Professional Documents

Culture Documents

Carbon Update 15 April 2013 PDF

Carbon Update 15 April 2013 PDF

Uploaded by

David BolesCopyright:

Available Formats

You might also like

- Carbon Update 31 May 2013 PDFDocument1 pageCarbon Update 31 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 26 April 2013 PDFDocument1 pageCarbon Update 26 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 29 April 2013 PDFDocument1 pageCarbon Update 29 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 25 June 2013Document1 pageCarbon Update 25 June 2013David BolesNo ratings yet

- Carbon Update 22 July 2013 PDFDocument1 pageCarbon Update 22 July 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 11 June 2013Document1 pageCarbon Update 11 June 2013David BolesNo ratings yet

- Carbon Update 27 March 2013 PDFDocument1 pageCarbon Update 27 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 02 July 2013Document1 pageCarbon Update 02 July 2013David BolesNo ratings yet

- Carbon Update 15 March 2013 PDFDocument1 pageCarbon Update 15 March 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 05 April 2013 PDFDocument1 pageCarbon Update 05 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 08 July 2013Document1 pageCarbon Update 08 July 2013David BolesNo ratings yet

- Carbon Update 19 April 2013Document1 pageCarbon Update 19 April 2013David BolesNo ratings yet

- Carbon Update 30 Aug 2013Document1 pageCarbon Update 30 Aug 2013David BolesNo ratings yet

- Carbon Update 13 March 2013 PDFDocument1 pageCarbon Update 13 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 16 April 2013Document1 pageCarbon Update 16 April 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 20 March 2013 PDFDocument1 pageCarbon Update 20 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 09 April 2013 PDFDocument1 pageCarbon Update 09 April 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 08 May 2013 PDFDocument1 pageCarbon Update 08 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 30 July 2013-1Document1 pageCarbon Update 30 July 2013-1David BolesNo ratings yet

- Carbon Update 26 March 2013 PDFDocument1 pageCarbon Update 26 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 28 May 2013 PDFDocument1 pageCarbon Update 28 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 12 June 2013Document1 pageCarbon Update 12 June 2013David BolesNo ratings yet

- Carbon Update 07 June 2013Document1 pageCarbon Update 07 June 2013David BolesNo ratings yet

- Carbon Update 12 July 2013Document1 pageCarbon Update 12 July 2013David BolesNo ratings yet

- Carbon Update 14 June 2013Document1 pageCarbon Update 14 June 2013David BolesNo ratings yet

- Carbon Update 05 June 2013Document1 pageCarbon Update 05 June 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 04 Sep 2013Document1 pageCarbon Update 04 Sep 2013queeny40No ratings yet

- Carbon Update 24 July 2013Document1 pageCarbon Update 24 July 2013David BolesNo ratings yet

- Carbon Update 10 May 2013 PDFDocument1 pageCarbon Update 10 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 03 May 2013 PDFDocument1 pageCarbon Update 03 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 21 May 2013 PDFDocument1 pageCarbon Update 21 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 23 April 2013 PDFDocument1 pageCarbon Update 23 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 28 June 2013Document1 pageCarbon Update 28 June 2013David BolesNo ratings yet

- Carbon Update 14 April 2013 PDFDocument1 pageCarbon Update 14 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 03 April 2013 PDFDocument1 pageCarbon Update 03 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 29 May 2013 PDFDocument1 pageCarbon Update 29 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 21 June 2013Document1 pageCarbon Update 21 June 2013David BolesNo ratings yet

- Carbon Update 22 April 2013 PDFDocument1 pageCarbon Update 22 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 17 June 2013Document1 pageCarbon Update 17 June 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon Updatequeeny40No ratings yet

- Carbon Update 28 Aug 2013Document1 pageCarbon Update 28 Aug 2013David BolesNo ratings yet

- Carbon Update 04 June 2013Document1 pageCarbon Update 04 June 2013David BolesNo ratings yet

- Carbon Update 15 July 2013Document1 pageCarbon Update 15 July 2013David BolesNo ratings yet

- Carbon Update 10 July 2013Document1 pageCarbon Update 10 July 2013David BolesNo ratings yet

- Carbon Update 19 Aug 2013Document1 pageCarbon Update 19 Aug 2013David BolesNo ratings yet

- Carbon Update 02 April 2013 PDFDocument1 pageCarbon Update 02 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 26 Aug 2013Document1 pageCarbon Update 26 Aug 2013David BolesNo ratings yet

- Carbon Update 30 April 2013 PDFDocument1 pageCarbon Update 30 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 14 April 2013 PDFDocument1 pageCarbon Update 14 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 20 May 2013 PDFDocument1 pageCarbon Update 20 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- Country Partnership Strategy: Georgia 2014 - 2018Document19 pagesCountry Partnership Strategy: Georgia 2014 - 2018David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 June 2015Document1 pageDBLM Solutions Carbon Newsletter 18 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 June 2015Document1 pageDBLM Solutions Carbon Newsletter 10 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 June 2015Document1 pageDBLM Solutions Carbon Newsletter 04 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 30 Apr 2015David BolesNo ratings yet

Carbon Update 15 April 2013 PDF

Carbon Update 15 April 2013 PDF

Uploaded by

David BolesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carbon Update 15 April 2013 PDF

Carbon Update 15 April 2013 PDF

Uploaded by

David BolesCopyright:

Available Formats

DBLM Solutions

Luciano Magliocco +353 87 9051928 (Mobile) dblmluc (SKYPE) luc@dblmsolutions.com

DBLM Solutions Carbon Update

Carbon Overview

David Boles 01 4433584 (Direct) dblmdavid (SKYPE) david@dblmsolutions.com

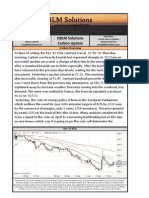

At time of writing the Dec '13 EUA Contract was at 4. 90. Prices started to rise last Friday lunchtime on optimism that tomorrows vote will go through to withhold 900 million EUA's from auction until the final three years of Phase 3. Analysts have predicted that carbon could fall below 1 tonne if the vote fails tomorrow. In other news , the UN has launched a commission study to establish access to sovereign wealth funds in order to try and save the ailing flexible mechanisms, ie the clean development mechanism and Joint Implementation. The carbon world is on its knees and the vote tomorrow will be decisive. We will let you know the results as soon as they become known. Results on the consultation process about carbon market reforms have been published. About 10% of the 200 responses came from utilities. These companies included CEZ, Dong energy, EON, GDF Suez, Iderbola, RWE, SSE, Statoil and Vattenfall. Nineteen out of the 23 respondents rejected the reform to ban UN offsets for compliance use. An interesting solution was proposed by EON, whereby an 'emission trading currency' would be established. This would enable offsets to be converted into EUA's and vice versa.

Dec 13 EUA

Past performance may not be a reliable guide to future performance. Mention of specific commodities should not be taken as a recommendation to buy or sell these commodities. Commodity Trading is risky and DBLM Solutions assume no liability for the use of any information contained herein. Past financial results are not necessarily indicative of future performance. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to accuracy. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples. Neither this information, nor any opinion expressed, constitutes a solicitation to buy or sell futures or options or futures contracts, or OTC products. Reproduction without authorization is forbidden. All rights reserved. DBLM Solutions.

You might also like

- Carbon Update 31 May 2013 PDFDocument1 pageCarbon Update 31 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 26 April 2013 PDFDocument1 pageCarbon Update 26 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 29 April 2013 PDFDocument1 pageCarbon Update 29 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 25 June 2013Document1 pageCarbon Update 25 June 2013David BolesNo ratings yet

- Carbon Update 22 July 2013 PDFDocument1 pageCarbon Update 22 July 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 11 June 2013Document1 pageCarbon Update 11 June 2013David BolesNo ratings yet

- Carbon Update 27 March 2013 PDFDocument1 pageCarbon Update 27 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 02 July 2013Document1 pageCarbon Update 02 July 2013David BolesNo ratings yet

- Carbon Update 15 March 2013 PDFDocument1 pageCarbon Update 15 March 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 05 April 2013 PDFDocument1 pageCarbon Update 05 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 08 July 2013Document1 pageCarbon Update 08 July 2013David BolesNo ratings yet

- Carbon Update 19 April 2013Document1 pageCarbon Update 19 April 2013David BolesNo ratings yet

- Carbon Update 30 Aug 2013Document1 pageCarbon Update 30 Aug 2013David BolesNo ratings yet

- Carbon Update 13 March 2013 PDFDocument1 pageCarbon Update 13 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 16 April 2013Document1 pageCarbon Update 16 April 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 20 March 2013 PDFDocument1 pageCarbon Update 20 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 09 April 2013 PDFDocument1 pageCarbon Update 09 April 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 08 May 2013 PDFDocument1 pageCarbon Update 08 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 30 July 2013-1Document1 pageCarbon Update 30 July 2013-1David BolesNo ratings yet

- Carbon Update 26 March 2013 PDFDocument1 pageCarbon Update 26 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 28 May 2013 PDFDocument1 pageCarbon Update 28 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 12 June 2013Document1 pageCarbon Update 12 June 2013David BolesNo ratings yet

- Carbon Update 07 June 2013Document1 pageCarbon Update 07 June 2013David BolesNo ratings yet

- Carbon Update 12 July 2013Document1 pageCarbon Update 12 July 2013David BolesNo ratings yet

- Carbon Update 14 June 2013Document1 pageCarbon Update 14 June 2013David BolesNo ratings yet

- Carbon Update 05 June 2013Document1 pageCarbon Update 05 June 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 04 Sep 2013Document1 pageCarbon Update 04 Sep 2013queeny40No ratings yet

- Carbon Update 24 July 2013Document1 pageCarbon Update 24 July 2013David BolesNo ratings yet

- Carbon Update 10 May 2013 PDFDocument1 pageCarbon Update 10 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 03 May 2013 PDFDocument1 pageCarbon Update 03 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 21 May 2013 PDFDocument1 pageCarbon Update 21 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 23 April 2013 PDFDocument1 pageCarbon Update 23 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 28 June 2013Document1 pageCarbon Update 28 June 2013David BolesNo ratings yet

- Carbon Update 14 April 2013 PDFDocument1 pageCarbon Update 14 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 03 April 2013 PDFDocument1 pageCarbon Update 03 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 29 May 2013 PDFDocument1 pageCarbon Update 29 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 21 June 2013Document1 pageCarbon Update 21 June 2013David BolesNo ratings yet

- Carbon Update 22 April 2013 PDFDocument1 pageCarbon Update 22 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 17 June 2013Document1 pageCarbon Update 17 June 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon Updatequeeny40No ratings yet

- Carbon Update 28 Aug 2013Document1 pageCarbon Update 28 Aug 2013David BolesNo ratings yet

- Carbon Update 04 June 2013Document1 pageCarbon Update 04 June 2013David BolesNo ratings yet

- Carbon Update 15 July 2013Document1 pageCarbon Update 15 July 2013David BolesNo ratings yet

- Carbon Update 10 July 2013Document1 pageCarbon Update 10 July 2013David BolesNo ratings yet

- Carbon Update 19 Aug 2013Document1 pageCarbon Update 19 Aug 2013David BolesNo ratings yet

- Carbon Update 02 April 2013 PDFDocument1 pageCarbon Update 02 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 26 Aug 2013Document1 pageCarbon Update 26 Aug 2013David BolesNo ratings yet

- Carbon Update 30 April 2013 PDFDocument1 pageCarbon Update 30 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 14 April 2013 PDFDocument1 pageCarbon Update 14 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 20 May 2013 PDFDocument1 pageCarbon Update 20 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- Country Partnership Strategy: Georgia 2014 - 2018Document19 pagesCountry Partnership Strategy: Georgia 2014 - 2018David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 June 2015Document1 pageDBLM Solutions Carbon Newsletter 18 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 June 2015Document1 pageDBLM Solutions Carbon Newsletter 10 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 June 2015Document1 pageDBLM Solutions Carbon Newsletter 04 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 30 Apr 2015David BolesNo ratings yet