Professional Documents

Culture Documents

00055

00055

Uploaded by

sivavalaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

00055

00055

Uploaded by

sivavalaiCopyright:

Available Formats

Goals/Choosing Project

Right

the

Project

27

- Abackwardintegrationthatcalculateswhatdownsidepotentialwould

cause the project not to be approved. The likelihood of that downside occurring can then be examined. This third method, although more time consuming, can be the most effective way of determining the real risks and making the decision as to whether to accept them. Common ways to perform this method: Market risk. Lower the volume and the price until the project is no longer profitable. If these numbers are feasible then the risk to the project is high. If they are out of the question, than the project risk is low. Capitalcost. Raisethecapital until theproject is no longerprofitable. Often, this number may be so highthattheprojectisdeemedtobe insensitive to capital. Schedule. Examinethemarketrequirements. Is thereadropdeaddate beyond which the customer will no longer take the new product? Is there a completion date that makes the project unprofitable? Technology. What are the non-performance scenarios? Is thereadrop dead performance issue? Environmental projects often have legal performance criteria. Profit-adding projects are based on meeting performance in volume,quality,and/orcost.Whatistheimpactofnot meeting a criteria? Can the performance be short of meeting the criteria and still be profitable? The sensitivity analysis gives the impact of not meeting the assumptions. The next As in the analysis determines the likelihood of the unprofitable event occurring. sensitivityanalysis,thecombinedknowledgeoftheintegratedteamandtheir assistants will be required to effectively answer the question of likelihood. Although it is not possible to cover every known risk possibility, here are some of the most common questions an integrated team should consider when doing a risk analysis: Market forecast:

- How good is the customers commitment to buying the product

volumes needed?

-

in the

Arecontracts in place?

- Has customer shared risk analysis with us? - What is the expected life of the product? - Whatarethecompetitiveproducts?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

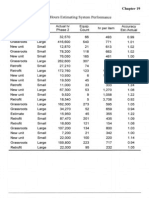

- Hours: Table 19.25 Engineering Estimating System PerformanceDocument1 pageHours: Table 19.25 Engineering Estimating System PerformancesivavalaiNo ratings yet

- Semi-Detailed Estimating System: M LabDocument1 pageSemi-Detailed Estimating System: M LabsivavalaiNo ratings yet

- 3 - Shakedown Areas.: Construction ManagementDocument1 page3 - Shakedown Areas.: Construction ManagementsivavalaiNo ratings yet

- Cost Estimate Summary Case: Estimating 119Document1 pageCost Estimate Summary Case: Estimating 119sivavalaiNo ratings yet

- Communications 241: 17.2 Documentation ChecklistDocument1 pageCommunications 241: 17.2 Documentation ChecklistsivavalaiNo ratings yet

- Phases The Startup: of An For ofDocument1 pagePhases The Startup: of An For ofsivavalaiNo ratings yet

- Project Control: Plant LayoutDocument1 pageProject Control: Plant LayoutsivavalaiNo ratings yet

- 00055Document1 page00055sivavalaiNo ratings yet

- This Page Intentionally Left BlankDocument1 pageThis Page Intentionally Left BlanksivavalaiNo ratings yet

- 15.5 Control During Construction: 80% of Bulk Materials Normally SuppliedDocument1 page15.5 Control During Construction: 80% of Bulk Materials Normally SuppliedsivavalaiNo ratings yet

- Project Control Problem Correction: During ConstructionDocument1 pageProject Control Problem Correction: During ConstructionsivavalaiNo ratings yet

- 14.3 Construction Management ActivitiesDocument1 page14.3 Construction Management ActivitiessivavalaiNo ratings yet

- Speclfic To Project: 2 - Depth and BreadthDocument1 pageSpeclfic To Project: 2 - Depth and BreadthsivavalaiNo ratings yet

- Process Design Phaseolphasel: Phase 1 SpecificationsDocument1 pageProcess Design Phaseolphasel: Phase 1 SpecificationssivavalaiNo ratings yet

- Agreement: ContractingDocument1 pageAgreement: ContractingsivavalaiNo ratings yet

- 2 - Drawings.: 3 - SpecificationsDocument1 page2 - Drawings.: 3 - SpecificationssivavalaiNo ratings yet

- Estimating Methods: Engineering EstimatesDocument1 pageEstimating Methods: Engineering EstimatessivavalaiNo ratings yet

- All Equipment Should Be Accessible by Either Crane or Lift TruckDocument1 pageAll Equipment Should Be Accessible by Either Crane or Lift TrucksivavalaiNo ratings yet