Professional Documents

Culture Documents

Membership Renewal Form Gift Aid Declaration: Please Pay To: Clydesdale Bank PLC. 20 Main Street, Tobermory, Isle

Membership Renewal Form Gift Aid Declaration: Please Pay To: Clydesdale Bank PLC. 20 Main Street, Tobermory, Isle

Uploaded by

Calum HallOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Membership Renewal Form Gift Aid Declaration: Please Pay To: Clydesdale Bank PLC. 20 Main Street, Tobermory, Isle

Membership Renewal Form Gift Aid Declaration: Please Pay To: Clydesdale Bank PLC. 20 Main Street, Tobermory, Isle

Uploaded by

Calum HallCopyright:

Available Formats

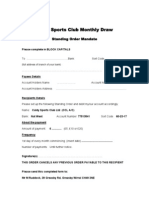

MEMBERSHIP RENEWAL FORM

Name: ...................................................................................

Address: ...............................................................................

...............................................................................

Postcode: ...................................

Email: ...................................................................................

Telephone: ..........................................................................

Membership Type:

Indvidual 10

Household 30

Payment Method Cash/Cheque/Standing Order

How would you prefer to receive information about An Tobars

forthcoming music, events, exhibitions & activities?

Email

Post

Both

STANDING ORDER MANDATE

TO: The Manager of:......................................... (Bank Name).

Bank Address:.......................................................................

...............................................................................................

Account Name:.....................................................................

Account Number:.................................................................

Sort Code:.............................................................................

Please debit the sum of ..... from the above account now & on 1st of

March each year until cancelled or amended in writing.

This instruction replaces any existing mandate on my account payable

to An Tobar.

Please pay to: Clydesdale Bank PLC. 20 main Street, Tobermory, Isle

of Mull. PA75 6NY.

Account Name: An Tobar.

Account number: 40107237.

SIGNED:............................... DATE:..../....../.....

Sort Code: 82-68-18.

Gift Aid Declaration

Name of charity or CASC ...................................................

Please treat

The enclosed gift of ...... as a gift aid donation; OR

All gifts of money that I make today & in the future as

Gift Aid donations; OR

All gifts of money that I have made in the past 6 years

and all future gifts of money that I make from the

date of this declaration as Gift Aid donations.

Please tick the appropriate box.

You must pay an amount of Income Tax/Captial Gains tax for each tax

year (6 Apr one year to 5 Apr the next) that is at least equal to the

amount of tax that the charity or Community Amateur Sports club

will reclaim on your gifts for that year.

Donors details:

Title ............... Initials ................... Surname ........................................................................

Home Address .........................................................................................................................

........................................................................................................................................................

Post Code: ........................................ Date: ...........................................................................

Signature: ...................................................................................................................................

Please notify the charity or CASC if you:

1. Want to cancel this declaration.

2. Change your Name or Home Address.

3. No longer pay sufficient tax on your income/capital gains.

Tax claimed by the charity or CASC

-The charity or CASC will reclaim 25p of tax on every 1 you give on or after

6th of April 2008.

-The government will pay to the charity or CASC an additional 3p on every 1

you give up to 6 April 2011. This does not affect your personal tax position.

If you pay income tax at the higher rate, you must include all your Gift Aid

donations on your Self Assessment tax return if you want the addditional

tax relief due to you.

You might also like

- CIS Application PDFDocument1 pageCIS Application PDFVictor Mirza100% (1)

- Credit Card Application Form 2016.cleanedDocument6 pagesCredit Card Application Form 2016.cleanedCERTKEN CONSULTNo ratings yet

- Application EngDocument1 pageApplication EngSaurabh KumarNo ratings yet

- Application FormDocument1 pageApplication FormGroup AIRSNo ratings yet

- Application Form Sac PDFDocument7 pagesApplication Form Sac PDFdasunwk4No ratings yet

- Surat Pernyataan Kepemilikan Kendaraan 2023Document1 pageSurat Pernyataan Kepemilikan Kendaraan 2023ajab24418No ratings yet

- Thornberry PSC: Registration FormDocument1 pageThornberry PSC: Registration FormVictor MirzaNo ratings yet

- Domain Charter Group Application - MASTER AUG 09 - BenDocument8 pagesDomain Charter Group Application - MASTER AUG 09 - Bennybor_1No ratings yet

- Membership Application FormDocument1 pageMembership Application FormDarren ScottNo ratings yet

- Trinity Online Application FormDocument2 pagesTrinity Online Application FormNatalia Hernán-WaleckaNo ratings yet

- Membership Application FormDocument2 pagesMembership Application FormJohn FisherNo ratings yet

- Tenancy Application FormDocument3 pagesTenancy Application FormLuis Villena ObesoNo ratings yet

- Thank You For Your Interest in Opening A Chase AccountDocument2 pagesThank You For Your Interest in Opening A Chase AccountVeronica BowmanNo ratings yet

- Staff Data FormDocument2 pagesStaff Data Formmahmoudessa3444No ratings yet

- Public Relation Executive For Professional Hire Application FormDocument1 pagePublic Relation Executive For Professional Hire Application FormYogi SaputraNo ratings yet

- Public Relation Executive For Professional Hire Application FormDocument1 pagePublic Relation Executive For Professional Hire Application FormAldo MensiaNo ratings yet

- Iskcon Congregational Services - Chennai: Shiksha Questionnaire For ShraddhavanDocument9 pagesIskcon Congregational Services - Chennai: Shiksha Questionnaire For ShraddhavanMBTNo ratings yet

- International Student Application Form: Section 1: Course DetailsDocument4 pagesInternational Student Application Form: Section 1: Course DetailsAbde SsamadNo ratings yet

- O'neill RD - Rental ApplicationDocument2 pagesO'neill RD - Rental Applicationbestreview7No ratings yet

- Job Application Form - AESL - Rev 01.04.2024Document2 pagesJob Application Form - AESL - Rev 01.04.2024sheikhsaab60No ratings yet

- EncodedDocument13 pagesEncodedleahparker857No ratings yet

- (Ontario) 565 - Commercial Tenant - Application & Credit InformDocument2 pages(Ontario) 565 - Commercial Tenant - Application & Credit Informsandra karasNo ratings yet

- UG Student New Membership FormDocument2 pagesUG Student New Membership FormAmandi PiumikaNo ratings yet

- NLSC Membership Form Rev8Document1 pageNLSC Membership Form Rev8chloespamzaccNo ratings yet

- Vendor Enrolment FormDocument2 pagesVendor Enrolment Formjagadish CNo ratings yet

- RLCmembershipformDocument1 pageRLCmembershipformjohnd5108No ratings yet

- BIODATA-WPS OfficeDocument1 pageBIODATA-WPS Officechewbrew07No ratings yet

- Housing-Application-FormDocument4 pagesHousing-Application-FormpankajsingheducationNo ratings yet

- International ESOL ApplicationDocument4 pagesInternational ESOL ApplicationNatalia Hernán-WaleckaNo ratings yet

- Format of Application For C Adm O, Air Force Station, .....................................................Document3 pagesFormat of Application For C Adm O, Air Force Station, .....................................................Sunil RAYALASEEMA GRAPHICSNo ratings yet

- 2024 Bursary in Take ApplicationDocument8 pages2024 Bursary in Take Applicationmakumenaledi03No ratings yet

- Example of Seminar Speaker CVDocument2 pagesExample of Seminar Speaker CVamandasyahra11No ratings yet

- Admission FormDocument1 pageAdmission FormYasin AhmedNo ratings yet

- Application Form Sac PDFDocument7 pagesApplication Form Sac PDFdasunwk4No ratings yet

- Form CVDocument1 pageForm CVSlamet RaharjaNo ratings yet

- Daftar Riwayat Hidup CVDocument1 pageDaftar Riwayat Hidup CVKartina DeNo ratings yet

- Application Form LusundvuDocument4 pagesApplication Form Lusundvubusiswamavimbela06No ratings yet

- Form Registrasi HerboxiDocument1 pageForm Registrasi HerboxiZumrotul MunfaridaNo ratings yet

- Label Dropship KecilDocument4 pagesLabel Dropship KecilkantongpembelajarNo ratings yet

- Application Form2Document1 pageApplication Form2Sakshi HavalNo ratings yet

- Untitled 2Document1 pageUntitled 2Lutfi_1234No ratings yet

- New Rental Application FormDocument2 pagesNew Rental Application Formyusufseidu926No ratings yet

- Stanley College Accommodation-Student-Application-Form - InteractiveDocument2 pagesStanley College Accommodation-Student-Application-Form - InteractiveVictor EleeasNo ratings yet

- FormDocument1 pageFormapi-128071725No ratings yet

- BSI UKCA Marking Enquiry Form Company Product ProfileDocument3 pagesBSI UKCA Marking Enquiry Form Company Product ProfileRizwanNo ratings yet

- PAD Form InteractiveDocument1 pagePAD Form InteractiveabhiNo ratings yet

- Application Form For Issue of Digital Signature CertificateDocument5 pagesApplication Form For Issue of Digital Signature CertificatePoorva Singh RajputNo ratings yet

- Standing Order Mandate CCSL DrawDocument1 pageStanding Order Mandate CCSL DrawBarry McDonnellNo ratings yet

- Application Form For Membership - New 2017Document1 pageApplication Form For Membership - New 2017Instech Premier Sdn BhdNo ratings yet

- Curriculum Vitae: Personal InformationDocument2 pagesCurriculum Vitae: Personal Informationmuhammad arial fikriNo ratings yet

- Subscription Order FormDocument1 pageSubscription Order FormnitahardianaNo ratings yet

- Recommendation LetterDocument1 pageRecommendation LettertimpilahNo ratings yet

- Sw-1621406129-Form 14aDocument3 pagesSw-1621406129-Form 14agman444No ratings yet

- Chennai Trade Centre November 27, 2009Document1 pageChennai Trade Centre November 27, 2009api-18948834No ratings yet

- Additional TRF FormDocument1 pageAdditional TRF FormMINH NGUYỄN PHAN DUYNo ratings yet

- TWS-Student Profile FY BPharm 2023-24Document2 pagesTWS-Student Profile FY BPharm 2023-24Dhaval TelangNo ratings yet

- Biodata of StudentDocument1 pageBiodata of Studentwan collectionNo ratings yet

- Application For Sending Original Test Report Form (TRF) HomeDocument1 pageApplication For Sending Original Test Report Form (TRF) HomeNguyễn Đức MạnhNo ratings yet

- March 2014 at Comar Venues An Tobar and Mull TheatreDocument1 pageMarch 2014 at Comar Venues An Tobar and Mull TheatreCalum HallNo ratings yet

- October Listings For An Tobar and Mull TheatreDocument1 pageOctober Listings For An Tobar and Mull TheatreCalum HallNo ratings yet

- Comar - Gift Aid DeclarationDocument1 pageComar - Gift Aid DeclarationCalum HallNo ratings yet

- Membership Form: Payment Method Credit /debit CardDocument1 pageMembership Form: Payment Method Credit /debit CardCalum HallNo ratings yet

- AB Awards 2013 Nomination FormDocument2 pagesAB Awards 2013 Nomination FormCalum HallNo ratings yet