Professional Documents

Culture Documents

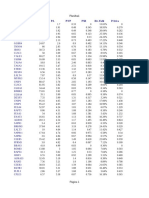

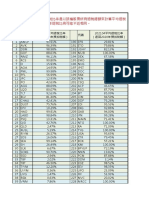

Allocation Based On PE & ROE (Ann)

Allocation Based On PE & ROE (Ann)

Uploaded by

anandhaa75Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allocation Based On PE & ROE (Ann)

Allocation Based On PE & ROE (Ann)

Uploaded by

anandhaa75Copyright:

Available Formats

Allocation based on PE & ROE (Ann)

SAMBA 1.12

51%

2002

31.1

35.1

13%

7%

SABB

1.21

51%

2003

44.5

43.5

(2%)

(1%) SABB

1.05

51%

2004

71.8

89.2

24%

12% RJHI

1.07

51%

SABB

1.10

49%

30.3

44.5

47%

23%

BSFR

1.16

49%

32.5

38.3

18%

9% RJHI

1.03

49%

57.7

85.8

49%

24% SABB

1.03

49%

BSFR

1.08

34.4

32.5

(5%)

0%

RJHI

1.04

29.4

38.3

30%

0% BSFR

1.02

67.8

86.6

28%

0% BSFR

0.99

RIBL

0.94

18.8

23.2

24%

0%

RIBL

0.97

23.2

27.7

19%

0% SAMBA 0.98

75.3

95.2

26%

0% SAMBA 0.97

RJHI

0.90

18.8

29.4

57%

0%

ARNB 0.96

25.0

29.7

19%

0% RIBL

0.98

44.2

54.5

23%

ARNB

0.86

17.9

25.0

40%

0%

SAMBA 0.83

35.1

43.5

24%

0% ARNB

0.96

47.4

62.4

32%

29.5%

Mkt

Sect

RIBL

1.05

50%

Q3 2005

70.8

RJHI

1.04

50%

SABB

7.6%

71.1%

31.4%

Mkt

Sect

BSFR

1.14

51%

ARNB 1.11

49%

78.2

10%

5%

139.7

230.8

65%

32%

1.03

138.3

137.3

(1%)

0%

SABB

ARNB

1.01

81.5

79.7

(2%)

BSFR

1.00

113.0

112.1

SAMBA 0.99

134.7

138.7

Q4 2005

112.1 101.8

88.6%

99.5%

Mkt

Sect

(9%)

(5%) RJHI

1.07

50%

50%

60.5

(24%)

(12%) ARNB

1.05

1.10

137.3

119.8

(13%)

0% SABB

0%

SAMBA 1.09

138.7

115.3

(17%)

0% BSFR

(1%)

0%

RJHI

1.07

230.8

126.3

(45%)

3%

0%

37.6%

23.9%

21.5%

RIBL

0.96

78.2

58.3

(25%)

Mkt

Sect

18%

9%

RJHI

1.04

49%

86.6

98.0

13%

0%

BSFR

95.2

117.3

23%

0%

0% ARNB 0.94

62.4

70.4

13%

0%

RIBL

0% RIBL

54.5

61.3

12%

0%

0.88

Q1 2006

126.3 138.8

36.6%

32.0%

10%

5% BSFR

Mkt

Sect

1.12

51%

49%

107.5

(10%)

1.05

101.8

90.6

0% SAMBA 1.02

115.3

58.3

0% RIBL

(16.5%)

(40.3%)

(30.2%)

0.91

ARNB 1.10

50%

Q1 2007

46.4

55.7

20%

10% RJHI

1.04

50%

RJHI

1.07

50%

89.6

74.5

(17%)

(8%)

BSFR

1.08

50%

58.3

70.0

20%

10% SAMBA 1.03

50%

ARNB

1.07

51.5

46.4

(10%)

0%

RJHI

1.05

74.5

75.8

2%

0% ARNB

SABB

1.03

73.0

59.5

(18%)

0%

SAMBA 0.98

89.7

82.0

(9%)

SAMBA 0.94

105.0

89.7

(15%)

0%

SABB

0.98

59.5

60.9

2%

32.4

25.1

(22%)

0%

(17.2%)

(5.9%)

(16.6%)

RIBL

0.96

25.1

30.3

21%

60.9

51%

Q1 2008

93.0

65.5

(30%)

(15%)

SAMBA 1.13

53%

Q2 2008

65.5

70.0

7%

4%

RJHI

0.96

49%

86.0

80.5

(6%)

(3%)

ARNB 1.01

47%

54.8

53.5

(2%)

(1%)

ARNB

0.96

66.5

54.8

(18%)

0%

BSFR

1.00

74.5

72.8

(2%)

0%

RIBL

0.94

42.8

31.8

(26%)

0%

SABB

0.99

85.5

83.8

(2%)

0%

BSFR

0.92

95.0

74.5

(22%)

0%

RJHI

0.96

80.5

83.0

3%

0%

SABB

0.90

101.0

85.5

(15%)

0%

(18.2%)

(14.5%)

(21.1%)

RIBL

0.91

31.8

33.0

4%

0%

2.5%

(3.6%)

0.6%

0%

1.02

95.9

89.6

(7%)

0%

95.9 (31%)

0%

ARNB 1.02

52.3

51.5

(1%)

0%

36.2 (18%)

0%

(16.4%)

(27.2%)

(26.2%)

RIBL

36.2

32.4 (10%)

0%

(1.9%)

(4.5%)

(3.5%)

44.2

Mkt

Sect

1.03

Q3 2007

93.2

99.8

0.89

Mkt

Sect

7%

4%

SAMBA 1.04

50%

ARNB 1.02

50%

(7%)

(3%)

66.5

2%

1%

1.02

85.0

95.0

12%

0%

RIBL

1.01

42.7

42.8

0%

0%

RJHI

0.99

93.4

86.0

(8%)

0%

SABB

0.95

91.9

101.0

10%

0%

(2.6%)

2.7%

2.5%

42.7

23%

12%

0% ARNB 1.03

65.1

65.5

1%

0%

BSFR

12%

0% RJHI

1.01

93.2

93.4

0%

0%

34.6

14%

0% BSFR

1.00

78.5

85.0

8%

0%

74.4

22%

0% SABB

18.3%

16.6%

17.3%

0.93

74.4

91.9

24%

0%

15.2%

3.0%

6.0%

Mkt

Sect

Q4 2007

99.8

93.0

65.5

34.6

Mkt

Sect

50%

Q3 2006

74.6

70.7

12.4%

22.2%

RJHI

0.94

50%

Mkt

Sect

0%

0% RIBL

5.8%

(2.7%)

(2.0%)

12% SAMBA 1.04

0%

30.9%

1%

(24%)

0.94

15%

16%

44.2

30.3

134.7

105.0

138.8

0.98

117.3

90.7

1.01

0% RIBL

0%

SAMBA 0.98

SAMBA 1.04

0% RJHI

78.5

15%

(3%)

(5%)

70.0

70.8

2%

109.7

1.00

61.3

(5%)

71.9 (33%)

0% BSFR

0%

0.99

73.0

107.5

17%

0%

16%

71.9

1.06

65.1

15%

81.5

49%

0% SABB

55.7

113.0

70.4

1.08

(11%)

1.02

98.0

SABB

0%

7% RIBL

1.01

ARNB 1.01

51%

90.7 (17%)

14%

15%

1.11

109.7

93.2

30%

BSFR

0% SAMBA 1.07

23%

16%

139.7

(9%)

(7%)

82.0

SAMBA 1.00

Q2 2006

90.6

74.6 (18%)

52.3 (15%)

Q2 2007

75.8

93.2

32%

107.3

20.0%

19.3%

61.5

Mkt

Sect

(9%)

0% SABB

20.1%

4.7%

4.1%

89.2

Q2 2005

105.2 138.3

21.6%

119.8

(18%)

Mkt

Sect

105.2

1.05

58.3

Mkt

Sect

51%

1% ARNB 1.08

Q4 2006

70.7

Mkt

Sect

1.08

2%

50%

Mkt

Sect

SABB

61.5

1.08

0.94

13%

60.5

BSFR

RIBL

25%

36.4%

79.7

Mkt

Sect

Q1 2005

85.8 107.3

Mkt

Sect

Prepared by

Anand Seshadri

Portfolio Manager

You might also like

- Tennessee Child Well-Being. Source: Tennessee Commission On Children and YouthDocument3 pagesTennessee Child Well-Being. Source: Tennessee Commission On Children and YouthAnita WadhwaniNo ratings yet

- Crude Oil Grades and PropertiesDocument2 pagesCrude Oil Grades and Propertiesnishant bhushanNo ratings yet

- Planetary Influences On Human Affairs by BV RamanDocument107 pagesPlanetary Influences On Human Affairs by BV Ramanattikka88% (17)

- Konsumsi PK, SK, PBBDocument60 pagesKonsumsi PK, SK, PBBAbyan TaufiqNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- Empresas de EnergiaDocument2 pagesEmpresas de EnergiaBruno Henrique CardosoNo ratings yet

- Volatilidades AcoesDocument1 pageVolatilidades AcoesfilipecolpoNo ratings yet

- Simple ScreeningDocument2 pagesSimple ScreeningJeffry KurniadiNo ratings yet

- TabelasDocument3 pagesTabelasKállison StolzeNo ratings yet

- 2009 Forbes 200 Small CompaniesDocument3 pages2009 Forbes 200 Small CompaniesOld School ValueNo ratings yet

- Analisis InvestasiDocument5 pagesAnalisis InvestasihynoNo ratings yet

- Symbol Price Price / Sales Revenue Yoy Revenue FWD Revenue 3YDocument6 pagesSymbol Price Price / Sales Revenue Yoy Revenue FWD Revenue 3YNarayan VaidyanathanNo ratings yet

- SQN SummaryDocument1 pageSQN Summaryyoussner327No ratings yet

- Normalized Balance SheetDocument1 pageNormalized Balance SheetPo_PimpNo ratings yet

- OREAS 256b CertificateDocument23 pagesOREAS 256b CertificateRidouane RidNo ratings yet

- PD 2 - SolucionarioDocument32 pagesPD 2 - SolucionarioAdrian Pedraza AquijeNo ratings yet

- Bigote Basic Screener - Updtd.04.02.20Document87 pagesBigote Basic Screener - Updtd.04.02.20Erjohn PapaNo ratings yet

- OREAS 175 CertificateDocument16 pagesOREAS 175 CertificateMearg NgusseNo ratings yet

- Gto Spin - Husng RangesDocument17 pagesGto Spin - Husng RangesptaranczukNo ratings yet

- Ações OdsDocument12 pagesAções OdsMaul CarlosNo ratings yet

- BauméDocument1 pageBauméHarry StewardNo ratings yet

- Gordugunuz Oranlar (Xg-Experts) Sisteminin Hesaplamis Oldugu Adi OranlardirDocument5 pagesGordugunuz Oranlar (Xg-Experts) Sisteminin Hesaplamis Oldugu Adi OranlardirionspinuNo ratings yet

- 2020退稅比率Document5 pages2020退稅比率Shao YuNo ratings yet

- Lista ETFs ExtendidaDocument3 pagesLista ETFs ExtendidaManuel DomínguezNo ratings yet

- GasificaciónDocument27 pagesGasificaciónStiven SofanNo ratings yet

- Company Na Beta Market D/E Tax Rate Fixed/Variab Market Cap Market Weighticker Symb Industry Sic Market Cap Current Pe Trailing PeDocument5 pagesCompany Na Beta Market D/E Tax Rate Fixed/Variab Market Cap Market Weighticker Symb Industry Sic Market Cap Current Pe Trailing PeAnjali BhatiaNo ratings yet

- Team Bless Xfers 83123 1215pmDocument1 pageTeam Bless Xfers 83123 1215pmKal LixtoNo ratings yet

- Lista ETFs de Apple, MSFT, Vanguard, Small CapsDocument2 pagesLista ETFs de Apple, MSFT, Vanguard, Small CapsManuel DomínguezNo ratings yet

- Charting Filter - 02242018Document115 pagesCharting Filter - 02242018Titus Keith CaddauanNo ratings yet

- Mining The Volatility Surface: XLE Mar 22, 2011Document1 pageMining The Volatility Surface: XLE Mar 22, 2011berrypatch268096No ratings yet

- Top Gainer Top Loser: Ticker Profit % P/L Ticker ProfitDocument3 pagesTop Gainer Top Loser: Ticker Profit % P/L Ticker ProfitHans WinataNo ratings yet

- OREAS 232b CertificateDocument26 pagesOREAS 232b CertificateRidouane RidNo ratings yet

- Excel Report - DataDocument29 pagesExcel Report - DataEng PhearumNo ratings yet

- Hot-Accounts Google FinanceDocument5 pagesHot-Accounts Google Financerbp_1973No ratings yet

- Drawability KASHIF 2021Document2 pagesDrawability KASHIF 2021mohdk1549No ratings yet

- Ontario Proj 30.05.2018 DetailedDocument5 pagesOntario Proj 30.05.2018 Detailedbryanbreguet100% (1)

- OREAS 264 CertificateDocument26 pagesOREAS 264 CertificateJose Marie AsuncionNo ratings yet

- StaksDocument17 pagesStaksJerome Christopher BaloteNo ratings yet

- OREAS 296 CertificateDocument18 pagesOREAS 296 CertificateRidouane RidNo ratings yet

- Tabela de Correlatos Academia Do Trader PDFDocument4 pagesTabela de Correlatos Academia Do Trader PDFCLELIO GOMES DE SOUZANo ratings yet

- Ranvijay BaDocument5 pagesRanvijay Baranvijaygalgotias27No ratings yet

- Ações AtualDocument18 pagesAções Atualyatan001No ratings yet

- Team Bless Xfers 83123 11amDocument1 pageTeam Bless Xfers 83123 11amKal LixtoNo ratings yet

- Physical and Chemical Properties of Profile Soil Samples of BirurDocument1 pagePhysical and Chemical Properties of Profile Soil Samples of BirurAnonymous PJ6WtNPNo ratings yet

- DataDocument13 pagesDataCh Raheel BhattiNo ratings yet

- Technidex: Stock Futures IndexDocument3 pagesTechnidex: Stock Futures IndexRaya DuraiNo ratings yet

- C3nr01500a SiDocument9 pagesC3nr01500a SiLorem IpsumNo ratings yet

- Investing Ideas - Week in Review 13Document3 pagesInvesting Ideas - Week in Review 13Speculator_NojusNo ratings yet

- Par de DivisasDocument38 pagesPar de DivisasRonny FarinangoNo ratings yet

- Analisis Tov Dan Etr (Kelas) Ting2 2019Document8 pagesAnalisis Tov Dan Etr (Kelas) Ting2 2019sahiranNo ratings yet

- Mon 120523 PDFDocument1 pageMon 120523 PDFahmadNo ratings yet

- Spot FrequenciesDocument9 pagesSpot FrequenciesPaulo RamalhoNo ratings yet

- HistoricalinvestDocument10 pagesHistoricalinvestranvijaygalgotias27No ratings yet

- Investing Ideas - Week in Review 12Document3 pagesInvesting Ideas - Week in Review 12Speculator_NojusNo ratings yet

- Base Case: Cash FlowDocument29 pagesBase Case: Cash FlowKumar Abhishek100% (3)

- Muhammad Rafi Ramanda - 11220051Document4 pagesMuhammad Rafi Ramanda - 11220051Bagas Cahya NuziartaNo ratings yet

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNo ratings yet

- Odds AnalyzerDocument4 pagesOdds AnalyzerАндрей НазарчукNo ratings yet

- Breakout Stock: Thursday, September 16, 2021Document1 pageBreakout Stock: Thursday, September 16, 2021Imran KhanNo ratings yet

- Caliculation of Hora CuspDocument95 pagesCaliculation of Hora Cuspphani1978100% (1)

- UNB Asset ManagementDocument3 pagesUNB Asset Managementanandhaa75No ratings yet

- 0622 PlapcianuDocument35 pages0622 Plapcianuanandhaa75100% (5)

- Value Portfolio Results SnapshotDocument1 pageValue Portfolio Results Snapshotanandhaa75No ratings yet

- 2005 FRM Examination: Study GuideDocument6 pages2005 FRM Examination: Study Guideanandhaa75No ratings yet