Professional Documents

Culture Documents

Balance Sheet: of Which Bridging Credit 0 0

Balance Sheet: of Which Bridging Credit 0 0

Uploaded by

Yonela JordanCopyright:

Available Formats

You might also like

- Case Solution - A New Financial Policy at Swedish Match - ANIDocument20 pagesCase Solution - A New Financial Policy at Swedish Match - ANIAnisha Goyal33% (3)

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- Monthly Report Aggregate Cover Pool 28-03-2013 QuarterlyDocument3 pagesMonthly Report Aggregate Cover Pool 28-03-2013 QuarterlyPaulo Jorge OliveiraNo ratings yet

- CHAP - 02 - Financial Statements of BankDocument72 pagesCHAP - 02 - Financial Statements of BankTran Thanh NganNo ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- Assignment Solution - Yield Curve and HedgingDocument12 pagesAssignment Solution - Yield Curve and HedgingAkashNo ratings yet

- Comparative Balance Sheet of Canara Bank Particulars Years 2011 2010Document8 pagesComparative Balance Sheet of Canara Bank Particulars Years 2011 2010Psanitha RaoNo ratings yet

- Balance SheetDocument1 pageBalance SheetBharat AroraNo ratings yet

- Maruti Balance SHTDocument12 pagesMaruti Balance SHTVishal KumarNo ratings yet

- Karishma WorkDocument14 pagesKarishma WorkApoorva MathurNo ratings yet

- Square Textile S Limite D: Balance SheetDocument5 pagesSquare Textile S Limite D: Balance Sheetjeeji126No ratings yet

- Balance Sheet of Future Group (Big Bazar)Document2 pagesBalance Sheet of Future Group (Big Bazar)NeilDuttaNo ratings yet

- CHAP - 04 - Financial Statements of Bank - For StudentDocument87 pagesCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252No ratings yet

- TCS Condensed IndianGAAP Q3 12Document29 pagesTCS Condensed IndianGAAP Q3 12Neha SahaNo ratings yet

- Binder - HCT - Collusion - MartinDocument9 pagesBinder - HCT - Collusion - MartinMy-Acts Of-SeditionNo ratings yet

- Kaspi Bank 21Document4 pagesKaspi Bank 21Serikkizi FatimaNo ratings yet

- Cash FlowDocument14 pagesCash Flowsujitpradhan1989gmaiNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Contoh Laporan Audit Independen PDFDocument202 pagesContoh Laporan Audit Independen PDFCitra Dewi ParamithaNo ratings yet

- Microsoft Corporation: United States Securities and Exchange CommissionDocument75 pagesMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745No ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- Balance Sheet As At: 38 Annual Report 2013-2014 108Document1 pageBalance Sheet As At: 38 Annual Report 2013-2014 108ankit singhNo ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Consolidated Financial Statements of Infosys Technologies Limited and SubsidiariesDocument1 pageConsolidated Financial Statements of Infosys Technologies Limited and Subsidiariessmartvicky4uNo ratings yet

- ITC Cash Flow StatementDocument1 pageITC Cash Flow StatementIna PawarNo ratings yet

- Horizontal Analysis: Particulars Equity and Liabilities Equity Regular SizeDocument4 pagesHorizontal Analysis: Particulars Equity and Liabilities Equity Regular SizeRizwan AhmadNo ratings yet

- 51 - 11219525 - Nguyễn Đỗ Thủy TiênDocument44 pages51 - 11219525 - Nguyễn Đỗ Thủy TiênThủy Tiên Nguyễn ĐỗNo ratings yet

- Corporate Finance LectureDocument124 pagesCorporate Finance LectureMuhammad Kashif ZafarNo ratings yet

- Balance SheetDocument1 pageBalance SheetAshutosh KumarNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Ισολογισμοσ Φυτοθρεπτικη Χρησησ 2012 EnDocument1 pageΙσολογισμοσ Φυτοθρεπτικη Χρησησ 2012 Env_tsoulosNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAbhishek RawatNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAchal GuptaNo ratings yet

- Finm 542 12101950Document9 pagesFinm 542 12101950srivaniNo ratings yet

- 2010 Financial Report C I LeasingDocument24 pages2010 Financial Report C I LeasingVikky MehtaNo ratings yet

- CPA IRELAND Accounting Framework April 07Document14 pagesCPA IRELAND Accounting Framework April 07Luke ShawNo ratings yet

- Kansai Nerolac Balance SheetDocument19 pagesKansai Nerolac Balance SheetAlex KuriakoseNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- !!!!!!!!!!balance SheetDocument1 page!!!!!!!!!!balance Sheetquickoffice_sqaNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- 4th Quarter Financial Report 2012Document89 pages4th Quarter Financial Report 2012HemasMaselvaPutriNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Balance Sheet ExtractDocument1 pageBalance Sheet ExtractjoamonsachinNo ratings yet

- 1h07additional PDFDocument30 pages1h07additional PDFVicaraolivia JosephNo ratings yet

- BBVA Bancomer, S.A.: Company Tear SheetDocument7 pagesBBVA Bancomer, S.A.: Company Tear SheetDavid AbonzaNo ratings yet

- Bank of AmericaDocument23 pagesBank of AmericaAzər ƏmiraslanNo ratings yet

- Sources of FundsDocument31 pagesSources of FundsrahulroycgNo ratings yet

- (Brief) Financial Statement 2008: I.B. Balance SheetDocument4 pages(Brief) Financial Statement 2008: I.B. Balance SheetpjnkpoogNo ratings yet

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- 31-Dec-10 31-Dec-09 Assets: Period EndingDocument4 pages31-Dec-10 31-Dec-09 Assets: Period EndingArsal SiddiqiNo ratings yet

- Luckycement Annual Report 2Document4 pagesLuckycement Annual Report 2jointariqaslamNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

Balance Sheet: of Which Bridging Credit 0 0

Balance Sheet: of Which Bridging Credit 0 0

Uploaded by

Yonela JordanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet: of Which Bridging Credit 0 0

Balance Sheet: of Which Bridging Credit 0 0

Uploaded by

Yonela JordanCopyright:

Available Formats

TATA Interactive Systems GmbH Universal Banking BANKING SIMULATION

Copyright (c) 2007 by TATA Interactive Systems Bank 2 IGC Bank Period 1 Seminar: Grupa2 Date 10.12.2011

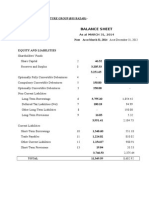

1. BALANCE SHEET

prev. period 987 0 prev. period

ASSETS Liquidity Money market instruments Due from banks on demand at term Due from customers secured by mortgage secured by other collateral unsecured Mortgage claims at variable interest rate at fixed interest rate Securities trading portfolio Domestic shares Foreign shares Domestic bonds Foreign bonds Holdings Physical assets Other physical assets Other assets Annual net loss TOTAL ASSETS

Period 2141 0

LIABILITIES Due to banks on demand of which bridging credit at term Due to customers savings accounts personal accounts

Period

630 0 7350

693 0 8085

1500 6500

1500 7500

11570 3823

12264 4040

3205 8922 10049

3267 9088 10266

on demand at term Medium-term notes

2814 7965 5316 2100 0 260 1000 250 1150

2974 8443 5635 2100 0 269 1000 250 1255

3898 8576

3947 8723

Long-term bonds of which subordinated Valuation adjustments and provisions Share capital Legal reserves Other reserves

0 0 0 0 0 96 100 500 0 44333

0 0 0 0 0 87 140 500 0 47159

Annual net profit TOTAL LIABILITIES

105 44333

150 47159

SUMMARY OF Mortgage claims Issue Period Issue Period Issue Period Issue Period Issue Period

at fixed interest rate -3 -2 -1 0 1 TOTAL

Volume M. EUR 1500 975 1246 1521 3481 8723 Volume M. EUR 1031 1320 855 1241 1188 TOTAL 5635 Volume M. EUR 300 400 300 500 600 0 0 2100

Payment due date in Period 2 3 4 5 6 Payment due date in Period 2 3 4 5 6

Interest % 7.00 7.25 6.00 7.39 6.72 6.84 Interest % 4.50 5.00 5.25 5.75 5.00 5.11 Interest % 5.00 5.75 6.25 6.50 7.00 0.00 0.00 6.25 Interest subordinated % 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

SUMMARY OF Medium-term notes Issue Period -3 Issue Period -2 Issue Period -1 Issue Period 0 Issue Period 1

LONG-TERM DEBT FINANCING Issues Long-term bonds Issue Period Issue Period Issue Period Issue Period Issue Period Issue Period Issue Period -5 -4 -3 -2 -1 0 1 TOTAL

of which Payment due subordinated date in Period M. EUR 5 0 6 0 7 0 8 0 9 0 0 0 0 0 0

You might also like

- Case Solution - A New Financial Policy at Swedish Match - ANIDocument20 pagesCase Solution - A New Financial Policy at Swedish Match - ANIAnisha Goyal33% (3)

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- Monthly Report Aggregate Cover Pool 28-03-2013 QuarterlyDocument3 pagesMonthly Report Aggregate Cover Pool 28-03-2013 QuarterlyPaulo Jorge OliveiraNo ratings yet

- CHAP - 02 - Financial Statements of BankDocument72 pagesCHAP - 02 - Financial Statements of BankTran Thanh NganNo ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- Assignment Solution - Yield Curve and HedgingDocument12 pagesAssignment Solution - Yield Curve and HedgingAkashNo ratings yet

- Comparative Balance Sheet of Canara Bank Particulars Years 2011 2010Document8 pagesComparative Balance Sheet of Canara Bank Particulars Years 2011 2010Psanitha RaoNo ratings yet

- Balance SheetDocument1 pageBalance SheetBharat AroraNo ratings yet

- Maruti Balance SHTDocument12 pagesMaruti Balance SHTVishal KumarNo ratings yet

- Karishma WorkDocument14 pagesKarishma WorkApoorva MathurNo ratings yet

- Square Textile S Limite D: Balance SheetDocument5 pagesSquare Textile S Limite D: Balance Sheetjeeji126No ratings yet

- Balance Sheet of Future Group (Big Bazar)Document2 pagesBalance Sheet of Future Group (Big Bazar)NeilDuttaNo ratings yet

- CHAP - 04 - Financial Statements of Bank - For StudentDocument87 pagesCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252No ratings yet

- TCS Condensed IndianGAAP Q3 12Document29 pagesTCS Condensed IndianGAAP Q3 12Neha SahaNo ratings yet

- Binder - HCT - Collusion - MartinDocument9 pagesBinder - HCT - Collusion - MartinMy-Acts Of-SeditionNo ratings yet

- Kaspi Bank 21Document4 pagesKaspi Bank 21Serikkizi FatimaNo ratings yet

- Cash FlowDocument14 pagesCash Flowsujitpradhan1989gmaiNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Contoh Laporan Audit Independen PDFDocument202 pagesContoh Laporan Audit Independen PDFCitra Dewi ParamithaNo ratings yet

- Microsoft Corporation: United States Securities and Exchange CommissionDocument75 pagesMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745No ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- Balance Sheet As At: 38 Annual Report 2013-2014 108Document1 pageBalance Sheet As At: 38 Annual Report 2013-2014 108ankit singhNo ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Consolidated Financial Statements of Infosys Technologies Limited and SubsidiariesDocument1 pageConsolidated Financial Statements of Infosys Technologies Limited and Subsidiariessmartvicky4uNo ratings yet

- ITC Cash Flow StatementDocument1 pageITC Cash Flow StatementIna PawarNo ratings yet

- Horizontal Analysis: Particulars Equity and Liabilities Equity Regular SizeDocument4 pagesHorizontal Analysis: Particulars Equity and Liabilities Equity Regular SizeRizwan AhmadNo ratings yet

- 51 - 11219525 - Nguyễn Đỗ Thủy TiênDocument44 pages51 - 11219525 - Nguyễn Đỗ Thủy TiênThủy Tiên Nguyễn ĐỗNo ratings yet

- Corporate Finance LectureDocument124 pagesCorporate Finance LectureMuhammad Kashif ZafarNo ratings yet

- Balance SheetDocument1 pageBalance SheetAshutosh KumarNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Ισολογισμοσ Φυτοθρεπτικη Χρησησ 2012 EnDocument1 pageΙσολογισμοσ Φυτοθρεπτικη Χρησησ 2012 Env_tsoulosNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAbhishek RawatNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAchal GuptaNo ratings yet

- Finm 542 12101950Document9 pagesFinm 542 12101950srivaniNo ratings yet

- 2010 Financial Report C I LeasingDocument24 pages2010 Financial Report C I LeasingVikky MehtaNo ratings yet

- CPA IRELAND Accounting Framework April 07Document14 pagesCPA IRELAND Accounting Framework April 07Luke ShawNo ratings yet

- Kansai Nerolac Balance SheetDocument19 pagesKansai Nerolac Balance SheetAlex KuriakoseNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- !!!!!!!!!!balance SheetDocument1 page!!!!!!!!!!balance Sheetquickoffice_sqaNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- 4th Quarter Financial Report 2012Document89 pages4th Quarter Financial Report 2012HemasMaselvaPutriNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Balance Sheet ExtractDocument1 pageBalance Sheet ExtractjoamonsachinNo ratings yet

- 1h07additional PDFDocument30 pages1h07additional PDFVicaraolivia JosephNo ratings yet

- BBVA Bancomer, S.A.: Company Tear SheetDocument7 pagesBBVA Bancomer, S.A.: Company Tear SheetDavid AbonzaNo ratings yet

- Bank of AmericaDocument23 pagesBank of AmericaAzər ƏmiraslanNo ratings yet

- Sources of FundsDocument31 pagesSources of FundsrahulroycgNo ratings yet

- (Brief) Financial Statement 2008: I.B. Balance SheetDocument4 pages(Brief) Financial Statement 2008: I.B. Balance SheetpjnkpoogNo ratings yet

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- 31-Dec-10 31-Dec-09 Assets: Period EndingDocument4 pages31-Dec-10 31-Dec-09 Assets: Period EndingArsal SiddiqiNo ratings yet

- Luckycement Annual Report 2Document4 pagesLuckycement Annual Report 2jointariqaslamNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet