Professional Documents

Culture Documents

CLG Section 365 of Companies Act 1965 (Amended)

CLG Section 365 of Companies Act 1965 (Amended)

Uploaded by

Lee Teck LingCopyright:

Available Formats

You might also like

- Barangay Capacity Development Agenda - Brgy TaugDocument4 pagesBarangay Capacity Development Agenda - Brgy TaugMela Balagot93% (42)

- ICAP Past 20 Attempts Questions - Topic WiseDocument38 pagesICAP Past 20 Attempts Questions - Topic Wisesohail merchant100% (1)

- SASIC District - Bernal InquiryDocument2 pagesSASIC District - Bernal InquiryMaritza NunezNo ratings yet

- Writ of AmparoDocument3 pagesWrit of AmparoDee ReyesNo ratings yet

- Reduction of CapitalDocument5 pagesReduction of CapitalIntanSyakieraNo ratings yet

- Tutorial 9 IILDocument9 pagesTutorial 9 IILWinjie PangNo ratings yet

- Corporate Laws & Practices - JA-2022 - Suggested AnswersDocument7 pagesCorporate Laws & Practices - JA-2022 - Suggested AnswersMd Ruhul AminNo ratings yet

- Ilovepdf MergedDocument42 pagesIlovepdf MergedSubhahan BashaNo ratings yet

- TUTORIALDocument11 pagesTUTORIALrazif hasanNo ratings yet

- P13Document14 pagesP13sogoja2705No ratings yet

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - ADocument48 pagesRevisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - Adeep_4uNo ratings yet

- Chapter:-2: Memorandum of Association & Articles of AssociationDocument29 pagesChapter:-2: Memorandum of Association & Articles of AssociationRahul NikamNo ratings yet

- TH STDocument34 pagesTH STShivani KumariNo ratings yet

- Chapter 7 Share CapitalDocument2 pagesChapter 7 Share CapitalNahar Sabirah100% (2)

- Suggested Answers of Company Law June 2019 Old Syl-Executive-RevisionDocument15 pagesSuggested Answers of Company Law June 2019 Old Syl-Executive-RevisionjesurajajosephNo ratings yet

- Week 5 (Article of Association)Document29 pagesWeek 5 (Article of Association)Siti Aishah Umairah Naser Binti Abdul RahmanNo ratings yet

- Company Law For Business BLAW2006: Tutorial QuestionsDocument6 pagesCompany Law For Business BLAW2006: Tutorial QuestionsYashrajsing LuckkanaNo ratings yet

- Alteration of Memorandum of Association AND Articles of AssociationDocument24 pagesAlteration of Memorandum of Association AND Articles of AssociationManisha SoniNo ratings yet

- Preliminary Answer Paper-1Document7 pagesPreliminary Answer Paper-1Yashu ChandakNo ratings yet

- T.Marks 100 C L Time: 3 H (+15 R)Document4 pagesT.Marks 100 C L Time: 3 H (+15 R)Nouman RashidNo ratings yet

- CFAP 2CorporateLawsModelPaperDocument5 pagesCFAP 2CorporateLawsModelPaperA-rif IftikharNo ratings yet

- Sec 185Document4 pagesSec 185Anupam BaliNo ratings yet

- Law Old CourseMCQDocument144 pagesLaw Old CourseMCQDeepa BhatiaNo ratings yet

- Company Tutorial QuesDocument7 pagesCompany Tutorial QuesSIK CHING MEINo ratings yet

- Chapter 12 - DebenturesDocument3 pagesChapter 12 - Debenturesmian UmairNo ratings yet

- Super 60 QuestionsDocument75 pagesSuper 60 Questionskaushikshivam291No ratings yet

- Top 100 Questions by Amit Popli Sir @caintergroupstudyDocument106 pagesTop 100 Questions by Amit Popli Sir @caintergroupstudypathakakash036No ratings yet

- Cfap 2 Cls Summer 2018Document4 pagesCfap 2 Cls Summer 2018Jawad TariqNo ratings yet

- April, 2019 - Company LawDocument10 pagesApril, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- CH 2 Forms of CRDocument16 pagesCH 2 Forms of CRvince_ezioNo ratings yet

- Chapter:-2: Memorandum of Association & Articles of AssociationDocument29 pagesChapter:-2: Memorandum of Association & Articles of AssociationShelly GuptaNo ratings yet

- Ep Os Module 1 Dec 20Document93 pagesEp Os Module 1 Dec 20Monika SinghNo ratings yet

- E15 CLSDocument2 pagesE15 CLSnabeelniniNo ratings yet

- IIBF Monthly ColumnDocument3 pagesIIBF Monthly ColumnNavneet PatelNo ratings yet

- Ilovepdf MergedDocument160 pagesIlovepdf Mergedcostinglecture2No ratings yet

- CA Final Law Notes by Gurukripa - AUDITORSDocument56 pagesCA Final Law Notes by Gurukripa - AUDITORSYogesh KumarNo ratings yet

- May 22 Law Ca Inter LawDocument17 pagesMay 22 Law Ca Inter LawChetan AgarwallaNo ratings yet

- CA Inter Corporate Law MCQDocument164 pagesCA Inter Corporate Law MCQRameshKumarMurali100% (5)

- Topic 4 To 6Document9 pagesTopic 4 To 6srocky2000No ratings yet

- MGT507 Company Law AssignmentDocument51 pagesMGT507 Company Law AssignmentWaiMan Tham100% (2)

- Test-5 - RevisedDocument8 pagesTest-5 - Revisedmangla.harsh77No ratings yet

- 2223 Bus2 lg08 Ce01 Student GuideDocument3 pages2223 Bus2 lg08 Ce01 Student Guidesamaratian12No ratings yet

- Sebi Regulations - Executive SummaryDocument25 pagesSebi Regulations - Executive SummaryChitra ParameswaranNo ratings yet

- Corporate Restructuring: Chapter 2 Internal ReconstructionDocument7 pagesCorporate Restructuring: Chapter 2 Internal ReconstructionUtkarsh GoradiaNo ratings yet

- CL1 T04Document3 pagesCL1 T04brunetthomas22No ratings yet

- Corporate Laws & Practices: RequirementsDocument3 pagesCorporate Laws & Practices: RequirementsReefat HasanNo ratings yet

- Who Does It (s588GA) Protect, and Is This Different To The Business Judgment Rule s180 (2) ? Give ReasonsDocument2 pagesWho Does It (s588GA) Protect, and Is This Different To The Business Judgment Rule s180 (2) ? Give ReasonsAAditya Shaujan PaudelNo ratings yet

- CBSE-XII Accounts - Chap-A7-A8, B4Document43 pagesCBSE-XII Accounts - Chap-A7-A8, B4priyanshudevil2005No ratings yet

- Corporate Law Task AnswersDocument7 pagesCorporate Law Task Answerschinwe.dozok.blog79620No ratings yet

- Law485 Apr 2011Document4 pagesLaw485 Apr 2011Khairul Ridzuan Bin Malik0% (1)

- Amit Bachhawat: Quesɵ Ons and AnswerDocument22 pagesAmit Bachhawat: Quesɵ Ons and AnswerSwatish GuptaNo ratings yet

- On Companies Act 1956 Vs Companies Bill 2012Document85 pagesOn Companies Act 1956 Vs Companies Bill 2012abmainkyakaru0% (1)

- Corporate Law - Super 50 QuestionsDocument54 pagesCorporate Law - Super 50 Questionssoumithansda286No ratings yet

- Cia2008 Tutorial 6 November 9-10 AM Partnership: Commented (wmc1) : Add On When The Partnership WillDocument11 pagesCia2008 Tutorial 6 November 9-10 AM Partnership: Commented (wmc1) : Add On When The Partnership WillChenluyan YangNo ratings yet

- Test Paper 7Document2 pagesTest Paper 7divyaagrawal701No ratings yet

- HIGHLIGHTS - OF - THE - NEW - COMPANIES - AND - ALLIED - MATTERS - ACT - 2020 - For MergeDocument7 pagesHIGHLIGHTS - OF - THE - NEW - COMPANIES - AND - ALLIED - MATTERS - ACT - 2020 - For MergeDavid ONo ratings yet

- Section 72 of The Companies Act 71 of 2008 Section 163 of The Companies Act 71 of 2008Document3 pagesSection 72 of The Companies Act 71 of 2008 Section 163 of The Companies Act 71 of 2008corymamkNo ratings yet

- Chapter 8 (3) - The Company SecretaryDocument4 pagesChapter 8 (3) - The Company SecretaryEkina EnterprisesNo ratings yet

- Chap 7 Company Audit 1Document49 pagesChap 7 Company Audit 1Akash GuptaNo ratings yet

- NK Academy For Ca: Revision Exam - 2Document5 pagesNK Academy For Ca: Revision Exam - 2S SNo ratings yet

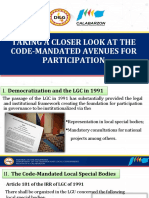

- Code Mandated Avenues of CSO ParticipationDocument25 pagesCode Mandated Avenues of CSO ParticipationDILG IV-A LUCENA CITYNo ratings yet

- Labor 28 - People Vs NograDocument4 pagesLabor 28 - People Vs Nograuchenna26No ratings yet

- Shekacho People's Movement.Document14 pagesShekacho People's Movement.Techikeji100% (1)

- Richards v. Washington Terminal Co., 233 U.S. 546 (1914)Document8 pagesRichards v. Washington Terminal Co., 233 U.S. 546 (1914)Scribd Government DocsNo ratings yet

- United States Supreme CourtDocument5 pagesUnited States Supreme CourtcaljicsNo ratings yet

- Tan Vs Sy Tiong GueDocument17 pagesTan Vs Sy Tiong GueJerome C obusanNo ratings yet

- Letter For Traffic ManagementDocument2 pagesLetter For Traffic ManagementLove MadrilejosNo ratings yet

- Rejoinder AffidavitDocument10 pagesRejoinder AffidavitAntonio de VeraNo ratings yet

- V-7 G.R. No. 150611 Saguid Vs CADocument7 pagesV-7 G.R. No. 150611 Saguid Vs CAIter MercatabantNo ratings yet

- In Re Grand Jury Proceedings. Appeal of FMC Corporation, 604 F.2d 806, 3rd Cir. (1979)Document2 pagesIn Re Grand Jury Proceedings. Appeal of FMC Corporation, 604 F.2d 806, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- Case No. 25 Nestor A. Jacot vs. Rogen T. Dal and Commission On Elections G.R. No. 179848 November 27, 2008 Nature of ActionDocument2 pagesCase No. 25 Nestor A. Jacot vs. Rogen T. Dal and Commission On Elections G.R. No. 179848 November 27, 2008 Nature of ActionNivNo ratings yet

- FORMAT Resolution PERSONA NON GRATADocument3 pagesFORMAT Resolution PERSONA NON GRATALGU CUYONo ratings yet

- Canada Immigration Forms: 3911eDocument14 pagesCanada Immigration Forms: 3911eOleksiy Kovyrin100% (1)

- Questionand AnswerDocument6 pagesQuestionand Answerxeileen080% (1)

- NCR - WAN - 003 - Non Statndard Storage (Reply For Response)Document2 pagesNCR - WAN - 003 - Non Statndard Storage (Reply For Response)Shabeer Shaarim Abdul JabbarNo ratings yet

- Anti-Hijacking Act, 2016Document7 pagesAnti-Hijacking Act, 2016Latest Laws TeamNo ratings yet

- The Tydings MC Duffie ActDocument13 pagesThe Tydings MC Duffie ActNine TailsNo ratings yet

- Syllabus EvidenceDocument4 pagesSyllabus Evidencejudith_marie1012No ratings yet

- City Gov't of QC vs. Bayan Telecom, Inc Tax1 #49 KPGDocument2 pagesCity Gov't of QC vs. Bayan Telecom, Inc Tax1 #49 KPGKenneth GeolinaNo ratings yet

- Municipal Circuit Trial CourtDocument2 pagesMunicipal Circuit Trial CourtConcepcion CejanoNo ratings yet

- Haney v. Scientology: Amicus Response To NCVBADocument22 pagesHaney v. Scientology: Amicus Response To NCVBATony OrtegaNo ratings yet

- (G.R. No. 123910. April 5, 1999) : DecisionDocument13 pages(G.R. No. 123910. April 5, 1999) : DecisionFritch GamNo ratings yet

- Lepsl 530 Third Party Doctrine and Csli AnalysisDocument4 pagesLepsl 530 Third Party Doctrine and Csli Analysisapi-462898831No ratings yet

- History of RussiaDocument22 pagesHistory of RussiaPaul CerneaNo ratings yet

- Documents of The 1898 Declaration of The Philippine IndependenceDocument33 pagesDocuments of The 1898 Declaration of The Philippine IndependencemyelNo ratings yet

- Sole Traders, Partnerships, Social EnterpriseDocument4 pagesSole Traders, Partnerships, Social EnterpriseKazi Rafsan NoorNo ratings yet

- Government of Hongkong Vs OlaliaDocument1 pageGovernment of Hongkong Vs OlaliaKatrina BudlongNo ratings yet

CLG Section 365 of Companies Act 1965 (Amended)

CLG Section 365 of Companies Act 1965 (Amended)

Uploaded by

Lee Teck LingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CLG Section 365 of Companies Act 1965 (Amended)

CLG Section 365 of Companies Act 1965 (Amended)

Uploaded by

Lee Teck LingCopyright:

Available Formats

Section 365 of Companies Act 1965 state that as regard to the payment of dividend from the company.

Section 365(2)(b) of Companies Act 1965 allows that the court to lift the veil of incorporation in terms of dividends are to be paid by the company even though there are out of profits which to pay creditors, then directors of the company have to declared the dividend as to be liable to pay the debts because the company is unable pay dividends to the creditors, which means dividends exceed the available profits. For an instance, Alex Sdn Bhd is a firm that deal with manufacturing of food processing. Fortnight ago, Alex went into bankruptcy winding up. The fact shows that it has been suffered loss from past 2 years and is totally insolvent. Victor as managing director of the company, and Mr. Chin Jia Rong as general manager have been advised that they should take an action to end up the firm into deliberation status. However, Mr. Chin and Victor think and apply seriously from the advices, and proceed to order on credit raw material that worth RM2 million from Jaya Sdn Bhd. The liquidator is now willing to sue or charge any of the directors to make them personally liable for all or any part of the RM 2 million debts.

You might also like

- Barangay Capacity Development Agenda - Brgy TaugDocument4 pagesBarangay Capacity Development Agenda - Brgy TaugMela Balagot93% (42)

- ICAP Past 20 Attempts Questions - Topic WiseDocument38 pagesICAP Past 20 Attempts Questions - Topic Wisesohail merchant100% (1)

- SASIC District - Bernal InquiryDocument2 pagesSASIC District - Bernal InquiryMaritza NunezNo ratings yet

- Writ of AmparoDocument3 pagesWrit of AmparoDee ReyesNo ratings yet

- Reduction of CapitalDocument5 pagesReduction of CapitalIntanSyakieraNo ratings yet

- Tutorial 9 IILDocument9 pagesTutorial 9 IILWinjie PangNo ratings yet

- Corporate Laws & Practices - JA-2022 - Suggested AnswersDocument7 pagesCorporate Laws & Practices - JA-2022 - Suggested AnswersMd Ruhul AminNo ratings yet

- Ilovepdf MergedDocument42 pagesIlovepdf MergedSubhahan BashaNo ratings yet

- TUTORIALDocument11 pagesTUTORIALrazif hasanNo ratings yet

- P13Document14 pagesP13sogoja2705No ratings yet

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - ADocument48 pagesRevisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - Adeep_4uNo ratings yet

- Chapter:-2: Memorandum of Association & Articles of AssociationDocument29 pagesChapter:-2: Memorandum of Association & Articles of AssociationRahul NikamNo ratings yet

- TH STDocument34 pagesTH STShivani KumariNo ratings yet

- Chapter 7 Share CapitalDocument2 pagesChapter 7 Share CapitalNahar Sabirah100% (2)

- Suggested Answers of Company Law June 2019 Old Syl-Executive-RevisionDocument15 pagesSuggested Answers of Company Law June 2019 Old Syl-Executive-RevisionjesurajajosephNo ratings yet

- Week 5 (Article of Association)Document29 pagesWeek 5 (Article of Association)Siti Aishah Umairah Naser Binti Abdul RahmanNo ratings yet

- Company Law For Business BLAW2006: Tutorial QuestionsDocument6 pagesCompany Law For Business BLAW2006: Tutorial QuestionsYashrajsing LuckkanaNo ratings yet

- Alteration of Memorandum of Association AND Articles of AssociationDocument24 pagesAlteration of Memorandum of Association AND Articles of AssociationManisha SoniNo ratings yet

- Preliminary Answer Paper-1Document7 pagesPreliminary Answer Paper-1Yashu ChandakNo ratings yet

- T.Marks 100 C L Time: 3 H (+15 R)Document4 pagesT.Marks 100 C L Time: 3 H (+15 R)Nouman RashidNo ratings yet

- CFAP 2CorporateLawsModelPaperDocument5 pagesCFAP 2CorporateLawsModelPaperA-rif IftikharNo ratings yet

- Sec 185Document4 pagesSec 185Anupam BaliNo ratings yet

- Law Old CourseMCQDocument144 pagesLaw Old CourseMCQDeepa BhatiaNo ratings yet

- Company Tutorial QuesDocument7 pagesCompany Tutorial QuesSIK CHING MEINo ratings yet

- Chapter 12 - DebenturesDocument3 pagesChapter 12 - Debenturesmian UmairNo ratings yet

- Super 60 QuestionsDocument75 pagesSuper 60 Questionskaushikshivam291No ratings yet

- Top 100 Questions by Amit Popli Sir @caintergroupstudyDocument106 pagesTop 100 Questions by Amit Popli Sir @caintergroupstudypathakakash036No ratings yet

- Cfap 2 Cls Summer 2018Document4 pagesCfap 2 Cls Summer 2018Jawad TariqNo ratings yet

- April, 2019 - Company LawDocument10 pagesApril, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- CH 2 Forms of CRDocument16 pagesCH 2 Forms of CRvince_ezioNo ratings yet

- Chapter:-2: Memorandum of Association & Articles of AssociationDocument29 pagesChapter:-2: Memorandum of Association & Articles of AssociationShelly GuptaNo ratings yet

- Ep Os Module 1 Dec 20Document93 pagesEp Os Module 1 Dec 20Monika SinghNo ratings yet

- E15 CLSDocument2 pagesE15 CLSnabeelniniNo ratings yet

- IIBF Monthly ColumnDocument3 pagesIIBF Monthly ColumnNavneet PatelNo ratings yet

- Ilovepdf MergedDocument160 pagesIlovepdf Mergedcostinglecture2No ratings yet

- CA Final Law Notes by Gurukripa - AUDITORSDocument56 pagesCA Final Law Notes by Gurukripa - AUDITORSYogesh KumarNo ratings yet

- May 22 Law Ca Inter LawDocument17 pagesMay 22 Law Ca Inter LawChetan AgarwallaNo ratings yet

- CA Inter Corporate Law MCQDocument164 pagesCA Inter Corporate Law MCQRameshKumarMurali100% (5)

- Topic 4 To 6Document9 pagesTopic 4 To 6srocky2000No ratings yet

- MGT507 Company Law AssignmentDocument51 pagesMGT507 Company Law AssignmentWaiMan Tham100% (2)

- Test-5 - RevisedDocument8 pagesTest-5 - Revisedmangla.harsh77No ratings yet

- 2223 Bus2 lg08 Ce01 Student GuideDocument3 pages2223 Bus2 lg08 Ce01 Student Guidesamaratian12No ratings yet

- Sebi Regulations - Executive SummaryDocument25 pagesSebi Regulations - Executive SummaryChitra ParameswaranNo ratings yet

- Corporate Restructuring: Chapter 2 Internal ReconstructionDocument7 pagesCorporate Restructuring: Chapter 2 Internal ReconstructionUtkarsh GoradiaNo ratings yet

- CL1 T04Document3 pagesCL1 T04brunetthomas22No ratings yet

- Corporate Laws & Practices: RequirementsDocument3 pagesCorporate Laws & Practices: RequirementsReefat HasanNo ratings yet

- Who Does It (s588GA) Protect, and Is This Different To The Business Judgment Rule s180 (2) ? Give ReasonsDocument2 pagesWho Does It (s588GA) Protect, and Is This Different To The Business Judgment Rule s180 (2) ? Give ReasonsAAditya Shaujan PaudelNo ratings yet

- CBSE-XII Accounts - Chap-A7-A8, B4Document43 pagesCBSE-XII Accounts - Chap-A7-A8, B4priyanshudevil2005No ratings yet

- Corporate Law Task AnswersDocument7 pagesCorporate Law Task Answerschinwe.dozok.blog79620No ratings yet

- Law485 Apr 2011Document4 pagesLaw485 Apr 2011Khairul Ridzuan Bin Malik0% (1)

- Amit Bachhawat: Quesɵ Ons and AnswerDocument22 pagesAmit Bachhawat: Quesɵ Ons and AnswerSwatish GuptaNo ratings yet

- On Companies Act 1956 Vs Companies Bill 2012Document85 pagesOn Companies Act 1956 Vs Companies Bill 2012abmainkyakaru0% (1)

- Corporate Law - Super 50 QuestionsDocument54 pagesCorporate Law - Super 50 Questionssoumithansda286No ratings yet

- Cia2008 Tutorial 6 November 9-10 AM Partnership: Commented (wmc1) : Add On When The Partnership WillDocument11 pagesCia2008 Tutorial 6 November 9-10 AM Partnership: Commented (wmc1) : Add On When The Partnership WillChenluyan YangNo ratings yet

- Test Paper 7Document2 pagesTest Paper 7divyaagrawal701No ratings yet

- HIGHLIGHTS - OF - THE - NEW - COMPANIES - AND - ALLIED - MATTERS - ACT - 2020 - For MergeDocument7 pagesHIGHLIGHTS - OF - THE - NEW - COMPANIES - AND - ALLIED - MATTERS - ACT - 2020 - For MergeDavid ONo ratings yet

- Section 72 of The Companies Act 71 of 2008 Section 163 of The Companies Act 71 of 2008Document3 pagesSection 72 of The Companies Act 71 of 2008 Section 163 of The Companies Act 71 of 2008corymamkNo ratings yet

- Chapter 8 (3) - The Company SecretaryDocument4 pagesChapter 8 (3) - The Company SecretaryEkina EnterprisesNo ratings yet

- Chap 7 Company Audit 1Document49 pagesChap 7 Company Audit 1Akash GuptaNo ratings yet

- NK Academy For Ca: Revision Exam - 2Document5 pagesNK Academy For Ca: Revision Exam - 2S SNo ratings yet

- Code Mandated Avenues of CSO ParticipationDocument25 pagesCode Mandated Avenues of CSO ParticipationDILG IV-A LUCENA CITYNo ratings yet

- Labor 28 - People Vs NograDocument4 pagesLabor 28 - People Vs Nograuchenna26No ratings yet

- Shekacho People's Movement.Document14 pagesShekacho People's Movement.Techikeji100% (1)

- Richards v. Washington Terminal Co., 233 U.S. 546 (1914)Document8 pagesRichards v. Washington Terminal Co., 233 U.S. 546 (1914)Scribd Government DocsNo ratings yet

- United States Supreme CourtDocument5 pagesUnited States Supreme CourtcaljicsNo ratings yet

- Tan Vs Sy Tiong GueDocument17 pagesTan Vs Sy Tiong GueJerome C obusanNo ratings yet

- Letter For Traffic ManagementDocument2 pagesLetter For Traffic ManagementLove MadrilejosNo ratings yet

- Rejoinder AffidavitDocument10 pagesRejoinder AffidavitAntonio de VeraNo ratings yet

- V-7 G.R. No. 150611 Saguid Vs CADocument7 pagesV-7 G.R. No. 150611 Saguid Vs CAIter MercatabantNo ratings yet

- In Re Grand Jury Proceedings. Appeal of FMC Corporation, 604 F.2d 806, 3rd Cir. (1979)Document2 pagesIn Re Grand Jury Proceedings. Appeal of FMC Corporation, 604 F.2d 806, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- Case No. 25 Nestor A. Jacot vs. Rogen T. Dal and Commission On Elections G.R. No. 179848 November 27, 2008 Nature of ActionDocument2 pagesCase No. 25 Nestor A. Jacot vs. Rogen T. Dal and Commission On Elections G.R. No. 179848 November 27, 2008 Nature of ActionNivNo ratings yet

- FORMAT Resolution PERSONA NON GRATADocument3 pagesFORMAT Resolution PERSONA NON GRATALGU CUYONo ratings yet

- Canada Immigration Forms: 3911eDocument14 pagesCanada Immigration Forms: 3911eOleksiy Kovyrin100% (1)

- Questionand AnswerDocument6 pagesQuestionand Answerxeileen080% (1)

- NCR - WAN - 003 - Non Statndard Storage (Reply For Response)Document2 pagesNCR - WAN - 003 - Non Statndard Storage (Reply For Response)Shabeer Shaarim Abdul JabbarNo ratings yet

- Anti-Hijacking Act, 2016Document7 pagesAnti-Hijacking Act, 2016Latest Laws TeamNo ratings yet

- The Tydings MC Duffie ActDocument13 pagesThe Tydings MC Duffie ActNine TailsNo ratings yet

- Syllabus EvidenceDocument4 pagesSyllabus Evidencejudith_marie1012No ratings yet

- City Gov't of QC vs. Bayan Telecom, Inc Tax1 #49 KPGDocument2 pagesCity Gov't of QC vs. Bayan Telecom, Inc Tax1 #49 KPGKenneth GeolinaNo ratings yet

- Municipal Circuit Trial CourtDocument2 pagesMunicipal Circuit Trial CourtConcepcion CejanoNo ratings yet

- Haney v. Scientology: Amicus Response To NCVBADocument22 pagesHaney v. Scientology: Amicus Response To NCVBATony OrtegaNo ratings yet

- (G.R. No. 123910. April 5, 1999) : DecisionDocument13 pages(G.R. No. 123910. April 5, 1999) : DecisionFritch GamNo ratings yet

- Lepsl 530 Third Party Doctrine and Csli AnalysisDocument4 pagesLepsl 530 Third Party Doctrine and Csli Analysisapi-462898831No ratings yet

- History of RussiaDocument22 pagesHistory of RussiaPaul CerneaNo ratings yet

- Documents of The 1898 Declaration of The Philippine IndependenceDocument33 pagesDocuments of The 1898 Declaration of The Philippine IndependencemyelNo ratings yet

- Sole Traders, Partnerships, Social EnterpriseDocument4 pagesSole Traders, Partnerships, Social EnterpriseKazi Rafsan NoorNo ratings yet

- Government of Hongkong Vs OlaliaDocument1 pageGovernment of Hongkong Vs OlaliaKatrina BudlongNo ratings yet