Professional Documents

Culture Documents

Chapter 8: Risk Analysis, Real Options, and Capital Budgeting

Chapter 8: Risk Analysis, Real Options, and Capital Budgeting

Uploaded by

ratikdayal0 ratings0% found this document useful (0 votes)

5 views1 pageThis document contains calculations of net present value (NPV) for various capital budgeting projects and scenarios. NPV is calculated for options like testing a market, focusing groups, consulting firms, and lowering prices. Break-even points are also calculated for units sold of calculators, televisions, abalones, and other products. Sensitivity analysis is performed using pessimistic, expected, and optimistic cases to calculate NPV ranges. The document also considers real options like abandonment and calculates the value of those options.

Original Description:

as

Original Title

Ch8.short

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains calculations of net present value (NPV) for various capital budgeting projects and scenarios. NPV is calculated for options like testing a market, focusing groups, consulting firms, and lowering prices. Break-even points are also calculated for units sold of calculators, televisions, abalones, and other products. Sensitivity analysis is performed using pessimistic, expected, and optimistic cases to calculate NPV ranges. The document also considers real options like abandonment and calculates the value of those options.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageChapter 8: Risk Analysis, Real Options, and Capital Budgeting

Chapter 8: Risk Analysis, Real Options, and Capital Budgeting

Uploaded by

ratikdayalThis document contains calculations of net present value (NPV) for various capital budgeting projects and scenarios. NPV is calculated for options like testing a market, focusing groups, consulting firms, and lowering prices. Break-even points are also calculated for units sold of calculators, televisions, abalones, and other products. Sensitivity analysis is performed using pessimistic, expected, and optimistic cases to calculate NPV ranges. The document also considers real options like abandonment and calculates the value of those options.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Chapter 8: Risk Analysis, Real Options, and Capital Budgeting

8.1

8.2

8.3

8.6

8.7

8.8

8.11

8.12

8.13

8.14

8.15

8.16

8.19

8.20

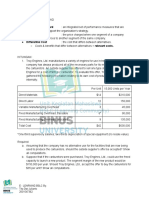

NPV(Go Directly) = 12,500,000.00

NPV(Test Market) = $12,130,434.78

NPV(Go Directly) = $600,000

NPV(Focus Group) = $720,000

NPV(Consulting Firm) = $680,000

NPV(Lower Prices) = -$1,547,500

NPV(Lobbyist) = -$1,300,000

The break-even sales price of the calculator is $66.

The distributor must sell 350 televisions per year to break even.

a. 281,250 abalones per year

b. Total Profit = $15,600

The present value break-even point is 297,657 abalones.

The present value break-even point is 20,532 units.

The break-even purchase price is $61,981.06.

Break-Even 3,518

a. Pessimistic: NPV = -$123,021.71

expected: NPV = $247,814.18

Optimistic: NPV = $653,146.42

b. NPV = $259,312.96

Pessimistic: NPV = -$675,701.68

expected: NPV = $399,304.88

Optimistic: NPV = $1,561,468.43

The expected NPV of the project is $428,357.21.

a. NPV = $608,425.33

b. The revised NPV is $699,334.42.

c. The option value of abandonment is $90,909.09.

a. NPV = $738,494,417.11

b. $12,403,973.08 = C1

You might also like

- Matheson ElectronicsDocument2 pagesMatheson ElectronicsReg Lagarteja80% (5)

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- Financial Control - 2 - Variances - Additional Exercises With SolutionDocument9 pagesFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- CH8 Practice-ProblemsDocument11 pagesCH8 Practice-ProblemsLuigi Enderez BalucanNo ratings yet

- Sol Q3Document4 pagesSol Q3hanaNo ratings yet

- Sol. Man. - Chapter 10 She 1Document9 pagesSol. Man. - Chapter 10 She 1Miguel AmihanNo ratings yet

- BA202.Exercises For ExamDocument29 pagesBA202.Exercises For ExamEnciong Goes Tiu100% (2)

- The xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalFrom EverandThe xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalNo ratings yet

- Selling To The World's PoorDocument9 pagesSelling To The World's PoorPatrick AdamsNo ratings yet

- Delhi NCRDocument533 pagesDelhi NCRratikdayal0% (2)

- Delhi NCRDocument533 pagesDelhi NCRratikdayal0% (2)

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- Problems 1-30: Input Boxes in TanDocument46 pagesProblems 1-30: Input Boxes in TanSindhu JattNo ratings yet

- Scenario AnalysisDocument2 pagesScenario AnalysisDickson WongNo ratings yet

- ACG 2071, Test 2-Sample QuestionsDocument11 pagesACG 2071, Test 2-Sample QuestionsCresenciano MalabuyocNo ratings yet

- CVP ReportDocument11 pagesCVP Reportsyed danishNo ratings yet

- Prac SolutionsDocument5 pagesPrac SolutionschrstncstlljNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- Revision Lecture With MADocument12 pagesRevision Lecture With MAMohamed ManoNo ratings yet

- Ma1 Me KaDocument5 pagesMa1 Me KaMarc Magbalon100% (1)

- AC and VC Plus CVPDocument6 pagesAC and VC Plus CVPEunice CoronadoNo ratings yet

- (Done) Activity-Chapter 2Document8 pages(Done) Activity-Chapter 2bbrightvc 一ไบร์ทNo ratings yet

- Solutions To ProblemsDocument5 pagesSolutions To ProblemsFajar KhanNo ratings yet

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Practice Exam Chapters 9-12 Solutions: Problem IDocument5 pagesPractice Exam Chapters 9-12 Solutions: Problem IAtif RehmanNo ratings yet

- M3 01. CVP IllustrationDocument2 pagesM3 01. CVP Illustrationhanis nabilaNo ratings yet

- Chapter 10 Shareholders' 1Document8 pagesChapter 10 Shareholders' 1Thalia Rhine AberteNo ratings yet

- Achievement Test QuestionsDocument3 pagesAchievement Test QuestionsglamfactorsalonspaNo ratings yet

- Cost II AssignmentDocument18 pagesCost II AssignmentAddisNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- S03-01 - Valuation Metric ExamplesDocument6 pagesS03-01 - Valuation Metric ExamplesArturo ArbajeNo ratings yet

- Polenar Budgeting-AssignmentDocument4 pagesPolenar Budgeting-AssignmentRyhanna Lou ReyesNo ratings yet

- CVP Analysis QA AllDocument63 pagesCVP Analysis QA Allg8kd6r8np2No ratings yet

- At Wid SolDocument4 pagesAt Wid SolglamfactorsalonspaNo ratings yet

- MTP 3 16 Answers 1681098469Document13 pagesMTP 3 16 Answers 1681098469Umar MalikNo ratings yet

- Exercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioDocument6 pagesExercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioMaryane AngelaNo ratings yet

- Institute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisDocument5 pagesInstitute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisMozid RahmanNo ratings yet

- Managerial Accounting PDFDocument8 pagesManagerial Accounting PDFMeryana DjapNo ratings yet

- 2014 Bep Analysis ExercisesDocument5 pages2014 Bep Analysis ExercisesaimeeNo ratings yet

- Assignment 2 - SolutionsDocument6 pagesAssignment 2 - SolutionsSiying GuNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Cost, Volume, Profit Analysis - Ex. SoluDocument19 pagesCost, Volume, Profit Analysis - Ex. SoluHimadri DeyNo ratings yet

- CH # 8 (By Product)Document10 pagesCH # 8 (By Product)Rooh Ullah KhanNo ratings yet

- Problems Chapter 13 (7,8,10)Document7 pagesProblems Chapter 13 (7,8,10)NUR SYAHIRAH BINTI SUFIANNo ratings yet

- COMPREHENSIVE PROBLEMS-lordyDocument8 pagesCOMPREHENSIVE PROBLEMS-lordyLordCelene C MagyayaNo ratings yet

- Problem 5-21:: Product White Fragrant Loonzain TotalDocument7 pagesProblem 5-21:: Product White Fragrant Loonzain Totalأبو كريم محمدNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Exercise 5-1: Total Per UnitDocument18 pagesExercise 5-1: Total Per UnitSaransh Chauhan 23No ratings yet

- ABC Practice Question 2 With SolutionDocument5 pagesABC Practice Question 2 With SolutionBennie KingNo ratings yet

- Managerial Accounting Chapter 6 Homework: 4 Out of 4 PointsDocument10 pagesManagerial Accounting Chapter 6 Homework: 4 Out of 4 PointsReal Estate Golden TownNo ratings yet

- Exercises Easy Average Difficult 1Document9 pagesExercises Easy Average Difficult 1Denzel Pambago Cruz100% (1)

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- 5.2 Capital Budgeting - Risk AnalysisDocument18 pages5.2 Capital Budgeting - Risk Analysisp44187No ratings yet

- Chapter 06-Sales Mix and ICPDocument11 pagesChapter 06-Sales Mix and ICPbbckk1No ratings yet

- Afm Week 2 Assignments Summer 2016Document4 pagesAfm Week 2 Assignments Summer 2016lexfred55No ratings yet

- The ABC Company: Balance SheetDocument10 pagesThe ABC Company: Balance SheetFahad AliNo ratings yet

- Case StudiesDocument6 pagesCase StudiesFrancesnova B. Dela PeñaNo ratings yet

- Test Bank - Chapter 17Document22 pagesTest Bank - Chapter 17Jihad NakibNo ratings yet

- 2nd Session Data Table What If AnalysisDocument6 pages2nd Session Data Table What If AnalysisAditya SinghNo ratings yet

- Hilton CH 7 Select SolutionsDocument25 pagesHilton CH 7 Select SolutionsParth ParthNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- 18959sm Finalnew Isca Cp7Document42 pages18959sm Finalnew Isca Cp7santu15038847420No ratings yet

- 10k Report GenpactDocument172 pages10k Report GenpactratikdayalNo ratings yet

- Genpact Manipal HospitalDocument3 pagesGenpact Manipal HospitalratikdayalNo ratings yet

- Diploma in Urdu PDFDocument39 pagesDiploma in Urdu PDFratikdayalNo ratings yet

- Chapter 5: How To Value BondsDocument1 pageChapter 5: How To Value BondsratikdayalNo ratings yet

- Mobile No OfbranchheadsDocument742 pagesMobile No Ofbranchheadsratikdayal0% (1)

- Chapter 9: Capital Market Theory: An Overview: You Earned $500 in Capital GainsDocument14 pagesChapter 9: Capital Market Theory: An Overview: You Earned $500 in Capital GainsratikdayalNo ratings yet

- Ch8 LongDocument14 pagesCh8 LongratikdayalNo ratings yet

- Andhra CollegesDocument88 pagesAndhra CollegesratikdayalNo ratings yet

- Chapter 9: Capital Market Theory: An OverviewDocument2 pagesChapter 9: Capital Market Theory: An OverviewratikdayalNo ratings yet

- Chapter 4: Net Present ValueDocument2 pagesChapter 4: Net Present ValueratikdayalNo ratings yet

- Chapter 6: Some Alternative Investment RulesDocument2 pagesChapter 6: Some Alternative Investment RulesratikdayalNo ratings yet

- Chapter 3: Long-Term Financial Planning and GrowthDocument1 pageChapter 3: Long-Term Financial Planning and GrowthratikdayalNo ratings yet

- Answers To Suggested Bond QuestionDocument1 pageAnswers To Suggested Bond QuestionratikdayalNo ratings yet