Professional Documents

Culture Documents

Lec02 Hansen Model

Lec02 Hansen Model

Uploaded by

lydia6vOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lec02 Hansen Model

Lec02 Hansen Model

Uploaded by

lydia6vCopyright:

Available Formats

'

&

$

%

Quantitative Macroeconomics

and Numerical Methods

Prof. Harald Uhlig

Humboldt Universitat Berlin

uhlig@wiwi.hu-berlin.de, January 31, 2003

http://www.wiwi.hu-berlin.de/wpol/

Copyright: Prof. H. Uhlig.

Do not copy without authors permission

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Hansens Model:

Explaining the solution strategy via an example

HU Berlin 1

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

The solution strategy

The solution strategy for a model works as follows:

1. Find the rst order necessary conditions

2. Calculate the steady state

3. Loglinearize around the steady state

4. Solve for the recursive law of motion

5. Calculate impulse responses and

(HP-ltered) moments

We will execute this strategy, using Hansens real business cycle model as

particular example.

HU Berlin 2

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Hansens benchmark Real Business Cycle Model

max E

_

t=0

t

(log c

t

An

t

)

_

s.t.

c

t

+k

t

= e

z

t

k

t1

n

1

t

+ (1 )k

t1

and

z

t

= z

t1

+

t

,

t

N(0,

2

) i.i.d.

where c

t

is consumption, n

t

is labor, k

t

is capital,

t

= e

z

t

is total

factor productivity (TFP).

HU Berlin 3

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Hansens benchmark Real Business Cycle Model

Dene, for convenience;

output: y

t

= e

z

t

k

t1

n

1

t

return: R

t

=

y

t

k

t1

+ 1

See:

1. Hansen, G., Indivisible Labor and the Business Cycle, Journal of

Monetary Economics, 1985, 16, 309-27.

2. Cooley, editor, Frontiers of Business Cycle Research, Princeton

University Press, 1995.

HU Berlin 4

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Rational expectations

We assume that the social planner chooses c

t

, k

t

, n

t

etc., using all

available information at date t, and forming rational expectations

about the future.

Rational expectations are the mathematical

expectations, using all available information

Rational expectations only live in a model, in which the stochastic

nature of all variables is clearly spelled out.

HU Berlin 5

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Rational expectations

Example: dice role.

Dice 1, date t: X

t

. Dice 2, date t + 1: Y

t+1

. Sum: S

t+1

= X

t

+Y

t+1

.

E

t1

[S

t+1

] = 7. E

t

[S

t+1

] = 3.5 +X

t

. E

t+1

[S

t+1

] = X

t

+Y

t+1

.

E.g. X

t

= 2, Y

t+1

= 1. Then E

t1

[S

t+1

] = 7, E

t

[S

t+1

] = 5.5,

E

t+1

[S

t+1

] = 3.

Example: AR(1)

z

t+1

= z

t

+

t+1

, E

t

[

t+1

] = 0.

Then: E

t

[z

t+1

] = z

t

.

HU Berlin 6

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Labor lotteries and labor supply

We assume a very elastic labor supply for aggregate labor n

t

,

u

t

= log(c

t

) An

t

... which turns out to be needed in order to quantitatively explain

observed employment uctuations.

However, we typically imagine individual labor elasticity to be small.

This can be true simultaneously by considering labor lotteries.

Source: Richard Rogerson, Indivisible Labor, Lotteries and Equilibrium,

Journal of Monetary Economics; 21(1), January 1988, 3-16.

HU Berlin 7

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Labor lotteries and labor supply

Individual labor supply n

t

may be based on some utility function u(c

t

) +

v( n

t

).

Suppose that

labor is indivisible: agents either have a job or do not, n

t

= 0 or

n

t

= n

.

Agents are assigned to jobs according to a lottery, with probability

t

.

Shirking, moral hazard etc. are not possible. Unemployment insurance

is perfect, and consumption c

t

is independent of job status.

Total labor supplied: n

t

=

t

n

Normalization: v(0) = 0, v(n

)/n

=: A < 0.

Expected utility:

E[u(c

t

) +v( n

t

)] = u(c

t

) +

t

v(n

) = u(c

t

) An

t

HU Berlin 8

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Step 1:

Find the rst-order necessary conditions (FONCS)

Form the Lagrangian

L = max E

_

t=0

t

((log c

t

An

t

)

t

_

c

t

+k

t

e

z

t

k

t1

n

1

t

(1 )k

t1

_

)

HU Berlin 9

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Find the rst-order necessary conditions...

Dierentiate:

L

c

t

:

1

c

t

=

t

L

n

t

: A =

t

(1 )

y

t

n

t

L

t

: c

t

+k

t

= e

z

t

k

t1

n

1

t

+ (1 )k

t1

L

k

t

:

t

= E

t

[

t+1

R

t+1

]

The last equation needs explanation.

HU Berlin 10

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Dierentiating with respect to k

t

Write out the objective at date t: for the future, one can only form

conditional expectations E

t

[]. Telescope out the Lagrangian:

L = . . . +

t

((log c

t

An

t

)

t

_

c

t

+k

t

e

z

t

k

t1

n

1

t

(1 )k

t1

__

+E

t

_

t+1

((log c

t+1

An

t+1

)

t+1

_

c

t+1

+k

t+1

e

z

t+1

k

t

n

1

t+1

(1 )k

t

__

+. . .

Dierentiate with respect to k

t

:

0 =

t

t

E

t

_

t+1

t+1

_

y

t+1

k

t

+ 1

__

HU Berlin 11

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Dierentiating with respect to k

t

Sort terms and use

R

t+1

=

y

t+1

k

t

+ 1

to nd

t

= E

t

[

t+1

R

t+1

]

This equation is called an Euler equation and also the Lucas asset

pricing equation.

HU Berlin 12

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Collecting equations

1. First order conditions and a denition:

1

c

t

=

t

A =

t

(1 )

y

t

n

t

R

t

=

y

t

k

t1

+ 1

t

= E

t

[

t+1

R

t+1

]

2. Technology and Feasibility constraints:

y

t

= e

z

t

k

t1

n

1

t

c

t

+k

t

= y

t

+ (1 )k

t1

z

t

= z

t1

+

t

,

t

N(0,

2

) i.i.d.

HU Berlin 13

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Step 2: Calculate the steady state

At the steady state, all variables are constant.

HU Berlin 14

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Take all equations ...

1. First order conditions and a denition:

1

c

t

=

t

A =

t

(1 )

y

t

n

t

R

t

=

y

t

k

t1

+ 1

t

= E

t

[

t+1

R

t+1

]

2. Technology and Feasibility constraints:

y

t

= e

z

t

k

t1

n

1

t

c

t

+k

t

= y

t

+ (1 )k

t1

z

t

= z

t1

+

t

,

t

N(0,

2

) i.i.d.

HU Berlin 15

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

... and drop the time subscripts.

1. First order conditions and a denition:

1

c

=

A =

(1 )

y

n

R =

y

k

+ 1

R

2. Technology and Feasibility constraints:

y = e

z

n

1

c +

k = y + (1 )

k

z = z

HU Berlin 16

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Parameters

1. Calibration: = 0.4, = 0.012, = 0.95,

= 0.007, = 0.987,

= 1, A so that n = 1/3 (see Cooley, Frontiers...).

2. Estimation:

(a) GMM: mimics calibration, see Christiano and Eichenbaum,

Current Real-Business Cycle Theories and Aggregate Labor Market

Fluctuations, American Economic Review, vol 82, no. 3, 430 - 450.

(b) Maximum Likelihood: see e.g. Leeper and Sims, Toward a

Modern Macroeconomic Model Usable for Policy Analysis, NBER

Macroeconomics Annual, 1994, 81 - 177.

With numbers for the parameters, the steady state can be calculated

explicitely.

HU Berlin 17

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Explicit calculation

From the production function,

y = e

z

n

1

we get

y =

_

e

z

_

y

k

_

_

1

1

n

HU Berlin 18

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Explicit calculation: n given, solve for A.

1.

R =

1

5. c = y

k

2.

y

k

=

R1+

6.

=

1

c

3. y =

_

e

z

_

y

k

_

_

1

1

n 7. A =

(1 )

y

n

4.

k =

_

y

k

_

1

y

HU Berlin 19

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Explicit calculation alternative: A given, solve for n.

1.

R =

1

5.

c

k

=

y

2.

y

k

=

R1+

6. c =

1

3.

y

n

=

_

e

z

_

y

k

_

_

1

1

7.

k =

c

(

c

k

)

4.

=

A

(1)

(

y

n

)

8. y =

_

y

k

_

k

HU Berlin 20

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Step 3: Loglinearize around the steady state

Replace the dynamic nonlinear equations by dynamic linear equations.

Interpretation and calculation are made easier, if the equations are linear

in percent deviations from the steady state.

HU Berlin 21

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

The Principle of Loglinearization

For x 0,

e

x

1 +x

For x

t

, let x

t

= log(x

t

/ x) be the log-deviation of x

t

from its steady state.

Thus, 100 x

t

is (approximately) the percent deviation of x

t

from x. Then,

x

t

= xe

x

t

x(1 + x

t

)

Application: The equation

x

t

+c

t

= y

t

together with its steady state version

x + c = y

deliver the dynamic relationship

x x

t

+ c c

t

= y y

t

HU Berlin 22

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Example: RBC

Do it slowly for two equations:

The resource constraint:

c

t

+k

t

= y

t

+ (1 )k

t1

ce

c

t

+

ke

k

t

= ye

y

t

+ (1 )

ke

k

t1

c(1 + c

t

) +

k(1 +

k

t

) y(1 + y

t

) + (1 )

k(1 +

k

t1

)

(Note: c +

k = y)

c c

t

+

k

k

t

y y

t

+ (1 )

k

t1

HU Berlin 23

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Example: RBC

The asset pricing equation:

t

= E

t

[

t+1

R

t+1

]

t

= E

t

_

Re

t+1

+

R

t+1

_

1 +

t

RE

t

_

1 +

t+1

+

R

t+1

_

( Note: 1 =

R)

t

E

t

_

t+1

+

R

t+1

_

On ignored Jensen terms: can also assume joint normality of

logdeviations insteady. This changes the steady state, not the

dynamics.

HU Berlin 24

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

All loglinearized equations

# Equation Loglinearized

(i)

1

c

t

=

t

0 = c

t

+

t

(ii) A =

t

(1 )

y

t

n

t

0 =

t

+ y

t

n

t

(iii) R

t

=

y

t

k

t1

+ 1 0 =

R

t

+

y

k

_

y

t

k

t1

_

(iv) y

t

= e

z

t

k

t1

n

1

t

0 = y

t

+z

t

+

k

t1

+ (1 ) n

t

(v) c

t

+k

t

= y

t

+ (1 )k

t1

0 = c c

t

k

t

+ y y

t

+ (1 )

k

t1

(vi)

t

= E

t

[

t+1

R

t+1

] 0 =

t

+E

t

[

t+1

+

R

t+1

]

(vii) z

t+1

= z

t

+

t+1

z

t+1

= z

t

+

t+1

HU Berlin 25

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Step 4: Solve for the recursive law of motion

The structure of the problem. There is an endogenous state

vector x

t

, size m 1, a list of other endogenous variables y

t

, size n 1,

and a list of exogenous stochastic processes z

t

, size k 1. The equilibrium

relationships between these variables are

0 = Ax

t

+Bx

t1

+Cy

t

+Dz

t

(1)

0 = E

t

[Fx

t+1

+Gx

t

+Hx

t1

+Jy

t+1

+Ky

t

+Lz

t+1

+Mz

t

]

z

t+1

= Nz

t

+

t+1

; E

t

[

t+1

] = 0,

where it is assumed that C is of size l n, l n and of rank n, that F is

of size (m+n l) n, and that N has only stable eigenvalues.

HU Berlin 26

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Example: RBC

Variables:

x

t

= [capital] = [

k

t

], y

t

=

_

_

Lagrangian

consumption

output

labor

interest

_

_

=

_

t

c

t

y

t

n

t

R

t

_

_

and

z

t

= [technology] = [z

t

]

HU Berlin 27

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Example: RBC

Matrices:

A =

_

_

0

0

0

0

k

_

_

, B =

_

_

0

0

(1 )

k

_

_

, C =

_

_

1 1 0 0 0

1 0 1 1 0

0 0

y

k

0

R

0 0 1 (1 ) 0

0 c y 0 0

_

_

,

and

F = [0], G = [0], H = [0], J = [1, 0, 0, 0, 1],

K = [1, 0, 0, 0, 0], L = [0], M = [0], N = []

HU Berlin 28

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Recursivity

State variables are: k

t1

, z

t

.

The dynamics of the model should be describable by recursive laws of

motion,

t

= f

()

(k

t1

, z

t

)

k

t

= f

(k)

(k

t1

, z

t

)

y

t

= f

(y)

(k

t1

, z

t

)

etc.

HU Berlin 29

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Recursivity

We shall assume these laws to be linear in log-deviations

t

=

k

k

t1

+

z

z

t

k

t

=

kk

k

t1

+

kz

z

t

y

t

=

yk

k

t1

+

yz

z

t

etc. for coecients

k

,

z

, etc.

To make life simpler here, we shall try to reduce the system to only k

and (one doesnt have to).

HU Berlin 30

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Simplify:

Note:

y

t

=

1

z

t

+

k

t1

+

1

t

Abbreviations:

1

=

y

k

+ (1 )

2

=

c

k

+

1

3

=

y

4

= 0

5

= 1 + (1 )

y

6

=

y

k

HU Berlin 31

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Obtaining the solution

We obtain the following rst-order two-dimensional stochastic

dierence equation:

0 =

k

t

+

1

k

t1

+

2

t

+

3

z

t

(2)

0 = E

t

[

t

+

4

k

t

+

5

t+1

+

6

z

t+1

] (3)

z

t

= z

t1

+

t

(4)

where z

t

is an exogenous stochastic process.

HU Berlin 32

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Obtaining the solution

Compare to the following rst-order two-dimensional stochastic dierence

equation to be studied in the lecture on dierence equations:

0 = x

t

+

1

x

t1

+

2

y

t

+

3

z

t

(5)

0 = E

t

[y

t

+

4

x

t

+

5

y

t+1

+

6

z

t+1

] (6)

z

t

= z

t1

+

t

(7)

They are the same with x

t

=

k

t

, y

t

=

t

.

HU Berlin 33

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

The Method of Undetermined Coecients

Postulate the recursive law of motion

t

=

k

k

t1

+

z

z

t

(8)

k

t

=

kk

k

t1

+

kz

z

t

(9)

Plug this into equations (2) once and (3) twice and exploit E

t

[z

t+1

] = z

t

,

so that only the date-t-states

k

t1

and z

t

remain,

0 = (

kk

+

1

+

2

k

)

k

t1

+ (

kz

+

2

z

+

3

) z

t

0 = (

k

+

4

kk

+

5

kk

)

k

t1

+ (

z

+

4

kz

+

5

kz

+ (

5

z

+

6

) ) z

t

Compare coecients

HU Berlin 34

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

On plugging in twice...

Plugging

t

=

k

k

t1

+

z

z

t

,

k

t

=

kk

k

t1

+

kz

z

t

z

t

= E

t

[z

t+1

]

twice into

0 = E

t

[

t

+

4

k

t

+

5

t+1

+

6

z

t+1

]

= E

t

[(

k

k

t1

+

z

z

t

) +

4

(

kk

k

t1

+

kz

z

t

)

+

5

(

k

k

t

+

z

z

t+1

) +

6

z

t+1

]

= E

t

[

k

k

t1

z

z

t

+

4

kk

k

t1

+

4

kz

z

t

)

+

5

k

(

kk

k

t1

+

kz

z

t

) + (

5

z

+

6

)z

t+1

]

= (

k

+

4

kk

+

5

kk

)

k

t1

+(

z

+

4

kz

+

5

kz

+ (

5

z

+

6

) ) z

t

HU Berlin 35

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Comparing coecients

On

k

t1

:

0 =

kk

+

1

+

2

k

0 =

k

+

4

kk

+

5

kk

One gets the characteristic quadratic equation

0 = p(

kk

) =

2

kk

4

+

1

5

_

kk

+

1

5

(10)

HU Berlin 36

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Solving the characteristic equation

Solutions:

kk

=

1

2

__

4

+

1

5

_

(11)

4

+

1

5

_

2

4

5

_

_

Choose the stable root |

kk

|< 1. There is at most one stable root, if

|

kk,1

kk,2

|=|

1

5

|> 1

With

kk

, calculate

k

=

2

HU Berlin 37

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Comparing coecients

On z

t

:

0 =

kz

+

2

z

+

3

0 =

z

+

4

kz

+

5

kz

+ (

5

z

+

6

)

Solution:

z

=

4

3

+

5

3

+

6

1

4

kz

=

2

z

+

3

HU Berlin 38

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Step 5: Calculate impulse responses

and (HP-ltered) moments

Impulse responses: will be explained now.

HP-ltered moments: will be discussed later.

HU Berlin 39

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Impulse Response Functions: response to a shock in z

t

1. Set z

0

= 0,

1

= 1,

t

= 0, t > 1

2. Calculate z

t

=

t

3. Set

k

0

= 0.

4. Calculate recursively

k

t

=

kk

k

t1

+

kz

z

t

5. With that, calculate

t

=

k

k

t1

+

z

z

t

HU Berlin 40

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

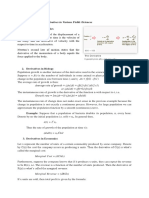

Results: Impulse Responses to shocks

2 0 2 4 6 8

0.5

0

0.5

1

1.5

2

Impulse responses to a shock in technology

Years after shock

P

e

r

c

e

n

t

d

e

v

i

a

t

i

o

n

f

r

o

m

s

t

e

a

d

y

s

t

a

t

e

capital

consumption

output

labor

interest

technology

HU Berlin 41

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Impulse Response Functions: response to an initial

deviation of the state k

t

from its steady state.

1. Set z

t

= 0, t 1

2. Set

k

0

= 1.

3. Calculate recursively

k

t

=

kk

k

t1

4. With that, calculate

t

=

k

k

t1

HU Berlin 42

QMacro&NumMeth, lec 2 Prof. H. Uhlig

'

&

$

%

Results: Impulse Responses to capital deviations

2 0 2 4 6 8

0.5

0

0.5

1

Impulse responses to a one percent deviation in capital

Years after shock

P

e

r

c

e

n

t

d

e

v

i

a

t

i

o

n

f

r

o

m

s

t

e

a

d

y

s

t

a

t

e

capital

consumption

output

labor

interest

HU Berlin 43

You might also like

- Economics - Exercise With Bellman EquationDocument16 pagesEconomics - Exercise With Bellman EquationSalvatore LaduNo ratings yet

- Human Capital Solow MRW PDFDocument4 pagesHuman Capital Solow MRW PDFJesús M. VilleroNo ratings yet

- Value & Ethics UNIT 1Document30 pagesValue & Ethics UNIT 1Vishal Singh100% (1)

- DLL Mathematics 6 q2 w7Document4 pagesDLL Mathematics 6 q2 w7Kymberly Jean Radores Quimpan100% (4)

- KPMG Boxwood TL Omni-Platform Paper November 2017 FinalDocument24 pagesKPMG Boxwood TL Omni-Platform Paper November 2017 FinalSeptiana Ayu Estri MahaniNo ratings yet

- A User's Guide To Solving Real Business Cycle ModelsDocument18 pagesA User's Guide To Solving Real Business Cycle Modelssamir880No ratings yet

- Olg GrowthDocument57 pagesOlg GrowthamzelsoskNo ratings yet

- Lagrange For Dyn OptDocument11 pagesLagrange For Dyn Optjohannes_schwarzerNo ratings yet

- Econ 101b Lecture NotesDocument7 pagesEcon 101b Lecture NotesSmi AndleebNo ratings yet

- Background On The Solution of DSGE ModelsDocument7 pagesBackground On The Solution of DSGE ModelsTheBlueBalloonNo ratings yet

- Macro I, 1998 Sdpe: © John Hassler, Can Be Copied Freely For Educational UseDocument13 pagesMacro I, 1998 Sdpe: © John Hassler, Can Be Copied Freely For Educational UsekeyyongparkNo ratings yet

- Makro - Otázka 2Document11 pagesMakro - Otázka 2Izvrsnost1No ratings yet

- Wickens Questions3Document229 pagesWickens Questions3zkNo ratings yet

- Imecc UnicampDocument14 pagesImecc UnicampShubha KandelNo ratings yet

- Modelling Volatility and Correlation: Introductory Econometrics For Finance' © Chris Brooks 2008 1Document52 pagesModelling Volatility and Correlation: Introductory Econometrics For Finance' © Chris Brooks 2008 1Ngọc HuyềnNo ratings yet

- Lecture 25: Models With Hamiltonians: T RT T T T T T TDocument5 pagesLecture 25: Models With Hamiltonians: T RT T T T T T TillmanNo ratings yet

- Guide PDFDocument8 pagesGuide PDFJoab Dan Valdivia CoriaNo ratings yet

- Ph.D. Core Exam - Macroeconomics 13 January 2017 - 8:00 Am To 3:00 PMDocument4 pagesPh.D. Core Exam - Macroeconomics 13 January 2017 - 8:00 Am To 3:00 PMTarun SharmaNo ratings yet

- 2021 Exam 1Document2 pages2021 Exam 1manuzipeixotoNo ratings yet

- Univariate Time Series Modelling and ForecastingDocument74 pagesUnivariate Time Series Modelling and ForecastingUploader_LLBBNo ratings yet

- Econ 614 Macroeconomic Theory Ii: The Basic Neoclassical ModelDocument31 pagesEcon 614 Macroeconomic Theory Ii: The Basic Neoclassical ModelaaxsenaaNo ratings yet

- Sargent T., Et. Al (2010) - Practicing DynareDocument66 pagesSargent T., Et. Al (2010) - Practicing DynareMiguel Ataurima ArellanoNo ratings yet

- The Solution of Linear Difference Models Under Rational ExpectationDocument8 pagesThe Solution of Linear Difference Models Under Rational Expectation穆伯扬No ratings yet

- Macroeconomics Notes 2Document14 pagesMacroeconomics Notes 2Maria GarciaNo ratings yet

- Financial Applications of Random MatrixDocument18 pagesFinancial Applications of Random Matrixxi yanNo ratings yet

- Chap 6Document40 pagesChap 6pranjal meshramNo ratings yet

- Schema ComputDocument13 pagesSchema ComputRossella GebbaniNo ratings yet

- Lecture Introductory Econometrics For Finance: Chapter 4 - Chris BrooksDocument52 pagesLecture Introductory Econometrics For Finance: Chapter 4 - Chris BrooksDuy100% (1)

- Eco 422 Assignment-2023Document2 pagesEco 422 Assignment-2023Abane Jude yenNo ratings yet

- Exam February 2013Document3 pagesExam February 2013zaurNo ratings yet

- Econ 242 Problem Set 4: U (C (T) ) e DTDocument3 pagesEcon 242 Problem Set 4: U (C (T) ) e DTkeyyongparkNo ratings yet

- Stata Lab4 2023Document36 pagesStata Lab4 2023Aadhav JayarajNo ratings yet

- Neoclassical Growth ModelDocument17 pagesNeoclassical Growth ModelSusmita SapkotaNo ratings yet

- Jablonsky 2015Document14 pagesJablonsky 2015anisbouzouita2005No ratings yet

- Econometrics Hw-1Document31 pagesEconometrics Hw-1saimaNo ratings yet

- Numerical Methods CollardDocument431 pagesNumerical Methods CollardSafis HajjouzNo ratings yet

- Lect Notes 1Document91 pagesLect Notes 1Safis HajjouzNo ratings yet

- AstinDocument18 pagesAstinBd ClasherNo ratings yet

- Blanchard Kahn (1980)Document8 pagesBlanchard Kahn (1980)Luis Antonio La Torre QuinteroNo ratings yet

- Applications of DerivativesDocument4 pagesApplications of DerivativesSharaine CastilloNo ratings yet

- Seitani (2013) Toolkit For DSGEDocument27 pagesSeitani (2013) Toolkit For DSGEJake BundokNo ratings yet

- Macro State ExamDocument17 pagesMacro State ExamOguz AslayNo ratings yet

- Lect Notes 1Document91 pagesLect Notes 1Edinho BordinNo ratings yet

- Lect Notes 2Document25 pagesLect Notes 2Safis HajjouzNo ratings yet

- VCREME K30-31 March-2019 MacroeconomicsDocument2 pagesVCREME K30-31 March-2019 MacroeconomicsThe HoangNo ratings yet

- Wang 2012Document15 pagesWang 2012Wang RickyNo ratings yet

- Liquidity Services: 1 The Sidrauski ModelDocument6 pagesLiquidity Services: 1 The Sidrauski ModelJuan GonzalezNo ratings yet

- Solving DSGE Models Using DynareDocument11 pagesSolving DSGE Models Using DynarerudiminNo ratings yet

- Solving DSGE Models Using DynareDocument11 pagesSolving DSGE Models Using DynarerudiminNo ratings yet

- Experimental Design, Response Surface Analysis, and OptimizationDocument24 pagesExperimental Design, Response Surface Analysis, and OptimizationMukul RaghavNo ratings yet

- From Navier Stokes To Black Scholes - Numerical Methods in Computational FinanceDocument13 pagesFrom Navier Stokes To Black Scholes - Numerical Methods in Computational FinanceTrader CatNo ratings yet

- Distributed Lag and Autoregressive DL Models.: Arithmetic Lag: Inverted V LagDocument8 pagesDistributed Lag and Autoregressive DL Models.: Arithmetic Lag: Inverted V LagAnnie SmileNo ratings yet

- Macroeconomics 1 PS3 Solution PDFDocument10 pagesMacroeconomics 1 PS3 Solution PDFTaib MuffakNo ratings yet

- Heer and Maussner PP 28-41Document14 pagesHeer and Maussner PP 28-411111111111111-859751No ratings yet

- Volker Hahn, Fuzhen Wang University of KonstanzDocument3 pagesVolker Hahn, Fuzhen Wang University of KonstanzzaurNo ratings yet

- GMM Resume PDFDocument60 pagesGMM Resume PDFdamian camargo100% (1)

- Macroeconomic Theory A Dynamic General Equilibrium PDFDocument230 pagesMacroeconomic Theory A Dynamic General Equilibrium PDFChristian Eduardo Rojas ArtetaNo ratings yet

- Semmler 2005Document16 pagesSemmler 2005Anonymous sGLwiwMA4No ratings yet

- Handout Class 3: 1 The Model EconomyDocument10 pagesHandout Class 3: 1 The Model EconomykeyyongparkNo ratings yet

- The Spectral Theory of Toeplitz Operators. (AM-99), Volume 99From EverandThe Spectral Theory of Toeplitz Operators. (AM-99), Volume 99No ratings yet

- Worksheet Verb To Be and Pronouns1Document3 pagesWorksheet Verb To Be and Pronouns1Evelin RinconNo ratings yet

- Total Population Number of Representative Group Population Standard DivisorDocument2 pagesTotal Population Number of Representative Group Population Standard DivisorMaica Pedroche100% (2)

- Sat Chakra Nirupana: Magnum Opus On Kundalini Chakras by PurnanandaDocument152 pagesSat Chakra Nirupana: Magnum Opus On Kundalini Chakras by Purnanandakrishnarajmd100% (3)

- Your Adv Plus Banking: Account SummaryDocument7 pagesYour Adv Plus Banking: Account SummaryRafaelNo ratings yet

- Labor Law Review Case Digest Duka - Book I To Book IIDocument24 pagesLabor Law Review Case Digest Duka - Book I To Book IINiñoMaurinNo ratings yet

- Philosophy DLLDocument10 pagesPhilosophy DLLGiljohn SoberanoNo ratings yet

- 1 Peter Study GuideDocument38 pages1 Peter Study Guidepastor_steve100% (1)

- Paper Template For International Academy PublishingDocument6 pagesPaper Template For International Academy PublishinglydiaNo ratings yet

- Therapeutic Models and Relevance To Nursing PracticeDocument5 pagesTherapeutic Models and Relevance To Nursing PracticeJewel Yap100% (1)

- FORMATOS POAS Navieros 2023 Cultivos OrgDocument7 pagesFORMATOS POAS Navieros 2023 Cultivos Orggerardo edison rodriguez meregildoNo ratings yet

- Ciné TranseDocument11 pagesCiné TransePROFESSOR VISITANTE 2023No ratings yet

- Market Analysis of Reliance Communications PDFDocument107 pagesMarket Analysis of Reliance Communications PDFanjali malhotraNo ratings yet

- Garcia-Rueda vs. Pascasio: Public Officers Ombudsman Nature of Office. PreliminarilyDocument16 pagesGarcia-Rueda vs. Pascasio: Public Officers Ombudsman Nature of Office. PreliminarilyMaria Francheska GarciaNo ratings yet

- Peterson, Anand - The Production of Culture PerspectiveDocument25 pagesPeterson, Anand - The Production of Culture Perspectiveqthestone45No ratings yet

- PQM-700 Manual v1.07.1 GB PDFDocument86 pagesPQM-700 Manual v1.07.1 GB PDFmuhdshafiq12No ratings yet

- Assignment 3 International BusinessDocument24 pagesAssignment 3 International BusinessHa PhuongNo ratings yet

- Historical ReviewDocument2 pagesHistorical ReviewKimber Lee BaldozNo ratings yet

- Treasury and War Justicia (Supreme Council of Grace andDocument4 pagesTreasury and War Justicia (Supreme Council of Grace andCaila PanerioNo ratings yet

- HE Beauty Care IDocument61 pagesHE Beauty Care IFrancis A. Buenaventura100% (1)

- Abyssinia of Today 00 Skin RichDocument332 pagesAbyssinia of Today 00 Skin Richtariku AberaNo ratings yet

- Prop Handmade RubricDocument1 pageProp Handmade Rubriccindy.humphlettNo ratings yet

- Unidad Didáctica "The Parts of The Body"Document14 pagesUnidad Didáctica "The Parts of The Body"Laura Deltell Polo100% (1)

- 5 6122652253280010393Document770 pages5 6122652253280010393Assyifa NurJihanNo ratings yet

- Put in 'Mustn't' or 'Don't / Doesn't Have To':: 1) We Have A Lot of Work Tomorrow. You Be LateDocument8 pagesPut in 'Mustn't' or 'Don't / Doesn't Have To':: 1) We Have A Lot of Work Tomorrow. You Be LateEmir XHNo ratings yet

- Diabetic Ketoacidosis and New Onset DiabetesDocument3 pagesDiabetic Ketoacidosis and New Onset DiabetessabrinaNo ratings yet

- Fpga ManualDocument7 pagesFpga ManualRahul SharmaNo ratings yet

- Foreign Court and JudgementDocument9 pagesForeign Court and JudgementLavanya NairNo ratings yet