Professional Documents

Culture Documents

Acting On Global Trends

Acting On Global Trends

Uploaded by

David SelvaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acting On Global Trends

Acting On Global Trends

Uploaded by

David SelvaCopyright:

Available Formats

J

e

a

n

-

F

r

a

n

o

i

s

M

a

r

t

i

n

Acting on global trends:

A McKinsey Global Survey

Business executives around the world agree that knowledge and technology trends, as well as those linked

to economic growth in emerging markets, will have a positive impact on the proftability of their companies,

the latest McKinsey Quarterly survey shows.

But there is a gap between the impact that executives assign to these trends and the extent to which they

have taken active steps to seize the opportunities.

Their responses to questions about 14 macroeconomic, political, social, environmental, and business trends

also reveal that executives view someincluding geopolitical instability and a social backlash against corporate

activitymore as risks than as opportunities.

2

Source: March 2007 McKinsey Quarterly global survey of business executives

Executives see opportunities as well as risks in the global business landscape,

yet many are not addressing them.

Acting on global trends:

A McKinsey Global Survey

Business executives around the world

largely agree that technological innovation, the

free fow of information, and the rise of a new

class of consumers in emerging markets are

developments that will have a positive impact on

the proftability of their companies, according to

the latest McKinsey Quarterly survey.

1

However, the survey also shows that there is a

relatively wide gap between the impact that

executives assign to these trends and the extent

to which their companies have taken active

steps to seize the opportunities.

In their responses to questions about 14

macroeconomic, political, social, environmental,

and business trends, executives from different

industries also reveal signifcant differences in

their assessments of the impact of the trends,

as well as the actions their companies are taking

to address them. For example, executives in

the energy and mining industries are far more

likely than most other respondents to see a

social backlash against corporate activity as a

threat to proftsand far more likely to have

taken some steps to address that threatthan

executives in other industries who are also

concerned about it.

To meet the competitive challenges these trends

are creating, executives say, one important

response is forming strategic partnerships.

Indeed, many companies are reaching outside

their own organizations in a range of directions.

Structural changes, including consolidation

within industries and the formation of upstream

and downstream partnerships, are widespread.

However, when sourcing their knowledge,

respondents report (somewhat counter to this

theme) that partnerships with other businesses

and academic institutions play a relatively

modest role.

1

The McKinsey Quarterly conducted the survey in March 2007 and received 3,693 responses from a worldwide representative sample of business executives

37 percent of whom are CEOs, other C-level executives, or board directors. All data are weighted by GDP of constituent countries to adjust for differences in

response rates.

3

Source: March 2007 McKinsey Quarterly global survey of business executives

It is crucial for companies to anticipate correctly

the future implications of trends shaping

the global landscape so that they can ride the

currents rather than swim against them.

When asked about the importance of the

14 trends for global business over the next fve

years, respondents cite trends linked to

economic growth in emerging markets as key

(Exhibit 1). Increasingly, the rising number of

consumers in emerging economies, global

labor and talent markets, and the shifting

economic activity between and within regions

make up three of the top four trends, all rated

as important or very important by more

than 75 percent of the panel. The panel also

puts trends in knowledge and technology at the

top of its list, with 75 percent of the respondents

rating three trends in this area as important

or very important.

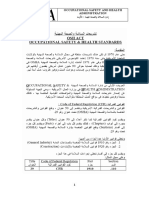

Exhibit 1

Importance for global

business

Important trends

% of respondents (n = 3,693)

1

As measured by the impact on global business during

the next 5 years, how important do you expect each

of the following trends to be?

Survey 2007

Global forces

Exhibit 1 of 6

Glance:

Exhibit title: Importance for global business

Figures may not sum to %, because of rounding; excludes respondents who answered dont know.

Social backlash against corporate activity 33 32 35

Shifting industry structures/emerging

forms of organization

48 29 22

Adoption of increasingly scientic

management techniques

50 25 24

Increasing sophistication of capital markets 56 27 18

Geopolitical instability 63 20 18

An aging population in developed economies 71 15 15

Increasing constraints on supply or usage

of natural resources

73 13 14

A faster pace of technological innovation 76 15 10

Development of technologies that empower

consumers and communities

77 12 11

Shifting of economic activity between and

within regions

77 13 10

Increasingly global labor and talent markets 78 13 9

Increasing availability of knowledge/ability

to exploit it

81 11 9

Growing number of consumers in

emerging economies

84 8 8

Growth of public sector 28 38 34

Very important/

important

Neither important

nor unimportant

Somewhat important/

not important

4

Source: March 2007 McKinsey Quarterly global survey of business executives

Exhibit 2

Impact on company

profits

When it comes to corporate proftability, the

importance of the trends shifts: a majority of

executives believe each of the six trends will

have a very positive or somewhat positive

impact on their proftability over the coming fve

years, but knowledge and technology trends

are at the top of the list. Respondents view the

increasing availability of knowledge and the

faster pace of technological innovation as the

two most positive trends, with the development

of technologies that empower consumers and

communities in fourth place (Exhibit 2).

Interestingly, executives rate a management

trendthe adoption of scientifc management

techniqueshigher for its positive impact on

proftability (61 percent) than for its importance

to global business as a whole (50 percent).

Among the 14 global trends, executives view

some to be risks rather than opportunities.

More than 40 percent of the respondents see

geopolitical instability as negative for profts,

while only 14 percent perceive it positively;

28 percent see a social backlash against

corporate activity negatively, compared with

13 percent who view it as an opportunity.

Good or bad for profits?

Very/somewhat positive Neutral Somewhat/very negative

% of respondents (n = 3,693)

1

What will be the impact of each of the following

trends on the protability of your company over

the next 5 years?

Survey 2007

Global forces

Exhibit 2 of 6

Glance:

Exhibit title: Impact on company prots

Figures may not sum to %, because of rounding; excludes respondents who answered dont know.

Increasing availability of knowledge/ability

to exploit it

76 18 6

A faster pace of technological innovation 73 21 7

Growing number of consumers in

emerging economies

63 32 4

Development of technologies that empower

consumers and communities

63 30 7

Adoption of increasingly scientic

management techniques

61 35 4

Increasingly global labor and talent markets 58 31 11

Shifting of economic activity between

and within regions

52 37 11

Shifting industry structures/emerging forms

of organization

42 50 8

Increasing sophistication of capital markets 41 53 6

An aging population in developed economies 36 46 18

Growth of public sector 30 56 14

Increasing constraints on supply or usage

of natural resources

25 48 28

Geopolitical instability 14 46 41

Social backlash against corporate activity 13 58 28

5

Source: March 2007 McKinsey Quarterly global survey of business executives

It is notable that executives regard most trends

as more important for global business

than for determining the proftability of their

own company. Seventy-three percent of

executives identify increasing constraints on

the supply or use of natural resources as

important or very important for global

business, but only 53 percent see this trend

as having any positive or negative impact on

the proftability of their companies. Similarly,

71 percent view an aging population in

developed countries as important or very

important, but only 54 percent believe that

demographic change will have an impact on the

proftability of their own business.

6

Source: March 2007 McKinsey Quarterly global survey of business executives

While executives view many trends as

opportunities and see signifcant risk in others,

their companies have not taken active steps to

address them to the extent that would appear

warranted. While 76 percent of the respondents

expect a positive impact on profts from the

increasing availability of knowledge and the

ability to exploit it, only 59 percent say their

companies have acted on this opportunity

(Exhibit 3). The gap is even wider between the

63 percent of executives who view consumers in

emerging markets as a future source of profts

and the 41 percent who say their companies

have pursued this opportunity.

Executives appear better prepared to manage

the riskiest trends in their industries than they

are to seize the ones they see as opportunities.

For example, executives within the pharma-

ceutical and energy and mining industries are

the ones most concerned with the social

backlash against corporate activitymore than

40 percent see this trend as negative for the

proftability of their companies. They are also

the most likely, at well over 30 percent,

to report that they have taken active steps to

address it.

Exhibit 3

Taking action

The action gap

% of respondents (n = 3,693)

1

Which of the following trends has your company taken active steps to address?

Survey 2007

Global forces

Exhibit 3 of 6

Glance:

Exhibit title: Taking action

Respondents could select more than one answer; those who answered none of the above are not shown.

Total

By industry

Travel,

transport

Business

services

High tech,

telecommu-

nications

Financial

services

Energy,

mining

Health care,

pharma

Manufac-

turing Retail

A faster pace of technological

innovation

60 58 55 77 55 55 63 59 51

Increasing availability of knowledge/

ability to exploit it

59 49 68 67 54 56 56 53 48

Development of technologies that

empower consumers, communities

50 52 45 53 55 33 64 37 59

Adoption of increasingly scien-

tic management techniques

49 45 50 65 48 41 46 46 47

Increasingly global labor and

talent markets

48 44 45 60 51 57 39 50 28

Shifting of economic activity

between and within regions

45 42 36 52 43 43 41 58 30

Growing number of consumers in

emerging economies

41 34 31 41 43 33 40 56 44

Increasing constraints on supply or

usage of natural resources

31 36 17 18 19 74 22 54 29

An aging population in developed

economies

30 26 24 33 41 26 33 27 35

Shifting industry structures/

emerging forms of organization

30 29 34 18 28 30 62 29 18

Increasing sophistication of

capital markets

26 21 17 17 62 21 14 15 11

Growth of public sector 19 23 31 16 10 18 9 5

Social backlash against corporate

activity

18 14 11 13 22 37 25 19 19

Geopolitical instability 12 15 9 9 14 29 7 12 5

10

Highest response rate for given

trend across industries

7

Source: March 2007 McKinsey Quarterly global survey of business executives

Shifting industry structures and emerging forms

of corporate organization are characteristics of

an increasingly competitive global economy.

Nearly fve out of ten respondents view this

trend as important for global business, and four

out of ten believe it will have a positive impact

on the proftability of their companies.

Over half of all executives say their industries

have consolidated in the past fve years, and as

many expect this development to continue. In

contrast, less than 10 percent of respondents

have seen or expect fragmentation in their

industries. Examining the responses by industry,

executives in the travel and transport, health

care, manufacturing, and automotive industries

expect the pace of consolidation to increase.

Executives in the energy and mining, fnancial-

services, pharmaceuticals, and retail industries

expect less consolidation during the next

fve years.

Strategic partnerships are an important example

of emerging forms of corporate organization.

Six out of ten executives report that their

companies have more partnerships today than

they had fve years ago, and 75 percent say a

need to strengthen their competitive position

has prompted changes to their partnerships.

A majority of companies in all the surveyed

industries have added to their portfolio of

partnerships, with pharmaceuticals as the most

active, at 72 percent.

Almost half of the companies have entered into

distribution partnerships, three out of ten into

manufacturing outsourcing, and two out of ten

into product design outsourcing (Exhibit 4).

Exhibit 4

Strategic partnerships

Structural changes

% of respondents (n = 3,335)

1

What types of strategic partnerships has your company entered into?

Survey 2007

Global forces

Exhibit 4 of 6

Glance:

Exhibit title: Strategic partnerships

Respondents could select more than one answer; those who chose other partnerships are not shown.

Total

Travel,

transport

Business

services

Energy,

mining

High tech,

telecommu-

nications

Health care,

pharma

Manufac-

turing Retail

Financial

services

Upstream

partnerships

Downstream

partnerships

Product design

outsourcing

21 17 14 27 13 33 30 20 14

Manufacturing

outsourcing

30 15 9 33 9 42 59 37 15

Other

upstream

Other

downstream

34 26 23 43 23 37 47 28 24

Distribution 49 64 26 59 51 26 51 57 53

20 21 35 18 21 26 22 16

By industry

24

3

Source: March 2007 McKinsey Quarterly global survey of business executives

The telecom and travel and transport industries

were most active at entering distribution

partnerships, with two-thirds of executives in

each category saying they had done so.

Partnerships to outsource manufacturing were,

perhaps surprisingly, particularly common in

both the manufacturing and pharmaceutical

industries. Almost six out of ten respondents in

each of these industries say they had entered

such partnerships. The pharmaceutical industry

was also the most active in establishing strategic

partnerships to outsource product design.

9

Source: March 2007 McKinsey Quarterly global survey of business executives

Many executives focus on knowledge,

innovation, and technology trends as important

drivers of future profts, which might suggest

that companies are reaching beyond their

companies to source knowledge. However, two

out of three executives say internal development

is their companies most important source of

knowledge. Little more than two out of ten

report that external sourcespartnerships with

other businesses, cooperation with academic

institutions, or relationships with investors such

as venture capital frmsare most important

(Exhibit 5).

In search of knowledge

While all respondents are biased toward

internal knowledge creation, there are

signifcant splits among industries about the

ways this knowledge is gathered. Industries with

an engineering or scientifc focusparticularly

pharmaceuticals and manufacturingare most

likely to use formal internal R&D processes.

In industries with a strong people focus,

including business and fnancial services and

retail, some 40 percent of executives favor

an informal approach.

Exhibit 5

Sources of knowledge % of respondents (n = 3,693)

1

What is the most important source of knowledge for your company?

Survey 2007

Global forces

Exhibit 5 of 6

Glance:

Exhibit title: Sources of knowledge

Figures do not sum to %, because respondents who answered investors in my company or other are not shown.

Total

Internal development

by formal R&D

department or

organization

36 14 19 49 45 49 61 22

Internal development

without formal R&D

department or

organization

31 45 42 24 21 12 15 38

Partnerships

with other

businesses

17 23 19 17 16 15 12 18

Cooperation with

academic

institutions

5 5 6 2

21

44

15

4 8 11 5 2

Travel,

transport

Business

services

Energy,

mining

High tech,

telecommu-

nications

Health care,

pharma

Manufac-

turing Retail

Financial

services

By industry

10

Source: March 2007 McKinsey Quarterly global survey of business executives

Capital markets have become increasingly

sophisticated, with many potential implications

for companies. Just over half of the respondents

see this trend as important for global business,

and executives across the globe share a similar

view of how it is affecting their companies.

Across all regions (with the exception of Latin

America), at least 40 percent of respondents

think their companies are facing rising

Sophisticated capital

Q

Contributors to the development and analysis of this survey include

Vanessa Freeman and Alice Woodwark, consultants in McKinseys London offce, and Elizabeth Stephenson, an associate principal in the

Chicago offce. Copyright 2007 McKinsey & Company. All rights reserved.

performance expectations. Further, a third or

more respondents around the world believe

that changes to capital markets are providing

advantageous new business opportunities, but

only in India and Latin America did that

advantage outweigh the pressure of rising

expectations. Indian company executives were

particularly bullish, with nearly 60 percent

seeing new opportunities (Exhibit 6).

Exhibit 6

The role of capital

markets

% of respondents (n = 3,693)

1

Capital markets have become increasingly sophisticated. Which of the following implications

apply to your company?

Survey 2007

Global forces

Exhibit 6 of 6

Glance:

Exhibit title: The role of capital markets

Respondents could select more than one answer.

Total

By region

Asia-

Pacic Europe India China

North

America

Latin

America

Rest of

world

My company faces rising

performance expectations.

43 40 41 46 45 45 33 43

My companys regulatory

burden has increased.

39 38 39 44 24 32 30 29

My company can take better

advantage of new business

opportunities.

35 36 32 35 58 32 40 47

The performance of my company

has become increasingly

transparent.

32 34 34 28 48 34 36 38

It is easier for my company

to source capital.

30 29 29 30 49 31 36 36

My company has better access

to new geographical markets

for sources of capital.

22 23 22 18 44 31 21 30

My company is better able to

hedge its business risks.

21 19 21 18 32 23 27 26

My company has better access

to nontraditional sources of

capital (eg, private equity).

19 21 16 21 31 14 22 25

It is harder for my company

to source capital.

7 7 7 7 5 5 11 8

There is little difference in

how my company operates.

23 23 24 23 14 22 19 20

You might also like

- PESTLE Analysis: Understand and plan for your business environmentFrom EverandPESTLE Analysis: Understand and plan for your business environmentRating: 4 out of 5 stars4/5 (1)

- Chap 3Document4 pagesChap 3Kios Kita86% (7)

- Hidden Strength of SWOTDocument4 pagesHidden Strength of SWOTDavid SelvaNo ratings yet

- Digital Transformation of PeopleDocument14 pagesDigital Transformation of PeopleAlaksam100% (1)

- Creating A New-Multistakeholder Methodology For Measuring ReputationDocument6 pagesCreating A New-Multistakeholder Methodology For Measuring ReputationDavid SelvaNo ratings yet

- Comparison of Shock Calculation MethodsDocument3 pagesComparison of Shock Calculation MethodsmegustalazorraNo ratings yet

- Experimental Characterization of Advanced Composite Materials PDFDocument2 pagesExperimental Characterization of Advanced Composite Materials PDFDeannaNo ratings yet

- C. Orwin, Stasis-and-Plague PDFDocument18 pagesC. Orwin, Stasis-and-Plague PDFDimitris PanomitrosNo ratings yet

- Ashurst EIU Future Forces ReportDocument68 pagesAshurst EIU Future Forces ReportAlicja MaszniczNo ratings yet

- Strategy and Social Issues: Ceos OnDocument9 pagesStrategy and Social Issues: Ceos Onashu548836No ratings yet

- Accenture 2013 Global Manufacturing Study Full ReportDocument44 pagesAccenture 2013 Global Manufacturing Study Full ReportFerry TriwahyudiNo ratings yet

- Epiphany 3: Traumatic Stress Has Hijacked Corporate StrategyDocument3 pagesEpiphany 3: Traumatic Stress Has Hijacked Corporate StrategyAviraj SahaNo ratings yet

- Pi Global Talent Trends 2023 SummaryDocument6 pagesPi Global Talent Trends 2023 SummarylefkisNo ratings yet

- CFO To Chief Future OfficerDocument24 pagesCFO To Chief Future OfficerSuccessful ChicNo ratings yet

- 18 - Chapter 10 Overview of CSR SurveysDocument25 pages18 - Chapter 10 Overview of CSR SurveysShifali ShettyNo ratings yet

- 2020 Factors Affect The Success and Exellence of SMEsDocument11 pages2020 Factors Affect The Success and Exellence of SMEsAbdii BoruuNo ratings yet

- Preparing America's 21ST Century Workforce: The Tech Sector Weighs in On Educational Gaps and Common Core State StandardsDocument40 pagesPreparing America's 21ST Century Workforce: The Tech Sector Weighs in On Educational Gaps and Common Core State Standardscritchie8142100% (1)

- The Global Companys ChallengeDocument5 pagesThe Global Companys ChallengeEric XuNo ratings yet

- 2012 State of The Internal Audit Profession SurveyDocument44 pages2012 State of The Internal Audit Profession SurveyAnshul BatraNo ratings yet

- Assignment #3 (Management Science)Document6 pagesAssignment #3 (Management Science)Zameer HussainNo ratings yet

- Long-Term Growth, Short-Term Differentiation and Profits From Sustainable Products and ServicesDocument12 pagesLong-Term Growth, Short-Term Differentiation and Profits From Sustainable Products and ServicespauldupuisNo ratings yet

- Nme Entrepreneurship Report Jan 8 2014Document240 pagesNme Entrepreneurship Report Jan 8 2014mono1984No ratings yet

- Riverside VIUaIcs4oAMCF6g OnlinewithZahidRiazIndustry-1Document3 pagesRiverside VIUaIcs4oAMCF6g OnlinewithZahidRiazIndustry-1he20003009No ratings yet

- 2016 Geib Full Findings FinalDocument88 pages2016 Geib Full Findings FinaljvalletNo ratings yet

- Combating Risk With Predictive IntelligenceDocument16 pagesCombating Risk With Predictive IntelligenceAlessandro CerboniNo ratings yet

- Hays Global Skills Index 2019 20 1570461146Document58 pagesHays Global Skills Index 2019 20 1570461146YhonNo ratings yet

- Ib Press Release 01-18-12Document3 pagesIb Press Release 01-18-12bhartiankurNo ratings yet

- Safety - A Foundation For Sustainable Growth: Session No. 532Document7 pagesSafety - A Foundation For Sustainable Growth: Session No. 532Waqas Ahmad KhanNo ratings yet

- Market Research - UpskillingDocument26 pagesMarket Research - Upskillinghr. nainaNo ratings yet

- Sean A. Stanley: Modern Portfolio Theory, Socially Responsible Investing, Stakeholder TheoryDocument18 pagesSean A. Stanley: Modern Portfolio Theory, Socially Responsible Investing, Stakeholder TheoryEd BayangosNo ratings yet

- Critical Success Factors of New Product Development: Evidence From Select CasesDocument11 pagesCritical Success Factors of New Product Development: Evidence From Select CasesRajeev DwivediNo ratings yet

- Wastage Adds Up Despite Motivated WorkersDocument16 pagesWastage Adds Up Despite Motivated Workersjazz0603No ratings yet

- 10 TrendsDocument11 pages10 Trendsroda_cris3161No ratings yet

- Deloitte Risk Management 2012Document20 pagesDeloitte Risk Management 2012Julio RomoNo ratings yet

- Forecasting Best Practices For Common ChalengesDocument26 pagesForecasting Best Practices For Common ChalengesacsgonzalesNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Disruptive TechnologyDocument178 pagesDisruptive TechnologyDennis GarrettNo ratings yet

- Boiling Point? The Skills Gap in US ManufacturingDocument16 pagesBoiling Point? The Skills Gap in US ManufacturingDeloitte AnalyticsNo ratings yet

- ATKearney C SuiteSurvey 2017Document32 pagesATKearney C SuiteSurvey 2017j.CNo ratings yet

- View Issue 14Document64 pagesView Issue 14abbeydotNo ratings yet

- Small and Medium Enterprises DissertationDocument9 pagesSmall and Medium Enterprises DissertationOrderPaperOnlineChicago100% (1)

- SustainabilityDocument6 pagesSustainabilityNeha PareekNo ratings yet

- EY Risk and Opps Business Pulse Oil and Gas 2013Document48 pagesEY Risk and Opps Business Pulse Oil and Gas 2013Simone SebastianNo ratings yet

- Chapter 2 - External Environment AnalysisDocument23 pagesChapter 2 - External Environment Analysismuhammad naufalNo ratings yet

- Making The Most of UncertainyDocument7 pagesMaking The Most of UncertainyShahriar RawshonNo ratings yet

- 2011 Global State of Information Security Survey-ReportDocument58 pages2011 Global State of Information Security Survey-ReportDan SoraNo ratings yet

- UNIT III Analyzing The OrganizationDocument9 pagesUNIT III Analyzing The Organizationrheyalhane tumamaoNo ratings yet

- Responding To The Challenges of Global Markets:: ChaqgeDocument13 pagesResponding To The Challenges of Global Markets:: ChaqgeDwi S. PratiwiNo ratings yet

- McKinsey Innovation MetricsDocument11 pagesMcKinsey Innovation MetricsLeocadio DobladoNo ratings yet

- RLW03005USENDocument30 pagesRLW03005USENAlina DanciuNo ratings yet

- The State of Corporate Philanthropy McKinsey Global SurveyDocument10 pagesThe State of Corporate Philanthropy McKinsey Global SurveygmjnjNo ratings yet

- Process Safety LPDocument56 pagesProcess Safety LPTFattahNo ratings yet

- Thesis IUDocument19 pagesThesis IUsneha sNo ratings yet

- 2016 Global CEO OutlookDocument46 pages2016 Global CEO OutlookYe PhoneNo ratings yet

- Empirical Public Relations Survey: Penn Schoen BerlandDocument7 pagesEmpirical Public Relations Survey: Penn Schoen Berlandpsbsrch123No ratings yet

- External AuditDocument36 pagesExternal AuditAndrea MercadoNo ratings yet

- PORT 1 (50%) - Article For Critical Review - GC - OMAN DECEMBER 2019 PDFDocument7 pagesPORT 1 (50%) - Article For Critical Review - GC - OMAN DECEMBER 2019 PDFpsana99gmailcomNo ratings yet

- The Global Company's Challenge: Martin Dewhurst, Jonathan Harris, and Suzanne HeywoodDocument5 pagesThe Global Company's Challenge: Martin Dewhurst, Jonathan Harris, and Suzanne Heywoodjamesjames13No ratings yet

- How Effevtive Are Active Labor Market Policies in Developing CountriesDocument28 pagesHow Effevtive Are Active Labor Market Policies in Developing CountriesRIFDANo ratings yet

- Global Talent 2021 Executive SummaryDocument21 pagesGlobal Talent 2021 Executive Summaryalberthdezhdez100% (1)

- Assessing Innovation MetricsDocument9 pagesAssessing Innovation MetricsVladimir BulatNo ratings yet

- Factors Influencing CEOs of Publicly Traded Companies:: Deviating From Pre-Established Long-Term Strategies in Response to Short-Term ExpectationsFrom EverandFactors Influencing CEOs of Publicly Traded Companies:: Deviating From Pre-Established Long-Term Strategies in Response to Short-Term ExpectationsNo ratings yet

- How State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaFrom EverandHow State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaNo ratings yet

- Strategy, Value and Risk: Industry Dynamics and Advanced Financial ManagementFrom EverandStrategy, Value and Risk: Industry Dynamics and Advanced Financial ManagementNo ratings yet

- Bench MarkingDocument2 pagesBench MarkingDavid SelvaNo ratings yet

- Ethical ConsumerismDocument17 pagesEthical ConsumerismDavid Selva100% (1)

- Letter Written in The Year 2070: Article Published in The Magazine "Crónicas de Los Tiempos", in April 2002Document21 pagesLetter Written in The Year 2070: Article Published in The Magazine "Crónicas de Los Tiempos", in April 2002David SelvaNo ratings yet

- Corporate Identity ManagementDocument27 pagesCorporate Identity ManagementDavid Selva100% (1)

- Cit 726 Computers in Society-2016Document1 pageCit 726 Computers in Society-2016opabalekeNo ratings yet

- Microwave Engineering PozarDocument316 pagesMicrowave Engineering PozarAyah TayyanNo ratings yet

- Crime Forecasting Webinar AttendeesDocument2 pagesCrime Forecasting Webinar AttendeesPNP MayoyaoNo ratings yet

- EEL6935 Presentation ArslanDocument33 pagesEEL6935 Presentation ArslanDipankarNaluiNo ratings yet

- 1989 Louisiana Loess Fieldtrip GuidebookDocument38 pages1989 Louisiana Loess Fieldtrip GuidebooketchplainNo ratings yet

- Analisis Pengaruh Bantuan Sosial PKH Terhadap Kesejahteraan Masyarakat PKH Di Kecamatan Panggungrejo Kabupaten Blitar Rohana Widhi Lestari, Abu TalkahDocument13 pagesAnalisis Pengaruh Bantuan Sosial PKH Terhadap Kesejahteraan Masyarakat PKH Di Kecamatan Panggungrejo Kabupaten Blitar Rohana Widhi Lestari, Abu TalkahᎷᏒ'ᏴᎬᎪᏚᎢ ᎷᏒ'ᏴᎬᎪᏚᎢNo ratings yet

- Lesson Plan English A-11aDocument4 pagesLesson Plan English A-11aDeejayF1No ratings yet

- Recognition Program 2015 EditedDocument2 pagesRecognition Program 2015 EditedsixtoturtosajrNo ratings yet

- CM - Ndungane ExerciseDocument30 pagesCM - Ndungane ExerciseCoryNo ratings yet

- 2018 LGU Training Program Design NCCA PCEPDocument4 pages2018 LGU Training Program Design NCCA PCEPMicca AldoverNo ratings yet

- Sex of A Child in Mother's Womb - Using Astrology - AstrologyDocument1 pageSex of A Child in Mother's Womb - Using Astrology - AstrologyUtpal KumarNo ratings yet

- الأوشا 3Document223 pagesالأوشا 3Rex AlasadiNo ratings yet

- 16.2 Equally Likely OutcomeDocument4 pages16.2 Equally Likely OutcomeTài Liệu LưuNo ratings yet

- Presentation About Self-Harm (Dhiyah Mumpuni 1806203654)Document14 pagesPresentation About Self-Harm (Dhiyah Mumpuni 1806203654)DhiyahNo ratings yet

- Metadiscourse and NominalizationDocument5 pagesMetadiscourse and NominalizationAlly HongNo ratings yet

- Measurement Scale SlideDocument40 pagesMeasurement Scale Slideginish12No ratings yet

- Data Manipulation With R: Printed BookDocument1 pageData Manipulation With R: Printed BookAndresEstebanSilvaSanchezNo ratings yet

- Srivastava en Al 2007 (Rural Poverty in MP)Document8 pagesSrivastava en Al 2007 (Rural Poverty in MP)rozgarNo ratings yet

- Introduction To Bioinformatics: Course 341 Department of Computing Imperial College, London Moustafa GhanemDocument42 pagesIntroduction To Bioinformatics: Course 341 Department of Computing Imperial College, London Moustafa GhanemCSiti HanifahNo ratings yet

- Operational Data StoresDocument3 pagesOperational Data StoresAllan Naranjo RojasNo ratings yet

- Realization Bart MarshallDocument5 pagesRealization Bart MarshallMoriaanNo ratings yet

- Kousuke Kikuchi's CVDocument2 pagesKousuke Kikuchi's CVKousuke KikuchiNo ratings yet

- Expectancy Violations TheoryDocument11 pagesExpectancy Violations Theorymeron beyeneNo ratings yet

- King of The RoadDocument3 pagesKing of The RoadLee CastroNo ratings yet

- Mca 1 Sem Principles of Management and Communication Kca103 2022Document1 pageMca 1 Sem Principles of Management and Communication Kca103 2022kimog66911No ratings yet

- Acidic Reactions of Ethanoic AcidDocument5 pagesAcidic Reactions of Ethanoic AcidKevin DevastianNo ratings yet

- Zybio z3 Hematology MDCDocument6 pagesZybio z3 Hematology MDCJesus martinez50% (2)