Professional Documents

Culture Documents

Kay Bonavente Mylene Luna: Net Incremental Benefit

Kay Bonavente Mylene Luna: Net Incremental Benefit

Uploaded by

Si Kaye0 ratings0% found this document useful (0 votes)

30 views1 pageThe document calculates the incremental benefit of increasing present sales by 30%. It determines that a 30% increase results in 60,000 additional units and P600,000 in incremental revenues. After accounting for bad debts, taxes, and the required 25% return on additional receivables investment, the net incremental benefit is P203,054.76.

Original Description:

Original Title

fin mgt

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document calculates the incremental benefit of increasing present sales by 30%. It determines that a 30% increase results in 60,000 additional units and P600,000 in incremental revenues. After accounting for bad debts, taxes, and the required 25% return on additional receivables investment, the net incremental benefit is P203,054.76.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

30 views1 pageKay Bonavente Mylene Luna: Net Incremental Benefit

Kay Bonavente Mylene Luna: Net Incremental Benefit

Uploaded by

Si KayeThe document calculates the incremental benefit of increasing present sales by 30%. It determines that a 30% increase results in 60,000 additional units and P600,000 in incremental revenues. After accounting for bad debts, taxes, and the required 25% return on additional receivables investment, the net incremental benefit is P203,054.76.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

KAY BONAVENTE

MYLENE LUNA

Present Sales

P 10,000000

To be increased

30%

Selling Price

P 50 / unit

Cost

P 40/unit

Required return

25%

Bad Debts

5%

Taxes

35%

CREDIT TERM:

From 60 days to 90 days

Determine the Incremental benefit

30% increase x P 10,000,000 =

P 3,000,000

No. of Units = P 3,000,000 P 50/unit = 60,000 units

Incremental Revenues

( P 10 x 60,000 units) =

Less: Bad Debts

( 2% x P 3,000,000 ) =

Margin before tax

=

Less: Taxes

( 35% x P 540,000)

=

Incremental Margin after tax =

P 600,000

P 60,000

P 540,000

P 189,000

P 351,000

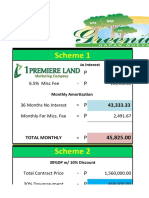

INCREMENTAL INVESTMENT

Additional Receivables:

P 8,219.18 x 90 days = P 739, 726.20

Investment in additional receivables:

Cost Ratio:

80% x P 739, 726.20 = P 591, 780.96

Required Return

P 591, 780.96 x 25% = P 147, 945.24

Net Incremental Benefit:

(P 351,000 - P 147, 945.24)

P 203,054.76

You might also like

- HW 6-19Document9 pagesHW 6-19tgawri100% (2)

- Agamata Chapter 5Document10 pagesAgamata Chapter 5Drama SubsNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Reales Tax Rev Computation ExerciseDocument4 pagesReales Tax Rev Computation ExerciseJethroret RealesNo ratings yet

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Exercise Chapter 6Document15 pagesExercise Chapter 6thaole.31221026851No ratings yet

- IV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods CorpDocument9 pagesIV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods Corpjennie martNo ratings yet

- Ex 3-22 Textbook SolutionDocument2 pagesEx 3-22 Textbook SolutionneedforschoolNo ratings yet

- 06a - Computation - BrokerageDocument8 pages06a - Computation - Brokeragerestieulip.rebapqcNo ratings yet

- 16 KTQT 22000360 LyGiaiHienDocument13 pages16 KTQT 22000360 LyGiaiHienPhan Ngọc Minh TriếtNo ratings yet

- Chapter 5 (2) CVPDocument11 pagesChapter 5 (2) CVPInocencio TiburcioNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- 2 - Ans-CVPDocument3 pages2 - Ans-CVPCANDISSE KIRSTEN YUENNo ratings yet

- Contribution Margin Ratio 0.2: Compute The Break-Even Point in Dollar Sales For Each ProductDocument4 pagesContribution Margin Ratio 0.2: Compute The Break-Even Point in Dollar Sales For Each ProductVõ Triệu VyNo ratings yet

- Income TaxationDocument41 pagesIncome TaxationErlindss Ilustrisimo GadainganNo ratings yet

- PERMALINO - Learning Activity 20. Capital Budgeting TechniquesDocument2 pagesPERMALINO - Learning Activity 20. Capital Budgeting TechniquesAra Joyce PermalinoNo ratings yet

- MCQADVACCDocument27 pagesMCQADVACCJungkookie BaeNo ratings yet

- Capital Budgeting Exercises 2 NUNEZ PDFDocument3 pagesCapital Budgeting Exercises 2 NUNEZ PDFAlexis KingNo ratings yet

- Cost, Volume, Profit Analysis - Ex. SoluDocument19 pagesCost, Volume, Profit Analysis - Ex. SoluHimadri DeyNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Practical Application of Taxation On CorporationsDocument5 pagesPractical Application of Taxation On CorporationsClaire BarbaNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- 2008 June Paper 1Document2 pages2008 June Paper 1zahid_mahmood3811No ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Strama Activity 2 SolmanDocument7 pagesStrama Activity 2 SolmanPaupauNo ratings yet

- Solution Chapter 2 DayagDocument28 pagesSolution Chapter 2 DayagClifford Angel Matias80% (5)

- Computation GWDocument133 pagesComputation GWJohn Jerome Santiago IINo ratings yet

- Chapter 3 Homework Chapter 3 HomeworkDocument8 pagesChapter 3 Homework Chapter 3 HomeworkPhương NguyễnNo ratings yet

- Chapter 11Document12 pagesChapter 11Ya LunNo ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Problem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductDocument15 pagesProblem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductJPNo ratings yet

- Fabm Week 1 Asnd 2Document5 pagesFabm Week 1 Asnd 2John Calvin GerolaoNo ratings yet

- Profitability Ratios: ProblemsDocument5 pagesProfitability Ratios: ProblemsMae Cuizon ComendadorNo ratings yet

- Ch05 Marginal Costing and Cost-Volume-Profit Relationships PDFDocument10 pagesCh05 Marginal Costing and Cost-Volume-Profit Relationships PDFjdiaz_646247No ratings yet

- The Contribution Margin Ratio Will DecreaseDocument7 pagesThe Contribution Margin Ratio Will DecreaseSaeym SegoviaNo ratings yet

- Gene Justine Sacdalan Test PaperDocument4 pagesGene Justine Sacdalan Test PaperGene Justine SacdalanNo ratings yet

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Ch08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFDocument10 pagesCh08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFjdiaz_646247No ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- Business Mathematics Module 1Document5 pagesBusiness Mathematics Module 1Yana MiguelNo ratings yet

- Cost of OverdraftDocument2 pagesCost of OverdraftRukayat BolaNo ratings yet

- Multiple Choice Answers and Solutions: Franchise AccountingDocument7 pagesMultiple Choice Answers and Solutions: Franchise Accountingmark_torreonNo ratings yet

- Susquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6Document6 pagesSusquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6EdTan RagadioNo ratings yet

- Public Notice 51 of 2023 - PAYE Tables ReviewDocument2 pagesPublic Notice 51 of 2023 - PAYE Tables ReviewPhillip Plat TsanguNo ratings yet

- Chapter 11 ADVANCED ACCOUNTING SOL MAN GUERRERODocument12 pagesChapter 11 ADVANCED ACCOUNTING SOL MAN GUERREROShiela PilarNo ratings yet

- Running Head: COUPON AND BONDSDocument3 pagesRunning Head: COUPON AND BONDSCarlos AlphonceNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- 2014 Volume 2 CH 5 AnswersDocument6 pages2014 Volume 2 CH 5 AnswersGirlie SisonNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Area Coordinators, Area Supervisor, Enumerators and Encoders of The National Household Targeting System For Poverty ReductionDocument2 pagesArea Coordinators, Area Supervisor, Enumerators and Encoders of The National Household Targeting System For Poverty ReductionSi Kaye0% (2)

- Proper Quoting: GuidelinesDocument4 pagesProper Quoting: GuidelinesSi KayeNo ratings yet

- Decision Panganiban, J.:: Oriental Assurance Corporation, Petitioner, vs. Solidbank Corporation, RespondentDocument7 pagesDecision Panganiban, J.:: Oriental Assurance Corporation, Petitioner, vs. Solidbank Corporation, RespondentSi KayeNo ratings yet

- Psychometric Tests 2012Document7 pagesPsychometric Tests 2012Harris ChikunyaNo ratings yet

- RO5 ProDocument23 pagesRO5 ProSi KayeNo ratings yet

- Supreme CourtDocument4 pagesSupreme CourtSi KayeNo ratings yet

- Lyiny inDocument11 pagesLyiny inSi Kaye100% (4)

- DNA, The Language of Evolution: Francis Crick & James WatsonDocument2 pagesDNA, The Language of Evolution: Francis Crick & James WatsonSi KayeNo ratings yet