Professional Documents

Culture Documents

Cost of Equity Capital Calculation Methods

Cost of Equity Capital Calculation Methods

Uploaded by

vikramkrishnan0 ratings0% found this document useful (0 votes)

13 views4 pagesC

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentC

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views4 pagesCost of Equity Capital Calculation Methods

Cost of Equity Capital Calculation Methods

Uploaded by

vikramkrishnanC

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 4

Cost of Equity Capital Calculation Methods

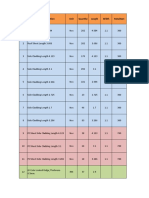

Market determined standard Comparable earnings standard

Market determined standard

Earnings-price ratio

Cost of equity capital is equal to the ratio of current earnings per share to the market price per share

Discounted cash flow model (DCF)

Formula is (d/p) + g

d is current dividend per share p is current market price per share g is expected rate of growth in dividends per share

Market determined standard (cont.)

Capital Asset Model (CAPM)

Formula is Rf + (Rm Rf)

Rf is risk free return RM is expected return on a stock market portfolio is the beta coefficient (companys relevant market risk)

Comparable earnings standard

Based on the idea of opportunity cost

capital should not be committed to any venture unless it can earn a return commensurate with that prospectively available in alternative employments of similar risk.testimony regarding Tampa Electric Co by S. F. Sherwin. Examine earnings on common equity for enterprises with similar risk, or with different risk with allowance for risk differences

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Notice of Assessment 2024 04 15 18 45 25 562888Document4 pagesNotice of Assessment 2024 04 15 18 45 25 562888kumar k0% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- Prelim Exam Questions - For PresentationDocument43 pagesPrelim Exam Questions - For PresentationJessica MabbayadNo ratings yet

- Upa v. RupaDocument36 pagesUpa v. Rupaapi-9512659No ratings yet

- Tata SteelDocument41 pagesTata SteelSanjana GuptaNo ratings yet

- Masala ChaiDocument2 pagesMasala ChaivikramkrishnanNo ratings yet

- Haskell NotesDocument192 pagesHaskell Notesvikramkrishnan100% (1)

- PastramiDocument2 pagesPastramivikramkrishnanNo ratings yet

- Lebanese Style Shish Tawook Chicken Kabob RecipeDocument2 pagesLebanese Style Shish Tawook Chicken Kabob RecipevikramkrishnanNo ratings yet

- Mutton BiryaniDocument4 pagesMutton BiryanivikramkrishnanNo ratings yet

- Souffle RothschildDocument3 pagesSouffle RothschildvikramkrishnanNo ratings yet

- Solutions Totutorial 1-Fall 2022Document8 pagesSolutions Totutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Business Finance 1ST Chunk 1Document52 pagesBusiness Finance 1ST Chunk 1Mary Ann EstudilloNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Chapter 12. Tool Kit For Financial Planning and Forecasting Financial StatementsDocument57 pagesChapter 12. Tool Kit For Financial Planning and Forecasting Financial StatementsHenry RizqyNo ratings yet

- Chapter 2: Stock Investments - Investor Accounting and ReportingDocument36 pagesChapter 2: Stock Investments - Investor Accounting and Reportingnikitarani kikiNo ratings yet

- F 5 Progressssjune 2016 SOLNDocument12 pagesF 5 Progressssjune 2016 SOLNAnisahMahmoodNo ratings yet

- De - Fundamentals of AccountingDocument16 pagesDe - Fundamentals of Accountingcamilla100% (1)

- Cost of CapitalDocument19 pagesCost of Capitalshraddha amatyaNo ratings yet

- Chapter 4 - FeasibilityDocument17 pagesChapter 4 - FeasibilityKim Nicole ReyesNo ratings yet

- Business Terminology For Beginners 3.0 PDFDocument3 pagesBusiness Terminology For Beginners 3.0 PDFmacskafogoNo ratings yet

- 2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Document2 pages2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Mayank Rana0% (1)

- Concept of Marginal CostDocument28 pagesConcept of Marginal CostdattacuriousNo ratings yet

- Solved The Dennis Company Reported Net Income of 50 000 On SalesDocument1 pageSolved The Dennis Company Reported Net Income of 50 000 On SalesAnbu jaromiaNo ratings yet

- Rate Workings-Profile Sheets KLBC (Byharshit)Document14 pagesRate Workings-Profile Sheets KLBC (Byharshit)Harshit AdwaniNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Tugas Akun 3Document16 pagesTugas Akun 3Latifah KhalisyahNo ratings yet

- Eco401 Economics Mcqs VuabidDocument103 pagesEco401 Economics Mcqs Vuabidsaeedsjaan82% (17)

- Cost Classification and Terminologies Harambe University CollegeDocument12 pagesCost Classification and Terminologies Harambe University Collegeአረጋዊ ሐይለማርያምNo ratings yet

- JOB ORDER-Rework Spoilage and EntriesDocument17 pagesJOB ORDER-Rework Spoilage and EntriesxjammerNo ratings yet

- Conventional BricksDocument8 pagesConventional BricksChenna Vivek KumarNo ratings yet

- Type The Document SubtitleDocument19 pagesType The Document SubtitleRahul agarwalNo ratings yet

- 12 x10 Financial Statement AnalysisDocument19 pages12 x10 Financial Statement Analysisrhazumie67% (3)

- Bata LK TW Iv 2020Document110 pagesBata LK TW Iv 2020galihNo ratings yet

- Beximco Pharmaceuticals Ltd.Document19 pagesBeximco Pharmaceuticals Ltd.Mahfuj RahmanNo ratings yet

- Cash Flow StatementsDocument19 pagesCash Flow Statementsyow jing peiNo ratings yet