Professional Documents

Culture Documents

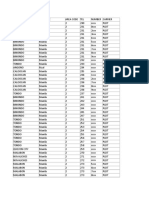

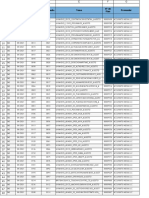

SEC FORM 13-F Information Table

SEC FORM 13-F Information Table

Uploaded by

Becket AdamsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SEC FORM 13-F Information Table

SEC FORM 13-F Information Table

Uploaded by

Becket AdamsCopyright:

Available Formats

8/15/13

SEC FORM 13-F Information Table

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate

and complete.

The reader should not assume that the information is accurate and complete.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

OMB APPROVAL

Washington, D.C. 20549

OMB Number:

FORM 13F

3235-0006

Expires:

July 31, 2015

Estimated av erage burden

FORM 13F INFORMATION TABLE

COLUMN 1

COLUMN 2

COLUMN COLUMN

3

4

hours per response:

COLUMN 5

VALUE SHRS OR SH/

COLUMN 6

COLUMN 7

PUT/ INVESTMENT

OTHER

23.8

COLUMN 8

VOTING AUTHORITY

NAME OF ISSUER

TITLE OF

CLASS

CUSIP

THE ADT

CORPORATION

COM

00101J106

22,914

575,000 SH

SOLE

575,000

AMC NETWORKS INC

CL A

00164V103

2,571

39,300 SH

SOLE

39,300

ABBOTT LABS

COM

002824100

36,075

1,034,252 SH

SOLE

1,034,252

ABBVIE INC

COM

00287Y109

41,702

1,008,752 SH

SOLE

1,008,752

ABBVIE INC

COM

00287Y109

6,821

165,000 SH

SOLE

165,000

ACACIA RESH CORP

ACACIA TCH

003881307

COM

51,962

2,324,900 SH

SOLE

2,324,900

ACTUATE CORP

COM

00508B102

7,747

1,166,766 SH

SOLE

1,166,766

AFFILIATED

MANAGERS GROUP

COM

008252108

5,428

33,109 SH

SOLE

33,109

ALCATEL-LUCENT

SPONSORED

ADR

013904305

2,730

1,500,000 SH

SOLE

1,500,000

AMAZON COM INC

COM

023135106

11,108

40,000 SH

SOLE

40,000

AMERICA MOVIL SAB

DE CV

SPON ADR L

SHS

02364W105

8,700

400,000 SH

SOLE

400,000

AMERICAN INTL

GROUP INC

COM NEW

026874784

101,507

2,270,849 SH

SOLE

2,270,849

ANGIES LIST INC

COM

034754101

29,205

1,100,000 SH

SOLE

1,100,000

APPLE INC

COM

037833100

26,458

66,800 SH

SOLE

66,800

APPLIED MICRO

CIRCUITS CORP

COM NEW

03822W406

1,988

225,876 SH

SOLE

225,876

BAIDU INC

SPON ADR

REP A

056752108

7,326

77,500 SH

SOLE

77,500

BAKER HUGHES INC

COM

057224107

10,247

222,141 SH

SOLE

222,141

BANKRATE INC DEL

COM

06647F102

15,920

1,108,613 SH

SOLE

1,108,613

BARRICK GOLD CORP

COM

067901108

30,221

1,920,000 SH

SOLE

1,920,000

BIOAMBER INC

*W EXP

05/09/201

09072Q114

107

194,000 SH

SOLE

194,000

BLACKHAWK

NETWORK HLDGS INC

CL A

09238E104

870

37,500 SH

SOLE

37,500

BOEING CO

COM

097023105

30,247

295,268 SH

SOLE

295,268

BRISTOL MYERS

SQUIBB CO

COM

110122108

4,469

100,000 SH

SOLE

100,000

(x$1000) PRN AMT PRN CALL DISCRETION MANAGER

Call

Put

Call

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

SOLE SHARED NONE

1/7

8/15/13

SEC FORM 13-F Information Table

BROCADE

COMMUNICATIONS

SYS I

COM NEW

111621306

73,536

12,766,666 SH

SOLE

12,766,666

CBS CORP NEW

CL B

124857202

2,444

50,000 SH

SOLE

50,000

CBS CORP NEW

CL B

124857202

10,263

210,000 SH

SOLE

210,000

CF INDS HLDGS INC

COM

125269100

5,883

34,308 SH

SOLE

34,308

CME GROUP INC

COM

12572Q105

2,279

30,000 SH

SOLE

30,000

CST BRANDS INC

COM

12646R105

1,048

34,000 SH

SOLE

34,000

CA INC

COM

12673P105

37,410

1,306,666 SH

SOLE

1,306,666

CABOT OIL & GAS

CORP

COM

127097103

7,742

109,000 SH

SOLE

109,000

CADENCE DESIGN

SYSTEM INC

NOTE

1.500%12/1

127387AF5

32,884

32,720,000 PRN

SOLE

32,720,000

CAESARS ENTMT

CORP

COM

127686103

82,041

5,988,342 SH

SOLE

5,988,342

CAMECO CORP

COM

13321L108

38,719

1,874,126 SH

SOLE

1,874,126

CAMECO CORP

COM

13321L108

52,892

2,560,100 SH

Call

SOLE

2,560,100

CDN IMPERIAL BK OF

COMMERCE

COM

136069951

24,958

352,000 SH

Put

SOLE

352,000

CARTER INC

COM

146229109

21,851

295,000 SH

SOLE

295,000

CEMEX SAB DE CV

SPON ADR

NEW

151290889

74,350

7,027,332 SH

SOLE

7,027,332

CENTERPOINT ENERGY

COM

INC

15189T107

3,077

131,000 SH

SOLE

131,000

CHARTER

COMMUNICATIONS

INC D

CL A NEW

16117M305

223,267

1,802,718 SH

SOLE

1,802,718

CHEVRON CORP NEW

COM

166764100

29,987

253,400 SH

SOLE

253,400

CHURCHILL DOWNS

INC

COM

171484108

47,542

602,943 SH

SOLE

602,943

CIENA CORP

NOTE 0.875%

6/1

171779AE1

SOLE

99,999,999

CISCO SYS INC

COM

17275R102

5,755

236,726 SH

SOLE

236,726

CITIGROUP INC

COM NEW

172967424

8,285

172,722 SH

SOLE

172,722

CITRIX SYS INC

COM

177376100

6,033

100,000 SH

SOLE

100,000

COINSTAR INC

COM

19259P300

26,406

450,000 SH

SOLE

450,000

COMCAST CORP NEW

CL A

20030N101

3,141

75,000 SH

SOLE

75,000

CONSTANT CONTACT

INC

COM

210313102

12,053

750,000 SH

SOLE

750,000

CONSTELLATION

BRANDS INC

CL A

21036P108

127,017

2,437,000 SH

SOLE

2,437,000

COTY INC

COM CL A

222070203

6,345

369,300 SH

SOLE

369,300

CUBIST

PHARMACEUTICALS

INC

COM

229678107

8,453

175,000 SH

SOLE

175,000

DELTA AIR LINES INC

DEL

COM NEW

247361702

96,390

5,151,757 SH

SOLE

5,151,757

DENBURY RES INC

COM NEW

247916208

33,891

1,956,791 SH

SOLE

1,956,791

DEXCOM INC

COM

252131107

2,245

100,000 SH

SOLE

100,000

101,779 105,607,000 PRN

Call

Put

NOTE 1.250%

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

2/7

8/15/13

SEC FORM 13-F Information Table

DIGITAL RIV INC

1/0

25388BAB0

5,683,000 PRN

SOLE

5,683,000

DIGITAL RIV INC

NOTE

2.000%11/0

25388BAD6

268,843 270,875,000 PRN

SOLE

99,999,999

DISH NETWORK CORP

CL A

25470M109

73,697

1,733,240 SH

SOLE

1,733,240

DISH NETWORK CORP

CL A

25470M109

95,117

2,237,000 SH

SOLE

2,237,000

DIRECTV

COM

25490A309

29,174

473,453 SH

SOLE

473,453

DYNEGY INC NEW DEL

COM

26817R108

1,120

49,650 SH

SOLE

49,650

EQT CORP

COM

26884L109

194,419

2,449,537 SH

SOLE

2,449,537

ENERGEN CORP

COM

29265N108

68,035

1,301,862 SH

SOLE

1,301,862

EVERCORE PARTNERS

INC

CLASS A

29977A105

1,587

40,400 SH

SOLE

40,400

EXAR CORP

COM

300645108

67,394

6,257,579 SH

SOLE

6,257,579

EXTREME NETWORKS

INC

COM

30226D106

31,865

9,236,249 SH

SOLE

9,236,249

F M C CORP

COM NEW

302491303

22,786

373,179 SH

SOLE

373,179

FAIRCHILD

COM

SEMICONDUCTOR INTL

303726103

1,380

100,000 SH

SOLE

100,000

GENERAL MTRS CO

COM

37045V100

25,249

758,000 SH

SOLE

758,000

GENERAL MTRS CO

JR PFD CNV

SRB

37045V209

26,522

550,700 SH

SOLE

550,700

GILEAD SCIENCES INC

COM

375558103

6,401

125,000 SH

SOLE

125,000

GLOBAL EAGLE ENTMT

COM

INC

37951D102

2,012

200,000 SH

SOLE

200,000

GOLDCORP INC NEW

COM

380956409

9,768

395,000 SH

Put

SOLE

395,000

GOODRICH PETE CORP

COM NEW

382410405

2,560

200,000 SH

Call

SOLE

200,000

GOODYEAR TIRE &

RUBR CO

COM

382550101

5,352

350,000 SH

SOLE

350,000

GOOGLE INC

CL A

38259P508

349,465

396,953 SH

SOLE

396,953

GOOGLE INC

CL A

38259P508

9,860

11,200 SH

SOLE

11,200

GRACE W R & CO DEL

NEW

COM

38388F108

13,503

160,668 SH

SOLE

160,668

GULFPORT ENERGY

CORP

COM NEW

402635304

22,890

486,289 SH

SOLE

486,289

GULFPORT ENERGY

CORP

COM NEW

402635304

4,707

100,000 SH

SOLE

100,000

432589109

3,078

93,042 SH

SOLE

93,042

16,996,000 PRN

SOLE

16,996,000

220,216 213,802,000 PRN

SOLE

99,999,999

HILLSHIRE BRANDS CO COM

5,598

Call

Call

Call

HOLOGIC INC

FRNT

2.000%12/1

436440AA9

HOLOGIC INC

FRNT

2.000%12/1

436440AG6

HOME DEPOT INC

COM

437076102

3,874

50,000 SH

SOLE

50,000

HOME INNS & HOTELS

MGMT INC

SPON ADR

43713W107

11,312

423,500 SH

SOLE

423,500

HOWARD HUGHES

CORP

COM

44267D107

11,209

100,000 SH

SOLE

100,000

ILLUMINA INC

COM

452327109

1,871

25,000 SH

SOLE

25,000

INTEL CORP

COM

458140100

6,943

286,666 SH

SOLE

286,666

ISHARES TR

MSCI EMERG

464287234

MKT

143,018

3,708,000 SH

SOLE

3,708,000

17,017

Put

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

3/7

8/15/13

SEC FORM 13-F Information Table

ISHARES TR

RUSSELL 2000 464287655

100,074

1,030,000 SH

Put

SOLE

1,030,000

ISHARES TR

DJ HOME

CONSTN

464288752

22,380

1,000,000 SH

Put

SOLE

1,000,000

JOHNSON & JOHNSON

COM

478160104

217,571

2,534,022 SH

SOLE

2,534,022

KINDER MORGAN INC

DEL

COM

49456B101

7,630

200,000 SH

SOLE

200,000

KRAFT FOODS GROUP

INC

COM

50076Q106

33,306

596,133 SH

SOLE

596,133

LSI CORPORATION

COM

502161102

21,896

3,066,666 SH

SOLE

3,066,666

LIBERTY INTERACTIVE INT COM SER

53071M104

CORP

A

2,991

130,000 SH

SOLE

130,000

LIONS GATE ENTMNT

CORP

COM NEW

535919203

3,964

144,300 SH

SOLE

144,300

LORAL SPACE &

COMMUNICATNS I

COM

543881106

42,301

705,258 SH

SOLE

705,258

LUMOS NETWORKS

CORP

COM

550283105

439

25,690 SH

SOLE

25,690

MACQUARIE

INFRASTR CO LLC

MEMBERSHIP

55608B105

INT

1,336

25,000 SH

SOLE

25,000

MACYS INC

COM

55616P104

85,440

1,780,000 SH

SOLE

1,780,000

MAGNUM HUNTER RES

COM

CORP DEL

55973B102

913

250,000 SH

SOLE

250,000

MARKET VECTORS ETF JR GOLD

TR

MINERS E

57060U589

10,992

1,200,000 SH

SOLE

1,200,000

MARKET VECTORS ETF JR GOLD

TR

MINERS E

57060U959

28,488

3,110,000 SH

SOLE

3,110,000

MARKETO INC

COM

57063L107

995

40,000 SH

SOLE

40,000

MEAD JOHNSON

NUTRITION CO

COM

582839106

11,799

148,920 SH

SOLE

148,920

MEADWESTVACO

CORP

COM

583334107

62,416

1,829,858 SH

SOLE

1,829,858

MEDICINES CO

COM

584688105

4,614

150,000 SH

SOLE

150,000

MERCK & CO INC NEW

COM

58933Y105

11,613

250,000 SH

SOLE

250,000

MERCURY SYS INC

COM

589378108

11,679

1,266,666 SH

SOLE

1,266,666

METLIFE INC

COM

59156R108

3,295

72,000 SH

SOLE

72,000

MICRON TECHNOLOGY

COM

INC

595112103

28,660

2,000,000 SH

SOLE

2,000,000

MICRON TECHNOLOGY NOTE 1.875%

INC

6/0

595112AH6

SOLE

99,999,999

MILLENNIAL MEDIA

INC

COM

60040N105

6,968

800,000 SH

SOLE

800,000

MONDELEZ INTL INC

CL A

609207105

27,113

950,343 SH

SOLE

950,343

MOTOROLA

SOLUTIONS INC

COM NEW

620076307

111,754

1,935,801 SH

SOLE

1,935,801

NRG ENERGY INC

COM NEW

629377508

28,921

1,083,188 SH

SOLE

1,083,188

NRG ENERGY INC

COM NEW

629377508

36,579

1,370,000 SH

SOLE

1,370,000

NETAPP INC

COM

64110D104

183,864

4,866,700 SH

SOLE

4,866,700

NETFLIX INC

COM

64110L106

8,444

40,000 SH

SOLE

40,000

NEUROCRINE

BIOSCIENCES INC

COM

64125C109

2,676

200,000 SH

SOLE

200,000

Put

Put

178,328 156,000,000 PRN

Call

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

4/7

8/15/13

SEC FORM 13-F Information Table

NEWMONT MINING

CORP

COM

651639106

33,469

1,117,500 SH

NICE SYS LTD

SPONSORED

ADR

653656108

9,900

NUANCE

COMMUNICATIONS

INC

NOTE

2.750%11/0

67020YAF7

OGE ENERGY CORP

COM

OCCIDENTAL PETE

CORP DEL

Put

SOLE

1,117,500

268,366 SH

SOLE

268,366

32,960

32,000,000 PRN

SOLE

32,000,000

670837103

18,260

267,747 SH

SOLE

267,747

COM

674599105

34,227

383,578 SH

SOLE

383,578

ON SEMICONDUCTOR

CORP

COM

682189105

2,020

250,000 SH

SOLE

250,000

OPENTABLE INC

COM

68372A104

2,291

35,821 SH

SOLE

35,821

PANDORA MEDIA INC

COM

698354107

6,016

326,956 SH

SOLE

326,956

PDC ENERGY INC

COM

69327R101

1,596

31,000 SH

SOLE

31,000

PENN VA CORP

COM

707882106

8,828

1,878,242 SH

SOLE

1,878,242

PENNEY J C INC

COM

708160106

341,368

19,986,361 SH

SOLE

19,986,361

PENNEY J C INC

COM

708160106

8,540

500,000 SH

SOLE

500,000

PEPSICO INC

COM

713448108

15,640

191,226 SH

SOLE

191,226

PEPSICO INC

COM

713448108

16,358

200,000 SH

SOLE

200,000

PHILLIPS 66

COM

718546104

8,695

147,600 SH

SOLE

147,600

PIONEER NAT RES CO

COM

723787107

141,890

980,240 SH

SOLE

980,240

POWERSHARES QQQ

TRUST

UNIT SER 1

73935A104

21,363

300,000 SH

Call

SOLE

300,000

POWERSHARES QQQ

TRUST

UNIT SER 1

73935A104

53,550

752,000 SH

Put

SOLE

752,000

PRUDENTIAL FINL INC

COM

744320102

4,033

55,219 SH

SOLE

55,219

QUANTUM CORP

NOTE

3.500%11/1

747906AG0

SOLE

99,999,999

RACKSPACE HOSTING

INC

COM

750086100

9,473

250,000 SH

SOLE

250,000

RADIAN GROUP INC

COM

750236101

19,225

1,654,500 SH

SOLE

1,654,500

RED HAT INC

COM

756577102

7,173

150,000 SH

SOLE

150,000

ROVI CORP

NOTE 2.625%

2/1

779376AB8

SOLE

99,999,999

Call

Call

127,706 130,980,000 PRN

Call

201,446 196,174,000 PRN

RUCKUS WIRELESS INC COM

781220108

981

76,600 SH

SOLE

76,600

SPDR S&P 500 ETF TR

TR UNIT

78462F103

4,185

26,157 SH

SOLE

26,157

SPDR S&P 500 ETF TR

TR UNIT

78462F103

22,977

143,600 SH

Call

SOLE

143,600

SPDR S&P 500 ETF TR

TR UNIT

78462F103

1,248,463

7,802,400 SH

Put

SOLE

7,802,400

SPDR SERIES TRUST

S&P

HOMEBUILD

78464A888

30,597

1,040,000 SH

Put

SOLE

1,040,000

SANDISK CORP

COM

80004C101

9,165

150,000 SH

SOLE

150,000

SAREPTA

THERAPEUTICS INC

COM

803607100

16,197

425,689 SH

SOLE

425,689

SELECT SECTOR SPDR

TR

SBI INTENERGY

81369Y506

48,858

623,500 SH

SOLE

623,500

SBI INT-FINL

81369Y605

3,898

200,000 SH

SOLE

200,000

SELECT SECTOR SPDR

Put

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

5/7

8/15/13

SEC FORM 13-F Information Table

TR

SEMGROUP CORP

CL A

81663A105

19,129

355,154 SH

SOLE

355,154

SHUTTERFLY INC

COM

82568P304

89,822

1,610,000 SH

SOLE

1,610,000

SMITHFIELD FOODS

INC

COM

832248108

5,458

166,666 SH

SOLE

166,666

SOUTHWEST AIRLS CO COM

844741108

3,646

282,820 SH

SOLE

282,820

SPREADTRUM

ADR

COMMUNICATIONS IN

849415203

49,875

1,900,000 SH

SOLE

1,900,000

STMICROELECTRONICS

NY REGISTRY 861012102

NV

15,882

1,766,666 SH

SOLE

1,766,666

SUPERTEX INC

COM

868532102

3,985

166,666 SH

SOLE

166,666

TD AMERITRADE

HLDG CORP

COM

87236Y108

5,635

232,000 SH

SOLE

232,000

T-MOBILE US INC

COM

872590104

4,114

165,840 SH

SOLE

165,840

TW TELECOM INC

COM

87311L104

11,197

397,909 SH

SOLE

397,909

TABLEAU SOFTWARE

INC

CL A

87336U105

1,108

20,000 SH

SOLE

20,000

TASMAN METALS

ORD (CVE)

COM

87652B103

903

1,666,666 SH

SOLE

1,666,666

TERADATA CORP DEL

COM

88076W103

22,132

440,600 SH

SOLE

440,600

88632Q103

27,107

1,266,666 SH

SOLE

1,266,666

SOLE

99,999,999

TIBCO SOFTWARE INC COM

TIBCO SOFTWARE INC

NOTE 2.250%

5/0

88632QAB9

TIME WARNER CABLE

INC

COM

88732J207

14,060

125,000 SH

SOLE

125,000

TIVO INC

COM

888706108

11,050

1,000,000 SH

SOLE

1,000,000

TOWERSTREAM CORP

COM

892000100

502

196,800 SH

SOLE

196,800

TOYOTA MOTOR CORP

SP ADR

REP2COM

892331307

9,170

76,000 SH

SOLE

76,000

TRIPADVISOR INC

COM

896945201

8,567

140,744 SH

SOLE

140,744

TURQUOISE HILL RES

LTD

COM

900435108

20,518

3,460,060 SH

SOLE

3,460,060

UNITED CONTL HLDGS

COM

INC

910047109

95,738

3,059,666 SH

SOLE

3,059,666

UNWIRED PLANET INC

COM

NEW

91531F103

11,700

6,000,000 SH

SOLE

6,000,000

VERISIGN INC

COM

92343E102

893

20,000 SH

SOLE

20,000

VERINT SYS INC

COM

92343X100

15,553

438,472 SH

SOLE

438,472

VERISK ANALYTICS

INC

CL A

92345Y106

6,650

111,384 SH

SOLE

111,384

VIRNETX HLDG CORP

COM

92823T108

1,000

50,000 SH

SOLE

50,000

VIROPHARMA INC

COM

928241108

1,433

50,000 SH

SOLE

50,000

VISTEON CORP

COM NEW

92839U206

23,629

374,350 SH

SOLE

374,350

WAL-MART STORES

INC

COM

931142103

30,541

410,000 SH

SOLE

410,000

WEBMD HEALTH CORP

NOTE 2.250%

3/3

94770VAH5

273,939 279,530,000 PRN

SOLE

99,999,999

WEBMD HEALTH CORP

NOTE 2.500%

1/3

94770VAF9

100,045 107,000,000 PRN

SOLE

99,999,999

171,506 175,006,000 PRN

Put

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

6/7

8/15/13

SEC FORM 13-F Information Table

WESTERN REFNG INC

COM

959319104

8,701

310,000 SH

SOLE

310,000

WHITING PETE CORP

NEW

COM

966387102

2,736

59,359 SH

SOLE

59,359

WISDOMTREE TRUST

JAPN HEDGE

EQT

97717W851

1,140

25,000 SH

SOLE

25,000

XYLEM INC

COM

98419M100

10,812

401,328 SH

SOLE

401,328

YAHOO INC

COM

984332106

2,511

100,000 SH

SOLE

100,000

YELP INC

CL A

985817105

40,855

1,175,000 SH

SOLE

1,175,000

ZOETIS INC

CL A

98978V103

74,285

2,404,811 SH

SOLE

2,404,811

ZOETIS INC

CL A

98978V103

958

31,000 SH

SOLE

31,000

DELPHI AUTOMOTIVE

PLC

SHS

G27823106

42,090

830,341 SH

SOLE

830,341

HERBALIFE LTD

COM USD

SHS

G4412G101

227,467

5,039,175 SH

SOLE

5,039,175

LIBERTY GLOBAL PLC

SHS CL A

G5480U104

100,512

1,356,805 SH

SOLE

1,356,805

LIBERTY GLOBAL PLC

SHS CL C

G5480U120

141,753

2,087,972 SH

SOLE

2,087,972

MANCHESTER UTD

PLC NEW

ORD CL A

G5784H106

47,252

2,968,097 SH

SOLE

2,968,097

MARVELL

TECHNOLOGY GROUP

LTD

ORD

G5876H105

26,348

2,250,000 SH

SOLE

2,250,000

ROWAN COMPANIES

PLC

SHS CL A

G7665A101

8,858

260,000 SH

SOLE

260,000

ADECOAGRO S A

COM

L00849106

161,969

25,915,076 SH

SOLE

25,915,076

CLICKSOFTWARE

TECHNOLOGIES L

ORD

M25082104

26,104

3,130,000 SH

SOLE

3,130,000

NXP

COM

SEMICONDUCTORS N V

N6596X109

4,647

150,000 SH

SOLE

150,000

Call

Put

www.sec.gov/Archives/edgar/data/1029160/000114036113032845/xslForm13F_X01/form13fInfoTable.xml

7/7

You might also like

- CCVDocument31 pagesCCVniro57% (7)

- CA Excel .Problem - Set A.BDocument65 pagesCA Excel .Problem - Set A.BStephen McSweeneyNo ratings yet

- Registru Incasari Plati PfaDocument11 pagesRegistru Incasari Plati Pfadora1975No ratings yet

- Marc AisenDocument120 pagesMarc AisenjeremyreedsNo ratings yet

- PLDT Area CodesDocument53 pagesPLDT Area Codesjosh0% (1)

- 7/20/2011 WWW - Sec.Gov/Archives/Edgar/Data/100 : PDF Created With Pdffactory Trial VersionDocument4 pages7/20/2011 WWW - Sec.Gov/Archives/Edgar/Data/100 : PDF Created With Pdffactory Trial VersionAnonymous Feglbx5No ratings yet

- SEC FORM 13-F Information TableDocument1 pageSEC FORM 13-F Information TableVerónica SilveriNo ratings yet

- Portafolio Warret BuffetDocument25 pagesPortafolio Warret BuffetAlvaPlayNo ratings yet

- Eaton Pipeline Strainer Pressure Drop CalculationsDocument1 pageEaton Pipeline Strainer Pressure Drop Calculationsreborn_willyNo ratings yet

- Portafolio MichaelDocument7 pagesPortafolio MichaelAlvaPlayNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Nfholdings 2001028Document184 pagesNfholdings 2001028Ramon RogersNo ratings yet

- Digital Channel Support of Contact CenterDocument17 pagesDigital Channel Support of Contact Centerኣስፋ ሙሉNo ratings yet

- 22jan2013 Section02A Summary Volume and Open Interest Int Rates Futures and Options 2013014Document2 pages22jan2013 Section02A Summary Volume and Open Interest Int Rates Futures and Options 2013014avadcsNo ratings yet

- Basicdata of Ceiling Fan Qe - 7674 - 2-2-7674 - 101Document9 pagesBasicdata of Ceiling Fan Qe - 7674 - 2-2-7674 - 101gsNo ratings yet

- Term Project ADRs FIN401 SP2013Document212 pagesTerm Project ADRs FIN401 SP2013Muhammed RafiudeenNo ratings yet

- Excel Training FileDocument52 pagesExcel Training FilesanjivNo ratings yet

- CA CB CC CD CE CG CF CH Notes:: FA FR FI FC AB CA A B N F FA FR FI FC AB NADocument1 pageCA CB CC CD CE CG CF CH Notes:: FA FR FI FC AB CA A B N F FA FR FI FC AB NAnucuoiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Pacs Operational ManualDocument10 pagesPacs Operational ManualKhushrajNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Name of Issuer Title of Class Cusip VALUE ($1000)Document14 pagesName of Issuer Title of Class Cusip VALUE ($1000)poopoosinghNo ratings yet

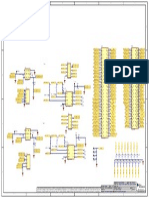

- Test Class Notes 21 LAB+4+Loadboard+SchematicDocument1 pageTest Class Notes 21 LAB+4+Loadboard+SchematicsuryayellamrajuNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- SEIU LM-2 2012 Labor Organization Annual ReportDocument444 pagesSEIU LM-2 2012 Labor Organization Annual ReportUnion MonitorNo ratings yet

- Book 5Document32 pagesBook 5Kaustubh ChaphalkarNo ratings yet

- SunSystems 5 & 6 Reporting and Analysis OverviewDocument5 pagesSunSystems 5 & 6 Reporting and Analysis OverviewIshmum Monjur NilockNo ratings yet

- S&P 1000 Index - Dividends and Implied Volatility Surfaces ParametersDocument8 pagesS&P 1000 Index - Dividends and Implied Volatility Surfaces ParametersQ.M.S Advisors LLCNo ratings yet

- 1710233831198Document6 pages1710233831198SGM CONo ratings yet

- Manifold Production July-19Document4 pagesManifold Production July-19Niranjan N UpparNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF ReportsDocument3 pagesPDF ReportsSIVANo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- 10-K Edgar Data 1028215 0001564590-18-023790 1Document208 pages10-K Edgar Data 1028215 0001564590-18-023790 1jeetNo ratings yet

- Sales Revenue: at Year 31 December 2009 Title and Explanation M&N Merchandising SDN BHDDocument4 pagesSales Revenue: at Year 31 December 2009 Title and Explanation M&N Merchandising SDN BHDHasan AnwerNo ratings yet

- Stanford 990Document208 pagesStanford 990coo9486No ratings yet

- 8/18/2011 WWW - Sec.Gov/Archives/Edgar/Data/143 : PDF Created With Pdffactory Trial VersionDocument6 pages8/18/2011 WWW - Sec.Gov/Archives/Edgar/Data/143 : PDF Created With Pdffactory Trial VersionAnonymous Feglbx5No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 13 Flist 1996 Q 2Document42 pages13 Flist 1996 Q 2doodle bobNo ratings yet

- 13 Flist 1996 Q 3Document306 pages13 Flist 1996 Q 3doodle bobNo ratings yet

- A026F938 Wiring InterconnectionsDocument16 pagesA026F938 Wiring InterconnectionsBushra TariqNo ratings yet

- Exchange Summary Volume and Open Interest Equity Index FuturesDocument2 pagesExchange Summary Volume and Open Interest Equity Index FuturesavadcsNo ratings yet

- 2010 LM-2 (AFSCME Council 5)Document28 pages2010 LM-2 (AFSCME Council 5)Jonathan BlakeNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Industrial Air Compressor Parts PDFDocument100 pagesIndustrial Air Compressor Parts PDFUbanAirlangga0% (1)

- Filing Instructions: Please Follow These Instructions CarefullyDocument4 pagesFiling Instructions: Please Follow These Instructions CarefullyMafer ChavezNo ratings yet

- Pur Reg IT 2 VendorsDocument5 pagesPur Reg IT 2 VendorsLaxmikant JoshiNo ratings yet

- Clarification (Company Update)Document1 pageClarification (Company Update)Shyam SunderNo ratings yet

- l111l l11l I L, 111I: Lil LilDocument26 pagesl111l l11l I L, 111I: Lil Lilcmf8926No ratings yet

- C12625 BomDocument19 pagesC12625 Bomsteve@air-innovations.co.za100% (1)

- Conciliación Accurate LLC AgostoDocument9 pagesConciliación Accurate LLC AgostoBritney CalderonNo ratings yet

- LJ LJ: Return of Organization Exempt From Income TaxDocument20 pagesLJ LJ: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Supply Chain Management and Business Performance: The VASC ModelFrom EverandSupply Chain Management and Business Performance: The VASC ModelNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Allison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyFrom EverandAllison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyRating: 5 out of 5 stars5/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Cliven Bundy Lawsuit vs. ObamaDocument5 pagesCliven Bundy Lawsuit vs. ObamaKaroliNo ratings yet

- Boston Globe President TrumpDocument1 pageBoston Globe President TrumpGerman LopezNo ratings yet

- Bundy DismissedDocument2 pagesBundy DismissedBecket Adams100% (1)

- Bundy DismissedDocument2 pagesBundy DismissedBecket Adams100% (1)

- Bundy DismissedDocument2 pagesBundy DismissedBecket Adams100% (1)

- Ben Carson Admits Fabricating West Point Scholarship - POLITICODocument4 pagesBen Carson Admits Fabricating West Point Scholarship - POLITICOBecket AdamsNo ratings yet

- Associated Press Complaint For Hillary Clinton RecordsDocument18 pagesAssociated Press Complaint For Hillary Clinton Recordsmlcalderone100% (1)

- DOJ OIG Report - Sharyl AttkissonDocument4 pagesDOJ OIG Report - Sharyl AttkissonMedia Matters for AmericaNo ratings yet

- Original: "Op-Ed Proposes Burning Kim Davis at The Stake"Document9 pagesOriginal: "Op-Ed Proposes Burning Kim Davis at The Stake"Becket AdamsNo ratings yet

- Co10162014 C592phxkrDocument5 pagesCo10162014 C592phxkrBecket AdamsNo ratings yet

- CDC-Emerging and Zoonotic Infectious Diseases: Major GoalsDocument2 pagesCDC-Emerging and Zoonotic Infectious Diseases: Major GoalsBecket AdamsNo ratings yet

- HP 14.07 NV ResultsDocument4 pagesHP 14.07 NV ResultsBecket AdamsNo ratings yet

- Fung - Letter To Stations Re RIDP Ad 9.29.14 DRAFTDocument3 pagesFung - Letter To Stations Re RIDP Ad 9.29.14 DRAFTBecket AdamsNo ratings yet

- Document 1Document1 pageDocument 1Becket AdamsNo ratings yet

- Office of Inspector General: United States Department of State and The Broadcasting Board of GovernorsDocument14 pagesOffice of Inspector General: United States Department of State and The Broadcasting Board of GovernorsBecket AdamsNo ratings yet

- 1144 A 42 Obama and International AffairsDocument3 pages1144 A 42 Obama and International AffairsBecket AdamsNo ratings yet

- Dir IT Infra 1Document14 pagesDir IT Infra 1CharlesNo ratings yet

- DB DotaDocument10,808 pagesDB DotaMichelle TorresNo ratings yet

- Catalogo Guica Sport SasDocument16 pagesCatalogo Guica Sport SasAlejo Mendez OsorioNo ratings yet

- Membership List: Russell 3000® IndexDocument33 pagesMembership List: Russell 3000® IndexFuboNo ratings yet

- Lista Donaldson PDFDocument7 pagesLista Donaldson PDFÁlvaro Ricardo LopatiukNo ratings yet

- Buscar Datos Repetidos en Dos Columnas en ExcelDocument4 pagesBuscar Datos Repetidos en Dos Columnas en ExcelNaarses Aahmed BbelalcazarNo ratings yet

- RelayDocument16 pagesRelayVasu Iyer100% (1)

- Gab Preliminar 822 Petrobras 23 004 01-1 PDFDocument1 pageGab Preliminar 822 Petrobras 23 004 01-1 PDFNailson BritoNo ratings yet

- Receipt 20971004Document468 pagesReceipt 20971004Asep ZaenalNo ratings yet

- Card Ending 4667Document50 pagesCard Ending 4667Dyan Gibbins100% (1)

- Warn Act Listings 2023 TWCDocument9 pagesWarn Act Listings 2023 TWCSubash NehruNo ratings yet

- Fabex Share Price Movement FinalDocument20 pagesFabex Share Price Movement FinalChinmay ShirsatNo ratings yet

- KrogerDocument3 pagesKrogerHaanz DirtyfingerNo ratings yet

- Saga0024 TV Sellout Week010Document198 pagesSaga0024 TV Sellout Week010valeria_villeNo ratings yet

- Stock Working FileDocument56 pagesStock Working FileSokhomNo ratings yet

- JPMorgan Equity Premium Income ETF ETF Shares Holdings 05 05 2023Document2 pagesJPMorgan Equity Premium Income ETF ETF Shares Holdings 05 05 2023Dario MartinelliNo ratings yet

- 70 PlatDocument2 pages70 PlatLuan SilvaNo ratings yet

- HbomaxDocument16 pagesHbomaxgastmathis8No ratings yet

- TPL PresentationDocument35 pagesTPL PresentationTodd SullivanNo ratings yet

- Interbrand: Interbrand's Annual Ranking of 100 of The World's Most Valuable Brands (2002)Document3 pagesInterbrand: Interbrand's Annual Ranking of 100 of The World's Most Valuable Brands (2002)designeducationNo ratings yet

- Bank Account Details PDF Branding Revise MobilityDocument1 pageBank Account Details PDF Branding Revise MobilityTEZ BUZZNo ratings yet

- PLDT Areas Covered SortedDocument43 pagesPLDT Areas Covered Sortedmcdale67% (3)

- 2023 DEI Top Scoring Companies - July - 11+TH+Updated+Document6 pages2023 DEI Top Scoring Companies - July - 11+TH+Updated+Ika Ratih WibawaNo ratings yet

- Dir IT Infra2Document18 pagesDir IT Infra2CharlesNo ratings yet

- Lista MDocument240 pagesLista MMaria MagicdNo ratings yet

- Fortune 500 Companies 2020 - Comparing Profits by Industry - FortuneDocument33 pagesFortune 500 Companies 2020 - Comparing Profits by Industry - FortuneAbhi KumarNo ratings yet

- Bin CartoesDocument1,094 pagesBin CartoesAngelo GzoNo ratings yet