Professional Documents

Culture Documents

The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013

The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013

Uploaded by

srichardequipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013

The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013

Uploaded by

srichardequipCopyright:

Available Formats

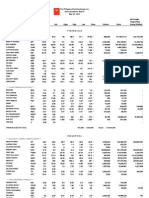

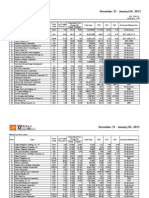

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIA UNITED

AUB

104

104.8

101.5

105.1

101.5

104

19,989,300

2,063,976,307

(525,792,596)

ASIATRUST

BANK PH ISLANDS

ASIA

BPI

106.6

106.7

106.3

107

105.8

106.6

2,663,490

283,822,940

194,578,625

BDO UNIBANK

BDO

95

95.8

94.45

96

93.95

95.8

1,873,010

177,572,669

32,234,742

CHINABANK

CHIB

76.65

76.95

76.9

77

76.9

76.95

92,770

7,138,806

153,800

CITYSTATE BANK

CSB

11.28

11.5

11.22

11.5

11.22

11.5

85,000

976,192

EAST WEST BANK

EW

36.65

36.7

36.8

36.85

36.5

36.65

1,231,700

45,211,450

(3,266,550)

EXPORT BANK

EIBA

EIBB

MBT

136.2

136.3

137

137

135.9

136.3

3,144,820

428,599,050

41,544,283

PBB

PBC

PNB

34.05

70

109.5

34.1

77.2

109.8

34

111

34.05

111

33.8

109.5

34.05

109.8

629,100

-

21,361,570

-

(47,530)

-

536,050

58,982,631

10,501,773

PSBANK

PTC

PSB

72

139.2

143

143

143

143

143

10

1,430

(1,430)

RCBC

RCB

72.5

73.5

74

74

72.5

73.5

233,900

17,145,932.5

5,520,330

SECURITY BANK

SECB

181

185.9

191

191

180

181

1,540,770

285,017,686

(132,209,089)

UNION BANK

UBP

153

153.6

153

153.8

151.2

153.8

42,130

6,460,385

5,170,416

1.32

2.18

1.33

2.2

1.31

2.18

1.32

2.18

402,000

76,000

529,650

166,780

EXPORT BANK B

METROBANK

PB BANK

PBCOM

PHIL NATL BANK

PHILTRUST

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BDO LEASING

BKD

BLFI

1.32

2.18

1.33

2.2

COL FINANCIAL

COL

20

20.3

20

20.45

20

20.3

12,300

246,375

FILIPINO FUND

FFI

21

22

21.8

21.8

21.6

21.6

6,100

132,380

FIRST ABACUS

FAF

I

0.82

2.82

0.83

2.97

2.82

2.97

2.82

2.97

29,000

84,330

(33,840)

MFC

MAKE

575

32.25

577

32.3

575

32.15

575

32.25

575

32.15

575

32.25

620

12,000

356,500

385,930

NTL REINSURANCE

MED

NRCP

0.425

1.87

0.44

1.88

0.435

1.88

0.44

1.88

0.42

1.87

0.44

1.88

1,830,000

110,000

782,750

206,640

(43,000)

(176,720)

PHIL STOCK EXCH

PSE

485

487.6

489.6

489.6

485

485

1,260

611,822

9,700

SUN LIFE

SLF

1,065

1,090

1,070

1,070

1,065

1,065

315

336,975

VANTAGE

2.78

2.88

2.79

2.79

2.76

2.76

200,000

552,300

VOLUME :

34,741,645

IREMIT

MANULIFE

MAYBANK ATR KE

MEDCO HLDG

FINANCIALS SECTOR TOTAL

VALUE :

3,400,659,480.5

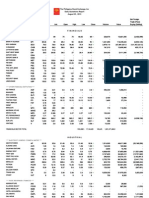

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

36.2

36.35

36.4

36.65

36.1

36.35

1,086,700

39,430,875

2,797,585

ALSONS CONS

ACR

1.43

1.43

1.39

1.4

2,317,000

3,249,260

CALAPAN VENTURE

H2O

6.88

7.05

7.46

7.46

6.88

6.88

210,000

1,466,228

ENERGY DEVT

EDC

6.33

6.35

6.36

6.39

6.32

6.35

16,661,400

105,830,002

(15,259,366)

FIRST GEN

FGEN

22.1

22.2

22

22.3

22

22.2

911,900

20,178,160

(3,640,985)

FIRST PHIL HLDG

FPH

106.7

106.8

107.4

107.4

106.7

106.7

305,690

32,640,149

(6,344,546)

MANILA WATER

MWC

40.3

40.4

40

40.45

39.95

40.4

891,800

35,888,710

(2,314,035)

MERALCO

MER

384.8

385

389

389

383.6

384.8

748,450

287,764,746

151,174,216

PETRON

PCOR

15.88

15.94

15.82

16

15.82

15.94

2,627,800

41,855,502

6,762,072

PHOENIX

SALCON POWER

PNX

SPC

7.42

5.25

7.44

5.41

7.43

5.25

7.44

5.25

7.41

5.25

7.44

5.25

450,000

3,000

3,341,942

15,750

2,023,323

(7,350)

TRANS ASIA

TA

2.79

2.8

2.75

2.81

2.73

2.79

11,767,000

32,530,850

45,130

VIVANT

VVT

9.7

10.4

9.9

10.5

9.9

10.5

3,500

35,250

6.55

1.89

6.56

1.9

6.5

1.91

6.56

1.93

6.5

1.9

6.55

1.9

19,800

1,076,000

129,248

2,049,250

546,260

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ALLIANCE SELECT

ANI

FOOD

BOGO MEDELLIN

BMM

54

58

54

54

54

54

60

3,240

CNTRL AZUCARERA

DNL INDUS

CAT

CBC

DNL

8.32

8.33

8.55

8.6

8.32

8.32

7,779,900

65,551,968

(30,657,073)

GINEBRA

GSMI

17.58

17.6

18

18

17.6

17.6

34,400

609,038

JOLLIBEE

JFC

139

139.4

136.5

139.4

136.5

139.4

287,290

39,873,175

12,597,097

LIBERTY FLOUR

LT GROUP

LFM

LTG

48.5

25.7

25.75

25.95

25.95

25.5

25.75

1,049,600

26,960,330

11,252,865

PANCAKE

PCKH

12

12.18

12.1

12.2

12

12

10,000

121,470

68,320

PEPSI COLA

PIP

6.38

6.39

6.52

6.52

6.37

6.39

392,000

2,511,664

(52,392)

PUREFOODS

PF

302

303

301

301.6

50,970

15,397,088

(1,844,672)

RFM CORP

RFM

5.81

5.88

5.9

5.92

5.81

5.81

2,050,500

12,058,026

1,898,345

ROXAS AND CO

ROXAS HLDG

RCI

ROX

2.28

2.95

2.4

3

2.96

2.96

2.95

2.95

49,000

144,580

SAN MIGUEL CORP

SMC

115

116

116.9

117

115

115

826,580

95,974,501

(37,497,632)

SWIFT FOODS

SFI

0.14

0.143

0.14

0.143

0.14

0.14

2,200,000

311,100

COSMOS

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

UNIV ROBINA

URC

127.8

127.9

130.5

130.8

126.6

127.9

2,275,900

290,258,105

(64,954,047)

VICTORIAS

VMC

1.79

1.8

1.74

1.8

1.74

1.79

2,222,000

3,934,780

1,046,140

VITARICH

VITA

0.92

0.93

0.92

0.93

0.92

0.93

455,000

421,630

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

CA

CAB

EEI

19.78

46

15

15.2

20

50

15.3

20

50

15.7

21.4

50

15.7

19.78

50

15.2

20

50

15.2

6,700

1,790

1,544,200

133,920

89,500

23,531,968

(9,606,392)

LAFARGE REP

FED

HLCM

LRI

8.1

15.22

12.12

10.88

15.3

12.14

15.3

12.08

15.7

12.22

15.3

12.08

15.3

12.14

466,100

697,500

7,200,470

8,488,912

1,600,090

(531,776)

MARIWASA

MMI

2.86

2.95

2.72

2.98

2.72

2.95

36,000

104,920

MEGAWIDE

MWIDE

22.3

22.35

22.55

22.6

22.35

22.35

718,300

16,153,380

(5,039,570)

PHINMA

TKC STEEL

PHN

PNC

CMT

SRDC

T

14.52

1.2

2.93

14.96

2.98

14.98

3

15

3

14.98

2.93

15

2.98

6,400

25,000

95,888

73,430

(17,650)

VULCAN INDL

VUL

2.02

2.03

2.04

2.08

2.03

2.03

839,000

1,719,870

CIP

COAT

EURO

LMG

73.25

3.05

1.78

2.31

119.9

3.09

1.99

2.48

3.05

2.44

3.05

2.58

3.03

2.44

3.05

2.5

47,000

52,000

143,210

129,120

126,620

MVC

MCP

MAH

MAHB

PPC

2.06

13.12

-

2.27

13.2

-

13.12

-

13.3

-

13.08

-

13.12

-

9,416,100

-

124,043,186

-

1,469,552

-

CONCRETE A

CONCRETE B

EEI CORP

FED CHEMICALS

HOLCIM

PNCC

SEACEM

SUPERCITY

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

EUROMED

LMG CHEMICALS

MABUHAY VINYL

MELCO CROWN

METROALLIANCE A

METROALLIANCE B

PRYCE CORP

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

16.5

16.8

16.92

17

16.6

16.6

3,400

56,988

GREENERGY

IONICS

GREEN

IMI

ION

0.017

3.68

0.65

0.018

3.69

0.67

0.017

3.69

0.67

0.018

3.69

0.67

0.016

3.69

0.65

0.018

3.69

0.65

72,300,000

9,000

428,000

1,229,300

33,210

278,440

51,000

(5,360)

PANASONIC

PMPC

5.5

5.85

5.5

5.5

5.5

5.5

100

550

INTEGRATED MICR

**** OTHER INDUSTRIALS ****

ALPHALAND

ALPHA

17.02

17.5

17.5

17.5

17.02

17.02

17,500

301,470

(54,730)

FILSYN A

SPLASH CORP

FYN

FYNB

PCP

SPH

2.03

2.03

1.97

2.03

119,000

237,320

(4,060)

STENIEL

STN

FILSYN B

PICOP RES

INDUSTRIALS SECTOR TOTAL

VOLUME :

148,860,520

VALUE :

1,616,368,296

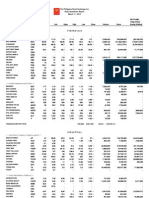

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS CONS

ALLIANCE GLOBAL

ABA

AEV

AGI

0.65

56

26

0.66

56.1

26.05

0.66

56

26.4

0.66

56.1

26.45

0.65

55.05

25.5

0.65

56

26

2,648,000

1,045,640

19,686,900

1,721,210

58,429,084.5

511,451,965

5,641,025

(186,508,645)

ANGLO PHIL HLDG

APO

2.25

ANSCOR

ANS

6.95

2.26

2.3

2.3

2.25

2.25

575,000

1,302,320

6.99

6.89

6.94

34,400

239,300

ASIA AMLGMATED

AAA

ATN

ATNB

AC

4.32

1.45

1.45

668.5

4.5

1.5

1.6

669

665

672

662

668.5

316,850

211,514,050

(64,320,425)

BH

COSCO

600

16.62

800

16.64

16.74

16.74

16.6

16.62

1,578,900

26,274,254

(1,582,500)

FILINVEST DEV

DMC

FC

FDC

58

6.68

58.2

6.7

58.3

6.79

58.3

6.79

57

6.67

58

6.7

900,790

734,600

51,785,430.5

4,925,174

(32,297,490)

(3,403,887)

FJ PRINCE A

FJP

3.5

3.78

3.5

3.8

3.5

3.79

56,000

204,760

FJ PRINCE B

FJPB

3.1

3.99

3.8

3.99

3.8

3.99

26,000

102,950

FORUM PACIFIC

GT CAPITAL

FPI

GTCAP

0.202

852

0.219

854

855

855

851.5

852

193,510

165,101,390

6,460,155

HOUSE OF INV

HI

9.08

9.1

9.12

9.15

8.81

9.1

2,533,700

22,884,360

11,736,993

JG SUMMIT

JGS

48.4

48.5

48.5

48.9

47.15

48.5

975,000

46,756,525

(32,636,205)

JOLLIVILLE HLDG

JOH

6.8

7.5

7.08

7.9

7.08

7.5

6,000

45,900

KEPPEL HLDG A

KPH

5.21

5.4

5.21

5.21

5.21

5.21

2,000

10,420

KEPPEL HLDG B

KPHB

5.2

5.63

5.6

5.6

5.6

5.6

30,000

168,000

168,000

LODESTAR

LIHC

0.79

0.84

0.87

0.87

0.8

0.8

605,000

484,320

LOPEZ HLDG

LPZ

6.82

6.85

6.98

6.98

6.8

6.82

4,716,300

32,536,138

715,822

MABUHAY HLDG

MHC

0.71

0.73

0.73

0.75

0.71

0.71

6,721,000

4,904,400

(370,000)

ABOITIZ EQUITY

ATN HLDG A

ATN HLDG B

AYALA CORP

BHI HLDG

COSCO CAPITAL

DMCI HLDG

FIL ESTATE CORP

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

Symbol

MARCVENTURES

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

METRO PAC INV

MARC

MPI

1.66

6.08

1.68

6.09

1.7

6.15

1.7

6.15

1.66

6.06

1.68

6.09

873,000

90,288,600

1,465,630

551,037,838

(40,760,123)

MINERALES IND

MIC

6.29

6.35

6.3

6.4

6.3

6.4

18,000

113,650

MJC INVESTMENTS

PRIME ORION

MJIC

PA

PRIM

POPI

5.61

0.045

1.98

0.67

5.88

0.048

2

0.7

2

0.67

2

0.7

2

0.67

2

0.7

2,000

201,000

4,000

134,700

700

REPUBLIC GLASS

REG

2.5

2.8

2.62

2.65

2.62

2.65

63,000

166,390

SEAFRONT RES

SINOPHIL

SPM

SINO

2.1

0.37

2.18

0.375

2.1

0.37

2.1

0.385

2.1

0.365

2.1

0.375

75,000

4,840,000

157,500

1,813,300

37,000

SM INVESTMENTS

SM

1,179

1,180

1,188

1,190

1,175

1,179

379,445

447,121,785

(28,469,820)

SOLID GROUP

SGI

2.18

2.2

2.2

2.2

2.18

2.18

748,000

1,641,440

(28,600)

SOUTH CHINA

SOC

1.15

1.18

1.19

1.19

1.19

1.19

4,000

4,760

SYNERGY GRID

WELLEX INDUS

SGP

UNI

WIN

333

0.239

0.25

450

0.245

0.255

0.238

0.26

0.238

0.26

0.238

0.25

0.238

0.255

100,000

40,000

23,800

10,150

ZEUS HLDG

ZHI

0.395

0.4

0.415

0.415

0.39

0.4

3,810,000

1,547,200

8,300

PACIFICA

PRIME MEDIA

UNIOIL HLDG

HOLDING FIRMS SECTOR TOTAL

VOLUME :

144,827,645

VALUE :

2,146,089,384

PROPERTY

**** PROPERTY ****

A BROWN

BRN

2.5

2.64

2.7

2.7

2.48

2.64

487,000

1,245,160

ANCHOR LAND

ARANETA PROP

ALHI

ARA

23

1.76

24

1.78

24

1.79

24

1.8

24

1.75

24

1.75

500

293,000

12,000

515,500

ARTHALAND CORP

ALCO

0.214

0.221

0.215

0.215

0.212

0.212

1,000,000

213,530

AYALA LAND

ALI

33.8

33.9

34.4

34.4

33.4

33.9

8,396,600

283,010,150

(54,131,250)

BELLE CORP

BEL

6.44

6.45

6.51

6.51

6.4

6.45

8,788,600

57,014,154

(11,386,505)

CEBU HLDG

CHI

6.5

6.51

6.5

6.65

6.5

6.51

710,600

4,622,213

1,554,285

CEBU PROP A

CEBU PROP B

CPV

CPVB

4.2

4.8

5.5

5.2

5.25

5.2

5.25

47,000

245,750

CENTURY PROP

CPG

2.27

2.28

2.25

2.29

2.22

2.28

15,700,000

35,529,610

(3,109,710)

CITY AND LAND

LAND

2.45

2.5

2.5

2.5

2.45

2.45

4,000

9,900

CITYLAND DEVT

CDC

1.14

1.17

1.14

1.14

1.13

1.14

64,000

72,820

CROWN EQUITIES

CEI

0.072

0.078

0.076

0.079

0.076

0.079

4,200,000

323,480

CYBER BAY

EMPIRE EAST

CYBR

ELI

0.68

1.11

0.69

1.12

0.68

1.12

0.68

1.12

0.68

1.09

0.68

1.12

2,330,000

915,000

1,584,400

1,007,180

466,400

EVER GOTESCO

EVER

0.35

0.355

0.35

0.35

0.35

0.35

330,000

115,500

FILINVEST LAND

FLI

2.21

2.22

2.16

2.23

2.14

2.22

47,033,000

102,960,600

16,533,000

GLOBAL ESTATE

GERI

2.26

2.27

2.33

2.33

2.22

2.27

16,061,000

36,550,080

7,154,240

GOTESCO LAND A

GO

GOB

HP

IRC

2.27

1.43

2.45

1.45

1.44

1.46

1.41

1.45

7,939,000

11,474,560

(5,760)

MEGAWORLD

KEP

MC

MCB

MEG

2.9

4.04

3.98

4.05

4.06

4.08

4.03

4.05

55,311,000

223,770,940

(107,977,010)

MRC ALLIED

MRC

0.115

0.116

0.118

0.118

0.116

0.116

10,490,000

1,221,390

PHIL ESTATES

PHES

0.53

0.56

0.56

0.56

0.53

0.56

540,000

288,100

PHIL REALTY

ROBINSONS LAND

RLT

TFC

PMT

PRMX

RLC

0.56

19

2.64

24.7

0.57

33.5

3.92

24.75

25.2

25.2

24.45

24.7

1,529,400

37,805,295

(19,233,925)

ROCKWELL

ROCK

2.96

2.99

2.96

10,132,000

30,293,410

(0)

SHANG PROP

SHNG

3.85

3.9

3.9

3.9

3.9

3.9

1,000

3,900

SM DEVT

SMDC

8.52

8.53

8.7

8.7

8.5

8.53

2,779,600

23,711,745

(1,452,616)

SM PRIME HLDG

SMPH

20.15

20.2

20.5

20.5

19.98

20.15

15,192,000

306,045,075

(132,741,595)

STA LUCIA LAND

SLI

0.78

0.79

0.82

0.83

0.79

0.79

5,444,000

4,377,840

STARMALLS

STR

3.71

3.92

3.92

3.93

3.92

3.93

51,000

199,930

SUNTRUST HOME

SUN

0.67

0.69

0.64

0.69

0.64

0.69

606,000

405,620

UNIWIDE HLDG

UW

VLL

6.84

6.88

6.99

6.99

6.84

6.88

8,337,800

57,303,152

(9,277,801)

GOTESCO LAND B

HIGHLANDS PRIME

IRC PROP

KEPPEL PROP

MARSTEEL A

MARSTEEL B

PHIL TOBACCO

PRIMETOWN PROP

PRIMEX CORP

VISTA LAND

PROPERTY SECTOR TOTAL

VOLUME :

224,793,100

VALUE :

1,222,171,234

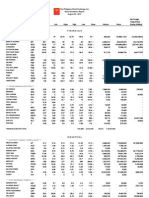

SERVICES

**** MEDIA ****

ABS CBN

GMA NETWORK

MANILA BULLETIN

MLA BRDCASTING

ABS

GMA7

MB

MBC

45.35

9.75

45.45

9.79

44.8

9.7

45.5

9.8

44.8

9.7

45.45

9.79

114,900

7,000

5,177,990

68,210

0.76

3.6

0.78

4.9

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

GLOBE TELECOM

LIBERTY TELECOM

Symbol

GLO

Bid

1,564

Ask

1,565

Open

High

1,580

1,580

Low

1,550

Close

1,564

Volume

46,055

Value

71,658,720

Net Foreign

Trade (Peso)

Buying (Selling)

15,108,995

PLDT

LIB

TEL

2.3

3,176

2.4

3,180

2.4

3,206

2.4

3,208

2.4

3,150

2.4

3,180

37,000

122,565

88,800

389,706,330

(150,583,060)

PTT CORP

PTT

DFNN

IMP

4.25

5.05

4.29

6

4.25

5.05

4.29

5.05

4.25

5.05

4.29

5.05

11,000

2,100

46,790

10,605

IP CONVERGE

IMPB

CLOUD

22

8.05

66

8.5

8.98

8.98

7.55

8.5

2,533,100

20,849,522

ISLAND INFO

IS

0.051

0.053

0.053

0.054

0.053

0.054

1,000,000

53,500

ISM COMM

PHILWEB

ISM

MG

NXT

WEB

2.37

0.53

15.18

2.5

0.54

15.46

2.49

0.54

15.48

2.49

0.54

15.48

2.36

0.53

15.18

2.49

0.54

15.46

175,000

558,000

318,300

435,620

300,090

4,915,964

(12,190)

(893,554)

TOUCH SOLUTIONS

TSI

19.68

19.7

20

20

19.2

19.7

118,000

2,312,754

TRANSPACIFIC BR

TBGI

2.33

2.44

2.34

2.44

2.33

2.44

3,000

7,110

2,330

YEHEY CORP

YEHEY

1.36

1.4

1.36

1.36

1.36

1.36

12,000

16,320

CEBU AIR

2GO

ATI

CEB

1.72

13.2

79.5

1.84

13.68

79.95

1.84

81

1.84

81

1.84

79.4

1.84

79.5

4,000

248,080

7,360

19,799,985

7,359,576

INTL CONTAINER

ICT

92.2

92.25

92.25

92.3

92.1

92.25

3,641,950

335,846,524

(176,537,539.5)

LORENZO SHIPPNG

LSC

MAC

PAL

1.36

2.45

-

1.59

2.55

-

**** INFORMATION TECHNOLOGY ****

DFNN INC

IMPERIAL A

IMPERIAL B

MG HLDG

NEXTSTAGE

**** TRANSPORTATION SERVICES ****

2GO GROUP

ASIAN TERMINALS

MACROASIA

PAL HLDG

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.28

1.31

1.28

1.31

1.28

1.31

14,000

17,980

BOULEVARD HLDG

BHI

0.179

0.18

0.181

0.182

0.179

0.179

74,890,000

13,441,590

5,400

GRAND PLAZA

GPH

WPI

33.15

0.395

45

0.415

0.4

0.415

0.395

0.415

1,200,000

474,450

CEU

FEU

IPO

10.98

1,180

11.6

11.08

1,290

11.9

10.98

11.5

10.98

11.5

10.98

11.5

10.98

11.5

6,900

8,000

75,762

92,000

BCOR

BLOOM

20.5

12.8

22

12.84

12.7

13.1

12.54

12.8

5,199,000

67,010,620

14,826,562

LEISURE AND RES

EG

LR

0.02

8.15

0.021

8.16

0.021

8.16

0.021

8.22

0.02

8.13

0.021

8.15

39,800,000

132,800

798,300

1,081,816

20,000

-

MANILA JOCKEY

MJC

2.36

2.4

2.4

2.4

2.4

2.4

140,000

336,000

PACIFIC ONLINE

LOTO

15.48

15.54

15.5

15.5

15.48

15.48

35,800

554,894

PHIL RACING

PRC

10.02

10.3

10.02

10.28

10.02

10.28

1,500

15,160

PRMIERE HORIZON

PHA

0.33

0.34

0.33

0.34

0.33

0.34

40,000

13,300

CALATA CORP

CAL

4.31

4.36

4.5

4.5

4.3

4.36

428,000

1,883,600

PHIL SEVEN CORP

SEVN

PGOLD

92

39.8

93

39.85

91.8

40.25

92

40.4

91.8

39.55

92

39.85

3,060

2,193,100

281,360

87,450,770

281,360

15,859,575

APC GROUP

APC

0.82

0.83

0.83

0.83

0.82

0.82

281,000

230,430

EASYCALL

ECP

PORT

ICTV

PAX

2.9

0.405

2.46

3

0.42

2.48

2.48

2.48

2.45

2.45

121,000

297,660

0.99

0.99

4,028,000

4,024,800

(547,000)

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

FAR EASTERN U

IPEOPLE

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

IP EGAME

**** RETAIL ****

PUREGOLD

**** OTHER SERVICES ****

GLOBALPORT

ICTV INC

PAXYS

PHILCOMSAT

STI HLDG

PHC

STI

SERVICES SECTOR TOTAL

VOLUME :

139,878,710

VALUE :

1,134,805,901

MINING & OIL

**** MINING ****

ABRA MINING

AR

APEX MINING A

APEX MINING B

APX

APXB

ATLAS MINING

AT

ATOK

BENGUET A

AB

BC

BENGUET B

BCB

0.0045

0.0046

0.0046

0.0046

0.0046

0.0046

6,000,000

27,600

3.98

4

4

4.05

4

4.06

4

4.06

4

4.01

4

4.01

106,000

284,000

424,000

1,142,410

(4,030)

19.88

19.9

20

20.05

19.9

19.9

547,200

10,934,552

(2,544,261)

17.1

14.5

19.98

14.8

14.7

14.7

14.5

14.5

27,900

405,390

14.6

14.8

14.8

14.8

14.7

14.7

20,600

304,180

(45,880)

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

Symbol

CENTURY PEAK

Bid

DIZON MINES

CPM

COAL

DIZ

1.09

1.02

8.12

GEOGRACE

GEO

LEPANTO A

LC

LEPANTO B

Ask

Open

High

Low

Close

1.1

1.03

8.42

1.1

1.03

8.51

1.1

1.03

8.51

1.09

1.02

8

0.49

0.5

0.49

0.52

0.48

0.5

0.67

0.68

0.67

0.69

0.64

0.68

LCB

0.7

0.71

0.71

0.72

0.67

0.71

MANILA MINING A

MA

0.05

0.051

0.051

0.052

0.05

MANILA MINING B

MAB

0.05

0.051

0.054

0.054

0.051

NICKEL ASIA

NIKL

22

22.1

22.1

22.15

22

NIHAO

NI

3.01

3.05

3.15

3.2

2.98

OMICO CORP

OM

0.55

0.59

0.55

0.55

0.55

ORNTL PENINSULA

ORE

2.27

2.28

2.5

2.5

PHILEX

PX

13.76

13.8

14.52

SEMIRARA MINING

SCC

279.2

280

286

UNITED PARAGON

UPM

0.015

0.016

COAL ASIA HLDG

Volume

1.1

1.02

8.45

Net Foreign

Trade (Peso)

Buying (Selling)

Value

336,000

378,000

286,500

366,690

385,710

2,320,271

1,215,000

830,000

405,050

44,220,000

29,027,570

20,200,000

14,037,030

579,350

0.051

124,790,000

6,343,600

0.051

96,910,000

5,038,300

348,800

22

233,100

5,131,970

(572,490)

3.05

2,027,000

6,115,100

179,870

0.55

36,000

19,800

2.25

2.27

3,038,000

7,003,600

(460,300)

14.52

13.7

13.8

8,801,900

124,616,570

21,077,232

286

279

280

118,450

33,196,066

(21,562,640)

0.016

0.016

0.015

0.015

29,100,000

436,800

**** OIL ****

BASIC PETROLEUM

BSC

0.27

0.285

0.275

0.285

0.27

0.285

230,000

62,850

ORIENTAL A

OPM

0.025

0.026

0.026

0.026

0.025

0.026

180,700,000

4,530,900

ORIENTAL B

OPMB

0.025

0.026

0.025

0.026

0.025

0.025

151,100,000

3,797,600

(2,500,000)

PETROENERGY

PERC

6.91

6.92

6.92

6.92

6.9

6.91

35,300

243,800

PHILODRILL

OV

PEC

PECB

PXP

0.043

19.74

0.044

19.8

0.043

21.3

0.044

21.3

0.043

19.72

0.043

19.76

126,000,000

136,400

5,421,900

2,728,103

21,500

(345,715)

VOLUME :

796,492,350

PNOC A

PNOC B

PX PETROLEUM

MINING AND OIL SECTOR TOTAL

VALUE :

264,467,412

PREFERRED

ABC PREF

SMC PREF 2B

ABC

ACPA

ACPR

DMCP

FGENF

FGENG

FPHP

PPREF

PFP

SFIP

SMCP1

SMC2A

SMC2B

525

110.3

112.8

110.7

1.26

79.8

79.5

528

116

114.2

111

1.45

79.95

82

529

112.7

79.95

81.05

529

112.7

79.95

82

529

111

79.9

81

529

111

79.95

82

10

2,030

2,568,110

20,100

5,290

225,364

205,319,609.5

1,628,238.5

(0)

-

SMC PREF 2C

SMC2C

83.35

83.5

83.3

83.5

83.25

83.5

773,950

64,613,415

(349,860)

BC PREF A

BCP

ABSP

GMAP

15.78

48

10

48.3

10.1

49

10

49

10

48

10

48

10

2,128,400

276,100

102,662,215

2,761,000

3,203,845

2,220,000

AC PREF A

AC PREF B

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

PCOR PREF

PF PREF

SFI PREF

SMC PREF 1

SMC PREF 2A

ABS HLDG PDR

GMA HLDG PDR

GLO PREF A

TEL PREF HH

GLOPA

TLHH

PREFERRED TOTAL

VOLUME :

5,768,700

VALUE :

377,215,132

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRC WARRANT

MEG WARRANT

MEG WARRANT 2

PLDT USD

IRW

MEGW1

0.05

2.96

2.98

3.01

3.01

2.96

2.96

80,000

238,250

MEGW2

DTEL

2.8

-

3.05

-

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

VOLUME :

80,000

VALUE :

238,250

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

MAKATI FINANCE

RPL

MFIN

8.93

3.02

9.49

4.5

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

1,489,593,970

VALUE :

VALUE :

9,784,561,707.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

NO. OF ADVANCES:

65

NO. OF DECLINES:

101

NO. OF UNCHANGED:

44

NO. OF TRADED ISSUES: 210

NO. OF TRADES:

32108

BLOCK SALES

SECURITY

MPI

VLL

GTCAP

AUB

PRICE

6.1266

6.98

859.8177

95

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

6,987,900

399,397,000

46,710

8,000,000

VALUE

42,812,068.14

2,787,791,060

40,162,084.767

760,000,000

246,675

156,634.31

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

545,889,998

4,990,271,688.98

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,899.91

11,032.2

6,567.49

3,016.03

2,135.77

17,986.86

7,308.85

4,511.64

1,900.14

11,060.11

6,590.37

3,016.03

2,136.53

18,000.29

7,315.83

4,518.58

1,889.28

10,962.99

6,517.23

2,964.19

2,112.33

17,616.33

7,254.53

4,487.51

1,893.94

10,991.44

6,554.28

2,980.81

2,123

17,688.26

7,279.87

4,496.21

0.03

-0.16

-0.29

-1.46

-0.61

-1.91

-0.42

-0.36

0.52

-17.61

-18.8

-44.18

-13.05

-344.69

-31.07

-16.26

42,749,755

149,003,904

151,862,760

624,213,018

139,879,488

796,563,330

4,160,678,263.55

1,616,416,809.19

2,229,074,243.46

4,010,000,656.68

1,134,820,962.46

264,492,619.39

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

1,904,272,255 Php 13,415,483,554.727

Php 5,250,899,679.4

Php 6,560,995,964.56

Companies Under Suspension by the Exchange as of 05/17/2013

ACPR

ASIA

CAT

CBC

CMT

EIBA

EIBB

FC

FPHP

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

NXT

PAL

PEC

PECB

PHC

PNC

PCP

PMT

PPC

PTT

STN

UW

ABC

TLHH

SMCP1

AC PREF B

ASIATRUST

CNTRL AZUCARERA

COSMOS

SEACEM

EXPORT BANK

EXPORT BANK B

- FIL ESTATE CORP

- FPH PREF

- FILSYN A

- FILSYN B

- GOTESCO LAND A

- GOTESCO LAND B

- METROALLIANCE A

- METROALLIANCE B

- MARSTEEL A

- MARSTEEL B

- NEXTSTAGE

- PAL HLDG

- PNOC A

- PNOC B

- PHILCOMSAT

- PNCC

- PICOP RES

- PRIMETOWN PROP

- PRYCE CORP

- PTT CORP

- STENIEL

- UNIWIDE HLDG

- ABC PREF

- TEL PREF HH

- SMC PREF 1

-

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 17 , 2013

Name

PORT

Symbol

-

Bid

GLOBALPORT

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

You might also like

- The Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 27, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 27, 2013srichardequipNo ratings yet

- Stockquotes 08122013Document7 pagesStockquotes 08122013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipNo ratings yet

- Stockquotes 08012013Document7 pagesStockquotes 08012013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNo ratings yet

- Stockquotes 08132013Document7 pagesStockquotes 08132013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- Stockquotes 08162013Document7 pagesStockquotes 08162013srichardequipNo ratings yet

- Stockquotes 08232013Document7 pagesStockquotes 08232013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNo ratings yet

- Stockquotes 08222013Document7 pagesStockquotes 08222013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Re-invigorating Private Sector Investment: Private Sector Assessment in FijiFrom EverandRe-invigorating Private Sector Investment: Private Sector Assessment in FijiNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- TABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- TABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011Document2 pagesTABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011srichardequipNo ratings yet

- TABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- Global High-End Fashion Companies: Haute-Couture - Luxury - PremiumDocument1 pageGlobal High-End Fashion Companies: Haute-Couture - Luxury - PremiumsrichardequipNo ratings yet

- Restaurant Operations ManualDocument4 pagesRestaurant Operations ManualsrichardequipNo ratings yet