Professional Documents

Culture Documents

Accountancy and Statistics Group Paper - II (B) 2-b Security Analysis and Port-Folio Management

Accountancy and Statistics Group Paper - II (B) 2-b Security Analysis and Port-Folio Management

Uploaded by

chetan203Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountancy and Statistics Group Paper - II (B) 2-b Security Analysis and Port-Folio Management

Accountancy and Statistics Group Paper - II (B) 2-b Security Analysis and Port-Folio Management

Uploaded by

chetan203Copyright:

Available Formats

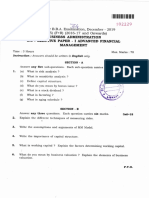

M.Com.

(Final) Examination 2001 ACCOUNTANCY AND STATISTICS GROUP Paper II (b)

2-b Security Analysis and Port-folio Management Time 3 Hours Attempt five questions in all. All questions carry equal marks. 1. (A) How is Speculation different from Investment? Explain 10+10 (B) Explain any two Forecasting techniques which are used for Investment Decisions. As a rational investor, how would you analyse the profitability, financial position and operating efficiency of a company? Explain with the help of examples. 20 Write the notes on the followings: (I) Internal-information; and (ii) International Accounting Issues, for the purpose of Company Analysis. Explain the following: (i) Beta (ii) Holding Period Return (iii) Profit Margin Approaches (iv) Investment Process 10+10 [Maximum Marks 100

2.

3.

4.

5*4

5.

(A) What is Bond? Give their types with detailed explanation. 10+10 (B) What is Holding Period Return (HPY) of a Bond? How is it calculated? Use imaginary figures. Explain the following (i) Correlation in forecasting Revenues and expenses; (ii) Price-Earning Ratio; and (iii) Decision Trees 10+5+5

6.

7.

What are the assumptions an investor keeps in his mind while managing the investment through Technical Analysis? How are the buying and selling signals determined under DowTheory of Technical Analysis? Use figures for elucidation. 10+5+5 Explain the two main statistical investigations to support the weak-form of the efficient market hypothiesis. Also explain about strong-form. 20 (i) (ii) Give the logical set of equations given by Markowitz to measure Risk a, variance (W1) and co variance (W 12) in case of two-securities portfolio. 12+8 Given Portfalio of X consists of Equities, Bonds and Real-estate. Their weights are 25%, and 25% respectively. Their standard deviations are 0.1689, 0.0716 and 0.0345 respectively. And, the correlations are Equity and Bond = 0.45, for Equities and Real Estates = 0.35 and for Bonds and Real Estates = 0.20. Find the variance of Portfolio.

8.

9.

10. (i) Explain Characteristic-Line under Sharpes Single Index Model. 15+5 (ii) How many inputs are needed for a portfolio analysis involving 75 securities, if covariances are computed using Markowitz and Sharpe approaches?

PDF created with FinePrint pdfFactory trial version http://www.fineprint.com

You might also like

- Gnanamani College of Technology: Ba5012 Security Analysis and Portfolio ManagementDocument2 pagesGnanamani College of Technology: Ba5012 Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- Time: 3 Hours Total Marks: 100Document81 pagesTime: 3 Hours Total Marks: 100geetanjali vermaNo ratings yet

- Celibacy and Spiritual LifeDocument12 pagesCelibacy and Spiritual LifeDebi Prasad SahooNo ratings yet

- FIN5203 Homework 5 FL22Document2 pagesFIN5203 Homework 5 FL22merly chermonNo ratings yet

- MODEL I SAPM - 1,2,3 UnitsDocument2 pagesMODEL I SAPM - 1,2,3 UnitsSabha PathyNo ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- SMM148 Theory of Finance Questions Jan 2020Document5 pagesSMM148 Theory of Finance Questions Jan 2020minh daoNo ratings yet

- FM Eco Test BookDocument73 pagesFM Eco Test BookkonaNo ratings yet

- 1725F63BDocument6 pages1725F63Bsoundar rajNo ratings yet

- 2015 QFIC Fall (PAK LPM)Document14 pages2015 QFIC Fall (PAK LPM)Noura ShamseddineNo ratings yet

- Kcse 2010 Business Studies p1Document5 pagesKcse 2010 Business Studies p1Urex ZNo ratings yet

- Iii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementDocument2 pagesIii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementGautam KumarNo ratings yet

- 70 Elective 1 Advance Financial Management Repeaters Prior To 2014 15Document4 pages70 Elective 1 Advance Financial Management Repeaters Prior To 2014 15premium info2222No ratings yet

- CLASS TEST - II (2018-19) Bachelor of Business Administration - VI Sem Fundamentals of E-Commerce (BBA-N-606) Time: 1.5Hrs. M.M.: 30Document2 pagesCLASS TEST - II (2018-19) Bachelor of Business Administration - VI Sem Fundamentals of E-Commerce (BBA-N-606) Time: 1.5Hrs. M.M.: 30Himanshu DarganNo ratings yet

- Final P 11 Sugge Dec 12Document17 pagesFinal P 11 Sugge Dec 12Aditya PakalaNo ratings yet

- Sub Ia 602Document9 pagesSub Ia 602Qausain AliNo ratings yet

- IMC Unit 2 Mock Exam 1 V18 March 2021Document33 pagesIMC Unit 2 Mock Exam 1 V18 March 2021SATHISH SNo ratings yet

- MCO-3-D15 ENG CompressedDocument2 pagesMCO-3-D15 ENG CompressedKripa Shankar MishraNo ratings yet

- bt31R07 12 11 09rahulDocument40 pagesbt31R07 12 11 09rahulPradeep NelapatiNo ratings yet

- 8054 Mma Nbbaa Not in The World of DesingDocument2 pages8054 Mma Nbbaa Not in The World of Desingnishasaini123No ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Economics)Document3 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Economics)Zabi ZabiNo ratings yet

- Auditing and Assurance - HonoursDocument2 pagesAuditing and Assurance - HonoursVardaan JaiswalNo ratings yet

- SMM148 Theory of Finance QuestionsDocument5 pagesSMM148 Theory of Finance Questionsminh daoNo ratings yet

- MS-042 Dec 2021Document2 pagesMS-042 Dec 2021chanduNo ratings yet

- Question Nbank - Accounting Software.Document71 pagesQuestion Nbank - Accounting Software.Sivaramakrishnan GNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- 4 Information Technology for BusinessDocument2 pages4 Information Technology for Businessvasu pradeepNo ratings yet

- IBO June 2005Document10 pagesIBO June 2005rajesh0504No ratings yet

- Revalidation Test Paper Question GR IIIDocument9 pagesRevalidation Test Paper Question GR IIIMinhaz AlamNo ratings yet

- 2nd Year EnglishDocument8 pages2nd Year EnglishKAJAL YADAVNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- EconomicDocument25 pagesEconomicbkcreation65No ratings yet

- MCO-5 ENG-J18 CompressedDocument3 pagesMCO-5 ENG-J18 CompressedTushar SharmaNo ratings yet

- Economics Class - XII Time - 3 Hours. Maximum Marks - 100 Notes: 1. 2. 3. 4. 5. 6. 7Document12 pagesEconomics Class - XII Time - 3 Hours. Maximum Marks - 100 Notes: 1. 2. 3. 4. 5. 6. 7sahilNo ratings yet

- Test-001 (Paper-I) 11th Oct 2020Document4 pagesTest-001 (Paper-I) 11th Oct 2020Raghav KumarNo ratings yet

- Bachelor of Business Administration (BBA) in Retailing II YearDocument8 pagesBachelor of Business Administration (BBA) in Retailing II YearManpreet KaurNo ratings yet

- Bachelor'S Degree Programme Term-End Examination June, 2016 Elective Course: Commerce Eco-1: Business OrganisationDocument32 pagesBachelor'S Degree Programme Term-End Examination June, 2016 Elective Course: Commerce Eco-1: Business OrganisationJapani TutorNo ratings yet

- TutorialsDocument28 pagesTutorialsmupiwamasimbaNo ratings yet

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- MBA 1.5 OutlinesDocument19 pagesMBA 1.5 OutlinesMuhammad Zahid FaridNo ratings yet

- Second Paper: Elements of Financial ManagementDocument5 pagesSecond Paper: Elements of Financial ManagementGuruKPONo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementHTB MoviesNo ratings yet

- Gate Degree & PG College - Tirupati Investment Management Model Paper - I Max. Time: 3 Hrs. Max. Marks: 75 Section - ADocument3 pagesGate Degree & PG College - Tirupati Investment Management Model Paper - I Max. Time: 3 Hrs. Max. Marks: 75 Section - ApsnmurthyNo ratings yet

- Managerial Economics and Financial AnalysisDocument4 pagesManagerial Economics and Financial Analysissrihari100% (1)

- Jaya College of Arts and Science Department of ManagDocument1 pageJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- UntitledDocument3 pagesUntitledJay PatelNo ratings yet

- 3 Hours / 80 Marks: Seat NoDocument4 pages3 Hours / 80 Marks: Seat NoDanish KumarNo ratings yet

- Economics Sample Paper 1Document3 pagesEconomics Sample Paper 1Rahul JohnNo ratings yet

- MS3EF07 Investment Analysis and Portfolio ManagementDocument5 pagesMS3EF07 Investment Analysis and Portfolio ManagementAshutosh ShuklaNo ratings yet

- Assignment QuestionsDocument2 pagesAssignment QuestionsPankaj GoplaniNo ratings yet

- 2019 Past PaperDocument7 pages2019 Past Papersidath thiranjayaNo ratings yet

- Project Planning & Evaluation - May10Document2 pagesProject Planning & Evaluation - May10puruaggarwalNo ratings yet

- Important Questions: Unit 1Document4 pagesImportant Questions: Unit 1Nageswara Rao ThotaNo ratings yet

- Commerce Paper 4.4 (A) Security Analysis and Portfolio Management Accounting and FinanceDocument3 pagesCommerce Paper 4.4 (A) Security Analysis and Portfolio Management Accounting and FinanceSanaullah M SultanpurNo ratings yet

- PP Invt&sec 2018Document5 pagesPP Invt&sec 2018Revatee HurilNo ratings yet

- Bachelor of Business Administration (BBA) in Retailing II YearDocument8 pagesBachelor of Business Administration (BBA) in Retailing II YearMoksh WariyaNo ratings yet

- 3 Hours / 80 Marks: Seat NoDocument4 pages3 Hours / 80 Marks: Seat NoInFiNiTyNo ratings yet

- FIN301Document3 pagesFIN301Smu DocNo ratings yet

- 260 - MCO-7 - ENG D18 - CompressedDocument2 pages260 - MCO-7 - ENG D18 - CompressedTushar SharmaNo ratings yet