Professional Documents

Culture Documents

Wolfram - Alpha MSFT YHOO GOOG Report

Wolfram - Alpha MSFT YHOO GOOG Report

Uploaded by

DvNetCopyright:

Available Formats

You might also like

- ORCAweb Administrator Guide V3.40Document113 pagesORCAweb Administrator Guide V3.40Kelipys FirminoNo ratings yet

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- Work Sample - M&A Private Equity Buyside AdvisingDocument20 pagesWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoNo ratings yet

- IMP Imexpharm ReportDocument24 pagesIMP Imexpharm Reportloc1409No ratings yet

- Overview of New York City's Fiscal Crisis (1995)Document10 pagesOverview of New York City's Fiscal Crisis (1995)DvNetNo ratings yet

- MF Global Bankruptcy DeclarationDocument44 pagesMF Global Bankruptcy DeclarationDvNetNo ratings yet

- Manpower Proposal Template v1.4Document13 pagesManpower Proposal Template v1.4Hytham sa'adeh100% (1)

- H H H H: Apple Microsoft Adobe GoogleDocument7 pagesH H H H: Apple Microsoft Adobe Googledjscribble2No ratings yet

- Appl 2Document6 pagesAppl 2aayush-the devilish angelNo ratings yet

- Leerink Cap Makts OvwDocument13 pagesLeerink Cap Makts Ovwjpeavy3No ratings yet

- Sula VineyardsDocument46 pagesSula VineyardsSubham JainNo ratings yet

- Elpro International LTDDocument3 pagesElpro International LTDHimanshuNo ratings yet

- Fin 4150 Week 8 LecturesDocument46 pagesFin 4150 Week 8 LecturesEric McLaughlinNo ratings yet

- Eastdil Secured - 201610 Puget Sound Market OverviewDocument21 pagesEastdil Secured - 201610 Puget Sound Market Overviewice388No ratings yet

- AnswersDocument15 pagesAnswerslika rukhadzeNo ratings yet

- LBO - UncompletedDocument10 pagesLBO - UncompletedRachel TangNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument27 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialPrasad VeesamshettyNo ratings yet

- Plantilla de Creigthons 2018Document15 pagesPlantilla de Creigthons 2018MariotelliNo ratings yet

- Apple Amazon GoogleDocument19 pagesApple Amazon GooglescottabellNo ratings yet

- GP PetroleumsDocument44 pagesGP Petroleumssingh66222No ratings yet

- 22 Upper Brook Street, London, United Kingdom W1K 7PZDocument1 page22 Upper Brook Street, London, United Kingdom W1K 7PZapi-26055241No ratings yet

- Reporte KACCDocument31 pagesReporte KACCvinuesafNo ratings yet

- Case Ascend The Finnacle FinalRound 2ADocument3 pagesCase Ascend The Finnacle FinalRound 2ASAHIL BERDENo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- PFE Financials As On 08-09-2023Document38 pagesPFE Financials As On 08-09-2023Asim MalikNo ratings yet

- Tahun Prod Oil (MMB) Investasi (Mmusd) : Perhitungan Pajak (Loss Carry Forward)Document12 pagesTahun Prod Oil (MMB) Investasi (Mmusd) : Perhitungan Pajak (Loss Carry Forward)DoomNo ratings yet

- Daily Digest - 15 June, 2023Document2 pagesDaily Digest - 15 June, 2023Anant VishnoiNo ratings yet

- Ayala Land Inc ALI 2Document1 pageAyala Land Inc ALI 2JC CalaycayNo ratings yet

- Lupin LTD.: Presentation OnDocument26 pagesLupin LTD.: Presentation OnawishmirzaNo ratings yet

- ModelDocument4 pagesModelHashNo ratings yet

- JUBLFOOD Equity Research ReportDocument9 pagesJUBLFOOD Equity Research ReportAshutosh RanjanNo ratings yet

- 19 4Q - Earning Release of LGEDocument19 pages19 4Q - Earning Release of LGEОverlord 4No ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Lady M ValuationDocument3 pagesLady M Valuationsairaj bhatkarNo ratings yet

- Fin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisDocument10 pagesFin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisGel viraNo ratings yet

- BAM - OCT 2021 - 2pagesDocument2 pagesBAM - OCT 2021 - 2pagesTincho PreitiNo ratings yet

- Mahindra Manulife MF - Market OutlookDocument1 pageMahindra Manulife MF - Market OutlookYasahNo ratings yet

- CRISILDocument19 pagesCRISILBcomE ANo ratings yet

- ButlercaseDocument3 pagesButlercaseAn HuNo ratings yet

- Portfolio 20230504131248Document24 pagesPortfolio 20230504131248Matheus CarmoNo ratings yet

- Valuation+ +excel+ +students+Document4 pagesValuation+ +excel+ +students+snigdha.sanaboinaNo ratings yet

- Derivatives and Risk ManagementDocument136 pagesDerivatives and Risk Managementabbas ali100% (3)

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- EPL LTD Financial Statements - XDocument16 pagesEPL LTD Financial Statements - XAakashNo ratings yet

- Caso Nextel DataDocument42 pagesCaso Nextel Dataelena ubillasNo ratings yet

- Value Investing ExperimentDocument14 pagesValue Investing ExperimentimbetbmNo ratings yet

- Proximus Consensus Ahead of q1 2023Document4 pagesProximus Consensus Ahead of q1 2023Laurent MillerNo ratings yet

- Stitch Fix Inc NasdaqGS SFIX FinancialsDocument41 pagesStitch Fix Inc NasdaqGS SFIX FinancialsanamNo ratings yet

- RGPPSEZ - Annual Report - 2022 - ENGDocument149 pagesRGPPSEZ - Annual Report - 2022 - ENGsteveNo ratings yet

- Opmt-33 AssignmentDocument16 pagesOpmt-33 AssignmentRisha SachdevNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Microsoft Investment AnalysisDocument4 pagesMicrosoft Investment AnalysisdkrauzaNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Jollibee Foods Corporation Financial Data (2017)Document10 pagesJollibee Foods Corporation Financial Data (2017)Sheila Mae AramanNo ratings yet

- Demand Estimation & P&LDocument2 pagesDemand Estimation & P&LAdnan MushtaqNo ratings yet

- Ratio Analysis Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument18 pagesRatio Analysis Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMAkshataNo ratings yet

- Max Healthcare Institute Limited BSE 543220 FinancialsDocument44 pagesMax Healthcare Institute Limited BSE 543220 Financialssubham kujmarNo ratings yet

- BOLT DCF ValuationDocument1 pageBOLT DCF ValuationOld School ValueNo ratings yet

- Traders' Takedown: Stories For The DayDocument9 pagesTraders' Takedown: Stories For The DayLeslie MirandaNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- HDFC Bank LTD ModelDocument15 pagesHDFC Bank LTD ModelAryan HateNo ratings yet

- Central Bank Incentive Program Questions & Answers January 2014Document4 pagesCentral Bank Incentive Program Questions & Answers January 2014DvNetNo ratings yet

- Government Development Bank For Puerto Rico Provides Update On Fiscal and Economic Development ProgressDocument2 pagesGovernment Development Bank For Puerto Rico Provides Update On Fiscal and Economic Development ProgressDvNetNo ratings yet

- 2013 08 07 Snap June2013Document4 pages2013 08 07 Snap June2013DvNetNo ratings yet

- Richard Koo - The Future of Central Banking and Closing Remarks - INET Hong KongDocument6 pagesRichard Koo - The Future of Central Banking and Closing Remarks - INET Hong KongDvNetNo ratings yet

- News 2012-6-26 PendencyPlanApprovedDocument3 pagesNews 2012-6-26 PendencyPlanApprovedDvNetNo ratings yet

- 7/5 Report For EmbedDocument15 pages7/5 Report For EmbedDvNetNo ratings yet

- PrimeX Marketing PresentationDocument30 pagesPrimeX Marketing PresentationDvNetNo ratings yet

- FOMC Minutes 6-22-2011Document21 pagesFOMC Minutes 6-22-2011DvNetNo ratings yet

- Peter Schiff Testimony House Sub-Committee On Government Reform and Stimulus OversightDocument9 pagesPeter Schiff Testimony House Sub-Committee On Government Reform and Stimulus OversightDvNetNo ratings yet

- Manual - Windows SDK Reference Guide - English - Rev - 1 - 26Document47 pagesManual - Windows SDK Reference Guide - English - Rev - 1 - 26Ibrahim AL-SORAIHINo ratings yet

- Gelec 2 PPT PerezDocument46 pagesGelec 2 PPT PerezNicole PerezNo ratings yet

- Microsoft Azure Exam AZ-500 Microsoft Azure Security Technologies - Marks4Sure - MansoorDocument4 pagesMicrosoft Azure Exam AZ-500 Microsoft Azure Security Technologies - Marks4Sure - MansoorMansoor AhmedNo ratings yet

- Export Datagridview To PDF in VB NetDocument2 pagesExport Datagridview To PDF in VB NetShirleyNo ratings yet

- Curriculum VitaeDocument2 pagesCurriculum VitaeArif KhairuddinNo ratings yet

- Global Production,: Outsourcing, and LogisticsDocument47 pagesGlobal Production,: Outsourcing, and LogisticsClyde SaladagaNo ratings yet

- Presentation CRMDocument9 pagesPresentation CRMPriyanshi AgarwalNo ratings yet

- Case Study - 3 The Strategy of Microsoft Versus Linux - Villanueva - Almaden - Draft2Document3 pagesCase Study - 3 The Strategy of Microsoft Versus Linux - Villanueva - Almaden - Draft2den meldrick almadenNo ratings yet

- Tengku Diyana Binti Tengku IbrahimDocument24 pagesTengku Diyana Binti Tengku IbrahimAnakha VenugopalNo ratings yet

- Getting Started With MOF 4.0Document68 pagesGetting Started With MOF 4.0crazyy_pravilNo ratings yet

- Resume Kartikey Bharadwaj-1Document2 pagesResume Kartikey Bharadwaj-1pratap singhNo ratings yet

- Steps To Create Macro That Creates PowerPoint Presentation Out of Excel Charts - v21Document7 pagesSteps To Create Macro That Creates PowerPoint Presentation Out of Excel Charts - v21Sunil DadhichNo ratings yet

- C# Code ShutdownDocument5 pagesC# Code ShutdownNhạt PhaiNo ratings yet

- Microsoft MB2-716 ExamDocument10 pagesMicrosoft MB2-716 Examexamkiller0% (2)

- Macie Baker - ResumeDocument2 pagesMacie Baker - Resumeapi-437312580No ratings yet

- SharePoint 2013 Books JDocument2 pagesSharePoint 2013 Books JShivprasad ShahapurkarNo ratings yet

- Erwin InstallDocument16 pagesErwin InstallJayant KolheNo ratings yet

- OJT PKL Itinerary - 2 PDFDocument1 pageOJT PKL Itinerary - 2 PDFMuhammad ZhafranNo ratings yet

- Create PowerPoint Presentations Automatically Using VBA - Chandoo - Org - Learn Microsoft Excel OnlineDocument20 pagesCreate PowerPoint Presentations Automatically Using VBA - Chandoo - Org - Learn Microsoft Excel OnlineGénesis Del CarmenNo ratings yet

- Microsoft Dynamics 365Document2 pagesMicrosoft Dynamics 365Saad KhanNo ratings yet

- PC Advi112014Document148 pagesPC Advi112014lipicu100% (1)

- PDFDocument2,078 pagesPDFstNo ratings yet

- CV Dessy Aryani SapitriDocument5 pagesCV Dessy Aryani SapitriAri KuswantoNo ratings yet

- 20741B ENU TrainerHandbookDocument568 pages20741B ENU TrainerHandbookDavid EscalierNo ratings yet

- Microsoft Certifications 2018Document2 pagesMicrosoft Certifications 2018Gianpiere Salcedo MedinaNo ratings yet

- Last Clean ExceptionDocument158 pagesLast Clean ExceptionJâssy Yässy BēbēNo ratings yet

- Magic Quadrant For CRM Lead ManagementDocument14 pagesMagic Quadrant For CRM Lead Managementabhik167No ratings yet

- 1-EA in Online GamingDocument2 pages1-EA in Online GamingCharan CvNo ratings yet

Wolfram - Alpha MSFT YHOO GOOG Report

Wolfram - Alpha MSFT YHOO GOOG Report

Uploaded by

DvNetOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wolfram - Alpha MSFT YHOO GOOG Report

Wolfram - Alpha MSFT YHOO GOOG Report

Uploaded by

DvNetCopyright:

Available Formats

GOOG YHOO MSFT

Input interpretation:

Google HGOOGL È Yahoo! HYHOOL È Microsoft HMSFTL

Latest trades:

GOOG $ 390.00 HGOOG È NASDAQ È Friday 8:10 pm EDT È 45 hours agoL

YHOO $ 14.91 HYHOO È NASDAQ È Friday 8:10 pm EDT È 45 hours agoL

MSFT $ 20.22 HMSFT È NASDAQ È Friday 8:10 pm EDT È 45 hours agoL

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

1

© Wolfram Alpha LLC—A Wolfram Research Company

GOOG YHOO MSFT

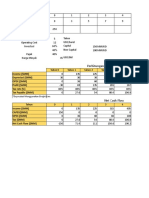

Fundamentals and financials:

Google Yahoo! Microsoft

market cap $ 122.4 billion $ 20.58 billion $ 178.5 billion

revenue $ 22.12 billion $ 7.209 billion $ 61.17 billion

employees 20 222 13 600 91 000

revenue / employee $ 1.24 million $ 510 600 $ 705 200

net income $ 4.343 billion $ 424.3 million $ 15.82 billion

shares outstanding 315.9 million 1.394 billion 8.9 billion

annual earnings / share $ 13.29 $ 0.33 $ 1.75

P/E ratio 29.16 44.73 11.46

annual dividends / share $ 0.48

dividend yield 2.37%

Hbased on trailing 12-month totals, last close price and annual employeesL

Recent returns:

day month YTD year 5 year

GOOG +0.65% +2.77% +26.77% -32.87%

YHOO +1.02% +6.35% +22.21% -46.27% -44.82%

MSFT +0.80% +7.38% +4.01% -33.60% -20.83%

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

2

© Wolfram Alpha LLC—A Wolfram Research Company

GOOG YHOO MSFT

Relative price history:

0%

-10%

-20%

-30%

-40%

-50%

-60%

Jul Oct Jan Apr

GOOG È YHOO È MSFT

Hnormalized relative to May 21, 2008 starting dateL

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

3

© Wolfram Alpha LLC—A Wolfram Research Company

GOOG YHOO MSFT

Performance comparisons:

average daily return daily volatility annual return annual volatility

GOOG -0.157% 3.21% -32.60% 50.85%

YHOO -0.205% 4.01% -40.23% 63.45%

MSFT -0.119% 3.37% -25.93% 53.47%

SP500 -0.181% 2.87% -36.47% 45.46%

bonds +0.017% 0.36% +4.31% 5.73%

T- bills +0.003% 0.00% +0.73% 0.00%

10%

bonds

0%

T-bills

-10%

realized return

-20%

-30% MSFT

GOOG

-40% SP500 YHOO

-50%

0% 10% 20% 30% 40% 50% 60% 70% 80%

volatility

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

4

© Wolfram Alpha LLC—A Wolfram Research Company

GOOG YHOO MSFT

Correlation matrix:

GOOG YHOO MSFT SP500

GOOG 1 0.335 0.603 0.677

YHOO 0.335 1 0.344 0.494

MSFT 0.603 0.344 1 0.754

SP500 0.677 0.494 0.754 1

Projections:

+100%

+50%

0%

-50%

-100%

Jul Jan Jul

GOOG È YHOO È MSFT

Hsimulated log-normal random walks based on historical parametersL

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

5

© Wolfram Alpha LLC—A Wolfram Research Company

GOOG YHOO MSFT

Mean-variance optimal portfolio:

weight shares cost

GOOG 6.77% 174 $ 67 860

YHOO 3.72% 2495 $ 37 200

MSFT 7.20% 3561 $ 72 000

SP500 15.48% 1745 $ 154 800

bonds 33.39% 334 $ 334 000

T-bills 33.45% 334 $ 334 000

Hamounts based on $1 million portfolioL

SP500

10%

expected return

bonds

optimal

5% T-bills

GOOG

0%

0% 20% 40% 60%

MSFT

expected volatility

optimal portfolio' s expected yearly return 5.01%

optimal portfolio' s yearly volatility 8.72%

YHOO

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

6

© Wolfram Alpha LLC—A Wolfram Research Company

GOOG YHOO MSFT

Generated by Wolfram|Alpha (www.wolframalpha.com) on May 17, 2009 from Champaign, IL.

7

© Wolfram Alpha LLC—A Wolfram Research Company

You might also like

- ORCAweb Administrator Guide V3.40Document113 pagesORCAweb Administrator Guide V3.40Kelipys FirminoNo ratings yet

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- Work Sample - M&A Private Equity Buyside AdvisingDocument20 pagesWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoNo ratings yet

- IMP Imexpharm ReportDocument24 pagesIMP Imexpharm Reportloc1409No ratings yet

- Overview of New York City's Fiscal Crisis (1995)Document10 pagesOverview of New York City's Fiscal Crisis (1995)DvNetNo ratings yet

- MF Global Bankruptcy DeclarationDocument44 pagesMF Global Bankruptcy DeclarationDvNetNo ratings yet

- Manpower Proposal Template v1.4Document13 pagesManpower Proposal Template v1.4Hytham sa'adeh100% (1)

- H H H H: Apple Microsoft Adobe GoogleDocument7 pagesH H H H: Apple Microsoft Adobe Googledjscribble2No ratings yet

- Appl 2Document6 pagesAppl 2aayush-the devilish angelNo ratings yet

- Leerink Cap Makts OvwDocument13 pagesLeerink Cap Makts Ovwjpeavy3No ratings yet

- Sula VineyardsDocument46 pagesSula VineyardsSubham JainNo ratings yet

- Elpro International LTDDocument3 pagesElpro International LTDHimanshuNo ratings yet

- Fin 4150 Week 8 LecturesDocument46 pagesFin 4150 Week 8 LecturesEric McLaughlinNo ratings yet

- Eastdil Secured - 201610 Puget Sound Market OverviewDocument21 pagesEastdil Secured - 201610 Puget Sound Market Overviewice388No ratings yet

- AnswersDocument15 pagesAnswerslika rukhadzeNo ratings yet

- LBO - UncompletedDocument10 pagesLBO - UncompletedRachel TangNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument27 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialPrasad VeesamshettyNo ratings yet

- Plantilla de Creigthons 2018Document15 pagesPlantilla de Creigthons 2018MariotelliNo ratings yet

- Apple Amazon GoogleDocument19 pagesApple Amazon GooglescottabellNo ratings yet

- GP PetroleumsDocument44 pagesGP Petroleumssingh66222No ratings yet

- 22 Upper Brook Street, London, United Kingdom W1K 7PZDocument1 page22 Upper Brook Street, London, United Kingdom W1K 7PZapi-26055241No ratings yet

- Reporte KACCDocument31 pagesReporte KACCvinuesafNo ratings yet

- Case Ascend The Finnacle FinalRound 2ADocument3 pagesCase Ascend The Finnacle FinalRound 2ASAHIL BERDENo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- PFE Financials As On 08-09-2023Document38 pagesPFE Financials As On 08-09-2023Asim MalikNo ratings yet

- Tahun Prod Oil (MMB) Investasi (Mmusd) : Perhitungan Pajak (Loss Carry Forward)Document12 pagesTahun Prod Oil (MMB) Investasi (Mmusd) : Perhitungan Pajak (Loss Carry Forward)DoomNo ratings yet

- Daily Digest - 15 June, 2023Document2 pagesDaily Digest - 15 June, 2023Anant VishnoiNo ratings yet

- Ayala Land Inc ALI 2Document1 pageAyala Land Inc ALI 2JC CalaycayNo ratings yet

- Lupin LTD.: Presentation OnDocument26 pagesLupin LTD.: Presentation OnawishmirzaNo ratings yet

- ModelDocument4 pagesModelHashNo ratings yet

- JUBLFOOD Equity Research ReportDocument9 pagesJUBLFOOD Equity Research ReportAshutosh RanjanNo ratings yet

- 19 4Q - Earning Release of LGEDocument19 pages19 4Q - Earning Release of LGEОverlord 4No ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Lady M ValuationDocument3 pagesLady M Valuationsairaj bhatkarNo ratings yet

- Fin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisDocument10 pagesFin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisGel viraNo ratings yet

- BAM - OCT 2021 - 2pagesDocument2 pagesBAM - OCT 2021 - 2pagesTincho PreitiNo ratings yet

- Mahindra Manulife MF - Market OutlookDocument1 pageMahindra Manulife MF - Market OutlookYasahNo ratings yet

- CRISILDocument19 pagesCRISILBcomE ANo ratings yet

- ButlercaseDocument3 pagesButlercaseAn HuNo ratings yet

- Portfolio 20230504131248Document24 pagesPortfolio 20230504131248Matheus CarmoNo ratings yet

- Valuation+ +excel+ +students+Document4 pagesValuation+ +excel+ +students+snigdha.sanaboinaNo ratings yet

- Derivatives and Risk ManagementDocument136 pagesDerivatives and Risk Managementabbas ali100% (3)

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- EPL LTD Financial Statements - XDocument16 pagesEPL LTD Financial Statements - XAakashNo ratings yet

- Caso Nextel DataDocument42 pagesCaso Nextel Dataelena ubillasNo ratings yet

- Value Investing ExperimentDocument14 pagesValue Investing ExperimentimbetbmNo ratings yet

- Proximus Consensus Ahead of q1 2023Document4 pagesProximus Consensus Ahead of q1 2023Laurent MillerNo ratings yet

- Stitch Fix Inc NasdaqGS SFIX FinancialsDocument41 pagesStitch Fix Inc NasdaqGS SFIX FinancialsanamNo ratings yet

- RGPPSEZ - Annual Report - 2022 - ENGDocument149 pagesRGPPSEZ - Annual Report - 2022 - ENGsteveNo ratings yet

- Opmt-33 AssignmentDocument16 pagesOpmt-33 AssignmentRisha SachdevNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Microsoft Investment AnalysisDocument4 pagesMicrosoft Investment AnalysisdkrauzaNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Jollibee Foods Corporation Financial Data (2017)Document10 pagesJollibee Foods Corporation Financial Data (2017)Sheila Mae AramanNo ratings yet

- Demand Estimation & P&LDocument2 pagesDemand Estimation & P&LAdnan MushtaqNo ratings yet

- Ratio Analysis Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument18 pagesRatio Analysis Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMAkshataNo ratings yet

- Max Healthcare Institute Limited BSE 543220 FinancialsDocument44 pagesMax Healthcare Institute Limited BSE 543220 Financialssubham kujmarNo ratings yet

- BOLT DCF ValuationDocument1 pageBOLT DCF ValuationOld School ValueNo ratings yet

- Traders' Takedown: Stories For The DayDocument9 pagesTraders' Takedown: Stories For The DayLeslie MirandaNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- HDFC Bank LTD ModelDocument15 pagesHDFC Bank LTD ModelAryan HateNo ratings yet

- Central Bank Incentive Program Questions & Answers January 2014Document4 pagesCentral Bank Incentive Program Questions & Answers January 2014DvNetNo ratings yet

- Government Development Bank For Puerto Rico Provides Update On Fiscal and Economic Development ProgressDocument2 pagesGovernment Development Bank For Puerto Rico Provides Update On Fiscal and Economic Development ProgressDvNetNo ratings yet

- 2013 08 07 Snap June2013Document4 pages2013 08 07 Snap June2013DvNetNo ratings yet

- Richard Koo - The Future of Central Banking and Closing Remarks - INET Hong KongDocument6 pagesRichard Koo - The Future of Central Banking and Closing Remarks - INET Hong KongDvNetNo ratings yet

- News 2012-6-26 PendencyPlanApprovedDocument3 pagesNews 2012-6-26 PendencyPlanApprovedDvNetNo ratings yet

- 7/5 Report For EmbedDocument15 pages7/5 Report For EmbedDvNetNo ratings yet

- PrimeX Marketing PresentationDocument30 pagesPrimeX Marketing PresentationDvNetNo ratings yet

- FOMC Minutes 6-22-2011Document21 pagesFOMC Minutes 6-22-2011DvNetNo ratings yet

- Peter Schiff Testimony House Sub-Committee On Government Reform and Stimulus OversightDocument9 pagesPeter Schiff Testimony House Sub-Committee On Government Reform and Stimulus OversightDvNetNo ratings yet

- Manual - Windows SDK Reference Guide - English - Rev - 1 - 26Document47 pagesManual - Windows SDK Reference Guide - English - Rev - 1 - 26Ibrahim AL-SORAIHINo ratings yet

- Gelec 2 PPT PerezDocument46 pagesGelec 2 PPT PerezNicole PerezNo ratings yet

- Microsoft Azure Exam AZ-500 Microsoft Azure Security Technologies - Marks4Sure - MansoorDocument4 pagesMicrosoft Azure Exam AZ-500 Microsoft Azure Security Technologies - Marks4Sure - MansoorMansoor AhmedNo ratings yet

- Export Datagridview To PDF in VB NetDocument2 pagesExport Datagridview To PDF in VB NetShirleyNo ratings yet

- Curriculum VitaeDocument2 pagesCurriculum VitaeArif KhairuddinNo ratings yet

- Global Production,: Outsourcing, and LogisticsDocument47 pagesGlobal Production,: Outsourcing, and LogisticsClyde SaladagaNo ratings yet

- Presentation CRMDocument9 pagesPresentation CRMPriyanshi AgarwalNo ratings yet

- Case Study - 3 The Strategy of Microsoft Versus Linux - Villanueva - Almaden - Draft2Document3 pagesCase Study - 3 The Strategy of Microsoft Versus Linux - Villanueva - Almaden - Draft2den meldrick almadenNo ratings yet

- Tengku Diyana Binti Tengku IbrahimDocument24 pagesTengku Diyana Binti Tengku IbrahimAnakha VenugopalNo ratings yet

- Getting Started With MOF 4.0Document68 pagesGetting Started With MOF 4.0crazyy_pravilNo ratings yet

- Resume Kartikey Bharadwaj-1Document2 pagesResume Kartikey Bharadwaj-1pratap singhNo ratings yet

- Steps To Create Macro That Creates PowerPoint Presentation Out of Excel Charts - v21Document7 pagesSteps To Create Macro That Creates PowerPoint Presentation Out of Excel Charts - v21Sunil DadhichNo ratings yet

- C# Code ShutdownDocument5 pagesC# Code ShutdownNhạt PhaiNo ratings yet

- Microsoft MB2-716 ExamDocument10 pagesMicrosoft MB2-716 Examexamkiller0% (2)

- Macie Baker - ResumeDocument2 pagesMacie Baker - Resumeapi-437312580No ratings yet

- SharePoint 2013 Books JDocument2 pagesSharePoint 2013 Books JShivprasad ShahapurkarNo ratings yet

- Erwin InstallDocument16 pagesErwin InstallJayant KolheNo ratings yet

- OJT PKL Itinerary - 2 PDFDocument1 pageOJT PKL Itinerary - 2 PDFMuhammad ZhafranNo ratings yet

- Create PowerPoint Presentations Automatically Using VBA - Chandoo - Org - Learn Microsoft Excel OnlineDocument20 pagesCreate PowerPoint Presentations Automatically Using VBA - Chandoo - Org - Learn Microsoft Excel OnlineGénesis Del CarmenNo ratings yet

- Microsoft Dynamics 365Document2 pagesMicrosoft Dynamics 365Saad KhanNo ratings yet

- PC Advi112014Document148 pagesPC Advi112014lipicu100% (1)

- PDFDocument2,078 pagesPDFstNo ratings yet

- CV Dessy Aryani SapitriDocument5 pagesCV Dessy Aryani SapitriAri KuswantoNo ratings yet

- 20741B ENU TrainerHandbookDocument568 pages20741B ENU TrainerHandbookDavid EscalierNo ratings yet

- Microsoft Certifications 2018Document2 pagesMicrosoft Certifications 2018Gianpiere Salcedo MedinaNo ratings yet

- Last Clean ExceptionDocument158 pagesLast Clean ExceptionJâssy Yässy BēbēNo ratings yet

- Magic Quadrant For CRM Lead ManagementDocument14 pagesMagic Quadrant For CRM Lead Managementabhik167No ratings yet

- 1-EA in Online GamingDocument2 pages1-EA in Online GamingCharan CvNo ratings yet