Professional Documents

Culture Documents

Acca F 8 L7

Acca F 8 L7

Uploaded by

Fahmi AbdullaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acca F 8 L7

Acca F 8 L7

Uploaded by

Fahmi AbdullaCopyright:

Available Formats

ACCA F8 AUDIT AND INTERNAL REVIEW INTERNATIONAL STREAM

Lecture 7 Audit Reports DATE: TUTOR: Autumn 2008

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

1 Auditors have to form an audit opinion as to whether the financial statements

give a true and fair view or are presented fairly, in all material respects, in accordance with the applicable financial reporting framework. 2

3 This involves an evaluation of whether the financial statements have been

prepared and presented in accordance with the specific requirements of the applicable financial reporting framework for particular classes of transactions, account balances and disclosures.

1 This evaluation includes considering whether :2 1 1. The accounting policies selected and applied are consistent with the financial reporting framework and are appropriate in the circumstances. 1 2. The accounting estimates made by management are reasonable in the

circumstances. 1 3. The information presented in the financial statements, including

accounting policies, is relevant, reliable, comparable and understandable. 1 4. The financial statements provide sufficient disclosures to enable users to

understand the effect of material transactions and events on the information conveyed in the financial statements, for example, in the case of financial statements prepared in accordance with International Financial Reporting Standards (IFRSs), the entitys financial position, financial performance and cash flows. 1 2 3 4 5

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

At the conclusion of the audit engagement, it is necessary for the auditor to

communicate to the members of the company via an audit report. This report is a result of the review work carried out by the auditor.

In addition the auditor also gives feedback to management on the matters

arising from audit engagement in the form of a management letter. This letter usually contains the weakness identified during the audit within the clients accounting systems and procedures. Recommendation is also given to improve and overcome the weakness within the system. True and Fair View:

For the financial statements to give a true and fair view they should contain

information that is sufficient in quantity and quality to enable financially knowledgeable shareholders to obtain an understanding of the state of affairs and profit or loss and is commensurate with both their reasonable needs and expectations. 2 3 4 5 True: the information in the financial statement is factual not fictitious. Fair: the information is presented fairly and not materially misstated.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

The auditors reporting duties

1. Companies Legislation requires the auditor to form an opinion on the financial statement whether or not: 1 - The financial statements are true and fair and also the view of the

companys state of affairs or groups state of affairs. 1 2 - The financial statements are properly prepared in accordance with National Companies legislation.

2. Proper accounting records have been kept.

3. All information and explanations has been received that was necessary for the audit work.

4. Adequate information received from branches not visited by the auditor.

5. The financial statements comply with accounting records and relevant accounting standard. 6. Directors report is consistent with the financial statements. 7. The directors transaction has been completely and accurately disclosed.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

Directors responsibilities:-

1. To prepare financial statements that give a true and fair view and also

comply with the national companies legislation and with relevant accounting standard. 2. To make reasonable and prudent judgements and accounting estimates

3. To ensure consistent application of proper accounting policies. 4. To prepare the financial statements on the going concern basis.

5. To maintain adequate accounting records 6. To safeguard assets 7. To prevent and detect fraud

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

Example : Independent Auditors Report

Note: Form and content of this section of the auditors report will vary depending on the nature of the auditors other reporting responsibilities.

Report on the Financial Statements We have audited the accompanying financial statements of ABC Company, which comprise the balance sheet as at________, and the income statement, statement of changes in equity and cash flow statement for the year then ended, and a summary of significant accounting policies and other explanatory notes. Managements Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Reporting Standards. This responsibility includes: designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditors Responsibility

Created on 6/6/2010 19:32:00 a6/p6 Page of 16 6

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entitys preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entitys internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion In our opinion, the financial statements give a true and fair view of (or present fairly, in all material respects,) the financial position of X Company as of_________, and of its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards.

Auditors signature Auditors address

Date of the auditors report

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

Contents of the Auditors Report

1. Title: The auditors report should have a title that clearly indicates that it is

the report of an independent auditor. 1 A title indicating the report is the report of an independent auditor, for

example, Independent Auditors Report, affirms that the auditor has met all of the relevant ethical requirements regarding independence and, therefore, distinguishes the independent auditors report from reports issued by others.

2. Addressee. National legislation may specify to whom the auditors report on

general purpose financial statements should be addressed in that particular the auditors report when the audit has been conducted in accordance with both ISAs and auditing standards of a specific jurisdiction or country. The auditors report on general purpose financial statements is addressed to those for whom the report is prepared, often either to the shareholders or to those charged with governance of the entity whose financial statements are being audited.

3. The introductory paragraph. This should identify the entity whose financial

statements have been audited and should state that the financial statements have been audited. 4. The introductory paragraph should also: 1 1. Identify the title of each of the financial statements that comprise the

complete set of financial statements. 1 2. Refer to the summary of significant accounting policies and other

explanatory notes. 1 3. Specify the date and period covered by the financial statements.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

5. Paragraph identifying the managements responsibility for the financial

statements 6. Opinion Paragraph. When the financial statements give a true and fair view an unqualified opinion should be expressed. It means that financial statement is free of material errors and prepared in accordance with companies legislation and comply with relevant accounting standard. An unqualified opinion indicates implicitly that any changes in accounting policies or in the method of their application, and the effects have been properly determined and disclosed in the financial statements. According to ISA 701 MODIFICATIONS TO THE INDEPENDENT AUDITORS REPORT, the opinion paragraph should be modified in the following 3 ways:1. Issuing an Except For Opinion. 2. Issuing a disclaimer 3. Issuing an adverse opinion.

1. Except Foropinion should be expressed when the auditor concludes that

an unqualified opinion cannot be expressed but that the effect of any disagreement with management or limitation of scope is not so material and pervasive as to require an adverse opinion or a disclaimer of opinion. A qualified opinion should be expressed a being except for the effects of the matter to which the qualification relates. Whenever the auditor expresses an opinion that is not unqualified, a clear description of all the substantive reasons should be included in the report and,

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

unless impracticable, a quantification of the possible effect(s) on the financial statements should be made. This information would be set out in a separate paragraph preceding (before) the opinion or disclaimer of opinion on the financial statements and may include a reference to a more extensive discussion, if any, in a note to the financial statements. This is know as the emphasis of matter paragraph. 1 There are 2 circumstances giving rise to audit qualification: 1 1 - Disagreement - Limitation of scope

Disagreement 1 Example of disagreement: - Disagreement over accounting policies. - Disagreement over accounting estimates - Disagreement over accounting disclosure notes - Lack or non -compliance with legislation and regulations (1) If the disagreement is material but not fundamental: - The matter which the auditor disagrees is significant by is capable of E.g. in accordance with IAS 2,

1

2 3 4

inventories should be valued at lower of cost or net realisable value.

1 1

isolation from the rest of the financial statements and therefore does not distort the overall view given (not pervasive to the rest of the financial statements.)

- This form of qualification is a qualified opinion Expect for.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

10

2 (2) If the disagreement is material and pervasive:

1 - In this situation the matter in question is so significant that it cannot be

isolated from the rest of the financial statements it pervades the whole of the financial statements and therefore distort the overall view given. 1 - The opinion given would be an adverse opinion, i.e. the financial statements

do not give a true and fair view.

Disagreement on Accounting PoliciesInappropriate Accounting Method- Qualified Opinion We have audited ... (remaining words are the same as illustrated in the introductory paragraph). We conducted our audit in accordance with ... (remaining words are the same as illustrated in the scope paragraph). Explanatory paragraph: As discussed in Note X to the financial statements, no depreciation has been provided in the financial statements which practice, in our opinion, is not in accordance with International Accounting Standards. The provision for the year ended_______, should be xxx based on the straight-line method of depreciation using annual rates of 5% for the building and 20% for the equipment. Accordingly, the fixed assets should be reduced by accumulated depreciation of xxx and the loss for the year and accumulated deficit should be increased by xxx and xxx, respectively.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

11

In our opinion, except for the effect on the financial statements of the matter referred to in the preceding paragraph, the financial statements give a true and ... (remaining words are the same as illustrated in the opinion paragraph). Disagreement on Accounting PoliciesInadequate Disclosure Qualified Opinion We have audited ... (remaining words are the same as illustrated in the introductory paragraph). We conducted our audit in accordance with ... (remaining words are the same as illustrated in the scope paragraph). On_______, the Company issued debentures in the amount of xxx for the purpose of financing plant expansion. The debenture agreement restricts the payment of future cash dividends to earnings after________. In our opinion, disclosure of this information is required by: In our opinion, except for the omission of the information included in the preceding paragraph, the financial statements give a true and ...

Limitation of Scope:

Arises when the auditor could not obtain the evidence that was necessary to form an opinion for example on whether or not one or more items in the accounts is fairly stated.

A limitation could arise because of:

(a) Limitation imposed on the auditors by entity (auditor should not accept the

appointment). 1

2

1 1

Examples : - Loss or corruptions of accounting records due to poor controls - Lack of access to the records of overseas branches

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

12

1 1

- Refusal to allow the auditors to attend a physical inventories count. - Refusal to allow the auditors to perform a circularisation of trade receivable (b) Limitation outside the control of directors and auditors (imposed by circumstances for example appointed after physical inventory count or lack of adequate accounting records).

1 1

The auditors have been appointed after the inventories count was performed. - Third party such as major customers or agent holding inventories refuses to

co-operate by returning confirmations. 1 - External political circumstances such as revolutions or civil wars If the limitation of scope is not so material and pervasive issue an except

for qualification.

Limitation on ScopeQualified Opinion We have audited ... (remaining words are the same as illustrated in the introductory paragraph of the unqualified report. Except as discussed in the following paragraph, we conducted our audit in accordance with ... We did not observe the counting of the physical inventories as of ________since that date was prior to the time we were initially engaged as auditors for the Company. Owing to the nature of the Companys records, we were unable to satisfy ourselves as to inventory quantities by other audit procedures.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

13

In our opinion, except for the effects of such adjustments, if any, as might have been determined to be necessary had we been able to satisfy ourselves as to physical inventory quantities, the financial statements give a true and ... If the limitation of scope so material and pervasive that the auditor is unable to express opinion Disclaimer of opinion should be appropriate.

Limitation on ScopeDisclaimer of Opinion We were engaged to audit the accompanying balance sheet of the ABC Company as of December 31, 2001, and the related statements of income and cash flows for the year then ended. These financial statements are the responsibility of the Companys management. (Omit the sentence stating the responsibility of the auditor). (The paragraph discussing the scope of the audit would either be omitted or amended according to the circumstances.) Additional explanatory paragraph : We were not able to observe all physical

inventories and confirm accounts receivable due to limitations placed on the scope of our work by the Company. Opinion Paragraph: Because of the significance of the matters discussed in the preceding paragraph, we do not express an opinion on the financial statements.

2. Issuing a Disclaimer of opinion 1

Created on 6/6/2010 19:32:00 a6/p6 Page of 16 14

Disclaimer of opinion should be expressed when the possible effects of a

limitation of scope is so material and pervasive that the auditor has not be able to obtain sufficient appropriate audit evidence and accordingly is unable to express an opinion on the financial statements.

3. Issuing an Adverse Opinion. 1 2 An adverse opinion should be expressed when the effect of a disagreement is so material and pervasive to the financial statement that the auditor concludes that a qualification of the report is not adequate to disclose the misleading or incomplete nature of the financial statement. Example: If in the auditors judgement the company will not be able to continue as a going concern and the financial statements have been prepared on a going concern basis.

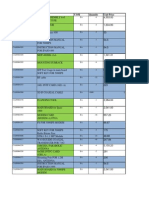

Summary of Audit Qualifications

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

15

1. Financial statements show a true and fair view = Unqualified Audit Opinion. 2. Material items in financial statements do not show a true and fait view = Qualified opinion Except for opinion. 3. Material disagreements = Adverse opinion. (Financial statements do not show a true and fair view because disagreements are pervasive).

4. The auditor is unable to conclude whether a true and fair view is given in

respect of material items due to limitation of scope = Qualified Audit opinion except for + any implied opinion 5. The auditor is unable to conclude whether a true and fair view is given at all due to limitation in scope = Disclaimer of Opinion.

Created on 6/6/2010 19:32:00 a6/p6

Page of 16

16

You might also like

- Introduction To Auditing Notes - Kenyan ContextDocument11 pagesIntroduction To Auditing Notes - Kenyan ContextHilda Muchunku100% (1)

- L11 Audit ReportDocument10 pagesL11 Audit ReportTanishaNo ratings yet

- Module - 2 Auditor'S Report: Objectives of The AuditorDocument20 pagesModule - 2 Auditor'S Report: Objectives of The AuditorVijay KumarNo ratings yet

- Module 12 - Audit ReportingDocument10 pagesModule 12 - Audit ReportingRufina B VerdeNo ratings yet

- Gaap and AuditDocument35 pagesGaap and AuditAayushi Arora100% (1)

- Ch6 Audit ReportDocument26 pagesCh6 Audit Reportkitababekele26No ratings yet

- Icpak Audit ManualDocument17 pagesIcpak Audit ManualHilda MuchunkuNo ratings yet

- Auditors Report On Financial StatementDocument13 pagesAuditors Report On Financial Statementaffanq86No ratings yet

- Audit Summary Chapter 25Document7 pagesAudit Summary Chapter 25bless villahermosaNo ratings yet

- Principles of Audit and AssuranceDocument20 pagesPrinciples of Audit and AssuranceUnique OfficialsNo ratings yet

- Audit Chapter 12 - SummaryDocument15 pagesAudit Chapter 12 - SummaryAninditra NuraufiNo ratings yet

- Comm - Ica Asa510 App1ill1Document3 pagesComm - Ica Asa510 App1ill1Hay JirenyaaNo ratings yet

- Singapore Standard On AuditingDocument14 pagesSingapore Standard On AuditingbabylovelylovelyNo ratings yet

- Isa 700Document8 pagesIsa 700AdzNo ratings yet

- 2022 TOPIC 2 - Regulation of AuditingDocument33 pages2022 TOPIC 2 - Regulation of AuditingIanNo ratings yet

- Module 2Document11 pagesModule 2Ruthika Sv789No ratings yet

- Audit GroupDocument17 pagesAudit GroupYoseph MekonnenNo ratings yet

- Isa 700Document22 pagesIsa 700baabasaamNo ratings yet

- Acctg 163 Auditing Theory Review 6 TmhsDocument11 pagesAcctg 163 Auditing Theory Review 6 TmhsXaviery John Martinez LunaNo ratings yet

- Unit 6Document14 pagesUnit 6YonasNo ratings yet

- Udit Eports: Prepared by Saba BanoDocument26 pagesUdit Eports: Prepared by Saba BanoMogiee MooNo ratings yet

- Auditors Report 2018Document93 pagesAuditors Report 2018Sultana LaboniNo ratings yet

- Auditor S Report - FUAU - 15 - 10 - 2021Document6 pagesAuditor S Report - FUAU - 15 - 10 - 2021JIMÉNEZ RAMÍREZ MARTINNo ratings yet

- Chapter 11 THE AUDITORS REPORT ON FINANCIALDocument95 pagesChapter 11 THE AUDITORS REPORT ON FINANCIALJay LloydNo ratings yet

- Introduction To AuditingDocument39 pagesIntroduction To AuditingVikrant Vikram SinghNo ratings yet

- CAF 08-Audit and Assurance: Ca NotesDocument2 pagesCAF 08-Audit and Assurance: Ca NotesAbuBakar MughalNo ratings yet

- 2 TFB106Q4 7LBManAHQH36Document133 pages2 TFB106Q4 7LBManAHQH36YudyChenNo ratings yet

- NOTES UnmodifiedDocument10 pagesNOTES Unmodifiedclaire mae DescartinNo ratings yet

- ISA 700 Sample Auditors ReportDocument25 pagesISA 700 Sample Auditors ReportMuhammad HarithNo ratings yet

- Audit ReportDocument18 pagesAudit ReportSricharan Reddy R100% (1)

- ISA 700 705 706 Audit Report UpdatedDocument28 pagesISA 700 705 706 Audit Report UpdatedAshraf Uz ZamanNo ratings yet

- Singapore Standard On AuditingDocument28 pagesSingapore Standard On AuditingbabylovelylovelyNo ratings yet

- Auditing Chapter 6$7Document14 pagesAuditing Chapter 6$7Getachew JoriyeNo ratings yet

- SLAuS 700 PDFDocument9 pagesSLAuS 700 PDFnaveen pragash100% (1)

- Kes Shroff College of Arts and CommerceDocument24 pagesKes Shroff College of Arts and CommerceSagar ChitrodaNo ratings yet

- I Cai ReportDocument22 pagesI Cai ReportInsta SickNo ratings yet

- Audit ReportDocument62 pagesAudit ReportPranay NavvulaNo ratings yet

- (Chapter - 11) Audit ReportDocument6 pages(Chapter - 11) Audit Reportzangzop5No ratings yet

- Auditors Report On Financial StatementDocument4 pagesAuditors Report On Financial StatementKafonyi JohnNo ratings yet

- Aas 28 The Auditor S Report On Financial StatementsDocument13 pagesAas 28 The Auditor S Report On Financial StatementsRishabh GuptaNo ratings yet

- Aas 2Document3 pagesAas 2Rishabh GuptaNo ratings yet

- ACC301 Auditing NotesDocument19 pagesACC301 Auditing NotesShakeel AhmedNo ratings yet

- Audit Prsentation On WiproDocument9 pagesAudit Prsentation On WiproNaina ChaudharyNo ratings yet

- PSA 700 Redrafted Own SummaryDocument1 pagePSA 700 Redrafted Own Summarykimjoonmyeon22No ratings yet

- Auditing: Module 4 Forming An Opinion and Reporting On Financial StatementsDocument48 pagesAuditing: Module 4 Forming An Opinion and Reporting On Financial StatementsJohn Archie AntonioNo ratings yet

- Tutorial 1Document13 pagesTutorial 1Mai TrầnNo ratings yet

- Chapter 29 Procedures and Reports On Special Purpose Audit EngagementsDocument30 pagesChapter 29 Procedures and Reports On Special Purpose Audit EngagementsClar Aaron BautistaNo ratings yet

- Sample Opinion For SME in IFRSDocument17 pagesSample Opinion For SME in IFRSnostradamus2639No ratings yet

- Audit and Corporate GovernanceDocument6 pagesAudit and Corporate GovernanceSuraj SatapathyNo ratings yet

- Chapter 1 AuditDocument29 pagesChapter 1 Auditmaryumarshad2No ratings yet

- 9 ReportingDocument12 pages9 ReportingHussain MustunNo ratings yet

- Audit Report by MRKDocument38 pagesAudit Report by MRKImtiaz ChowdhuryNo ratings yet

- AT - Activity - No. 11 - Auditor's Report in The Financial Statements PDFDocument7 pagesAT - Activity - No. 11 - Auditor's Report in The Financial Statements PDFDanielle VasquezNo ratings yet

- Audit Report Zain's MillsDocument5 pagesAudit Report Zain's MillsZainNo ratings yet

- Illustrative Branch Audit Report FormatDocument5 pagesIllustrative Branch Audit Report FormatCA K Vijay SrinivasNo ratings yet

- 1197astra AR 19-20 Final Organized PDFDocument8 pages1197astra AR 19-20 Final Organized PDFelenaNo ratings yet

- Chapter 11 Audit Reports On Financial StatementsDocument54 pagesChapter 11 Audit Reports On Financial StatementsKayla Sophia PatioNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Internal Audit CharterDocument15 pagesInternal Audit CharterFahmi Abdulla100% (2)

- 09 Quang Linh Huynh-PDocument13 pages09 Quang Linh Huynh-PFahmi AbdullaNo ratings yet

- DipIFR-Session31 d08 Operating SegmentsDocument0 pagesDipIFR-Session31 d08 Operating SegmentsFahmi AbdullaNo ratings yet

- Paper 2.4 - ATC InternationalDocument0 pagesPaper 2.4 - ATC InternationalFahmi AbdullaNo ratings yet

- Acca p1 NotesDocument67 pagesAcca p1 NotesAsis KoiralaNo ratings yet

- Share Based PaymentDocument19 pagesShare Based PaymentFahmi AbdullaNo ratings yet

- Siv - Microwave ProjectDocument32 pagesSiv - Microwave ProjectFahmi AbdullaNo ratings yet