Professional Documents

Culture Documents

Challan 280

Challan 280

Uploaded by

purepuneetCopyright:

Available Formats

You might also like

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- 27180Document1 page27180nupursingh604No ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- Challan 280-3Document1 pageChallan 280-3KamalNo ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- CHALLAN 280 For 2013-14Document1 pageCHALLAN 280 For 2013-14mohanktvmNo ratings yet

- ChallanDocument1 pageChallanRAVINDERNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment Yearanaga1982No ratings yet

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- Sureshbhai (Challan)Document1 pageSureshbhai (Challan)Ketan DhameliyaNo ratings yet

- Axis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280Document1 pageAxis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280bha_goNo ratings yet

- Challan NO./ ITNS 280: A D G P M 4 8 2 8 BDocument1 pageChallan NO./ ITNS 280: A D G P M 4 8 2 8 BKarur KumarNo ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- 15-16 Self Assesment TaxDocument1 page15-16 Self Assesment TaxmohanNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- SRA Tax Return GuideDocument8 pagesSRA Tax Return Guidechopp7510No ratings yet

- Tax Applicable (Tax Deducted/Collected at Source From) (0021) NON-COMPANY DEDUCTEES (0020) COMPANYDocument22 pagesTax Applicable (Tax Deducted/Collected at Source From) (0021) NON-COMPANY DEDUCTEES (0020) COMPANYMahendra100% (1)

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- CBDT E-Payment Request FormDocument1 pageCBDT E-Payment Request FormAlicia Barnes67% (21)

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- E-Payment Request Form: Payment Details Payment InstructionsDocument1 pageE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- CBDT Tax Payment Return ReceiptDocument1 pageCBDT Tax Payment Return ReceiptAppurva ShahNo ratings yet

- CBDT e Payment Request Form Use For All 1Document1 pageCBDT e Payment Request Form Use For All 1ashwiniNo ratings yet

- Factory Rent TDS Dec 2013Document1 pageFactory Rent TDS Dec 2013Tej Vir SinghNo ratings yet

- Income Tax ChallanDocument1 pageIncome Tax ChallanSHRI RAMAYANINo ratings yet

- Computation Bhoopendra Ay 21-22Document2 pagesComputation Bhoopendra Ay 21-22SHELESH GARGNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Challan Income TaxDocument1 pageChallan Income Taxrahul jhaNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- PB Tax 2022Document1 pagePB Tax 2022greenstoresaviNo ratings yet

- BSNL Mobile Bill: Current Invoice Details RsDocument1 pageBSNL Mobile Bill: Current Invoice Details Rsk v reddyNo ratings yet

- Challanitns 280Document2 pagesChallanitns 280VENKATALAKSHMINo ratings yet

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaNo ratings yet

- 2122 CompDocument2 pages2122 CompAjay PratapNo ratings yet

- GST/HST NETFILE - Confirmation: Your Confirmation Number Is: 769194Document1 pageGST/HST NETFILE - Confirmation: Your Confirmation Number Is: 769194Tadeusz ZajacNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearSuresh KumarNo ratings yet

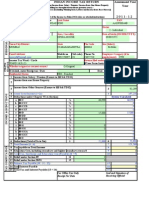

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONINo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

Challan 280

Challan 280

Uploaded by

purepuneetOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challan 280

Challan 280

Uploaded by

purepuneetCopyright:

Available Formats

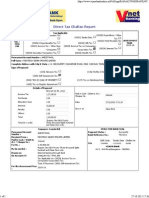

Tax Applicable (Tick One)*

CHALLAN NO./ ITNS 280

Permanent Account Number

(0020) INCOME-TAX ON COMPANIES (CORPORATION TAX) (0021) INCOME TAX (OTHER THAN COMPANIES)

Assessment Year 2 0 1 4 1 5

A D H P K 0 7 0 5 C Full Name N I L E S H R K A M D A R ADDRESS SHIV SHANKAR, KHANDUBHAI DESAI ROAD, VILE PARLE E (e), (W) MUMBAI MUMBAI 400056 400056

Type of Payment (Tick One) Advance Tax (100) Self Assessment Tax (300) Tax on Regular Assessment (400)

DETAILS OF PAYMENTS

Surtax (102) Tax on Distributed Profits of Domestic Companies (106) Tax on Distributed Income to Unit Holders (107 Amount (in Rs. Only) 4 0 0 0 0

FOR USE IN RECEIVING BANK

Income Tax Surcharge Education Cess Interest Penalty Others Total Total (in words)

CRORES LACS

Debit to A/c / Cheque credited on D D M M Y Y

ONE LAKH FORTY THOUSANDTWO HUNDRED THIRTY ONLY

THOUSANDS HUNDREDS TENS UNITS

Paid in Cash/Debit to A/c /Cheque No. Drawn on Date: 9/11/2013

Forty 000161 Dated 9/11/2013 HDFC Bank, Khar (Name of the Bank and Branch) Signature of person making payment

PAN

ADHPK0705C Received from NILESH R KAMDAR (Name) Cash/ Debit to A/c /Cheque No. 000161 FORTY THOUSAND ONLY Rs. (in words) HDFC BANK, KHAR Drawn on Advance Tax (100) Received from Type of Payment for the Assessment Year For Rs. 40,000/-

(Name of the Bank and Branch) Companies/Other than Companies/Tax

(Strike out whichever is not applicable) (To be filled up by person making the payment)

Collect it from www.fastworking.blogspot.com

You might also like

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- 27180Document1 page27180nupursingh604No ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- Challan 280-3Document1 pageChallan 280-3KamalNo ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- CHALLAN 280 For 2013-14Document1 pageCHALLAN 280 For 2013-14mohanktvmNo ratings yet

- ChallanDocument1 pageChallanRAVINDERNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment Yearanaga1982No ratings yet

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- Sureshbhai (Challan)Document1 pageSureshbhai (Challan)Ketan DhameliyaNo ratings yet

- Axis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280Document1 pageAxis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280bha_goNo ratings yet

- Challan NO./ ITNS 280: A D G P M 4 8 2 8 BDocument1 pageChallan NO./ ITNS 280: A D G P M 4 8 2 8 BKarur KumarNo ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- 15-16 Self Assesment TaxDocument1 page15-16 Self Assesment TaxmohanNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- SRA Tax Return GuideDocument8 pagesSRA Tax Return Guidechopp7510No ratings yet

- Tax Applicable (Tax Deducted/Collected at Source From) (0021) NON-COMPANY DEDUCTEES (0020) COMPANYDocument22 pagesTax Applicable (Tax Deducted/Collected at Source From) (0021) NON-COMPANY DEDUCTEES (0020) COMPANYMahendra100% (1)

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- CBDT E-Payment Request FormDocument1 pageCBDT E-Payment Request FormAlicia Barnes67% (21)

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- E-Payment Request Form: Payment Details Payment InstructionsDocument1 pageE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- CBDT Tax Payment Return ReceiptDocument1 pageCBDT Tax Payment Return ReceiptAppurva ShahNo ratings yet

- CBDT e Payment Request Form Use For All 1Document1 pageCBDT e Payment Request Form Use For All 1ashwiniNo ratings yet

- Factory Rent TDS Dec 2013Document1 pageFactory Rent TDS Dec 2013Tej Vir SinghNo ratings yet

- Income Tax ChallanDocument1 pageIncome Tax ChallanSHRI RAMAYANINo ratings yet

- Computation Bhoopendra Ay 21-22Document2 pagesComputation Bhoopendra Ay 21-22SHELESH GARGNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Challan Income TaxDocument1 pageChallan Income Taxrahul jhaNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- PB Tax 2022Document1 pagePB Tax 2022greenstoresaviNo ratings yet

- BSNL Mobile Bill: Current Invoice Details RsDocument1 pageBSNL Mobile Bill: Current Invoice Details Rsk v reddyNo ratings yet

- Challanitns 280Document2 pagesChallanitns 280VENKATALAKSHMINo ratings yet

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaNo ratings yet

- 2122 CompDocument2 pages2122 CompAjay PratapNo ratings yet

- GST/HST NETFILE - Confirmation: Your Confirmation Number Is: 769194Document1 pageGST/HST NETFILE - Confirmation: Your Confirmation Number Is: 769194Tadeusz ZajacNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearSuresh KumarNo ratings yet

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONINo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet