4. All common transaction between holding company and subsidiary company will not show in the consolidated balance.

You might also like

- Kunci Jawaban Advance Accounting Chapter 3Document25 pagesKunci Jawaban Advance Accounting Chapter 3jiajia67% (6)

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Chapter 3 - 12thEDITIONDocument21 pagesChapter 3 - 12thEDITIONHyewon43% (7)

- Chp3 Advanced Acc Beams 11eDocument21 pagesChp3 Advanced Acc Beams 11eFelixNovendraNo ratings yet

- Beams AdvAcc11 ChapterDocument21 pagesBeams AdvAcc11 Chaptermd salehinNo ratings yet

- Consolidation TheoryDocument22 pagesConsolidation TheorySmruti RanjanNo ratings yet

- Consolidation TheoryDocument22 pagesConsolidation TheorySmruti RanjanNo ratings yet

- Consolidation of Financial Statements: Explanation With ExampleDocument6 pagesConsolidation of Financial Statements: Explanation With ExampleNishit ShahNo ratings yet

- Holding Company AccountsDocument8 pagesHolding Company AccountsHasnain MahmoodNo ratings yet

- Accounting For Investments in SubsidiariesDocument63 pagesAccounting For Investments in SubsidiariesSoledad Perez100% (2)

- Consolidations: Chapter-6Document54 pagesConsolidations: Chapter-6Ram KumarNo ratings yet

- Commerce Balance SheetDocument3 pagesCommerce Balance SheetVikas ChoudharyNo ratings yet

- Consolidation Model - Theory & ExampleDocument7 pagesConsolidation Model - Theory & Examplesubhash dalviNo ratings yet

- MCOM - Ac - Paper - IDocument542 pagesMCOM - Ac - Paper - IKaran BindraNo ratings yet

- On Holding Co.Document62 pagesOn Holding Co.Rahul SinhaNo ratings yet

- Tugas Chap 5Document3 pagesTugas Chap 5Elva RosNo ratings yet

- MCOM Sem 1 FA Project On Consolidated Financial StatementDocument27 pagesMCOM Sem 1 FA Project On Consolidated Financial StatementAnand Singh100% (5)

- How Do You Calculate Total Owners Equity?: How Owner's Equity Is Shown On A Balance SheetDocument4 pagesHow Do You Calculate Total Owners Equity?: How Owner's Equity Is Shown On A Balance SheetSaad kaleemNo ratings yet

- Distinguish Corporation, Partnership, and Sole Proprietorship in Terms ofDocument6 pagesDistinguish Corporation, Partnership, and Sole Proprietorship in Terms ofMarkyle De VeraNo ratings yet

- Consolidated Financial StatementDocument1 pageConsolidated Financial Statement1abd1212abdNo ratings yet

- Chapter 3 Advanced AccountingDocument23 pagesChapter 3 Advanced AccountingMarife De Leon VillalonNo ratings yet

- ch03, AccountingDocument27 pagesch03, AccountingEkta Saraswat Vig50% (2)

- Intercompany Inventory and Land Profits: Solutions Manual, Chapter 6Document40 pagesIntercompany Inventory and Land Profits: Solutions Manual, Chapter 6HelloWorldNowNo ratings yet

- Topic 5: Equity AccountingDocument9 pagesTopic 5: Equity AccountingaltonpoonNo ratings yet

- Ch03 Beams12ge SMDocument22 pagesCh03 Beams12ge SMWira Moki50% (2)

- Accounting For PartnershipDocument3 pagesAccounting For PartnershipafifahNo ratings yet

- Analyzing Investing Activities:: Special TopicsDocument40 pagesAnalyzing Investing Activities:: Special TopicsAbhishek PandaNo ratings yet

- Chapter Four AdvDocument23 pagesChapter Four AdvMisganu AyanaNo ratings yet

- Chapter Ten: Additional Consolidation Reporting Issues: 1. Consolidated Statement of Cash FlowDocument4 pagesChapter Ten: Additional Consolidation Reporting Issues: 1. Consolidated Statement of Cash FlowRizki AnnisaNo ratings yet

- Consolidation Finanacial StatementDocument38 pagesConsolidation Finanacial Statementsneha9121No ratings yet

- Practical 4 Preparation of Balance Sheet of Broiler in Chitwan District ObjectivesDocument16 pagesPractical 4 Preparation of Balance Sheet of Broiler in Chitwan District ObjectivesPurna DhanukNo ratings yet

- Acc201 Su5Document13 pagesAcc201 Su5Gwyneth LimNo ratings yet

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- MinorityDocument1 pageMinorityPak_4everNo ratings yet

- Accounting For Groups of CompaniesDocument9 pagesAccounting For Groups of CompaniesEmmanuel MwapeNo ratings yet

- FM Term Paper On Financial Statement AnalysisDocument8 pagesFM Term Paper On Financial Statement Analysisnahidctg100% (1)

- Accounting: Lecture 4.2 Associates & JVDocument14 pagesAccounting: Lecture 4.2 Associates & JVcynthiama7777No ratings yet

- Fabm2-3 Statement of Changes in EquityDocument24 pagesFabm2-3 Statement of Changes in EquityJacel GadonNo ratings yet

- Accounts of Holding CompaniesDocument16 pagesAccounts of Holding CompaniesNawab Ali Khan100% (1)

- What Is A Shareholder's EquityDocument4 pagesWhat Is A Shareholder's EquityblezylNo ratings yet

- ABM 12 - Accounting - Module 3 - SCEDocument4 pagesABM 12 - Accounting - Module 3 - SCEWella LozadaNo ratings yet

- Dundalk Centre Accounting For GroupsDocument26 pagesDundalk Centre Accounting For GroupsThéotime HabinezaNo ratings yet

- Lesson 36Document3 pagesLesson 36Abdul MananNo ratings yet

- Pages From Chapter 5 Associates and Joint VenturesDocument4 pagesPages From Chapter 5 Associates and Joint VenturesKiran FatimaNo ratings yet

- Holding CompaniesDocument23 pagesHolding CompaniesSumathi Ganeshan100% (1)

- Standalone VS Consolidated Vijay MalikDocument14 pagesStandalone VS Consolidated Vijay MalikHaardik GandhiNo ratings yet

- Presentation On Theme: "Holding Companies." - Presentation Transcript: Holding CompaniesDocument9 pagesPresentation On Theme: "Holding Companies." - Presentation Transcript: Holding CompanieskamalkavNo ratings yet

- AFA II UU Unit 2 Consolidation Date of Aquisition PDF ProtectedDocument24 pagesAFA II UU Unit 2 Consolidation Date of Aquisition PDF Protectednatnaelsleshi3No ratings yet

- Consolidation GAAPDocument77 pagesConsolidation GAAPMisganaw DebasNo ratings yet

- Chapter 4 - Ratio AnalysisDocument6 pagesChapter 4 - Ratio AnalysisLysss EpssssNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Ifrs Updates and Advanced Applications Seminar DecemberDocument1 pageIfrs Updates and Advanced Applications Seminar Decembersalehin1969No ratings yet

- Equity Method of AccountingDocument4 pagesEquity Method of Accountingsalehin1969No ratings yet

- 6847merger Acquisition DivisionDocument10 pages6847merger Acquisition Divisionsalehin1969No ratings yet

- Consolidation PDFDocument5 pagesConsolidation PDFsalehin1969No ratings yet

- Ex Right Issue PriceDocument6 pagesEx Right Issue Pricesalehin1969No ratings yet

- 053846805X 228070 PDFDocument31 pages053846805X 228070 PDFsalehin1969No ratings yet

- Message To Shareholders Consolidated Statement of Income Consolidated Balance Sheet Consolidated Statement of Cash Flows Notes To Consolidated Financial StatementsDocument1 pageMessage To Shareholders Consolidated Statement of Income Consolidated Balance Sheet Consolidated Statement of Cash Flows Notes To Consolidated Financial Statementssalehin1969No ratings yet

- Ar 2005 Financial Statements p55 eDocument3 pagesAr 2005 Financial Statements p55 esalehin1969No ratings yet

- Gtal 2010 Ta Alert 2010 44 Non Controlling Interests and Other Comprehensive IncomeDocument8 pagesGtal 2010 Ta Alert 2010 44 Non Controlling Interests and Other Comprehensive Incomesalehin1969No ratings yet

- Consolidated Fi Anders SvenssonDocument13 pagesConsolidated Fi Anders Svenssonsalehin1969No ratings yet

- Ifrs 10 2011 PDFDocument8 pagesIfrs 10 2011 PDFJoshua Capa FrondaNo ratings yet

- Minutes AGMDocument4 pagesMinutes AGMsalehin1969No ratings yet

- Ifrs 3 Business CombinationsDocument4 pagesIfrs 3 Business Combinationssalehin1969No ratings yet

- Applying IFRS 3 in Accounting For Business Acquisitions: - A Case StudyDocument70 pagesApplying IFRS 3 in Accounting For Business Acquisitions: - A Case Studysalehin1969No ratings yet

- Chap 006Document51 pagesChap 006kel458100% (1)

- Capital Structure Decisions: Part I: Answers To Beginning-Of-Chapter QuestionsDocument24 pagesCapital Structure Decisions: Part I: Answers To Beginning-Of-Chapter Questionssalehin1969No ratings yet