Professional Documents

Culture Documents

Income Tax

Income Tax

Uploaded by

nvpatel2671988Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax

Income Tax

Uploaded by

nvpatel2671988Copyright:

Available Formats

Section 4

Particular Charge of Income Tax

1.

2. 3.

4.

Explanation Tax shall be charged at the rates prescribed for the year by the Annual Finance Act. The charge is on every person specified U/S 2(31). The tax is chargeable on the total income earned during the previous year and not the assessment year. (There are certain exceptions provided by sections 172, 174, 174A, 175 and 176.) The tax shall be levied in accordance with and subject to the various provisions contained in the Act.

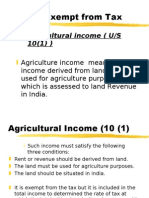

Agriculture Income Payments Received from Family income by a member of HUF 10(2A) Share of profit of a firm 10(4) Interest received by a nonresident from prescribed securities 10(4) Interest received by a person who is resident outside India on amounts credited in the Nonresident (External) Account 10(5) Leave travel concession provided by employer to his Indian Citizen employees 10(6) Remuneration received by foreign diplomats of all categories 10(6)(vi) Salary received by a foreign citizen as an employee of a foreign enterprise provided

10(1) 10(2)

his stay in India not exceed 90 days

You might also like

- Incomes Which Do Not Form Part of Total Income - ItDocument33 pagesIncomes Which Do Not Form Part of Total Income - ItVijayendra RaoNo ratings yet

- Tax AljamiaDocument22 pagesTax AljamiaFlash Light100% (2)

- 11.tax Free Incomes FinalDocument48 pages11.tax Free Incomes FinalaeeciviltrNo ratings yet

- Income Tax Exemptions: Income Type Under SectionDocument17 pagesIncome Tax Exemptions: Income Type Under Section12345566788990100% (2)

- Introduction To ResidenceDocument4 pagesIntroduction To ResidenceNiya Maria NixonNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomezxcNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalGhs ShahpurkandiNo ratings yet

- IT-03 Incomes Exempt From TaxDocument18 pagesIT-03 Incomes Exempt From TaxAkshat GoyalNo ratings yet

- Module-1: Basic Concepts and DefinitionsDocument35 pagesModule-1: Basic Concepts and Definitions2VX20BA091No ratings yet

- Tax Free IncomesDocument45 pagesTax Free IncomesAayush GiriNo ratings yet

- 11.tax Free Incomes FinalDocument38 pages11.tax Free Incomes FinalshineNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalKARTHIK ANo ratings yet

- 11.tax Free Incomes FinalDocument45 pages11.tax Free Incomes FinalAyushi DixitNo ratings yet

- 11.tax Free Incomes FinalDocument42 pages11.tax Free Incomes FinalAmit PandeyNo ratings yet

- Exempted Incomes For Different CategoriesDocument10 pagesExempted Incomes For Different Categorieskmr_arnNo ratings yet

- Person (Section 2 (31) )Document1 pagePerson (Section 2 (31) )Tejas PandeyNo ratings yet

- Memory Aid TaxationDocument26 pagesMemory Aid TaxationGela Bea BarriosNo ratings yet

- The Direct Taxes CodeDocument3 pagesThe Direct Taxes Codeanuj91No ratings yet

- ch-11 Taxation of NRIsDocument25 pagesch-11 Taxation of NRIsdean.socNo ratings yet

- Some Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCJinoy P MathewNo ratings yet

- Unit 4Document14 pagesUnit 4Rupesh PatilNo ratings yet

- Chinmayanand DTDocument5 pagesChinmayanand DTAnand PandeyNo ratings yet

- Incomes Which Do Not Form Part of Total Income: Section 64Document91 pagesIncomes Which Do Not Form Part of Total Income: Section 64d-fbuser-65596417No ratings yet

- Chapter 2 Incomes which do not form part of Total IncomeDocument46 pagesChapter 2 Incomes which do not form part of Total Incomerachitaggarwal.rnmNo ratings yet

- 11 TaxDocument37 pages11 TaxArpita KapoorNo ratings yet

- Income Tax Short Notes For C S C A C M A Exam 2014Document43 pagesIncome Tax Short Notes For C S C A C M A Exam 2014Jolly SinghalNo ratings yet

- Exempted Income 1Document24 pagesExempted Income 1jerin joshy100% (1)

- 11.tax Free Incomes FinalDocument37 pages11.tax Free Incomes FinalsaandoNo ratings yet

- Incomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToDocument50 pagesIncomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- TDS Rate ChartDocument9 pagesTDS Rate Chartjibin samuelNo ratings yet

- Seminar On TDSDocument29 pagesSeminar On TDSCA Virendra ChhajerNo ratings yet

- Exemptions and DeductionsDocument72 pagesExemptions and DeductionsSyed Parveez AlamNo ratings yet

- Chapter 2 InctaxDocument14 pagesChapter 2 InctaxLiRose SmithNo ratings yet

- Section 64: Incomes Which Do Not Form Part of Total Income Incomes Not Included in Total Income. 10Document33 pagesSection 64: Incomes Which Do Not Form Part of Total Income Incomes Not Included in Total Income. 10Mandar RaneNo ratings yet

- Income Not Chargeable in The Hands of Non-ResidentsDocument6 pagesIncome Not Chargeable in The Hands of Non-ResidentssidhuaraviiNo ratings yet

- TaxationDocument13 pagesTaxationAubrey LegaspiNo ratings yet

- Study Note - 13: Incomes Which Do Not Form Part of Total IncomeDocument37 pagesStudy Note - 13: Incomes Which Do Not Form Part of Total Incomes4sahithNo ratings yet

- 11.tax Free Incomes FinalDocument29 pages11.tax Free Incomes FinalRaun JainNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- 16 Taxtreatment Offoreign Income of Resident CRC 1Document68 pages16 Taxtreatment Offoreign Income of Resident CRC 1Vaibhavi NarNo ratings yet

- CTPM ProblemsDocument31 pagesCTPM ProblemsViraja GuruNo ratings yet

- Income Tax Law & PracticeDocument32 pagesIncome Tax Law & PracticeGautam TamtaNo ratings yet

- 62287bos50449 Mod1 cp3Document51 pages62287bos50449 Mod1 cp3monicabhat96No ratings yet

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocument10 pagesChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNo ratings yet

- Exempted IncomeDocument6 pagesExempted Incomeshyam visanaNo ratings yet

- Section 9 of Income Tax Act 1961Document55 pagesSection 9 of Income Tax Act 1961Bharath SimhaReddyNaiduNo ratings yet

- Excemptions Under Section 10Document52 pagesExcemptions Under Section 10anuragmamgainNo ratings yet

- IncomeTax Short QuestionsDocument7 pagesIncomeTax Short QuestionsWatsun ArmstrongNo ratings yet

- TaxationDocument15 pagesTaxationharshithaaba8No ratings yet

- It Act Sec 10Document39 pagesIt Act Sec 10Ramod SayedNo ratings yet

- Subject: Taxation Law-I: Chanakya National Law University, PatnaDocument20 pagesSubject: Taxation Law-I: Chanakya National Law University, PatnaKritika SinghNo ratings yet

- AHL - Shareholder Communication - TDS DeductionDocument6 pagesAHL - Shareholder Communication - TDS DeductionJay RajNo ratings yet

- Income Tax ActDocument12 pagesIncome Tax ActSomnath GuptaNo ratings yet

- 11.tax Free Incomes FinalDocument35 pages11.tax Free Incomes Finalpraveenr5883No ratings yet

- Income ExemptDocument21 pagesIncome Exemptapi-3832224100% (1)

- Section 5 of Income Tax ActDocument4 pagesSection 5 of Income Tax ActParth PandeyNo ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrNo ratings yet

- Passive Income and Other Sources of Income, Consist of Interest From Foreign and Philippine Currency Bank Deposits (Including Yields andDocument12 pagesPassive Income and Other Sources of Income, Consist of Interest From Foreign and Philippine Currency Bank Deposits (Including Yields andMichelle SilvaNo ratings yet

- F A Gjrpi O (HDocument2 pagesF A Gjrpi O (Hnvpatel2671988No ratings yet

- Lesson 4: Will and Going To: Will and Going To Are Popular Words To Do This, So We Will Look at Them, But There AreDocument3 pagesLesson 4: Will and Going To: Will and Going To Are Popular Words To Do This, So We Will Look at Them, But There Arenvpatel2671988No ratings yet

- Dumbells Exercises: AbdominalsDocument5 pagesDumbells Exercises: Abdominalsnvpatel2671988No ratings yet

- Challan - 2Document17 pagesChallan - 2nvpatel2671988No ratings yet

- Geeta Aaaaa Geeta AaaaaDocument6 pagesGeeta Aaaaa Geeta Aaaaanvpatel2671988No ratings yet

- Lesson 9: IELTS Graphs A Common MistakeDocument4 pagesLesson 9: IELTS Graphs A Common Mistakenvpatel2671988No ratings yet

- Lesson 19Document6 pagesLesson 19nvpatel2671988No ratings yet

- Fweteu 327Document1 pageFweteu 327nvpatel2671988No ratings yet

- Lesson 11Document3 pagesLesson 11nvpatel2671988No ratings yet

- Writing Task 2Document4 pagesWriting Task 2nvpatel2671988No ratings yet

- Lesson 6Document5 pagesLesson 6nvpatel2671988No ratings yet

- Lesson 8 IELTS True False Not Given Reading QuestionsDocument6 pagesLesson 8 IELTS True False Not Given Reading QuestionsBehrooz YaghmaeyanNo ratings yet

- UML Solution Second Internal ExamDocument11 pagesUML Solution Second Internal Examnvpatel2671988No ratings yet

- Book 1Document5 pagesBook 1nvpatel2671988No ratings yet

- IELTS Problem Solution EssaysDocument6 pagesIELTS Problem Solution Essaysnvpatel2671988No ratings yet

- Video Editing Software ListDocument4 pagesVideo Editing Software Listnvpatel2671988100% (1)

- The Updated List of SPP Colleges & Universities For Indian Students For 2013 IntakesDocument2 pagesThe Updated List of SPP Colleges & Universities For Indian Students For 2013 Intakesnvpatel2671988No ratings yet

- Process ID Time of Arrival Execution Time PriorityDocument1 pageProcess ID Time of Arrival Execution Time Prioritynvpatel2671988No ratings yet