Professional Documents

Culture Documents

Implprem

Implprem

Uploaded by

arunasagar_20110 ratings0% found this document useful (0 votes)

5 views4 pagesExcel format

Original Title

implprem.xls

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExcel format

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views4 pagesImplprem

Implprem

Uploaded by

arunasagar_2011Excel format

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 4

Sheet1

Implied Risk Premium Calculator

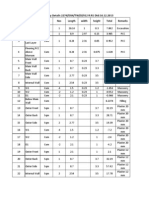

Enter level of the index = Enter current dividend yield = Enter expected growth rate in earnings for next 5 years for market = Enter current long term bond rate = Enter risk premium = Enter expected growth rate in the long term = 1418.3 3.75% 6.00% 4.70% 4.91% 4.70%

Intrinsic Value Estimate

Expected Dividends = Expected Terminal Value = Present Value = Intrinsic Value of Index = Implied Risk Premium in current level of Index = 1 Expected Dividends = Expected Terminal Value = Present Value = Intrinsic Value of Index = $56.38 $51.79 $1,418.30 1 $56.38 $51.43 $1,200.06 2 $59.76 $49.74 3 $63.35 $48.10 4 $67.15 $46.52 5 $71.18 $1,517.73 $1,004.26

Implied Risk Premium 4.16% (Go under Tools and choose Solver: See below)

2 $59.76 $50.43 3 $63.35 $49.11 4 $67.15 $47.82 5 $71.18 $1,792.42 $1,219.15

This is a picture of the solver option, with the inputs that I used (Do not try to enter numbers in it). Enter current level of index where you see 759.64.

Page 1

Sheet1

Page 2

Sheet1

$75.80

enter numbers in it).

Page 3

Sheet1

Page 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Civil DesignDocument2 pagesCivil Designarunasagar_2011No ratings yet

- Security Cabin Qty Details 2274/DSN/TW/D/012 R:R1 Dtd:16.12.2013Document4 pagesSecurity Cabin Qty Details 2274/DSN/TW/D/012 R:R1 Dtd:16.12.2013arunasagar_2011No ratings yet

- Lower: Alan Jones Bob Smith Carol Williams Cardiff ABC123Document1 pageLower: Alan Jones Bob Smith Carol Williams Cardiff ABC123arunasagar_2011No ratings yet

- Alan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?Document2 pagesAlan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?arunasagar_2011No ratings yet

- Minute: What Does It Do?Document2 pagesMinute: What Does It Do?arunasagar_2011No ratings yet

- What Does It Do ?: 2 MOD (C4, D4) 6 MOD (C5, D5) 0 MOD (C6, D6) 1 MOD (C7, D7) 3 MOD (C8, D8)Document1 pageWhat Does It Do ?: 2 MOD (C4, D4) 6 MOD (C5, D5) 0 MOD (C6, D6) 1 MOD (C7, D7) 3 MOD (C8, D8)arunasagar_2011No ratings yet

- MeadianDocument1 pageMeadianarunasagar_2011No ratings yet

- 800 MAX (C4:G4) : What Does It Do ?Document1 page800 MAX (C4:G4) : What Does It Do ?arunasagar_2011No ratings yet

- Abcdedf 1 3 Abcdedf 2 3 Abcdedf 5 2 ABC-100-DEF ABC-200-DEF ABC-300-DEF Item Size: Large Item Size: Medium Item Size: SmallDocument2 pagesAbcdedf 1 3 Abcdedf 2 3 Abcdedf 5 2 ABC-100-DEF ABC-200-DEF ABC-300-DEF Item Size: Large Item Size: Medium Item Size: Smallarunasagar_2011No ratings yet

- Match: Bob 250 Alan 600 David 1000 Carol 4000 Alan 1000Document3 pagesMatch: Bob 250 Alan 600 David 1000 Carol 4000 Alan 1000arunasagar_2011No ratings yet

- LookupDocument2 pagesLookuparunasagar_2011No ratings yet

- What Does It Do ?: 60 LCM (C4, D4) 36 LCM (C5, D5) 1632 LCM (C6, D6)Document1 pageWhat Does It Do ?: 60 LCM (C4, D4) 36 LCM (C5, D5) 1632 LCM (C6, D6)arunasagar_2011No ratings yet

- Lookup VectorDocument1 pageLookup Vectorarunasagar_2011No ratings yet

- FREQUENCYDocument2 pagesFREQUENCYarunasagar_2011No ratings yet

- IsrefDocument1 pageIsrefarunasagar_2011No ratings yet

- Islogical: False True 20 1-Jan-98 Hello #DIV/0!Document1 pageIslogical: False True 20 1-Jan-98 Hello #DIV/0!arunasagar_2011No ratings yet

- Calculator - Million, Billion, TrillionDocument1 pageCalculator - Million, Billion, Trillionarunasagar_2011No ratings yet

- LargeDocument1 pageLargearunasagar_2011No ratings yet

- Iseven: 1 2 2.5 2.6 3.5 3.6 Hello 1-Feb-98 1-Feb-96Document1 pageIseven: 1 2 2.5 2.6 3.5 3.6 Hello 1-Feb-98 1-Feb-96arunasagar_2011No ratings yet

- IserrDocument1 pageIserrarunasagar_2011No ratings yet

- 1 Hello 1-Jan-98 #N/A: What Does It Do?Document1 page1 Hello 1-Jan-98 #N/A: What Does It Do?arunasagar_2011No ratings yet

- ISNONTEXTDocument1 pageISNONTEXTarunasagar_2011No ratings yet

- Index: 250 INDEX (D7:G9, G11, G12)Document3 pagesIndex: 250 INDEX (D7:G9, G11, G12)arunasagar_2011No ratings yet

- Alan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?Document2 pagesAlan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?arunasagar_2011No ratings yet

- Indirect: What Does It Do ?Document2 pagesIndirect: What Does It Do ?arunasagar_2011No ratings yet

- IsblankDocument1 pageIsblankarunasagar_2011No ratings yet

- Hex2Dec: 0 1 2 3 1A 1B 7Fffffffff 8000000000 FFFFFFFFFF Fffffffffe FFFFFFFFFDDocument1 pageHex2Dec: 0 1 2 3 1A 1B 7Fffffffff 8000000000 FFFFFFFFFF Fffffffffe FFFFFFFFFDarunasagar_2011No ratings yet

- What Does It Do ?: 1 INT (C4) 2 INT (C5) 10 INT (C6) - 2 INT (C7)Document2 pagesWhat Does It Do ?: 1 INT (C4) 2 INT (C5) 10 INT (C6) - 2 INT (C7)arunasagar_2011No ratings yet

- What Does It Do ?: 3 GCD (C4, D4) 7 GCD (C5, D5) 1 GCD (C6, D6)Document1 pageWhat Does It Do ?: 3 GCD (C4, D4) 7 GCD (C5, D5) 1 GCD (C6, D6)arunasagar_2011No ratings yet

- What Does It Do?: 21 HOUR (C4) 6 HOUR (C5)Document1 pageWhat Does It Do?: 21 HOUR (C4) 6 HOUR (C5)arunasagar_2011No ratings yet