Professional Documents

Culture Documents

Income Tax Return Forms 1-8 (New)

Income Tax Return Forms 1-8 (New)

Uploaded by

jayamurli195479220 ratings0% found this document useful (0 votes)

344 views1 pageThe document lists the new income tax return forms for the 2009-10 assessment year in India, including ITR-1 for individuals with income from salary, pension, or interest; ITR-2 for individuals and HUFs without business income; and ITR-3 for individuals/HUFs who are partners in firms. It also includes forms for individuals with proprietary business income (ITR-4), companies (ITR-6), and returns for fringe benefits (ITR-8).

Original Description:

NEW INCOME-TAX RETURN FORMS

(For Assessment Year 2009-10)

Original Title

Income Tax return Forms 1-8(New)

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists the new income tax return forms for the 2009-10 assessment year in India, including ITR-1 for individuals with income from salary, pension, or interest; ITR-2 for individuals and HUFs without business income; and ITR-3 for individuals/HUFs who are partners in firms. It also includes forms for individuals with proprietary business income (ITR-4), companies (ITR-6), and returns for fringe benefits (ITR-8).

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

344 views1 pageIncome Tax Return Forms 1-8 (New)

Income Tax Return Forms 1-8 (New)

Uploaded by

jayamurli19547922The document lists the new income tax return forms for the 2009-10 assessment year in India, including ITR-1 for individuals with income from salary, pension, or interest; ITR-2 for individuals and HUFs without business income; and ITR-3 for individuals/HUFs who are partners in firms. It also includes forms for individuals with proprietary business income (ITR-4), companies (ITR-6), and returns for fringe benefits (ITR-8).

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

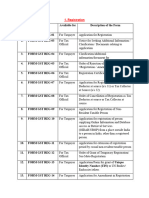

NEW INCOME-TAX RETURN FORMS

(For Assessment Year 2009-10)

Form No. Heading Instructions

ITR-1 For Individuals having Income from ITR-1 - Instructions

Salary/ Pension/ family pension and

Interest

ITR-2 For Individuals and HUFs not ITR-2 - Instructions

having Income from Business or

Profession

ITR-3 For Individuals/HUFs being ITR-3 - Instructions

partners in firms and not carrying

out business or profession under

any proprietorship

ITR-4 For individuals and HUFs having ITR-4 - Instructions

income from a proprietory business

or profession

ITR-5 Including Fringe Benefit Tax Return ITR-5 - Instructions

ITR-6 For Companies other than ITR-6 - Instructions

companies claiming exemption

under section 11

ITR-7 For persons including companies ITR-7 - Instructions

required to furnish return under

section 139(4A) or section 139(4B)

or section 139(4C) or section

139(4D)

ITR-8 Return for Fringe Benefits ITR-8 - Instructions

ITR-V Where the data of the Return of ITR-V - Instructions

Income/Fringe Benefits in Form

ITR-1, ITR-2, ITR-3, ITR-4, ITR-5,

ITR-6 & ITR-8 transmitted

electronically without digital

signature

Acknowledgment

You might also like

- IRS Form SS-4: EIN NumberDocument2 pagesIRS Form SS-4: EIN Numberlccommunists100% (3)

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- HMRC Statement of Practice PDFDocument356 pagesHMRC Statement of Practice PDFchc011133No ratings yet

- Instruction For Itr 7 Ay 2015-16: Read/DownloadDocument3 pagesInstruction For Itr 7 Ay 2015-16: Read/DownloadSabitabrata MukhopadhyayNo ratings yet

- Government Notifies New Income Tax Return Forms For The Financial Year 2014-15Document8 pagesGovernment Notifies New Income Tax Return Forms For The Financial Year 2014-15HimanshuNo ratings yet

- 11 Task Performance TaxDocument2 pages11 Task Performance Taxjeffersam31No ratings yet

- IT ReturnsDocument11 pagesIT ReturnsAnjali Krishna SNo ratings yet

- Income Tax Return Online - WEB ONLINE CADocument56 pagesIncome Tax Return Online - WEB ONLINE CAwebonlineca2024No ratings yet

- LM B K Vatsaraj 23june2010Document61 pagesLM B K Vatsaraj 23june2010Basavaraja C KNo ratings yet

- Forms in GSTDocument11 pagesForms in GSTsagayNo ratings yet

- Taxmitr-What Is ITRDocument3 pagesTaxmitr-What Is ITRTaxmitr ITR OnlineNo ratings yet

- GSTR 9 9A CA Mohit SinghalDocument61 pagesGSTR 9 9A CA Mohit SinghalRishav AnandNo ratings yet

- Desi Town: Income Tax, Income Tax Return Form, WWW - Incometaxindia.gov - In, Last Date Income Tax ReturnDocument3 pagesDesi Town: Income Tax, Income Tax Return Form, WWW - Incometaxindia.gov - In, Last Date Income Tax ReturnarulmcaNo ratings yet

- US Internal Revenue Service: I1099r 06Document15 pagesUS Internal Revenue Service: I1099r 06IRSNo ratings yet

- CA Sandesh Mundra, Reach Us at WWW - Smaca.inDocument28 pagesCA Sandesh Mundra, Reach Us at WWW - Smaca.inrohanNo ratings yet

- Computerised Accounting and E Filing of Tax ReturnsDocument10 pagesComputerised Accounting and E Filing of Tax ReturnsAnkit SinghNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- Rmo 5-2017Document12 pagesRmo 5-2017Romer LesondatoNo ratings yet

- Common ItrDocument169 pagesCommon ItrJITENDRA AGARWALNo ratings yet

- HMCR Tax Guidance Manual 2010Document145 pagesHMCR Tax Guidance Manual 2010Fuzzy_Wood_PersonNo ratings yet

- US Internal Revenue Service: I1099int 07Document5 pagesUS Internal Revenue Service: I1099int 07IRSNo ratings yet

- Form Itr Acknowledgement Ay 2023 24Document2 pagesForm Itr Acknowledgement Ay 2023 24Sakshi KaleNo ratings yet

- Instructions For Form 990-T: Internal Revenue ServiceDocument16 pagesInstructions For Form 990-T: Internal Revenue ServiceIRSNo ratings yet

- Taxmitr-What Is ITRDocument2 pagesTaxmitr-What Is ITRTaxmitr ITR OnlineNo ratings yet

- Taxmanagement SemvDocument6 pagesTaxmanagement SemvGopal DasNo ratings yet

- Taxation of Salaried Employees, Pensioners and Senior by IndiagovermentDocument88 pagesTaxation of Salaried Employees, Pensioners and Senior by IndiagovermentHarshala NileshNo ratings yet

- Theorypresentation 170218171210Document66 pagesTheorypresentation 170218171210SumitNo ratings yet

- GST One LinersDocument36 pagesGST One LinersSonali PalNo ratings yet

- 2.5 Income Tax FilingDocument17 pages2.5 Income Tax Filing128hrithikabishtNo ratings yet

- US Internal Revenue Service: f945 - 2004Document2 pagesUS Internal Revenue Service: f945 - 2004IRSNo ratings yet

- IT Rules (English) Part4Document47 pagesIT Rules (English) Part4Partha Pratim BiswasNo ratings yet

- Unit 20 - AppendixDocument43 pagesUnit 20 - AppendixTejaswi ReddyNo ratings yet

- After The Previous Year ExpiryDocument4 pagesAfter The Previous Year ExpiryRaj JamadarNo ratings yet

- Salaried Individuals For AY 2023-24 - Income Tax DepartmentDocument26 pagesSalaried Individuals For AY 2023-24 - Income Tax DepartmentSunitha GNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Payment FormsDocument4 pagesPayment FormsMhyckee GuinoNo ratings yet

- Presentation On Issues in ITR 7 Data Filling by TaxpayersDocument14 pagesPresentation On Issues in ITR 7 Data Filling by Taxpayersbap1986No ratings yet

- Circulars 2009 Onreturnforms Final 10062009Document6 pagesCirculars 2009 Onreturnforms Final 10062009api-20002381No ratings yet

- PERA - RMC No. 139-2020Document5 pagesPERA - RMC No. 139-2020Denden GajudoNo ratings yet

- Return of Income, Revised Return, Incomplete Return & Income Escaping AssessmentDocument7 pagesReturn of Income, Revised Return, Incomplete Return & Income Escaping AssessmentAjinkya NaikNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument7 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionfiazNo ratings yet

- IT ELEC 03 G01 How To Complete The Company Income Tax Return ITR14 Efiling External GuideDocument39 pagesIT ELEC 03 G01 How To Complete The Company Income Tax Return ITR14 Efiling External GuideSiphoNo ratings yet

- Garnishments in Sap Us PayrollDocument15 pagesGarnishments in Sap Us PayrollAnantha JiwajiNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- ITR BasicDocument13 pagesITR BasicChandrashekar BNo ratings yet

- Tax ReturnsDocument14 pagesTax ReturnsMhyckee GuinoNo ratings yet

- An Overview of The Process of E-Filing of ReturnsDocument9 pagesAn Overview of The Process of E-Filing of ReturnsNitin RangapurNo ratings yet

- Filing of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaDocument13 pagesFiling of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaMohan PatelNo ratings yet

- Assessment ProcedureDocument58 pagesAssessment ProcedureDrop Singh MeenaNo ratings yet

- Form MGT-7A HelpDocument17 pagesForm MGT-7A HelpDNo ratings yet

- Itr Returns On Listed EntitiesDocument21 pagesItr Returns On Listed EntitiesShyam SultaniaNo ratings yet

- Direct Tax CS FinalDocument19 pagesDirect Tax CS FinalkapilNo ratings yet

- US Internal Revenue Service: I5498eDocument1 pageUS Internal Revenue Service: I5498eIRSNo ratings yet

- Tax Planning AssignmentDocument10 pagesTax Planning AssignmentJayashree Mohandass100% (1)

- Lesson 4Document11 pagesLesson 4devravidhan382No ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Income Tax Return FormDocument3 pagesIncome Tax Return FormTru TaxNo ratings yet

- Tax AssignmentDocument14 pagesTax Assignmentrushi sreedhar100% (1)

- US Internal Revenue Service: I5498e 07Document1 pageUS Internal Revenue Service: I5498e 07IRSNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Circular - 107-01-2009-STDocument5 pagesCircular - 107-01-2009-STjayamurli19547922No ratings yet

- Circular - 108-02-2009-STDocument2 pagesCircular - 108-02-2009-STjayamurli19547922No ratings yet

- Circular - 109-03-2009-STDocument2 pagesCircular - 109-03-2009-STjayamurli19547922100% (2)

- Circular - 110-04-2009-STDocument2 pagesCircular - 110-04-2009-STjayamurli19547922No ratings yet

- Circular - 111-05-2009-STDocument2 pagesCircular - 111-05-2009-STjayamurli19547922No ratings yet

- New Pension Scheme - List of Account Opening CentersDocument18 pagesNew Pension Scheme - List of Account Opening Centersjayamurli19547922100% (1)

- New Pension Scheme - An OverviewDocument25 pagesNew Pension Scheme - An Overviewjayamurli19547922100% (3)