Professional Documents

Culture Documents

Crisil CRP Rates

Crisil CRP Rates

Uploaded by

gurudev001Copyright:

Available Formats

You might also like

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNo ratings yet

- NCFM - NSE's Certification in Financial MarketsDocument100 pagesNCFM - NSE's Certification in Financial Marketsvjbansi75% (4)

- CLSA Microstrategy Dividend 2013-3-01Document191 pagesCLSA Microstrategy Dividend 2013-3-01kennethtslee100% (1)

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDocument90 pages35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- CRISIL Mutual Fund Ranking ListDocument50 pagesCRISIL Mutual Fund Ranking ListRajan MahyavanshiNo ratings yet

- CRISIL MF Ranking Booklet December 2013Document18 pagesCRISIL MF Ranking Booklet December 2013meattleNo ratings yet

- CRISIL - AMFI Money Market Fund Performance Index: Factsheet - March 2014Document7 pagesCRISIL - AMFI Money Market Fund Performance Index: Factsheet - March 2014Shreesh ChandraNo ratings yet

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- All Funds - Period (Last 5 Years)Document3 pagesAll Funds - Period (Last 5 Years)vivekNo ratings yet

- Sharekhan's Top Equity Mutual Fund Picks: April 20, 2012Document4 pagesSharekhan's Top Equity Mutual Fund Picks: April 20, 2012rajdeeppawarNo ratings yet

- Reliance Money ProjectDocument52 pagesReliance Money ProjectShreya AgarwalNo ratings yet

- Sharekhan Top Mutual Fund Picks May 2015Document14 pagesSharekhan Top Mutual Fund Picks May 2015Siddhant PardeshiNo ratings yet

- Mutual Fund Shortlist June 19Document7 pagesMutual Fund Shortlist June 19Sanjay ENo ratings yet

- Mutual Fund Category Analysis - Equity Diversified Small-Cap FundsDocument6 pagesMutual Fund Category Analysis - Equity Diversified Small-Cap FundsGauriGanNo ratings yet

- Fund Performance ScorecardDocument25 pagesFund Performance ScorecardSatish DakshinamoorthyNo ratings yet

- The Best Performing Fund Yesterday, Today and Tomorrow!: For Agent/broker Use OnlyDocument15 pagesThe Best Performing Fund Yesterday, Today and Tomorrow!: For Agent/broker Use OnlySandeep BorseNo ratings yet

- Mutual Funds Dialy ScoreDocument372 pagesMutual Funds Dialy ScorePrince VamsiNo ratings yet

- MF Daily Score Card 14052018OUDocument326 pagesMF Daily Score Card 14052018OUsanjaydeNo ratings yet

- FactSheet April14Document15 pagesFactSheet April14Prasad JadhavNo ratings yet

- Alexander ForbesDocument128 pagesAlexander ForbesSandra NarismuluNo ratings yet

- S No. Return: Name of The Mutual Fund SchemeDocument4 pagesS No. Return: Name of The Mutual Fund SchemeHarsh KandeleNo ratings yet

- MF Daily Score Card 01022018Document322 pagesMF Daily Score Card 01022018Sumit TutejaNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- Fund Manager RRSF Equity:-Omprakash KuckianDocument16 pagesFund Manager RRSF Equity:-Omprakash KuckianJoe BenzNo ratings yet

- Initiating Coverage Report - YES BankDocument35 pagesInitiating Coverage Report - YES Bankarnabmoitra11No ratings yet

- Comparative Analysis of Mutual FundsDocument28 pagesComparative Analysis of Mutual FundsMonish ShresthaNo ratings yet

- Sundaram Select MidcapDocument2 pagesSundaram Select Midcapredchillies7No ratings yet

- CRISIL Research Ier Report Alok Industries 2012Document38 pagesCRISIL Research Ier Report Alok Industries 2012Akash MohindraNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- Small Cap SharesDocument7 pagesSmall Cap SharesDynamic LevelsNo ratings yet

- Simfund MF OverviewDocument26 pagesSimfund MF OverviewRama ChandranNo ratings yet

- SBI Securities Morning Update - 18-01-2023Document7 pagesSBI Securities Morning Update - 18-01-2023deepaksinghbishtNo ratings yet

- Quick Reference Guide For Financial Planning Aug 2012Document7 pagesQuick Reference Guide For Financial Planning Aug 2012imygoalsNo ratings yet

- Company ProfileDocument6 pagesCompany ProfileSunil KumarNo ratings yet

- Sneha ProjectDocument25 pagesSneha ProjectPooja KannakeNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Presented By:: Gagandeep Kumar CUN120550014Document33 pagesPresented By:: Gagandeep Kumar CUN120550014saamksdNo ratings yet

- BNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowDocument2 pagesBNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowPrasad Dhondiram Zinjurde PatilNo ratings yet

- Equity Mutual Fund 19 Equity Mutual Funds OffereDocument1 pageEquity Mutual Fund 19 Equity Mutual Funds OfferedrhimanshuagniNo ratings yet

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelNo ratings yet

- Best Mutual Funds ETMONEYDocument9 pagesBest Mutual Funds ETMONEYcristianoNo ratings yet

- Training and Development RelienceDocument81 pagesTraining and Development RelienceAbdullah KhanNo ratings yet

- There'S Life Beyond Bank FdsDocument20 pagesThere'S Life Beyond Bank FdsSandeep BorseNo ratings yet

- HDFC Large Cap Equity Fund PDFDocument25 pagesHDFC Large Cap Equity Fund PDFaadhil1992No ratings yet

- Religare Asset Management: June 2012Document37 pagesReligare Asset Management: June 2012Navjyotsingh JagirdarNo ratings yet

- March11 Vanguard PresentationDocument32 pagesMarch11 Vanguard Presentationcnvb alskNo ratings yet

- ITC Project ReportDocument50 pagesITC Project ReportKeshavNo ratings yet

- IIML PresentationDocument23 pagesIIML PresentationManish MishraNo ratings yet

- Historical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument6 pagesHistorical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolNeha BhallaNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- Mirae Asset Emerging Bluechip FundDocument4 pagesMirae Asset Emerging Bluechip Fundsachin_sac100% (1)

- Mutual Fund RankDocument2 pagesMutual Fund Rankdeep0523No ratings yet

- Ut CommissionsDocument16 pagesUt CommissionsSanjay PunjabiNo ratings yet

- PDFDocument111 pagesPDFParas JainNo ratings yet

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforNo ratings yet

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingFrom EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- 2013 Virtual Academy: Creative Computer Programming For Engineering Simulations and Animations Lecture 1Document1 page2013 Virtual Academy: Creative Computer Programming For Engineering Simulations and Animations Lecture 1gurudev001No ratings yet

- Coulomb DampingDocument6 pagesCoulomb Dampinggurudev001No ratings yet

- Engineering - Issues, Challenges and Opportunities For DevelopmentDocument392 pagesEngineering - Issues, Challenges and Opportunities For DevelopmentsitinurulhazwaniNo ratings yet

- 2016 - Center 6 SeatingDocument34 pages2016 - Center 6 Seatinggurudev001No ratings yet

- 8040 Datasheet PDFDocument2 pages8040 Datasheet PDFrahul.yerrawarNo ratings yet

- Engineer and Engineers DoDocument1 pageEngineer and Engineers Dogurudev001No ratings yet

- Measurement of ElasticDocument1 pageMeasurement of Elasticgurudev001No ratings yet

- 2013 Virtual Academy: Introduction To Metal FormingDocument1 page2013 Virtual Academy: Introduction To Metal Forminggurudev001No ratings yet

- Lakshmi Venkateswara Gardens: NorthDocument1 pageLakshmi Venkateswara Gardens: Northgurudev001No ratings yet

- Watch: For Diabetic PatientsDocument8 pagesWatch: For Diabetic Patientsgurudev001No ratings yet

- Intermetallics PDFDocument4 pagesIntermetallics PDFgurudev001No ratings yet

- TM163 1015 Centre of PercusionDocument2 pagesTM163 1015 Centre of Percusiongurudev001No ratings yet

- TM160 1015 Free VibrationsDocument2 pagesTM160 1015 Free Vibrationsgurudev001No ratings yet

- VatsavDocument8 pagesVatsavgurudev001No ratings yet

- Free Mechanical Engineering SoftwaresDocument23 pagesFree Mechanical Engineering Softwaresgurudev001No ratings yet

- Max Marks: 20 (For Ece & Eee) Time:20 MinsDocument1 pageMax Marks: 20 (For Ece & Eee) Time:20 Minsgurudev001No ratings yet

- ScimagojrDocument766 pagesScimagojrgurudev001No ratings yet

- Department of Mechanical Engineering 4/4 B. Tech - Mechanical Engineering - II Semester - 2014-15 List of Project Students and Faculty SupervisorsDocument7 pagesDepartment of Mechanical Engineering 4/4 B. Tech - Mechanical Engineering - II Semester - 2014-15 List of Project Students and Faculty Supervisorsgurudev001No ratings yet

- Ntu Mae UgDocument53 pagesNtu Mae Uggurudev001100% (1)

- Sharpen Your Solidworks Skills: Become A Solidworks Accredited EducatorDocument2 pagesSharpen Your Solidworks Skills: Become A Solidworks Accredited Educatorgurudev001No ratings yet

Crisil CRP Rates

Crisil CRP Rates

Uploaded by

gurudev001Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crisil CRP Rates

Crisil CRP Rates

Uploaded by

gurudev001Copyright:

Available Formats

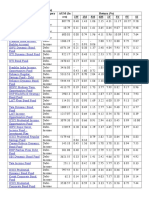

CRISIL~CPR Mutual Fund Performance Rankings : Quarter Ended December 2007

Large Cap Oriented Equity Schemes Diversified Equity Schemes Equity Linked Savings Schemes (ELSS) Income Schemes Debt Short Schemes Balanced Schemes Liquid Schemes Liquid Institutional Schemes Liquid Super Institutional Schemes Gilt Schemes MIP Aggressive Schemes MIP Conservative Schemes Floaters Sectoral - IT Schemes Index Schemes

Large Cap Oriented Equity Schemes Final CPR Rank Weightages DWS Alpha Equity Fund Principal Large Cap Fund Sundaram BNP Paribas Select Focus Birla Sun Life Frontline Equity Fund DSP Merrill Lynch Top 100 Equity Fund Kotak 30 SBI Magnum Equity Fund Sundaram BNP Paribas Growth Fund Tata Pure Equity Fund ABN AMRO Equity Fund Bonanza Exclusive Growth Scheme DSP Merrill Lynch Opportunities Fund Franklin India Prima Plus HDFC Top 200 Fund HSBC Equity Fund ICICI Prudential Growth Plan Taurus Starshare Templeton India Growth Fund UTI Index Select Equity Fund UTI Master Plus Unit Scheme UTI Mastershare Unit Scheme 1 1 1 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 3 3 3 N.A. 3 3 3 4 2 3 3 3 4 4 3 3 3 3 3 3 3 2 3 4 3 3 3 3 5 4 4 2 1 5 2 1 3 2 3 5 1 2 2 2 4 5 5 3 4 3 3 1 4 5 4 3 2 3 4 2 5 4 2 1 3 2 1 2 2 2 2 1 2 3 3 1 2 4 3 3 1 2 3 4 2 2 3 3 2 2 3 3 2 N.A. 1 Sep - 07 Superior Rank Return Score 75% 2 1 1 Industry Concentration 10% 3 3 3 Company Concentration 5% 3 3 3

Change

Liquidity 10% 2 3 2

UTI-Services Industries Fund Birla Advantage Fund Birla Top 100 Fund Franklin India Bluechip Fund Franklin India Flexi Cap Fund ING L.I.O.N Fund LICMF Opportunities Fund HDFC Core and Satellite Fund HDFC Premier MultiCap Fund UTI Master Growth Unit Scheme

3 4 4 4 4 4 4

2 4 N.A. 4 3 N.A. 4

3 4 5 3 4 5 5

4 3 3 3 3 2 2

3 1 3 4 3 3 3

3 3 3 4 5 1 1

5 5 5

5 5 5

4 4 4

5 4 4

4 4 3

4 3 3 Top

Diversified Equity Schemes Final CPR Rank Weightages DSP Merrill Lynch India T.I.G.E.R. Fund ICICI Prudential Infrastructure Fund JM Basic Fund Kotak Opportunities Standard Chartered Premier Equity Fund Sundaram BNP Paribas CAPEX Opportunities Fund Tata Infrastructure Fund Birla Midcap Fund Birla Sun Life Basic Industries Fund Canara Robeco Infrastructure DBS Chola Opportunities Fund DSP Merrill Lynch Equity Fund Fidelity Equity Fund ICICI Prudential Services Industries Fund Reliance Growth Fund Reliance Regular Savings Fund - Equity Sundaram BNP Paribas S M I L E Fund Sundaram BNP Paribas Select Midcap Tata Equity Opportunities Fund Tata Equity PE Fund 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 N.A. N.A. 1 N.A. N.A. 2 3 3 2 3 3 2 2 2 2 2 2 2 2 2 2 2 2 2 3 2 2 1 1 3 4 2 4 3 3 3 3 1 2 3 2 1 2 3 5 4 1 1 2 3 3 2 2 1 1 3 4 2 4 3 3 3 3 1 1 1 2 N.A. 1 1 Sep 07 Rank Superior Return Score 75% 1 1 1 1 1 1 1 Industry Concentration 10% 1 1 3 2 4 4 2 Company Concentration 5% 1 3 5 1 3 3 1

Change

Liquidity 10% 1 1 3 2 4 4 2

Tata Select Equity Fund UTI Infrastructure Fund ABN AMRO Opportunities Fund Birla Sun Life Equity Fund Franklin India Opportunities Fund HDFC Growth Fund HSBC India Opportunities Fund ICICI Prudential Dynamic Plan ICICI Prudential Emerging S T A R Fund ICICI Prudential Power ING Domestic Opportunities Fund JM Emerging Leaders Fund Kotak Midcap LICMF Equity Fund Principal Growth Fund Principal Junior Cap Fund Principal Resurgent India Equity Fund Reliance Equity Opportunities Fund Reliance Vision Fund SBI Magnum Global Fund SBI Magnum Midcap Fund SBI Magnum Multiplier Plus Scheme 1993 SBI Magnum Sector Umbrella - Contra Fund Standard Chartered Classic Equity Fund Sundaram BNP Paribas India Leadership Fund Tata Dividend Yield Fund Tata Growth Fund Tata Service Industries Fund Taurus Discovery Stock UTI Dividend Yield Fund UTI Opportunities Fund Birla India GenNext Fund Canara Robeco Equity Diversified Franklin India Prima Fund HDFC Capital Builder Fund HDFC Equity Fund HSBC Midcap Equity Fund JM Equity Fund Kotak Contra LICMF Growth Fund Principal Dividend Yield

2 2

2 1

2 2

3 2

2 3

3 2

3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4

3 2 3 3 3 2 3 3 3 4 3 4 4 3 3 2 2 3 3 2 2 3 2 3 3 3 N.A. 4 3 3 3 5 4 N.A. 4 3 4 4 5

3 3 3 3 3 3 3 3 3 3 3 3 4 3 3 3 3 3 3 3 3 4 3 3 3 3 3 3 4 3 4 4 4 3 3 4 4 5 4

3 2 3 4 3 3 5 4 2 4 4 2 1 3 3 4 4 3 5 3 3 1 3 2 3 5 3 2 2 5 2 4 3 5 3 5 2 1 3

3 2 5 4 3 4 3 3 3 4 2 4 3 4 4 3 4 2 3 5 2 3 2 3 3 2 5 3 4 4 4 3 4 3 2 5 3 2 3

3 2 3 4 3 3 5 4 2 4 4 2 1 3 3 4 4 3 5 3 3 1 3 2 3 5 3 2 2 5 2 4 3 5 3 5 2 1 3

Fund SBI Magnum MultiCap Fund SBI Magnum Sector Umbrella - Emerging Business Fund Tata Contra Fund Tata Mid Cap Fund UTI Master Value Fund Birla Dividend Yield Plus Birla India Opportunities Fund - Plan B Canara Robeco Fortune 1994 ICICI Prudential Discovery Fund Kotak Global India UTI Equity Fund UTI Thematic - Mid Cap Fund 4 3 4 3 3 3

4 4 4 4 5 5 5 5 5 5 5

4 N.A. 5 5 5 4 5 4 3 4 5

4 4 4 4 5 5 5 5 5 5 4

4 3 4 3 3 3 2 5 3 4 4

5 3 3 3 2 4 4 4 3 3 2

4 3 4 3 3 3 2 5 3 4 4 Top

Equity Linked Savings Schemes (ELSS) Final CPR Rank Weightages Principal Personal Tax Saver Principal Tax Saving Fund Birla Sun Life Tax Relief 96 Kotak Tax Saver Scheme SBI Magnum Tax Gain Scheme 1993 Sundaram BNP Paribas Taxsaver ABN AMRO Tax Advantage Plan Birla Equity Plan Canara Robeco Equity Tax Saver Franklin Taxshield Fund LICMF Tax Plan 1997 Reliance Tax Saver Fund Tata Tax Saving Fund DBS Chola Tax Saver Fund HDFC Tax Saver Fund ING Tax Savings Fund 1 1 2 2 2 2 3 3 3 3 3 3 3 4 4 4 N.A. 3 3 4 4 4 2 3 4 3 4 2 2 3 2 N.A. 3 3 3 4 5 5 3 3 3 3 3 3 3 4 5 3 3 1 3 2 3 2 4 4 5 5 3 3 3 1 2 1 5 2 2 N.A. 2 2 2 2 2 2 3 3 1 2 4 1 1 2 3 3 4 3 1 1 Sep - 07 Rank Superior Return Score 80% 1 1 Industry Concentration 10% 2 4 Company Concentration 5% 2 3

Change

Liquidity 5% 4 4

UTI Equity Tax Saving Plan (ETSP) HDFC Long Term Advantage Fund ICICI Prudential Tax Plan

5 5

4 4

5 5

3 5

3 3

4 5 Top

Income Schemes Final Sep CPR 07 Rank Change Rank Weightages Birla Income Plus Birla Sun Life Income Fund Grindlays Super Saver Income Fund Investment Plan ICICI Prudential Income Plan Kotak Bond Regular Reliance Income Fund HDFC Income Fund JM Income Fund LICMF Bond Fund Principal Income Fund Tata Income Fund Appreciation UTI Bond Fund DSP Merrill Lynch Bond Fund Sundaram BNP Paribas Bond Saver Templeton India Income Builder Account - Plan A Templeton India Income Fund HDFC High Interest Fund SBI Magnum Income Fund 1 1 2 1 Superior Return Score 50% 1 1 Average Debt Company Maturity Concentration 10% 3 4 5% 2 5 Debt Sectoral Concentration 5% 4 3 Debt Debt Asset Liquidity Quality 10% 3 3 20% 3 2

2 2 2 2

2 2 1 3

3 2 2 2

2 4 3 4

3 2 3 2

2 3 2 1

1 2 2 1

1 3 5 2

3 3 3 3

4 3 3 2

4 4 2 3

3 3 1 4

3 4 5 1

2 4 1 3

5 2 4 4

2 1 5 4

3 3

3 3

3 3

2 3

4 1

4 5

4 4

2 4

4 4

5 4

3 3

5 5

3 2

3 3

3 3

3 3

5 5

5 3

5 5

2 2

4 4

2 5

5 3

4 3 Top

Debt Short Schemes Final Change Sep Mean Volatility Asset Company Sectoral Asset Average DRP

CPR Rank Weightages Birla Sun Life Short Term Fund DBS Chola Freedom Income Short Term Fund HDFC High Interest Fund - Short Term Plan Kotak Bond Short Term Plan Reliance Short Term Fund HDFC Short Term Plan ICICI Prudential Short Term Plan ING Income Fund - Short Term JM Short Term Fund Principal Income Fund - Short Term Plan Tata Short Term Bond Fund Templeton India Short Term Income Plan DWS Short Term Maturity Fund Grindlays Super Saver Income Fund - Short Term UTI Short Term Income Fund DSP Merrill Lynch Short Term Fund Fidelity Short Term Income Fund

07 Return Rank 30% 20%

Size 5%

Concentration Concentration Quality Maturity 5% 5% 12.5% 12.5% 10%

3 3

3 4

2 3

3 3

3 5

3 3

4 3

5 3

3 5

3 4

N.A.

N.A.

5 Top

Balanced Schemes Final Sep CPR 07 Rank Change Rank Weightages Kotak Balance Tata Balanced Fund DSP Merrill Lynch Balanced Fund JM Balanced Fund LICMF Balanced Fund - Plan C Birla Sun Life 95 Fund Canara Robeco Balance II FT India Balanced Fund HDFC Prudence Fund SBI Magnum Balanced Fund Sundaram BNP Paribas Balanced Fund ICICI Prudential Balanced Fund Principal Balanced Fund UTI Balanced Fund Birla Balance Fund HDFC Balanced Fund 1 3 Superior Return Score 70% 2 Industry Company Debt Asset Concentration Concentration Quality 10% 2 10% 2 Debt Liquidity Equity Liquidity 10%*K 2

5%*(100- 5%*(100K) K) 3 3

2 2

2 1

2 3

2 1

1 2

5 1

2 1

4 2

4 4

4 4

3 4

3 3

3 3

4 2

3 4

3 5

4 Top

K = Equity Component in Hybrid Funds

Liquid Schemes Final CPR Rank Weightages Sep 07 Change Rank Mean Asset Return Volatility Size 30% 20% 10% Average Maturity 5.0% Asset Quality 15% Company Concentration 5%

DRP 15.0%

ICICI Prudential Liquid Plan Standard Chartered Liquidity Manager Plus UTI Liquid Cash Plan Birla Cash Plus Retail Principal CMF Liquid Reliance Floating Rate Fund Reliance Liquid Fund - Treasury Plan Templeton India Money Market Account Birla Sun Life Cash Manager Fidelity Cash Fund - Retail Plan Grindlays Cash Fund HDFC Cash Management Fund - Savings Plan HDFC Liquid Fund ING Liquid Fund Kotak Liquid SBI Magnum InstaCash Sundaram BNP Paribas Money Fund DSP Merrill Lynch Liquidity Fund LICMF Liquid Fund JM High Liquidity Fund Templeton India Treasury Management Account UTI Money Market Fund DBS Chola Liquid Fund - Regular DWS Insta Cash Plus Fund HSBC Cash Fund

1 1

1 3

3 3

2 2

3 1

3 2

2 2

1 3

3 1

2 2 2

2 3 1

2 4 1

3 1 3

1 2 3

2 2 5

2 3 1

3 3 3

2 1 3

3 3 3

N.A. N.A. 3

3 4 5

4 4 2

4 4 5

3 3 1

3 4 5

2 1 1

4 3 5

3 3 3 3 3

2 3 3 2 4

1 2 3 4 3

3 3 1 2 3

2 2 3 2 3

3 3 3 2 3

1 2 4 4 3

4 5 3 3 4

3 3 1 3 3

4 4 4

3 3 5

5 2 4

3 3 3

4 2 3

4 2 1

5 2 3

2 5 4

4 2 2

4 4

5 4

3 3

5 4

3 5

5 1

3 3

3 4

3 5

5 5 5

4 5 4

5 2 3

4 5 4

4 3 3

4 4 3

5 3 3

2 5 4

4 2 3 Top

Liquid Institutional Schemes (10 lakhs - 4.99 crore) Final Sep CPR Change 07 Mean Asset Return Volatility Size Average Maturity DRP Asset Quality Company Concentration

Rank Weightages Tata Liquid Fund SHIP Birla Cash Plus INSTITUTIONAL ICICI Prudential Liquid Plan INSTITUTIONAL Reliance Liquid Fund - Treasury Plan INSTITUTIONAL ABN AMRO Cash Fund - Institutional Plan Birla Sun Life Cash Manager INSTITUTIONAL ING Liquid Fund Institutional Plan Kotak Liquid INSTITUTIONAL Plan Principal CMF Liquid INSTITUTIONAL Canara Robeco Liquid - Institutional DBS Chola Liquid Fund INSTITUTIONAL Plus HSBC Cash Fund INSTITUTIONAL SBI Premier Liquid Fund - Institutional 1 2

Rank 30% 1 1 20% 2 10% 2 5.0% 3 15.0% 1 15% 2 5% 3

N.A.

3 3 3

3 3 3

2 3 4

4 3 3

5 3 2

3 3 2

3 2 4

1 3 3

4 2 3

4 4

5 4

4 3

4 5

4 3

5 3

4 3

2 4

5 3

3 Top

Liquid Super Institutional Schemes Final Sep CPR 07 Mean Asset Average Rank Change Rank Return Volatility Size Maturity 30% 20% 10% 5.0% Asset Quality 15% Company Concentration 5%

(5 crore & Above) Weightages ICICI Prudential Liquid Plan - Super Institutional Reliance Liquidity Fund Birla Cash Plus INSTITUTIONAL PREMIUM Principal CMF - Liquid - INSTITUTIONAL Premium UTI Liquid Cash Plan INSTITUTIONAL Plan Fidelity Cash Fund Super Institutional Plan

DRP 15.0%

1 1

1 2

1 1

2 3

1 1

3 3

1 2

3 2

3 1

2 2

3 3

3 4

1 2

3 2

2 2

3 3

3 3

1 1

N.A.

HDFC Liquid Fund PREMIUM PLUS PLAN ING Liquid Fund Super Institutional Plan Kotak Liquid INSTITUTIONAL Premium Plan Sundaram BNP Paribas Money Fund Super Institutional Templeton India Treasury Management Account - Super Institutional Plan DSP Merrill Lynch Liquidity Fund Institutional Plan HSBC Cash Fund Institutional Plus JM High Liquidity Fund - Super Institutional DWS Insta Cash Plus Fund - Institutional Lotus India Liquid Fund - Super Institutional

4 4

4 3

5 3

3 4

4 3

5 3

5 3

1 4

5 3

N.A.

4 Top

Gilt Schemes Final CPR Rank Weightages ICICI Prudential Gilt - Investment PF Option Birla Gilt Plus - Regular Plan ICICI Prudential Gilt - Investment Reliance Gilt Securities Fund - Long Term Plan LICMF G-Sec Fund Principal Gilt Fund - Investment Plan Templeton India G-Sec Fund Composite Plan Templeton India G-Sec Fund - Long Term Plan UTI G-Sec Fund DSP Merrill Lynch Govt Sec Fund (Plan A) Tata Gilt Securities Fund UTI Gilt Advantage Fund - Long Term Plan Birla Gilt Plus - PF Plan 1 2 2 2 3 3 3 3 3 4 4 4 5 3 4 3 3 Top 4 5 3 5 4 4 2 3 3 3 3 2 3 N.A. 4 3 3 3 2 3 3 3 1 3 3 5 2 5 4 3 2 1 2 1 2 2 1 3 2 4 4 3 4 2 2 Change Sep - 07 Rank Superior Return Score 70% 2 Average Maturity 10% 4 Liquidity 20% 4

MIP Conservative Schemes Final Sep Superior Debt CPR - 07 Return Industry Company Asset Rank Change Rank Score Concentration Concentration Quality Weightages Birla Sun Life Monthly Income Birla Monthly Income Plan C Principal MIP Accumulation Plan HSBC MIP Regular ICICI Prudential MIP Plan Templeton Monthly Income Plan SBI Magnum Monthly Income Plan UTI Monthly Income Scheme Tata Monthly Income Fund 55% 5% 5% 15% Debt Liquidity Equity Average Liquidity Maturity 10%

10%*(100K) 10%*K

3 Top

K = Equity Component in Hybrid Funds

MIP Aggressive Schemes Final Sep - Superior Debt CPR 07 Return Industry Company Asset Rank Change Rank Score Concentration Concentration Quality Weightages HSBC MIP Savings Principal MIP - MIP Plus ABN AMRO Monthly Income Plan DSP Merrill Lynch Savings Plus Fund Aggressive HDFC Monthly Income Plan - LTP 1 1 55% 1 5% 2 5% 1 15% 3 Debt Liquidity Equity Average Liquidity Maturity 10% 5

10%*(100K) 10%*K 4 3

N.A.

Birla MIP II - Wealth 25 Plan DSP Merrill Lynch Savings Plus Fund Moderate FT India Monthly Income Plan LICMF Monthly Income Plan UTI MIS Advantage Plan Kotak Income Plus Reliance Monthly Income Plan Growth Tata MIP Plus Fund HDFC Monthly Income Plan - STP Sundaram BNP Paribas Monthly Income Plan

4 4

3 4

3 4

4 4

3 4

3 2

2 3

5 3

5 3

3 Top

K = Equity Component in Hybrid Funds

Floaters Final CPR Rank Weightages Principal Floating Rate Fund - Flexible Maturity Plan Tata Floating Rate Fund Short Term DBS Chola Short Term Floating Rate Fund Grindlays Floating Rate Fund - LTP HDFC Floating Rate Income Fund - Short Term Plan - Retail Principal Floating Rate Fund - Short Maturity Plan Sep 07 Rank Mean Return 35% Asset Size 10% Company Concentration 5% Asset Quality 10%

Change

Volatility 20%

DRP 20%

1 1

2 1

1 3

4 1

1 3

1 4

3 1

1 2

2 2

1 3

2 4

3 3

2 1

3 3

2 2

2 4

Canara Robeco Floating Rate - STP Grindlays Floating Rate Fund - STP HSBC Floating Rate Fund - Long Term Plan HSBC Floating Rate Fund - Short Term Plan Kotak Floater - Short Term LICMF Floating Rate Fund SBI Magnum InstaCash Liquid Floater Plan Tata Floater Fund Templeton Floating Rate Income Fund - Short Term Plan Birla Floating Rate Fund Short Term ICICI Prudential Floating Rate Plan - Option A Templeton Floating Rate Income Fund - Long Term Plan UTI Floating Rate Fund STP DSP Merrill Lynch Floating Rate Fund HDFC Floating Rate Income Fund - Long Term Plan

3 3 3 3 3 3 3 3

3 3 4 3 3 2 N.A. 3

3 5 1 3 3 2 3 2

2 1 4 3 2 3 2 4

3 5 4 3 3 3 4 2

2 5 2 3 1 3 3 3

5 1 3 2 3 5 3 2

3 5 3 3 3 3 3 3

4 4

4 4

4 3

3 3

5 3

4 4

3 4

4 3

4 4

3 4

3 4

4 5

2 3

3 3

4 4

4 2

4 Top

Sectoral - IT Schemes Final CPR Rank Weightages DSP Merrill Lynch Technology Fund Birla Sun Life New Millennium Fund ICICI Prudential Technology Fund Kotak Tech Fund SBI Magnum Sector Umbrella Infotech Fund UTI-Software Fund Franklin Infotech Fund 1 2 3 3 3 4 5 5 5 5 2 Top Index Schemes Index Schemes Weightages Nifty Benchmark Exchange Traded Scheme - Nifty BeES 1 1 Final CPR Rank Change Sep - 07 Rank 3 4 4 3 3 4 3 3 3 3 3 3 3 5 1 3 2 2 2 4 1 Change Sep - 07 Rank Superior Return Score 75% 1 Company Concentration 15% 1 Liquidity 10% 3

Franklin India Index Fund - NSE Nifty Plan S&P CNX Nifty UTI Notional Depository Receipts Scheme (SUNDER) UTI Master Index Fund Franklin India Index Fund - BSE Sensex Plan HDFC Index Fund - Sensex Plan ICICI Prudential Index Fund - Nifty Plan Principal Index Fund UTI Nifty Index Fund HDFC Index Fund - Nifty Plan LICMF Index Fund - Sensex Plan SBI Magnum Index Fund LICMF Index Fund - Nifty Plan 2 2 2 3 3 3 3 3 4 4 4 5 5 Top 4 4 N.A. 3 3 3 N.A. 3 2 2 3

CRISIL CPR Ranking Scale & Definition Based on percentile of number of schemes considered in the category: CRISIL CPR~1 Top 10% Very Good Performance CRISIL CPR~2 Next 20% Good Performance CRISIL CPR~3 Next 40% Average Performance CRISIL CPR~4 Next 20% Below Average Performance CRISIL CPR~5 Last 10% Poorest Performance

Note: An entity wishing to use the CRISIL~CPR rankings in its prospectus / offer document / advertisement / promotion/ sales literature, or wishing to re-disseminate these rankings, may do so only after obtaining the written permission of the ranking entity, CRISIL FundServices, CRISIL Limited

Disclaimer: This document should not be used for any other purpose either by you or by any of the companies/publications in your Group either in the same or different form for compiling any Reports or documents for distribution for payment or otherwise or for dissemination, for payment or otherwise, in print or electronic media including Websites, Portals, etc., belonging to you or any of your Group companies/publications or any third party.

You might also like

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNo ratings yet

- NCFM - NSE's Certification in Financial MarketsDocument100 pagesNCFM - NSE's Certification in Financial Marketsvjbansi75% (4)

- CLSA Microstrategy Dividend 2013-3-01Document191 pagesCLSA Microstrategy Dividend 2013-3-01kennethtslee100% (1)

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDocument90 pages35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- CRISIL Mutual Fund Ranking ListDocument50 pagesCRISIL Mutual Fund Ranking ListRajan MahyavanshiNo ratings yet

- CRISIL MF Ranking Booklet December 2013Document18 pagesCRISIL MF Ranking Booklet December 2013meattleNo ratings yet

- CRISIL - AMFI Money Market Fund Performance Index: Factsheet - March 2014Document7 pagesCRISIL - AMFI Money Market Fund Performance Index: Factsheet - March 2014Shreesh ChandraNo ratings yet

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- All Funds - Period (Last 5 Years)Document3 pagesAll Funds - Period (Last 5 Years)vivekNo ratings yet

- Sharekhan's Top Equity Mutual Fund Picks: April 20, 2012Document4 pagesSharekhan's Top Equity Mutual Fund Picks: April 20, 2012rajdeeppawarNo ratings yet

- Reliance Money ProjectDocument52 pagesReliance Money ProjectShreya AgarwalNo ratings yet

- Sharekhan Top Mutual Fund Picks May 2015Document14 pagesSharekhan Top Mutual Fund Picks May 2015Siddhant PardeshiNo ratings yet

- Mutual Fund Shortlist June 19Document7 pagesMutual Fund Shortlist June 19Sanjay ENo ratings yet

- Mutual Fund Category Analysis - Equity Diversified Small-Cap FundsDocument6 pagesMutual Fund Category Analysis - Equity Diversified Small-Cap FundsGauriGanNo ratings yet

- Fund Performance ScorecardDocument25 pagesFund Performance ScorecardSatish DakshinamoorthyNo ratings yet

- The Best Performing Fund Yesterday, Today and Tomorrow!: For Agent/broker Use OnlyDocument15 pagesThe Best Performing Fund Yesterday, Today and Tomorrow!: For Agent/broker Use OnlySandeep BorseNo ratings yet

- Mutual Funds Dialy ScoreDocument372 pagesMutual Funds Dialy ScorePrince VamsiNo ratings yet

- MF Daily Score Card 14052018OUDocument326 pagesMF Daily Score Card 14052018OUsanjaydeNo ratings yet

- FactSheet April14Document15 pagesFactSheet April14Prasad JadhavNo ratings yet

- Alexander ForbesDocument128 pagesAlexander ForbesSandra NarismuluNo ratings yet

- S No. Return: Name of The Mutual Fund SchemeDocument4 pagesS No. Return: Name of The Mutual Fund SchemeHarsh KandeleNo ratings yet

- MF Daily Score Card 01022018Document322 pagesMF Daily Score Card 01022018Sumit TutejaNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- Fund Manager RRSF Equity:-Omprakash KuckianDocument16 pagesFund Manager RRSF Equity:-Omprakash KuckianJoe BenzNo ratings yet

- Initiating Coverage Report - YES BankDocument35 pagesInitiating Coverage Report - YES Bankarnabmoitra11No ratings yet

- Comparative Analysis of Mutual FundsDocument28 pagesComparative Analysis of Mutual FundsMonish ShresthaNo ratings yet

- Sundaram Select MidcapDocument2 pagesSundaram Select Midcapredchillies7No ratings yet

- CRISIL Research Ier Report Alok Industries 2012Document38 pagesCRISIL Research Ier Report Alok Industries 2012Akash MohindraNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- Small Cap SharesDocument7 pagesSmall Cap SharesDynamic LevelsNo ratings yet

- Simfund MF OverviewDocument26 pagesSimfund MF OverviewRama ChandranNo ratings yet

- SBI Securities Morning Update - 18-01-2023Document7 pagesSBI Securities Morning Update - 18-01-2023deepaksinghbishtNo ratings yet

- Quick Reference Guide For Financial Planning Aug 2012Document7 pagesQuick Reference Guide For Financial Planning Aug 2012imygoalsNo ratings yet

- Company ProfileDocument6 pagesCompany ProfileSunil KumarNo ratings yet

- Sneha ProjectDocument25 pagesSneha ProjectPooja KannakeNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Presented By:: Gagandeep Kumar CUN120550014Document33 pagesPresented By:: Gagandeep Kumar CUN120550014saamksdNo ratings yet

- BNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowDocument2 pagesBNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowPrasad Dhondiram Zinjurde PatilNo ratings yet

- Equity Mutual Fund 19 Equity Mutual Funds OffereDocument1 pageEquity Mutual Fund 19 Equity Mutual Funds OfferedrhimanshuagniNo ratings yet

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelNo ratings yet

- Best Mutual Funds ETMONEYDocument9 pagesBest Mutual Funds ETMONEYcristianoNo ratings yet

- Training and Development RelienceDocument81 pagesTraining and Development RelienceAbdullah KhanNo ratings yet

- There'S Life Beyond Bank FdsDocument20 pagesThere'S Life Beyond Bank FdsSandeep BorseNo ratings yet

- HDFC Large Cap Equity Fund PDFDocument25 pagesHDFC Large Cap Equity Fund PDFaadhil1992No ratings yet

- Religare Asset Management: June 2012Document37 pagesReligare Asset Management: June 2012Navjyotsingh JagirdarNo ratings yet

- March11 Vanguard PresentationDocument32 pagesMarch11 Vanguard Presentationcnvb alskNo ratings yet

- ITC Project ReportDocument50 pagesITC Project ReportKeshavNo ratings yet

- IIML PresentationDocument23 pagesIIML PresentationManish MishraNo ratings yet

- Historical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument6 pagesHistorical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolNeha BhallaNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- Mirae Asset Emerging Bluechip FundDocument4 pagesMirae Asset Emerging Bluechip Fundsachin_sac100% (1)

- Mutual Fund RankDocument2 pagesMutual Fund Rankdeep0523No ratings yet

- Ut CommissionsDocument16 pagesUt CommissionsSanjay PunjabiNo ratings yet

- PDFDocument111 pagesPDFParas JainNo ratings yet

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforNo ratings yet

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingFrom EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- 2013 Virtual Academy: Creative Computer Programming For Engineering Simulations and Animations Lecture 1Document1 page2013 Virtual Academy: Creative Computer Programming For Engineering Simulations and Animations Lecture 1gurudev001No ratings yet

- Coulomb DampingDocument6 pagesCoulomb Dampinggurudev001No ratings yet

- Engineering - Issues, Challenges and Opportunities For DevelopmentDocument392 pagesEngineering - Issues, Challenges and Opportunities For DevelopmentsitinurulhazwaniNo ratings yet

- 2016 - Center 6 SeatingDocument34 pages2016 - Center 6 Seatinggurudev001No ratings yet

- 8040 Datasheet PDFDocument2 pages8040 Datasheet PDFrahul.yerrawarNo ratings yet

- Engineer and Engineers DoDocument1 pageEngineer and Engineers Dogurudev001No ratings yet

- Measurement of ElasticDocument1 pageMeasurement of Elasticgurudev001No ratings yet

- 2013 Virtual Academy: Introduction To Metal FormingDocument1 page2013 Virtual Academy: Introduction To Metal Forminggurudev001No ratings yet

- Lakshmi Venkateswara Gardens: NorthDocument1 pageLakshmi Venkateswara Gardens: Northgurudev001No ratings yet

- Watch: For Diabetic PatientsDocument8 pagesWatch: For Diabetic Patientsgurudev001No ratings yet

- Intermetallics PDFDocument4 pagesIntermetallics PDFgurudev001No ratings yet

- TM163 1015 Centre of PercusionDocument2 pagesTM163 1015 Centre of Percusiongurudev001No ratings yet

- TM160 1015 Free VibrationsDocument2 pagesTM160 1015 Free Vibrationsgurudev001No ratings yet

- VatsavDocument8 pagesVatsavgurudev001No ratings yet

- Free Mechanical Engineering SoftwaresDocument23 pagesFree Mechanical Engineering Softwaresgurudev001No ratings yet

- Max Marks: 20 (For Ece & Eee) Time:20 MinsDocument1 pageMax Marks: 20 (For Ece & Eee) Time:20 Minsgurudev001No ratings yet

- ScimagojrDocument766 pagesScimagojrgurudev001No ratings yet

- Department of Mechanical Engineering 4/4 B. Tech - Mechanical Engineering - II Semester - 2014-15 List of Project Students and Faculty SupervisorsDocument7 pagesDepartment of Mechanical Engineering 4/4 B. Tech - Mechanical Engineering - II Semester - 2014-15 List of Project Students and Faculty Supervisorsgurudev001No ratings yet

- Ntu Mae UgDocument53 pagesNtu Mae Uggurudev001100% (1)

- Sharpen Your Solidworks Skills: Become A Solidworks Accredited EducatorDocument2 pagesSharpen Your Solidworks Skills: Become A Solidworks Accredited Educatorgurudev001No ratings yet