Professional Documents

Culture Documents

The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013

The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013

Uploaded by

srichardequipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013

The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013

Uploaded by

srichardequipCopyright:

Available Formats

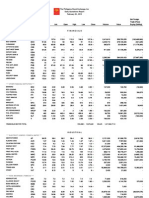

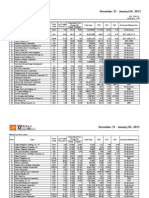

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIATRUST

BANK PH ISLANDS

ASIA

BPI

109

109.4

108.7

109.4

105.8

109.4

2,127,390

228,923,030

(85,021,592)

BDO UNIBANK

CHINABANK

BDO

92

92.05

91.55

92.9

91.5

92

7,633,070

702,577,775

(4,537,577.5)

CHIB

CSB

EW

66.9

15.5

32.85

67

25

32.9

67

31.45

67

32.9

65

30.95

67

32.9

218,900

11,664,100

14,461,676

378,977,695

173,985

80,375,745

115.6

116

117

117.2

115.6

115.6

METROBANK

EIBA

EIBB

MBT

2,510,900

292,638,189

106,079,564

PB BANK

PBB

36.1

36.15

35.2

36.2

34.5

36.15

4,112,200

145,503,040

12,733,700

PBCOM

PBC

73

79

73

73

73

73

800

58,400

PHIL. NATL BANK

PNB

95.95

96

96.8

96.8

95.75

96

758,760

72,821,601

3,859,605

PHILTRUST

70

110

63.7

116.5

63.85

63.9

64.3

63.5

63.7

RCBC

PTC

PSB

RCB

420,320

26,762,720.5

(1,836,641)

SECURITY BANK

SECB

172.4

172.5

172.8

172.8

171.8

172.4

810,740

139,680,196

14,336,792

UNION BANK

UBP

123.6

124

123.4

124

123

123.5

245,770

30,316,796

9,434,720

CITYSTATE BANK

EAST WEST BANK

EXPORT BANK

EXPORT BANK B

PSBANK

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BKD

0.91

0.92

0.91

0.94

0.9

0.94

199,000

181,720

(13,020)

BDO LEASING

BLFI

2.04

1.97

1.98

1.95

1.98

27,000

53,060

COL FINANCIAL

FILIPINO FUND

COL

FFI

18.5

11.3

18.7

11.76

18.5

11.3

18.7

11.3

18.5

11.3

18.7

11.3

4,000

300

74,490

3,390

FIRST ABACUS

FAF

0.79

0.82

0.79

0.79

0.79

0.79

30,000

23,700

IREMIT

2.8

2.89

2.89

2.9

2.8

2.8

8,000

22,960

(2,900)

MANULIFE

MFC

541

555

555

555

545

545

360

197,200

MAYBANK ATR KE

MAKE

25.85

25.9

25.85

25.85

25.8

25.85

10,700

276,545

MEDCO HLDG

PHILNARE

MED

NRCP

1.99

1.99

1.98

930,000

1,857,000

PSE

PSE

463.2

464

465

465

463

463.2

7,310

3,391,448

282,970

SUN LIFE

SLF

1,105

1,109

1,105

1,109

15

16,595

VANTAGE

2.56

2.57

2.56

2.56

2.56

2.56

211,000

540,160

VOLUME :

31,930,635

FINANCIALS SECTOR TOTAL

VALUE :

2,039,359,386.5

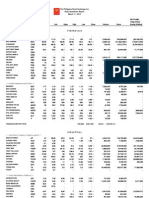

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

37.8

37.85

37.8

37.9

37.75

37.85

3,696,800

139,816,485

(23,560,490)

ALSONS CONS

ACR

1.43

1.44

1.47

1.47

1.43

1.43

1,660,000

2,394,900

7,350

CALAPAN VENTURE

FIRST GEN

H2O

EDC

FGEN

4.15

7.37

25.85

4.24

7.4

25.95

7.38

26.3

7.4

26.5

7.3

25.2

7.4

25.95

22,690,000

3,878,500

167,273,778

100,551,530

54,526,064

(30,762,180)

FIRST PHIL HLDG

FPH

111.8

112

108.9

112.4

108.9

112

1,133,900

126,373,773

54,524,953

MANILA WATER

MWC

35

35.15

34.8

35.15

34.7

35.15

2,231,600

77,676,655

(15,507,290)

MERALCO

MER

309.2

309.4

310

310

304.6

309.4

655,940

201,394,668

69,774,060

PETRON

PCOR

13.5

13.52

13.7

13.7

13.4

13.5

10,764,900

145,815,872

(10,964,808)

PHOENIX

SALCON POWER

PNX

SPC

10.8

4.92

10.86

4.93

10.8

4.93

10.8

4.93

10.7

4.92

10.8

4.93

236,300

45,000

2,538,106

221,650

701,116

49,300

TRANS-ASIA

TA

1.93

1.94

2.03

1.9

1.93

50,242,000

98,163,520

1,270,710

VIVANT

VVT

9.15

9.2

9.1

9.15

9.1

9.15

8,100

73,885

ENERGY DEVT

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

7.4

7.58

7.42

7.42

7.42

7.42

5,000

37,100

ALLIANCE SELECT

FOOD

1.86

1.89

1.93

1.93

1.85

1.88

8,369,000

15,753,590

1,069,780

BOGO MEDELLIN

BMM

CAT

53

13.1

64.85

15

13

13

13

13

15,000

195,000

CBC

DNL

6.84

6.85

6.9

7.1

6.82

6.85

19,392,600

134,269,081

(77,194,635)

GSMI

JFC

16.6

123.3

17

123.4

16.58

117

16.58

124

16.58

117

16.58

123.3

500

1,699,780

8,290

205,421,431

124,761,608

LT GROUP

LFM

LTG

43

15.36

59

15.38

15.46

15.5

15.06

15.36

1,213,200

18,553,350

7,837,058

PANCAKE

PCKH

7.68

2,000

16,000

PEPSI-COLA

PIP

6.25

6.38

6.4

6.4

6.23

6.38

4,201,700

26,837,632

216,820

PUREFOODS A

PF

295

295.8

300

300

294

295.8

109,590

32,583,362

18,684,152

RFM CORP

RFM

4.7

4.74

4.8

4.82

4.68

4.7

1,142,000

5,401,920

919,130

ROXAS AND CO.

RCI

ROX

2.26

3.2

2.37

3.25

3.1

3.2

3.1

3.2

126,000

394,100

SAN MIGUEL CORP.

SMB

SMC

119.4

119.6

120

120.1

118.4

119.6

553,890

66,237,004

25,643,988

SWIFT

SFI

0.141

0.144

0.141

0.141

0.141

0.141

100,000

14,100

CNTRL AZUCARERA

COSMOS

DNL INDUS

GINEBRA

JOLLIBEE

LIBERTY FLOUR

ROXAS HLDG.

SAN MIGUEL

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

UNIV ROBINA

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

VICTORIAS

URC

VMC

93.95

1.48

94

1.49

93.8

1.51

94.05

1.51

93.5

1.48

94

1.49

1,914,600

1,851,000

179,741,174.5

2,759,730

30,588,664.5

-

VITARICH

VITA

0.94

0.95

0.94

0.95

0.94

0.95

256,000

240,700

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

18.78

19

18.78

19

18.76

19

15,800

296,728

CONCRETE A

EEI CORP

CA

CAB

EEI

50

15

12.96

64

12.98

13.1

13.1

12.92

12.96

1,039,600

13,514,904

(9,623,090)

FED CHEMICALS

FED

9.4

10

9.7

9.7

9.55

9.55

6,600

63,270

HOLCIM

LAFARGE REP

HLCM

LRI

13

11.7

13.1

11.9

13.02

11.7

13.1

11.9

13

11.6

13.1

11.9

15,800

64,100

205,750

751,670

32,500

549,300

MARIWASA

MMI

5.75

5.9

5.4

5.75

5.4

5.75

47,400

268,034

MEGAWIDE

MWIDE

17.5

17.52

17.6

17.6

17.46

17.5

83,400

1,460,106

110,212

PHINMA

PHN

PNC

CMT

SRDC

T

VUL

13.3

1.2

1.66

1.61

13.78

1.69

1.62

1.67

1.61

1.67

1.62

1.66

1.61

1.66

1.62

13,000

246,000

21,610

397,460

EUROMED

CIP

COAT

EURO

73

2.89

1.78

103.9

2.95

1.94

2.95

1.83

2.95

1.83

2.88

1.75

2.95

1.75

148,000

47,000

430,170

84,120

LMG CHEMICALS

LMG

2.7

2.71

2.7

2.7

2.7

2.7

529,000

1,428,300

MABUHAY VINYL

MANCHESTER A

MVC

MIH

1.71

16.68

1.89

16.7

16

17.36

16

16.68

761,100

12,865,812

MANCHESTER B

MIHB

16.62

16.7

16.96

17.3

16.52

16.62

223,100

3,769,674

870,768

METROALLIANCE A

MAH

MAHB

PPC

CONCRETE B

PNCC

SEACEM

SUPERCITY

TKC STEEL

VULCAN IND`L

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

METROALLIANCE B

PRYCE CORP

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

20.85

20.9

21.55

21.55

20.8

20.9

71,500

1,502,780

GREENERGY

GREEN

0.018

0.019

0.019

0.019

0.018

0.019

90,900,000

1,714,400

(955,700)

INTEGRATED MICR

IMI

4.09

4.1

20,000

80,600

40,500

IONICS

ION

0.75

0.76

0.77

0.79

0.74

0.76

808,000

607,610

52,400

PANASONIC

PMPC

4.75

SPLASH CORP.

ALPHA

FYN

FYNB

PCP

SPH

1.71

1.77

1.77

1.77

1.7

1.71

69,000

119,000

STENIEL

STN

**** OTHER INDUSTRIALS ****

ALPHALAND

FILSYN A

FILSYN B

PICOP RES

INDUSTRIALS SECTOR TOTAL

VOLUME :

235,341,350

VALUE :

1,951,314,567

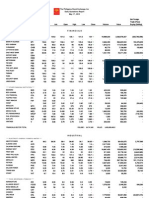

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS CONS

ABA

0.66

0.67

0.66

0.67

0.65

0.67

5,455,000

3,592,010

ABOITIZ EQUITY

AEV

59.5

59.9

58

60.3

57.8

59.9

1,312,100

77,933,731

21,160,079.5

ALCORN GOLD

APM

0.156

0.157

0.154

0.158

0.154

0.156

370,630,000

58,121,960

233,500

ALLIANCE GLOBAL

AGI

20.9

21

20.9

21.95

20.6

20.9

11,522,200

241,812,670

(95,127,870)

ANGLO PHIL HLDG

APO

2.35

2.36

2.35

2.36

2.32

2.36

3,914,000

9,159,610

(69,900)

ANSCOR

ANS

6.38

6.47

6.33

6.44

6.28

6.38

150,400

952,490

(6,280)

ASIA AMLGMATED

AAA

4.71

4.98

4.71

4.71

4.71

4.71

68,000

320,280

ATN HLDG A

ATN

0.91

0.96

0.92

0.92

0.91

0.91

179,000

164,150

ATN HLDG B

ATNB

0.93

0.96

0.95

0.95

0.92

0.93

227,000

212,820

88,000

AYALA CORP

AC

567

568

579.5

579.5

567

568

509,390

290,698,190

(97,826,005)

BHI HLDG

BH

DMC

432

52.05

645

52.15

53

53

51.95

52.15

5,308,830

277,402,796.5

(43,996,368.5)

GT CAPITAL

FC

FDC

FJP

FJPB

FPI

GTCAP

5.98

2.95

2.9

0.219

730

6

3

3.4

0.24

732

5.99

750

6

750

5.98

730

5.98

730

183,100

242,930

1,096,459

178,348,900

146,807

(104,902,720)

HOUSE OF INV

HI

8.04

8.1

8.3

8.3

8.04

8.04

7,300

58,791

JG SUMMIT

JGS

38.5

38.55

38.95

38.95

38.5

38.5

694,500

26,766,605

(14,842,430)

JOLLIVILLE HLDG

JOH

KPH

6.01

5

6.12

5.65

6.69

5.69

6.7

5.69

6.12

5.69

6.12

5.69

26,700

2,500

165,875

14,225

LODESTAR

KPHB

LIHC

5

0.91

5.59

0.92

0.92

0.93

0.91

0.91

1,438,000

1,314,810

LOPEZ HLDG

LPZ

7.49

7.5

7.53

7.6

7.38

7.5

3,299,700

24,790,723

372,047

DMCI HLDG

FIL ESTATE CORP

FILINVEST DEV

FJ PRINCE A

FJ PRINCE B

FORUM PACIFIC

KEPPEL HLDG A

KEPPEL HLDG B

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

Symbol

MABUHAY HLDG

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MARCVENTURES

MHC

MARC

0.58

1.86

0.6

1.91

0.62

1.9

0.62

1.92

0.57

1.86

0.6

1.86

1,800,000

3,156,000

1,062,600

5,937,170

METRO PAC INV

MPI

5.14

5.15

5.18

5.18

5.1

5.15

71,726,500

369,287,483

(34,601,151)

MINERALES IND

MIC

6.55

6.75

6.5

6.9

6.5

6.55

101,800

666,185

MJC INVESTMENTS

MJIC

PA

6.02

0.05

6.44

0.051

0.049

0.05

0.049

0.05

550,000

27,490

SEAFRONT RES.

PRIM

POPI

REG

SPM

0.67

2.16

0.68

2.23

0.67

2.15

0.69

2.24

0.67

2.15

0.67

2.23

665,000

25,000

447,350

54,720

(4,900)

-

SINOPHIL

SINO

0.325

0.33

0.325

0.325

0.325

0.325

7,570,000

2,460,250

(1,322,750)

SM INVESTMENTS

SM

1,014

1,023

1,007

1,023

1,003

1,023

389,970

395,096,210

(3,641,640)

SOLID GROUP

SGI

2.3

2.32

2.33

2.39

2.27

2.3

1,164,000

2,705,790

(58,500)

SOUTH CHINA

SOC

1.14

1.2

1.2

1.2

1.2

1.2

10,000

12,000

SYNERGY GRID

UNIOIL HLDG.

SGP

UNI

366

0.265

480

0.27

0.265

0.27

0.265

0.265

1,240,000

332,950

WELLEX INDUS

WIN

0.28

0.285

0.285

0.29

0.28

0.285

800,000

226,100

ZEUS HOLDINGS

ZHI

0.48

0.49

0.52

0.52

0.49

0.49

5,646,000

2,804,810

(5,000)

PACIFICA

PRIME MEDIA

PRIME ORION

REPUBLIC GLASS

HOLDING FIRMS SECTOR TOTAL

VOLUME :

500,017,560

VALUE :

1,975,427,653.5

PROPERTY

**** PROPERTY ****

A BROWN

BRN

2.74

2.8

2.85

2.87

2.7

2.72

210,000

582,310

ANCHOR LAND

19.5

1.42

20

1.44

1.42

1.45

1.4

1.42

ARANETA PROP

ALHI

ARA

2,078,000

2,961,640

681,900

ARTHALAND CORP

ALCO

0.209

0.214

0.21

0.21

0.209

0.209

700,000

146,700

AYALA LAND

ALI

31.95

32.5

32

32.5

31.8

32.5

2,750,600

88,403,470

23,208,680

BELLE CORP

BEL

5.19

5.2

5.23

5.27

5.19

5.2

13,272,000

69,114,177

21,218,104

CEBU HLDG

CHI

4.99

5.07

5.07

966,200

4,842,826

(69,980)

CEBU PROP A

CENTURY PROP

CPV

CPVB

CPG

4.91

4.81

2.12

5.2

5.1

2.13

2.14

2.16

2.08

2.13

9,601,000

20,306,130

5,187,650

CITY AND LAND

LAND

CITYLAND DEVT

CROWN EQUITIES

CDC

CEI

CYBER BAY

EMPIRE EAST

CEBU PROP B

2.4

2.5

2.5

2.5

2.5

2.5

2,000

5,000

1.13

0.068

1.15

0.069

0.068

0.068

0.068

0.068

780,000

53,040

CYBR

0.78

0.79

0.78

0.79

0.78

0.78

523,000

411,400

ELI

1.03

1.04

1.05

1.05

1.03

1.03

11,639,000

12,022,100

291,200

EVER GOTESCO

EVER

0.35

0.36

0.36

0.36

0.355

0.355

810,000

289,850

FILINVEST LAND

FLI

1.86

1.87

1.9

1.9

1.85

1.87

16,098,000

30,166,430

2,298,270

GLOBAL ESTATE

HIGHLANDS PRIME

GERI

GO

GOB

HP

1.98

2.65

1.99

2.82

1.99

2.8

2.02

3

1.97

2.6

1.99

2.84

3,349,000

352,000

6,678,580

1,006,400

(478,240)

420

IRC PROP

IRC

1.17

1.22

1.21

1.23

1.16

1.22

1,143,000

1,367,110

(351,200)

KEPPEL PROP

MEGAWORLD

KEP

MC

MCB

MEG

2.85

3.83

3.18

3.84

2.85

3.87

2.85

3.9

2.85

3.77

2.85

3.83

15,000

150,267,000

42,750

575,766,780

(127,895,660)

MRC ALLIED

MRC

0.12

0.121

0.123

0.123

0.119

0.12

4,160,000

497,780

PHIL ESTATES

PHES

0.58

0.59

0.56

0.6

0.54

0.58

7,380,000

4,195,820

110,000

PHIL. TOBACCO

TFC

RLT

20

0.5

25

0.51

0.48

0.51

0.48

0.5

578,000

291,300

ROBINSONS LAND

PMT

PRMX

RLC

2.75

22

3.25

22.05

21.65

22.1

21.65

22

2,695,800

59,296,695

41,601,800

ROCKWELL

ROCK

3.07

3.08

3.13

3.15

3.06

3.08

1,416,000

4,383,620

(0)

SAN MIGUEL PROP

SHNG PROPERTIES

SMP

SHNG

3.2

3.29

3.15

3.29

3.15

3.29

142,000

456,340

182,580

SM DEVT

SMDC

9.5

9.52

8.86

9.6

8.68

9.52

27,814,400

261,280,301

(1,222,354)

SM PRIME HLDG.

SMPH

19.46

19.48

19.9

20.6

19.4

19.48

20,103,000

393,968,517

(129,724,159)

STA.LUCIA LAND

SLI

STR

SUN

UW

VLL

0.79

3.65

0.59

5.25

0.8

3.85

0.6

5.3

0.78

3.8

0.6

5.34

0.79

3.85

0.6

5.34

0.78

3.8

0.6

5.24

0.79

3.85

0.6

5.3

656,000

3,000

21,000

33,149,800

516,610

11,450

12,600

174,720,238

(31,600)

24,152,537

GOTESCO LAND A

GOTESCO LAND B

MARSTEEL A

MARSTEEL B

PHILREALTY

PRIMETOWN PROP

PRIMEX CORP.

STARMALLS

SUNTRUST HOME

UNIWIDE HLDG

VISTA LAND

PROPERTY SECTOR TOTAL

VOLUME :

313,441,800

VALUE :

1,715,903,964

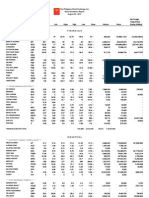

SERVICES

**** MEDIA ****

ABS CBN

ABS

37.9

38

38.6

38.6

37.9

37.9

110,700

4,226,245

GMA NETWORK

GMA7

MB

9.88

0.86

9.95

0.9

9.95

0.87

9.95

0.92

9.8

0.85

9.95

0.9

238,300

157,000

2,362,698

135,300

MANILA BULLETIN

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

MLA BRDCASTING

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MBC

3.5

LIBERTY TELECOM

GLO

LIB

1,118

2.41

1,120

2.5

1,120

2.41

1,130

2.41

1,117

2.4

1,120

2.41

53,045

39,000

59,529,520

93,890

(10,485,415)

-

PLDT

TEL

2,890

2,896

2,878

2,898

2,850

2,896

208,640

602,744,930

142,809,420

PTT CORP

PTT

**** TELCOMMUNICATION ****

GLOBE TELECOM

**** INFORMATION TECHNOLOGY ****

DFNN INC

DFNN

4.78

4.8

4.68

4.9

4.68

4.8

336,000

1,625,140

(48,000)

IMPERIAL A

IP CONVERGE

IMP

IMPB

CLOUD

5.12

4.1

5.99

47.5

4.32

4.11

4.28

4.01

4.1

110,000

460,820

(4,110)

IPVG CORP

IP

0.65

0.67

0.64

0.68

0.64

0.67

753,000

489,560

ISLAND INFO

PHILWEB

IS

ISM

NXT

WEB

0.05

2.2

14.5

0.054

2.24

14.54

0.051

14.4

0.051

14.54

0.05

14.4

0.051

14.54

2,350,000

2,089,900

118,500

30,236,966

16,009,488

TOUCH SOLUTIONS

TSI

14

14.02

14.52

14.8

14

14

98,700

1,404,942

TRANSPACIFIC BR

TBGI

1.95

2.17

1.88

2.17

1.87

2.17

4,000

8,090

YEHEY

YEHEY

1.37

1.39

1.38

1.4

1.37

1.37

41,000

56,500

IMPERIAL B

ISM COMM

NEXTSTAGE

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

1.75

1.89

1.8

1.8

1.78

1.78

46,000

82,340

ASIAN TERMINALS

ATI

13.12

13.48

13.6

13.6

12.6

13.48

22,300

300,640

CEBU AIR, INC.

CEB

66

66.05

66.2

66.2

65.8

66

233,300

15,393,607

(6,414,979.5)

INTL CONTAINER

ICT

83.4

83.5

84.5

84.5

82.2

83.5

1,683,270

140,598,863

(44,724,309)

LORENZO SHIPPNG

MACROASIA

LSC

MAC

1.41

2.55

1.57

2.65

2.55

2.55

2.55

2.55

3,000

7,650

PAL HOLDINGS

PAL

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.3

1.32

1.33

1.33

1.32

1.32

18,000

23,770

BOULEVARD HLDG

BHI

0.132

0.133

0.135

0.136

0.132

0.132

42,260,000

5,624,380

1,340

GRAND PLAZA

GPH

WPI

26.05

0.42

45

0.425

0.435

0.435

0.42

0.425

620,000

263,900

(0)

FAR EASTERN U

CEU

FEU

11.2

1,110

11.88

1,150

11.2

1,220

11.88

1,220

11.2

1,220

11.88

1,220

6,900

5

77,484

6,100

IPEOPLE

IPO

9.55

10

9.55

10

9.55

10

10,800

105,390

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

**** CASINOS & GAMING ****

BERJAYA

BCOR

25.05

25.3

25.05

25.05

25.05

25.05

2,000

50,100

BLOOMBERRY

BLOOM

13.94

14

14.16

14.16

13.94

13.94

7,091,000

99,155,024

(24,790,144)

IP EGAME

EG

0.023

0.024

0.025

0.025

0.024

0.024

90,800,000

2,185,200

LEISURE AND RES

LR

8.6

8.7

8.85

8.85

8.6

8.6

712,900

6,213,396

(1,015,627)

MANILA JOCKEY

MJC

2.9

2.91

2.9

2.92

2.85

2.9

1,601,000

4,635,970

(145,000)

PACIFIC ONLINE

PHIL. RACING

LOTO

PRC

14

10.58

14.02

10.78

14.02

10.4

14.02

10.8

14

10.4

14

10.78

6,800

6,300

95,300

66,138

21,040

PREMIEREHORIZON

PHA

0.34

0.345

0.34

0.34

0.34

0.34

1,430,000

486,200

**** RETAIL ****

7-11

CALATA CORP

SEVN

CAL

90.05

3.67

93.25

3.68

3.68

3.68

3.66

3.68

725,000

2,656,080

PUREGOLD

PGOLD

39.35

39.4

38.5

40.25

38.3

39.35

6,977,400

275,250,890

20,260,560

**** OTHER SERVICES ****

APC GROUP

APC

0.81

0.82

0.83

0.83

0.82

0.82

17,725,000

14,589,960

581,000

EASYCALL

ECP

PORT

ICTV

2.95

10

0.43

3.25

19

0.44

0.43

0.445

0.43

0.44

2,110,000

922,650

21,500

PAX

PHC

STI

2.63

0.99

2.64

1.01

2.63

1.02

2.65

1.02

2.62

1

2.63

1.01

353,000

20,903,000

926,900

20,994,120

78,900

600,000

GLOBALPORTS

ICTV INC

PAXYS

PHILCOMSAT

STI_HOLDINGS

SERVICES SECTOR TOTAL

VOLUME :

206,364,060

VALUE :

1,361,439,738

MINING & OIL

**** MINING ****

ABRA MINING

AR

0.005

0.0051

0.005

0.0051

0.005

0.0051

63,000,000

315,200

APEX MINING A

APX

4.42

4.64

4.43

4.43

4.4

4.4

61,000

268,850

APEX MINING B

APXB

4.41

4.79

4.43

4.43

4.4

4.4

125,000

550,410

334,400

ATLAS MINING

AT

20.85

20.9

20.8

20.9

20.35

20.85

1,420,800

29,430,770

4,988,190

ATOK

AB

19.6

22

19.8

19.8

19.6

19.6

4,200

82,920

(43,320)

BENGUET A

BC

18.5

18.9

18.5

18.5

18.5

18.5

3,700

68,450

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

BENGUET B

BCB

18.32

18.8

18.34

18.34

18.3

18.3

42,600

780,620

CENTURY PEAK

CPM

0.98

0.99

0.98

0.99

1,602,000

1,576,230

COAL ASIA HLDG

COAL

1.03

1.04

1.05

1.05

1.02

1.03

6,526,000

6,759,580

155,000

DIZON MINES

DIZ

12.06

12.6

12.1

13.2

11.6

12.6

689,700

8,393,656

24,880

GEOGRACE

0.53

1.13

0.54

1.15

0.54

1.15

0.54

1.15

0.53

1.12

0.54

1.15

748,000

397,180

LEPANTO A

GEO

LC

13,284,000

15,117,570

LEPANTO B

LCB

1.24

1.26

1.26

1.26

1.24

1.26

7,132,000

8,927,000

1,173,640

MANILA MINING A

MA

MAB

0.061

0.065

0.062

0.067

0.062

0.066

0.062

0.067

0.06

0.066

0.062

0.067

156,540,000

9,569,440

MANILA MINING B

108,900,000

7,237,800

NICKELASIA

NIKL

20.4

20.5

21.2

21.2

19.7

20.5

4,056,000

82,814,565

(27,264,673)

NIHAO

NI

3.5

3.51

3.58

3.6

3.5

3.5

15,303,000

53,944,640

6,172,960

OMICO CORP.

OM

0.56

0.59

0.56

0.56

0.56

0.56

44,000

24,640

ORIENTAL P

ORE

3.41

3.42

3.46

3.48

3.35

3.42

1,100,000

3,739,100

PHILEX

PX

17.48

17.5

17.9

17.9

17.22

17.5

6,179,600

107,844,936

(2,859,386)

SEMIRARA MINING

SCC

231

231.4

233

235

222

231

475,680

108,897,076

15,509,948

UNITED PARAGON

UPM

0.017

0.018

0.018

0.018

0.018

0.018

265,200,000

4,773,600

(732,992)

**** OIL ****

BASIC PETROLEUM

BSC

0.29

0.295

0.285

0.29

0.28

0.29

3,070,000

874,400

ORIENTAL A

OPM

0.021

0.022

0.022

0.022

0.022

0.022

500,100,000

11,002,200

ORIENTAL B

PETROENERGY

OPMB

PERC

0.022

6.7

0.024

6.9

0.023

6.95

0.023

6.95

0.023

6.65

0.023

6.9

24,400,000

135,300

561,200

918,158

PHILEXPETROLEUM

PXP

PHILODRILL A

OV

PNOC A

PEC

PECB

PNOC B

32

32.8

32

32.8

32

32.8

169,600

5,517,955

1,380,020

0.043

0.044

0.044

0.044

0.043

0.043

29,300,000

1,266,800

68,400

MINING AND OIL SECTOR TOTAL

VOLUME :

1,209,612,180

VALUE :

471,654,946

PREFERRED

ABC PREF

PBC PREF

AC PREF A

AC PREF B

ABC

PBCP

ACPA

12.5

522

523

523

523

522

522

2,640

1,379,450

261,500

105.3

107.8

106

106

106

106

190

20,140

FGEN PREF F

ACPR

DMCP

FGENF

FGEN PREF G

FGENG

109

109.5

109

109

109

109

13,600

1,482,400

FPH PREF

FPHP

PPREF

100.8

108.3

101

109

100.9

109

101

109

100.8

108.3

100.8

108.3

24,120

37,480

2,433,320

4,074,120

SMCPREFS2C

SMCP1

SMC2A

SMC2B

SMC2C

74.95

75.2

76.95

75

75.25

77

75

75.25

77

75

75.25

77

74.95

75.25

76.9

75

75.25

77

1,562,950

232,610

161,480

117,220,140

17,503,902.5

12,433,135

(93,880,250)

(615,200)

SMPFC PREFS

PFP

1,025

1,030

1,025

1,040

1,025

1,030

5,620

5,807,025

SWIFT PREF

ABS HLDG PDR

SFIP

BCP

ABSP

1.3

11.96

41.05

1.5

41.5

42

42

41.35

41.45

728,700

30,238,025

(387,430)

GMA HOLDINGS

GMAP

9.6

10

10.04

10.04

9.9

10

3,699,100

36,996,560

4,207,900

GLO PREF A

GLOPA

TLHH

767,000

2,106,000

DMC PREF

PETRON PREF

SMC PREF 1

SMCPREFS2A

SMCPREFS2B

BC PREF A

TEL PREF HH

PREFERRED TOTAL

VOLUME :

6,468,490

VALUE :

229,588,217.5

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRCPROPERTIES W

MEG-WARRANTS

IRW

MEGW2

MEGW1

PLDT USD

DTEL

MEG WARRANT 2

0.05

2.55

2.74

2.8

2.77

2.8

2.8

2.71

2.74

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

VOLUME :

767,000

VALUE :

2,106,000

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

RPL

8.88

9.38

9.5

9.5

8.88

9.38

9,100

82,634

MAKATI FINANCE

MFIN

2.5

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

9,100

2,496,716,685

VALUE :

VALUE :

82,634

9,515,182,889

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

NO. OF ADVANCES:

59

NO. OF DECLINES:

117

NO. OF UNCHANGED:

38

NO. OF TRADED ISSUES: 214

NO. OF TRADES:

37131

BLOCK SALES

SECURITY

PRICE

BPI

108.2978

MBT

115.6304

GLO

1,121.2684

AGI

21.0573

AGI

21.0573

AC

580.7932

AC

578.1164

AC

578.0173

AC

580.7932

DMC

52.9646

MAC

2.51

BDO

91.4532

BDO

91.4968

PERC

6

EDC

7.3933

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

453,560

347,000

99,375

7,200,000

8,712,000

50,000

44,500

90,000

53,200

2,000,000

85,110,000

311,150

714,170

28,226,551

5,000,000

VALUE

49,119,550.168

40,123,748.8

111,426,047.25

151,612,560

183,451,197.6

29,039,660

25,726,179.8

52,021,557

30,898,198.24

105,929,200

213,626,100

28,455,663.18

65,344,269.656

169,359,306

36,966,500

227,136

203,071.22

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

284,669,547

3,002,569,404.68

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,768.8

9,910.37

5,762.2

2,773.34

1,926.9

21,545.85

6,637.83

4,142.55

1,770.02

9,960.75

5,783.62

2,802.25

1,946.48

21,545.85

6,667.41

4,150.71

1,753.04

9,885.24

5,729.86

2,757.51

1,926.9

21,002.58

6,617.28

4,125.28

1,768.45

9,958.97

5,783.62

2,784.47

1,942.31

21,344.18

6,667.41

4,146.58

0.15

0.37

0.08

0.64

0.12

-1.03

0.28

0.03

2.59

37.09

4.83

17.66

2.39

-222.37

18.84

1.13

33,757,585

240,350,934

518,172,387

313,460,067

291,652,907

1,237,952,347

2,222,420,194.25

1,988,319,030.91

2,554,123,904.86

1,715,967,554.49

1,686,538,468.6

641,033,910.81

9,100

82,634

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

2,635,355,327 Php 10,808,485,697.914

Php 5,646,028,367.18

Php 5,819,521,595.07

Companies Under Suspension by the Exchange as of 02/21/2013

ACPR

ALPHA

ASIA

CBC

CMT

EIBA

EIBB

FC

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

NXT

PAL

PEC

PECB

PHC

- AC PREF B

- ALPHALAND

- ASIATRUST

- COSMOS

- SEACEM

- EXPORT BANK

- EXPORT BANK B

- FIL ESTATE CORP

- FILSYN A

- FILSYN B

- GOTESCO LAND A

- GOTESCO LAND B

- METROALLIANCE A

- METROALLIANCE B

- MARSTEEL A

- MARSTEEL B

- NEXTSTAGE

- PAL HOLDINGS

- PNOC A

- PNOC B

- PHILCOMSAT

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 21 , 2013

Name

PNC

PRIM

SMB

SMP

MED

PCP

PMT

PPC

PTT

REG

STN

UW

ABC

TLHH

SMCP1

Symbol

-

Bid

PNCC

PRIME MEDIA

SAN MIGUEL

SAN MIGUEL PROP

MEDCO HLDG

PICOP RES

PRIMETOWN PROP

PRYCE CORP

PTT CORP

REPUBLIC GLASS

STENIEL

UNIWIDE HLDG

ABC PREF

TEL PREF HH

- SMC PREF 1

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

You might also like

- Physics Review PDFDocument27 pagesPhysics Review PDFRizahGepes100% (5)

- DLL 3rd ObservationDocument5 pagesDLL 3rd ObservationDanilo Alburo100% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 26, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 26, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 18, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 18, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 17, 2012Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 17, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 12, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 12, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 19, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 19, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNo ratings yet

- Stockquotes 08222013Document7 pagesStockquotes 08222013srichardequipNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Improving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentFrom EverandImproving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentRating: 5 out of 5 stars5/5 (1)

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- TABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- TABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- Restaurant Operations ManualDocument4 pagesRestaurant Operations ManualsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- Global High-End Fashion Companies: Haute-Couture - Luxury - PremiumDocument1 pageGlobal High-End Fashion Companies: Haute-Couture - Luxury - PremiumsrichardequipNo ratings yet

- TABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011Document2 pagesTABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011srichardequipNo ratings yet

- Manual Inverter Shihlin ss2 Mas Serigraf PDFDocument161 pagesManual Inverter Shihlin ss2 Mas Serigraf PDFAnonymous 4aChpF1hZNo ratings yet

- Building Utilities 3: Part 1 Acoustics: Ar - GabrielangelobucadDocument77 pagesBuilding Utilities 3: Part 1 Acoustics: Ar - GabrielangelobucadMichael De Guzman AgustinNo ratings yet

- Corporate Profile - Crystal Future Venture LimitedDocument25 pagesCorporate Profile - Crystal Future Venture LimitedSami DohaNo ratings yet

- Gis Reader BookDocument233 pagesGis Reader BookSaurabh Suman100% (2)

- 0510 s10 QP 22Document16 pages0510 s10 QP 22Mohamed AmrNo ratings yet

- Musical Dramaturgy in Jeux D'eau by Maurice Ravel: Gina-Mihaela PAVELDocument8 pagesMusical Dramaturgy in Jeux D'eau by Maurice Ravel: Gina-Mihaela PAVELGabrielNo ratings yet

- Hong Kong Archives - INDOFILM - Nonton Film Bioskop 21 Online INDOXXI Layarkaca21Document7 pagesHong Kong Archives - INDOFILM - Nonton Film Bioskop 21 Online INDOXXI Layarkaca21HACK THANKSNo ratings yet

- Lista Das Apostilas de BateriaDocument2 pagesLista Das Apostilas de BateriaFelipe TiagoNo ratings yet

- An Introduction To Error-Correcting Codes: The Virtues of RedundancyDocument38 pagesAn Introduction To Error-Correcting Codes: The Virtues of RedundancyKrish Cs20No ratings yet

- ApsDocument200 pagesApspriyajenatNo ratings yet

- Antenna Article Hrry Vpo Spirl LoopDocument2 pagesAntenna Article Hrry Vpo Spirl LoopkedalNo ratings yet

- Repair Courses - 2018Document7 pagesRepair Courses - 2018João GomesNo ratings yet

- DX 10 15 AM Transmitter Technical MannualDocument2 pagesDX 10 15 AM Transmitter Technical MannualMosabber AliNo ratings yet

- Test Bank For Strategic Management Theory An Integrated Approach 11th EditionDocument24 pagesTest Bank For Strategic Management Theory An Integrated Approach 11th Editioncynthiagraynpsiakmyoz100% (48)

- RFID-Danish Qazi (4837), Talha Peracha (4860)Document24 pagesRFID-Danish Qazi (4837), Talha Peracha (4860)Husnain JafriNo ratings yet

- Unit 4: Sitcom: What Happened To You?! Scene 1Document2 pagesUnit 4: Sitcom: What Happened To You?! Scene 1didier santiago diaz100% (2)

- A Report On Practical Training: Yagyavalkya Institute of Technology Jaipur, RajasthanDocument56 pagesA Report On Practical Training: Yagyavalkya Institute of Technology Jaipur, RajasthanvarunNo ratings yet

- System Design Guide: For Audio InstallationDocument32 pagesSystem Design Guide: For Audio InstallationLord VarioNo ratings yet

- 02 Unit 2 - KCDocument22 pages02 Unit 2 - KCRizka Apriliana KumalasariNo ratings yet

- Paradise City - Guns N' RosesDocument5 pagesParadise City - Guns N' RosesCésar Raúl Banegas-OrdóñezNo ratings yet

- Vodafone ProposalDocument14 pagesVodafone ProposalSudin GabaNo ratings yet

- Tutorial On The Trimble 4000SST Checklist For Gathering DataDocument10 pagesTutorial On The Trimble 4000SST Checklist For Gathering DataosamazpNo ratings yet

- Grade - 1 Lessons Musicatics InternationalDocument13 pagesGrade - 1 Lessons Musicatics InternationalysrcreationNo ratings yet

- Shakespeare Crossdressing-Handout PDFDocument8 pagesShakespeare Crossdressing-Handout PDFRichard MorenoNo ratings yet

- Vocab CreativeProjectDocument141 pagesVocab CreativeProjectKarumon UtsumiNo ratings yet

- Cingcowong As One of The Cultural..... (English Paper)Document40 pagesCingcowong As One of The Cultural..... (English Paper)Indra KaesarNo ratings yet

- Operation BarbarossaDocument27 pagesOperation BarbarossaF4Phantom100% (6)

- Mamma MiaDocument2 pagesMamma Miamark ceasarNo ratings yet