Professional Documents

Culture Documents

Satyam Scandal

Satyam Scandal

Uploaded by

Mayank ShuklaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Satyam Scandal

Satyam Scandal

Uploaded by

Mayank ShuklaCopyright:

Available Formats

The mega corporate fraud

Satyam Computer Services Ltd.is a consulting and information technology services company based in Hyderabad, India . The company offers information technology(IT) services spanning various sectors, and is listed on the New York Stock Exchange and Euronext. It is considered as an icon among the IT companies and at one point had over a billion dollar revenue. Satyam's network covers 67 countries across six continents. The company employs 40,000 IT professionals across development centres in India, the United States, the United Kingdom, the UAE, Canada, Hungary, Singapore, Malaysia, China, Japan, Egypt and Australia. It serves over 654 global companies, 185 of which are Fortune 500 corporations.

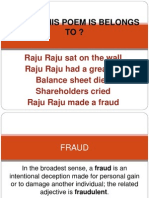

On Jan 2009, company Chairman Ramalingam Raju resigned after notifying board members and SEBI that Satyams accounts had been falsified. He confessed that Satyam balance sheet of September 2008 contained: Inflated figured for cash and bank balances of Rs.5040 Crores as against Rs.5361 crores reflected in balance sheet. An accrued interest of Rs.376 Crores which was non- existent. An understated liability of Rs.1230 Crores on accounts of frauds arranged by himself. An overstated debtors position of Rs.490 Crores against Rs.2361Crores reflected in the books. 40000 against 50000 employees reflected in books. After investors voice against Satyam- Maytas deal. This complete fraud come into limelight which has shaken all corporate bodies, government, investors and other stakeholders of the company.

New York Stock Exchange remove Satyam from its trading list. NSE also announce to remove Satyam from its trading list. Satyams auditing firm PrincewaterhouseCooperss license is revoked in India. Due to Satyam fiasco BSE & NSE report downfall of 7%. Others who suffered are Government IT sector. SEBI Promoters Employees of Satyam. And most importantour NATION IMAGE.

The main reason behind this scam is GREED. To save taxes. To achieve targets. To impress investors. To earn more and more money in short period of time. To overcome the competitors. The loopholes in Corporate Governance also encourages them to adopt unethical and illegal way of earning money.

Atul Pal Mayank Shukla Deepika Handoo Sneha Gupta Parul Garg Akshay Gupta

You might also like

- Service Integration and Management (SIAM™) Professional Body of Knowledge (BoK), Second editionFrom EverandService Integration and Management (SIAM™) Professional Body of Knowledge (BoK), Second editionNo ratings yet

- Ethics CaseDocument10 pagesEthics CaseAayush AkhauriNo ratings yet

- Case Study On Organisational ConflictsDocument18 pagesCase Study On Organisational ConflictsManjeet PradhanNo ratings yet

- Preface: Accounting Scandals, or Corporate Accounting Scandals, AreDocument4 pagesPreface: Accounting Scandals, or Corporate Accounting Scandals, AreSanya DuggalNo ratings yet

- Satyam - An IntrospectiveDocument34 pagesSatyam - An IntrospectiveAbhishek MishraNo ratings yet

- The Satyam Fiasco: A Corporate Governance Disaster!Document10 pagesThe Satyam Fiasco: A Corporate Governance Disaster!Jasper de VeenNo ratings yet

- Report of Case Study On Satyam ScandalDocument16 pagesReport of Case Study On Satyam ScandalMrunal PanchalNo ratings yet

- NCRD'S Sterling Institute of Management Studies: Subject Assignment Submitted To Submitted ByDocument4 pagesNCRD'S Sterling Institute of Management Studies: Subject Assignment Submitted To Submitted ByNishita ShivkarNo ratings yet

- Key Facts:: Satyam Computer Services Ltd. Is A Consulting and Information Technology Services CompanyDocument11 pagesKey Facts:: Satyam Computer Services Ltd. Is A Consulting and Information Technology Services Companyrohini2008No ratings yet

- Review of Governance Failure at SatyamDocument2 pagesReview of Governance Failure at SatyamerikericashNo ratings yet

- Case Study of Satyam ScamDocument22 pagesCase Study of Satyam ScamAnubhav JainNo ratings yet

- Case Study On Auditing (Satyam Computers LTD.)Document10 pagesCase Study On Auditing (Satyam Computers LTD.)niti saxenaNo ratings yet

- Question: Give A Brief Chronology of Significant Events Leading To The Downfall ofDocument6 pagesQuestion: Give A Brief Chronology of Significant Events Leading To The Downfall ofPrateek YadavNo ratings yet

- Assignment On Satyam Scam PGDM Vii A 2009-2011Document5 pagesAssignment On Satyam Scam PGDM Vii A 2009-2011mishikaachuNo ratings yet

- Powerpoint Templates Powerpoint TemplatesDocument30 pagesPowerpoint Templates Powerpoint TemplatesParth PanchalNo ratings yet

- Chrome-Extension Mhjfbmdgcfjbbpaeojofohoefgiehjai IndexDocument14 pagesChrome-Extension Mhjfbmdgcfjbbpaeojofohoefgiehjai IndexkullsNo ratings yet

- Satyam - An Introspective: Presented By:-Anup Kumar Avinash 10HM06Document12 pagesSatyam - An Introspective: Presented By:-Anup Kumar Avinash 10HM06Anup Kumar AvinashNo ratings yet

- Business Case Study Presentation-1Document11 pagesBusiness Case Study Presentation-1Deepak RajoriyaNo ratings yet

- The Scam at Satyam Computer ServicesDocument6 pagesThe Scam at Satyam Computer ServicesMahima VirmaniNo ratings yet

- Satyam ScandalDocument25 pagesSatyam ScandalSachin MethreeNo ratings yet

- Corporate FraudDocument12 pagesCorporate FraudMahender ChauhanNo ratings yet

- SATYAM - The Case StudyDocument29 pagesSATYAM - The Case StudyPratul Kukreja100% (1)

- Satyam 1Document31 pagesSatyam 1sharmadisha0703No ratings yet

- SatYam Case StudyDocument9 pagesSatYam Case Studyrockers_86100% (1)

- Rameet Kaur, CSRDocument11 pagesRameet Kaur, CSRRameet KaurNo ratings yet

- New Microsoft Office Word 97 - 2003 DocumentDocument2 pagesNew Microsoft Office Word 97 - 2003 DocumentharilkrishnaNo ratings yet

- Satyam DetailsDocument12 pagesSatyam DetailsJanaki DevarajanNo ratings yet

- A Case Study of Satyam LTDDocument36 pagesA Case Study of Satyam LTDKaustav GhoshNo ratings yet

- Satyam ScandalDocument6 pagesSatyam ScandalRhislee PabrigaNo ratings yet

- Satyam Sam 23Document7 pagesSatyam Sam 23Punam GuptaNo ratings yet

- Satyam Computer Scam - Pre and Post DiagnosisDocument16 pagesSatyam Computer Scam - Pre and Post DiagnosismetopeNo ratings yet

- The Satyam Fiasco - Summary & AnalysisDocument2 pagesThe Satyam Fiasco - Summary & AnalysisManasvi MarkandeyNo ratings yet

- The Satyam Scandal Has Shocked IndiaDocument4 pagesThe Satyam Scandal Has Shocked Indiatarun100No ratings yet

- Satyam Scam: Presented by Abhiman BeheraDocument16 pagesSatyam Scam: Presented by Abhiman BeheraMahesh GaddamediNo ratings yet

- Satyam Scandal: Ethics in Corporate GovernanceDocument14 pagesSatyam Scandal: Ethics in Corporate Governancepuneet.glennNo ratings yet

- Financial Management Assignment About Agency Problem CIA-3A: Prof. Rajani RamdasDocument4 pagesFinancial Management Assignment About Agency Problem CIA-3A: Prof. Rajani RamdasAbin Som 2028121No ratings yet

- Presentation On SATYAM SCAMDocument10 pagesPresentation On SATYAM SCAMKhushi Gupta100% (1)

- "C CC C!CCC (C!CCC C CB C (!! CC C CC (:C C CC CC 'C C (!C C C:C C C C C (C, C:C C C# C! C#$C C CC C!%Document3 pages"C CC C!CCC (C!CCC C CB C (!! CC C CC (:C C CC CC 'C C (!C C C:C C C C C (C, C:C C C# C! C#$C C CC C!%Akshat AroraNo ratings yet

- Satyam PPT FinalDocument16 pagesSatyam PPT FinalBhumika ThakkarNo ratings yet

- Satyam Corporate FraudDocument9 pagesSatyam Corporate FraudBALAJI IYER100% (1)

- Corporate Governance Failure atDocument20 pagesCorporate Governance Failure atvovik9No ratings yet

- Satyam Scandal 'India'S Enron': Submitted By:-Mansi Mangla Submitted To: - DR Charu Shri GuptaDocument13 pagesSatyam Scandal 'India'S Enron': Submitted By:-Mansi Mangla Submitted To: - DR Charu Shri GuptaMansi ManglaNo ratings yet

- Case Pointers For Satyam Case StudyDocument3 pagesCase Pointers For Satyam Case StudyBRAHM PRAKASHNo ratings yet

- Satyam Computer Services LTD: Akhilesh SinhaDocument17 pagesSatyam Computer Services LTD: Akhilesh Sinhachaitanya psNo ratings yet

- Satyam Computer Services' ScandalDocument7 pagesSatyam Computer Services' ScandalLu XiyunNo ratings yet

- Satyam Computers Services Scandal - Case StudyDocument4 pagesSatyam Computers Services Scandal - Case StudyRavi RavalNo ratings yet

- Satyam ScandalDocument11 pagesSatyam ScandalBadri NarayanNo ratings yet

- BRITON - Satyam CaseDocument21 pagesBRITON - Satyam CaseSoorya HaridasanNo ratings yet

- Satyam ScamDocument41 pagesSatyam ScamRajasree VarmaNo ratings yet

- Case StudyDocument15 pagesCase Studysonam shrivasNo ratings yet

- Learnings From Corporate Scandals - LAB ProjectDocument8 pagesLearnings From Corporate Scandals - LAB ProjectAnimesh VermaNo ratings yet

- Satyam Computer Services LTD Slides FinalDocument17 pagesSatyam Computer Services LTD Slides Finaljhawarkishan4No ratings yet

- Satyam Scam: Abhijit SamantaDocument4 pagesSatyam Scam: Abhijit Samantaabhijitsamanta1No ratings yet

- Atyam Scanda: About The CompanyDocument4 pagesAtyam Scanda: About The CompanyKaveriNandaNo ratings yet

- Satyam Computer ScamDocument4 pagesSatyam Computer ScamSubham MehtaNo ratings yet

- Name of The Topic: Fraud and Scam Team Members Name and Roll NoDocument10 pagesName of The Topic: Fraud and Scam Team Members Name and Roll NoRicha ManeNo ratings yet

- Guess This Poem Is Belongs ToDocument27 pagesGuess This Poem Is Belongs ToShreyash SuryavanshiNo ratings yet

- SatyamDocument11 pagesSatyamAnamIqbalNo ratings yet

- Do You Want to Be a Digital Entrepreneur? What You Need to Know to Start and Protect Your Knowledge-Based Digital BusinessFrom EverandDo You Want to Be a Digital Entrepreneur? What You Need to Know to Start and Protect Your Knowledge-Based Digital BusinessNo ratings yet