Professional Documents

Culture Documents

ACC 225 Week 8 Assignment Internal Control and Bank Reconciliations

ACC 225 Week 8 Assignment Internal Control and Bank Reconciliations

Uploaded by

Praveen SudarsanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 225 Week 8 Assignment Internal Control and Bank Reconciliations

ACC 225 Week 8 Assignment Internal Control and Bank Reconciliations

Uploaded by

Praveen SudarsanCopyright:

Available Formats

P8-1A)

1. Violates separation of duties. The company should implement a policy whereby the

person recording incoming cash receipts is not responsible for posting the payments to

the customer accounts.

2. Violates the principle of establishing responsibility. Only Julia should have access to the

petty cash fund since she is the custodian. The company should implement a policy of

not allowing petty cash transactions over the lunch hour. Alternatively, Justine could

also serve as a petty cash custodian with his own petty cash fund.

3. Violates the proper application of technological controls. While the daily backup is a

very good internal control, the tape needs to be taken off the premises every night. If

the building and computer are destroyed, the data then can be restored from the tape

since it is safely kept off the premises. The company should implement a policy of

storing tapes off the premises nightly.

4. Violates regular and independent review. Benedict Shales needs to implement a way to

regularly and independently review his employees. Hiring of internal auditors or an

outside consultant to objectively review the internal controls and the employees work

needs to be implemented.

5. Violates the insuring of assets and the bonding of key employees. We do not have enough

information to know if the company can afford the move to the higher deductible on the

property insurance. However, we can say that dropping the insurance for bonding the

employees weakens internal control. If the company does need to engage in cost cutting

they should do it without compromising its internal controls. The insurance for the

bonding of employees (or at least key employees and those in sensitive positions) should

be reinstated.

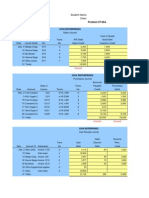

P8-3A)

Part 1

May 1 Petty Cash...............................................................................

Cash...................................................................................

To establish the $300 petty cash fund.

300.00

May 15 Janitorial Expenses................................................................

Miscellaneous Expenses.........................................................

Postage Expenses....................................................................

Advertising Expense...............................................................

Cash Over and Short........................................................

Cash...................................................................................

To reimburse the petty cash fund.

88.00

53.68

53.50

47.15

May 16 Petty Cash...............................................................................

Cash...................................................................................

To increase the petty cash fund to $500.

200.00

300.00

4.48

237.85

200.00

Note: The May 31 entries can be combined into one entry.

May 31 Postage Expenses....................................................................

Mileage Expense.....................................................................

Delivery Expense....................................................................

Cash Over and Short..............................................................

Cash...................................................................................

To reimburse the petty cash fund.

147.36

23.50

34.75

6.19

May 31 Cash.........................................................................................

Petty Cash.........................................................................

To decrease the petty cash fund to $400.

100.00

211.80

100.00

Part 2

If the May 31 replenishment is not made and no entry is recorded, then several expenses

would not be recognized and both net income and equity would be overstated by $211.80

($147.36 + $23.50 + $34.75 + $6.19). Also, the petty cash asset and total assets would be

overstated by $211.80.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BUS 475 Week 5 Final Strategic Plan and PresentationDocument5 pagesBUS 475 Week 5 Final Strategic Plan and PresentationPraveen SudarsanNo ratings yet

- ACC 225 Week 6 Problem 6-1ADocument6 pagesACC 225 Week 6 Problem 6-1APraveen SudarsanNo ratings yet

- ACC 225 Week 9 Final Project Comprehensive Problem-PerpetualDocument9 pagesACC 225 Week 9 Final Project Comprehensive Problem-PerpetualPraveen SudarsanNo ratings yet

- ACC 225 Week 4 CheckPoint Preparing Balance Sheets and StatementsDocument4 pagesACC 225 Week 4 CheckPoint Preparing Balance Sheets and StatementsPraveen SudarsanNo ratings yet

- ACC 225 Week 2 CheckPoint Debits and CreditsDocument2 pagesACC 225 Week 2 CheckPoint Debits and CreditsPraveen SudarsanNo ratings yet

- BUS 475 Final Exam PostDocument19 pagesBUS 475 Final Exam PostPraveen Sudarsan100% (1)

- ACC 225 Week 2 Assignment Preparing Journal Entries and Trial BalancesDocument6 pagesACC 225 Week 2 Assignment Preparing Journal Entries and Trial BalancesPraveen SudarsanNo ratings yet

- ACC 225 CheckPoint Adjustments and Accrual and Cash Basis AccountingDocument2 pagesACC 225 CheckPoint Adjustments and Accrual and Cash Basis AccountingPraveen SudarsanNo ratings yet

- BUS 475 Integrated Business Topics Strategic Plan, Part II SWOTT AnalysisDocument10 pagesBUS 475 Integrated Business Topics Strategic Plan, Part II SWOTT AnalysisPraveen Sudarsan100% (1)

- Rjet Task 5 Cfo-Ceo ReportsDocument11 pagesRjet Task 5 Cfo-Ceo ReportsPraveen Sudarsan100% (3)